Introduction

Navigating the complexities of backup withholding can feel overwhelming for many taxpayers, especially when unexpected inquiries from banks arise. We understand that this tax mechanism, intended to ensure compliance and guard against potential evasion, can lead to significant deductions if proper taxpayer identification information isn’t provided.

As you grapple with the implications of these regulations, you might be wondering: what exactly triggers backup withholding? And how can you effectively navigate these challenges to avoid unnecessary financial strain?

You're not alone in this journey. Many individuals face similar concerns, and it’s completely normal to feel uncertain. Let’s explore the key aspects of backup withholding together, so you can feel more confident and informed.

Define Backup Withholding and Its Purpose

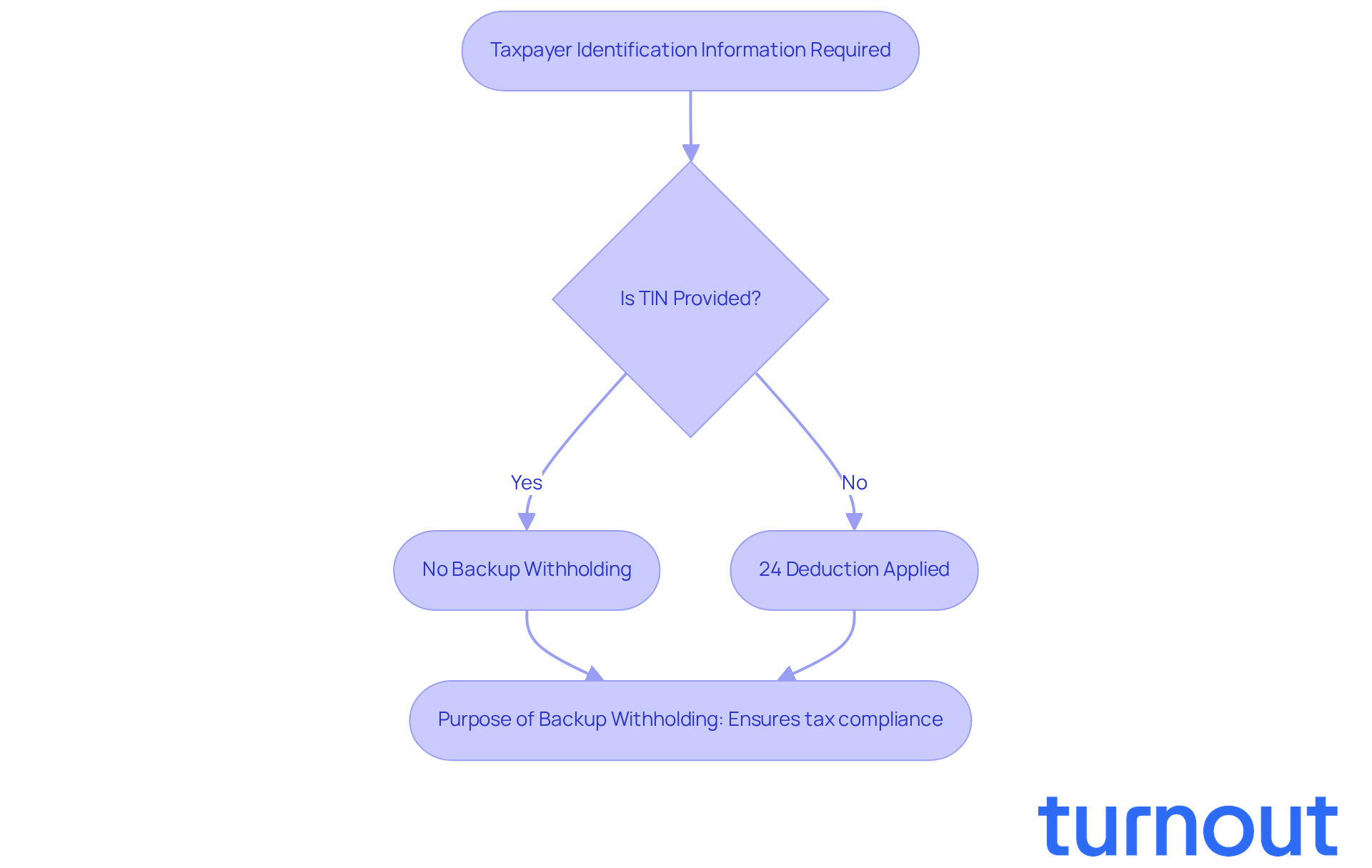

Backup retention is a tax mechanism that the Internal Revenue Service (IRS) enforces to help protect taxpayers like you. It requires financial institutions to deduct 24% from certain payments if you haven’t provided the necessary taxpayer identification information. We understand that this can be confusing, especially if you haven’t supplied a correct Taxpayer Identification Number (TIN) or if you’re unsure about why is my bank asking about backup withholding when reporting your interest and dividends accurately.

The main goal of this secondary tax collection is to ensure that the IRS receives taxes on income that might otherwise go unreported. This serves as a safeguard against potential tax evasion, leading many to wonder why is my bank asking about backup withholding. As we look ahead to 2026, it’s important to note that a significant number of taxpayers may find themselves facing additional tax retention. This highlights the importance of staying informed and compliant with IRS regulations.

For instance, if your adjusted wage amount is $2,015, the standard deduction would be $158. This example shows how backup retention can directly impact your take-home pay. It’s common to feel overwhelmed by these regulations, which is why is my bank asking about backup withholding, but remember, this system is designed not only to promote accurate income reporting but also to help the IRS maintain tax compliance among individuals like you.

We’re here to help you navigate these complexities. If you have questions or need assistance, don’t hesitate to reach out. You are not alone in this journey.

