Overview

Are you wondering if you'll receive a W-2 for your long-term disability (LTD) benefits? It’s a common concern, and we’re here to help you navigate this. Whether you get a W-2 largely depends on who pays the premiums for your LTD coverage.

If your employer covers the costs, the benefits you receive are generally taxable and will be reported on a W-2. However, if you paid the premiums with after-tax dollars, those benefits may not be taxable, meaning you wouldn’t need a W-2 at all. Understanding this distinction is crucial for managing your tax obligations related to LTD benefits.

We understand that tax matters can feel overwhelming, especially when dealing with disability. Knowing the source of your premium payments can provide clarity and peace of mind. Remember, you’re not alone in this journey, and it’s important to seek guidance if you have questions. If you need further assistance, don’t hesitate to reach out.

Introduction

Navigating the complexities of long-term disability (LTD) benefits can feel overwhelming, especially when it comes to understanding tax implications and documentation requirements. We know that as you face medical challenges, clarity on whether you’ll receive a W-2 for LTD payments is essential for your financial future.

This guide aims to shed light on the key factors that influence W-2 eligibility, the tax responsibilities associated with different premium payment scenarios, and the documentation needed to support your claims. It’s common to feel uncertain when tax reporting intersects with your pressing need for financial support.

But don’t worry; we’re here to help you through this often confusing landscape. Together, we’ll explore the answers that can illuminate your path forward.

