Introduction

Federal taxes often evoke feelings of frustration, don’t they? Yet, they play a crucial role in supporting the essential services that shape our society. By funding public goods like healthcare, education, and social security, these taxes help meet the needs of all citizens, especially those who are most vulnerable.

As discussions about potential tax cuts and eliminations heat up, it’s important to consider the profound implications. What would happen to the very programs that millions rely on? This article invites you to explore the economic principles, social expectations, and political influences that underscore the necessity of federal taxes. Together, let’s delve into why they’re here to stay and what it means for the future of public benefits.

We understand that navigating these topics can be overwhelming. But remember, you’re not alone in this journey. Let’s take a closer look at how these taxes impact our lives and the vital services we all depend on.

Examine Economic Principles Sustaining Federal Taxes

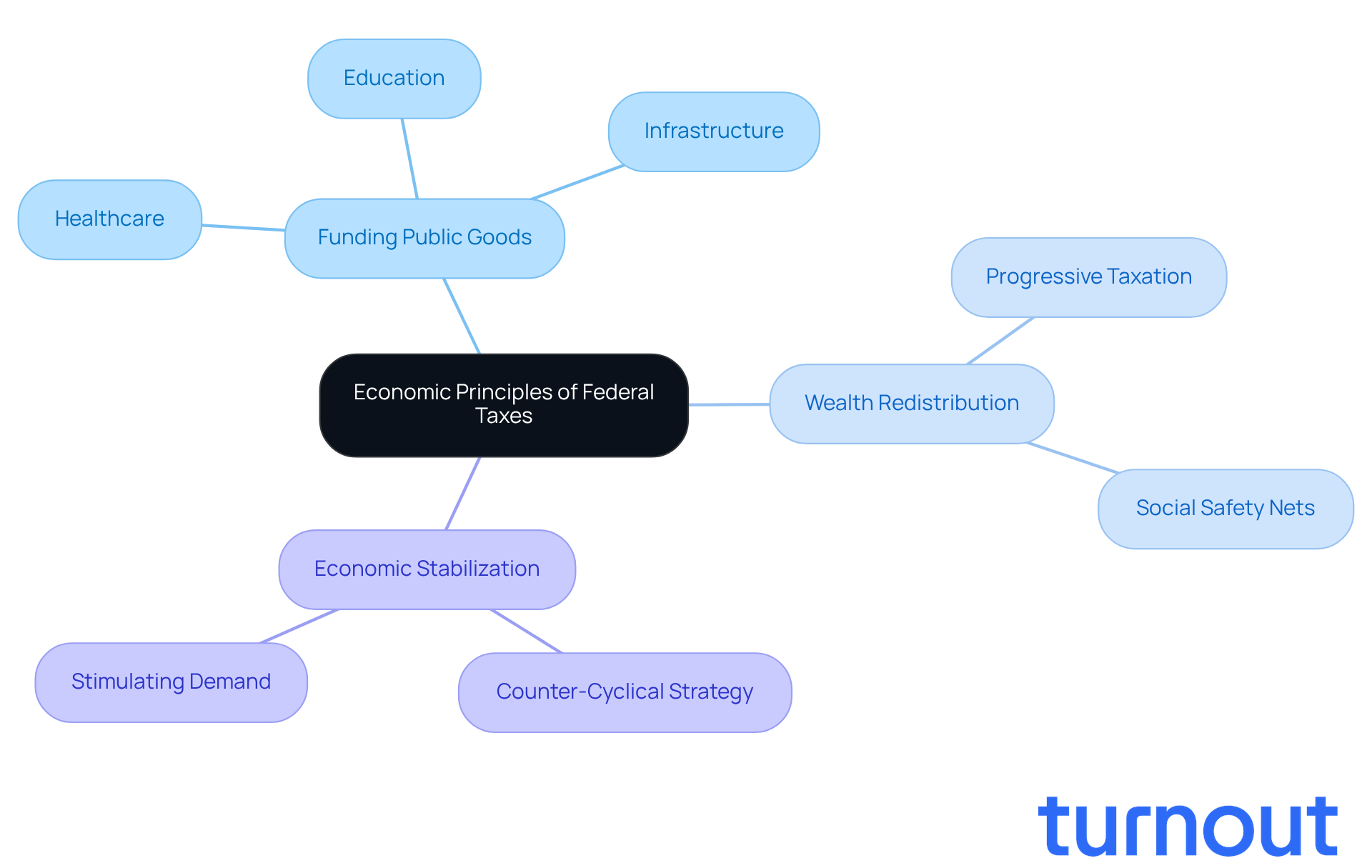

Federal levies are rooted in several economic principles that underscore their significance for a thriving society. We understand that taxes can feel burdensome, but at their core, they serve as a means for the government to gather revenue. This revenue is essential for funding public needs like healthcare, education, and infrastructure, which benefit us all. The principle of public goods theory highlights that certain provisions, such as national defense and public education, cannot be efficiently supplied by the private sector alone. This is why taxation is crucial for ensuring these vital services are available to everyone.

Moreover, taxes play a pivotal role in redistributing wealth, helping to alleviate economic inequality. Progressive taxation, where higher earners contribute a larger percentage of their income, is designed to ensure that those with greater financial resources help support the community. For instance, it's concerning that eighty percent of the tax cuts from Missouri's capital gains exemption will benefit the richest 5 percent of households. This illustrates how tax policies can sometimes widen the gap between the wealthy and the less fortunate. This redistribution is vital for funding social safety nets, including Social Security and disability benefits, which support millions of Americans in need.

Additionally, levies are essential for stabilizing the economy. We know that during tough economic times, government spending funded by taxes can stimulate demand and promote recovery. This counter-cyclical financial strategy is crucial for maintaining economic stability and ensuring that essential programs remain funded, even in challenging periods. As Hardik Gandhi, Partner at Deloitte India, wisely notes, "The upcoming Budget presents a timely opportunity to reinforce India’s consumption-driven growth path through targeted tax measures and structural reforms." This highlights the ongoing need for effective tax policies that support public resources and address economic challenges.

In this journey, remember that you are not alone. We're here to help you navigate these complexities and understand how taxes impact your life.

