Introduction

Misrepresentation on life insurance applications is a serious concern that can deeply affect both applicants and their loved ones. With fraud adding nearly $75 billion to the insurance industry, the need for accurate disclosures is more important than ever.

We understand that navigating these waters can be overwhelming. This article explores the different types of misrepresentation, the potential impacts on claims and coverage, and the vital role of consumer advocacy. How can you ensure your application is truthful and complete? What happens if it’s not?

These questions are crucial for anyone looking to protect their family through life insurance. Remember, you are not alone in this journey. We're here to help you understand these dynamics and make informed decisions.

Define Misrepresentation in Life Insurance Applications

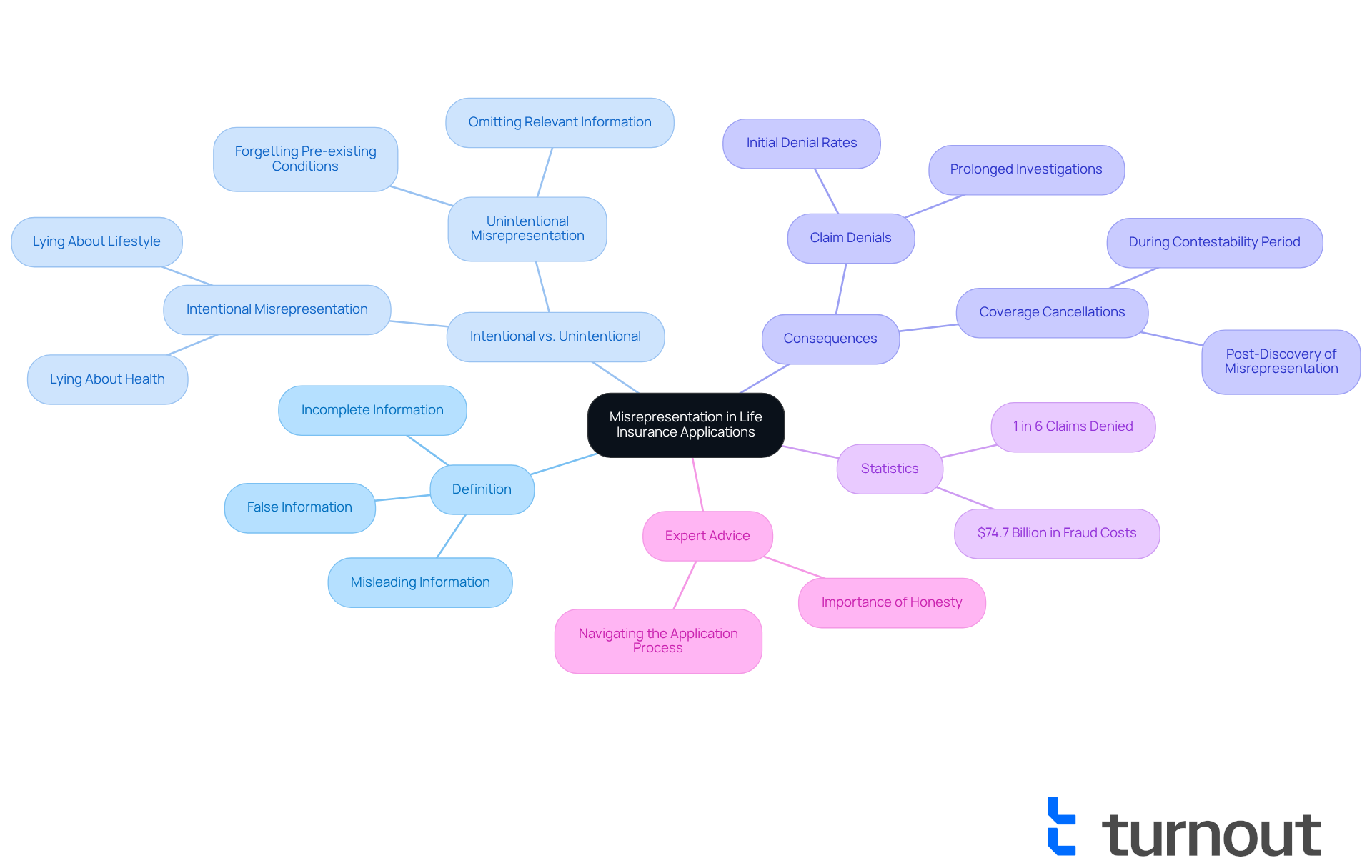

Misrepresentation in life insurance applications can be a daunting topic. It involves providing false, misleading, or incomplete information during the application process. This might happen intentionally, like when someone lies about their health or lifestyle, or unintentionally, such as forgetting to mention a pre-existing condition.

Understanding this concept is crucial for applicants. It directly impacts your eligibility for benefits and the validity of your policy. We understand that navigating these waters can be stressful. Did you know that fraud related to policies adds a staggering $74.7 billion to the overall fraud expense in the industry? This highlights just how important integrity is when submitting your application.

Your coverage can be voided during the two-year contestability period when a misrepresentation on a life insurance policy application is discovered. The stakes are high, and providing accurate information is essential. A case study on the consequences of misrepresentation shows that benefits can be denied and coverage canceled when a misrepresentation on a life insurance policy application is discovered. This emphasizes the need for truthful disclosures.

It's common to feel overwhelmed, especially when you learn that about one in six death-benefit claims faces an initial denial or prolonged investigation. This illustrates the prevalence of issues that arise when a misrepresentation on a life insurance policy application is discovered. Insurance experts stress that even slight inaccuracies can have serious repercussions, like claim denials or reduced payouts.

