Overview

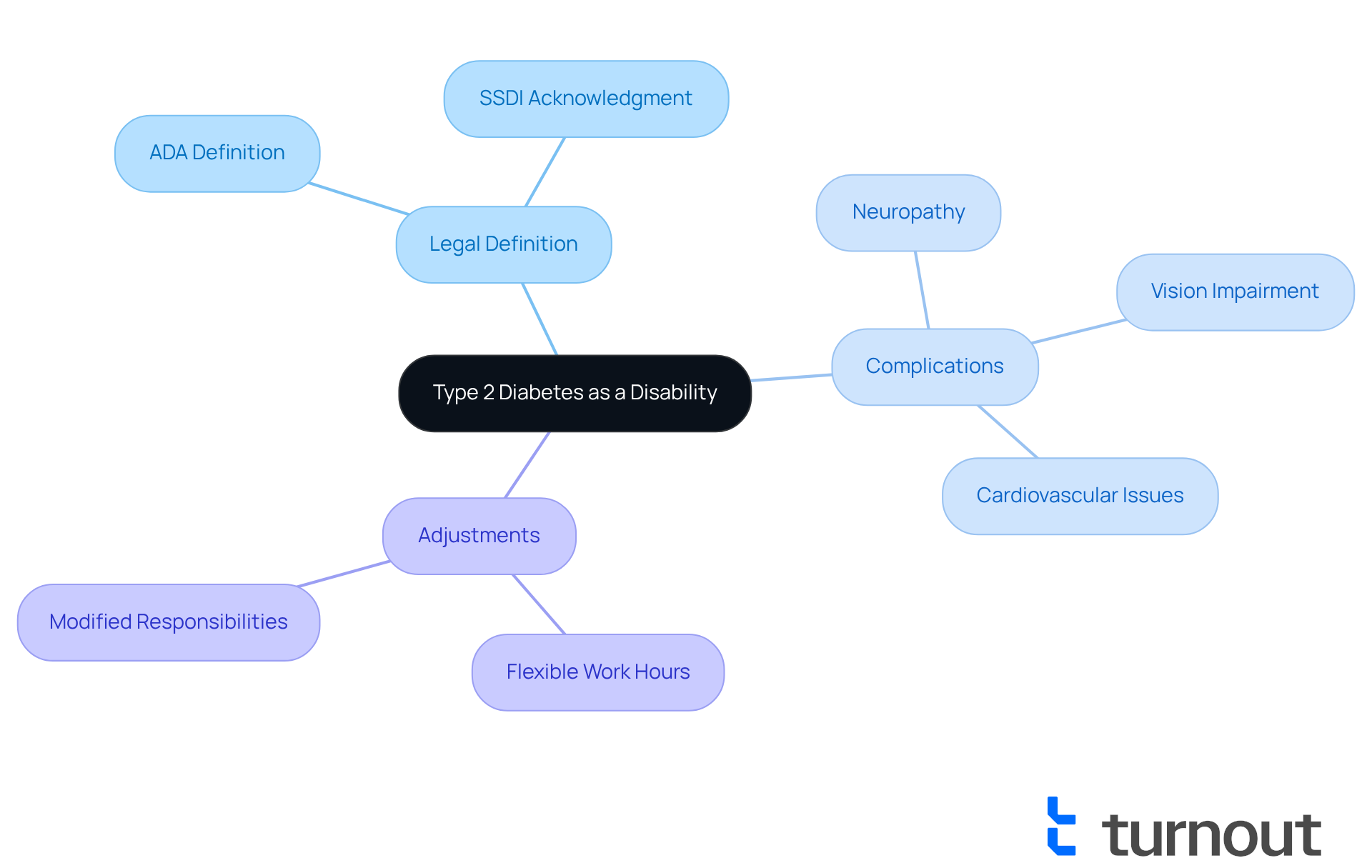

Type 2 diabetes can be considered a disability under certain legal frameworks, such as the Americans with Disabilities Act (ADA) and the Social Security Administration (SSA). This is especially true when the condition leads to significant limitations in daily activities or work capacity.

We understand that managing diabetes can be challenging, and complications from the condition can qualify individuals for important benefits like Social Security Disability Insurance (SSDI). Legal definitions recognize the impairments associated with diabetes management, providing avenues for necessary workplace adjustments and financial support.

You are not alone in this journey, and there are resources available to help you navigate these challenges.

Introduction

Understanding the complexities of Type 2 diabetes goes beyond just medical management; it touches on legal definitions and benefits that can significantly impact lives. We understand that living with this condition presents daily challenges, and you may wonder if it qualifies as a disability under various legal frameworks. This article explores the implications of recognizing Type 2 diabetes as a disability, highlighting the potential benefits available to those affected.