Explore Social Expectations and Public Services Funding

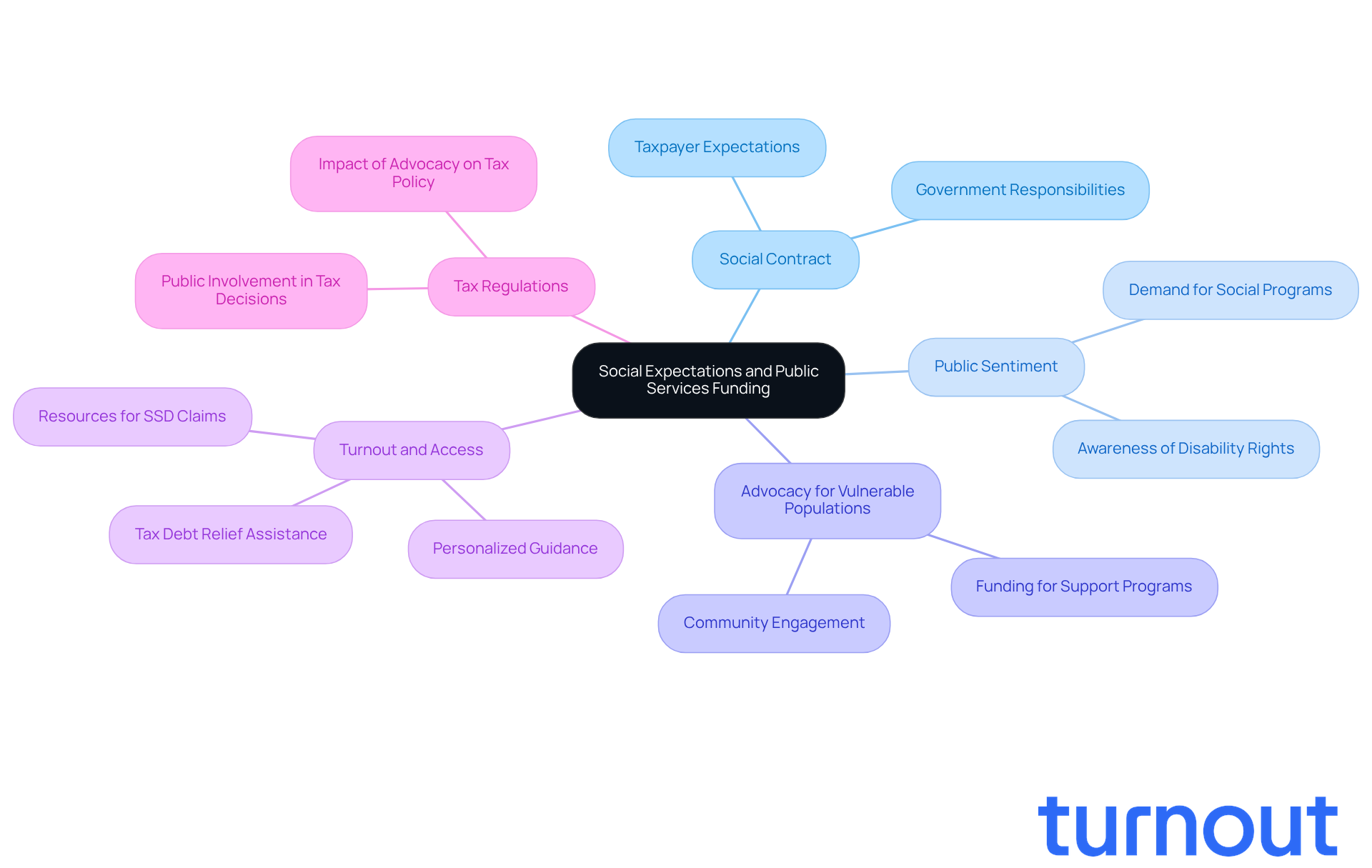

The connection between federal levies and social expectations is deeply intertwined. We understand that citizens look to their government for essential support that enhances their quality of life-think healthcare, education, and social security. This expectation forms a social contract: individuals agree to pay taxes in exchange for these vital services.

Public sentiment often drives the demand for increased financial support for social programs. As awareness of disability rights and the needs of vulnerable populations grows, there’s a heartfelt push for more robust funding for programs that support these groups. Turnout plays a crucial role in this landscape, offering tools and assistance-like personalized guidance and resources-that help consumers navigate these complex systems, especially in areas like Social Security Disability (SSD) claims and tax debt relief. This dynamic illustrates how our societal values shape tax regulations and the distribution of resources.

Moreover, the financial support of public services through taxes reflects a society's priorities. When citizens advocate for greater funding for education or healthcare, they’re essentially questioning if and when federal taxes will go away to ensure that the government can meet these needs. Turnout’s approach, utilizing trained nonlawyer advocates and IRS-licensed enrolled agents, simplifies access to these benefits without the need for legal representation. This interplay between social expectations and taxation highlights the importance of public involvement in shaping tax regulations.

We’re here to help you navigate these challenges. You are not alone in this journey.

