Introduction

Navigating the complexities of Medicaid can feel overwhelming, especially for those who have recently received a settlement. We understand that the fear of losing essential health benefits due to financial windfalls raises critical questions about eligibility and asset management. In this article, we’ll explore vital strategies to help you safeguard your Medicaid benefits after a settlement. Our goal is to provide you with insights on how to effectively navigate the intersection of legal agreements and healthcare coverage.

What steps can you take to ensure that a financial settlement doesn’t jeopardize your access to necessary medical care? You are not alone in this journey, and we’re here to help.

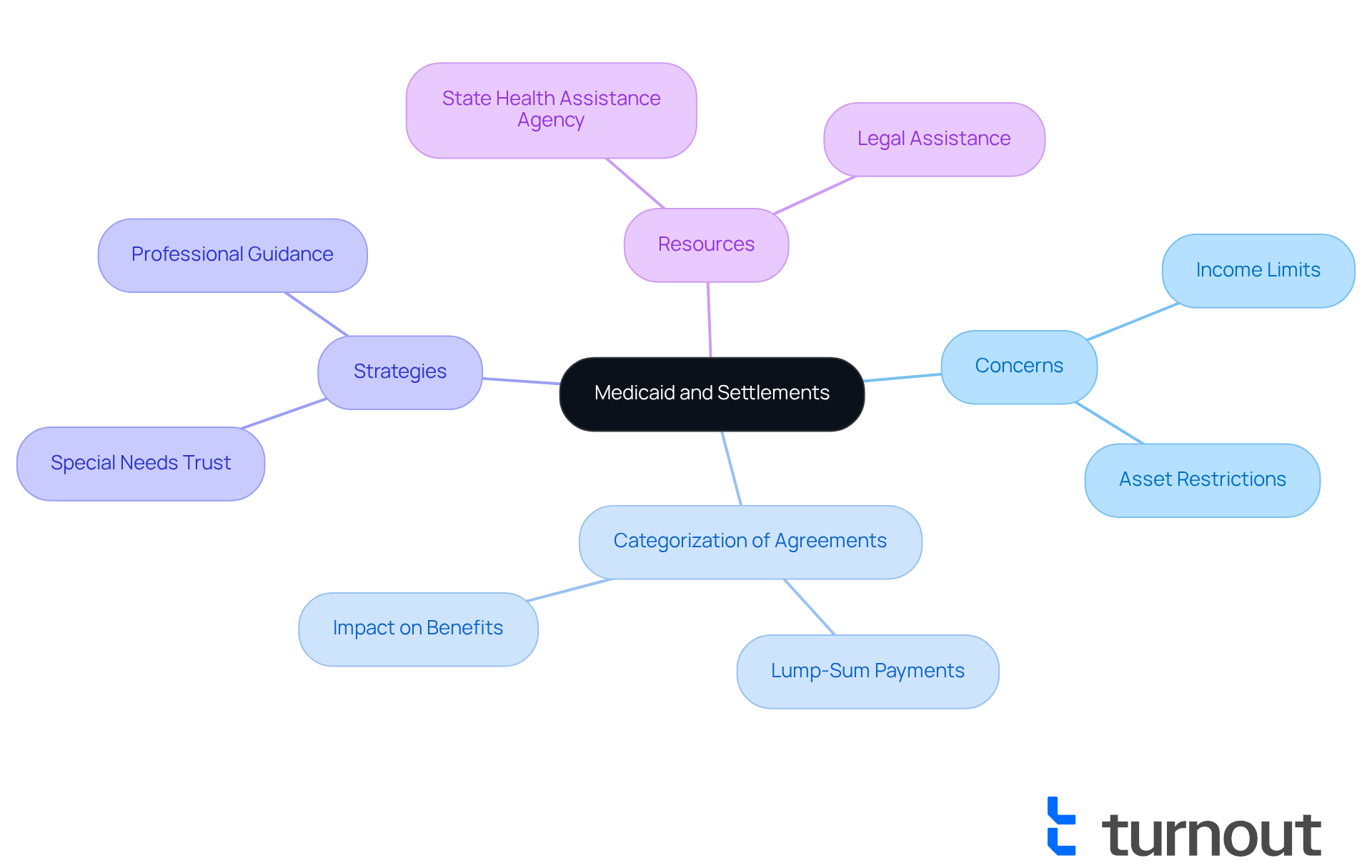

Understand Medicaid and Its Impact on Settlements

Navigating health coverage can be overwhelming, especially for low-income individuals and those with disabilities. We understand that the intricacies of financial agreements can raise concerns such as 'will I lose my Medicaid if I get a settlement,' which can significantly impact your eligibility for assistance. If an agreement is classified as income or assets, it could push you above the permissible limits, leading to concerns about whether you will lose your Medicaid if you get a settlement, which risks your vital benefits.

It's crucial to grasp how these agreements are categorized. For example, a lump-sum payment might be considered income for the month it’s received, potentially exceeding the income limit of your assistance program. In areas with strict asset restrictions, keeping compensation funds in a personal account could lead to disqualification from health assistance. That’s why reaching out to your state health assistance agency is essential. They can provide clarity on the specific regulations that apply to your situation.

Statistics reveal that many individuals only realize the impact of their agreements on health benefits after facing unexpected medical expenses or treatment interruptions. Imagine receiving a $10,000 personal injury compensation and then worrying, will I lose my Medicaid if I get a settlement because the funds weren’t managed properly.

Real-life stories highlight the importance of strategic planning. One individual, after receiving compensation, established a Special Needs Trust (SNT) to protect their eligibility for assistance. By placing the compensation funds into the trust, they maintained access to necessary medical care without jeopardizing their benefits.

Advocates stress the importance of carefully navigating these complexities. As one expert noted, understanding the link between personal injury compensations and health coverage is vital for protecting your entitlements, particularly concerning the question of will I lose my Medicaid if I get a settlement. Engaging with knowledgeable professionals can empower you to make informed decisions that safeguard your financial and health needs.

