Overview

We understand that receiving a tax levy on your paycheck can be distressing. This situation often arises from unpaid tax debts, frequently due to unaddressed IRS notifications about payment obligations. It's common to feel overwhelmed by persistent noncompliance with tax responsibilities, which can lead to serious financial consequences. Wage garnishment, for instance, can significantly affect your ability to manage essential expenses.

You are not alone in this journey. Many individuals face similar challenges, and it’s crucial to acknowledge the emotional toll this can take. Seeking assistance is a vital step towards regaining control over your financial situation. Remember, there are solutions available, and we’re here to help you navigate through these difficulties.

Introduction

Navigating the complexities of tax levies can feel overwhelming, but it’s an important aspect of personal finance that many individuals encounter. A tax levy, typically initiated by the IRS or state authorities, can result in significant financial stress, as it involves the seizure of assets to settle unpaid tax debts. In this article, we will explore the various reasons behind a tax levy on paychecks, the serious implications it can have for your financial well-being, and the proactive steps you can take to tackle this pressing issue.

We understand that it can be distressing to think about what drives the IRS to impose such drastic measures. However, it’s essential to know that you are not alone in this journey. Together, we can navigate the complexities of tax levies and help you regain control of your financial situation.

Define Tax Levy: Understanding the Basics

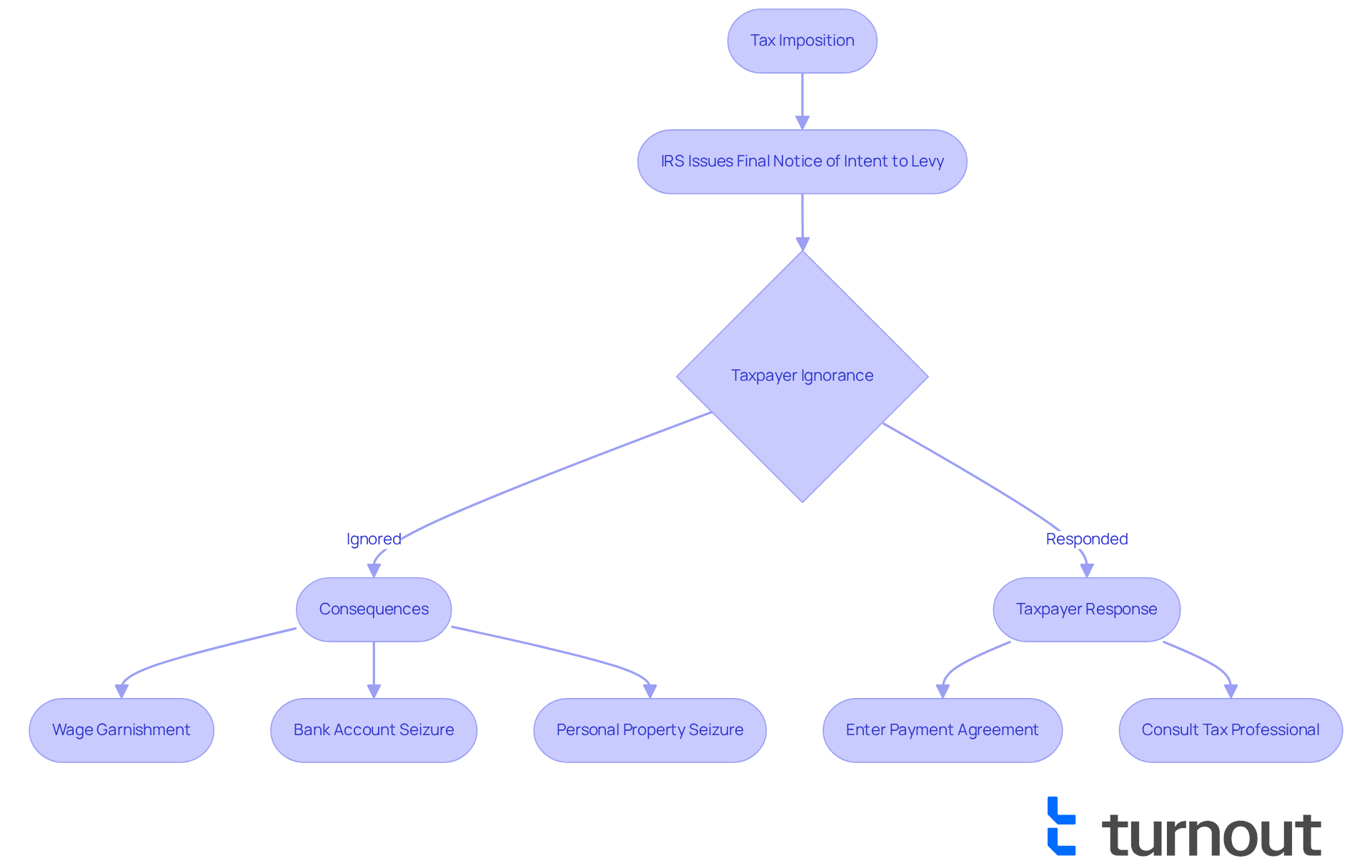

A tax imposition can feel overwhelming, but it is important to understand what it means. It is a legal action initiated by the government, specifically the Internal Revenue Service (IRS) or state tax authorities, to seize a taxpayer's assets in order to satisfy unpaid tax debts. This can manifest in various forms, such as:

- Garnishing wages

- Seizing funds from bank accounts

- Taking possession of personal property

Unlike a tax lien, which functions as a claim against property to ensure payment, a seizure entails the actual physical appropriation of assets. This distinction is crucial for taxpayers, as it emphasizes the seriousness of a charge and the prompt action needed to fulfill tax responsibilities.