Understand Long-Term Disability Benefits and W-2 Forms

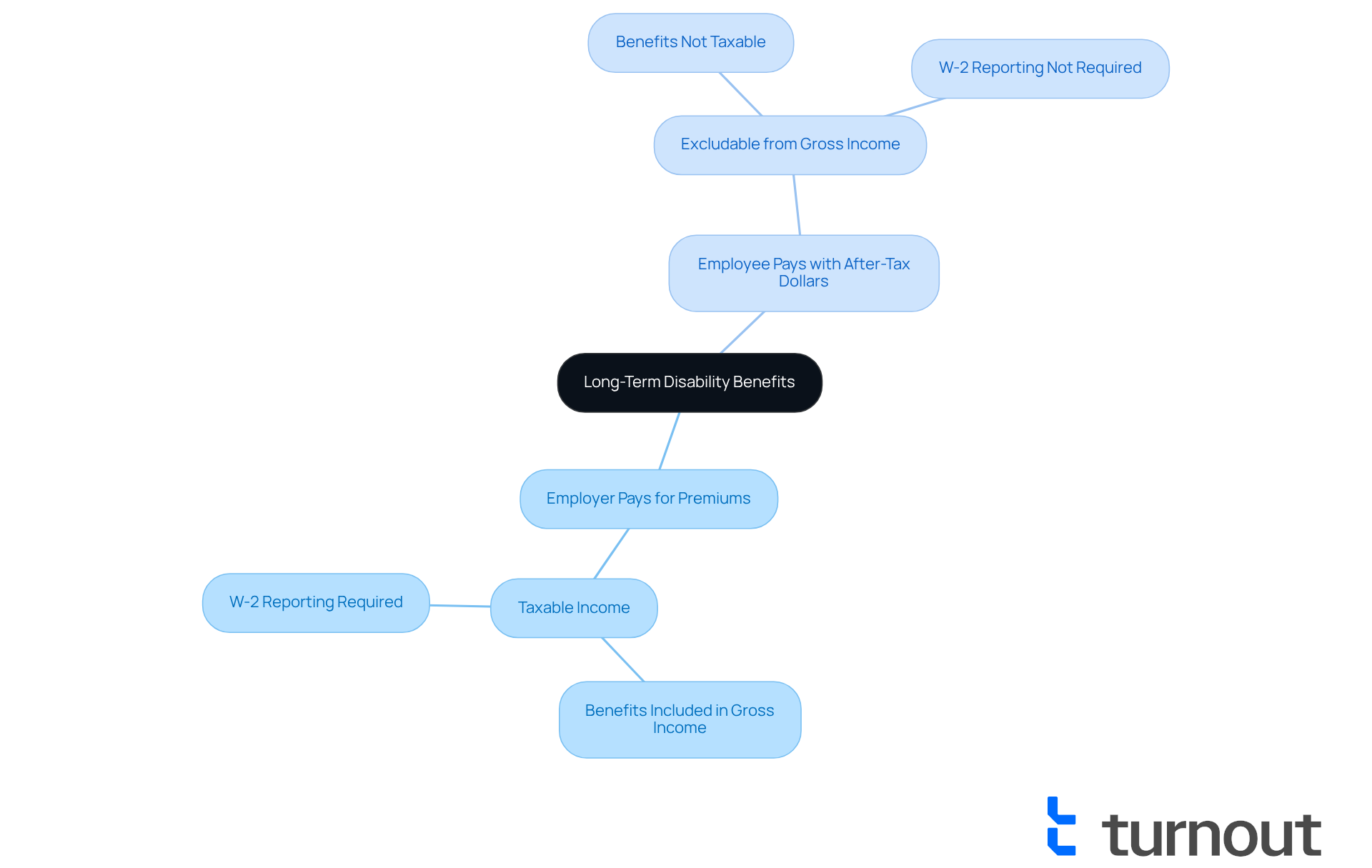

Long-term disability (LTD) assistance is here to provide crucial financial support for those unable to work due to medical issues. We understand that navigating the complexities of tax documents, especially the W-2, can be overwhelming. It’s important to know how these benefits are reported for accurate tax submission. If your employer pays for your LTD insurance, you might ask, will I get a W-2 for long term disability payments that detail the amount received and any taxes deducted? However, if you paid the premiums with after-tax dollars, those benefits might not be taxable, so you may wonder, will I get a W2 for long term disability for those payments?

According to IRS guidelines for 2025:

- If your employer covers the premiums, those benefits are generally considered taxable income and must be reported.

- If you’ve made the choice to have the coverage paid on an after-tax basis, those benefits can be excluded from your gross income under § 104(a)(3).

Understanding this distinction is vital for grasping your tax responsibilities related to LTD benefits.

Most LTD policies replace a portion of your pre-disability earnings, typically around 66%. This highlights the financial impact these provisions can have. For accurate reporting, familiarize yourself with the IRS instructions for Forms W-2 and W-3, as these include detailed guidance on reporting long-term disability payments and address the question of will I get a W2 for long term disability to ensure compliance with tax regulations. Additionally, resources like the TBI Disability Center are available to help you navigate LTD claims. Remember, you’re not alone in this journey, and there are people ready to support you.

