Overview

This article offers a compassionate, step-by-step guide on how to file for Social Security Disability Insurance (SSDI) online. We understand that navigating the application process can be overwhelming, which is why we detail everything from eligibility criteria to required documentation and follow-up procedures.

It's common to feel uncertain, but thorough preparation and proactive engagement can help you effectively manage the complexities and potential delays associated with SSDI claims. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) can indeed feel daunting. We understand that many individuals are grappling with the challenges of long-term medical conditions. With millions relying on this vital program for financial support, it’s crucial to understand how to effectively file for benefits online.

However, it’s common to face significant hurdles along the way, from determining eligibility to gathering the necessary documentation. How can you successfully maneuver through this intricate process and secure the assistance you desperately need?

Remember, you are not alone in this journey; we're here to help.

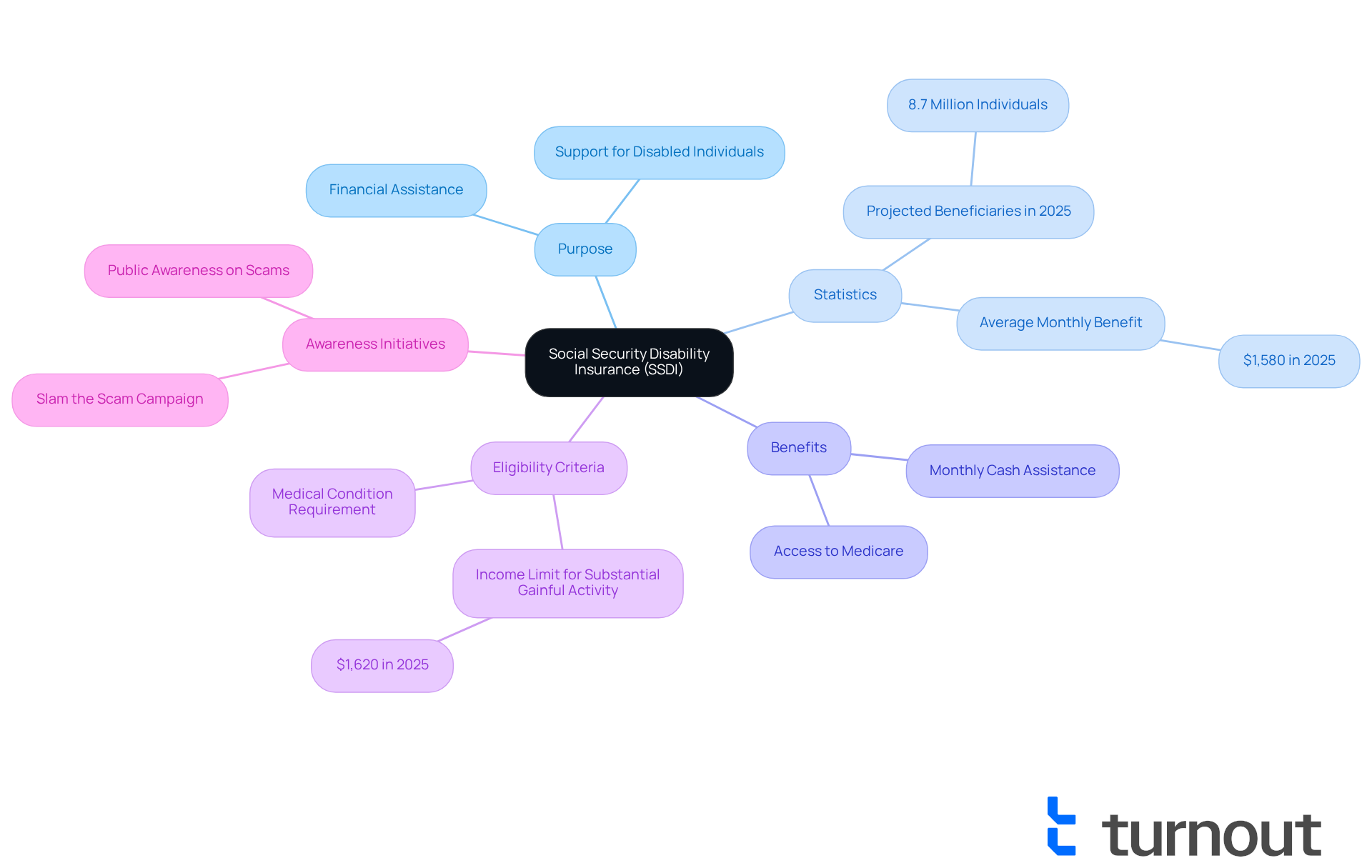

Understand Social Security Disability Insurance (SSDI)

Disability Insurance is an essential federal program that offers financial assistance to individuals unable to work due to a medical condition expected to last at least one year or lead to death. Funded through payroll taxes, this program is designed to assist those who have contributed to the Social Security system during their working years. Understanding the program's purpose and the advantages it provides is crucial for prospective applicants.

