Overview

IRS payment plans can stop automatically due to several triggers. We understand that this can be a source of stress.

- Missed payments

- New tax obligations

- Failure to file required returns

- Providing inaccurate information

- Significant changes in financial circumstances

These factors can lead to termination of your plan. It's crucial to understand these triggers to maintain your agreements and avoid severe financial consequences. Even one missed installment can have serious implications.

Remember, you're not alone in this journey. We're here to help you navigate these challenges.

Introduction

Understanding the intricacies of IRS payment plans is crucial for taxpayers who want to manage their financial obligations effectively. We understand that the potential for automatic termination can be a source of anxiety. It’s important to identify the triggers that can lead to such cancellations. This article delves into common pitfalls that can jeopardize your agreement with the IRS, offering insights into how to maintain compliance and avoid severe financial repercussions.

What happens when a missed payment or new tax responsibility threatens to unravel a carefully constructed payment plan? It’s common to feel overwhelmed by these challenges. However, there are ways to navigate these obstacles and safeguard your financial future. We're here to help you through this journey.

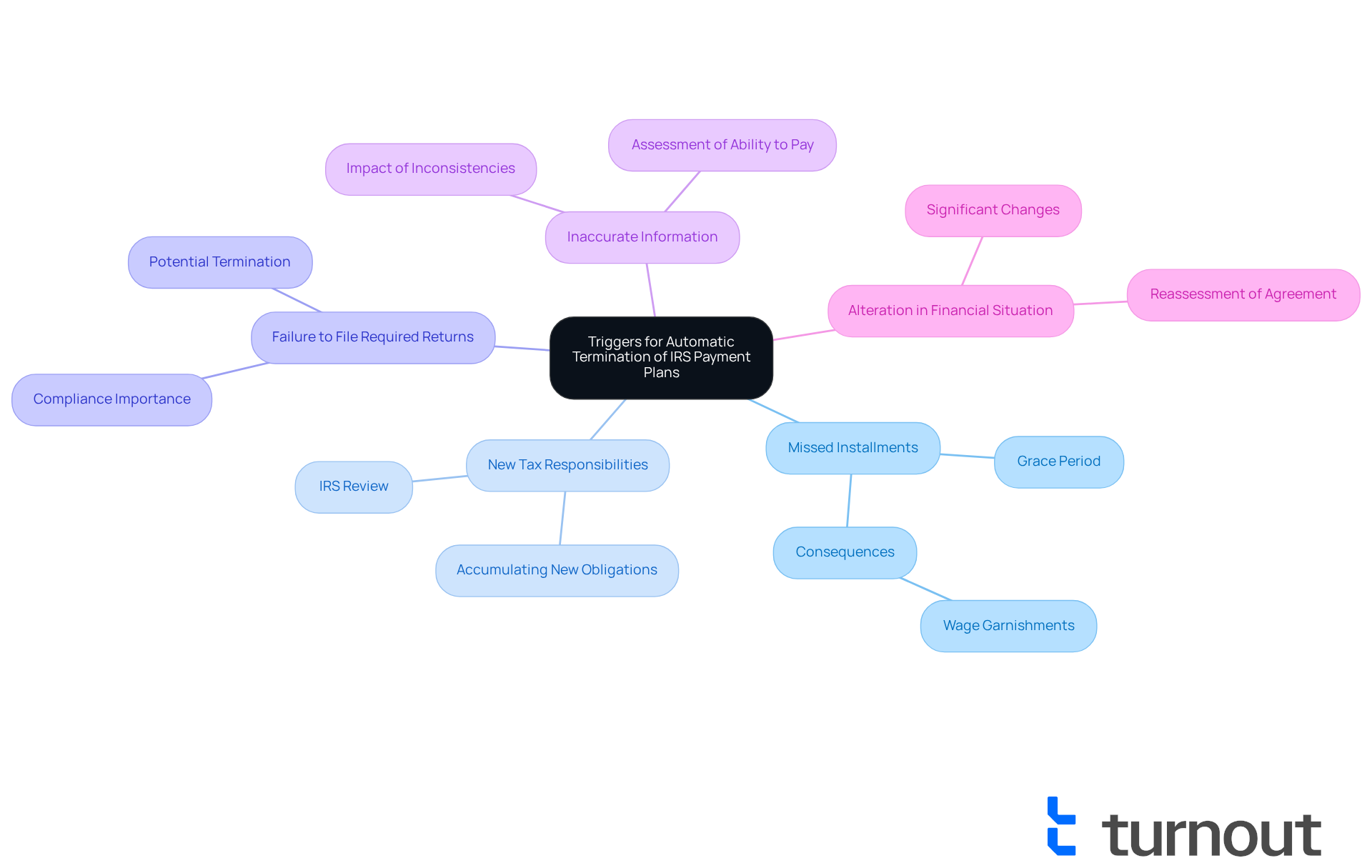

Identify Common Triggers for Automatic Termination of IRS Payment Plans

There are several common triggers that can lead to the automatic cancellation of IRS s, prompting the question of whether the . It's important for taxpayers to understand these factors, including how does IRS payment plan stop automatically, to uphold their agreements and avoid serious financial consequences. Here are some key triggers to be aware of:

- : If you miss even one installment, it can initiate the termination process. The IRS typically allows a grace period for catching up, but repeated failures may lead to more severe consequences, such as wage garnishments.

