Overview

Receiving IRS certified mail can be daunting, but it’s important to remember that it serves as a formal notification about significant tax matters that need your attention, such as outstanding balances or audits. We understand that opening such correspondence can feel overwhelming. However, responding promptly can help clarify misunderstandings and prevent potential penalties.

By reaching out, you establish communication with the IRS, paving the way for more favorable outcomes. You're not alone in this journey; many people feel the same way when faced with tax-related issues.

Take a deep breath and consider the benefits of addressing these matters head-on. It’s common to feel anxious, but proactive steps can lead to resolution and peace of mind. Remember, we’re here to help you navigate this process.

Introduction

Receiving a letter from the IRS can instill a sense of dread, especially when it arrives as certified mail, which requires a signature upon delivery. We understand that this specialized form of communication often feels alarming and is frequently associated with serious tax matters. Many people wonder if certified mail from the IRS is always bad news. However, it’s important to recognize that these notifications can offer critical opportunities for taxpayers to address issues proactively and avoid escalating consequences.

What if, instead of viewing these letters with fear, individuals recognized them as a chance to clarify misunderstandings and protect their financial interests? You are not alone in this journey. We’re here to help you navigate these situations with confidence and care.

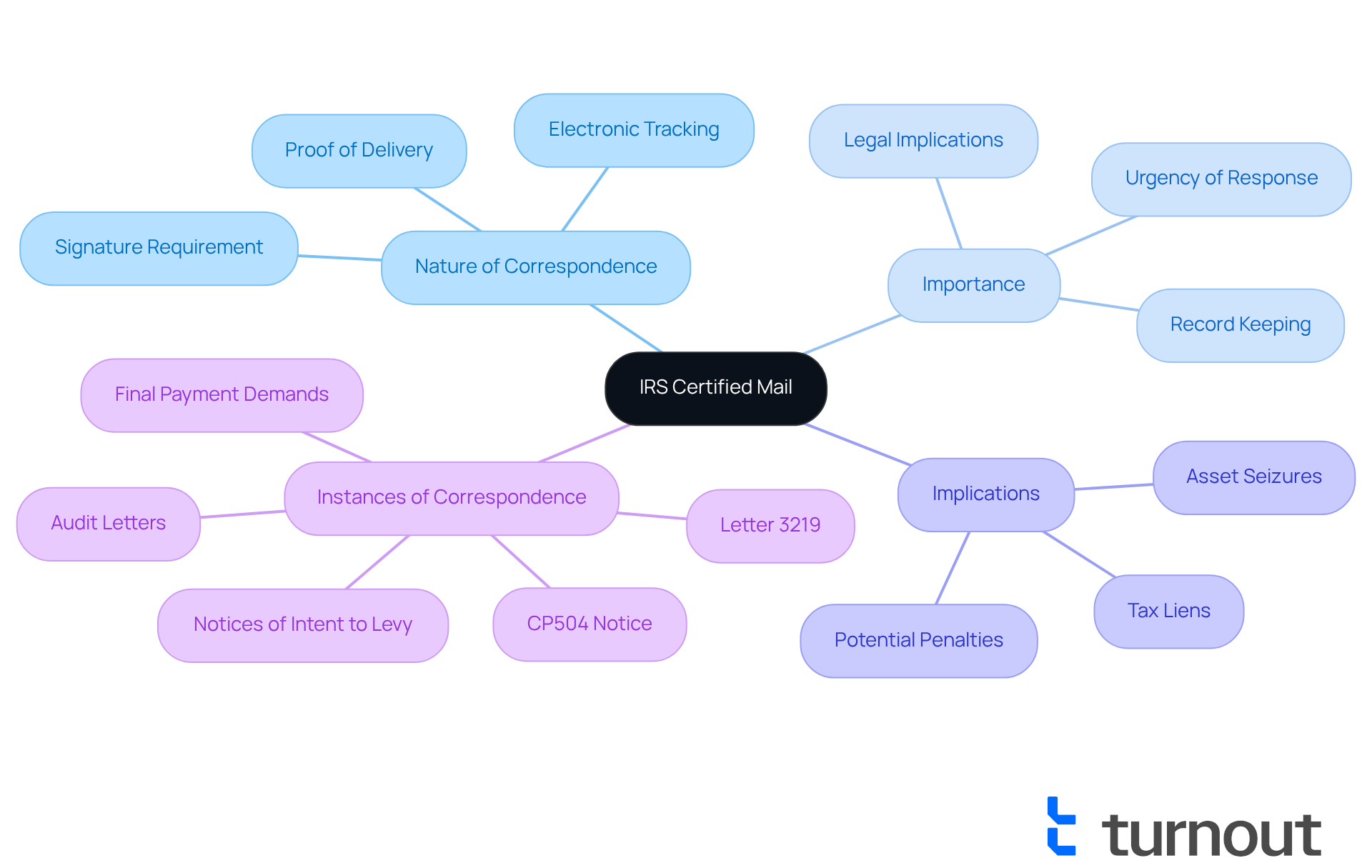

Understanding the Nature of IRS Certified Mail

IRS registered correspondence is a specialized form of communication that provides proof of delivery, distinguishing it from standard post. Unlike regular mail, registered delivery requires a signature upon arrival, confirming that the recipient acknowledges receipt. The IRS uses this method to share important information about tax obligations, compliance issues, or other significant matters.

We understand that registered correspondence may feel daunting. It's essential to recognize that this is not just typical communication; it serves as a formal notification. Acknowledging this can help you appreciate the urgency and significance of the contents within the envelope. While registered correspondence often carries serious implications, it raises the question: is certified mail from IRS always bad news? Each letter must be evaluated on its own merits.

In fact, the IRS sends out more than 160 million items each year, with a considerable portion dispatched through registered delivery to ensure that critical communications are received. Tax professionals emphasize the importance of understanding these notices, as timely responses can prevent further complications. For instance, receiving an official letter may indicate missed tax payments or an audit, which requires prompt attention to avert escalating collection efforts.

Instances of IRS authorized correspondence include:

- Notices of intent to levy

- Final payment demands

- Alerts regarding federal tax liens

Each of these necessitates swift action to mitigate possible repercussions. Remember, you are not alone in this journey; we’re here to help you navigate these communications with confidence.