You are not alone in this journey. Turnout offers valuable tools and services to help individuals navigate these complex financial systems. From support for SSD claims through trained nonlawyer advocates to guidance on tax debt relief options, we’re here to help you receive the financial assistance you deserve.

Explore Medicaid Liens and Legal Framework

Liens are claims that regions can impose on a recipient's compensation to recover expenses incurred for medical treatment related to an injury. We understand that navigating the legal structure surrounding these liens can be overwhelming for anyone dealing with personal injury compensation. Typically, federal regulations prevent local health assistance programs from placing liens on a beneficiary's assets, raising the question of whether I will lose my Medicaid if I get a settlement to recoup medical expenses. The program is entitled to recover only the sums related to medical costs it has previously paid. This means that when you receive compensation, the health program may claim a lien against it, leading to concerns about whether I will lose my Medicaid if I get a settlement, which could reduce the net amount you ultimately receive.

For instance, in the landmark case of Gallardo v. Marstiller, the U.S. Supreme Court ruled that regional health programs could reclaim expenses for future medical treatment from beneficiaries who obtain compensation. This decision allows Florida's health care assistance program to recover significant sums from agreements, impacting how beneficiaries negotiate their claims. In Gallardo's case, her $800,000 compensation included $35,367.52 for previous medical costs, while the government sought to reclaim over $300,000 for future care.

The legal landscape is further complicated by the fact that every region has a third-party recovery law, which requires adherence to federal guidelines for retrieving healthcare payments. This can lead to states claiming substantial portions of tort compensations, especially when future medical expenses are involved. Therefore, it’s crucial for beneficiaries to consult with legal professionals who can guide them in negotiating or challenging these liens effectively, especially concerning whether they will lose their Medicaid if they get a settlement. As one legal expert noted, understanding the intricacies of recovery can significantly influence negotiation outcomes, helping beneficiaries retain as much of their awarded funds as possible.

Remember, you are not alone in this journey. Seeking the right support can make all the difference.