- New Tax Responsibilities: Accumulating while under a financial arrangement can threaten your current agreement. The IRS expects continuous adherence to all tax responsibilities, and any new obligations may prompt a review of your financial arrangement.

- Failure to File Required Returns: Staying compliant with all filing requirements is crucial. If you fail to provide necessary tax returns, it can lead to a review of your financial arrangement, potentially resulting in termination if the IRS deems you non-compliant.

- Inaccurate Information: Providing incomplete or incorrect information during the application or review process can also lead to termination. The IRS relies on accurate information to assess your ability to pay, and any inconsistencies can undermine your agreement.

- Alteration in Financial Situation: Significant changes in your earnings or financial condition may prompt the IRS to reassess your . If you're unable to meet the agreed terms due to financial difficulties, this could result in termination.

Understanding these triggers is essential for maintaining your and avoiding default, particularly in relation to whether an IRS payment plan does stop automatically. In 2025, approximately 30% of IRS arrangements were terminated due to missed installments, highlighting the importance of timely adherence. Real-world examples show that even one overlooked installment can lead to the loss of a contract. Therefore, it's vital to handle your tax responsibilities with care.

As tax professional Logan Allec points out, "A notice of deficiency is a legal notice the IRS sends via certified mail," which emphasizes the seriousness of staying compliant. Remember, you're not alone in this journey. Resources like the (TAS) and Low-Income Taxpayer Clinics (LITCs) are available to assist you in navigating these complex issues. We're here to help you every step of the way.

