Overview

Navigating tax debt can feel overwhelming, but there are relief options available to help you. This article outlines essential steps, highlighting programs like Offer in Compromise and penalty abatement, which allow you to settle your debts for less than what you owe. We understand that you may be feeling anxious about your financial situation, and we are here to guide you through this process.

In this article, you will find detailed guidance on:

- Eligibility criteria

- Application processes

- Troubleshooting common issues

By equipping yourself with this knowledge, you can effectively seek tax debt forgiveness and take control of your financial future. Remember, you are not alone in this journey; many individuals have successfully navigated these options with the right support.

We encourage you to take the first step towards relief. Explore these programs and see how they can work for you. Together, we can find a way to ease your tax burdens and move forward with confidence.

Introduction

Facing tax debt can feel like navigating a labyrinth of stress and uncertainty. We understand that this journey can be overwhelming, but the path to relief is more accessible than many realize. Understanding tax debt forgiveness programs offers a lifeline for those burdened by financial obligations, allowing them to settle their debts for less than what they owe.

However, it's common to feel confused by the intricacies of eligibility criteria and potential impacts on credit. What steps must be taken to successfully navigate this complex terrain? This guide will explore the essential processes and options available for achieving tax debt forgiveness. Together, we can empower you to take control of your financial future.

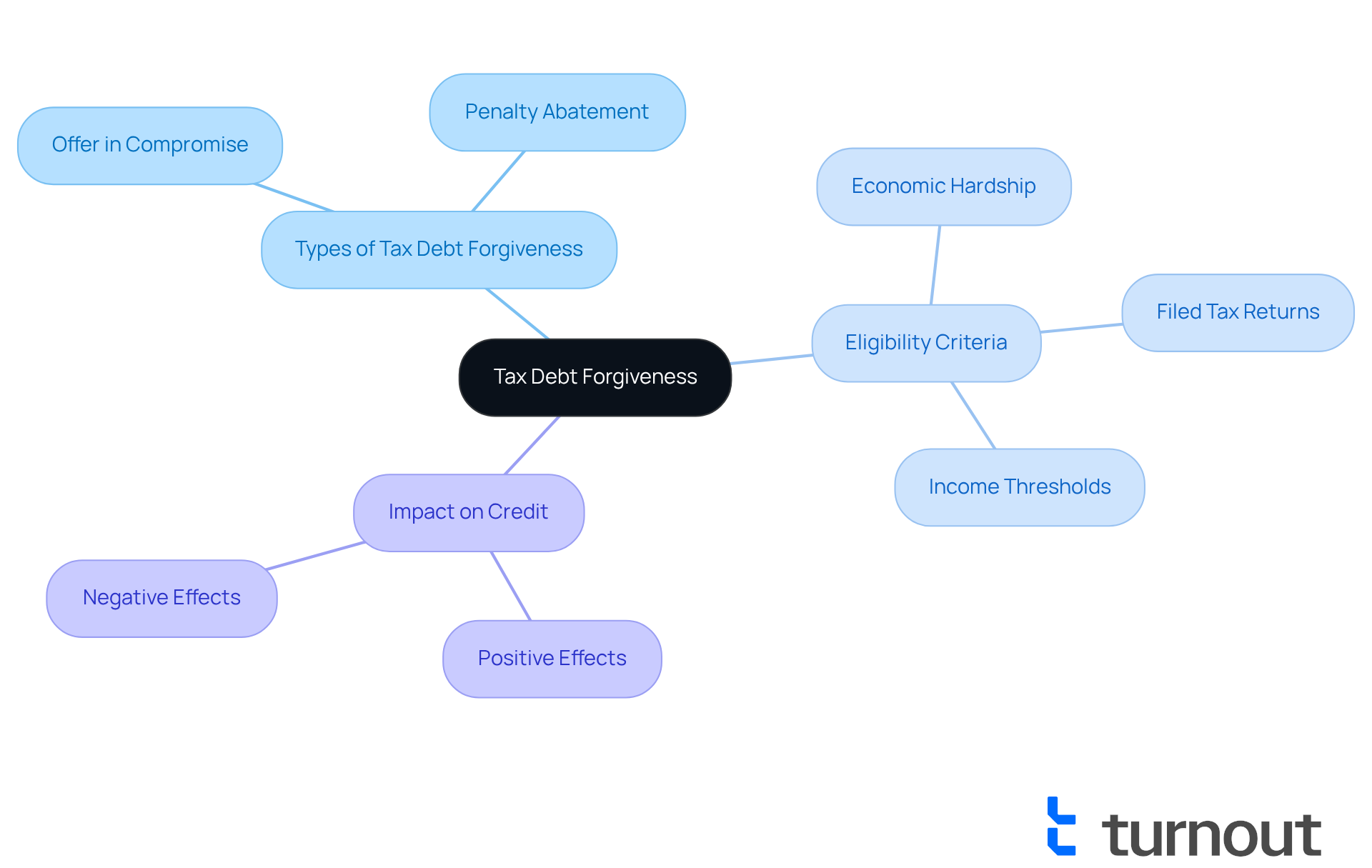

Understand Tax Debt Forgiveness

Programs that forgive tax debt allow taxpayers to settle their debts for less than the full amount owed. We understand that facing tax liabilities can be overwhelming, and grasping this concept is essential for anyone in such a situation. Here are some key points to consider:

- Types of Tax Debt Forgiveness: Common programs include the Offer in Compromise (OIC), which enables taxpayers to negotiate a lower payment based on their financial situation, and penalty abatement, which can remove penalties for first-time offenders.

- Eligibility Criteria: To qualify to forgive tax debt, taxpayers typically need to demonstrate economic hardship, have filed all required tax returns, and may need to meet specific income thresholds. It's common to feel uncertain about meeting these criteria, but there is support available.

- Impact on Credit: While to forgive tax debt can relieve financial burdens, it may also have implications for credit scores. Understanding these effects is crucial as you navigate your options.

By grasping these fundamentals, you can better navigate your options to forgive tax debt. Remember, you're not alone in this journey, and we're here to help you explore the possibilities.