Identify Triggers for Backup Withholding Requirements

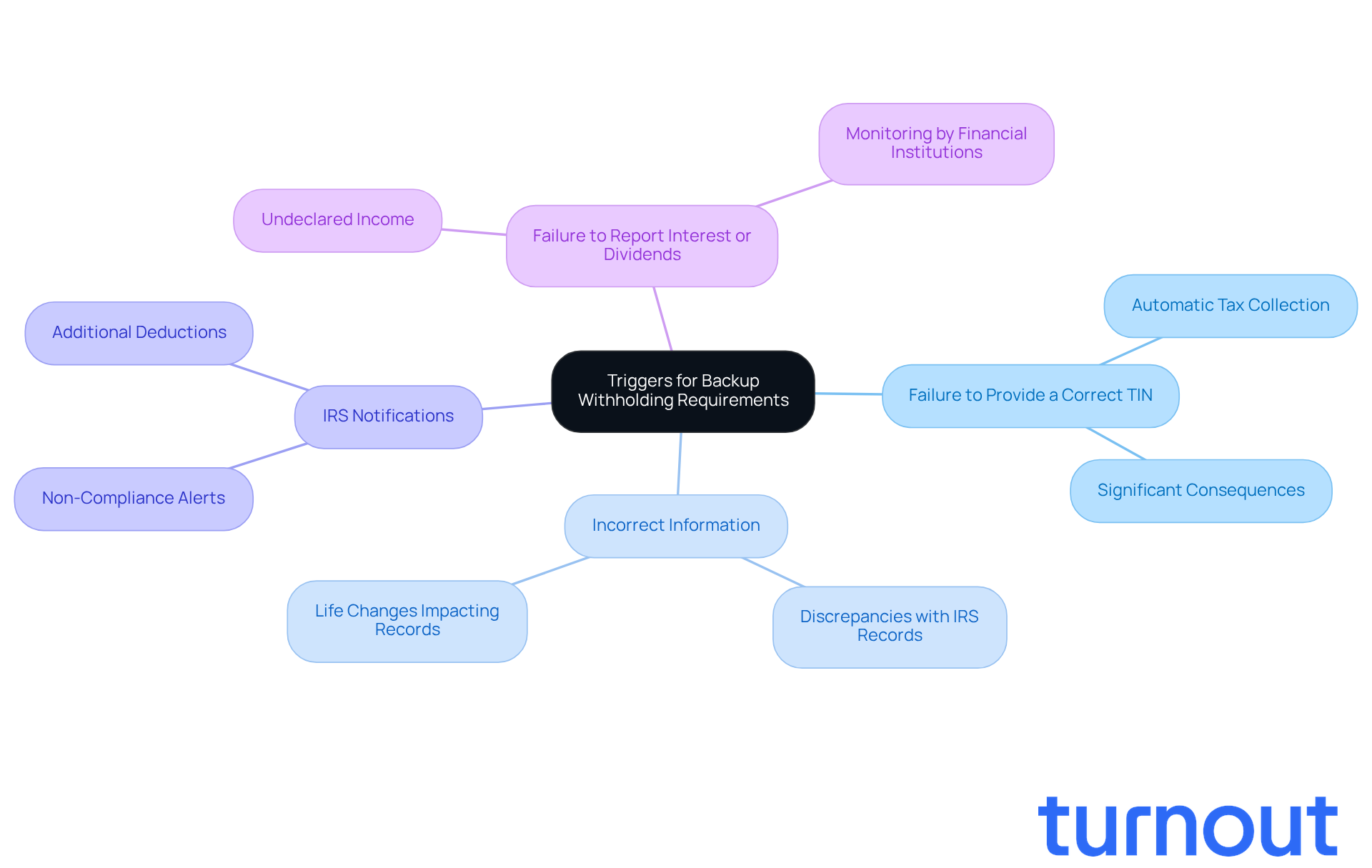

It is essential for everyone to understand why my bank is asking about backup withholding, especially when it comes to avoiding unexpected deductions. We understand that navigating tax issues, including why is my bank asking about backup withholding, can be overwhelming, but recognizing the common triggers can help you stay on top of your finances. Here are some key factors to consider:

-

Failure to Provide a Correct TIN: If you don’t provide a valid Taxpayer Identification Number (TIN) to your financial institution or payer, you may face automatic additional tax collection. It’s a simple oversight that can have significant consequences.

-

Incorrect Information: Sometimes, discrepancies between your name on the account and IRS records can lead to retention. This often happens during life changes, like marriage or divorce, when updating your information might slip your mind.

-

IRS Notifications: If the IRS notifies your payer about extra deductions due to previous non-compliance, you could see additional deductions. This can occur if there are issues with your reported income or tax filings.

-

Failure to Report Interest or Dividends: Not declaring certain income, such as interest or dividends, can also lead to extra tax deductions. Financial institutions are diligent in monitoring these reports to ensure compliance.

We understand that keeping track of these details can be challenging. However, by actively managing your tax documents and ensuring all your information is accurate and up-to-date, you can significantly reduce the risk of unnecessary deductions, which makes me wonder why is my bank asking about backup withholding. Remember, you’re not alone in this journey; we’re here to help you navigate these complexities.