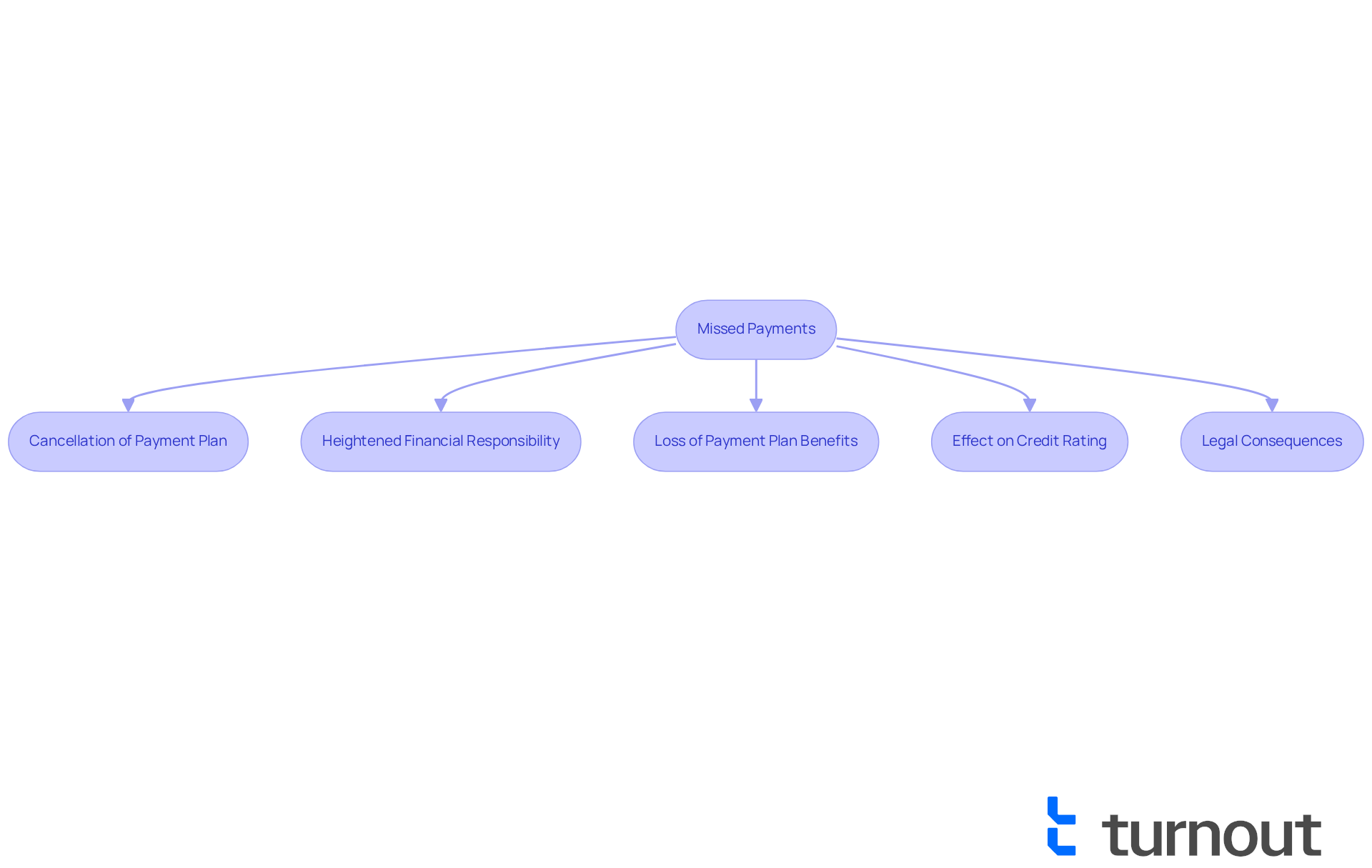

Examine Consequences of Missed Payments on Your Payment Plan Status

Neglected contributions on an IRS installment arrangement can lead to serious repercussions that may affect your . It's important to understand these potential consequences:

- Cancellation of the Payment Plan: Missing installments could result in the cancellation of your . The IRS might send a CP523 notice, indicating their intent to terminate the agreement and pursue collection actions.

- Heightened Financial Responsibility: If your settlement arrangement is ended, you may face immediate collection measures, such as wage garnishments and bank levies. This can worsen financial difficulties, especially if you're already struggling with tax debt.

- Loss of Payment Plan Benefits: Taxpayers on installment agreements often enjoy reduced penalties and interest rates. Neglected dues can lead to losing these advantages, resulting in a greater overall tax obligation.

- Effect on Credit Rating: Not adhering to an IRS installment agreement can negatively impact your credit rating, making it harder to secure loans or credit in the future.

- Legal Consequences: In extreme cases, failure to comply with IRS settlement agreements can lead to legal actions, including liens against your property or assets.