Remember, honesty during the submission process is vital. We're here to help you navigate these challenges, ensuring you understand the importance of providing accurate information. You are not alone in this journey.

Examine Types of Misrepresentation and Their Impacts

Misrepresentation in life insurance submissions can take several forms, and each carries significant implications for you, the policyholder, especially when a misrepresentation on a life insurance policy application is discovered. Here are the primary types to be aware of:

-

Health Misrepresentation: This happens when applicants don’t disclose existing medical conditions or treatments. Such omissions can lead to serious repercussions, including contract cancellation or denial of claims, particularly when a misrepresentation on a life insurance policy application is discovered during the contestability period. It’s common for misrepresentations related to health conditions, like diabetes or heart disease, to impact claims significantly.

-

Lifestyle Misrepresentation: If applicants fail to reveal risky behaviors - like smoking or engaging in extreme sports - they risk having their claims denied. Insurers scrutinize these applications closely, particularly if a claim arises soon after coverage begins.

-

Financial Misrepresentation: Providing incorrect information about income or current insurance agreements can negatively affect underwriting decisions. This type of misrepresentation can lead to rescission of the policy when a misrepresentation on a life insurance policy application is discovered, especially if the insurer finds that inaccuracies influenced their decision to issue coverage.

Each of these misrepresentation types underscores the critical importance of honesty during the submission process. When a misrepresentation on a life insurance policy application is discovered, failure to disclose accurate information can lead to denied claims and financial loss. As James Swinton, 2nd Vice President of Underwriting Risk Management, wisely notes, 'Strong monitoring practices are necessary for carriers to mitigate fraud attempts.'

Understanding these implications is crucial for anyone seeking coverage. You are not alone in this journey.