Examine Consequences of Being Subject to Backup Withholding

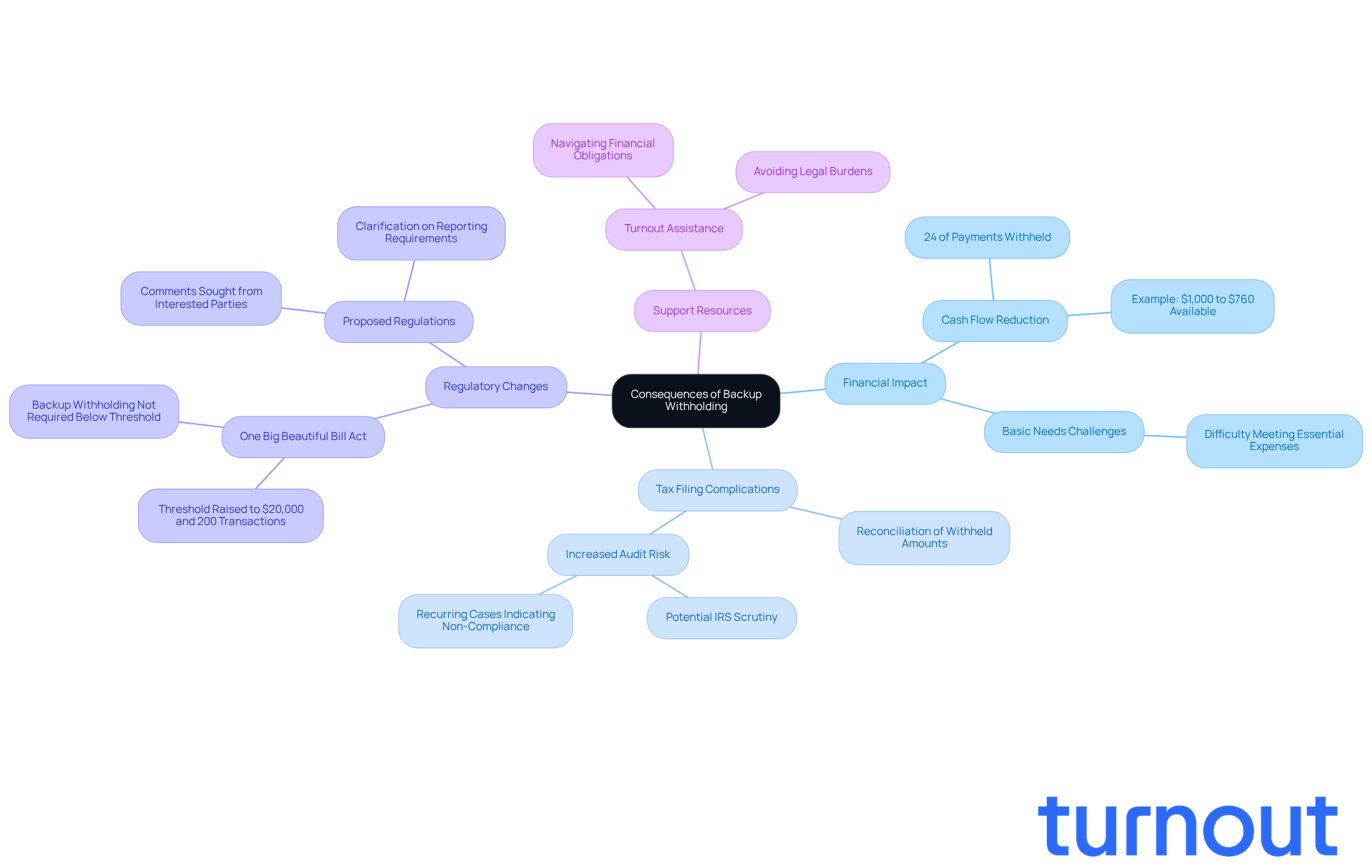

Being subject to retention of funds can deeply impact your financial situation, especially if you rely on Social Security Disability (SSD) benefits. We understand that the immediate consequence is a reduction in cash flow, with 24% of payments withheld and sent directly to the IRS. For example, if you receive $1,000 monthly, you might find only $760 available for your needs. This can make it tough to meet basic requirements, which is particularly concerning for those who depend on these payments for essential expenses.

Moreover, reserve tax deductions can complicate your filing process. Taxpayers must reconcile withheld amounts when preparing their tax returns, which can lead to delays in receiving refunds. It’s common to feel overwhelmed by this added complexity, and it may even attract additional scrutiny from the IRS, increasing the likelihood of audits. Financial specialists point out that recurring cases of tax retention can signal possible non-compliance to the IRS, which might result in further audits or penalties.

Recent changes under the One Big Beautiful Bill Act have raised the limit for reserve deductions. This means that third-party settlement organizations typically aren’t required to reserve deduct unless the total amount of reportable payment transactions exceeds $20,000 and the number of transactions goes beyond 200. Understanding these consequences and the current regulatory landscape is crucial for you. It empowers you to navigate your financial obligations more effectively and helps you avoid unexpected challenges during tax season.

