Overview

Navigating the status of your amended tax refund can feel overwhelming, and we understand that. This guide offers a step-by-step approach to help ease your concerns. Patience is key, and knowing how to use IRS resources effectively can make a significant difference.

Start by allowing the appropriate timeframe for your amended return to be processed. It’s common to feel anxious during this waiting period, but remember, good things take time. Utilizing the IRS website for tracking is a helpful tool, ensuring you have the most up-to-date information.

Don’t forget to verify your personal information. Small errors can lead to delays, and we’re here to help you avoid those pitfalls. By following these essential steps, you can confidently monitor your amended tax return status and reduce any stress you may feel.

You are not alone in this journey. We encourage you to take these steps with a sense of assurance that you are on the right path. Together, we can navigate this process and ensure you receive the support you need.

Introduction

Navigating the complexities of tax returns can often feel daunting. We understand that errors may necessitate amendments, leaving you uncertain about the next steps. Understanding how to file an amended tax return using Form 1040-X is essential for ensuring accuracy and potentially reclaiming owed refunds.

Once you submit your amended return, it’s common to feel anxious about its status.

- How can you effectively track your amended tax refund?

- What steps should you take if issues arise?

This guide offers a clear, step-by-step approach to demystifying the process. We're here to empower you to navigate your amended tax refund status with confidence.