In 2025, more than 8.7 million individuals are anticipated to obtain disability benefits. This highlights the program's vital role in supporting those with disabilities. The average monthly benefit for disabled workers is expected to rise to $1,580, thanks to a 2.5% cost-of-living adjustment (COLA). This increase is significant for many, as it helps cover living expenses and provides a measure of financial stability.

Social Security Disability Insurance offers not only monthly cash assistance but also access to Medicare after a waiting period, which is essential for managing healthcare expenses. Many recipients have shared success stories about how Social Security Disability Insurance has transformed their lives, allowing them to focus on recovery and wellness rather than financial stress.

Supporters emphasize that Social Security Disability Insurance serves as a lifeline for individuals unable to engage in substantial gainful activity due to their medical conditions. As eligibility criteria evolve, understanding these changes is vital for applicants navigating the system. In 2025, the income limit for substantial gainful activity will be $1,620 for individuals with disabilities other than blindness, ensuring that those who qualify can receive the support they need.

It's important for potential applicants to be aware of scams related to Social Security. The "Slam the Scam" initiative raises public awareness about government imposter scams, which is a genuine concern for the target audience. Overall, the program serves as a crucial safety net, offering not just financial support but also hope and security for millions of Americans facing difficult situations. With Turnout's guidance, the process becomes more accessible, reminding you that you are not alone in this journey.

