Introduction

As we look ahead to 2025, many individuals may feel the effects of a projected 2.5% increase in Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) payments. This adjustment is designed not just to keep pace with inflation, but also to provide a vital opportunity for recipients to rethink their financial strategies amid rising living costs.

We understand that navigating these changes can be overwhelming. How can you prepare effectively for these adjustments? It’s common to feel uncertain about maximizing your benefits, especially with the complexities surrounding eligibility and documentation.

You are not alone in this journey. Together, we can explore ways to ensure you’re ready to make the most of these changes. Let's take a closer look at how you can approach this transition with confidence.

Understand the 2025 Disability Increase

In 2025, Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) payments are set to increase by about 2.5% due to a cost-of-living adjustment (COLA). This change will significantly affect millions of Americans. For instance, the maximum SSI payment will rise from $943 to $967 per month. SSDI beneficiaries can expect an average increase of around $40, bringing the average monthly payment to approximately $1,580.

We understand that navigating financial planning can be challenging, especially for those relying on these benefits. The COLA is a vital tool that helps ensure your benefits keep pace with rising living costs, particularly in times of inflation. For individuals depending on disability assistance, the question of whether disability will increase in 2025 is especially important as it helps maintain purchasing power amid increasing expenses.

In early December, recipients will receive updated notifications from the Social Security Administration, detailing their new payment amounts in a clear and straightforward format. This proactive communication aims to enhance clarity and ensure that you are well-informed about your financial entitlements. As the COLA reflects current economic realities, it underscores the importance of staying informed about changes to your benefits, enabling you to manage your personal finances effectively.

If you’re seeking assistance with SSD claims, Turnout is here to help. They offer valuable support through trained nonlawyer advocates who can guide you through the complexities of the application process. It’s important to note that Turnout is not a law firm and does not provide legal representation or advice. Their expertise in navigating these systems can be crucial in helping you obtain the benefits you deserve. Remember, you are not alone in this journey.