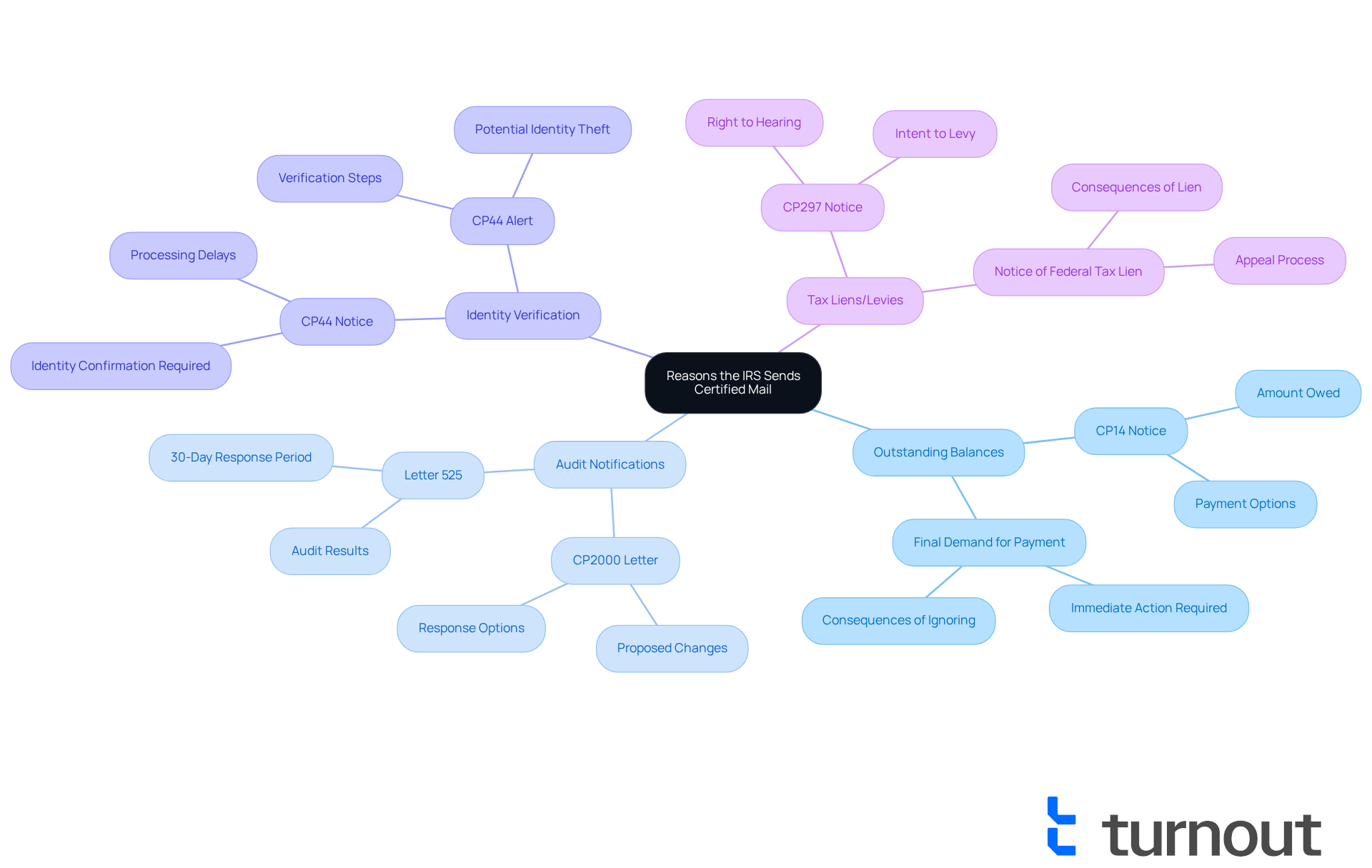

Reasons the IRS Sends Certified Mail

The IRS uses registered correspondence for several important communications, such as informing individuals about outstanding balances, requesting additional information, and notifying them of audits. Here are some common scenarios that you might encounter:

-

If you have outstanding balances, you may wonder if certified mail from the IRS is always bad. This notice prompts immediate action to avoid penalties and additional interest. It's common to feel overwhelmed by these notifications, but responding promptly can help prevent further fines.

-

Audit Notifications: Many people wonder if certified mail from IRS is always bad, as it often indicates that the IRS is conducting an audit. This requires you to provide essential documentation or clarification to resolve any discrepancies. For instance, a CP2000 letter may be sent to inform you of suggested changes to your tax liability based on third-party information. We understand that audits can be stressful, but addressing them head-on is crucial.

-

Identity Verification: If the IRS suspects identity theft or inconsistencies in tax filings, they may send authorized correspondence to confirm your identity. This step is vital, especially with the rise in IRS scam letters in 2025. Remember, verifying the authenticity of any certified correspondence you receive is important to protect yourself.

-

Many people wonder if certified mail from IRS is always bad, as it is frequently used to notify individuals of potential tax liens or levies, which can have serious financial implications if not addressed quickly. For example, a CP14 letter informs you of the amount owed and provides payment options. It's understandable to feel anxious about these matters, but timely responses can help you navigate them effectively.

Understanding these reasons is essential for anyone facing taxation issues. Timely responses can prevent further complications and ensure compliance with IRS requirements. Remember, opening and responding to official IRS correspondence promptly can help you avoid significant repercussions. You're not alone in this journey; we're here to help you every step of the way.