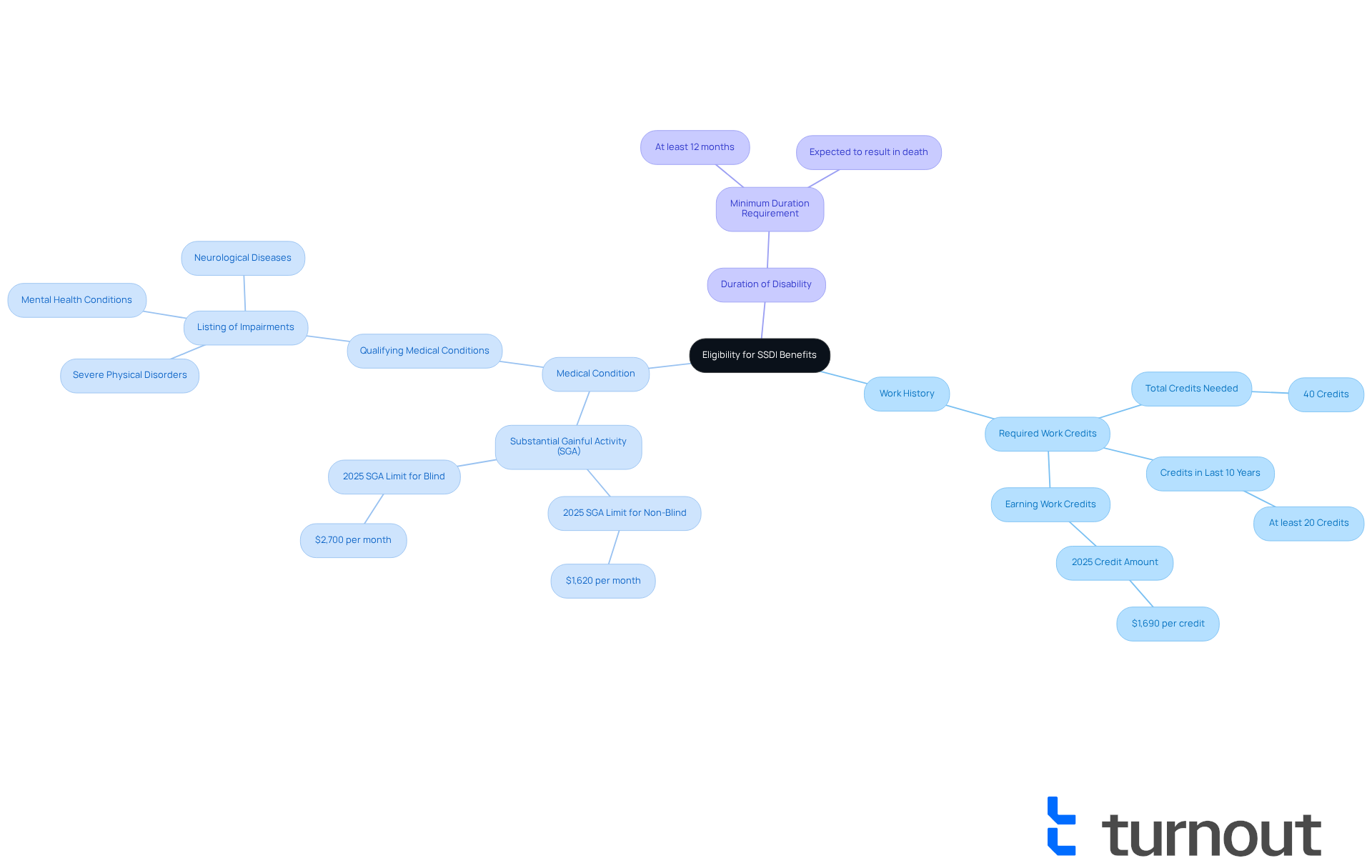

Determine Eligibility for SSDI Benefits

To qualify for SSDI benefits, you must meet specific criteria that can feel overwhelming. Let's break it down together:

- Work History: You need to have been employed in positions covered by social insurance and accumulated adequate work credits. Generally, this means you require 40 credits, with at least 20 earned in the last 10 years. In 2025, one work credit is earned for every $1,690 in wages or self-employment income. This highlights the importance of maintaining a consistent work history.

- Medical Condition: Your condition must be severe enough to prevent you from engaging in substantial gainful activity (SGA). For 2025, the SGA threshold is set at $1,620 per month for non-blind individuals and $2,700 for those who are statutorily blind. This means you cannot perform any work that pays above these limits.

- Duration of Disability: It’s essential that your disability is expected to last at least 12 months or result in death. This requirement ensures that only those with long-term disabilities qualify for benefits.

It's important to note that roughly two-thirds of initial disability benefit requests are rejected. This statistic underscores the challenges many face in meeting these requirements. However, real-life examples show that individuals with conditions such as cancer, heart disease, and mental health disorders have successfully qualified for benefits. They did this by providing comprehensive medical evidence and demonstrating how their disabilities impact their ability to work.

To evaluate your eligibility, consider using the Administration's (SSA) online resources to file social security disability online. Alternatively, consulting with informed advocates can provide clarity regarding your situation and assist you in how to file social security disability online. Remember, you are not alone in this journey; we’re here to help you navigate these challenges.