Identify Eligibility Criteria for Receiving a W-2

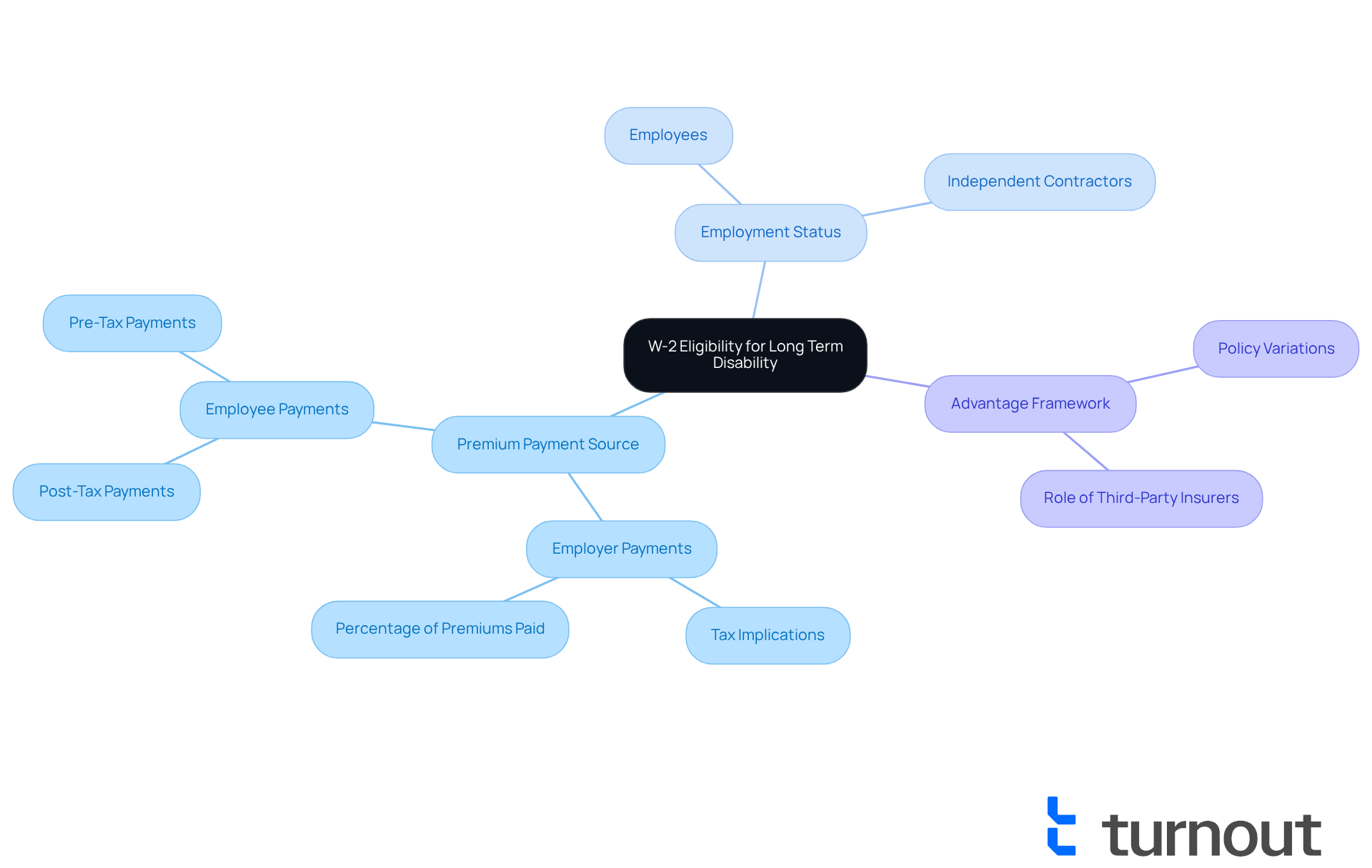

If you're wondering, will I get a W-2 for long term disability (LTD) benefits, you're not alone. Many people face uncertainty in this area, and understanding the eligibility criteria can help ease your concerns. Let's explore some key factors that can influence your situation.

-

Premium Payment Source: One of the first things to consider is who pays the premiums for your LTD insurance. If your employer covers these costs, you may be wondering, will I get a W-2 for long term disability? However, if you’ve been paying the premiums with after-tax dollars, those benefits might not show up on a W-2. Tax experts, like Richard Reich, emphasize that the source of premium payments plays a significant role in tax reporting obligations. For instance, if your employer pays 50% of the premiums, you might find that 66.6% of the benefits could be taxable if part of it is paid with post-tax dollars.

-

Employment Status: It’s also essential to consider your employment status. To determine if I will get a W-2 for long term disability, you need to be an employee of the company providing the LTD benefits. If you’re an independent contractor or self-employed, you’ll typically receive a different tax form, such as a 1099, which doesn’t apply to W-2 reporting.

-

Advantage Framework: Take a close look at your LTD policy to understand how benefits are structured and reported. Policies can vary widely; some may not require a W-2 if payments come from a third-party insurer. For example, if your employer pays for 50% of the premiums, the benefits you receive might be partially taxable, which could affect whether you get a W-2.

By reflecting on these criteria, you can gain a clearer picture of what to expect regarding your tax documentation for long-term disability assistance. Remember, the details surrounding premium payments and your employment status are crucial in determining your tax obligations. We’re here to help you navigate this process, and you’re not alone in this journey.