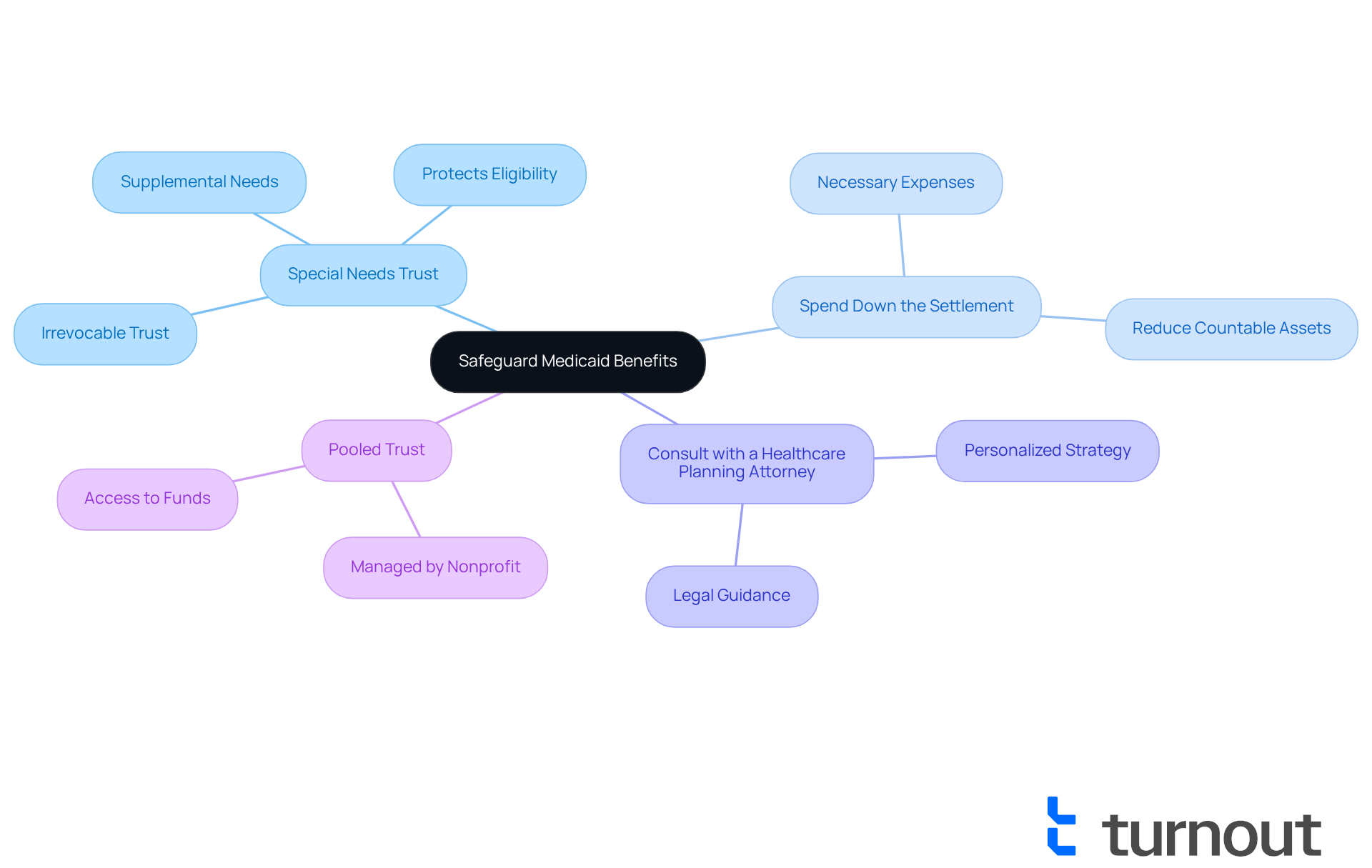

Implement Strategies to Safeguard Your Medicaid Benefits

We understand that navigating healthcare assistance after a resolution can be challenging, particularly when you're wondering, will I lose my Medicaid if I get a settlement? To help you protect your benefits, consider these supportive strategies:

-

Establish a Special Needs Trust (SNT): This allows you to allocate your compensation funds in a way that won’t affect your eligibility for assistance.

-

Spend Down the Settlement: Use the funds for necessary expenses. This can help reduce your countable assets, making it easier to maintain your coverage.

