Introduction

Navigating the complexities of tax filings can feel overwhelming, especially for disabled individuals who often encounter unique financial hurdles. We understand that this journey can be daunting. The 1040-X form is a vital resource, allowing you to amend past tax returns and ensure your financial records truly reflect your circumstances.

However, many may not realize how significant this form is. Mismanagement can lead to unexpected tax liabilities or missed deductions, which can add to your stress. It's common to feel uncertain about how to proceed. How can you confidently navigate this intricate landscape to safeguard your financial well-being and avoid potential pitfalls?

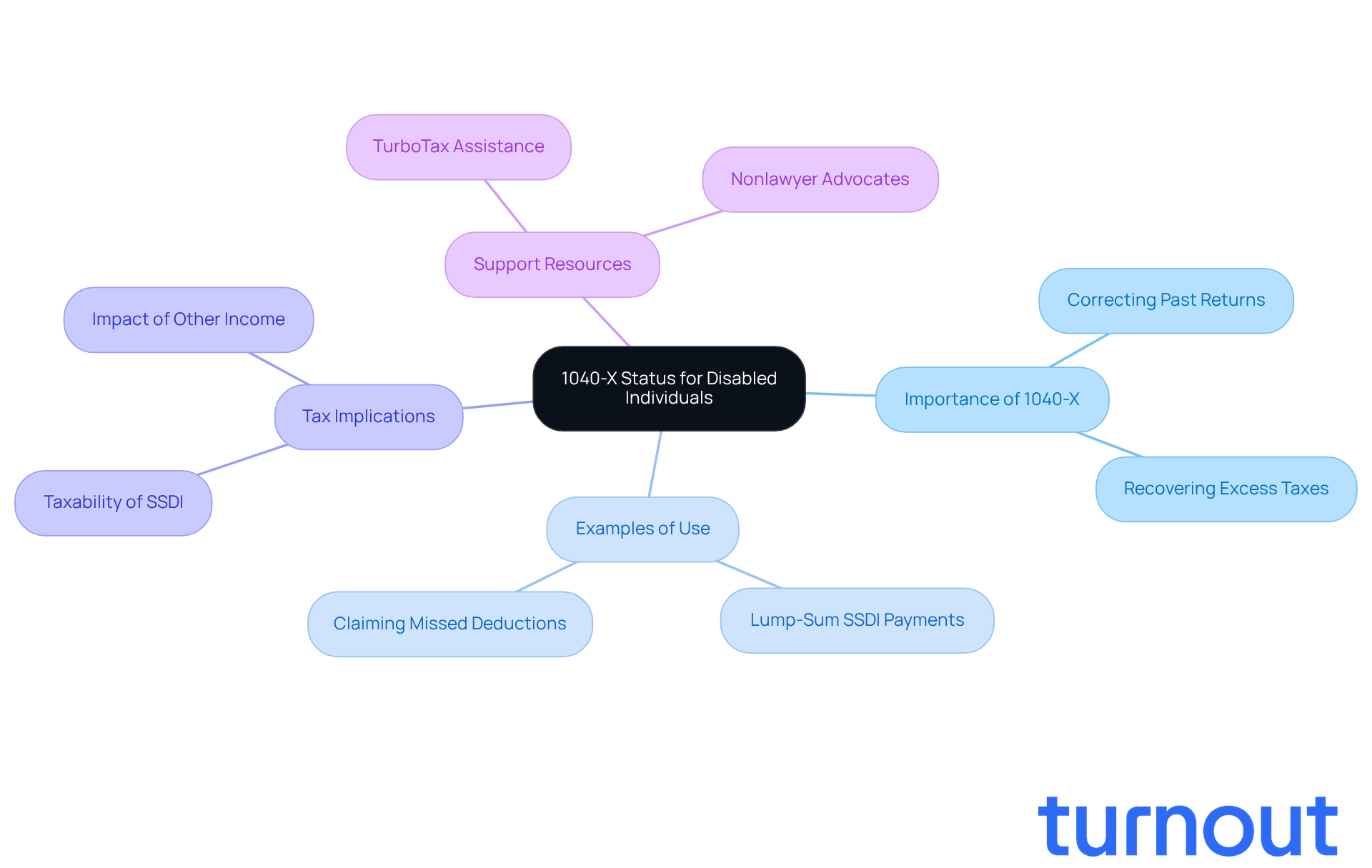

Understand the Significance of 1040 x Status for Disabled Individuals

The 1040-X form, or Amended U.S. Personal Income Tax Return, is a vital tool for individuals with disabilities who need to correct or update their tax filings. We understand that navigating tax obligations can be challenging, especially when various forms of income, like Social Security Disability Insurance (SSDI) and other benefits, come into play. By submitting a 1040-X, you can modify past returns to accurately reflect your income, claim missed deductions, or fix mistakes that could lead to penalties.

For instance, if you receive a lump-sum payment from SSDI, it’s important to amend your tax return to report this income correctly. This can significantly impact your tax liability. The 1040-X also allows you to recover excess taxes, ensuring you receive the assistance you deserve. Each year, many individuals with disabilities submit the 1040-X status, highlighting its importance in managing tax responsibilities effectively.

Understanding the implications of the 1040-X status is crucial for those looking to improve their financial situation and navigate the complexities of tax matters. As one tax expert pointed out, "Social Security disability benefits may or may not be taxable depending on how much other income you (and your spouse, if you're married) may have." This emphasizes the need for accurate income reporting to avoid unexpected tax liabilities. SSDI recipients should be particularly mindful of how their benefits interact with other income sources, as changes in tax laws can affect overall obligations.

We’re here to help. Turnout provides essential support through trained nonlawyer advocates and IRS-licensed enrolled agents, guiding clients through these complexities. Real-world examples of individuals successfully using the 1040-X to amend their returns illustrate its practical value. Remember, you are not alone in this journey; awareness and understanding of this important tax form can make a significant difference.

