Overview

We understand that navigating the complexities of overtime pay can be challenging. While it's important to know that overtime pay is not taxed at a higher rate than regular wages, it can still lead to some unexpected outcomes. The additional earnings might push you into a higher tax bracket, which can increase your overall tax burden.

It's common to feel overwhelmed by the thought of how these changes affect your finances. Although the extra income is taxed at the same federal rates, the cumulative effect can elevate your tax bracket. This means that a larger percentage of your income could be subject to taxation.

Remember, you are not alone in this journey, and we’re here to help you understand these implications better. If you have concerns about your tax situation, consider reaching out for guidance. Together, we can navigate these waters and find the best path forward.

Introduction

Overtime pay is more than just extra income; it brings with it a complex web of tax implications that can affect your financial stability. We understand that many American workers are increasingly relying on those extra hours to cope with rising living costs. This makes it essential to grasp whether overtime pay is taxed at a higher rate. However, the reality is often more nuanced than it seems. While overtime earnings may not be taxed at a higher percentage, they can push you into elevated tax brackets, resulting in a greater overall tax burden.

How can you maximize your earnings while navigating the intricacies of overtime taxation? We're here to help you find the answers.

Define Overtime Pay and Its Importance

Overtime pay is more than just extra dollars; it raises the question of , as it represents the hard work you put in beyond your standard hours, typically over 40 hours in a workweek. Under the (FLSA), non-exempt workers are entitled to at least one and a half times their regular hourly pay for these additional hours. , particularly in relation to whether is overtime pay taxed higher, is crucial because it directly impacts your income and can significantly influence your overall financial well-being, especially if you rely on those extra hours to meet your financial obligations. By grasping how these hours are calculated, you empower yourself to and ensure you receive fair compensation, including knowing if overtime pay is taxed higher.

The importance of additional pay is especially relevant in 2025, particularly when considering if overtime pay is taxed higher, as many American workers face rising living costs and economic uncertainties. Labor economists emphasize that understanding how is overtime pay taxed higher can enhance your , allowing you to cover essential expenses, save for emergencies, and invest in your future. For instance, studies reveal that employees who regularly receive overtime pay often ask whether is overtime pay taxed higher, as they report greater financial security and experience less stress regarding their economic circumstances.

Real-life examples illustrate the positive effects of fair compensation on financial stability. Companies like Marks & Spencer have demonstrated that , including just compensation for extra hours, lead to increased productivity and reduced turnover. Their initiatives have resulted in productivity boosts of 20% to 61%, wage increases of 12% to 42%, an 85% decrease in absenteeism, and a 65% reduction in employee turnover. This clearly shows how fair compensation practices can benefit both employees and employers.

Moreover, the Ethical Trading Initiative (ETI) encourages its member companies to adhere to national laws and industry standards regarding working hours, highlighting the significance of fair pay in the workplace. Understanding how your extra hours are calculated helps you champion your rights and ensures you receive , especially in relation to whether is overtime pay taxed higher. As the work landscape continues to evolve, the importance of knowing if is overtime pay taxed higher remains a vital consideration for American workers striving for financial stability. Remember, you are not alone in this journey; we're here to help you navigate these challenges.

Explore Taxation Rules for Overtime Pay

Overtime pay is subject to the same federal income tax rates as regular wages. However, we understand that the can raise the question of whether , which may push a worker into a and lead to a greater percentage of their income being taxed. For instance, if your standard salary places you in the 12% tax tier, generating extra income through extended hours could elevate you to the 22% tier. It's important to note that while extra pay itself is not taxed at a higher rate, it raises the question of whether overtime pay is taxed higher, as the cumulative effect of increased earnings can result in a higher overall . Moreover, workers are required to contribute to payroll levies, such as and Medicare, on their additional earnings.

Tax specialists stress the significance of and additional hours earned to properly evaluate tax consequences. We know that navigating these details can feel overwhelming. The , effective from January 1, 2025, allows qualified workers to subtract up to $12,500 in eligible , enhancing the financial appeal of extra work. This exemption applies only to federal income tax, and the deduction phases out for individuals earning $150,000 and above. While the new law provides some relief, careful record-keeping is essential for compliance and potential audits. Employers must also adjust their payroll management and tax planning strategies due to these changes in how additional compensation is taxed. Remember, you are not alone in this journey; .