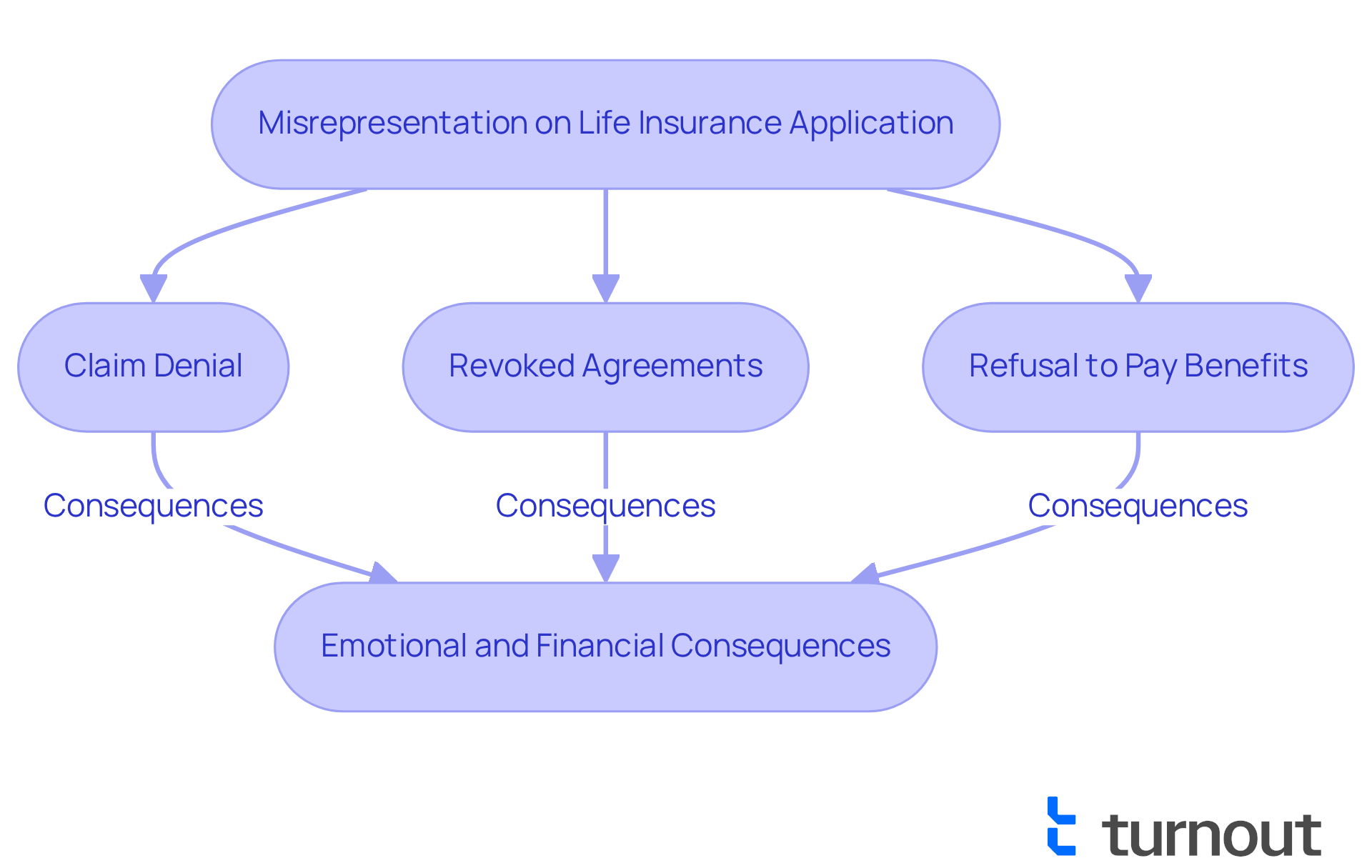

Analyze Consequences of Misrepresentation on Claim Denials

The consequences of misrepresentation on life insurance requests can be truly severe. We understand that navigating this process can be overwhelming. An insurer may deny claims, revoke agreements, or refuse to pay out benefits when a misrepresentation on a life insurance policy application is discovered. This is especially common during the initial two years of the agreement, known as the contestability period, when a misrepresentation on a life insurance policy application is discovered. During this time, insurers are allowed to verify the accuracy of the information provided.

For beneficiaries, this situation can lead to significant financial hardship and emotional distress. Imagine facing a critical time without the intended support you were counting on. It’s common to feel anxious about these possibilities, but understanding these consequences highlights the importance of providing accurate information from the very beginning.