We understand that navigating tax issues can be challenging. In recent years, the IRS has imposed millions of financial claims annually, reflecting the increasing difficulties taxpayers encounter in handling their debts. For instance, if you owe $50,000 and ignore multiple notices, the IRS may issue a Final Notice of Intent to Levy, leading to wage garnishment or bank account seizures. Such actions can have significant financial repercussions, making it essential for individuals to respond promptly to IRS communications.

Tax professionals emphasize the importance of understanding these processes. As one specialist pointed out, "A charge is a legal confiscation of your property to settle a tax obligation," highlighting the urgency for taxpayers to connect with the IRS and explore options to prevent or address charges. Additionally, the IRS is required to send a Final Notice of Intent to Collect at least 30 days before the collection, giving you a vital opportunity to address your tax responsibilities.

By understanding the distinctions between a tax charge and a tax lien, you can more effectively manage your financial circumstances. Remember, you are not alone in this journey. We're here to help you take proactive measures to safeguard your assets.

Identify Causes: Reasons for a Tax Levy on Your Paycheck

It's important to recognize why there is a tax levy on my paycheck, as several factors can contribute to this situation. Individuals often wonder why there is a tax levy on my paycheck, with one of the most common reasons being unpaid tax debt, which occurs when they struggle to pay their taxes by the due date. If the IRS has reached out with several notifications for payment and there’s no response, it can feel overwhelming, and a seizure may be imposed. Additionally, persistent noncompliance with payment agreements can lead to further charges, making one wonder why there is a tax levy on my paycheck.

We understand that economic hardships, such as job loss or unexpected expenses, can make it difficult to meet obligations. This situation can prompt the IRS to take action, adding to your stress. Grasping these causes is essential for taxpayers to avoid falling into a cycle of debt and monetary distress. Remember, you are not alone in this journey; we’re here to help you navigate these challenges and find a way forward.