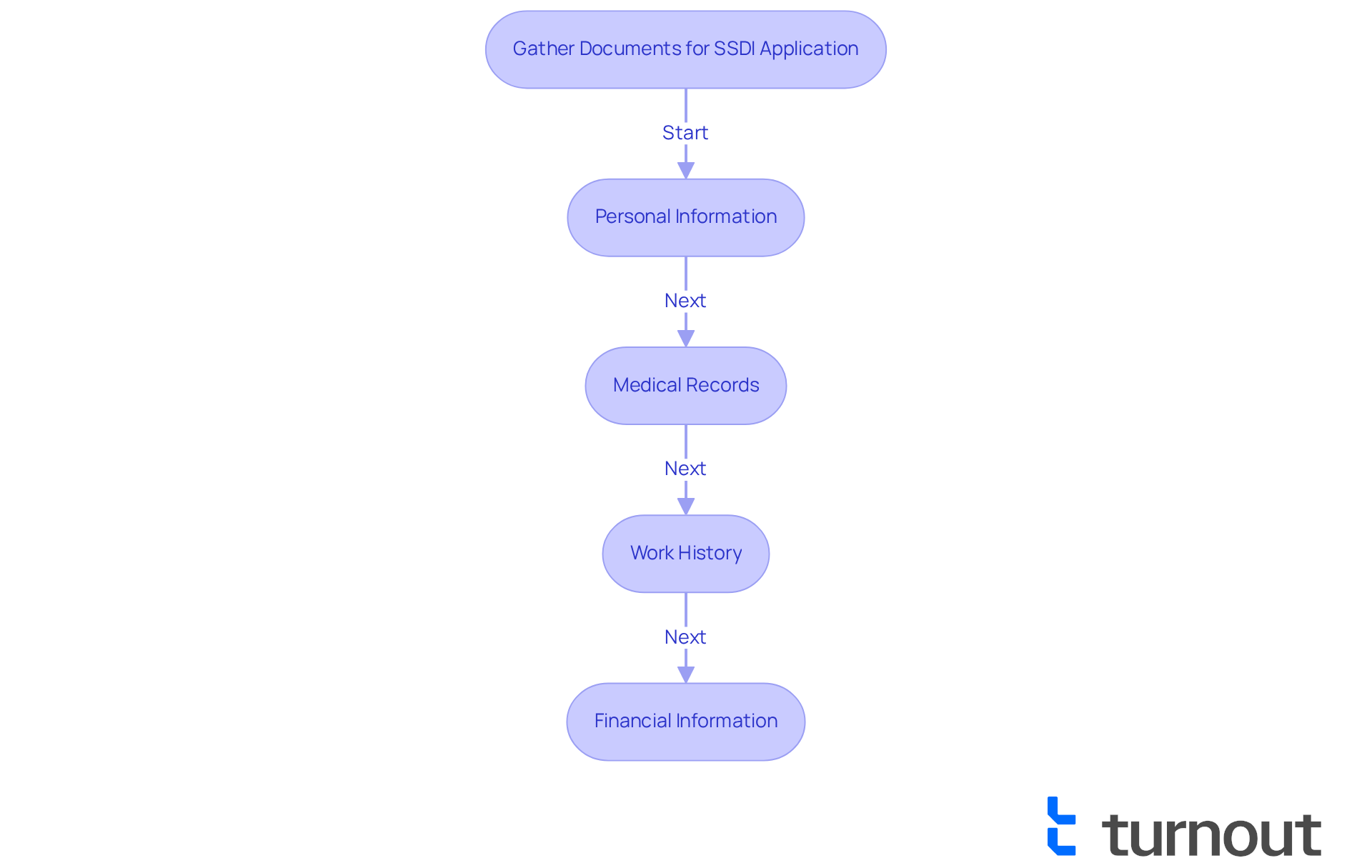

Gather Required Documentation for Your Application

Before you file social security disability online, we understand how overwhelming the SSDI application process can feel. Gathering the right documents is crucial, and we’re here to help you through it. Here are the essential documents you’ll need:

- Personal Information: This includes your Social Security number, birth certificate, and proof of U.S. citizenship or lawful alien status.

- Medical Records: It’s important to obtain detailed medical documentation from your healthcare providers. This should outline your condition, treatment history, and how it affects your ability to work. Remember, many SSDI requests are rejected due to insufficient documentation, so having strong medical evidence is vital.

- Work History: Prepare a list of jobs you’ve held over the past 15 years. Include the names of employers, dates of employment, and job descriptions. This information is necessary for assessing your work history.

- Financial Information: Document any income, assets, and resources, as this may be relevant for determining your eligibility.

By preparing these documents, you’ll simplify the submission process and help ensure that you can file social security disability online without unnecessary delays. While Turnout is not a law firm and does not provide legal representation, we offer access to trained nonlawyer advocates who can assist you in navigating the SSD claims process. You are not alone in this journey; we are here to support you in compiling your documentation effectively.

Please be aware that the Social Security Administration (SSA) is currently experiencing staffing shortages, which may lead to longer wait times for processing requests. Therefore, submitting a comprehensive request with all necessary documentation is essential to prevent potential delays.