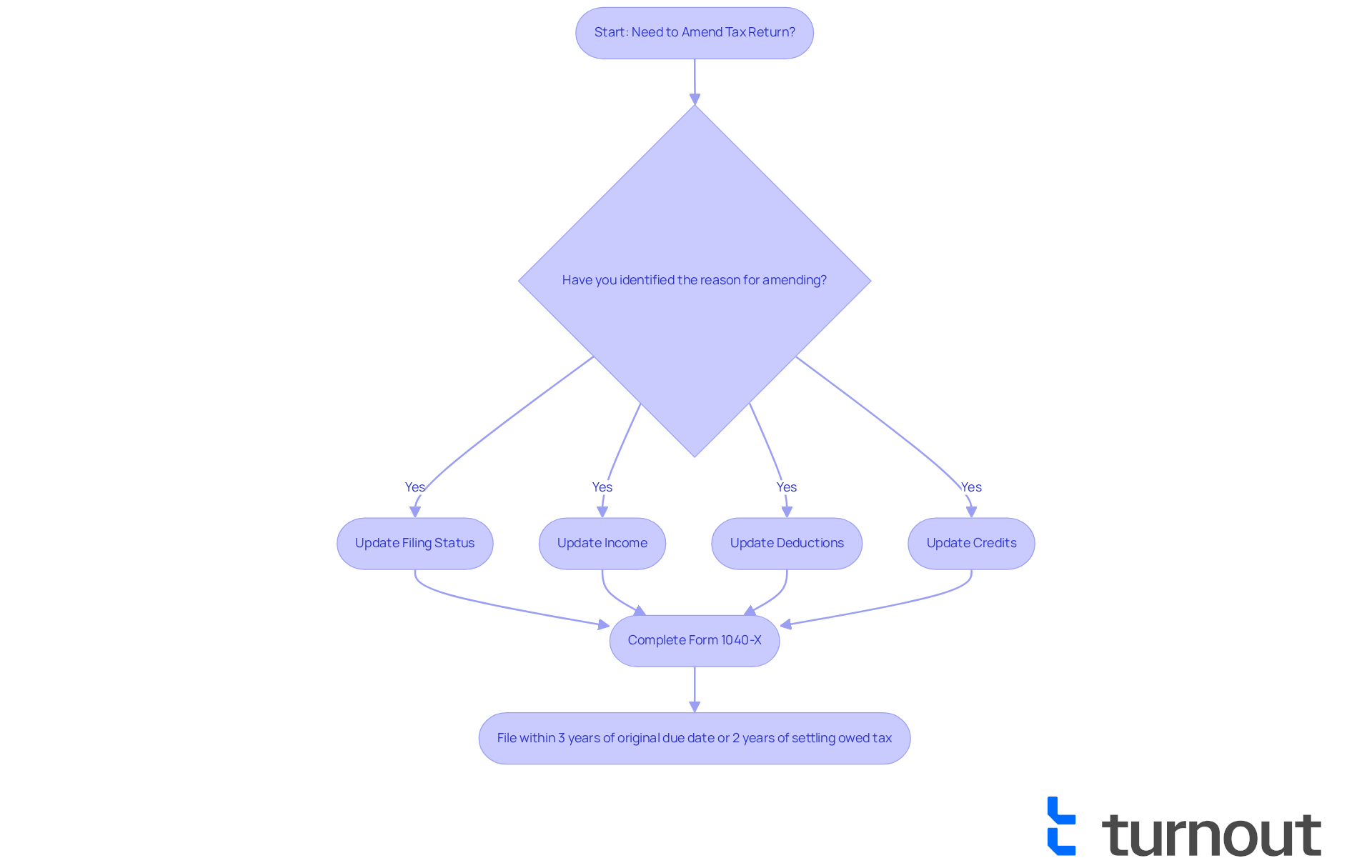

Understand Amended Tax Returns

We understand that navigating can be overwhelming, especially when mistakes happen. A revised tax document can be submitted using Form 1040-X to correct errors or make adjustments to a previously submitted tax return. Common reasons for submitting a revision include:

- Updating your filing status

- Updating your income

- Updating your deductions

- Updating your credits

It's essential to remember that revised submissions need to be of the original submission's due date or within two years of settling any owed tax. Understanding this process is vital, as it directly impacts your eligibility for the and ensures the overall accuracy of your tax filings.

You're not alone in this journey, and we're here to help you through it. Take the time to ensure your tax documents reflect your true financial situation, and don't hesitate to reach out for assistance if you need it.

