Introduction

Receiving a letter from the IRS can stir up a wave of anxiety. It’s completely normal to wonder what these communications mean. These letters can serve many purposes, from reminding you of your responsibilities to clarifying any discrepancies in your tax returns. Understanding what these messages entail is crucial. Many are just routine notifications, not alarming threats.

But what if you choose to ignore them? It’s common to feel overwhelmed, but this article will guide you through the common triggers for IRS correspondence, the potential consequences of inaction, and the resources available to help you navigate these challenges effectively. Remember, you’re not alone in this journey, and we’re here to help.

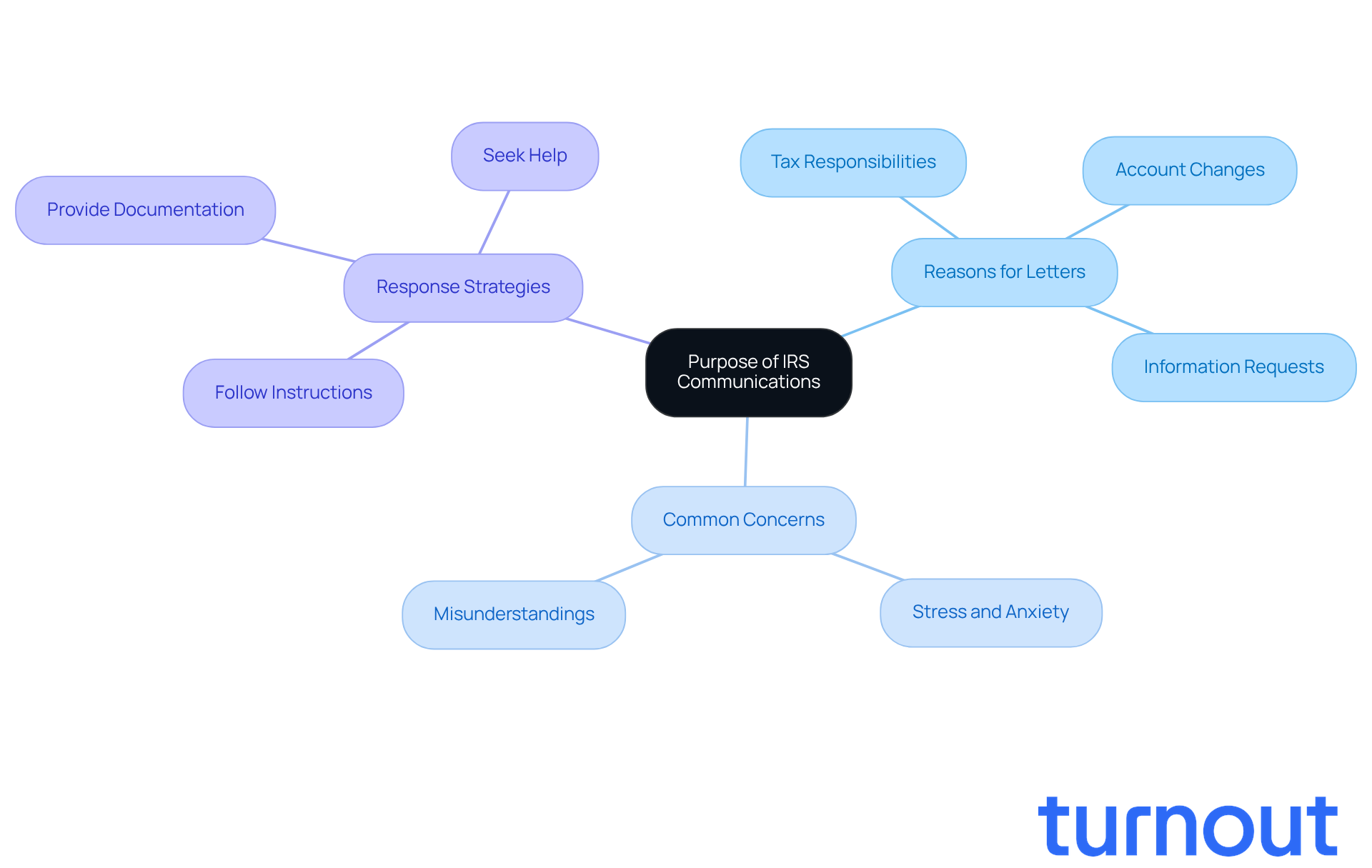

Understand the Purpose of IRS Communications

There are various reasons why the IRS sends out letters, leading me to question why would IRS send me a letter. Primarily, these are to inform you about your tax responsibilities, changes to your accounts, or to ask for more information. It’s important to know that a large portion of these communications are routine notifications, like reminders of outstanding balances or requests for identity verification.