It's common to feel overwhelmed by the varying interpretations from legal entities and advocacy groups. By delving into these complexities, we aim to provide clarity and support. How can you navigate this intricate landscape to secure the assistance you need? You're not alone in this journey, and together we can uncover the resources that may be available to you.

Defining Type 2 Diabetes as a Disability: Legal Frameworks

Condition 2 of sugar metabolism can be a significant challenge, and we understand how it affects your daily life. Under various legal systems, especially the , the question of whether is recognized. The ADA defines a disability as a physical or mental impairment that substantially limits one or more major life activities. This definition includes , such as:

- Neuropathy

- Vision impairment

- Cardiovascular issues

These complications can greatly hinder your ability to function daily.

The Social Security Administration (SSA) acknowledges this health condition as one that may qualify for Insurance (SSDI) if it significantly limits your ability to work. For instance, individuals with this condition can demonstrate their eligibility for SSDI by providing medical proof of complications that restrict their work capacity. It's crucial to formally recognize this second category blood sugar condition as a disability, particularly when addressing the question of whether type 2 diabetes is considered a disability for those seeking workplace adjustments and .

Many individuals have successfully obtained adjustments, such as:

- Flexible work hours

- Modified responsibilities

These adjustments help manage their health more effectively. This not only helps you understand your rights but also highlights how this condition impacts your ability to carry out everyday tasks. Remember, you are not alone in this journey, and there are resources available to support you.

Available Benefits for Type 2 Diabetes: A Comparative Analysis

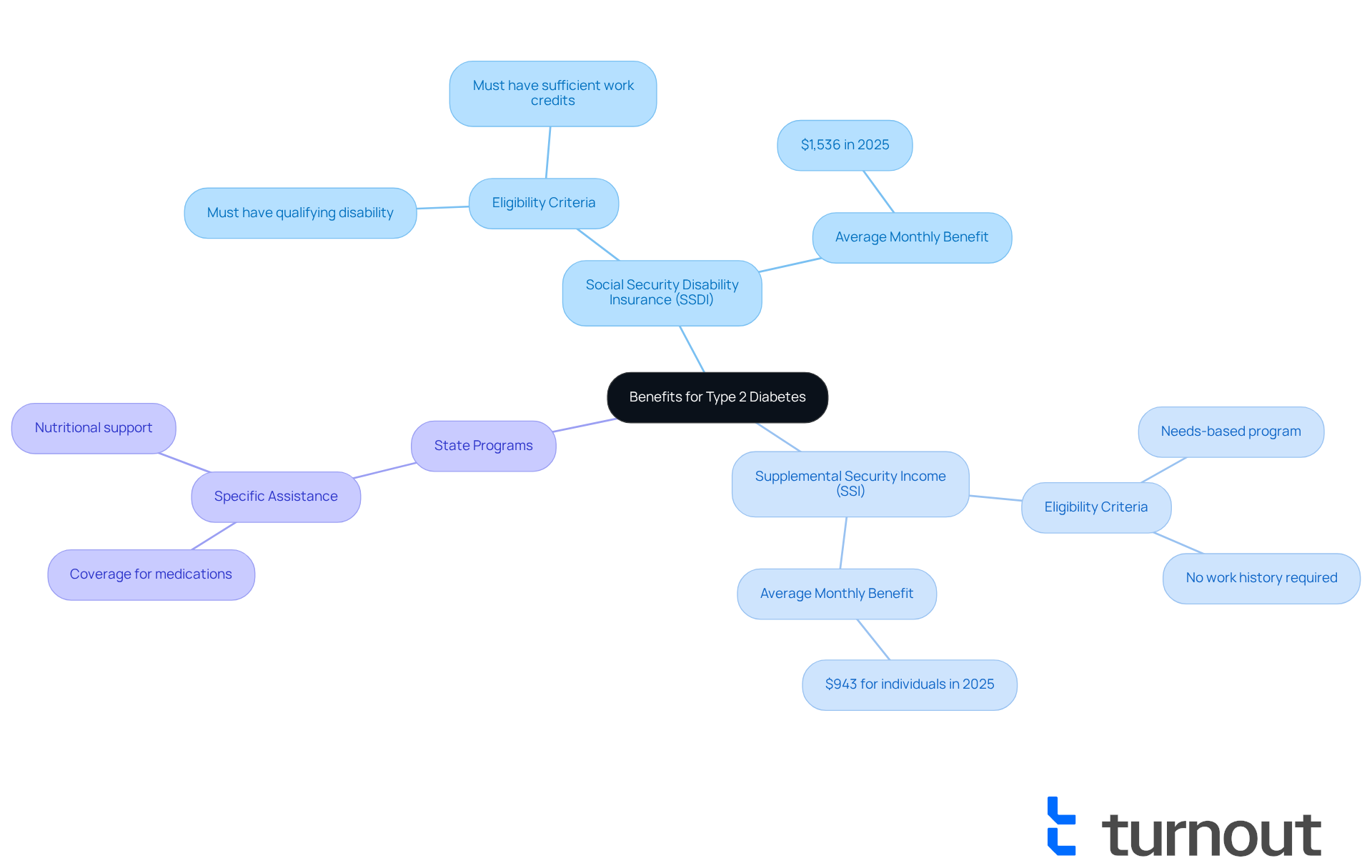

If you or someone you know is living with Type 2 diabetes, it’s important to understand if type 2 diabetes is considered a disability, which could provide various benefits to help . You may qualify for:

- Specific state programs designed to provide support, especially if .