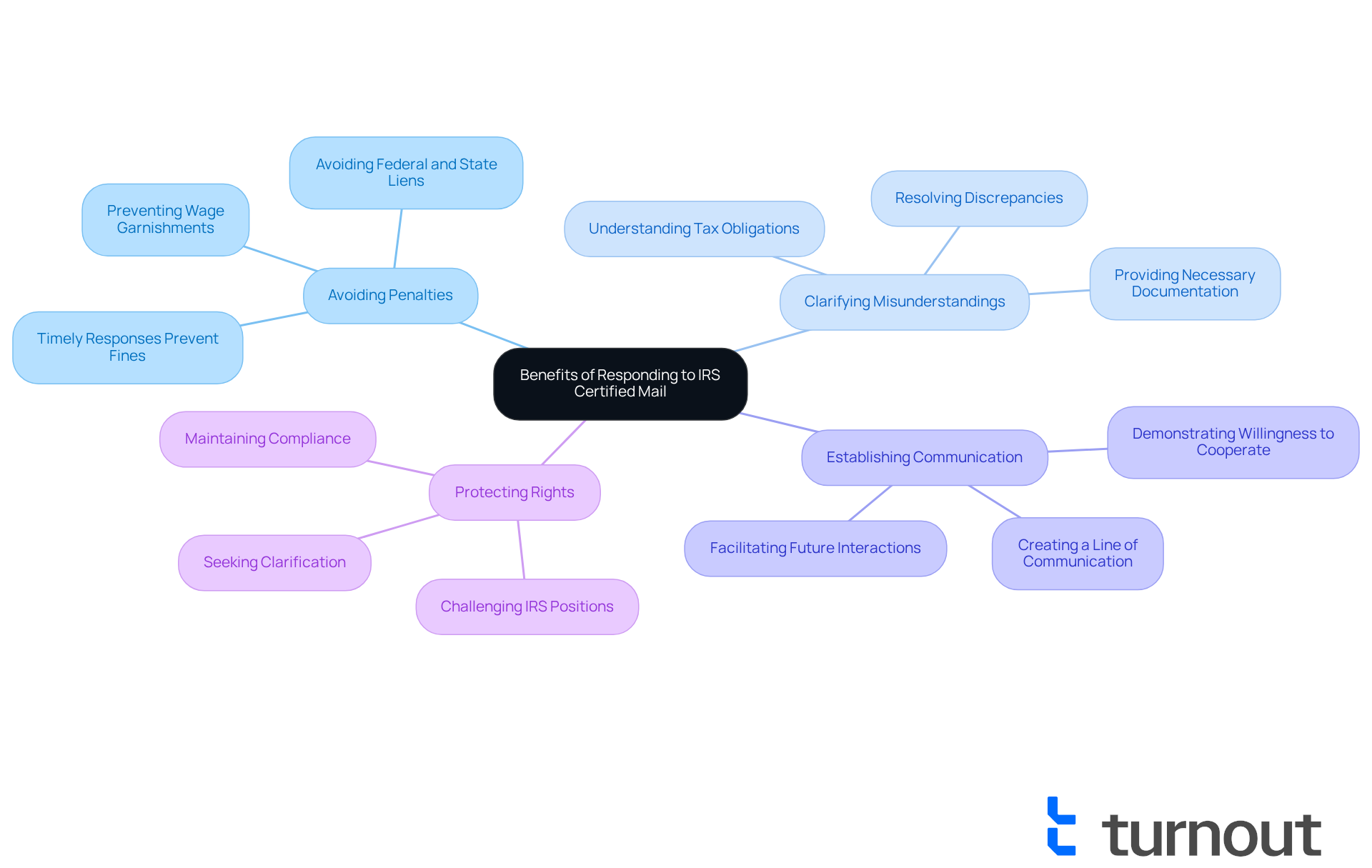

Potential Benefits of Responding to IRS Certified Mail

While many wonder if certified mail from the IRS is always bad, responding to it can offer several significant benefits for taxpayers, and we understand that navigating these communications can be daunting. Here are some reasons why it’s important to engage:

-

Avoiding Penalties: Timely responses can prevent additional fines or penalties that may arise from non-compliance or failure to address outstanding issues. Individuals who promptly respond to notices often evade increasing penalties, which can accumulate quickly if overlooked. Neglecting registered mail, especially if it is certified mail from IRS, can lead to serious repercussions, such as federal and state liens and potential wage garnishments.

-

Clarifying Misunderstandings: Interacting with the IRS can help clarify any misconceptions or discrepancies, potentially leading to a resolution that benefits you. Many individuals have successfully resolved issues simply by providing the necessary documentation or explanations in response to certified letters.

-

Establishing Communication: By responding, you can create a line of communication with the IRS, facilitating future interactions and negotiations regarding your tax situation. This proactive approach can result in more favorable outcomes, showing your willingness to cooperate and resolve issues.

-

Protecting Rights: Responding promptly ensures that you protect your rights and interests, especially in cases involving audits or disputes. You have the right to challenge IRS positions and seek clarification, which is crucial in maintaining compliance and avoiding further complications.