We’re here to help you navigate these challenges. By ensuring that all information is truthful and complete, you can protect your loved ones from unnecessary difficulties. Remember, you are not alone in this journey.

Emphasize the Importance of Accuracy and Consumer Advocacy

Accuracy in life coverage applications isn’t just a legal requirement; it’s crucial for protecting you, the consumer. When you provide truthful and complete information, you help ensure that your policy works as it should, allowing benefits to reach those you care about most. We understand that navigating this landscape can be overwhelming, which is why consumer advocacy is so important. Organizations and professionals are here to assist you in understanding your rights and making sense of the complexities involved.

Resources like legal aid, consumer advocacy groups, and educational materials empower you to make informed decisions. This support significantly reduces the risks associated with situations that arise when a misrepresentation on a life insurance policy application is discovered. Did you know that 42 percent of adults feel they don’t have enough coverage for their well-being? This statistic highlights just how vital it is to fill out applications accurately and make informed choices.

Moreover, many consumers are often misled by agents about the true nature of investment schemes tied to policies, particularly universal plans, which may not meet your goals. As the Consumer Advocacy Center for Life Coverage points out, "the vast majority of coverage investment schemes... will fail to meet the consumer’s goals as depicted in the illustration." Consumer advocacy groups play a pivotal role in enhancing the accuracy of life insurance applications, especially when a misrepresentation on a life insurance policy application is discovered, by raising awareness and providing support. They protect the interests of all applicants, especially those from Black and Hispanic communities who report a greater need for life insurance protection.

Remember, you’re not alone in this journey. We’re here to help you navigate these challenges and ensure that you have the coverage you need.

Conclusion

Misrepresentation in life insurance applications is a serious concern that can deeply affect policyholders. We understand that providing accurate and complete information isn’t just a formality; it’s crucial for ensuring that your coverage remains valid and that benefits are accessible when you need them most. The stakes are high. Even minor inaccuracies can lead to claim denials, policy cancellations, and significant financial hardship for your loved ones.

Throughout this article, we’ve explored various forms of misrepresentation - health, lifestyle, and financial - each illustrating the severe implications that can arise when honest disclosures aren’t made. It’s vital to remember that insurers are vigilant, especially during the contestability period. This is why honesty during the application process is so important. Additionally, consumer advocacy plays a key role in this journey, helping individuals understand their rights and navigate the complexities of life insurance.

Ultimately, the importance of accuracy in life insurance applications cannot be overstated. By committing to transparency and honesty, you can protect yourself and your loved ones from the adverse effects of misrepresentation. We encourage you to seek support, stay informed, and ensure that your applications reflect the truth. Taking these steps not only safeguards your personal interests but also contributes to a more trustworthy insurance landscape for everyone. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is misrepresentation in life insurance applications?

Misrepresentation in life insurance applications involves providing false, misleading, or incomplete information during the application process, either intentionally or unintentionally.

What are some examples of misrepresentation?

Examples of misrepresentation include lying about health or lifestyle choices, or unintentionally failing to mention a pre-existing condition.

Why is understanding misrepresentation important for applicants?

Understanding misrepresentation is crucial because it impacts eligibility for benefits and the validity of the life insurance policy.

How much does fraud related to life insurance policies contribute to overall fraud expenses in the industry?

Fraud related to life insurance policies adds approximately $74.7 billion to the overall fraud expense in the industry.

What can happen if a misrepresentation is discovered during the two-year contestability period?

If a misrepresentation is discovered during the two-year contestability period, the coverage can be voided, and benefits may be denied.

What are the potential consequences of misrepresentation on life insurance policies?

Consequences of misrepresentation can include denial of benefits, cancellation of coverage, and serious repercussions from even slight inaccuracies.

How common are issues related to misrepresentation in death-benefit claims?

About one in six death-benefit claims faces an initial denial or prolonged investigation due to issues related to misrepresentation.

What should applicants remember when submitting their life insurance applications?

Applicants should remember that honesty during the submission process is vital to avoid negative consequences related to misrepresentation.