Gather Necessary Documentation for Your Claim

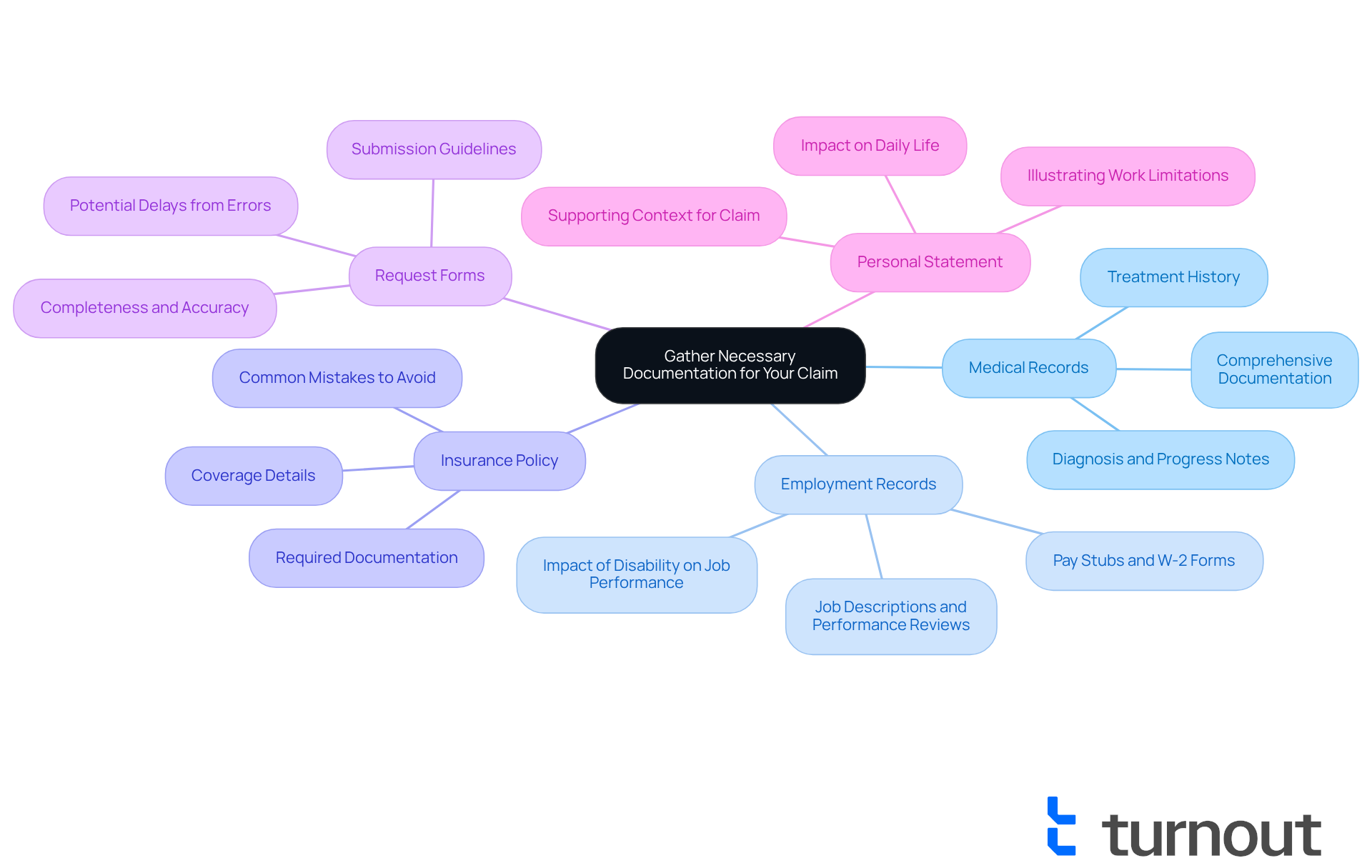

When you're preparing to apply for long-term disability assistance, gathering the right documentation is essential to support your request. We understand that this process can feel overwhelming, so here’s a helpful checklist of crucial documents:

-

Medical Records: Start by obtaining comprehensive medical records that detail your condition and treatment history. This documentation is vital for establishing your eligibility for benefits. Remember, the Social Security Administration emphasizes that medical evidence is the cornerstone of disability determination.

-

Employment Records: Next, collect pay stubs, W-2 forms, and any other employment-related documents that show your income before your disability began to determine if I will get a W2 for long term disability. This information is necessary to assess your financial situation prior to your request.