To mitigate these risks, it’s crucial to prioritize timely payments and proactively engage with the IRS to determine if the does stop automatically when you anticipate challenges in meeting your obligations. We understand that navigating these circumstances can be overwhelming, but knowing the repercussions of overlooked dues can empower you to manage your financial situation and avoid the pitfalls associated with default. Remember, you're not alone in this journey, and we're here to help.

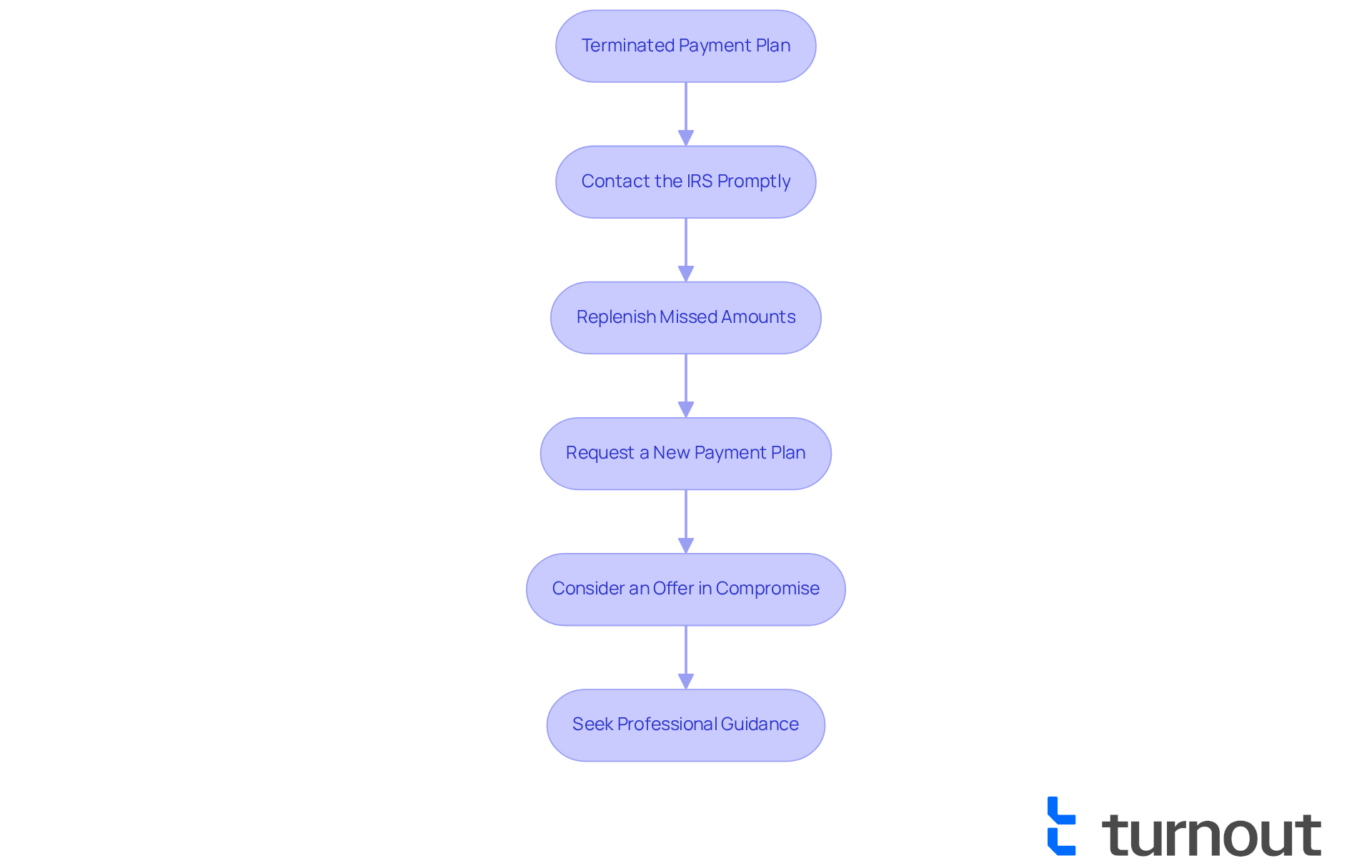

Explore Options for Reinstating a Terminated Payment Plan

If an has been terminated, it’s understandable to feel overwhelmed about what happens next and whether the IRS payment plan does stop automatically. Thankfully, there are several options available for reinstatement that can help you regain control of your :

- : The first step is to reach out to the IRS as soon as possible after receiving a termination notice. You can call the IRS at 800-829-1040 to discuss your situation and explore options for reinstatement. Prompt communication is crucial, as the IRS allows a 30-day window to remedy the default before further actions, such as asset seizure, may occur.

- Replenish Missed Amounts: If the termination resulted from missed payments, replenishing those dues quickly can sometimes lead to reinstatement. Be prepared to provide evidence of your contributions. Many individuals have successfully reinstated their plans by acting swiftly to resolve overdue amounts, demonstrating their commitment to compliance. the likelihood of reinstatement.

- Request a New Payment Plan: If reinstatement isn’t feasible, you can apply for a new installment agreement. This may involve submitting a new Form 9465 and providing updated financial information to show your ability to pay. Keep in mind that a if the financial arrangement has lapsed due to default.

- Consider an : If you’re unable to pay your tax debt in full, an Offer in Compromise may be a viable option. This allows you to resolve your tax obligations for an amount lower than what is fully due, depending on your financial circumstances. This route can be particularly beneficial if you’re facing significant financial hardship.

- : Navigating the reinstatement process can be complex, and you don’t have to do it alone. Seeking assistance from a qualified advocate can provide you with personalized guidance and support throughout the process. As Gary Massey, a CPA, wisely states, "Taking proactive steps can help you manage your financial situation more effectively." Engaging with a tax expert can enhance your chances of a successful outcome, as they can help identify the best strategies tailored to your individual needs.

By understanding the options available for reinstating a canceled financial arrangement, you can take proactive measures to ensure that the IRS payment plan does not stop automatically, thereby restoring compliance and preventing further monetary difficulties. Remember, timely action and informed decisions are key to managing your tax obligations effectively. You are not alone in this journey, and we’re here to help.

