Overview

Navigating the world of short-term disability benefits can be overwhelming, especially when it comes to understanding the tax implications of your W2. You might receive a W2 for these benefits, depending on who pays the premiums. If your employer covers the premiums, it's important to know that the benefits are typically taxable and reported on your W2. We understand that these details can feel complicated.

The article highlights that understanding the payment structure—whether the employer or the employee pays the premiums—determines the tax implications and reporting requirements. This clarity is crucial, as it helps you understand the conditions under which a W2 will be issued. Remember, you are not alone in this journey; we’re here to help you navigate these complexities with confidence.

Introduction

Understanding the nuances of short-term disability (STD) insurance is essential for employees who may be facing temporary work absences due to health issues. We understand that navigating these benefits can be overwhelming, and questions often arise regarding tax implications and W2 reporting. Specifically, many wonder if they will receive a W2 for short-term disability payments.

This article aims to shed light on the complexities of STD insurance. We will explore the circumstances that determine taxability and W2 issuance, while addressing common uncertainties that many encounter. What are the key factors that influence whether a W2 will be issued for these benefits? How can you ensure you are fully informed about your financial responsibilities? We're here to help you find clarity in this journey.

Understand Short-Term Disability and Its Tax Implications

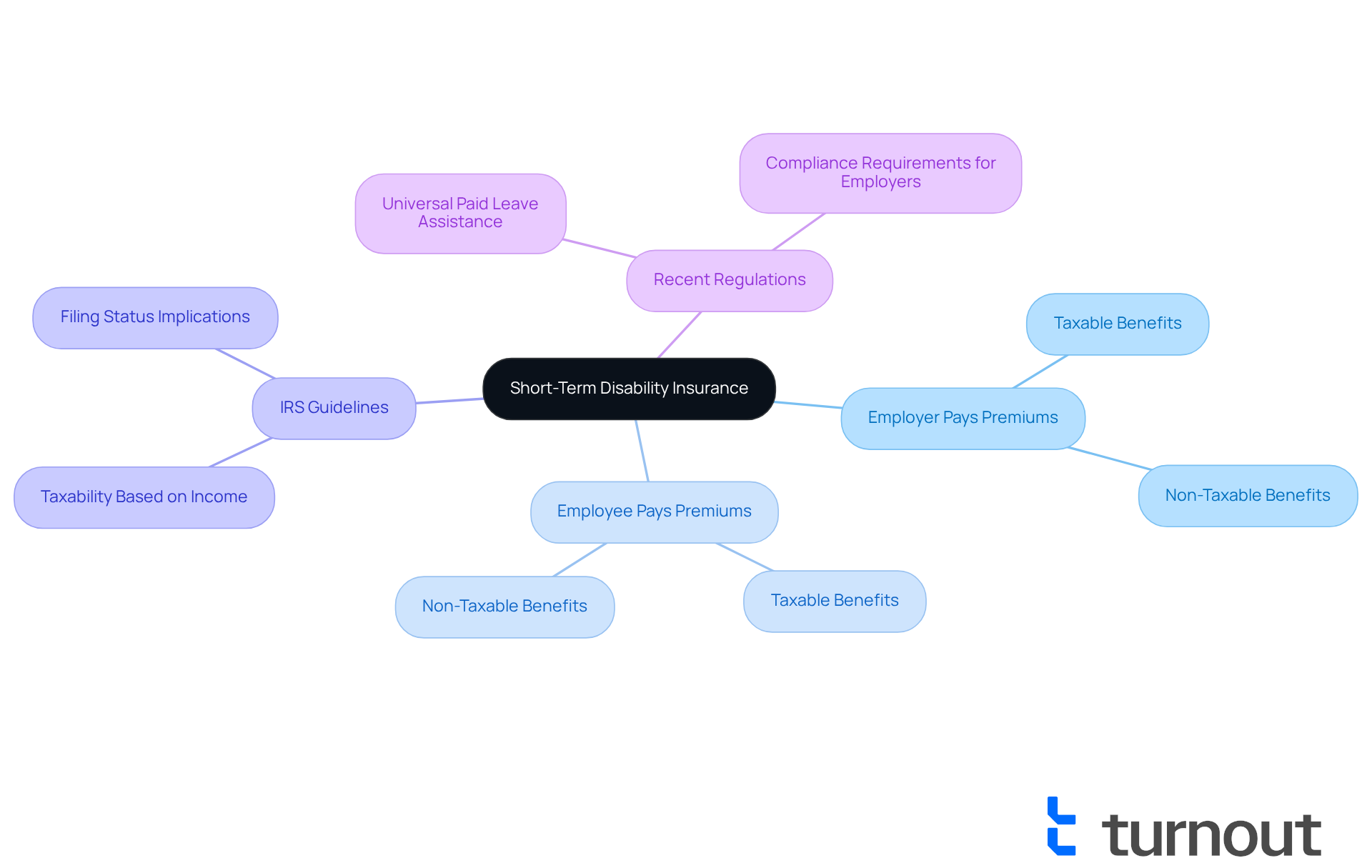

Short-term disability (STD) insurance can be a lifeline for employees who find themselves temporarily unable to work due to medical conditions. We understand that navigating the complexities of these benefits can be overwhelming, particularly regarding questions like, will I receive a W2 for short-term disability and understanding the associated tax implications. Generally, if your employer pays the STD insurance premiums, you may wonder, will I receive a W2 for short-term disability benefits, as they are likely taxable. However, if you pay the premiums with after-tax dollars, you might wonder, will I receive a W2 for short-term disability benefits, which are typically non-taxable? It’s important to examine your specific policy and payment structure to accurately assess whether I will receive a W2 for short-term disability and its tax consequences.