Analyze Political Influences on Taxation Policies

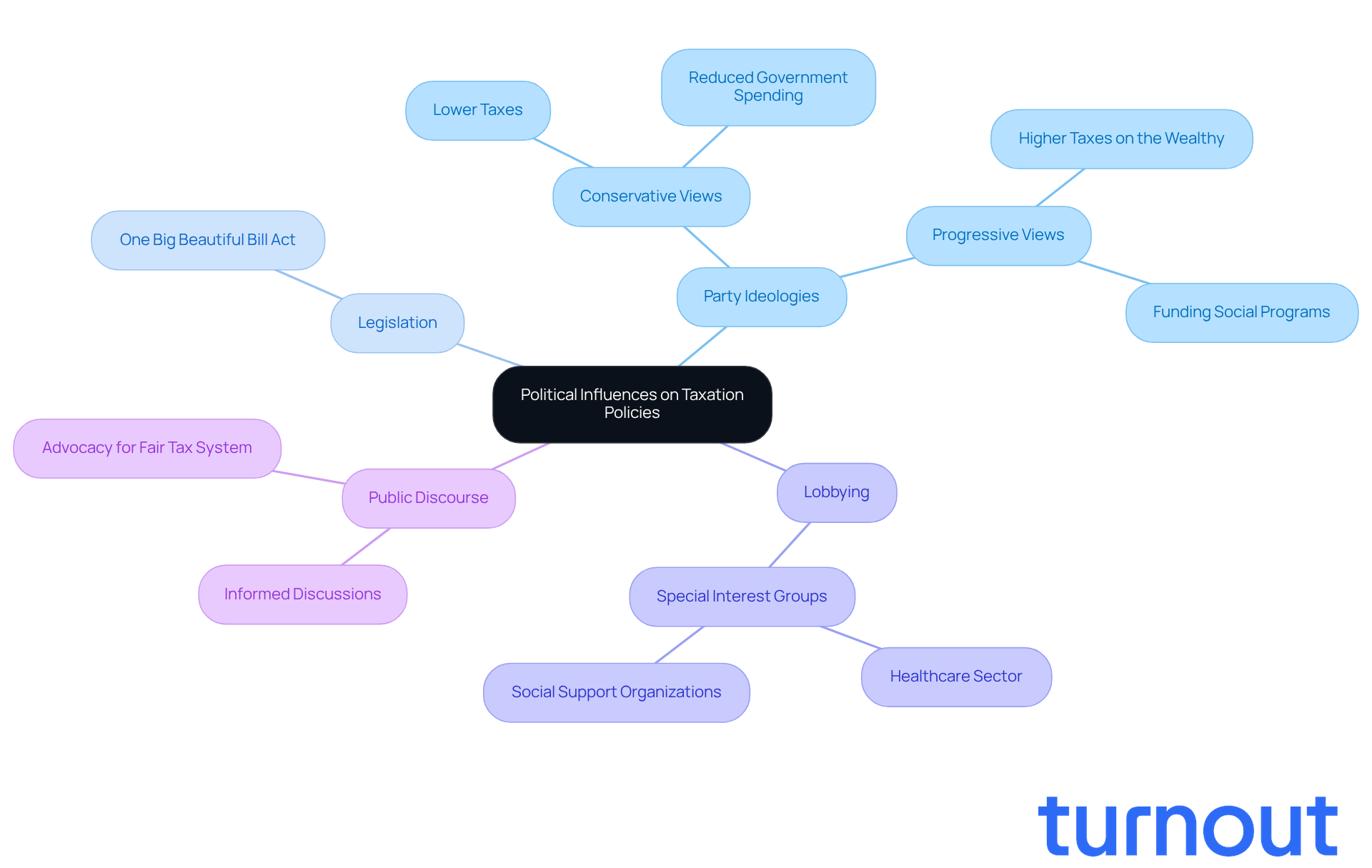

Taxation frameworks are deeply intertwined with the political landscape, where party ideologies and agendas significantly shape tax regulations. We understand that navigating these complexities can be challenging. Political parties often hold differing views on taxation. For example, conservative factions may advocate for lower taxes and reduced government spending, while progressive groups typically support higher taxes on the wealthy to fund essential social programs.

Legislation like the One Big Beautiful Bill Act reflects these political influences. It encompasses tax cuts and spending priorities that align with the ruling party's agenda. It's common to feel uncertain about how these changes might affect vital resources for programs you rely on. The political environment can lead to shifts in tax laws, impacting the stability of these regulations.