SSDI offers monthly payments to individuals who have contributed to Social Security through their work history but are unable to work due to their condition, leading to inquiries about whether is type 2 diabetes considered a disability. On the other hand, SSI is aimed at individuals with limited income and resources, which raises the question of whether is type 2 diabetes considered a disability. For 2025, the is approximately $1,536, which is significantly higher than the average SSI benefit of $943.

Moreover, many states have established specifically for managing diabetes-related conditions, particularly in discussions about whether is type 2 diabetes considered a disability. These programs can include coverage for essential medications and nutritional support. For instance, some regions offer assistance with insulin costs and education initiatives that focus on effective blood sugar management. This support can make a meaningful difference in how individuals manage their diabetes, especially when considering if is type 2 diabetes considered a disability.

It’s essential to recognize that while SSDI generally provides higher monthly benefits, SSI may be more accessible for those who have limited work history. Understanding these distinctions is crucial as it can significantly influence your financial stability and access to necessary healthcare resources. Remember, you are not alone in this journey; we’re here to help you explore your options and find the support you need.

Diverse Interpretations of Disability: Perspectives from Legal Entities and Advocacy Groups

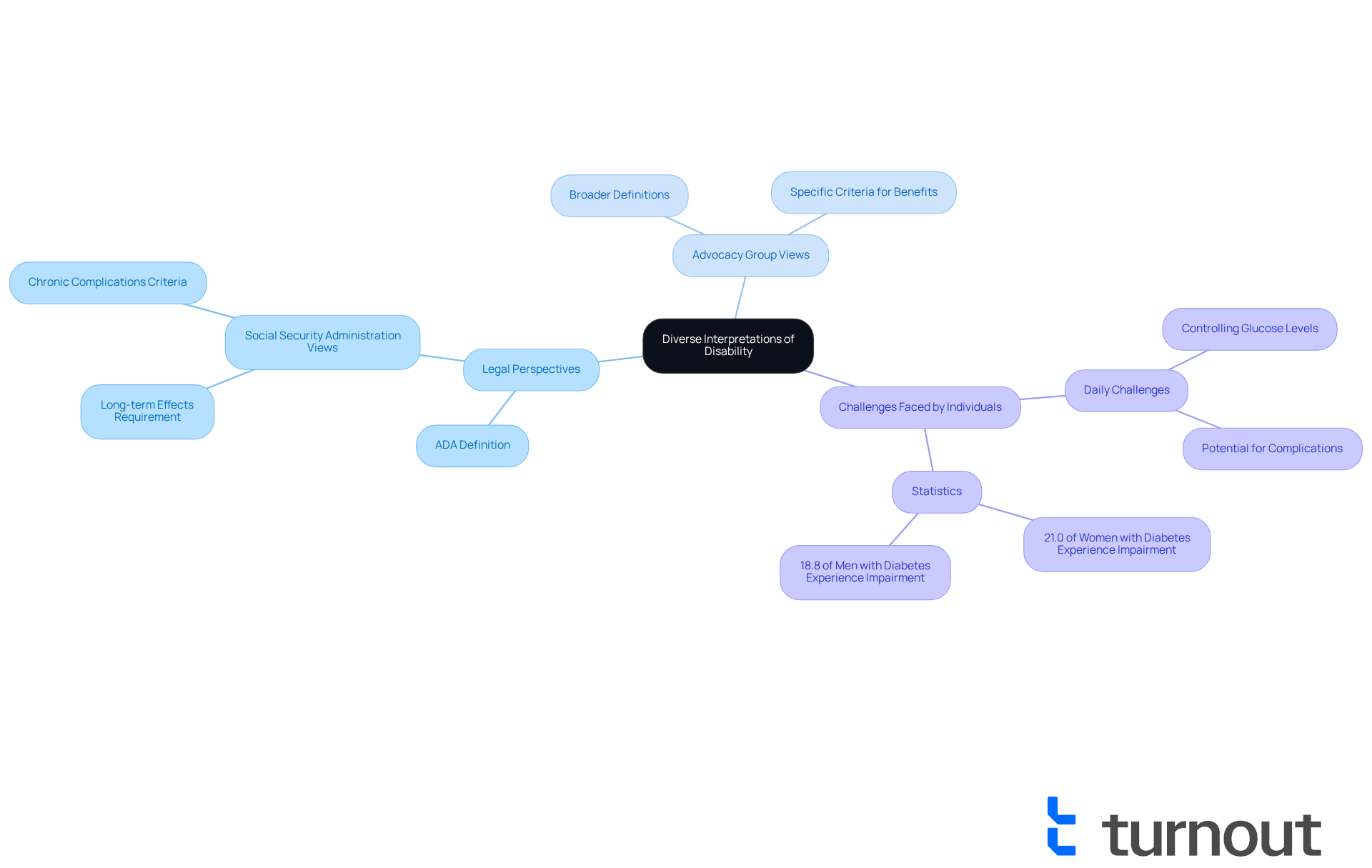

The categorization of Type 2 diabetes as a condition often leads to confusion about whether , which can be quite complex. Different legal entities and advocacy organizations view it in varied ways. For instance, the Americans with Disabilities Act (ADA) offers a broad definition of disability. However, some advocacy groups emphasize the need for specific criteria to qualify for benefits. This discrepancy may leave feeling uncertain about their options.

Advocacy groups often advocate for a broader definition that acknowledges the . These challenges include:

- The potential for complications

Did you know that the occurrence of impairment among adults with Type 2 diabetes tends to rise with age? For example, data shows that 21.0% of adult women affected by this condition experience impairment, compared to only 8.5% of women who are not affected.

Moreover, legal perspectives indicate that both categories 1 and 2 of blood sugar conditions might raise the issue of whether is type 2 diabetes considered a disability under the ADA if they lead to . The reinforces this by stating that 'is type 2 diabetes considered a disability under the ADA if the disease has long-term, debilitating effects on the person’s body, just like type 1 conditions.' Understanding these various viewpoints is crucial, as they directly influence the resources and assistance available to those managing Type 2 diabetes.

We want you to know that there are and financial support. Organizations like Turnout provide guidance for individuals navigating SSD claims and . It's also important to be aware that individuals with Type 2 diabetes may encounter earnings caps when claiming benefits, which can significantly impact their financial situation. Remember, you are not alone in this journey, and support is available to help you through it.

