Overview

We understand that delays in processing amended returns, particularly Form 1040-X, can be frustrating and concerning. These delays are primarily caused by issues such as:

- Incomplete or incorrect information

- Staffing shortages at the IRS

- Increased scrutiny due to new fraud prevention measures

It's common to feel overwhelmed by these challenges.

Moreover, external influences like legislative changes and economic conditions contribute to a backlog, complicating the processing of revised tax submissions. This situation can lead to extended wait times for taxpayers, which only adds to the stress of an already complex process.

We want you to know that you're not alone in this journey. We're here to help you navigate these challenges and seek the assistance you need. Together, we can work towards a resolution that eases your concerns and gets your amended return processed as quickly as possible.

Introduction

Navigating the intricacies of tax returns can feel overwhelming, especially when it comes to amended submissions. Many taxpayers grapple with the frustrating question: why is my amended return taking so long? We understand that this uncertainty can be stressful. This article explores common pitfalls that lead to delays, such as:

- Incomplete information

- The method of filing

Additionally, we will shed light on broader systemic issues within the IRS, including:

- Staffing shortages

- Evolving regulations

As the wait stretches beyond the expected timeframe, understanding these challenges becomes crucial. What can you do to expedite your amended returns amidst these complexities? We're here to help you through this journey.

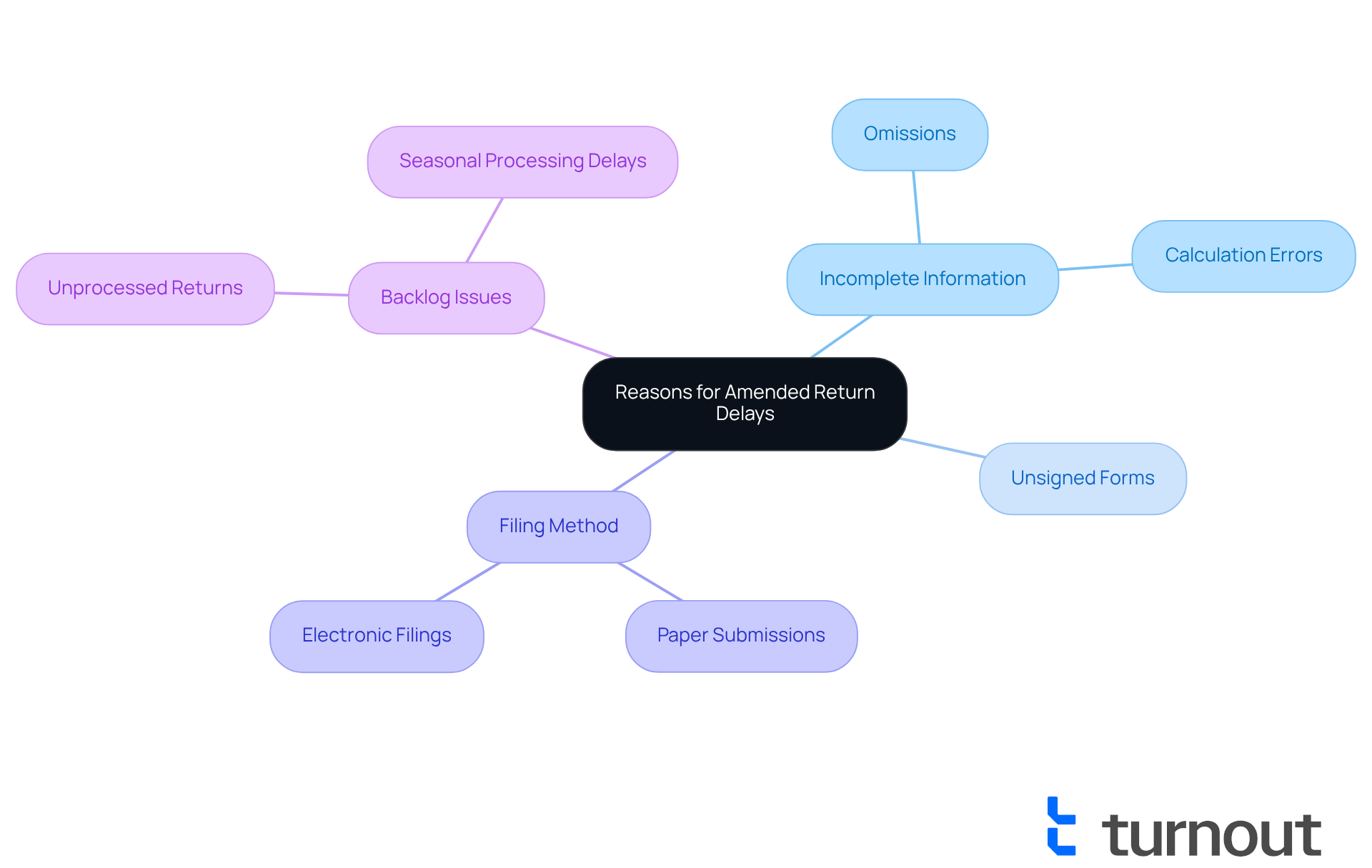

Identify Common Reasons for Amended Return Delays

Amended submissions, particularly Form 1040-X, can often cause frustration due to common issues that many taxpayers face. We understand that a significant factor contributing to why is my amended return taking so long is the submission of incomplete or incorrect information. It's easy to unintentionally omit crucial details or make calculation errors, which can lead to additional reviews by the IRS. If an amended return is unsigned or lacks required documentation, it can further worsen these delays.

