Introduction

Navigating the U.S. tax system can feel overwhelming. Many diligent taxpayers find themselves lost in a maze of regulations, forms, and deadlines. It’s common to feel confused and anxious about potential errors and disputes with the IRS.

We understand that these challenges can be stressful. That’s where tax resolution firms come in. Their expertise can turn a daunting situation into something manageable, providing the support you need.

But what happens if you choose to ignore these tax challenges? The consequences can be severe. This raises an important question: is professional assistance the key to finding financial peace of mind?

You are not alone in this journey. We’re here to help you navigate these complexities with confidence.

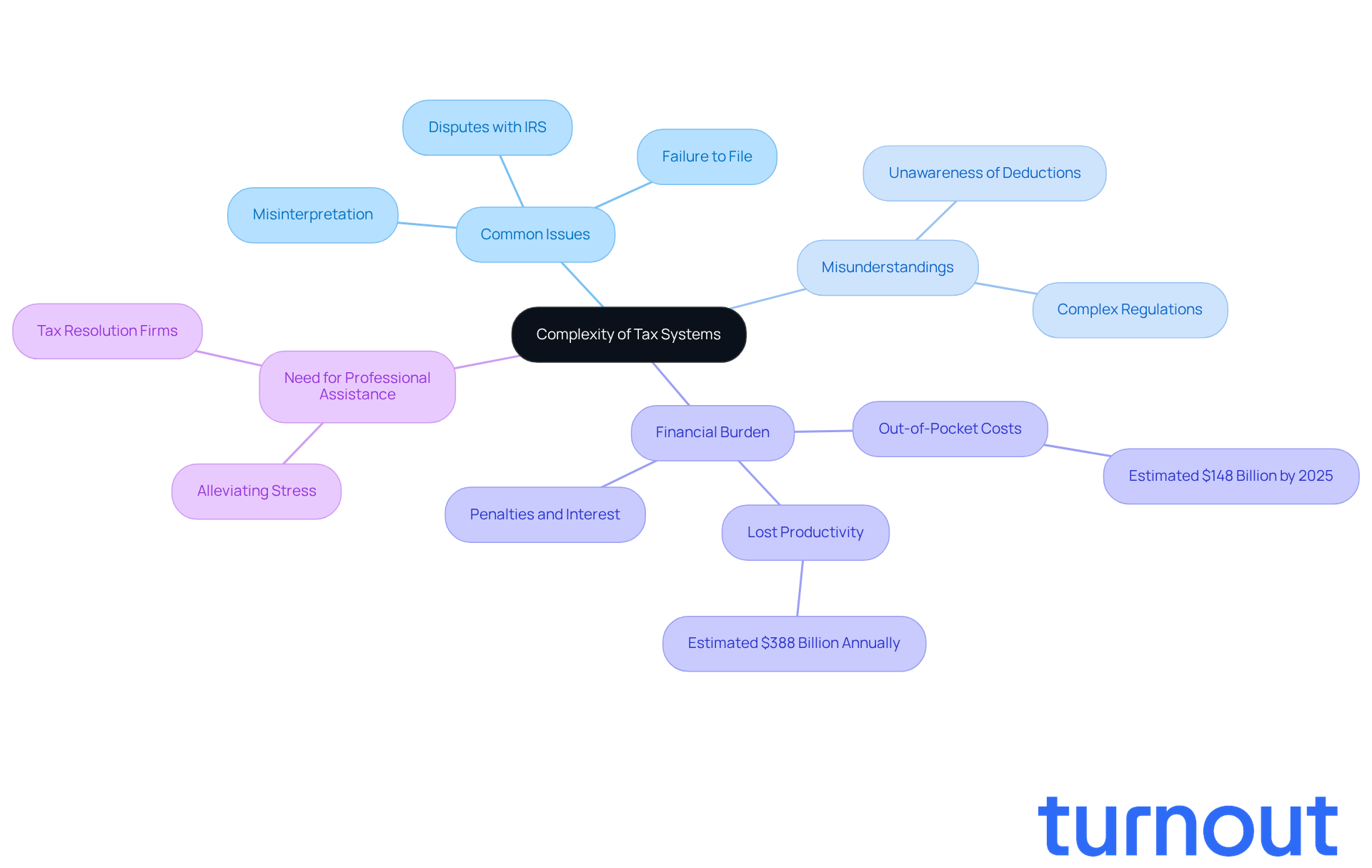

Understand the Complexity of Tax Systems and Common Issues

Navigating the U.S. tax system can feel overwhelming. With its intricate web of regulations, forms, and deadlines, it’s no wonder that even the most diligent taxpayers often find themselves confused. Many individuals misunderstand tax laws, leading to common issues like misinterpretation, failure to file, and disputes with the IRS over owed amounts.