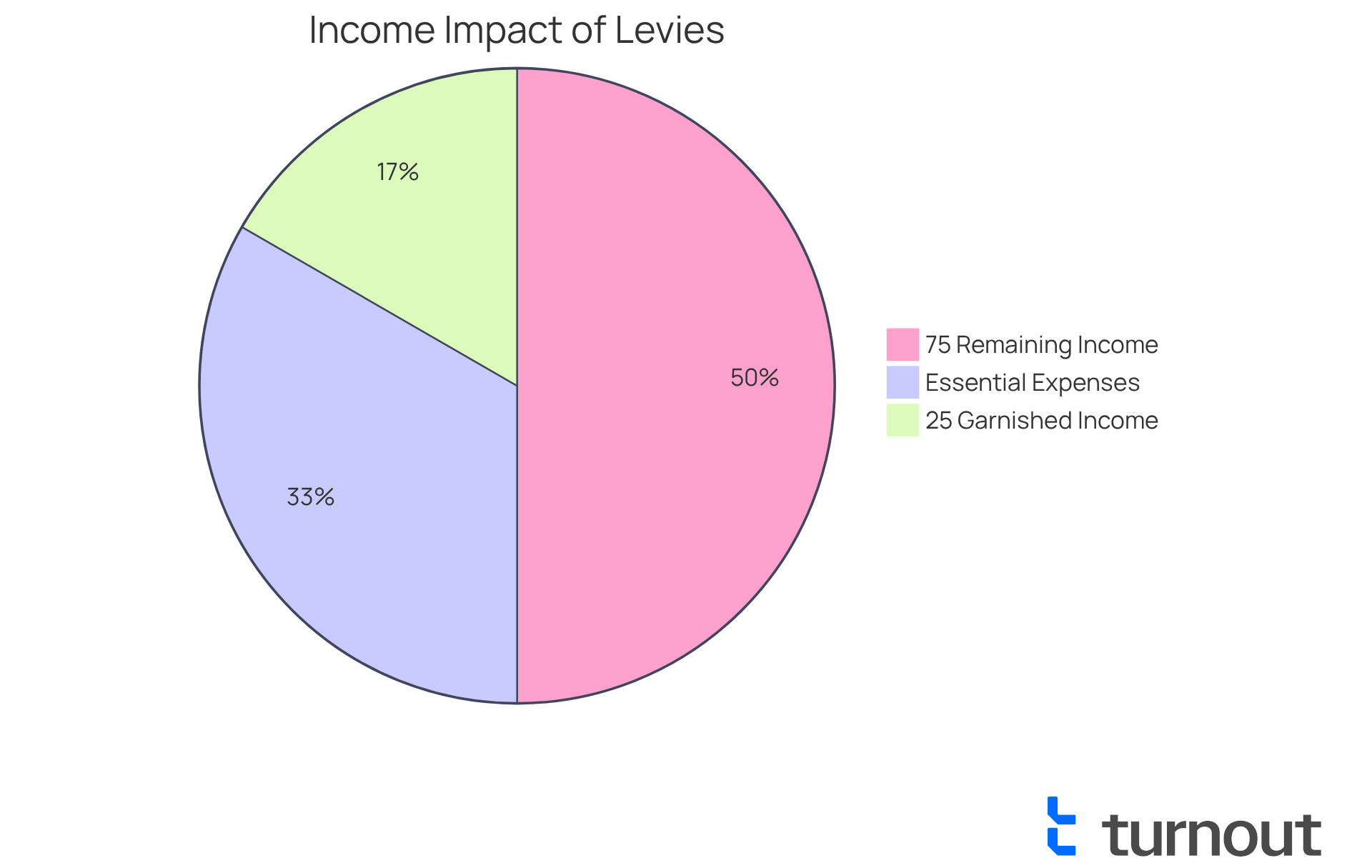

Examine Consequences: Impact of a Tax Levy on Your Finances

One might wonder why there is a tax levy on my paycheck, as its effect on a person's finances can be devastating. We understand that when the IRS garnishes wages, a significant portion of income is withheld, leading many to wonder why there is a tax levy on my paycheck, which makes it challenging to cover essential expenses like rent, utilities, and groceries. In fact, up to 25% of disposable income can be garnished, severely straining a household budget. Moreover, tax impositions can lead to bank account seizures, further limiting access to funds and complicating money management.

It's common to feel overwhelmed by the emotional burden of a tax increase. This distress often results in increased stress and anxiety, as individuals grapple with their economic circumstances. The negative impact on credit scores can compound these feelings, making it more difficult to secure loans or credit in the future.

Real-world examples highlight how tax charges can disrupt daily living. For many, the inability to access frozen bank funds during the 21-day waiting period can lead to missed payments and heightened economic instability. However, during this time, individuals can negotiate with the IRS to potentially halt the garnishment, which is important when considering why there is a tax levy on my paycheck.