Check Your Amended Tax Refund Status

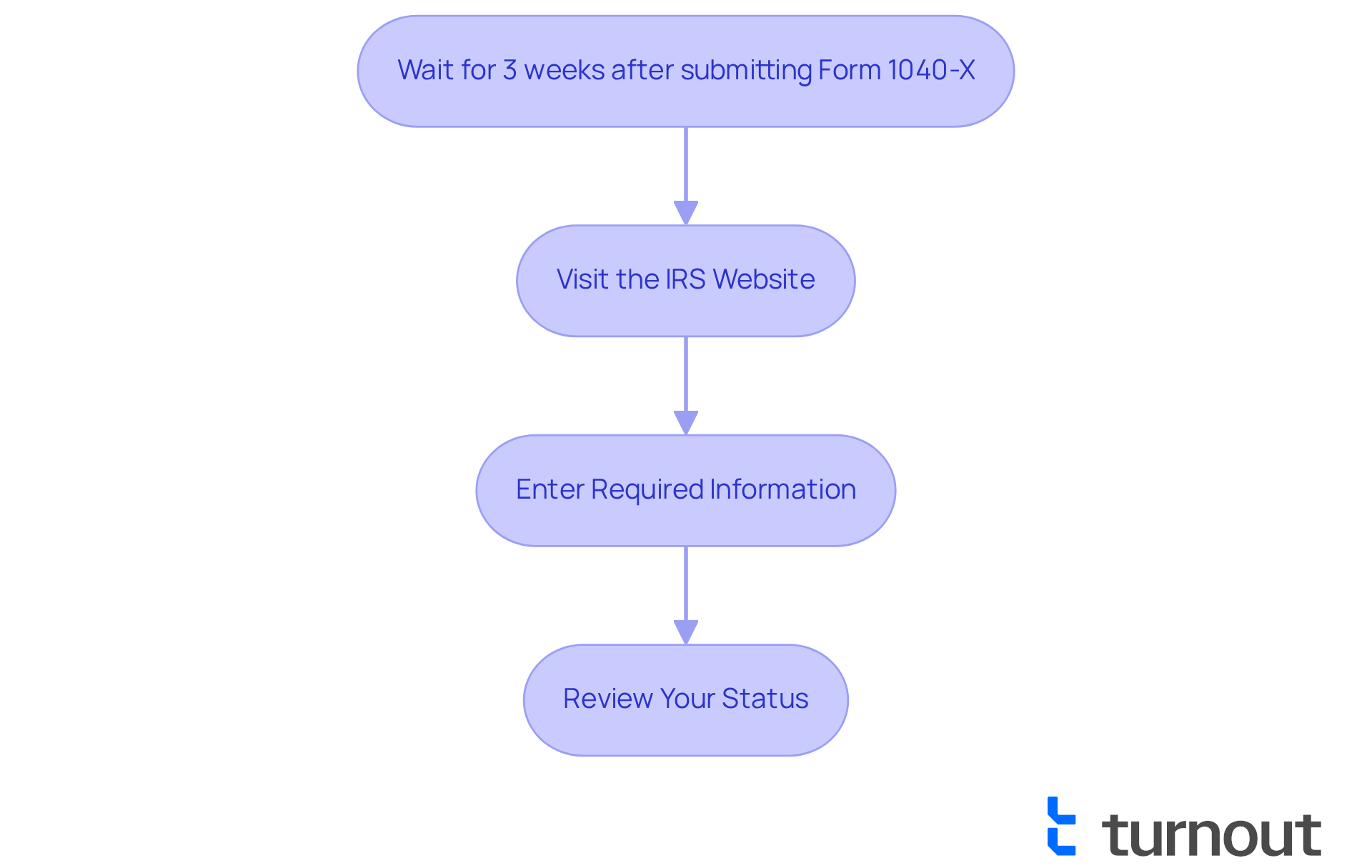

We understand that checking the status of your amended can feel daunting. To help you through this process, here are some simple steps to follow:

- Wait for the Appropriate Timeframe: It's common to feel anxious, but you can approximately three weeks after submitting your Form 1040-X. The IRS typically processes the for revised filings within 8 to 12 weeks, so patience is key.

- Visit the : You can find reassurance by going to the IRS 'Where's My Amended Return?' tool at .

- Enter Required Information: To verify your identity, input your number, date of birth, and ZIP code. This step is essential for your security.

- Review Your Status: The tool will indicate whether your submission is pending, processing, or completed. If you prefer a more personal touch, remember that you can also call the IRS at 866-464-2050 for assistance.

We’re here to help you , and you are not alone in this process.