-

Insurance Policy: Take a close look at your long-term disability insurance policy to understand the coverage details and any specific documentation required for requests. Knowing your policy can help you avoid common mistakes that might lead to denial of benefits.

-

Request Forms: Make sure to complete all necessary request forms provided by your insurance provider. It’s important that all information is accurate and thorough to prevent delays in processing your request. Even minor mistakes can lead to a loss of advantages.

-

Personal Statement: Finally, write a personal statement explaining how your condition affects your ability to work. This narrative can provide valuable context to your claim, illustrating the impact of your disability on your daily life.

Having these documents ready will not only simplify the process but also clarify any tax consequences associated with your entitlements, such as whether I will get a W2 for long term disability. Statistics show that thorough documentation significantly enhances the chances of approval, underscoring the importance of approaching this process with diligence and care. Remember, you are not alone in this journey, and we're here to help.

Monitor Your Claim Status and Address Potential Issues

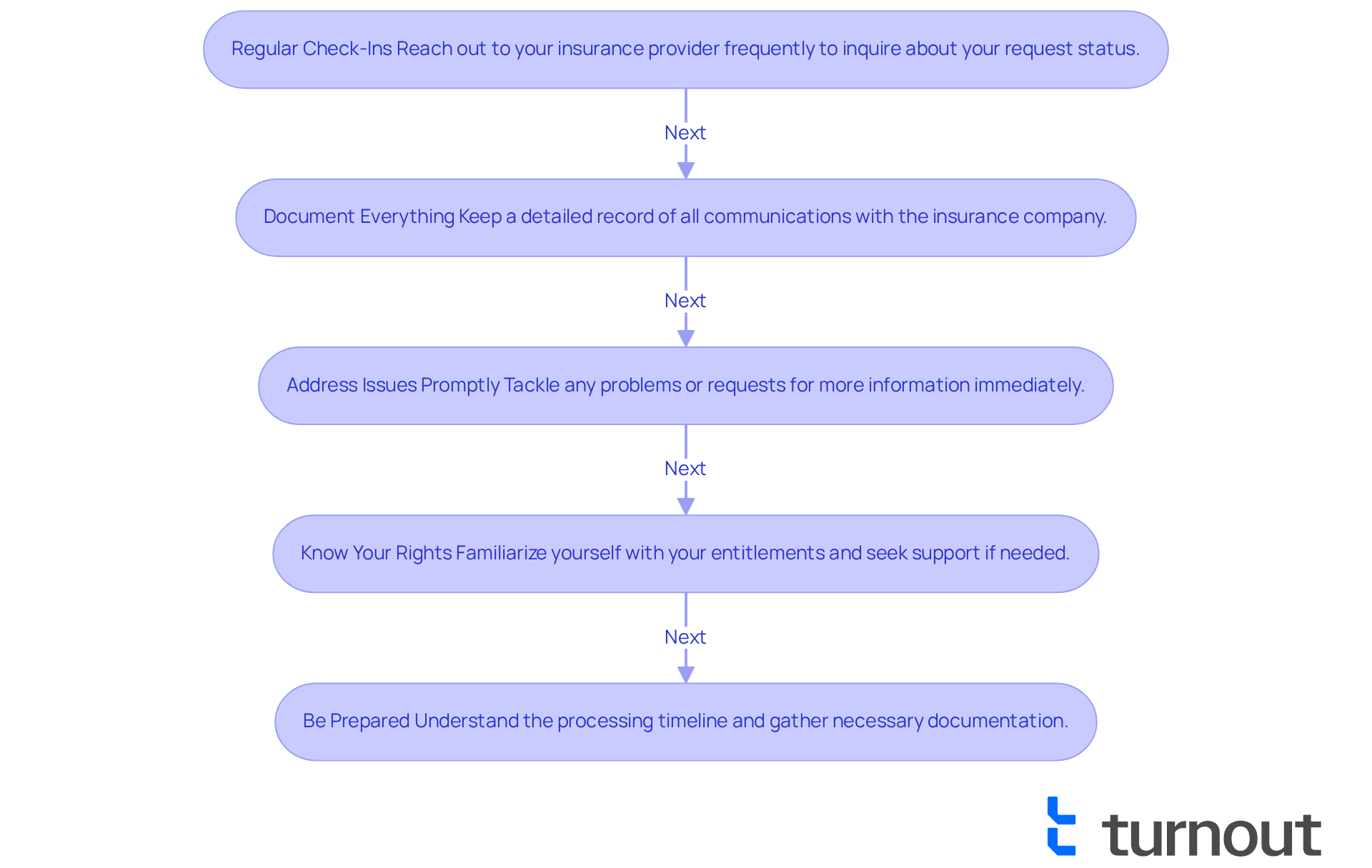

Once you’ve submitted your request for long-term disability benefits, it’s essential to keep an eye on its status. We understand that this process can be overwhelming, but staying informed can make a significant difference. Here are some steps to help you navigate this journey:

-

Regular Check-Ins: Make it a habit to reach out to your insurance provider frequently. Inquire about the status of your request. This way, you’ll stay updated on any actions you need to take or additional documentation required.

-

Document Everything: Keep a detailed record of all your communications with the insurance company. Note down dates, times, and the names of representatives you speak with. This documentation can be invaluable if any issues arise.

-

Address Issues Promptly: If you encounter problems, like requests for more information or processing delays, tackle them right away. Providing any requested documentation swiftly can help prevent further delays.

-

Know Your Rights: Familiarize yourself with your entitlements during this process. If you feel your request is being unfairly delayed or denied, consider reaching out to a consumer advocacy group for support.

By being proactive and informed, you can manage the reimbursement process more effectively, ensuring that your long-term disability assistance is handled promptly. It’s important to remember that nearly 40% of American adults struggle with unexpected costs, highlighting the need to secure your entitlements as quickly as possible. Additionally, many valid LTD requests are wrongly denied or benefits terminated after the two-year mark, making meticulous record-keeping essential.