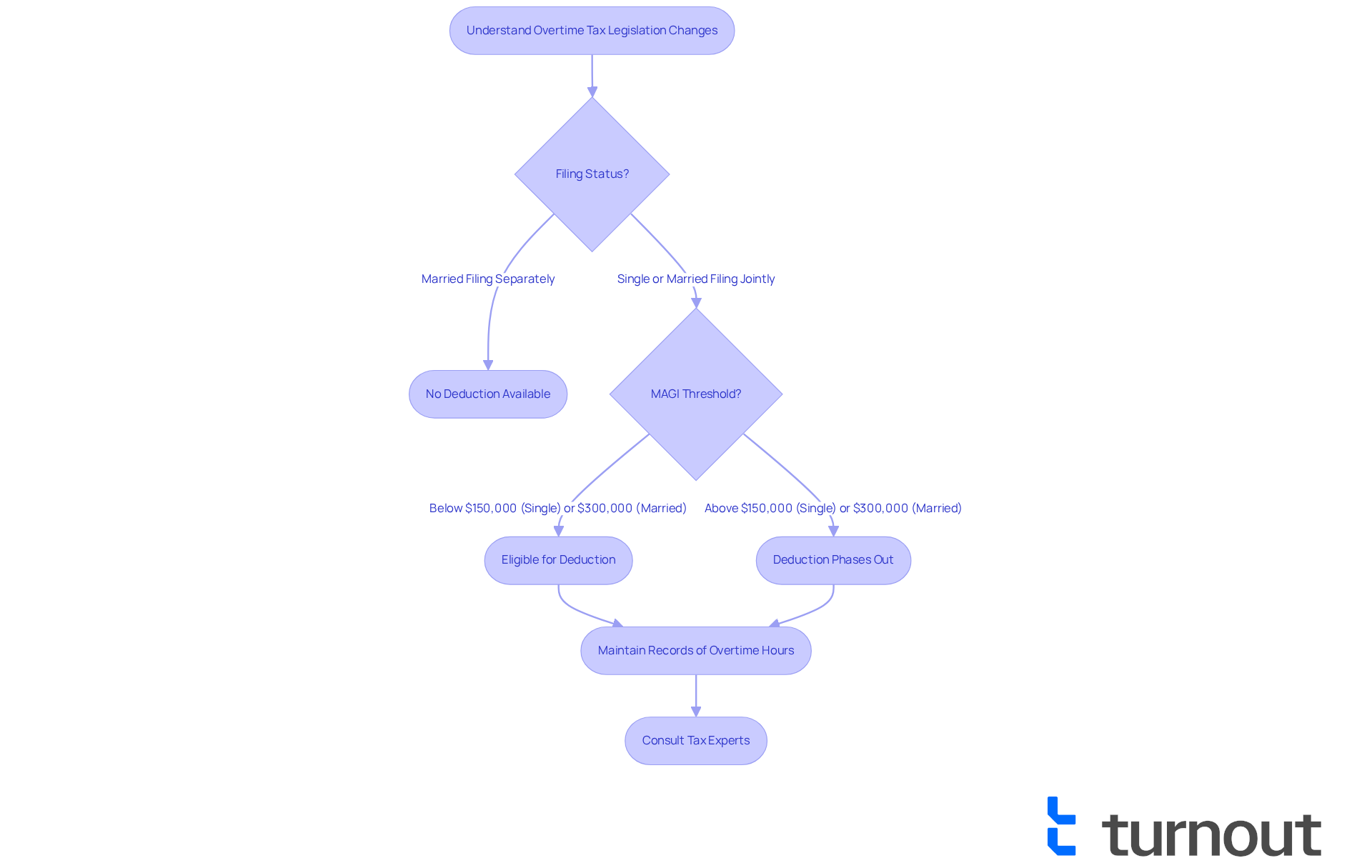

Analyze Recent Changes in Overtime Tax Legislation

Recent legislation, particularly the , has introduced important changes to extra work compensation and taxation. Starting January 1, 2025, qualified staff members will have the opportunity to subtract a portion of their extra work compensation from their taxable earnings—up to $12,500 for individuals and $25,000 for those filing jointly. However, it’s essential to understand that this deduction is not available for taxpayers who choose the Married Filing Separately status. Furthermore, the deduction begins to phase out for Modified Adjusted Gross Incomes (MAGI) starting at $150,000 for single filers and $300,000 for married filing jointly. This provision is designed to ease the on employees who rely on extra hours to boost their income, which leads to the question of . Yet, it's important to remember that workers must declare their total income, including extra hours, to determine if overtime pay is taxed higher when submitting their taxes. Staying informed about these changes is crucial for .