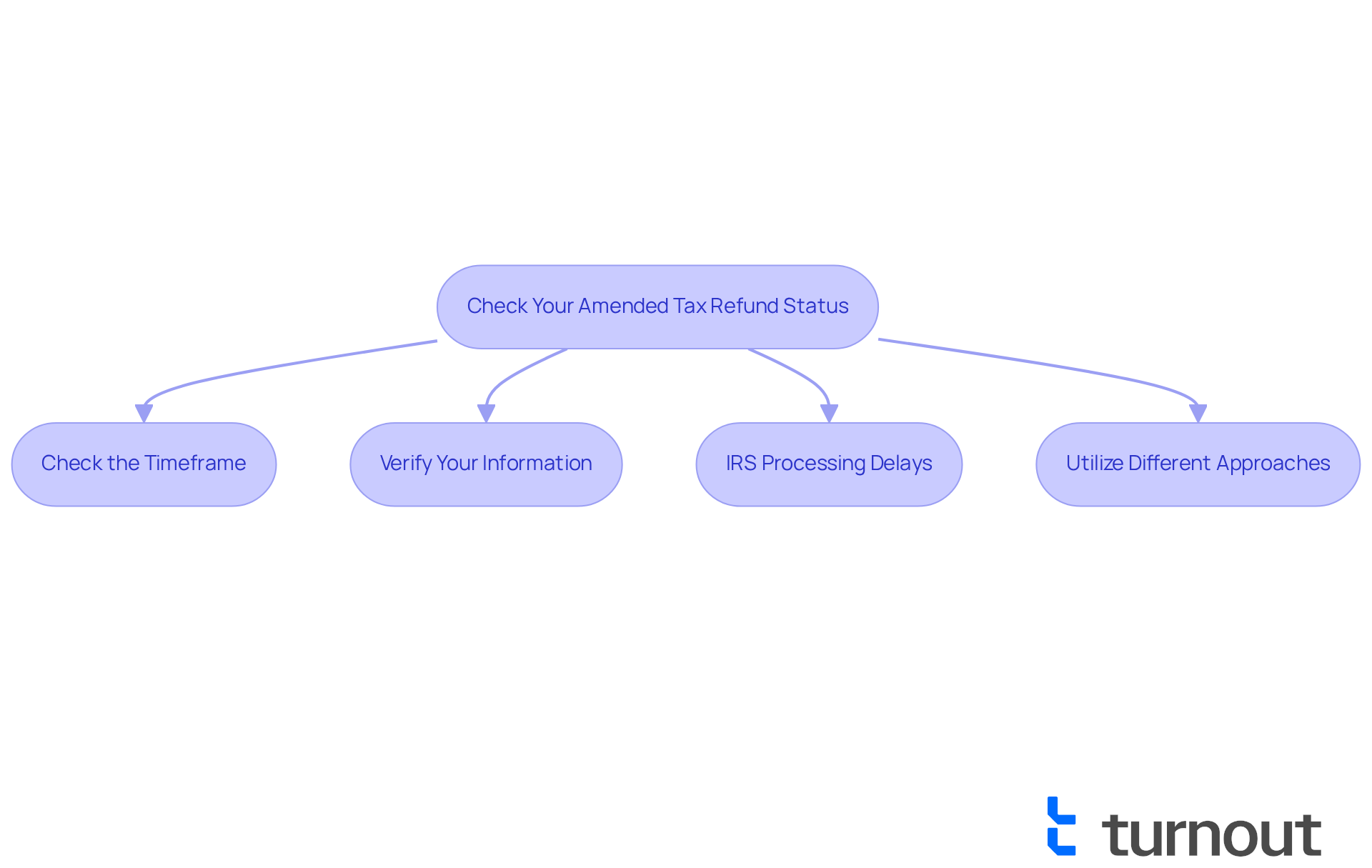

Troubleshoot Common Tracking Issues

We understand that checking the status of your can be a stressful experience. If you encounter issues, consider these helpful tips:

- Check the Timeframe: Make sure you are looking at your status at least three weeks after submitting your revised document. It's common to feel anxious during this wait.

- Verify Your Information: Double-check that you’re entering the correct Social Security number, date of birth, and ZIP code. Any discrepancies can prevent you from accessing your status, and we want to ensure you have the right information.

- IRS Processing Delays: Remember that can vary. If it has been more than 16 weeks since you filed, it may be helpful to reach out to the IRS to inquire about your amended tax refund status for further assistance. You're not alone in this journey.

- Utilize Different Approaches: If the online tool isn’t working, don’t hesitate to at 866-464-2050 for updates on your revised status. We're here to help you navigate this process.