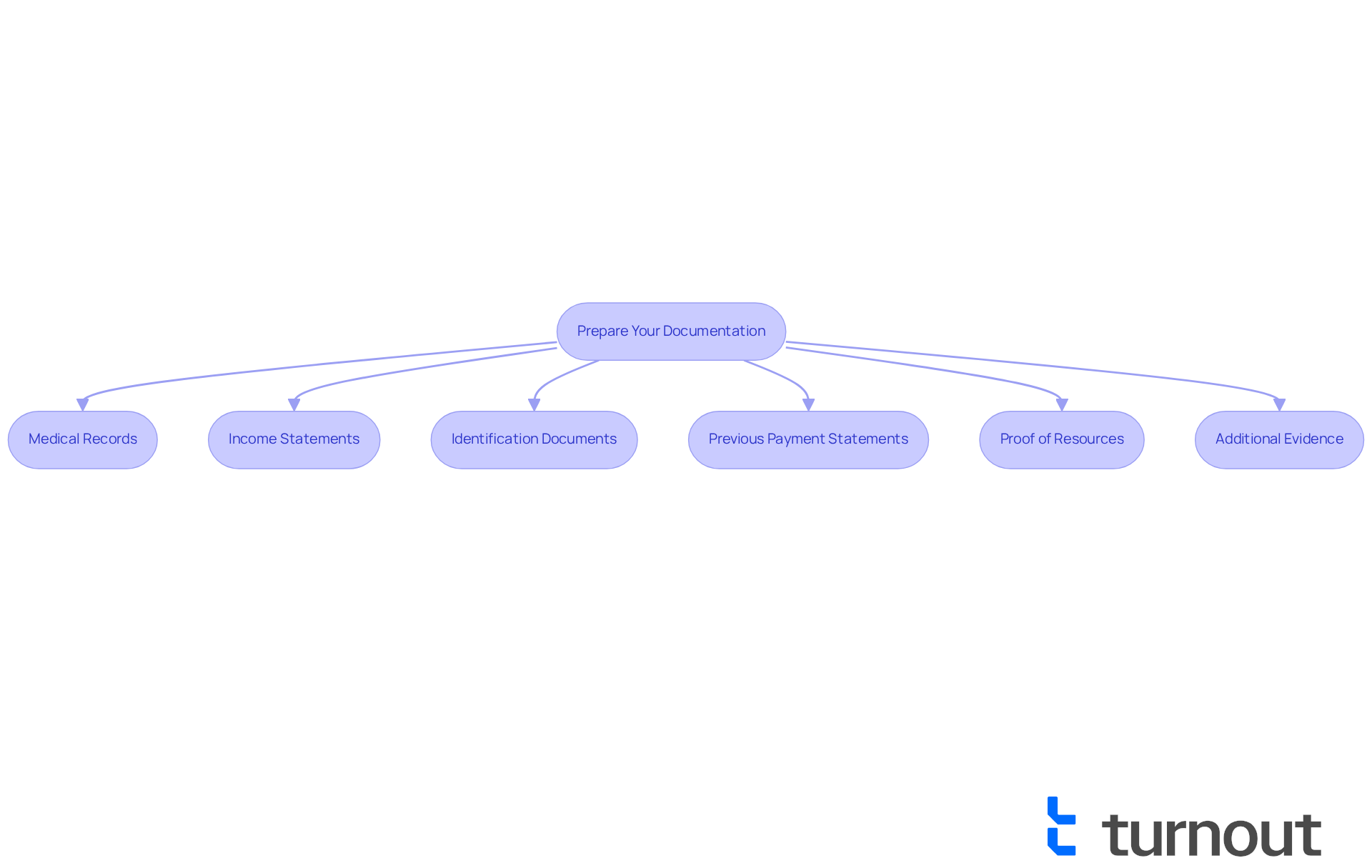

Prepare Your Documentation and Eligibility

Preparing for the 2025 impairment increase raises the question of whether disability will increase in 2025, but gathering the necessary documentation to support your eligibility for benefits is essential. We understand that this process can be daunting, so let’s break it down together. Here’s what you’ll need:

-

Medical Records: Make sure you have comprehensive and up-to-date medical documentation that clearly outlines your disability and its impact on your ability to work. This should include detailed reports from healthcare providers, treatment histories, and any relevant test results.

-

Income Statements: Collect recent pay stubs, tax returns, and other income-related documents to verify your financial situation. This is crucial, as your earnings must fall below the Substantial Gainful Activity (SGA) limit to qualify for SSDI.

-

Identification Documents: Have your Social Security card, birth certificate, naturalization certificate, U.S. passport, and any other identification readily available. If you are a noncitizen, ensure you have the necessary immigration documents, such as a Permanent Resident Card or military discharge papers if applicable.

-

Previous Payment Statements: Keep copies of your past SSDI or SSI statements to reference your current payment levels. This can assist in understanding any changes in your benefits as we consider how disability will increase in 2025.

-

Proof of Resources: Gather documentation to prove your resources, such as bank statements, property deeds, and other financial assets, as these may be necessary for your application.

-

Additional Evidence: If applicable, gather letters or documents from healthcare providers that support your claim. This could include recommendations for treatment or assessments of your condition's impact on daily activities.

At Turnout, we’re here to assist you in navigating this process. Utilizing trained nonlawyer advocates, we can help streamline your SSD claims, ensuring you have the support needed to effectively manage your application. Please remember, Turnout is not a law firm and does not provide legal advice. Arranging these documents now will make the application process smoother when the new advantages take effect, helping you navigate the complexities of the SSDI and SSI systems with ease.

And don’t worry if some documents are missing - you can still submit your application. Don’t delay your filing; you are not alone in this journey.