The One Big Beautiful Bill Act not only brings these deductions but also signifies a broader initiative to reform affecting workers. We understand that navigating these changes can be overwhelming, but analysts suggest that this legislation aims to help workers retain a larger portion of their earnings, promoting fair compensation practices. It’s vital to recognize that not all additional work hours are exempt from taxes; while considering if overtime pay is taxed higher, only qualifying extra wages under specific income limits may be free from federal income tax, although Social Security and Medicare taxes will still apply.

Due to these adjustments, staff members should maintain meticulous records of their extra hours and compensation to substantiate their deductions during an IRS audit. We recommend to fully grasp the implications of the additional hours deduction on your overall tax situation. Understanding the criteria for qualifying for the benefit is essential, as workers must be classified as non-exempt individuals (FLSA). Remember, you are not alone in this journey; we’re here to help you navigate these changes.

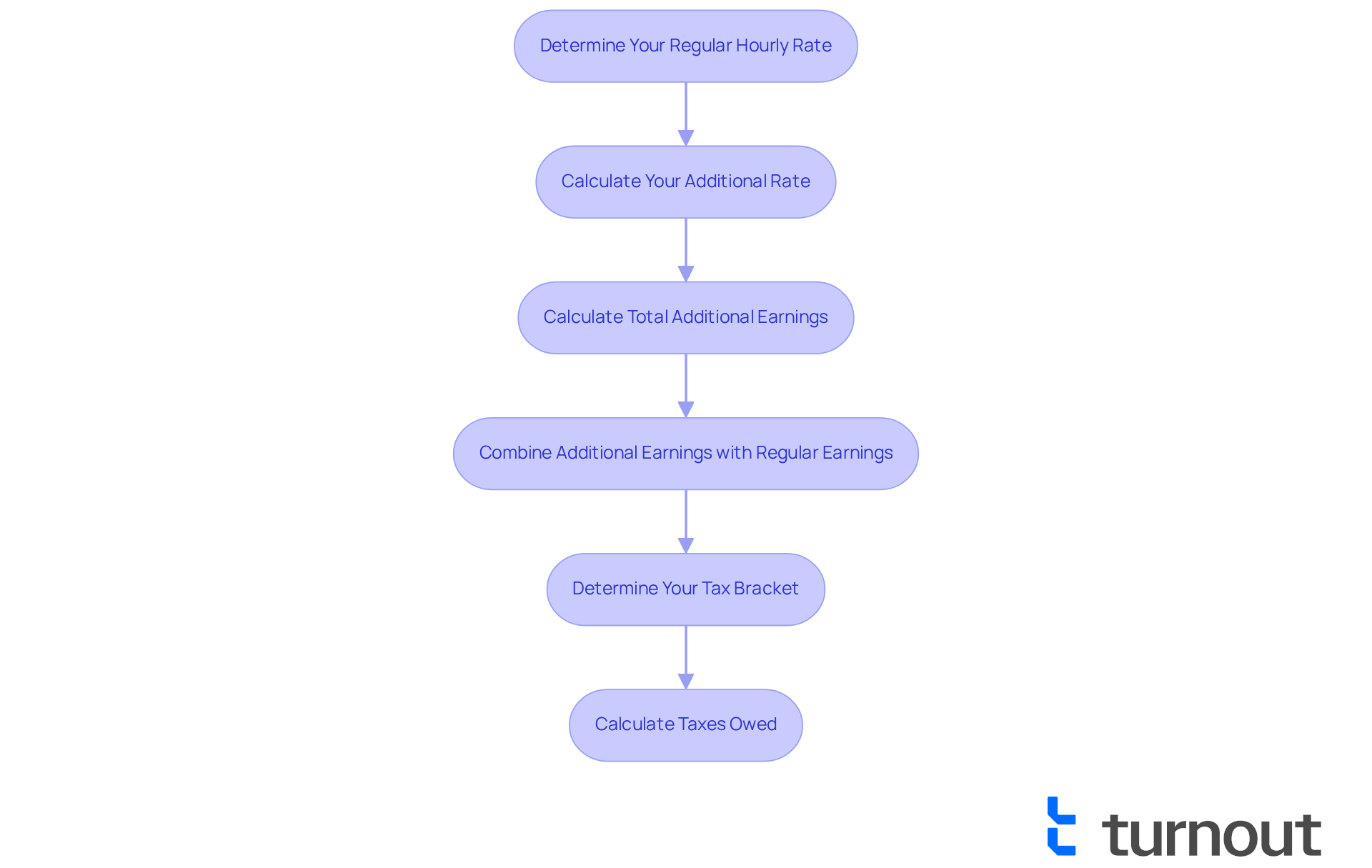

Calculate Overtime Taxes: A Step-by-Step Guide

Calculating taxes on your overtime pay can feel overwhelming, especially when considering if , but we're here to help you through it. By following these steps, you can gain clarity and confidence in managing your finances, especially when understanding if overtime pay is taxed higher.