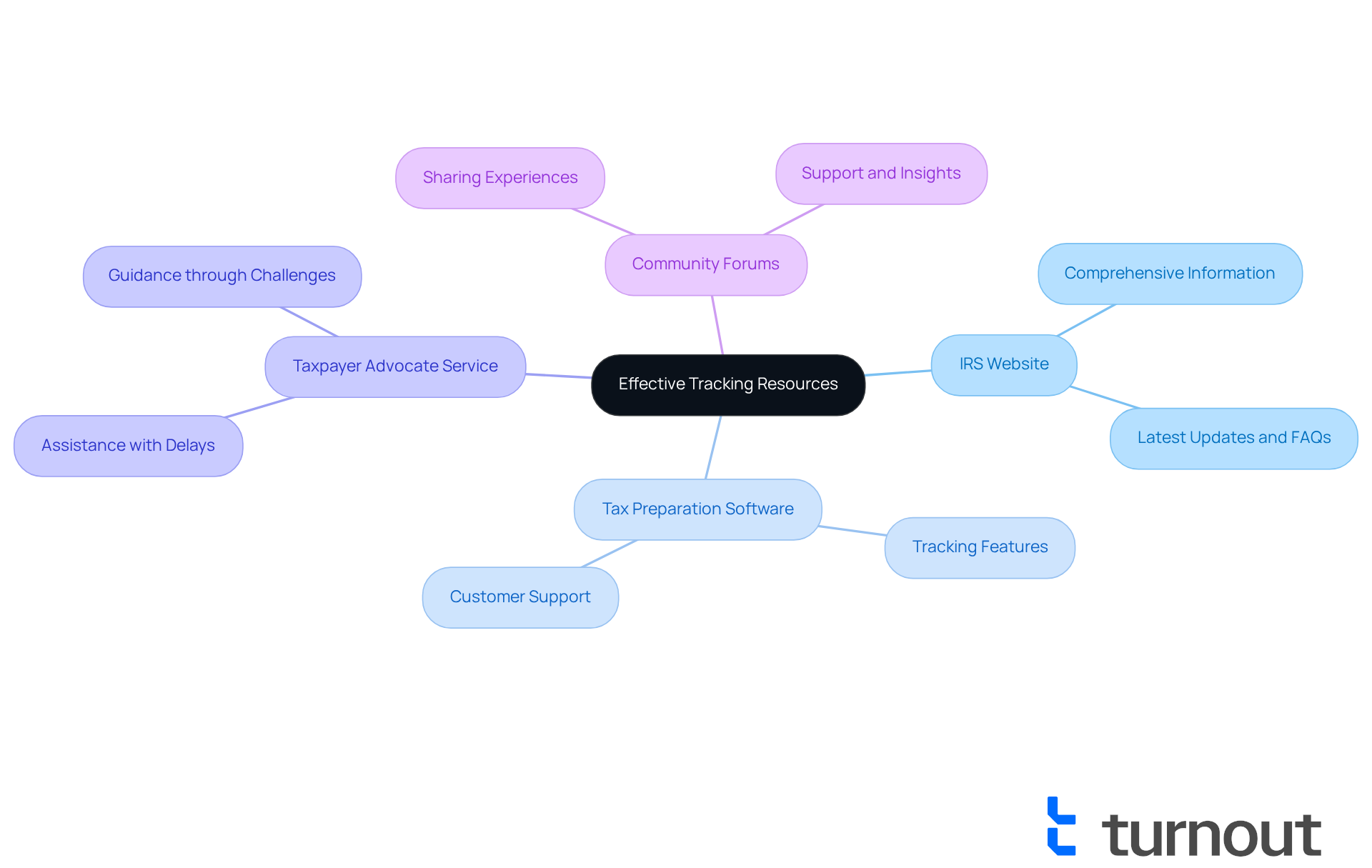

Utilize Resources for Effective Tracking

Tracking your can feel overwhelming, but you are not alone in this journey. Here are some resources that can help you with confidence:

- IRS Website: The IRS provides comprehensive information about revised submissions and tracking resources. We encourage you to visit for the latest updates and FAQs, which can help ease your concerns.

- : If you used tax software to file your return, check to see if they offer tracking features or customer support for inquiries about your [amended tax refund status](https://blog.myturnout.com/complete-the-ssa-1696-form-step-by-step-instructions). This can provide you with peace of mind during this waiting period.

- Taxpayer Advocate Service: If you encounter significant delays or issues, the Taxpayer Advocate Service is here to assist you. Their website offers valuable information that can guide you through any challenges you may face.

- Community Forums: Engaging with online forums and communities can be a source of support. Sharing experiences with others who have faced similar issues can be incredibly reassuring. Websites like Reddit or tax-related forums can provide insights and a sense of camaraderie.

Remember, seeking help is a sign of strength, and we’re here to support you every step of the way.

Conclusion

Navigating the complexities of amended tax returns can be challenging, and we understand how overwhelming it may feel. However, grasping the process is crucial for ensuring accuracy and securing your rightful refund. This guide has equipped you with essential steps to check your amended tax refund status. Remember, patience and proper verification are key, and utilizing available resources can make a significant difference.

It’s important to file Form 1040-X within designated timeframes and to know how to effectively track your refund status, whether online or through direct communication with the IRS. If you encounter common issues, know that you’re not alone. Resources like the IRS website and community forums can provide valuable support and alleviate stress during this process.

Ultimately, staying informed and proactive is vital when dealing with amended tax returns. By following the outlined steps and seeking support when needed, you can confidently navigate the tracking process and ensure your tax documents accurately reflect your financial situation. Embrace this journey of understanding your taxes, and remember, assistance is always available to help you along the way.

Frequently Asked Questions

What is an amended tax return?

An amended tax return is a revised tax document submitted using Form 1040-X to correct errors or make adjustments to a previously submitted tax return.

Why would someone submit an amended tax return?

Common reasons for submitting an amended tax return include updating your filing status, income, deductions, or credits.

What is the deadline for filing an amended tax return?

Revised submissions must be filed within three years of the original submission's due date or within two years of settling any owed tax.

How does submitting an amended tax return affect my eligibility for a refund?

Understanding the process of submitting an amended tax return is vital, as it impacts your eligibility for the amended tax refund status and ensures the accuracy of your tax filings.