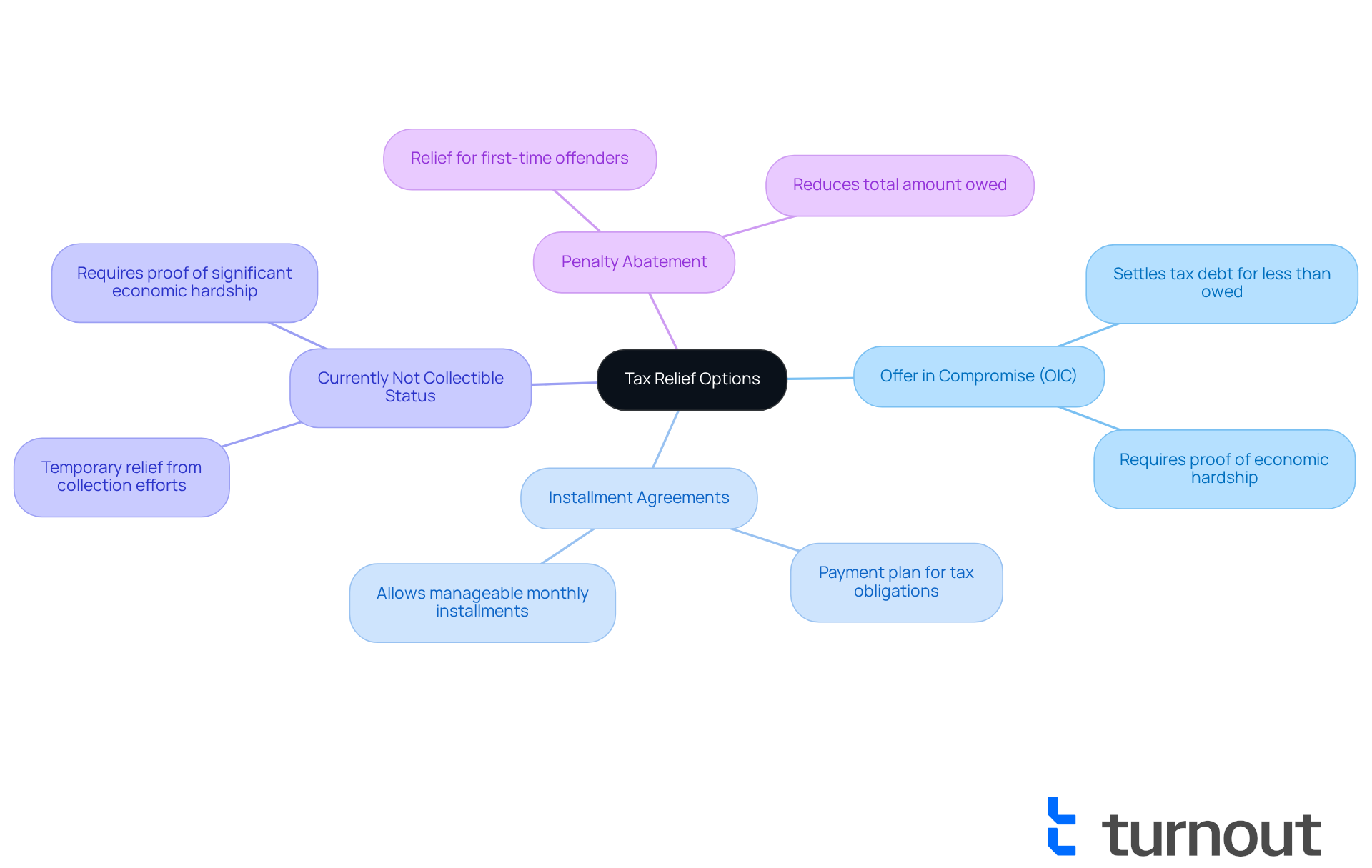

Explore Available Relief Options

If you're facing tax liabilities, know that you're not alone. There are several relief options available that can help ease your burden. Let's explore some of the most common ones together:

- Offer in Compromise (OIC): This program allows you to settle your tax debt for less than the total amount owed. To apply, you'll need to demonstrate that paying the full amount would create economic hardship for you.

- Installment Agreements: If you're unable to pay your tax obligation in full, you may qualify for a payment plan. This allows you to settle your balance in manageable monthly installments, making it easier on your finances.

- Currently Not Collectible Status: If you’re experiencing significant economic hardship, you can request the IRS to forgive tax debt and temporarily stop collection efforts. While this status doesn't remove your obligation, it can provide you with much-needed temporary relief.

- Penalty Abatement: If you have a clean compliance history, you might qualify for penalty relief as a first-time offender. This can significantly reduce the total amount you owe, giving you a fresh start.

We understand that navigating these options can feel overwhelming. Researching each of these relief programs thoroughly will empower you to find the one that aligns best with your financial situation. Remember, we're here to help you through this journey.