Overall, proactive engagement with IRS communications can clarify whether certified mail from the IRS is always bad, leading to more favorable outcomes and a clearer understanding of your tax obligations. Consulting with tax professionals can further enhance this process, ensuring that your responses are timely and effective. As Logan Allec, a CPA, emphasizes, "The IRS wants more information about your tax return," highlighting the importance of addressing these communications promptly. With the IRS dispatching over 160 million items annually, prompt replies are essential to prevent escalating problems. Remember, you are not alone in this journey; we're here to help you navigate these challenges.

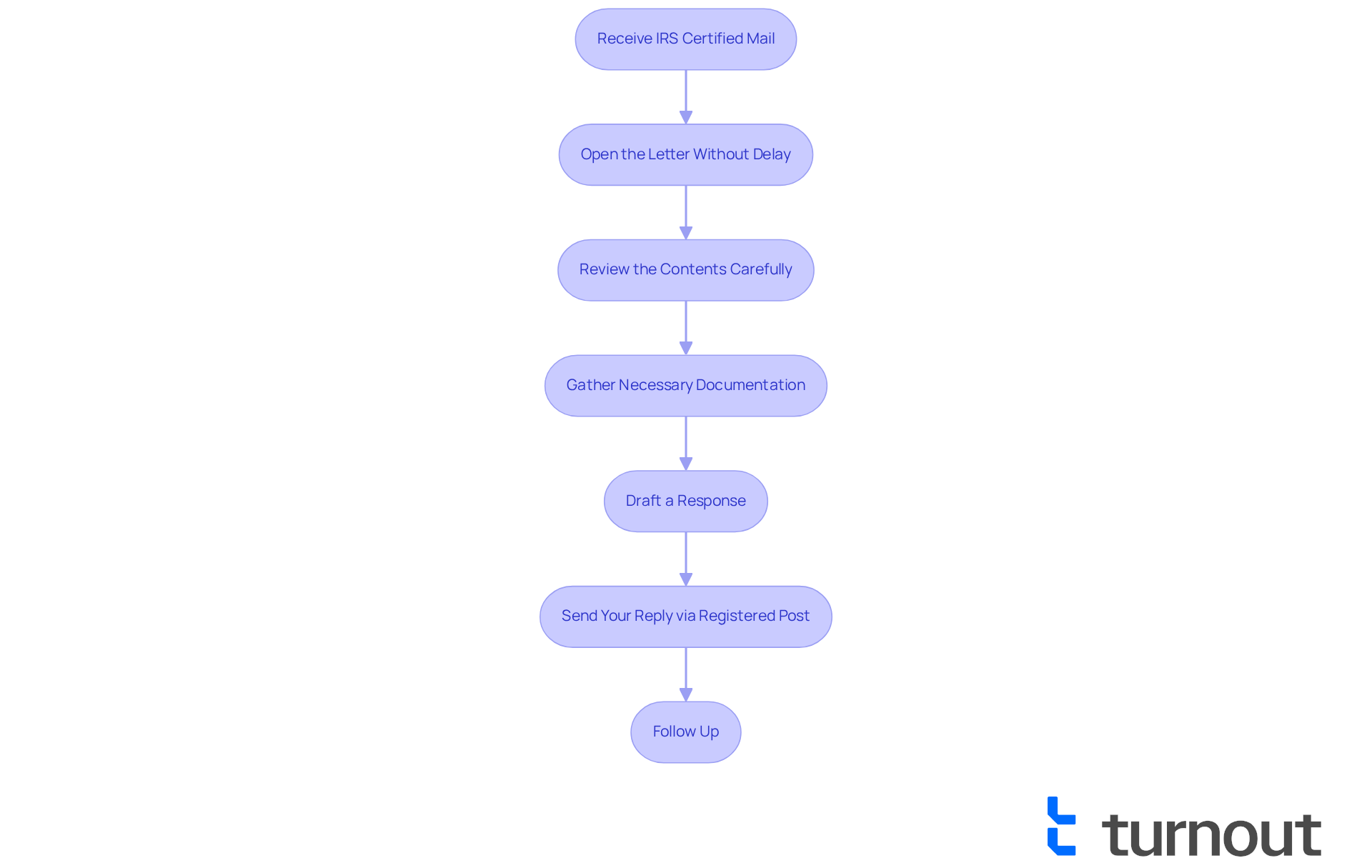

Navigating the Response Process to IRS Certified Mail

Navigating the response process to IRS certified mail can feel overwhelming, especially when considering if certified mail from the IRS is always bad, but we’re here to help. By following these key steps, you can manage your interactions with the IRS with confidence and care.

