Overview

We understand that dealing with tax debt can be overwhelming and stressful. This article outlines essential steps to help you resolve your tax issues.

- First, it’s important to grasp the implications of back taxes.

- Then, gather your financial records and file any outstanding returns.

- Exploring payment options is also crucial in this journey.

Taking proactive measures can make a significant difference.

- Utilize IRS resources

- Consider consulting tax professionals who can guide you through this process.

Remember, you are not alone in this. By addressing unpaid taxes, you can alleviate the burden and avoid severe consequences like wage garnishments and tax liens.

We’re here to help you navigate these challenges. Taking the first step can lead to a brighter financial future. Let’s work together to find the best solutions for your situation.

Introduction

Dealing with back taxes can feel like navigating a labyrinth of financial stress. Each wrong turn leads to mounting penalties and overwhelming anxiety. We understand that understanding the implications of unpaid tax obligations is crucial; they can escalate quickly, affecting everything from credit scores to personal assets. This article provides essential steps to help you regain control over your tax situation.

We will explore effective strategies for:

- Filing overdue returns

- Identifying viable payment options

How can you transform this daunting challenge into a manageable path forward? You're not alone in this journey, and we're here to help.

Understand Back Taxes and Their Implications

Unpaid dues refer to amounts owed that have not been settled by the deadline. We understand that dealing with such financial burdens can be overwhelming. These dues can accumulate interest and penalties, leading to a significantly higher amount owed over time. Understanding the implications of is essential:

- Consequences: Failing to pay back taxes can lead to wage garnishments, tax liens, and even property seizures. It's common to feel anxious about these possibilities. The if obligations remain unpaid, including garnishing wages without a court order.

- Interest and Penalties: The IRS charges interest on unpaid taxes, which compounds daily. Additionally, there are penalties for late payments that can add up to 25% of the unpaid tax amount. However, and administrative waivers may provide relief from these penalties under certain conditions, offering a glimmer of hope.

- Tax Liens: A , which can affect your credit score and ability to secure loans. The long-lasting effects of tax liens can create considerable monetary challenges. We know how daunting this can be, making it crucial to tackle without delay.

Recognizing these implications underscores the urgency of taking action to resolve your tax situation. Taxpayers have various options available, such as setting up a or negotiating an Offer in Compromise (OIC). These solutions can help alleviate the burden of back taxes. By understanding these avenues, you can better appreciate the importance of addressing your tax situation as soon as possible. Remember, you are not alone in this journey; we're here to help.