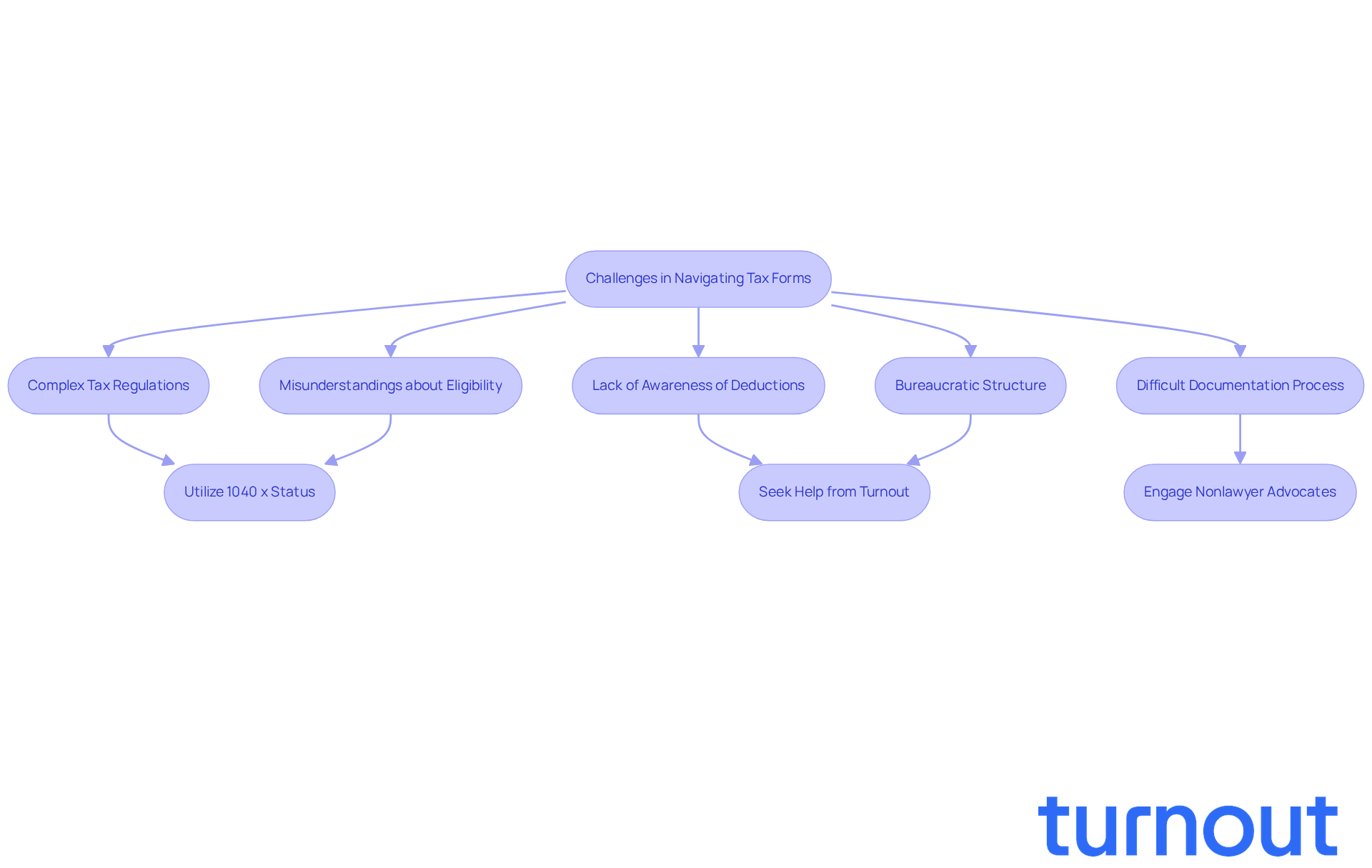

Identify Challenges in Navigating Tax Forms and Benefits

Navigating tax forms and benefits can be incredibly challenging for people with disabilities. We understand that the complex nature of tax regulations often leaves many feeling overwhelmed, especially when juggling health-related issues alongside financial responsibilities. It's concerning that a significant number of disabled individuals are unaware of crucial tax deductions and credits, like the Earned Income Tax Credit (EITC) and the Credit for the Elderly or Disabled. These credits could provide substantial financial relief.

The documentation process adds another layer of difficulty, requiring meticulous records of income, medical expenses, and other financial details. Misunderstandings about eligibility criteria can lead to missed opportunities for tax advantages, which only heightens economic pressure. Additionally, the bureaucratic structure of tax agencies can be daunting, with long wait times for assistance and unclear communication about tax obligations.

These challenges highlight the importance of understanding the 1040 x status process. This form allows individuals to modify prior tax returns, correcting any errors that may have occurred due to the complexities of the tax system. By utilizing the 1040 x status, those with disabilities can ensure they aren’t penalized for mistakes stemming from these systemic challenges, ultimately paving the way for better economic outcomes.

Turnout plays a vital role in this process by offering tools and services that simplify access to government benefits and assistance, particularly for SSD claims and tax relief. With the support of trained nonlawyer advocates and IRS-licensed enrolled agents, Turnout provides essential guidance to help clients navigate these complexities effectively. Remember, you are not alone in this journey; we're here to help.