We understand that when you receive an IRS letter, you might be asking yourself, 'why would IRS send me a letter,' and it can be stressful. However, understanding why would IRS send me a letter, as many of these letters are standard procedures, can help ease your worries. For example, if you get a notice about a balance due, it often can be resolved with a simple payment or clarification. Acknowledging the routine nature of these communications allows you to approach them calmly, reducing anxiety and avoiding unnecessary panic.

Remember, the IRS's goal is to ensure compliance and provide clarity, not to intimidate or threaten those who pay taxes. Understanding why would IRS send me a letter can help you respond appropriately and manage your tax obligations more effectively. As tax professionals often say, "Most IRS letters are not a cause for alarm; they are simply part of the process to ensure compliance."

If you disagree with the contents of a communication, it’s important to follow the provided instructions to challenge it. Include any relevant information and supporting documents to strengthen your case. You are not alone in this journey; we’re here to help you navigate through it.

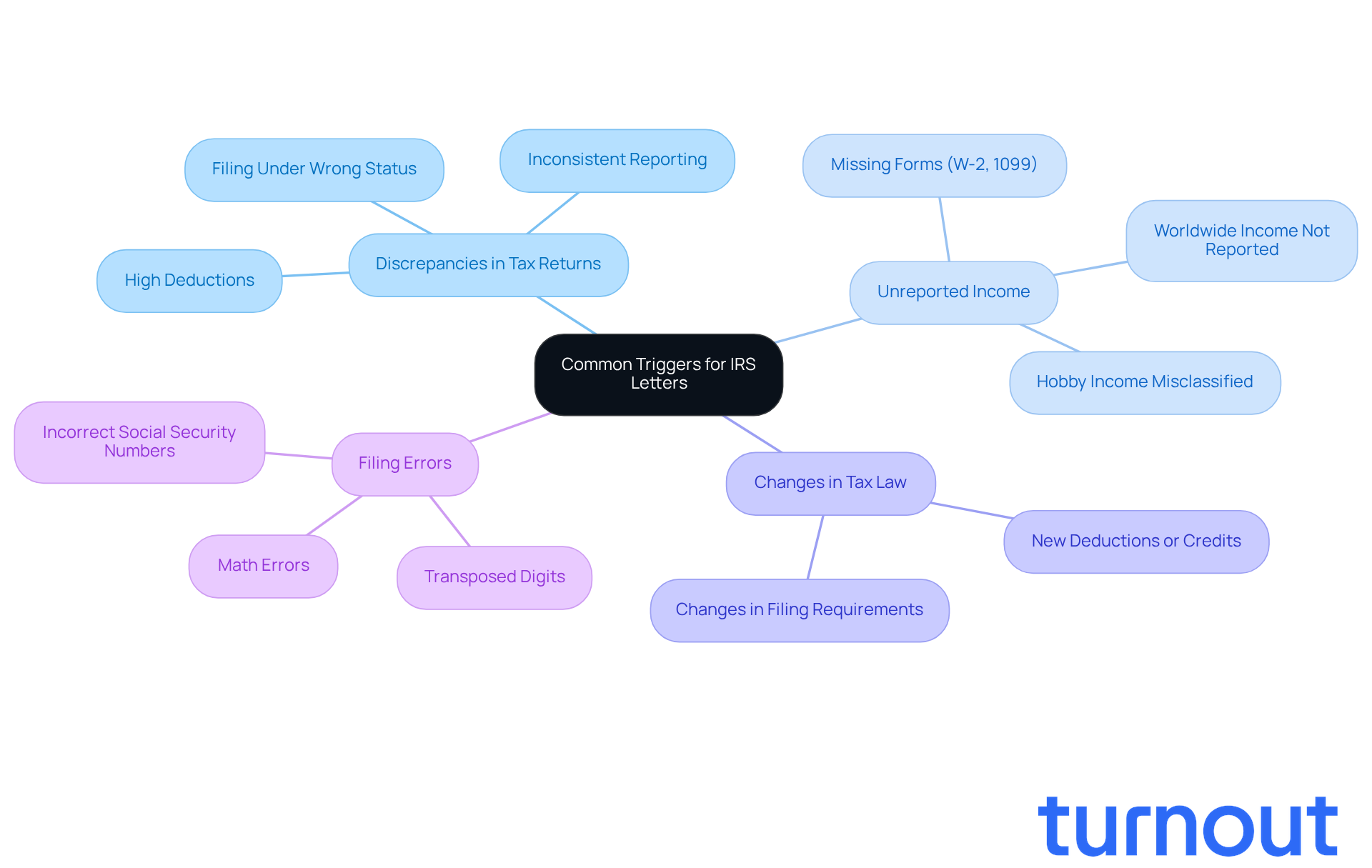

Identify Common Triggers for IRS Letters

Receiving a letter from the IRS can be stressful, and it’s common to feel overwhelmed, prompting the question, why would IRS send me a letter? Many triggers for these letters stem from discrepancies in tax returns, unreported income, or significant changes in tax law that might affect your situation. For instance, if you forget to declare all sources of income, the IRS may reach out to clarify the inconsistency.

The IRS uses a Matching Program that identifies missing figures automatically, which is why it’s so important to ensure that all your income is reported accurately. If you claim deductions that seem disproportionately high compared to your reported income, this can also prompt the IRS to seek clarification.

Even minor errors, like transposed digits or incorrect Social Security Numbers, can lead to immediate rejections of e-filed returns. Just one wrong digit can cause an instant rejection, which can be frustrating. By keeping meticulous records and ensuring accuracy in your filings, you can significantly reduce the chances of receiving unexpected correspondence from the IRS, so you won't have to wonder why would IRS send me a letter.

Remember, you’re not alone in this journey. We’re here to help you navigate these challenges with confidence.