Gather Your Financial Records and Assess Your Tax Situation

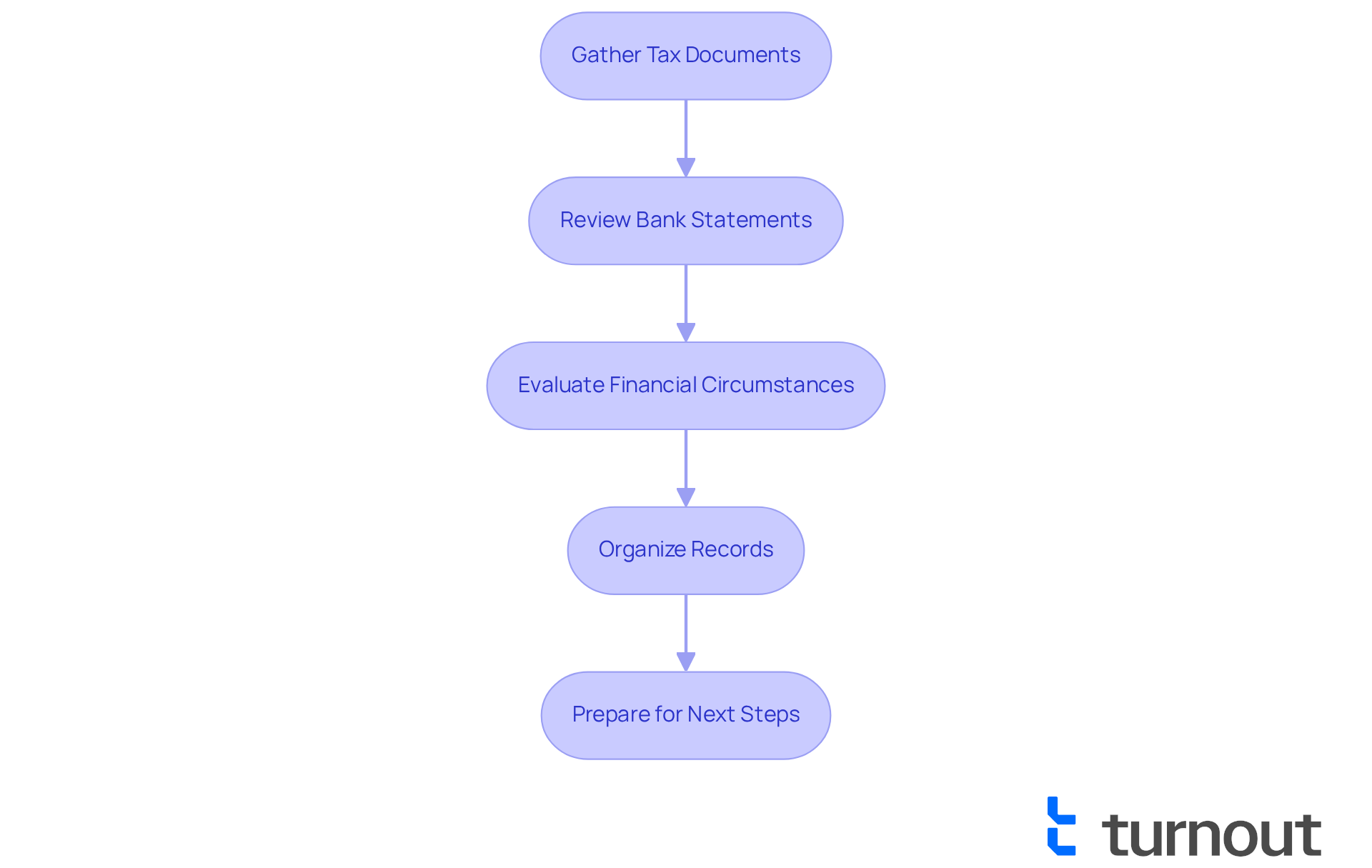

To effectively resolve your , begin by .

We understand that this process can feel overwhelming, but taking it step by step can make a significant difference. Start by collecting your tax documents. Assemble W-2s, 1099s, and any other income statements for the years you owe taxes. This documentation is essential for accurately filing your returns.

Next, review your bank statements. Examine them to identify any additional income or deductions that may apply, ensuring you capture all financial aspects. It’s common to miss details, so take your time with this step.

Then, . Calculate your total income, expenses, and any other liabilities. This evaluation will assist you in comprehending how much back taxes help you can afford to allocate towards your .

Finally, organize your records. Maintain your documents in an orderly manner by year and type. This approach streamlines the filing process and makes it easier to reference information as needed.

By thoroughly evaluating your monetary situation, you can create a clear picture of your tax obligations and prepare for the next steps. In fact, studies indicate that a significant percentage of Americans—around 70%—struggle with keeping organized tax records. This highlights the importance of utilizing available resources like IRS Free File for efficient tax preparation. Financial advisors emphasize the importance of to facilitate smoother tax filing and resolution processes.

For example, individuals who proactively evaluate their monetary situations often find that back taxes help them manage tax debt more effectively. They can pinpoint possible deductions and credits that may lessen their burden. Additionally, the IRS states, "Filing electronically and selecting direct deposit remains the fastest and safest way for taxpayers to receive their 2024 tax refunds." This reinforces the need for timely and organized filing.

Maintaining your tax documents in order not only helps with compliance but also enables you to take charge of your monetary future. Remember, you are not alone in this journey. Utilizing the can help you view and pay your tax balances, ensuring you stay on top of your obligations. We’re here to help you through this process.

File Your Back Tax Returns: A Step-by-Step Process

Filing your back tax returns can feel overwhelming, but us simplify the process for you. By following these steps, you can take control of your , and back taxes help you achieve peace of mind.