-

Consult with a Healthcare Planning Attorney: An experienced attorney can guide you through the complexities of healthcare regulations and help create a personalized strategy to safeguard your benefits.

-

Consider a Pooled Trust: This option enables you to keep access to your funds while ensuring they remain outside your countable assets.

Each of these strategies can help you maintain your healthcare coverage while considering whether I will lose my Medicaid if I get a settlement. Remember, you are not alone in this journey; we’re here to help you every step of the way.

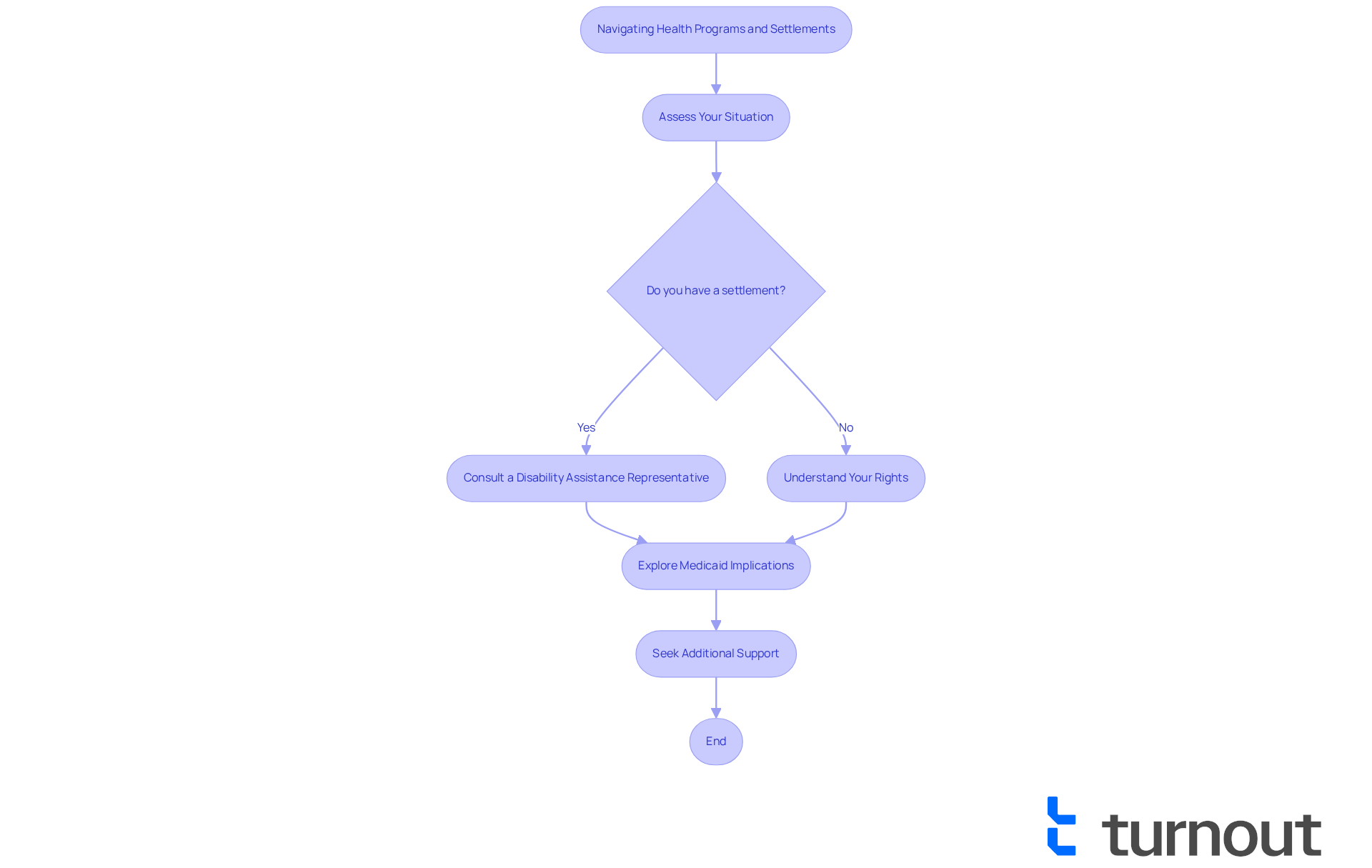

Seek Professional Guidance for Effective Navigation

Navigating the intersection of government health programs and personal injury settlements raises the question, will I lose my Medicaid if I get a settlement, which can feel overwhelming. We understand that this journey is not easy, and that’s why hiring a qualified disability assistance representative is so important. At Turnout, our trained nonlawyer advocates specialize in government health programs, providing the support you need to navigate these complexities with confidence.