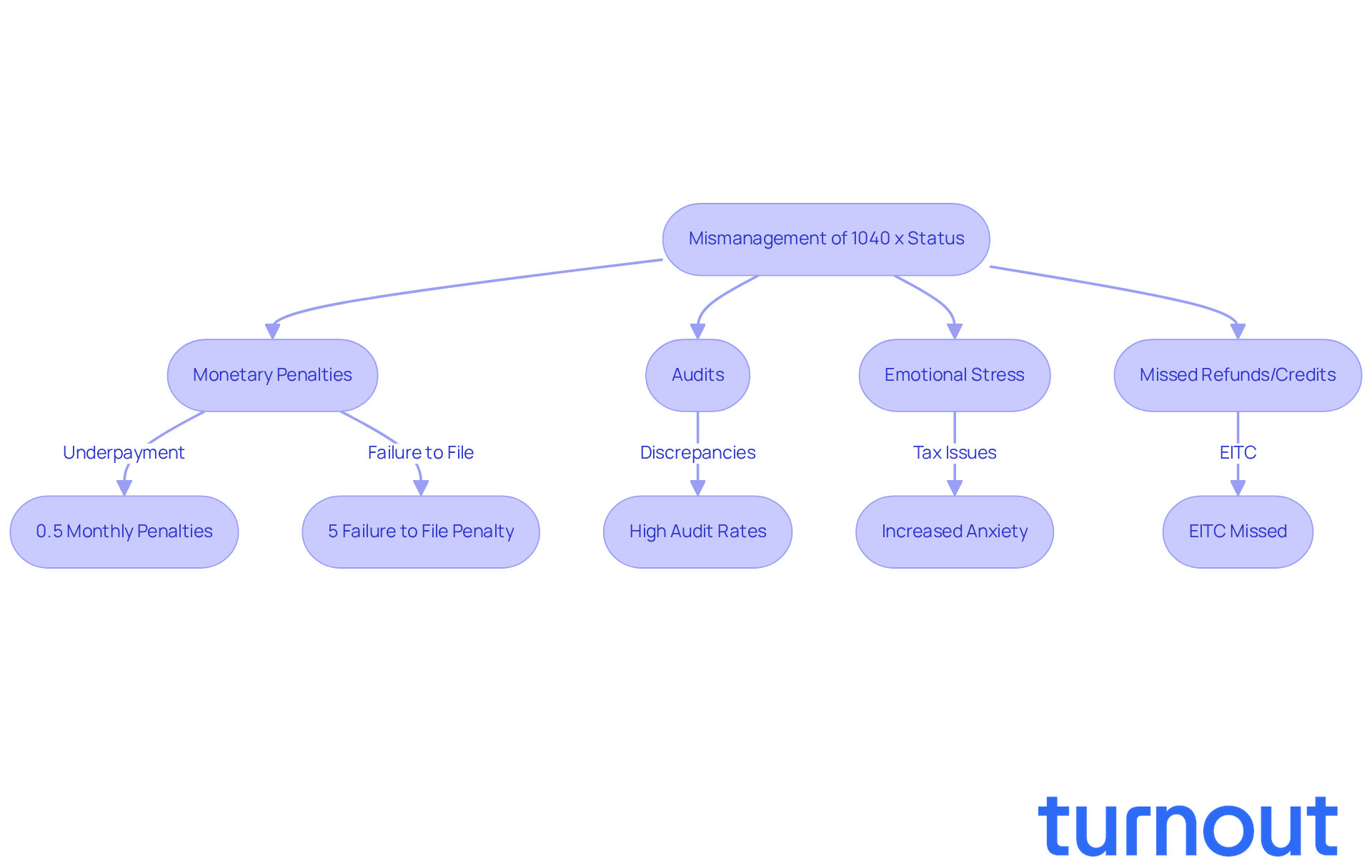

Examine Consequences of Mismanaging 1040 x Status

Mismanaging your 1040 x status can lead to serious challenges, especially for individuals with disabilities. We understand that navigating tax issues can be overwhelming, and one of the most pressing risks is facing monetary penalties due to underreporting income or missing out on eligible deductions. For example, if you overlook adjusting your tax return to include a lump-sum Social Security Disability Insurance (SSDI) payment, you might find yourself with unexpected tax obligations that add to your financial strain. The IRS imposes penalties of 0.5% per month on unpaid amounts, which can quickly add up to a maximum of 25%. Additionally, there’s a failure to file penalty of 5% of the owed amount, capped at 25%. This highlights just how serious the consequences of mismanagement can be.

Moreover, errors in tax filings can lead to audits, which can add even more stress to an already challenging situation. It's common to feel anxious about audits, especially since individuals with disabilities may face disproportionately high audit rates when discrepancies arise from misreported income or deductions. The emotional toll of dealing with tax issues can be particularly heavy for those already facing health challenges, compounding their difficulties.