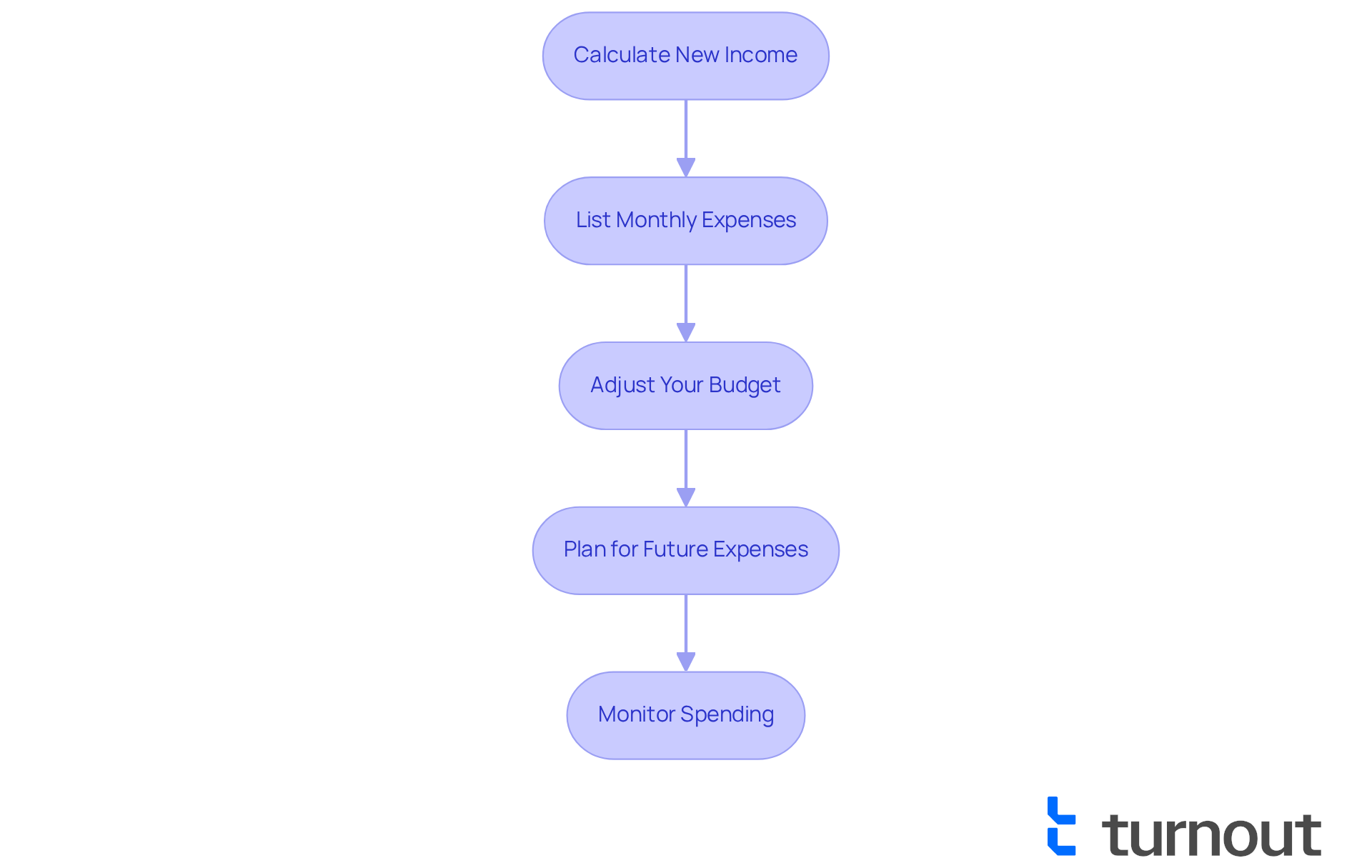

Assess the Impact on Monthly Payments and Budgeting

As you anticipate the rise in disability support, it’s essential to take a moment to reevaluate your monthly budget. We understand that managing finances can be challenging, but with a few adjustments, you can navigate this change smoothly. Here’s how to get started:

- Calculate New Income: Begin by determining your new monthly assistance amount based on the expected 2.5% increase. For instance, if your current SSDI payment is $1,540, you can expect it to rise to around $1,580.

- List Monthly Expenses: Take the time to write down all your fixed and variable expenses. This includes housing, utilities, groceries, and medical costs. Knowing where your money goes is a crucial step.

- Adjust Your Budget: With the increase in support, consider reallocating funds to areas that may have felt limited before, like savings or emergency funds. It’s a great opportunity to strengthen your financial security.