Understanding these consequences underscores the urgency of addressing the question of why there is a tax levy on my paycheck promptly. We’re here to help. Turnout offers essential support through trained nonlawyer advocates who assist individuals in navigating these challenges. You are not alone in this journey; we ensure you receive the necessary help without the need for legal representation. By utilizing Turnout's services, you can better manage the economic impact of tax assessments and work towards a solution that eases both monetary and emotional stress.

Explore Solutions: How to Address a Tax Levy on Your Paycheck

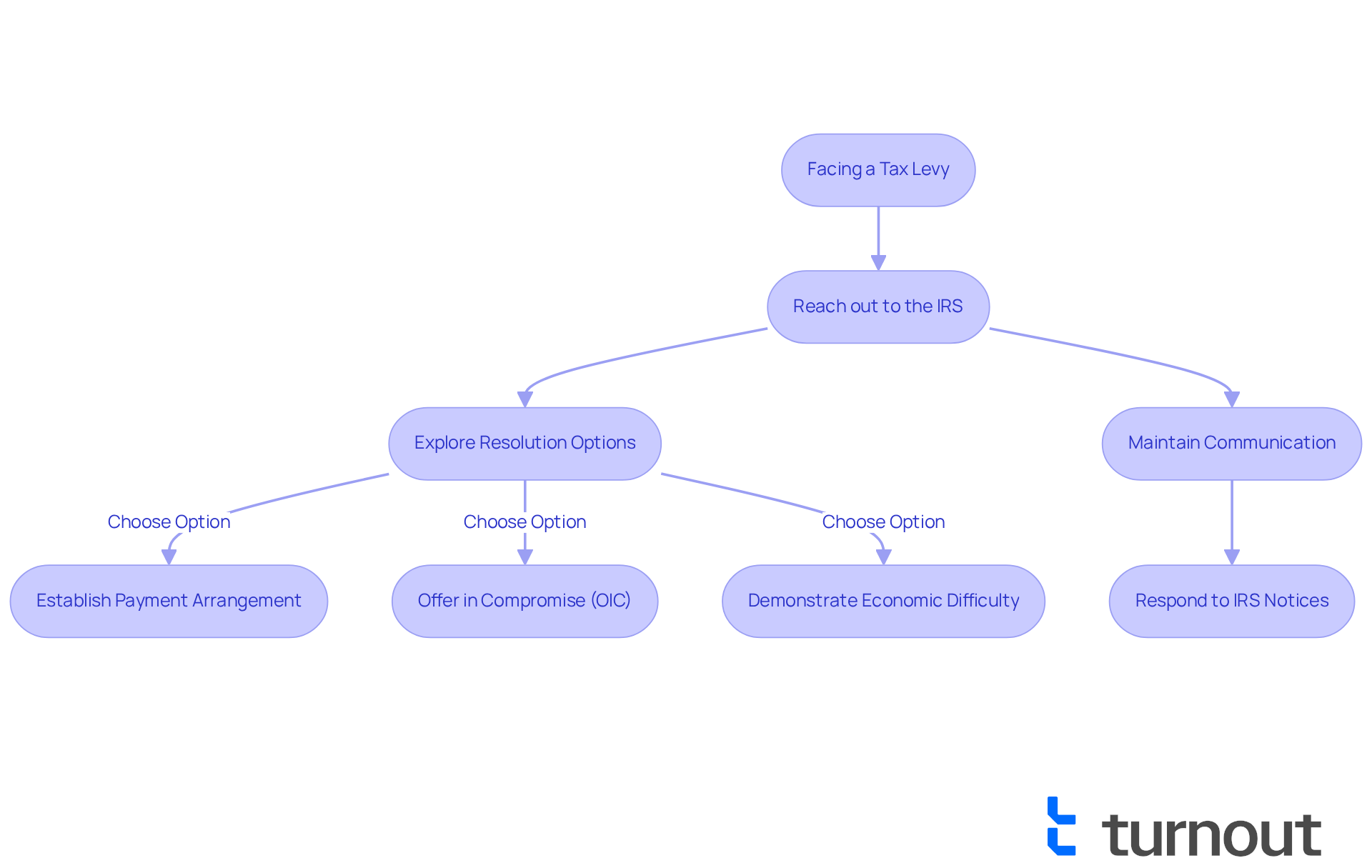

Facing a tax assessment can feel overwhelming, but there are effective steps you can take to navigate this challenge. We understand that this situation can be stressful. Start by reaching out to the IRS right away to discuss your tax liability and explore your resolution options. This may include:

- Establishing a payment arrangement

- Suggesting an Offer in Compromise (OIC)

- Demonstrating economic difficulty to request a release of the hold

It's crucial to respond promptly to IRS notices and keep the lines of communication open to prevent further escalation.

Did you know that the acceptance rate for OIC applications hovers around 36%, with a variation of +/- 5%? This statistic underscores the importance of presenting a well-documented case. If you can show that paying your tax debt in full would lead to economic hardship, you may qualify for an OIC, allowing you to resolve your tax debt for less than the total amount owed. Remember, clients must provide complete and accurate documentation to support their OIC application.

If a tax imposed creates immediate economic difficulty, it may be lifted by the IRS. This highlights the urgency of addressing your tax issue. Additionally, consider seeking help from consumer advocacy organizations like Jackson Hewitt. They can offer valuable support and guidance as you navigate the complexities of tax issues. Proactive measures, such as understanding your options and maintaining communication with the IRS, can significantly reduce the impact of a tax levy, which raises the question of why is there a tax levy on my paycheck and pave the way for your financial recovery. You're not alone in this journey, and we're here to help you find a way forward.

Conclusion

Understanding the reasons behind a tax levy on your paycheck is crucial if you find yourself facing this daunting situation. A tax levy is a legal action taken by the IRS or state tax authorities to seize assets in order to satisfy unpaid tax debts. This can lead to significant financial strain, with wage garnishments and bank account seizures leaving you struggling to meet essential expenses. Recognizing the seriousness of a tax levy and the need for timely action can help mitigate its impact.

We understand that several key factors contribute to tax levies, including:

- Unpaid tax debts

- Persistent noncompliance with payment agreements

- Economic hardships that can exacerbate these issues

Furthermore, the consequences of a tax levy can be devastating, affecting not only your immediate finances but also your long-term creditworthiness and emotional well-being. It is essential to address these challenges proactively by engaging with the IRS and exploring available options.

Ultimately, navigating a tax levy requires understanding the complexities involved and taking decisive action. Seeking assistance from tax professionals or consumer advocacy organizations can provide valuable support in resolving these issues. By staying informed and proactive, you can work towards alleviating the burdens of a tax levy and reclaiming your financial stability. Remember, taking the first step towards resolution is vital, as help is available to guide you through this challenging process.

Frequently Asked Questions

What is a tax levy?

A tax levy is a legal action initiated by the government, specifically the IRS or state tax authorities, to seize a taxpayer's assets in order to satisfy unpaid tax debts.

What forms can a tax levy take?

A tax levy can manifest in various forms, such as garnishing wages, seizing funds from bank accounts, or taking possession of personal property.

How does a tax levy differ from a tax lien?

A tax lien functions as a claim against property to ensure payment, while a tax levy involves the actual physical appropriation of assets. This distinction emphasizes the seriousness of the charge and the need for prompt action.

What happens if I ignore tax levy notices from the IRS?

If you ignore multiple notices, the IRS may issue a Final Notice of Intent to Levy, which can lead to actions such as wage garnishment or bank account seizures, resulting in significant financial repercussions.

How much notice does the IRS provide before a tax levy?

The IRS is required to send a Final Notice of Intent to Collect at least 30 days before the collection, giving taxpayers an opportunity to address their tax responsibilities.

Why is it important to understand the tax levy process?

Understanding the tax levy process is crucial for taxpayers to manage their financial circumstances effectively and to take proactive measures to safeguard their assets.

What should I do if I receive a tax levy notice?

It is important to connect with the IRS promptly to explore options to prevent or address the tax levy.