Have you ever felt uncertain about your tax situation? You’re not alone. A significant number of taxpayers are unaware that they qualify for specific deductions or credits, which can lead to unnecessary overpayments. The complexities surrounding tax debt can also result in rapidly accumulating penalties and interest, trapping individuals in a cycle of financial distress.

In fact, the IRS estimates that by 2025, taxpayer out-of-pocket costs will reach a staggering $148 billion. This highlights the financial burden of compliance that many face. For a tax resolution firm, understanding these complexities is crucial. It helps you identify when you might need the services of a tax resolution firm for professional assistance.

We understand that navigating the tax landscape without support can exacerbate your challenges, making the assistance of a tax resolution firm essential. Remember, you are not alone in this journey. Seeking help can make a significant difference in alleviating your stress and ensuring you’re on the right path.

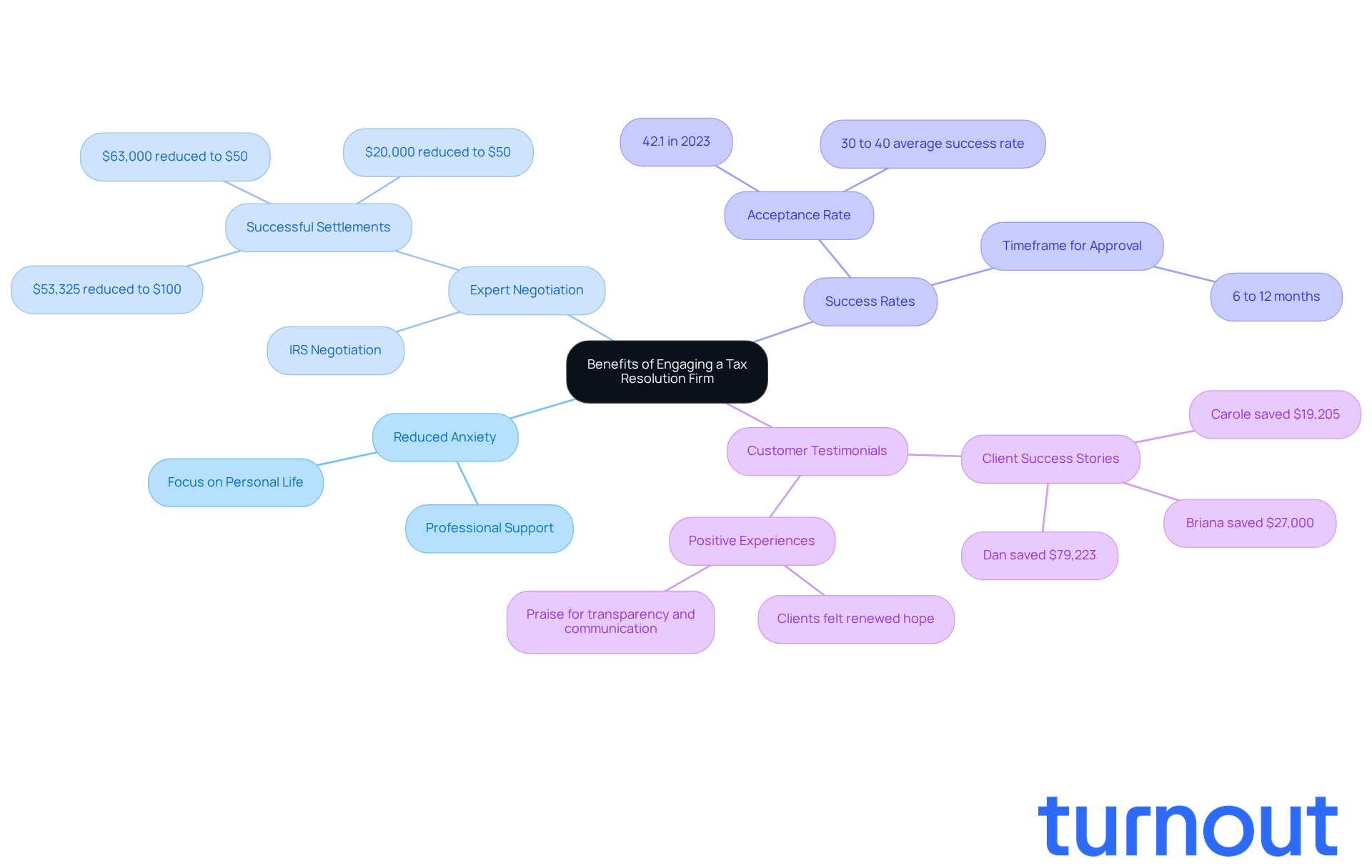

Explore the Benefits of Engaging a Tax Resolution Firm

Are you feeling overwhelmed by tax problems? Hiring a tax resolution firm can significantly ease that anxiety. These companies offer various advantages that help you navigate complex financial situations with care and expertise. With their specialized understanding of tax laws and regulations, they provide personalized guidance tailored to your unique circumstances.