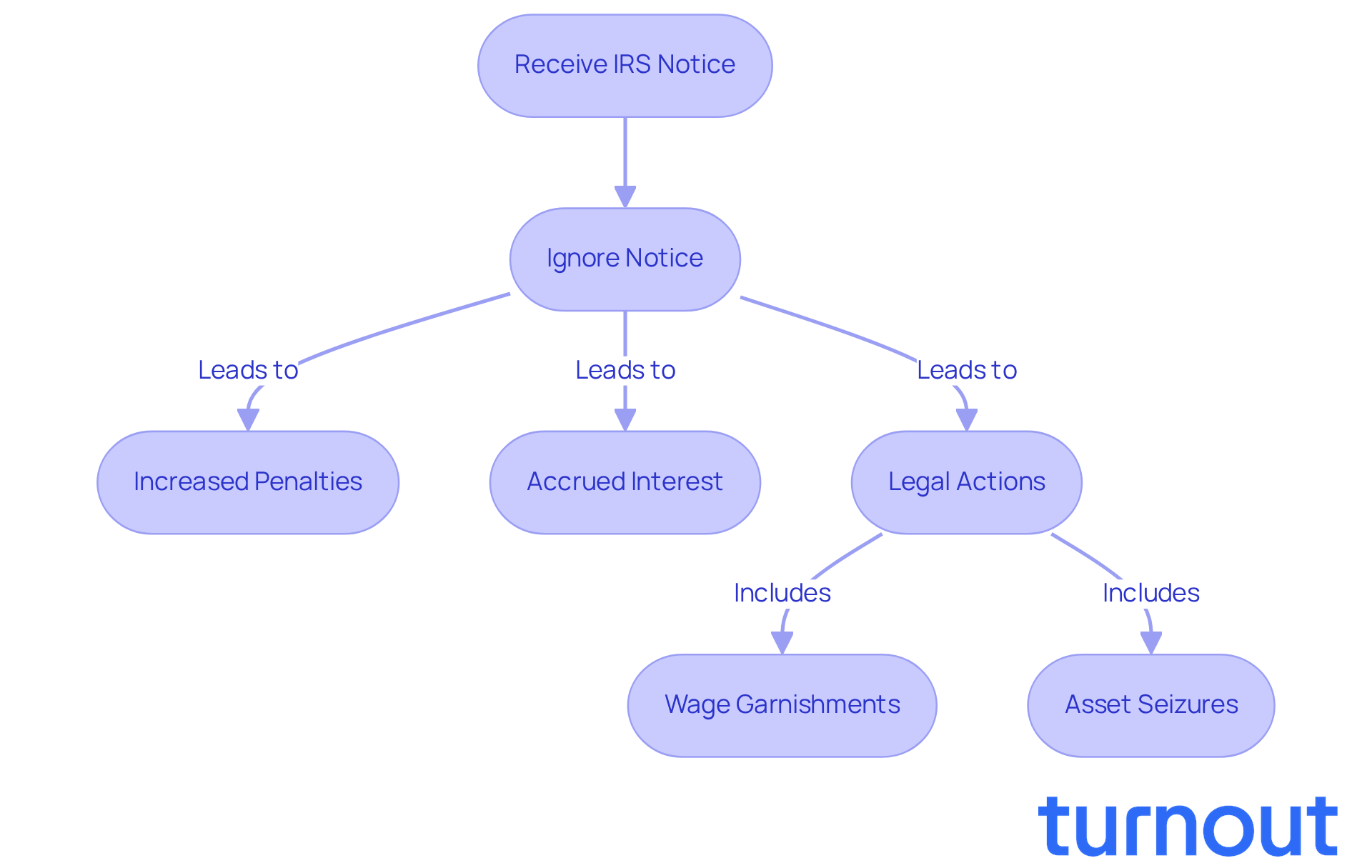

Evaluate the Consequences of Ignoring IRS Notices

Many people find it overwhelming when they receive communications from the IRS, leading them to wonder, why would IRS send me a letter, and ignoring these messages can result in serious consequences. We understand that dealing with tax issues can be stressful, and the last thing you want is to face increasing penalties or legal actions like wage garnishments or asset seizures. For instance, did you know that the IRS imposes a failure-to-pay penalty of 0.5% of the unpaid tax amount for each month the debt remains unpaid? This can add up to a maximum of 25%! Plus, unpaid taxes accrue interest daily, which only adds to your financial burden.

As tax attorney Dawn Delia wisely points out, "Disregarding IRS communications is a risky and expensive error." If you receive a notice about a balance due and choose not to respond, you may be left wondering why would IRS send me a letter, as they might escalate the situation, leading to more aggressive enforcement actions. In fiscal year 2024, the IRS collected a staggering $120.2 billion in unpaid assessments, highlighting the importance of addressing your tax obligations promptly.

Timely responses to IRS communications are crucial. They not only help mitigate these risks but also ensure that you remain compliant with your tax responsibilities. Remember, you're not alone in this journey. We're here to help you navigate these challenges and find the best path forward.