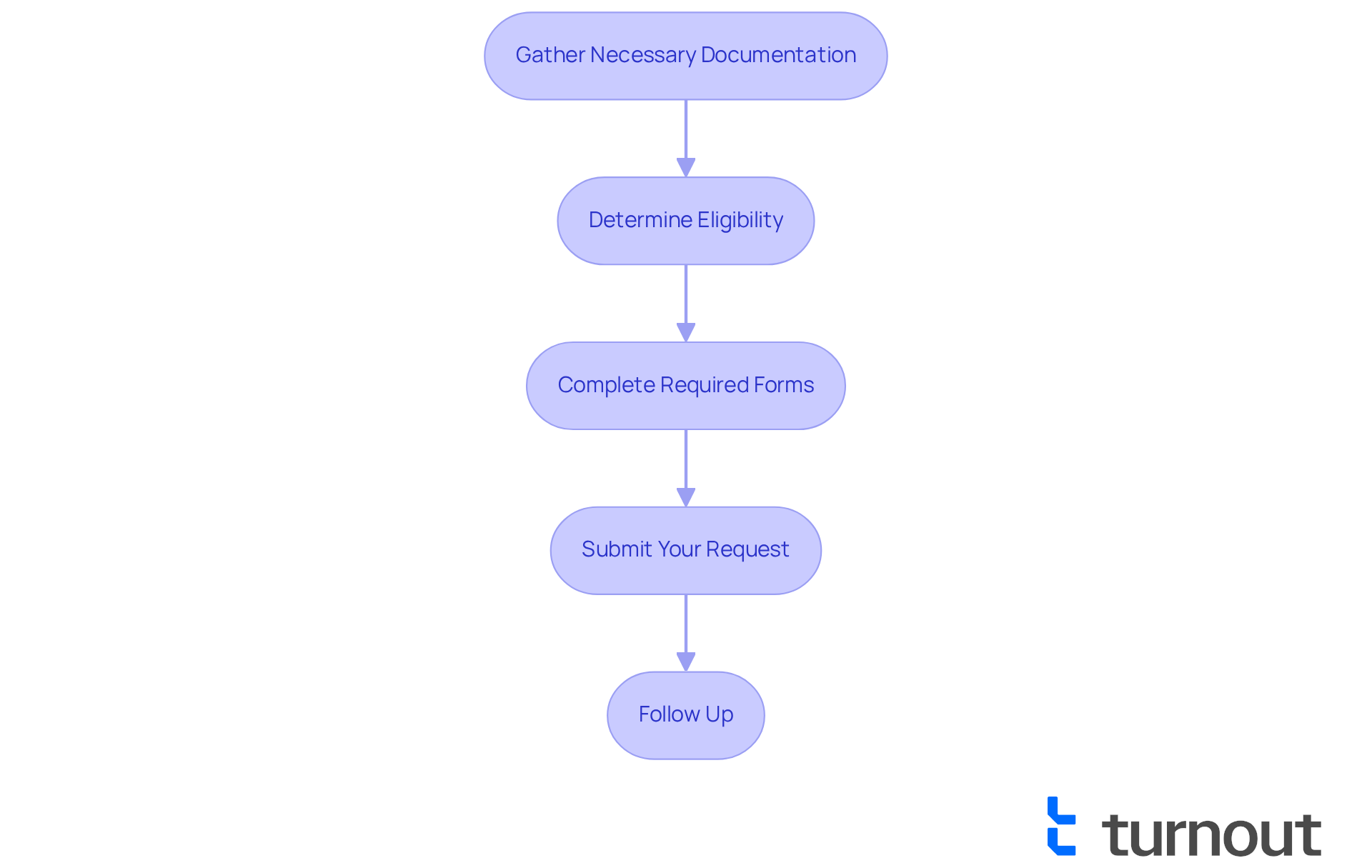

Apply for Tax Debt Forgiveness

Applying for [forgiveness of tax debt](https://blog.turnout.co/10-essential-tips-to-maximize-your-group-tax-benefits) can feel overwhelming, but we're here to help you through each step of the process. Follow this guide to ensure a smooth application experience:

- Gather Necessary Documentation: Start by collecting all relevant monetary documents, such as income statements, bank statements, and tax returns. This information is crucial for demonstrating your financial situation and can ease your worries.

- Determine Eligibility: It’s common to wonder if you qualify. Use the IRS's Offer in Compromise Pre-Qualifier tool to assess your eligibility for the OIC program. This tool will guide you in understanding if you meet the necessary criteria.

- Complete Required Forms: Filling out forms can be daunting, but take your time with Form 656 for the OIC and Form 433-A (OIC) for individuals. Make sure all information is accurate and complete to avoid any delays.

- Submit Your Request: Once you've filled out the forms, send them along with the fee (if applicable) to the IRS. Remember to keep copies of everything you submit for your records—this will help you stay organized and reduce stress.

- Follow Up: After submission, it’s important to keep track of the status of your request. The IRS may ask for additional information, so be prepared to respond promptly. We understand that waiting can be tough, but staying proactive is key.

By adhering to these steps, you can successfully manage the process to forgive tax debt. Remember, you are not alone in this journey; we’re here to support you every step of the way.