- Determine Your Regular Hourly Rate: If you earn a salary, divide your annual salary by the number of hours you work in a year—typically around 2,080 hours for full-time employees. This will give you a clear starting point.

- : Multiply your regular hourly rate by 1.5. This is your extra pay rate for those additional hours you’ve put in.

- : Next, take your extra rate and multiply it by the number of extra hours worked. This helps you see how much more you’ve earned.

- Combine Additional Earnings with Regular Earnings: Now, merge your regular earnings with your additional earnings. This total income for the pay period is important for the next steps.

- : Refer to the IRS tax brackets to understand where your total income falls. Knowing this can ease your worries about tax time.

- : Finally, apply the appropriate tax rate to your total income to determine your tax liability. Don’t forget to consider any deductions you might be eligible for, such as the new extra hours deduction. This allows for a maximum yearly deduction of $12,500 for individuals and $25,000 for joint filers. Keep in mind that this deduction phases out for individuals with modified adjusted gross income over $75,000 and joint filers over $150,000.

By following these steps, you can gain a clearer understanding of how much tax you will owe on your extra earnings, specifically regarding whether overtime pay is taxed higher, and plan your finances accordingly. Looking ahead to 2025, the average additional pay rate for American workers is projected to be around $31.46/hour, reflecting a year-over-year rise of 3.70%. This increase may lead to larger tax refunds or reduced tax obligations when you file, thanks to the deduction for extra hours worked. It’s crucial to calculate your earnings accurately.

Additionally, can provide valuable insights into whether overtime pay is taxed higher and how it affects your overall tax situation. Remember, you are not alone in this journey, and seeking assistance can make a significant difference.

Conclusion

Understanding the intricacies of overtime pay and its taxation is essential for workers striving to maximize their earnings and achieve financial stability. While overtime pay is not taxed at a higher rate, it can elevate individuals into higher tax brackets, resulting in increased overall tax liabilities. This article has explored the significance of overtime pay, the relevant taxation rules, and recent legislative changes designed to offer relief for employees.

Key insights reveal the necessity of accurate record-keeping to navigate the complexities of overtime taxation, especially with new laws coming into effect in 2025. The introduction of deductions for extra work compensation under the One Big Beautiful Bill Act presents an opportunity for workers to retain more of their hard-earned income. By understanding these developments and accurately calculating their taxes, employees can better manage their financial situations and advocate for their rights in the workplace.

Ultimately, being informed about overtime pay and its tax implications is crucial for your financial well-being. As the landscape of work continues to evolve, we encourage you to stay updated on legislation and seek professional advice when needed. Embracing this knowledge not only empowers you to make informed decisions but also contributes to a fairer and more equitable workplace for all. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

What is overtime pay?

Overtime pay is the additional compensation earned by non-exempt workers for hours worked beyond the standard 40 hours in a workweek, typically calculated at a rate of at least one and a half times their regular hourly pay.

Why is understanding overtime pay important?

Understanding overtime pay is crucial because it directly impacts your income and financial well-being, especially if you rely on extra hours to meet financial obligations.

Is overtime pay taxed higher than regular pay?

The article raises the question of whether overtime pay is taxed higher, indicating that this is a common concern among workers, particularly regarding its impact on overall financial stability.

How does overtime pay affect financial stability?

Regularly receiving overtime pay can enhance financial stability, allowing employees to cover essential expenses, save for emergencies, and invest in their future.

What real-life examples illustrate the benefits of fair compensation?

Companies like Marks & Spencer have shown that ethical labor practices, including fair compensation for extra hours, lead to increased productivity, reduced turnover, and significant decreases in absenteeism.

What organization promotes fair pay and labor practices?

The Ethical Trading Initiative (ETI) encourages its member companies to adhere to national laws and industry standards regarding working hours, emphasizing the importance of fair pay in the workplace.

How can understanding overtime pay calculations empower workers?

By understanding how extra hours are calculated, workers can advocate for their rights and ensure they receive fair compensation for their hard work.