According to IRS guidelines, taxpayers should take half of their Social Security payments collected during the year and add it to their other income to determine taxability. For instance, if a dental assistant earning $39,000 a year receives STD compensation, the taxability will depend on whether the premiums were covered by the employer or paid by the employee. It’s common to feel uncertain about these details, but understanding them can provide peace of mind.

Additionally, a recent regulation implemented on May 19, 2025, prevents insurers from reducing support under short-term illness insurance based on Universal Paid Leave assistance. This change is designed to improve financial aid for employees during short-term illness or leave, ensuring that you receive the support you deserve. Familiarizing yourself with these guidelines can help ensure compliance and prevent unexpected tax liabilities. Remember, you are not alone in this journey; we’re here to help you navigate these challenges.

Identify Criteria for W2 Reporting of Short-Term Disability Payments

Navigating the complexities of temporary benefits can be challenging, and we understand that you may have questions regarding if and when you will receive a W2 for short-term disability. Here are some important criteria to consider:

-

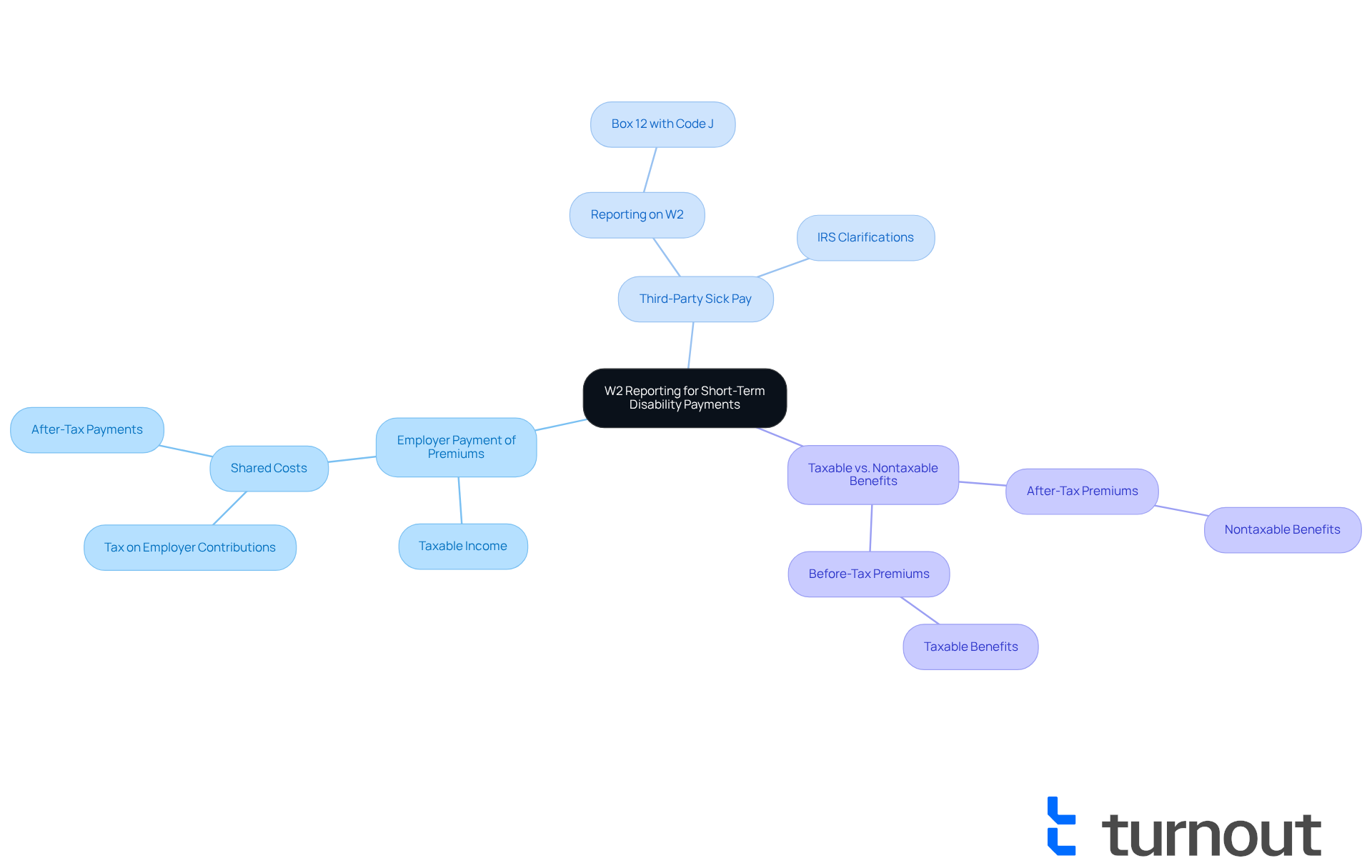

Employer Payment of Premiums: If your employer covers the premiums for your short-term disability (STD) insurance, these benefits are typically subject to taxation and should be reported on your W2. If you and your employer both contribute to the cost of a disability plan, you will only be taxed on the amount received from your employer's contributions, which raises the question: will I receive a W2 for short-term disability?