Mismanagement of your 1040 x status can also mean missing out on valuable refunds or credits that could significantly ease your financial burden. For instance, failing to claim the Earned Income Tax Credit (EITC) could result in missing thousands of dollars in potential refunds. Understanding and effectively managing your 1040 x status is crucial to protecting your economic well-being and avoiding unnecessary complications.

At Turnout, we’re here to help. We offer vital tools and services, including trained nonlawyer advocates and IRS-licensed enrolled agents, to assist you in navigating these complex processes. You deserve the support you need, and we’re committed to ensuring you receive it without the need for legal representation.

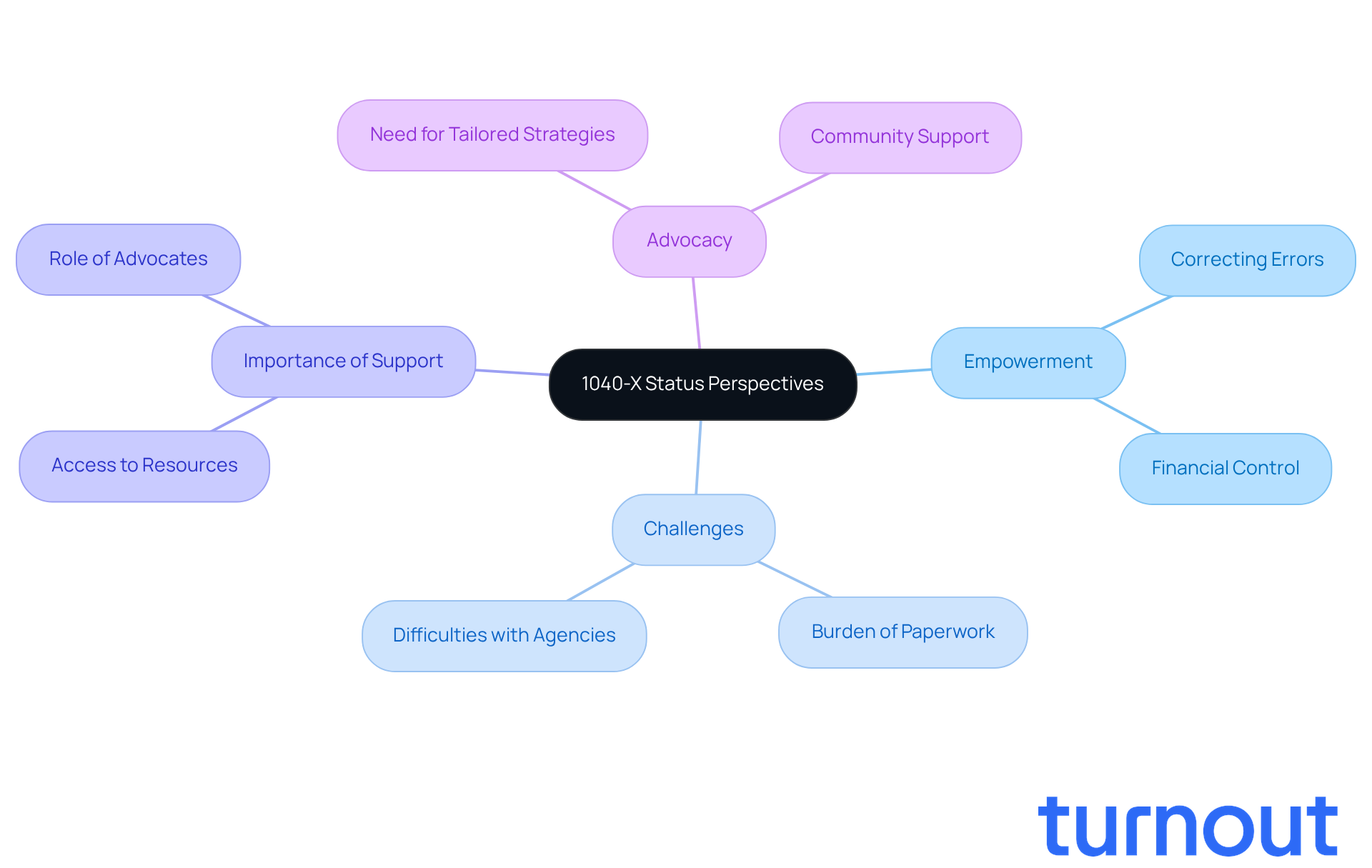

Explore Alternative Perspectives on 1040 x Status

The experiences of disabled individuals with the 1040-X status reveal a wide range of perspectives. For many, the ability to amend tax returns is a vital tool. It empowers them to correct errors and stay compliant with tax regulations. This process fosters a sense of control over their financial circumstances, allowing them to navigate the complexities of tax obligations with greater confidence.

However, it's common to feel that the 1040-X process can be an added burden. Some may have faced difficulties with tax agencies or find the associated paperwork overwhelming. We understand that these challenges can be daunting.

Access to resources and support plays a crucial role in shaping these experiences. While some individuals benefit from the guidance of knowledgeable advocates or tax professionals, others may struggle to find help. This can lead to feelings of isolation and frustration. It highlights the need for advocacy efforts specifically designed to address the unique challenges faced by disabled individuals in managing their tax responsibilities.

Turnout provides essential support through trained nonlawyer advocates and IRS-licensed enrolled agents. They assist clients with SSD claims and tax debt relief. By recognizing and understanding these varied perspectives, advocates can enhance their support strategies. This ensures that individuals feel empowered and informed throughout the 1040-X status process. Remember, you are not alone in this journey; we're here to help.

Conclusion

Understanding the 1040-X status is vital for disabled individuals navigating the complexities of tax obligations. This form is a crucial tool for correcting past tax returns, ensuring accurate income reporting, and reclaiming potential refunds. By recognizing the significance of the 1040-X, you can take meaningful steps to manage your financial responsibilities and steer clear of the pitfalls that often accompany tax mismanagement.