Imagine having someone negotiate with the IRS on your behalf. A tax resolution firm can potentially lower your tax obligations and secure favorable payment arrangements. This is especially important since the IRS typically takes 6 to 12 months to assess Offer in Compromise applications. In 2023, the IRS accepted 12,711 proposals out of 30,163 submitted, resulting in an acceptance rate of around 42.1%. This highlights how effective these companies can be in negotiating with the IRS.

For instance, consider a self-employed freelancer who resolved a $53,325 tax obligation for just $100 through the negotiation efforts of a tax resolution firm. That’s a remarkable saving! Customer endorsements further emphasize the effectiveness of these services. One individual saw their tax obligation of over $20,000 drop to only $50, showcasing the transformative impact of professional support. Another customer reduced their tax obligation from over $63,000 to just $50, illustrating the significant benefits of working with a tax resolution firm.

These companies also take care of all communications with tax authorities. This allows you to focus on your personal and professional life without the stress of constant IRS interactions. Such professional support not only leads to quicker resolutions but also brings peace of mind, making it a worthwhile investment for anyone facing tax challenges.

With an average success rate of 30% to 40% for Offer in Compromise applications, the expertise of these firms can greatly enhance your chances of a favorable outcome. However, it’s important to remember that once an Offer in Compromise is accepted, you must adhere to specific conditions. This includes staying current with tax filings and payments for five years to maintain your agreement with the IRS.

You’re not alone in this journey. If you’re feeling stuck, reaching out for help could be the first step toward relief.

Recognize the Risks of Ignoring Tax Problems

Ignoring tax problems can lead to serious consequences. You might face escalating debt, penalties, and even legal action. We understand that this can be overwhelming. Taxpayers who don’t address their obligations may find themselves dealing with:

- Wage garnishments

- Property liens

- A damaged credit score

In extreme cases, persistent neglect can even lead to criminal charges for tax evasion.

The emotional toll of tax issues is significant. Stress and anxiety can affect your overall well-being. It’s common to feel lost in this situation, but recognizing these risks is the first step toward finding a solution. Seeking help from a tax resolution firm can make a world of difference in navigating these challenges effectively.

At Turnout, we’re here to help. Our tax resolution firm provides access to IRS-licensed enrolled agents who can assist with tax debt relief. You don’t have to face this alone. Our team ensures that you receive the necessary support without the need for legal representation. This approach allows you to tackle your tax issues confidently and effectively, minimizing the risks associated with neglecting your financial obligations.