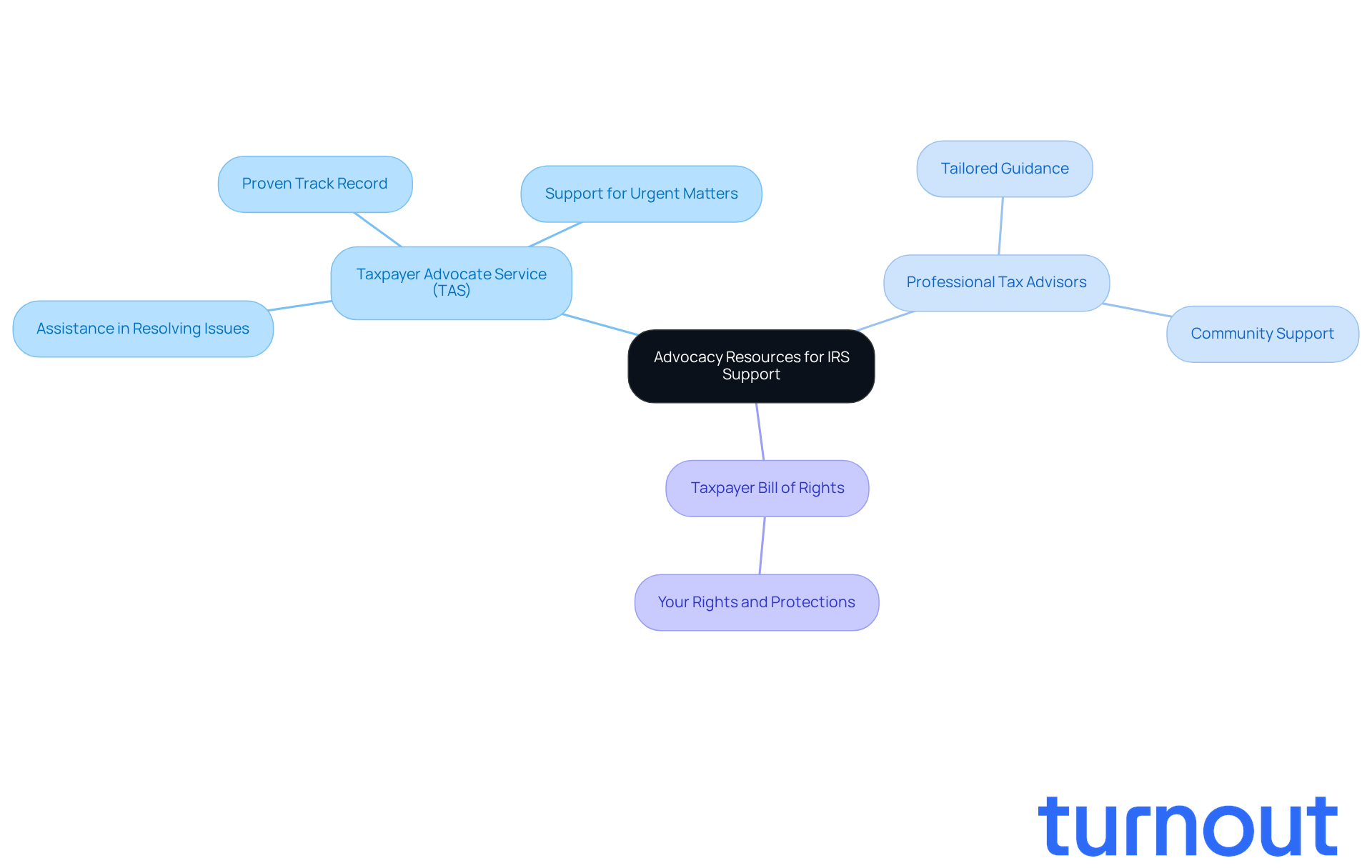

Leverage Advocacy Resources for IRS Communication Support

Are you feeling overwhelmed by IRS communications? You’re not alone. Many taxpayers face challenges when dealing with the IRS, but there’s hope. The Taxpayer Advocate Service (TAS) is here to help. They provide valuable assistance in resolving tax issues, ensuring that you understand your rights and are treated fairly.

With TAS offices in all 50 states, Washington, D.C., and Puerto Rico, help is just around the corner. In the 2025 filing season, the IRS achieved an 87% Level of Service on its Accounts Management lines. However, many still experienced difficulties, with an average wait time of 12.6 minutes. This highlights the importance of effective advocacy.

Engaging with TAS can lead to successful resolutions, especially for urgent matters. Imagine having a personal advocate who negotiates on your behalf. This service is a lifeline for those who haven’t found solutions through standard IRS channels. TAS has a proven track record of expediting IRS actions involving multiple parties, providing crucial support when you need it most.

Additionally, working with professional tax advisors and legal advocates can offer tailored guidance, increasing your chances of a favorable outcome. These resources help you navigate complex IRS processes and foster a sense of community during what can often feel like a daunting experience. By leveraging these advocacy resources, you can approach your challenges with greater confidence and clarity.

Understanding the Taxpayer Bill of Rights is also empowering. It outlines your rights and protections in dealings with the IRS. Remember, you are not alone in this journey. We’re here to help you every step of the way.

Conclusion

Receiving a letter from the IRS can often trigger anxiety and uncertainty. We understand that this experience can feel overwhelming. However, grasping the reasons behind these communications is crucial. The IRS primarily sends letters to:

- Clarify tax responsibilities

- Notify taxpayers of account changes

- Request additional information

Recognizing that many of these letters are routine can alleviate stress and empower you to respond appropriately. Remember, these communications are part of the compliance process, not a cause for alarm.