We understand that accurately reporting Social Security Disability Insurance (SSDI) income can be daunting. The potential financial relief from missed deductions is significant, and the emotional toll of dealing with tax issues can weigh heavily. The challenges you face, including the overwhelming process of documentation and the risk of penalties for errors, highlight the necessity of understanding the 1040-X status. Support from organizations like Turnout can provide invaluable assistance, ensuring you don’t have to face these challenges alone.

Ultimately, being aware of the 1040-X process can greatly impact your financial well-being. By taking the initiative to learn about this important tax form and seeking support when needed, you empower yourself to make informed decisions that positively affect your economic circumstances. Remember, you are not alone in this journey; resources and support systems are available to help you manage these financial responsibilities effectively.

Frequently Asked Questions

What is the 1040-X form?

The 1040-X form, or Amended U.S. Personal Income Tax Return, is used to correct or update tax filings for individuals, including those with disabilities.

Why is the 1040-X form important for individuals with disabilities?

It allows individuals with disabilities to modify past returns to accurately reflect their income, claim missed deductions, or fix mistakes that could lead to penalties.

How can a lump-sum payment from Social Security Disability Insurance (SSDI) affect tax returns?

A lump-sum payment from SSDI must be reported correctly on tax returns, and failing to do so can significantly impact tax liability.

What benefits can individuals with disabilities recover by submitting a 1040-X?

Submitting a 1040-X can help recover excess taxes and ensure individuals receive the financial assistance they deserve.

Why is accurate income reporting important for SSDI recipients?

Accurate income reporting is crucial because Social Security disability benefits may be taxable depending on the recipient's total income, which could lead to unexpected tax liabilities.

What support does Turnout provide for individuals navigating tax complexities?

Turnout offers support through trained nonlawyer advocates and IRS-licensed enrolled agents to guide clients through tax complexities.

Are there real-world examples of individuals benefiting from using the 1040-X?

Yes, there are examples of individuals who have successfully used the 1040-X to amend their returns, demonstrating its practical value in managing tax responsibilities.