Moreover, lobbying by special interest groups adds another layer of complexity to the tax framework. Organizations representing various sectors, including healthcare and social support, often advocate for tax incentives or funding that align with their interests. This interplay between politics and taxation underscores the importance of informed public discourse. We’re here to help ensure that tax policies reflect the needs of all citizens, especially those who depend on government support.

By engaging in discussions about these issues, we can work together to create a fairer tax system that truly serves everyone.

Assess Consequences of Potential Tax Elimination

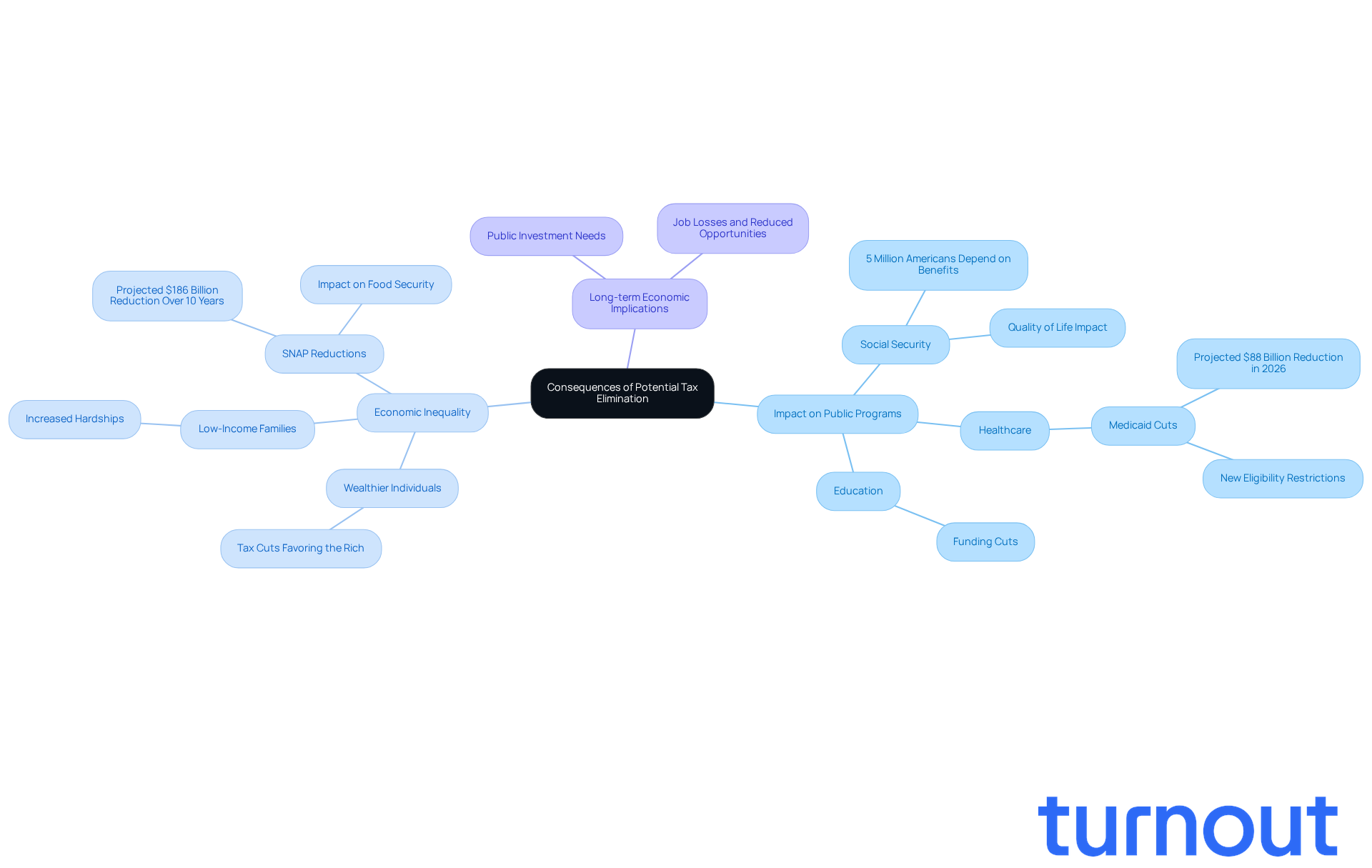

The serious consequences for public programs and the individuals who rely on them will depend on whether federal taxes will go away. Without tax revenue, the government would struggle to fund essential services like Social Security, healthcare, and education. This could lead to a significant reduction in support for vulnerable populations, including individuals with disabilities who depend on these services for their livelihoods. In fact, nearly 5 million Americans rely on Social Security Disability benefits, and any cuts to these programs could severely impact their quality of life.

We understand that if the question of whether federal taxes will go away is not addressed, it could worsen economic inequality. Wealthier individuals and corporations may benefit from tax cuts, while low-income families could face increased hardships as social safety nets are dismantled. For instance, a projected reduction of $186 billion in support for programs like SNAP over the next decade could leave millions struggling to afford basic necessities, further widening the gap between the affluent and the disadvantaged.

It's common to feel concerned about the long-term economic implications of whether federal taxes will go away. Public investment in infrastructure, education, and healthcare is crucial for economic growth and stability. Without adequate funding, the economy could suffer, leading to job losses and reduced opportunities for all citizens. The potential fallout from tax elimination raises concerns about when federal taxes will go away, highlighting the importance of maintaining a balanced and equitable tax system that supports the needs of all Americans, particularly those who are most vulnerable. We're here to help ensure that everyone has access to the support they need.

Conclusion

Federal taxes play a vital role in keeping our society functional. They provide essential funding for services like healthcare, education, and social security. While they might feel burdensome at times, these taxes are crucial for ensuring that everyone has access to public goods and for addressing economic disparities through wealth redistribution. It’s important to recognize how federal taxes help stabilize our economy and support those who are most vulnerable.