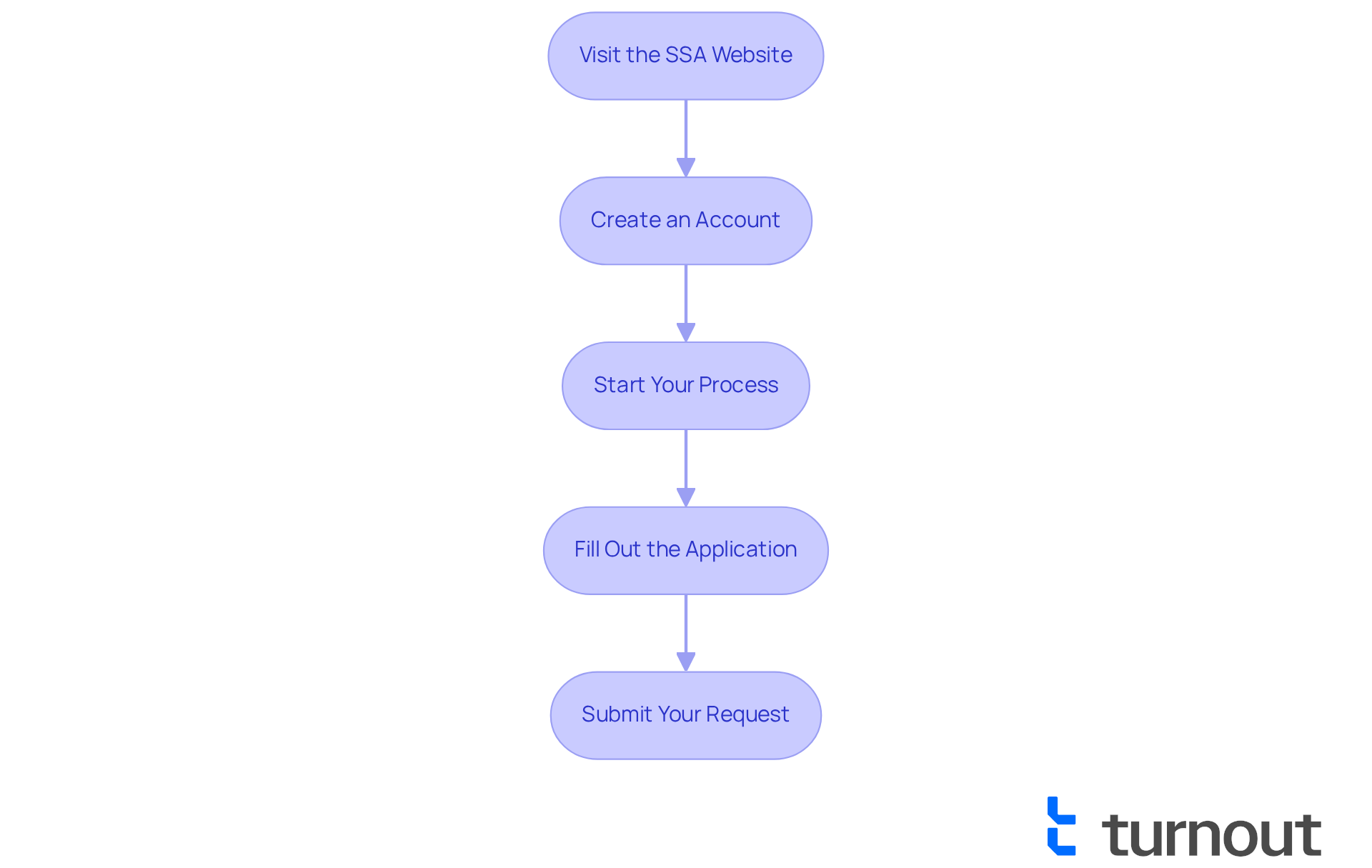

Complete the Online SSDI Application Process

[Filing your SSDI application](https://usafacts.org/data-projects/disability-benefit-process) can feel overwhelming, but we're here to help you file social security disability online every step of the way. Follow these simple steps to make the process easier:

- Visit the SSA Website: Begin by going to www.ssa.gov/disability.

- Create an Account: If you don’t have a personal my Social Security account yet, take a moment to create one. This will allow you to save your progress and return to it whenever you need.

- Start Your Process: Select 'Apply for Disability Benefits' and follow the prompts to initiate your request.

- Fill Out the Application: Provide all required information, including personal details, work history, and medical information. Being thorough and accurate is key to avoiding delays.

- Submit Your Request: Once you’ve reviewed your request for completeness and accuracy, send it electronically. You will receive a confirmation once your request is submitted.

Filing the form online is not only the quickest method but also allows you to file social security disability online from the comfort of your own home. We understand that recent changes to the online submission process have made it more user-friendly, but some applicants still encounter challenges, such as system outages and identity verification issues. Many individuals have successfully navigated the process to file social security disability online, emphasizing the convenience and speed as significant advantages.