- Open the Letter Without Delay: Upon receiving registered correspondence, it’s important to open it swiftly. Understanding the contents and any deadlines involved is crucial.

- Review the Contents Carefully: Take your time to read the letter thoroughly. Note any specific requests or required actions. Ignoring these communications can lead to serious consequences, including wage garnishments and liens. Remember, disregarding IRS official correspondence can impact your financial well-being.

- Gather Necessary Documentation: If the letter requests information or documentation, gather the necessary materials to respond accurately. This preparation is vital to avoid penalties and ensure compliance.

- Draft a Response: Prepare a clear and concise response addressing the IRS's requests. Ensure that all required information is included. Timely and accurate responses can prevent escalation of issues. Acting quickly is essential to protect your interests.

- Send Your Reply via Registered Post: To keep a record of your communication, return your response to the IRS using registered post. This provides proof of your timely response and establishes a formal record of your interaction.

- Follow Up: After sending your response, consider following up with the IRS to confirm receipt and clarify any outstanding issues. This proactive approach can help mitigate potential complications and ensure that your concerns are addressed.

By following these steps, you can effectively manage your interactions with the IRS and reduce the risk of further complications. Consulting with a tax professional can also provide additional guidance tailored to your individual circumstances. Remember, you are not alone in this journey. A successful case study illustrates that the question of whether certified mail from the IRS is always bad can be addressed by a timely response, which led to the resolution of a tax issue without further penalties.

Conclusion

Receiving certified mail from the IRS can often evoke feelings of anxiety. However, it's important to remember that it is not inherently bad news. This form of communication serves as a formal notification that requires your attention and action. It is a critical means for the IRS to convey important information regarding your tax obligations and compliance issues. By recognizing the nature of this correspondence, you can demystify its purpose and encourage proactive engagement.

We understand that each letter you receive may carry different implications. It's essential to evaluate each one individually, as they can range from requests for additional information to notifications of audits or outstanding balances. Engaging with these communications promptly can prevent further complications, clarify misunderstandings, and establish a line of communication with the IRS. By addressing your concerns head-on, you can navigate your tax situation more effectively and avoid escalating issues.

In conclusion, understanding the true nature of IRS certified mail empowers you to take control of your financial responsibilities. Instead of fearing these letters, embracing a proactive approach can lead to positive outcomes. Whether it involves:

- Gathering documentation

- Drafting a timely response

- Consulting a tax professional

Taking action is vital. Remember, by doing so, you can protect your rights and interests, ensuring compliance and ultimately relieving the stress associated with IRS communications.

Frequently Asked Questions

What is IRS certified mail?

IRS certified mail, also known as registered correspondence, is a specialized form of communication that provides proof of delivery and requires a signature upon arrival, confirming that the recipient acknowledges receipt.

Why does the IRS use registered mail?

The IRS uses registered mail to share important information about tax obligations, compliance issues, or other significant matters, ensuring that critical communications are received.

Does receiving IRS certified mail always mean bad news?

Not necessarily. Each letter must be evaluated on its own merits, and while registered correspondence often carries serious implications, it does not always indicate negative news.

How many items does the IRS send out each year?

The IRS sends out more than 160 million items each year, with a significant portion dispatched through registered delivery.

What are some examples of IRS authorized correspondence?

Examples include notices of intent to levy, final payment demands, and alerts regarding federal tax liens.

What should I do if I receive IRS certified mail?

It is essential to understand the contents of the letter and respond promptly, as timely responses can prevent further complications, such as missed tax payments or audits.

How can I navigate communications from the IRS confidently?

Recognizing the urgency and significance of the contents within the envelope and seeking assistance can help you navigate these communications with confidence.