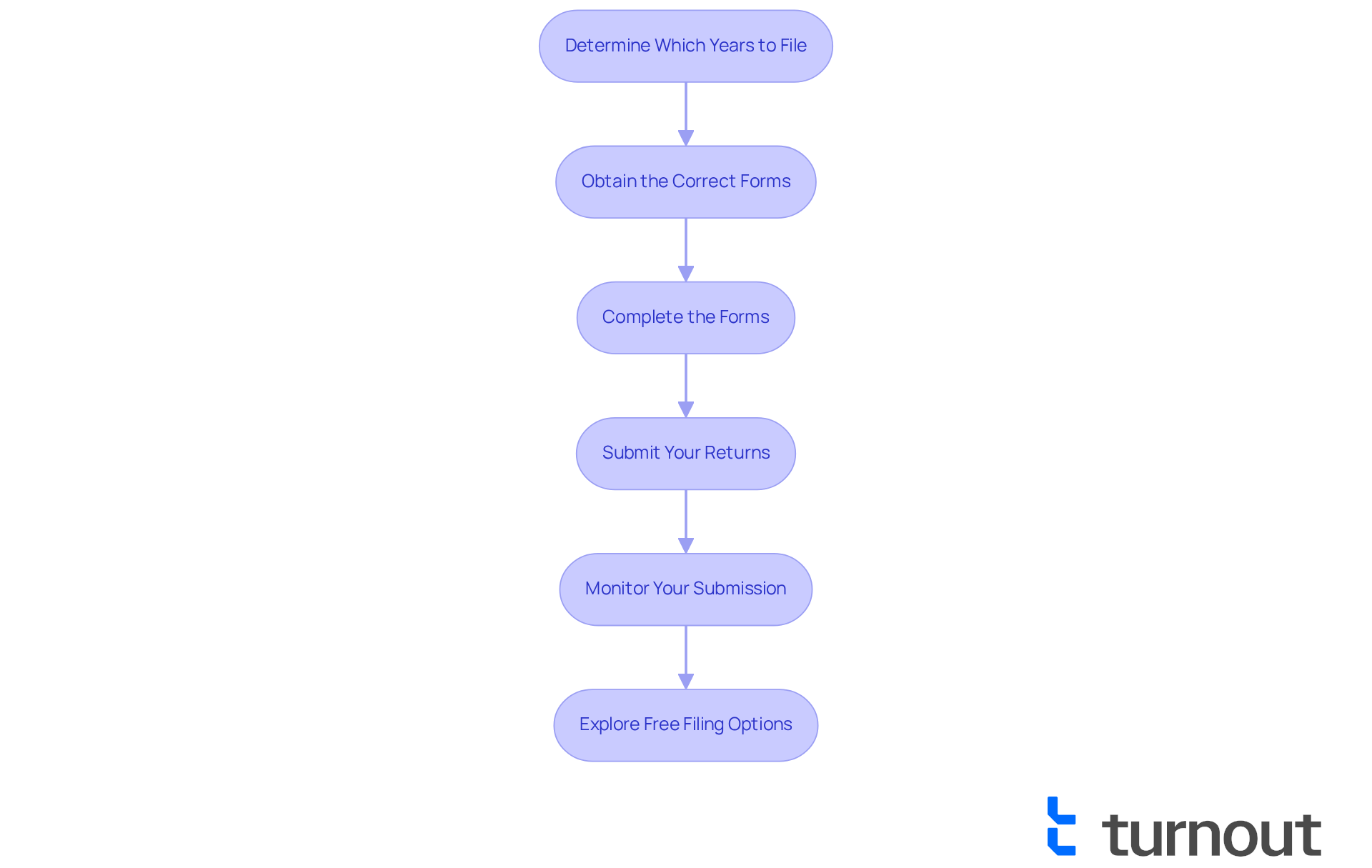

- Determine Which Years to File: It’s important to identify the tax years for which you have not filed. You can easily check your for this information. On average, many Americans miss filing taxes for about three years, according to IRS statistics. Addressing this promptly is crucial.

- Obtain the Correct Forms: Visit the IRS website to download the appropriate tax forms for each year you need to file. Make sure you are using the correct forms for the specific tax year. Notably, the IRS has announced no changes to certain information returns or withholding tables for Tax Year 2025.

- Complete the Forms: Fill out the forms accurately, using the financial records you gathered earlier. Be sure to report all income and claim any deductions you are eligible for. Tax professionals often emphasize that common mistakes include failing to report all income or neglecting to claim eligible deductions, which can lead to complications. As one tax expert noted, "Many individuals overlook deductions that could significantly reduce their tax liability."

- : Once completed, mail your tax returns to the appropriate IRS address for the specific forms you are using. We recommend using certified mail to confirm delivery, ensuring that your submission is tracked.