- Plan for Future Expenses: Think ahead about any upcoming expenses that will disability increase in 2025, including healthcare costs or necessary home modifications. By factoring these into your budget now, you’ll feel more prepared.

- Monitor Spending: Keep an eye on your spending habits. This will help ensure you’re living within your means while making the most of your increased support.

At Turnout, we’re here to help you navigate these changes effectively. Our skilled nonlawyer advocates are dedicated to assisting you with SSD claims, ensuring you have the support you need to optimize your benefits without the complexities of legal representation. Remember, you are not alone in this journey; we’re here to help.

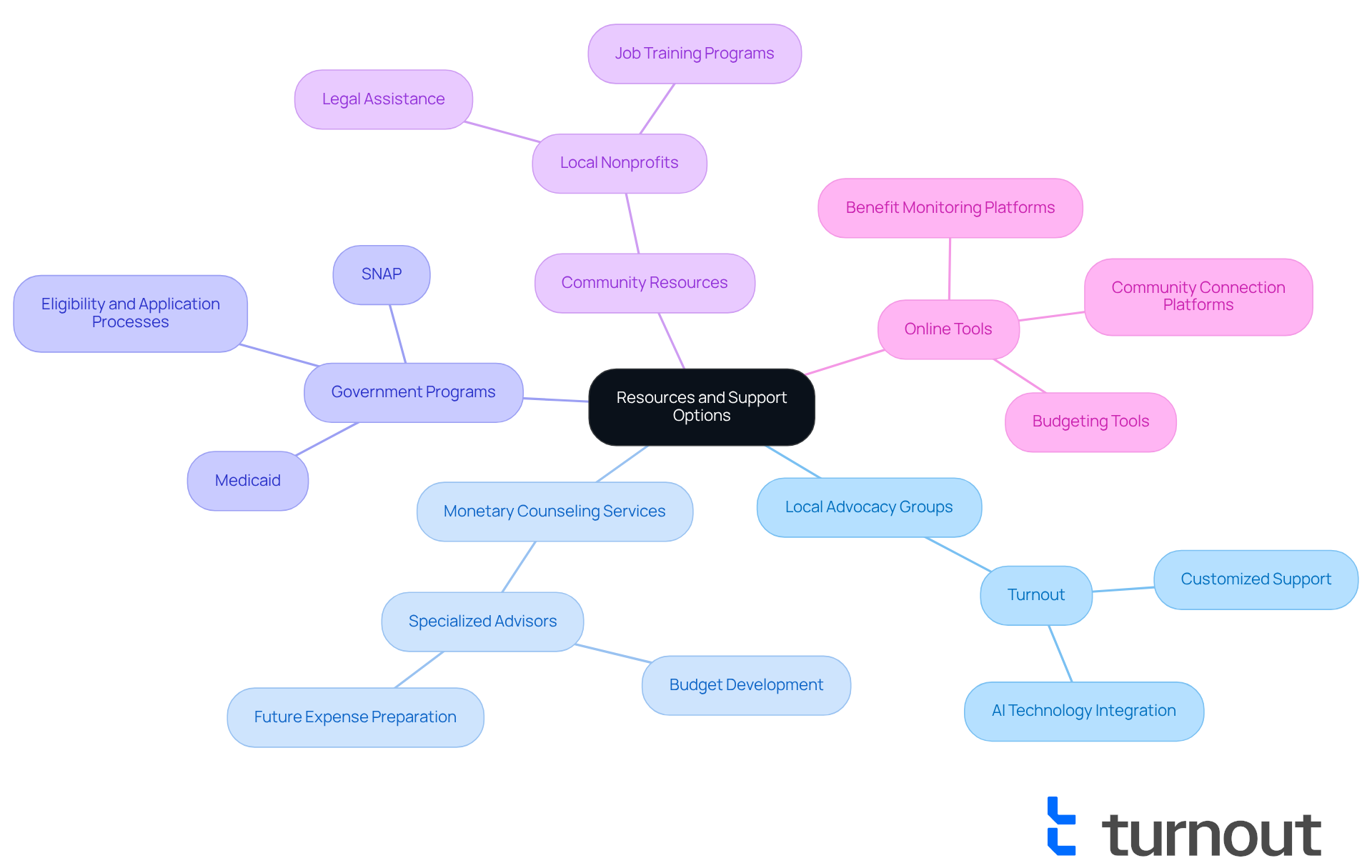

Explore Additional Resources and Support Options

We understand that navigating the world of benefits can be overwhelming, especially for individuals with disabilities. But there’s good news! A variety of resources are available to support you on this journey:

-

Local Advocacy Groups: Organizations like Turnout are here to help you. They provide customized support to navigate the complexities of assistance programs, including understanding service charges and government fees related to applications. Their innovative approach combines AI technology with human expertise, ensuring you receive timely and effective support.

-

Monetary Counseling Services: Engaging with advisors who specialize in disability benefits can be a game-changer. These experts offer crucial guidance on managing your resources effectively. They can help you develop budgets and prepare for future expenses, paving the way for economic stability.

-

Government Programs: Additional assistance programs, such as SNAP (food assistance) and Medicaid, can provide essential financial relief. It’s important to understand the eligibility and application processes for these programs to maximize the support available to you.

-

Community Resources: Many local nonprofits offer a range of services, from legal assistance to job training, specifically designed for individuals with disabilities. These organizations play a vital role in empowering you to achieve greater independence and success.

-

Online Tools: There are various online platforms that can help you monitor benefits, budget expenses, and connect with others facing similar challenges. Turnout also provides electronic communication for updates and disclosures, making it easier for you to access information about your benefits.

By leveraging these resources, you can enhance your financial security and ensure you’re fully utilizing your benefits. Remember, you are not alone in this journey, and we’re here to help!

Conclusion

The anticipated increase in disability benefits for 2025 presents a significant opportunity for those relying on Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) to enhance their financial stability. With a projected 2.5% rise in payments, beneficiaries can better manage the challenges posed by rising living costs, ensuring that their purchasing power remains intact.

We understand that navigating these changes can feel overwhelming. Throughout this article, we’ve shared key insights on how to prepare effectively. From understanding the upcoming adjustments in payment amounts to gathering necessary documentation and reassessing personal budgets, each step is crucial in navigating this transition. Remember, utilizing available resources, such as advocacy groups and monetary counseling services, can empower you to manage your benefits wisely.

As the landscape of disability support evolves, it’s essential to take proactive measures to secure your financial well-being. By preparing documentation, adjusting budgets, and leveraging community resources, you can not only adapt to the changes in 2025 but also thrive despite them. The message is clear: staying informed and organized is vital in maximizing the benefits and support available. Together, we can ensure a more secure future for all disability recipients.

Frequently Asked Questions

What is the expected increase in Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) payments in 2025?

In 2025, SSDI and SSI payments are set to increase by about 2.5% due to a cost-of-living adjustment (COLA).

How much will the maximum SSI payment increase in 2025?

The maximum SSI payment will rise from $943 to $967 per month in 2025.

What is the average increase for SSDI beneficiaries in 2025?

SSDI beneficiaries can expect an average increase of around $40, bringing the average monthly payment to approximately $1,580.

Why is the cost-of-living adjustment (COLA) important for disability benefits?

The COLA is vital as it helps ensure that benefits keep pace with rising living costs, particularly during times of inflation, thereby maintaining purchasing power amid increasing expenses.

When will recipients receive notifications about their new payment amounts?

Recipients will receive updated notifications from the Social Security Administration in early December, detailing their new payment amounts.

How does the Social Security Administration communicate changes to benefits?

The Social Security Administration communicates changes through clear and straightforward notifications to ensure recipients are well-informed about their financial entitlements.

What support does Turnout offer for SSD claims?

Turnout offers assistance through trained nonlawyer advocates who can guide individuals through the complexities of the SSD application process.

Is Turnout a law firm?

No, Turnout is not a law firm and does not provide legal representation or advice; their expertise lies in navigating the SSD system to help individuals obtain the benefits they deserve.