Remember, you’re not alone in this journey. Turnout is here to assist you in navigating these complexities, ensuring you receive the financial support you need without the burden of legal representation.

Explore Solutions to Manage or Avoid Backup Withholding

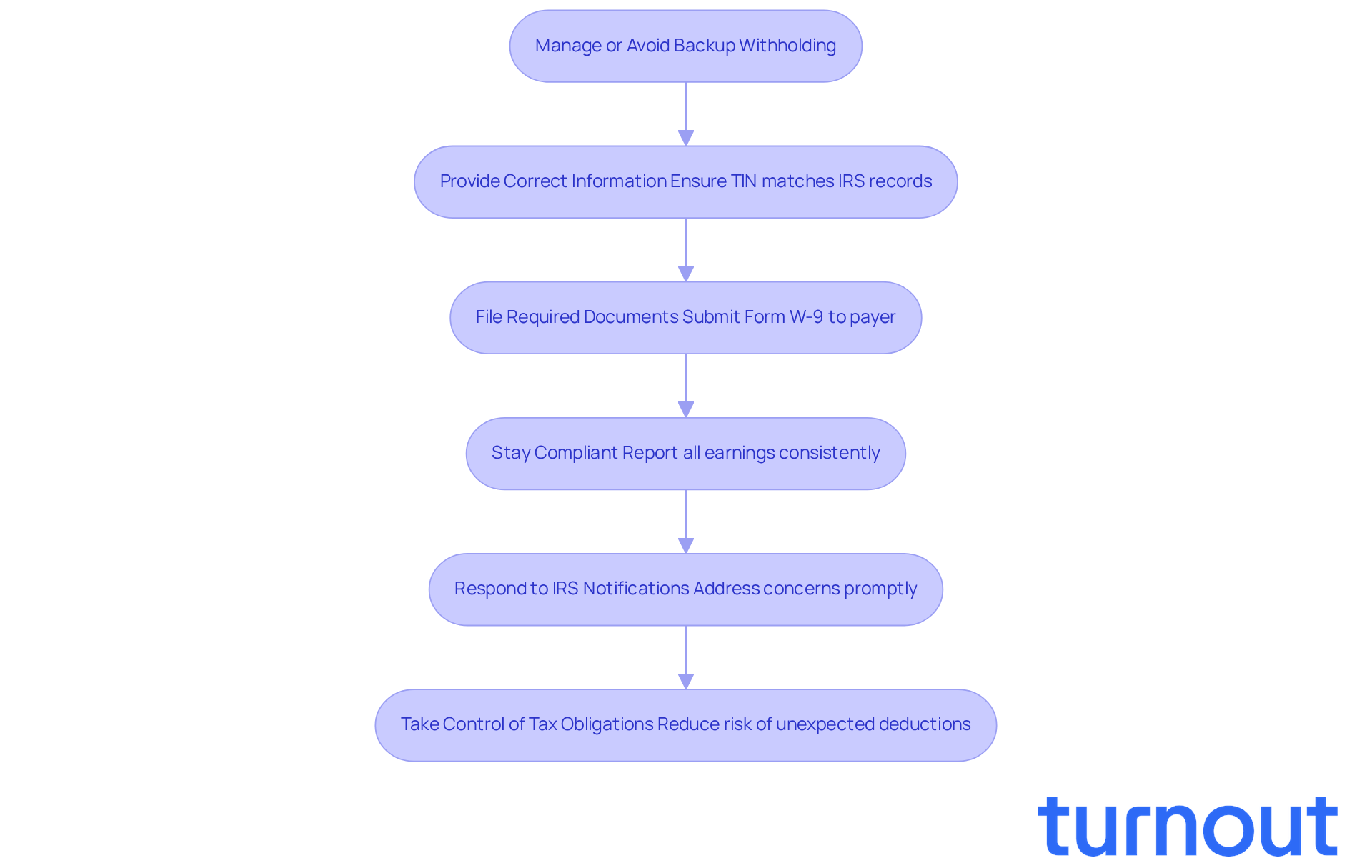

Managing backup withholding can feel overwhelming, especially when considering why is my bank asking about backup withholding, but there are steps you can take to navigate this process with confidence. Here’s how you can effectively manage or even avoid backup withholding:

-

Provide Correct Information: It’s essential to ensure that all your identification details, especially your Taxpayer Identification Number (TIN), are accurate and match IRS records. Take a moment to review your documents and, if needed, confirm your details with the IRS. This small step can make a big difference.