Keep in mind that processing LTD claims typically takes 5 to 20 days. Being prepared can significantly enhance your chances of a favorable outcome. Remember, you are not alone in this journey; we’re here to help.

Conclusion

Understanding the complexities of long-term disability (LTD) benefits and their tax implications can feel overwhelming. We recognize that navigating this landscape is challenging, and it’s crucial to know how the distinction between taxable and non-taxable benefits depends largely on who pays the premiums. Clarity about your coverage is essential. By grasping these nuances, you can prepare for your tax responsibilities and ensure compliance.

Key points in this guide highlight the importance of:

- Knowing where your premium payments come from

- Gathering thorough documentation

- Keeping an eye on the status of your LTD claim

Each of these elements is vital in determining whether you’ll receive a W-2 for long-term disability payments and how those payments will be taxed. Moreover, understanding your rights and being proactive can significantly enhance your chances of a favorable outcome.

Ultimately, securing long-term disability benefits is about more than just financial support; it’s about empowering you to navigate your rights and responsibilities effectively. If you’re facing the uncertainties of LTD claims, staying informed and organized is key. Remember, you’re not alone in this journey. Engage with the resources and support systems available to you, and take charge of your situation. Understanding your benefits can lead to a smoother and more successful experience in managing long-term disability assistance.

Frequently Asked Questions

What are long-term disability (LTD) benefits?

Long-term disability benefits provide financial support for individuals who are unable to work due to medical issues.

How are long-term disability benefits reported for tax purposes?

The reporting of long-term disability benefits depends on who pays the premiums. If your employer covers the premiums, those benefits are generally considered taxable income. However, if you paid the premiums with after-tax dollars, the benefits may not be taxable.

Will I receive a W-2 form for long-term disability payments?

If your employer pays for your LTD insurance, you will receive a W-2 form detailing the amount received and any taxes deducted. If you paid the premiums with after-tax dollars, you may not receive a W-2 for those payments.

What percentage of pre-disability earnings do LTD policies typically replace?

Most long-term disability policies replace about 66% of your pre-disability earnings.

Where can I find guidance on reporting long-term disability payments?

For accurate reporting, you can refer to the IRS instructions for Forms W-2 and W-3, which provide detailed guidance on reporting long-term disability payments.

What resources are available to help with LTD claims?

Resources like the TBI Disability Center can assist you in navigating long-term disability claims and understanding your rights and responsibilities.