Advocates emphasize that individuals can significantly reduce wait times by choosing to file social security disability online, as these times have increased dramatically in recent years. Currently, applicants average over seven months for a decision. By establishing a my Benefits account, you can simplify your request process and stay updated on your case status. Remember, while Turnout provides support through trained nonlawyer advocates, they do not offer legal representation or legal advice. This ensures you have the guidance needed to navigate the SSD claims process effectively. You are not alone in this journey; we’re here to support you.

Follow Up on Your SSDI Application Status

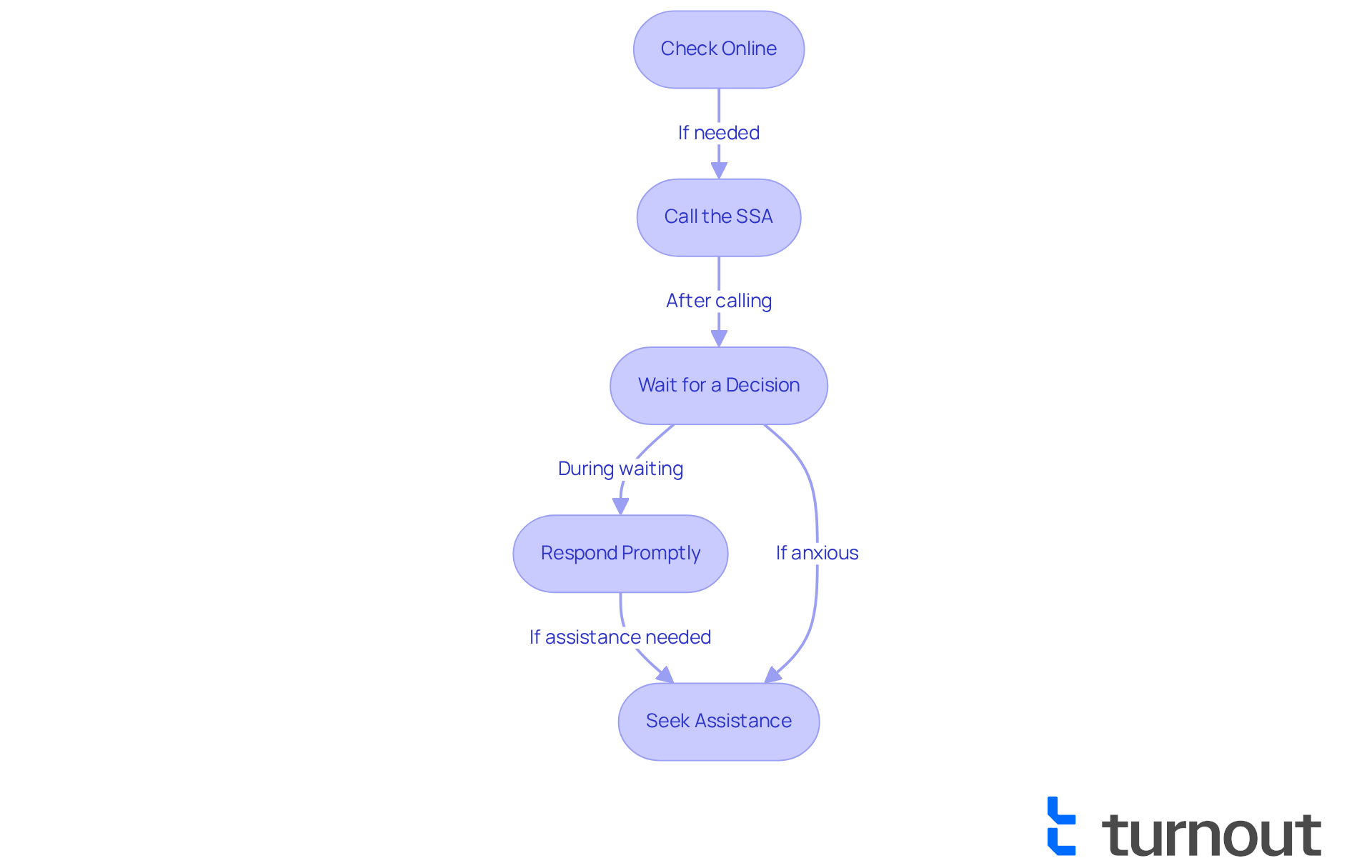

After submitting your SSDI request, following up is essential to ensure it is being processed efficiently. We understand that this can be a stressful time, and staying informed is crucial. Here’s how you can keep track of your application:

- Check Online: Log into your account to view the status of your request. This is the quickest way to get updates and can ease your mind.