- Monitor Your Submission: After filing, keep an eye on your IRS account or wait for confirmation of receipt. This will help you ensure that your returns have been processed. Additionally, be cautious of potential scams during tax season; it’s common for scammers to target individuals with misleading offers or threats.

- Explore Free Filing Options: If you qualify, consider using the , which offers free online tax preparation options for eligible taxpayers. This can help ease the financial burden of tax preparation.

By following these steps, you can efficiently submit your overdue tax returns and get back taxes help to address your tax obligations. Many individuals have successfully navigated this process, transforming what once seemed daunting into a manageable task. For instance, one taxpayer resolved their tax issues by diligently following the filing steps and utilizing available resources, ultimately achieving peace of mind.

Explore Payment Options for Your Back Taxes

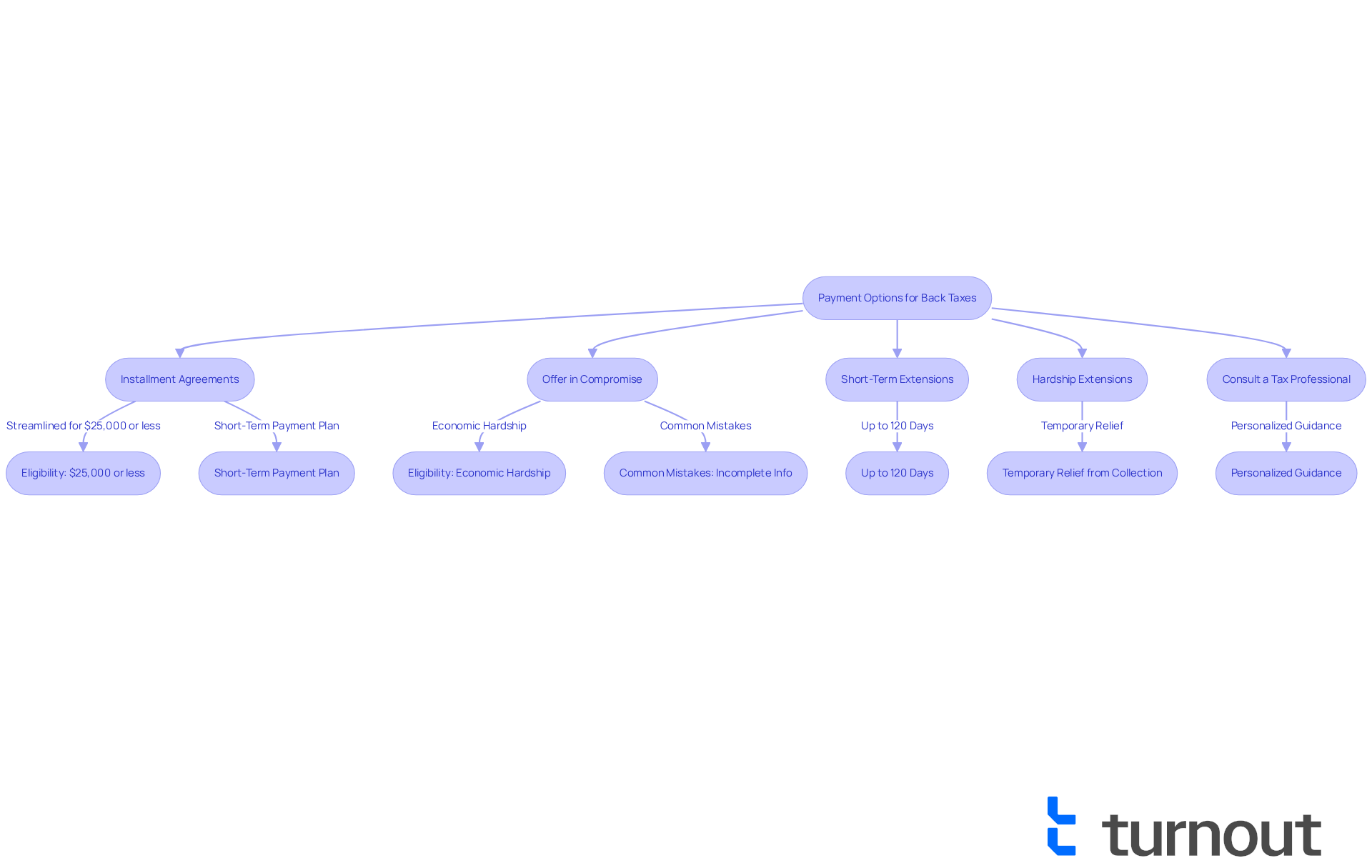

Once you have filed your back tax returns, we understand it can be overwhelming to explore how with your . Here are some pathways to consider:

- : The IRS offers installment agreements that allow you to settle your . You can apply for either a short-term or long-term payment plan, depending on your financial situation. For instance, streamlined installment agreements are available for tax liabilities of $25,000 or less, allowing manageable monthly payments. In fact, over 90% of individual taxpayers with tax obligations will qualify for a Simple Payment Plan introduced in 2025, making this option highly accessible.

- : If you find it challenging to pay your full tax obligation, you may qualify for an Offer in Compromise (OIC). This program enables you to resolve your tax obligation for less than the total sum due, as long as you can prove economic hardship. As noted by tax professionals, "Most offers get rejected because applicants either don't qualify financially or make errors in their applications." In 2025, the IRS has made this option more accessible, with flexible evaluation standards that consider increased living expenses. However, it's important to note that the IRS accepts less than half of all applications, so thorough preparation is crucial.

- : If you need additional time to pay, you can request a short-term extension to settle your tax bill in full, typically available for up to 120 days. This option can provide temporary relief while you arrange your finances.

- : For individuals facing considerable economic challenges, a hardship extension may be accessible. This option can temporarily stop collection actions, enabling you to handle your circumstances without the stress of immediate payment. It's essential to understand the specific conditions under which hardship extensions are granted, as they can provide crucial support during tough times.

- : Navigating these options can be complex, so consider consulting a tax professional. They can offer personalized guidance tailored to your specific circumstances, helping you choose the best path forward. As highlighted in case studies, understanding options like Currently Not Collectible Status can illustrate real-life applications of these payment strategies.

By exploring these payment options, you can find a solution that provides back taxes help and aligns with your financial situation. Remember, you are not alone in this journey; take proactive steps to manage your tax debt and seek the support you deserve.

Conclusion

Addressing back taxes is a crucial step toward regaining your financial stability and peace of mind. We understand that the journey to resolving tax debt may seem daunting, but knowing the implications of unpaid taxes and the options available can empower you to take control of your financial future. By recognizing the potential consequences, such as wage garnishments and tax liens, it becomes clear that timely action is necessary to prevent further complications.

Throughout this guide, we have outlined key strategies to support you, including:

- Gathering financial records

- Filing back tax returns

- Exploring various payment options

Each step is designed to provide clarity, ensuring that you can effectively navigate the complexities of tax obligations. From utilizing IRS resources to considering installment agreements and Offers in Compromise, there are pathways available to alleviate the burden of back taxes.

Ultimately, the importance of addressing tax debt cannot be overstated. By taking proactive measures and seeking assistance, you can transform a seemingly insurmountable challenge into a manageable task. Embracing this process not only helps in resolving current obligations but also fosters a healthier financial future. Remember, you are not alone in this journey; stay informed, utilize available resources, and take decisive action to reclaim control over your financial situation.

Frequently Asked Questions

What are unpaid dues in relation to taxes?

Unpaid dues refer to amounts owed to the IRS that have not been settled by the deadline.

What are the consequences of failing to pay back taxes?

Failing to pay back taxes can lead to wage garnishments, tax liens, and property seizures. The IRS may take aggressive collection measures, including garnishing wages without a court order.

How does the IRS penalize unpaid taxes?

The IRS charges interest on unpaid taxes that compounds daily, and there are penalties for late payments that can add up to 25% of the unpaid tax amount.

Are there any options to relieve penalties on back taxes?

Yes, options like the First Time Penalty Abatement policy and administrative waivers may provide relief from penalties under certain conditions.

What is a tax lien and how does it affect me?

A tax lien is a legal claim against your property, which can negatively affect your credit score and your ability to secure loans, creating significant monetary challenges.

What options do taxpayers have to resolve back taxes?

Taxpayers can set up a payment plan or negotiate an Offer in Compromise (OIC) to alleviate the burden of back taxes.

Why is it important to address tax obligations promptly?

Understanding the implications of back taxes underscores the urgency of resolving tax situations to avoid severe consequences and financial burdens.