-

File Required Documents: Sending in Form W-9 to your payer is crucial. This form confirms that you’re not subject to additional deductions, helping you prevent unnecessary withholdings. In fact, statistics from 2026 show that many taxpayers who submit Form W-9 successfully avoid having funds withheld, underscoring its importance.

-

Stay Compliant: We understand that keeping track of all your earnings, including interest and dividends, can be challenging. However, consistently reporting these earnings is vital to avoid triggering additional deductions due to non-reporting. Staying compliant with these requirements is key to your financial peace of mind.

-

Respond to IRS Notifications: If you receive any notifications from the IRS regarding additional tax deductions, it’s important to address these concerns promptly. Swift action can help you avoid further complications down the road.

By following these steps, you can take control of your tax obligations and address concerns like why is my bank asking about backup withholding to reduce the risk of unexpected deductions. Remember, backup withholding only applies if your transaction volume exceeds 200 transactions and the dollar amount exceeds $20,000, as clarified in the proposed regulations (REG-112829-25) under the One Big Beautiful Bill Act. You’re not alone in this journey; we’re here to help you navigate your financial interactions with confidence.

Conclusion

Understanding backup withholding is crucial for maintaining your financial health and staying compliant with IRS regulations. This tax mechanism helps ensure that financial institutions collect taxes on income that might otherwise go unreported, protecting both you and the government. We understand that the necessity for backup withholding can arise when individuals fail to provide accurate taxpayer identification information, leading to unexpected deductions from payments.

Common triggers for backup withholding include:

- Not providing a correct Taxpayer Identification Number (TIN)

- Discrepancies in personal information

- Failing to report interest or dividends

These factors can significantly impact your cash flow and complicate tax filing processes, potentially leading to audits or penalties. It's common to feel overwhelmed by these complexities, especially with recent regulatory changes emphasizing the importance of understanding these implications.

In light of this information, it’s essential for you to proactively manage your tax documentation and ensure compliance with IRS requirements. By providing accurate information, filing necessary forms, and promptly addressing IRS notifications, you can mitigate the risk of backup withholding. Remember, you are not alone in this journey. This knowledge empowers you to take control of your financial situation and highlights the importance of staying informed about backup withholding regulations.

Taking these steps can lead to greater financial peace of mind and a smoother tax experience. We’re here to help you navigate these challenges, ensuring you feel supported every step of the way.

Frequently Asked Questions

What is backup withholding?

Backup withholding is a tax mechanism enforced by the IRS that requires financial institutions to deduct 24% from certain payments if a taxpayer has not provided the necessary taxpayer identification information.

Why does backup withholding exist?

The main purpose of backup withholding is to ensure that the IRS receives taxes on income that might otherwise go unreported, serving as a safeguard against potential tax evasion.

When might my bank ask about backup withholding?

Your bank may ask about backup withholding if you have not supplied a correct Taxpayer Identification Number (TIN) or if they need to ensure accurate reporting of your interest and dividends.

How does backup withholding affect my income?

Backup withholding can directly impact your take-home pay by deducting a percentage from your payments, which may reduce the amount you receive.

What should I do if I'm confused about backup withholding?

If you have questions or need assistance regarding backup withholding, you should reach out for help, as you are not alone in navigating these complexities.

What changes might occur regarding backup withholding by 2026?

By 2026, a significant number of taxpayers may face additional tax retention, highlighting the importance of staying informed and compliant with IRS regulations.