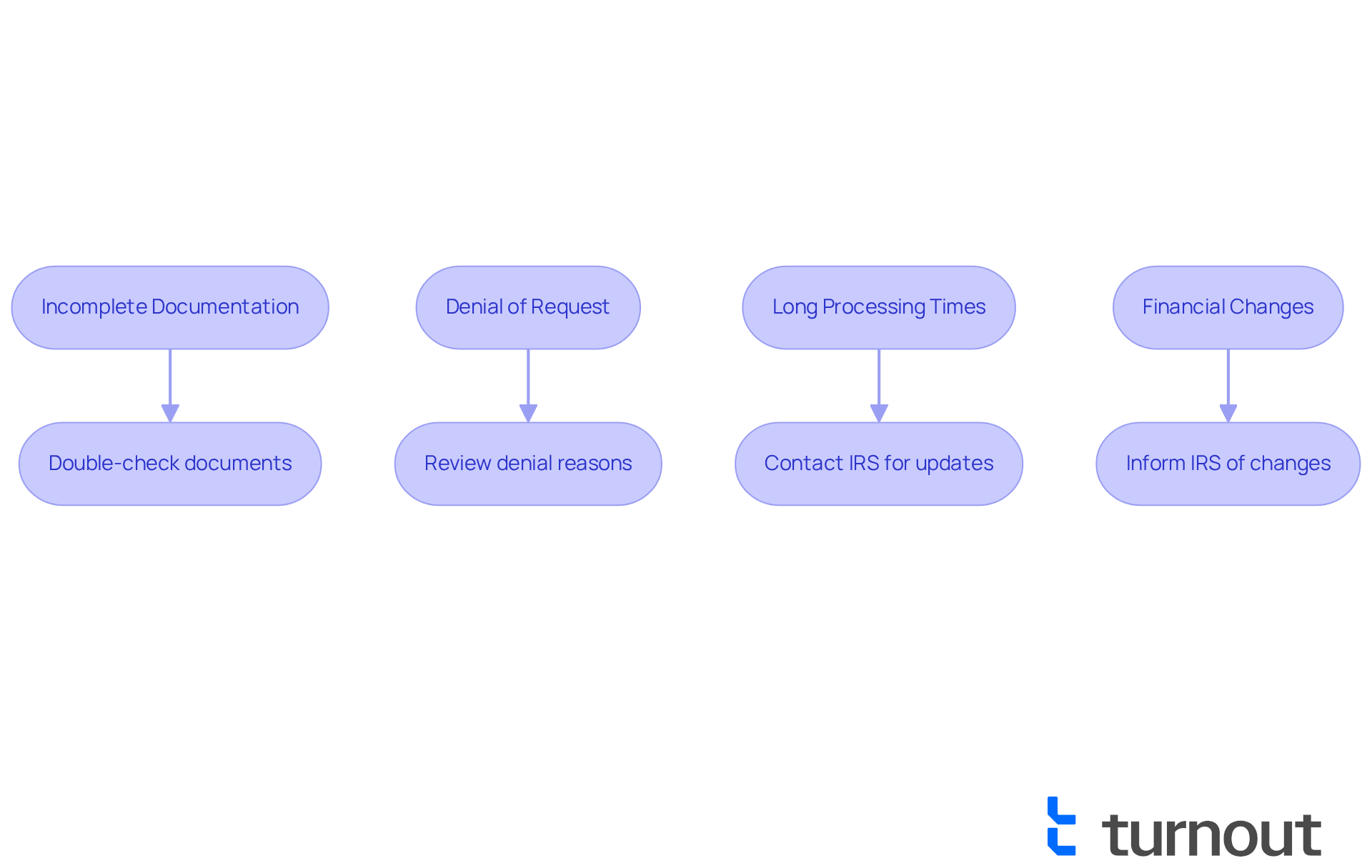

Troubleshoot Common Issues

Navigating the process to forgive tax debt can be challenging, and you may encounter several common issues along the way. Here’s how to troubleshoot them with care:

- Incomplete Documentation: We understand how frustrating it can be to gather all necessary documents. Ensure that everything required is submitted with your application. Missing information can lead to delays or denials, so double-check your forms before submission.

- Denial of Request: If your request is denied, it’s important to review the reasons provided by the IRS. You may have the option to appeal the decision or reapply with additional documentation. Remember, you are not alone in this journey.

- Long Processing Times: It’s common to feel anxious about long processing times. The IRS can take time to handle requests. If you encounter delays, consider reaching out to the IRS for updates on your status; staying informed can ease your worries.

- Financial Changes: If your financial situation changes after submitting your application, inform the IRS immediately. This may affect your eligibility, and keeping them updated is crucial.

By being proactive and prepared for these common issues, you can enhance your chances of successfully navigating the forgive tax debt process. Remember, we're here to help you through this challenging time.

Conclusion

Understanding the pathways to tax debt forgiveness is essential for those grappling with financial burdens. We recognize that navigating these challenges can be overwhelming. This article sheds light on various relief options available, emphasizing that taxpayers can settle their debts for less than what they owe through programs like Offer in Compromise and penalty abatement. Recognizing eligibility criteria and the impact on credit scores is crucial in making informed decisions about tax debt relief.