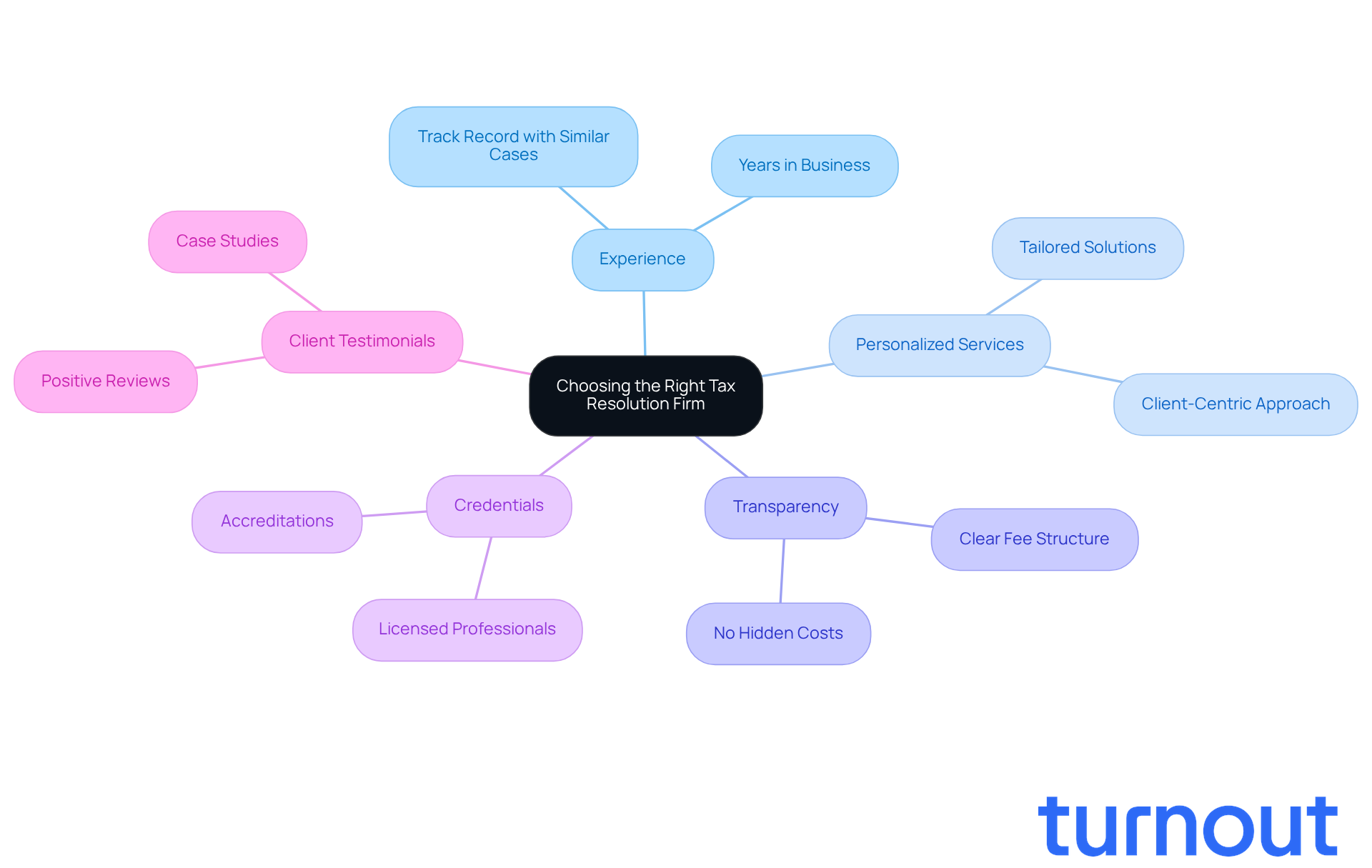

Identify Key Factors in Choosing the Right Tax Resolution Firm

Choosing a tax resolution firm can feel overwhelming, and we understand that. It's crucial to consider a few key factors to ensure you receive the help you need. Start by looking at the company's experience and track record with cases like yours. Personalized services can make a significant difference, leading to better outcomes tailored to your unique situation.

Transparency is vital, too. Trustworthy agencies will provide clear information about their fees and processes right from the start. You deserve to know what to expect without any hidden surprises. Don't forget to check for credentials and client testimonials; these can give you insight into the firm's reliability and effectiveness.

By keeping these factors in mind, you can make informed choices that enhance your chances of successfully resolving your tax issues through a tax resolution firm. Remember, you're not alone in this journey, and we're here to help you every step of the way.

Conclusion

Navigating the complexities of the tax system can feel overwhelming. Many individuals find themselves caught in a cycle of confusion and financial distress. That’s why engaging a tax resolution firm is so important. These professionals offer the expertise and support needed to tackle tax challenges effectively. By seeking assistance, you can lighten your burdens and discover a clear path toward resolution.

Throughout this article, we’ve shared key insights about the benefits of hiring a tax resolution firm. From personalized guidance tailored to your unique circumstances to successful negotiations with the IRS, these firms can help you reduce your tax obligations and achieve favorable outcomes. Ignoring tax problems can lead to escalating debt and legal repercussions, which is why understanding what to consider when choosing a firm is crucial. This ensures you receive the right support for your situation.

Ultimately, the message is clear: you don’t have to face tax challenges alone. Taking the proactive step of consulting a tax resolution firm can lead to significant financial relief and peace of mind. By recognizing the complexities of tax laws and the potential consequences of inaction, you empower yourself to make informed decisions that positively impact your financial future. Seeking help isn’t just a necessity; it’s a strategic move toward reclaiming control over your financial well-being. Remember, we’re here to help.

Frequently Asked Questions

Why is the U.S. tax system considered complex?

The U.S. tax system is considered complex due to its intricate web of regulations, forms, and deadlines, which can lead to confusion among taxpayers.

What are some common issues taxpayers face with the tax system?

Common issues include misunderstanding tax laws, failure to file, and disputes with the IRS over owed amounts.

How can taxpayers unknowingly overpay?

Many taxpayers are unaware that they qualify for specific deductions or credits, which can lead to unnecessary overpayments.

What are the consequences of tax debt?

The complexities surrounding tax debt can result in rapidly accumulating penalties and interest, trapping individuals in a cycle of financial distress.

What does the IRS estimate about taxpayer costs by 2025?

The IRS estimates that taxpayer out-of-pocket costs will reach $148 billion by 2025, highlighting the financial burden of compliance.

Why is it important to understand tax complexities?

Understanding tax complexities is crucial for identifying when to seek the services of a tax resolution firm for professional assistance.

How can a tax resolution firm help taxpayers?

A tax resolution firm can provide support in navigating the tax landscape, alleviating challenges, and ensuring taxpayers are on the right path.