- Call the SSA: If you prefer to speak with someone, you can call the SSA at 1-800-772-1213. Be prepared to provide your Social Security number and other identifying information, as this will help expedite your inquiry.

- Wait for a Decision: It's common to feel anxious during this waiting period. Usually, it takes more than 225 days to receive a verdict regarding your request—over seven months. If you haven’t heard back within this timeframe, we encourage you to check your status.

- Respond Promptly: If the SSA requests additional information or documentation, please respond as quickly as possible. This proactive approach can prevent delays in processing your claim.

Statistics indicate that approximately three out of five applicants are denied benefits after waiting over seven months for an initial decision. This highlights the importance of being proactive. Consistently reviewing your status can assist in recognizing any problems early, such as the need for extra information or possible errors that could delay the claim process.

At Turnout, we're here to assist you in navigating this complex process. By employing skilled nonlawyer advocates, we offer assistance customized to your needs, ensuring you receive the guidance necessary to follow up efficiently on your SSDI request. Staying engaged with your application can significantly reduce the time it takes to receive your benefits, especially given the current backlog of over 1.15 million pending applications as of November 2023. The financial strain of waiting for a decision can be considerable, making it even more essential to actively track your claim. Remember, you are not alone in this journey; we are here to help.

Conclusion

Filing for Social Security Disability Insurance (SSDI) can indeed feel overwhelming. However, by understanding the steps involved and the support available, you can make this journey much more manageable. This guide highlights the importance of SSDI as a vital financial resource for individuals unable to work due to long-term disabilities. It emphasizes the program's role in providing both monetary assistance and access to healthcare through Medicare.

We understand that navigating eligibility requirements can be challenging. These requirements depend on your work history, the severity and duration of your medical condition, and the importance of gathering comprehensive documentation. Thankfully, the process of filing an application online has been simplified, allowing you to navigate it more easily. Remember, following up on your application status is crucial to avoid delays. With the right preparation and support, you can enhance your chances of a successful application.

Ultimately, you do not have to face the journey to secure SSDI benefits alone. By leveraging available resources, staying informed about the application process, and remaining proactive in your follow-ups, you can navigate the complexities of the system more effectively. It is vital to take action, gather the necessary documentation, and seek assistance when needed. You deserve support, and with the right steps, you can obtain it without unnecessary stress.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

SSDI is a federal program that provides financial assistance to individuals who are unable to work due to a medical condition expected to last at least one year or lead to death. It is funded through payroll taxes and is designed to assist those who have contributed to the Social Security system during their working years.

How many individuals are expected to receive SSDI benefits in 2025?

In 2025, more than 8.7 million individuals are anticipated to obtain disability benefits from the program.

What is the average monthly benefit for disabled workers in 2025?

The average monthly benefit for disabled workers is expected to rise to $1,580 in 2025, thanks to a 2.5% cost-of-living adjustment (COLA).

What additional benefits does SSDI provide besides cash assistance?

SSDI provides access to Medicare after a waiting period, which is essential for managing healthcare expenses.

What are the eligibility criteria for SSDI benefits?

To qualify for SSDI benefits, you must meet the following criteria: 1. Work History: You need 40 work credits, with at least 20 earned in the last 10 years. 2. Medical Condition: Your condition must prevent you from engaging in substantial gainful activity (SGA), which is set at $1,620 per month for non-blind individuals in 2025. 3. Duration of Disability: Your disability must be expected to last at least 12 months or result in death.

What is the SGA threshold for individuals who are statutorily blind in 2025?

The SGA threshold for individuals who are statutorily blind is set at $2,700 per month in 2025.

What percentage of initial SSDI benefit requests are rejected?

Approximately two-thirds of initial disability benefit requests are rejected, highlighting the challenges many face in meeting the eligibility requirements.

What types of conditions have successfully qualified for SSDI benefits?

Individuals with conditions such as cancer, heart disease, and mental health disorders have successfully qualified for benefits by providing comprehensive medical evidence demonstrating how their disabilities impact their ability to work.

How can potential applicants evaluate their eligibility for SSDI?

Potential applicants can evaluate their eligibility by using the Social Security Administration's online resources or consulting with informed advocates who can assist them in the application process.

What initiative raises awareness about scams related to Social Security?

The "Slam the Scam" initiative raises public awareness about government imposter scams, which is a concern for individuals looking into SSDI benefits.