We understand that discussions about taxes can be overwhelming. However, it’s essential to highlight the significance of federal taxes in funding public services and meeting social expectations. The political landscape also shapes tax policies, influencing how resources are allocated and which programs receive support. Eliminating taxes could have serious consequences, risking the essential services that millions rely on, especially those in need.

Ultimately, grasping the multifaceted role of federal taxes is key to fostering informed public discourse. Engaging in conversations about taxation can help ensure that the needs of all individuals are met, particularly those who depend on government support. By recognizing the importance of taxes in maintaining public services and economic stability, we can work towards a more equitable and supportive society. Remember, you are not alone in this journey; together, we can advocate for policies that truly serve the greater good.

Frequently Asked Questions

What are the primary purposes of federal taxes?

Federal taxes are primarily used to gather revenue for funding public needs such as healthcare, education, and infrastructure, which benefit society as a whole.

Why are taxes necessary for public goods?

Taxes are necessary for public goods because certain provisions, like national defense and public education, cannot be efficiently supplied by the private sector alone. Taxation ensures these vital services are available to everyone.

How do taxes help in redistributing wealth?

Taxes help redistribute wealth through progressive taxation, where higher earners contribute a larger percentage of their income. This approach is designed to ensure that those with greater financial resources support the community and help alleviate economic inequality.

What is an example of how tax policies can affect economic inequality?

An example is the capital gains exemption in Missouri, where eighty percent of the tax cuts benefit the richest 5 percent of households, illustrating how tax policies can sometimes widen the gap between the wealthy and the less fortunate.

How do taxes contribute to economic stability?

Taxes contribute to economic stability by funding government spending during tough economic times, which can stimulate demand and promote recovery. This counter-cyclical financial strategy helps maintain essential programs even in challenging periods.

What role do taxes play in funding social safety nets?

Taxes are vital for funding social safety nets, including programs like Social Security and disability benefits, which support millions of Americans in need.

What is the significance of targeted tax measures and structural reforms?

Targeted tax measures and structural reforms are significant as they can reinforce consumption-driven growth and address economic challenges, as highlighted by experts in the field.