The IRS suggests allowing 8 to 12 weeks for processing; however, the timeframe for Form 1040-X can sometimes exceed 20 weeks. Many taxpayers report waiting much longer and asking themselves why is my amended return taking so long because of these frequent obstacles. Additionally, the method of filing plays a crucial role in processing times. Paper submissions generally take longer than electronic filings, which can add to the frustration for those who prefer traditional methods. As Holland remarked, "Documents must be input into the computer manually, which significantly prolongs their processing time."

For instance, as of May 13, 2023, the IRS had 1.43 million unprocessed revised tax submissions filed on Form 1040-X. This statistic highlights why is my amended return taking so long due to the backlog that can occur when mistakes or omissions are present. We encourage you to utilize the 'Where's My Amended Return?' tool to monitor the status of your revised filings. This proactive step helps ensure that your submissions are completed correctly and effectively. Remember, you are not alone in this journey; we’re here to help you navigate through these challenges.

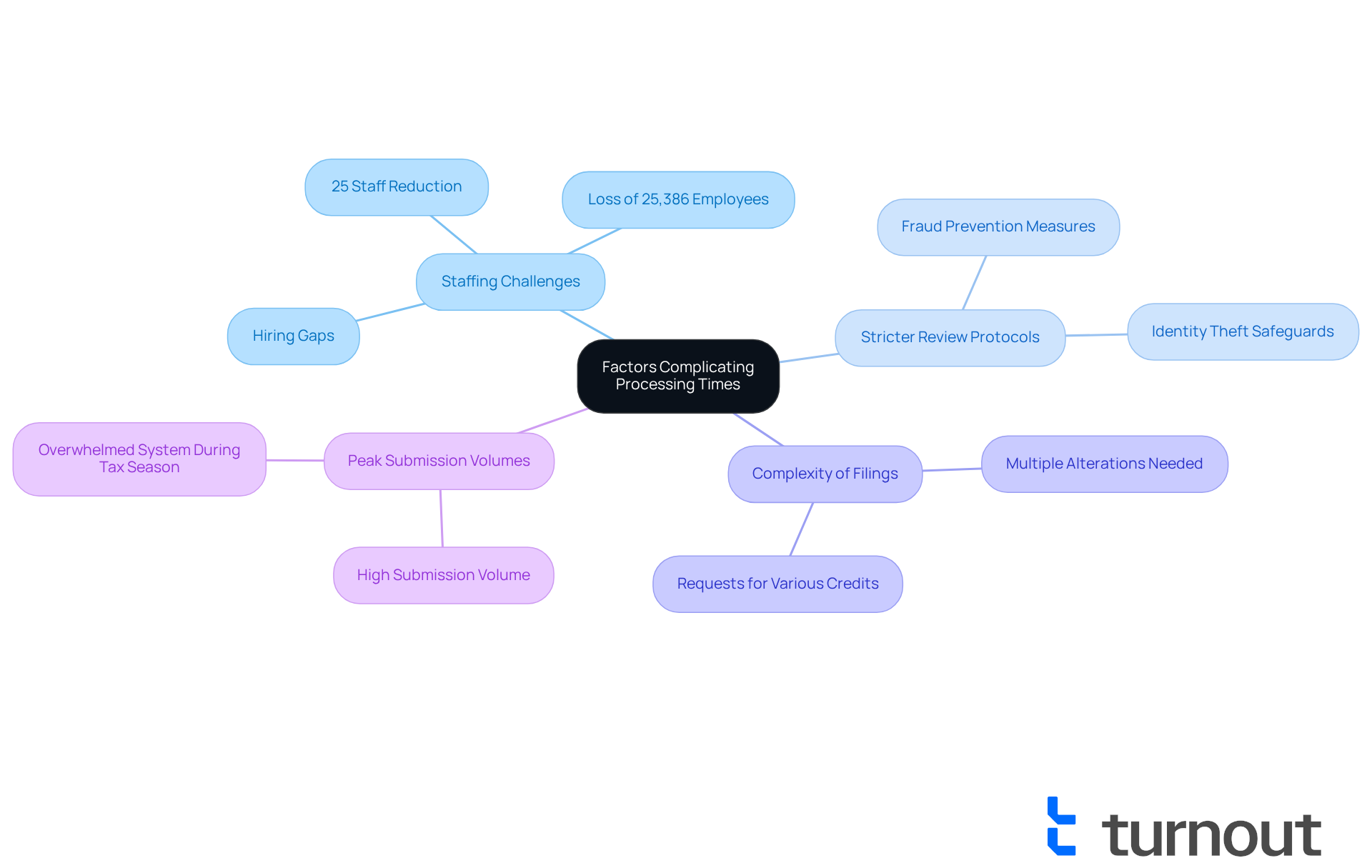

Examine Factors Complicating Processing Times

We understand that processing times for modified submissions can be frustrating, which raises the question of why is my amended return taking so long, as this is influenced by several interconnected factors beyond individual mistakes. A primary concern is the IRS's ongoing staffing challenges, which have intensified due to significant workforce reductions. The agency has lost around 25% of its staff, leading to a significant accumulation of submissions pending review.

In addition, the IRS has adopted stricter review protocols aimed at preventing fraud and identity theft. While these measures are essential for safeguarding taxpayer information, they can inadvertently prolong processing times. It's common to feel overwhelmed by the intricacy of revised filings, and many wonder why is my amended return taking so long; submissions that involve multiple alterations or requests for various credits often necessitate more detailed scrutiny, further contributing to delays.

Additionally, during peak tax season, the sheer volume of submissions can overwhelm the system, exacerbating wait times. These systemic challenges underscore the difficulties taxpayers encounter. Remember, you are not alone in this journey, and understanding the broader context of IRS operations can help ease some of your concerns. We’re here to help navigate these complexities together.

Analyze External Influences on Processing Delays

We understand that external factors can greatly affect why my amended return is taking so long with revised tax filings. Changes in legislation, such as new tax statutes or alterations to current regulations, often lead to confusion. This confusion can necessitate extra training for IRS staff, which may further delay completion times. Economic circumstances, like downturns or increasing unemployment rates, frequently result in a surge of revised filings as individuals strive to rectify their tax situations.

Moreover, natural disasters or public health emergencies can disrupt IRS operations, causing temporary closures or reduced staffing levels. It's concerning to note that the IRS has lost 3,623 revenue agents, indicating a 31% decrease in tax auditors. This significant reduction weakens their ability to handle returns and provide taxpayer support. Former Acting Commissioner of the IRS Douglas O'Donnell has pointed out that this unprecedented reduction will lead to longer examination time frames.