Conclusion

Understanding the classification of Type 2 diabetes as a disability is crucial for individuals navigating the complexities of this condition. We understand that this journey can be overwhelming. The article highlights that under legal frameworks such as the Americans with Disabilities Act (ADA) and the Social Security Administration (SSA), Type 2 diabetes can indeed be recognized as a disability. This recognition is vital, as it opens doors to essential benefits and workplace accommodations that can significantly improve the quality of life for those affected.

Key points discussed include the legal definitions and implications surrounding Type 2 diabetes in terms of disability. It’s important to be aware of the various benefits available, such as:

- Social Security Disability Insurance (SSDI)

- Supplemental Security Income (SSI)

Additionally, diverse interpretations from legal entities and advocacy groups can create confusion. These insights underscore the importance of understanding not only the rights and resources available but also the challenges faced by individuals managing this condition.

Ultimately, recognizing Type 2 diabetes as a disability is not just a legal classification; it is a call to action for better support and understanding within society. Awareness of the available benefits and the complexities of disability rights can empower individuals to seek the assistance they need. By advocating for clearer definitions and support systems, society can ensure that those living with Type 2 diabetes receive the recognition and resources necessary to lead fulfilling lives. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

What is the legal definition of disability under the Americans with Disabilities Act (ADA)?

The ADA defines a disability as a physical or mental impairment that substantially limits one or more major life activities.

How does type 2 diabetes qualify as a disability?

Type 2 diabetes can qualify as a disability under the ADA due to complications associated with the condition, such as neuropathy, vision impairment, and cardiovascular issues, which can significantly hinder daily functioning.

Can individuals with type 2 diabetes qualify for Social Security Disability Insurance (SSDI)?

Yes, the Social Security Administration (SSA) acknowledges type 2 diabetes as a condition that may qualify for SSDI if it significantly limits an individual's ability to work.

What evidence is needed to demonstrate eligibility for SSDI due to type 2 diabetes?

Individuals can demonstrate eligibility for SSDI by providing medical proof of complications from type 2 diabetes that restrict their work capacity.

What workplace adjustments can individuals with type 2 diabetes request?

Individuals with type 2 diabetes can request adjustments such as flexible work hours and modified responsibilities to help manage their health more effectively.

Why is it important to formally recognize type 2 diabetes as a disability?

Recognizing type 2 diabetes as a disability is crucial for individuals seeking workplace adjustments and access to essential benefits, as it helps them understand their rights and the impact of the condition on their daily tasks.