Throughout this article, we highlighted key points, including common triggers for IRS letters, such as discrepancies in tax returns or unreported income. Ignoring these notices can lead to severe consequences, including escalating penalties and legal actions. But you’re not alone in this. Resources like the Taxpayer Advocate Service provide essential support for navigating these challenges, ensuring that you understand your rights and have access to advocacy when needed.

Ultimately, staying informed and proactive in addressing IRS communications is vital. By leveraging available resources and maintaining accurate records, you can mitigate risks and manage your tax obligations effectively. Embracing this knowledge transforms the experience from one of fear to one of empowerment. We encourage you to take control of your financial responsibilities and seek help when necessary. Remember, we're here to help you every step of the way.

Frequently Asked Questions

Why does the IRS send out letters?

The IRS sends letters to inform taxpayers about their tax responsibilities, changes to their accounts, or to request more information. Many letters are routine notifications, such as reminders of outstanding balances or requests for identity verification.

What should I do if I receive an IRS letter?

If you receive an IRS letter, it's important to read it carefully and follow any provided instructions. Many communications can be resolved with a simple payment or clarification.

Are IRS letters a cause for alarm?

Most IRS letters are not a cause for alarm; they are standard procedures to ensure compliance and provide clarity regarding tax obligations.

How can I manage my anxiety when receiving an IRS letter?

Understanding that many IRS communications are routine can help ease worries. Approaching these letters calmly reduces anxiety and avoids unnecessary panic.

What if I disagree with the contents of an IRS communication?

If you disagree with an IRS communication, follow the instructions provided in the letter to challenge it, and include any relevant information and supporting documents to strengthen your case.