Our advocates clarify your rights and guide you through the legal maze, ensuring you understand every step. They can help protect your entitlements and communicate with health care programs about any liens, making sure you adhere to all necessary regulations. For instance, families like the Lathams have successfully worked with our advocates to secure essential healthcare coverage for their son, Calvin, who requires extensive medical attention. Their experience shows just how impactful professional guidance can be in maintaining your benefits.

Lindsay Latham shares, "Without the healthcare program, we would face severe financial strain, potentially forcing one of us to leave our job to provide care for Calvin." This statement underscores the urgency of seeking help. Remember, you are not alone in this journey. The right support from Turnout can truly make a difference in addressing the question of will I lose my Medicaid if I get a settlement during challenging times.

If you’re feeling lost, reach out to us. We’re here to help you navigate this path with compassion and expertise.

Conclusion

Understanding how settlements can affect Medicaid eligibility is crucial for anyone navigating personal injury compensation. We understand that the potential loss of benefits can pose significant risks. That’s why it’s essential to adopt strategies that protect these vital resources. By recognizing the implications of lump-sum payments, liens, and the legal landscape surrounding Medicaid, you can better safeguard your health coverage and financial stability.

Key strategies to consider include:

- Establishing a Special Needs Trust

- Spending down settlement funds wisely

- Consulting with healthcare planning attorneys

- Considering pooled trusts

Each of these approaches offers a pathway to maintaining eligibility while ensuring that necessary medical care remains accessible. Remember, the importance of professional guidance cannot be overstated; enlisting the help of experienced advocates can clarify your rights and help you navigate the complexities of Medicaid regulations effectively.

Ultimately, the journey to protect Medicaid benefits after a settlement may seem daunting. But proactive planning and informed decision-making can make all the difference. Engaging with knowledgeable professionals and implementing strategic measures will not only safeguard your health coverage but also empower you to navigate the intricacies of your financial and medical needs with confidence. Taking these steps ensures that vital support remains intact, allowing for a more secure and healthier future. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is the main concern for individuals regarding Medicaid and settlements?

The main concern is whether individuals will lose their Medicaid benefits if they receive a settlement, as certain agreements can be classified as income or assets, potentially exceeding permissible limits.

How can a settlement affect Medicaid eligibility?

A lump-sum settlement might be considered income for the month it is received, which could push an individual above the income limit of their assistance program. Additionally, keeping compensation funds in a personal account may lead to disqualification from health assistance due to strict asset restrictions.

Why is it important to contact a state health assistance agency?

It is crucial to contact a state health assistance agency to gain clarity on the specific regulations and how they apply to an individual's situation regarding settlements and Medicaid eligibility.

What do statistics reveal about individuals and their understanding of settlement impacts on health benefits?

Statistics show that many individuals only realize the impact of their settlements on health benefits after encountering unexpected medical expenses or treatment interruptions.

How can individuals protect their Medicaid eligibility after receiving a settlement?

Individuals can protect their Medicaid eligibility by establishing a Special Needs Trust (SNT) to place their compensation funds into, which allows them to maintain access to necessary medical care without jeopardizing their benefits.

What role do advocates play in navigating Medicaid and settlements?

Advocates emphasize the importance of understanding the link between personal injury compensations and health coverage, helping individuals make informed decisions to protect their financial and health needs.

What resources does Turnout offer to assist individuals with these issues?

Turnout provides valuable tools and services, including support for SSD claims through trained nonlawyer advocates and guidance on tax debt relief options, to help individuals navigate complex financial systems and receive the assistance they deserve.