These external factors create a ripple effect, which raises concerns about why my amended return is taking so long, impacting not only the speed of processing but also the overall efficiency of the IRS. Recognizing these influences helps you contextualize your experiences. It's important to understand that the question of why is my amended return taking so long may stem from larger systemic issues rather than being solely reflective of your individual circumstances. Remember, you are not alone in this journey, and we’re here to help.

Conclusion

Navigating the complexities of amended tax returns can indeed be challenging, especially when delays occur. It's important to understand the reasons behind these prolonged processing times, including:

- Incomplete submissions

- IRS staffing shortages

- External factors like legislative changes

These elements can contribute to the frustration of waiting for an amended return, often leading you to wonder, "Why is my amended return taking so long?"

Key insights show that common issues, such as:

- Incorrect information

- The method of filing

- Increased scrutiny due to fraud prevention measures

significantly affect processing times. The IRS's backlog, worsened by a reduced workforce and the high volume of submissions during peak periods, illustrates the systemic challenges many face. Moreover, external factors like economic fluctuations and natural disasters can complicate the situation further, resulting in longer wait times for taxpayers seeking resolution.

Recognizing the broader context of these delays can offer some comfort. While your experience may feel isolating, it's essential to know that many individuals are navigating similar challenges. Staying informed about the status of your amended return using tools like the 'Where's My Amended Return?' feature can empower you to take proactive steps. By acknowledging these complexities and remaining patient, you can better manage your expectations and contribute to a more efficient resolution process.

Frequently Asked Questions

What are common reasons for delays in amended returns?

Common reasons for delays in amended returns include the submission of incomplete or incorrect information, unsigned forms, lack of required documentation, and calculation errors.

How long does the IRS suggest it will take to process an amended return?

The IRS suggests allowing 8 to 12 weeks for processing an amended return, but it can sometimes exceed 20 weeks.

Why might my amended return take longer than expected?

Amended returns can take longer due to additional reviews by the IRS caused by mistakes or omissions, as well as the backlog of unprocessed submissions. For instance, as of May 13, 2023, there were 1.43 million unprocessed revised tax submissions on Form 1040-X.

Does the method of filing affect the processing time of amended returns?

Yes, the method of filing affects processing times. Paper submissions generally take longer than electronic filings because paper documents must be manually input into the computer.

How can I check the status of my amended return?

You can monitor the status of your amended return by using the 'Where's My Amended Return?' tool provided by the IRS.