The exploration of relief options, including installment agreements and Currently Not Collectible status, offers valuable insights for individuals seeking financial reprieve. Each step of the application process has been outlined to help you navigate the complexities of seeking forgiveness effectively. It's common to feel apprehensive about addressing issues such as incomplete documentation and denial of requests, but understanding these common hurdles empowers you to tackle potential obstacles.

Ultimately, the journey toward tax debt forgiveness is not one that needs to be faced alone. By taking proactive steps and utilizing available resources, you can find a path to financial freedom. Remember, the significance of understanding tax debt relief options cannot be overstated; it opens doors to a brighter financial future. We're here to help you every step of the way.

Frequently Asked Questions

What is tax debt forgiveness?

Tax debt forgiveness refers to programs that allow taxpayers to settle their tax debts for less than the full amount owed.

What are some common types of tax debt forgiveness programs?

Common programs include the Offer in Compromise (OIC), which allows taxpayers to negotiate a lower payment based on their financial situation, and penalty abatement, which can remove penalties for first-time offenders.

What are the eligibility criteria for tax debt forgiveness?

To qualify for tax debt forgiveness, taxpayers typically need to demonstrate economic hardship, have filed all required tax returns, and may need to meet specific income thresholds.

How does tax debt forgiveness impact credit scores?

While tax debt forgiveness can relieve financial burdens, it may also have implications for credit scores, making it important to understand these effects as you explore your options.

What support is available for those facing tax debt?

There is support available for individuals uncertain about meeting eligibility criteria for tax debt forgiveness programs, helping them navigate their options.