-

Third-Party Sick Pay: In cases where a third-party insurer provides your STD payments, these may still appear on your W2, often noted in Box 12 with Code J. The IRS has clarified the rules surrounding sick-pay reporting, specifically addressing the question of whether I will receive a W2 for short-term disability and common confusion regarding payments made by third-party payers.

-

Taxable vs. Nontaxable Benefits: If you paid the premiums with after-tax funds, the benefits may not be taxable. It’s vital to review the specifics of your policy and consult with your HR department for clarity on how your entitlements are categorized.

Additionally, please keep in mind that a draft version of the 2026 Form W-2 will be released soon, which may introduce new reporting requirements. Understanding these distinctions is essential, especially as many workers navigate the intricacies of disability benefits and their tax implications. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Verify Your W2 Status for Short-Term Disability Payments

We understand that navigating your W2 standing can feel overwhelming, especially when you are wondering, will I receive a W2 for short-term disability? To help you through this process, here are some steps to follow:

-

Contact Your Employer: Reach out to your HR department or payroll administrator. It's important to ask specifically, will I receive a W2 for short-term disability benefits?

-

Review Your Pay Stubs: Take a moment to examine your pay stubs for any deductions related to short-term illness insurance premiums. Research indicates that about 70% of employees regularly check their pay stubs for such deductions, which can clarify your situation.

-

Consult with the Insurer: If your benefits come from a third-party insurer, don’t hesitate to contact them directly. Verify how and when they notify your employer about your benefits.

-

Consult IRS guidelines to determine if I will receive a W2 for short-term disability payments. Understanding your obligations can help you avoid surprises when filing your taxes.

Remember, taking a proactive approach will ease your mind. Tax advisors often recommend checking your W2 status early to ensure all information is accurate and complete. This way, you can enjoy a smoother tax filing process.

It's also important to note that covered workers may take up to 26 weeks of disability during a 52-week period, receiving up to $170 per week. You are not alone in this journey; we’re here to help you every step of the way.

Conclusion

Understanding the intricacies of short-term disability (STD) benefits and their tax implications is crucial for employees facing temporary work absences. We understand that navigating these complexities can be overwhelming. The question of whether a W2 will be issued for short-term disability payments hinges on several factors, including who pays the premiums and how those payments are structured. By grasping these details, you can approach your benefits with greater confidence.

Key insights highlight that:

- If your employer pays the STD premiums, the benefits are typically taxable and reported on a W2.

- Conversely, if you pay the premiums with after-tax dollars, you may not owe taxes on the benefits received.

- Understanding the role of third-party insurers and recent regulatory changes can further clarify your reporting requirements and tax obligations.

- It's important to consult with HR and review your pay stubs, as these actions provide clarity and help prevent unexpected tax liabilities.

Ultimately, staying informed about short-term disability benefits and their tax implications empowers you to make better financial decisions. Taking proactive steps to verify your W2 status and understanding the criteria for reporting can lead to a smoother tax filing experience. As the landscape of disability benefits continues to evolve, being equipped with knowledge and resources is essential for ensuring that you receive the support you deserve during challenging times. Remember, you're not alone in this journey—we're here to help.

Frequently Asked Questions

What is short-term disability (STD) insurance?

Short-term disability insurance provides financial support to employees who are temporarily unable to work due to medical conditions.

Will I receive a W2 for short-term disability benefits?

Whether you receive a W2 for short-term disability benefits depends on who pays the premiums. If your employer pays the premiums, the benefits are likely taxable, and you will receive a W2. If you pay the premiums with after-tax dollars, the benefits are typically non-taxable, and you may not receive a W2.

How do I determine the tax implications of my short-term disability benefits?

The tax implications depend on the payment structure of your STD insurance premiums. If your employer pays the premiums, the benefits are generally taxable. If you pay with after-tax dollars, the benefits are usually non-taxable. It’s important to review your specific policy.

What are the IRS guidelines regarding Social Security payments and taxability?

According to IRS guidelines, taxpayers must take half of their Social Security payments collected during the year and add it to their other income to determine the taxability of their income.

How does the recent regulation implemented on May 19, 2025, affect short-term disability insurance?

The regulation prevents insurers from reducing support under short-term illness insurance based on Universal Paid Leave assistance, ensuring better financial aid for employees during short-term illness or leave.

What should I do if I have questions about my short-term disability benefits and taxes?

If you have questions about your short-term disability benefits and their tax implications, it is advisable to familiarize yourself with your specific policy and consult with a tax professional for guidance.