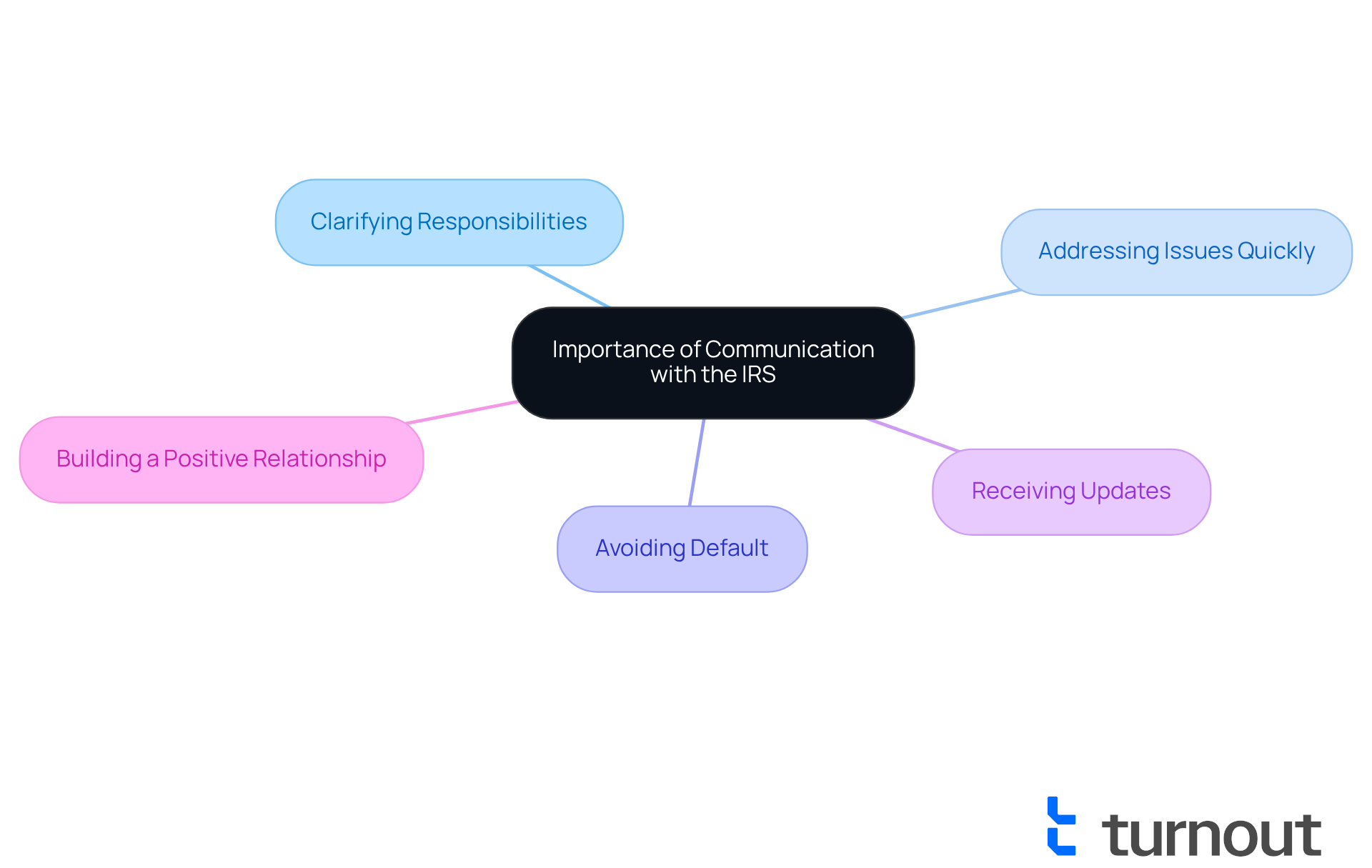

Understand the Importance of Communication with the IRS

Effective communication with the IRS is essential for individuals handling financial arrangements. We understand that can be overwhelming, and can make a significant difference. Here are key reasons why reaching out is so important:

- Clarifying Responsibilities: Open lines of communication assist you in and comprehending the terms of your financial agreements. This significantly decreases the likelihood of misunderstandings, allowing you to feel more secure in your arrangements.

- : If you anticipate challenges in fulfilling your obligations, may lead to possible resolutions, such as modifying amounts owed or extending deadlines. This proactive approach can alleviate stress and prevent complications, helping you feel more in control.

- Avoiding Default: Proactive communication can by enabling you to address issues before they escalate. The IRS is often willing to work with individuals who show a commitment to compliance, which can lead to more manageable arrangements for you.

- Receiving Updates: Staying informed about any modifications to transaction arrangements or IRS policies that may impact your agreements is essential. Regular communication ensures you are aware of your current status and any necessary adjustments, giving you peace of mind.

- [[Building a Positive Relationship](https://nstp.org/article/IRS Makes It Easier to Set Up Payment Agreements)](https://nstp.org/article/IRS Makes It Easier to Set Up Payment Agreements): Establishing a rapport with IRS representatives can lead to more favorable outcomes. Taxpayers who communicate effectively are often viewed more favorably, which can be beneficial in negotiations or disputes.

In conclusion, maintaining open communication with the IRS is vital for successfully navigating payment plans and clarifying if an does stop automatically, thus avoiding complications that could lead to termination. Remember, you're not alone in this journey; every step of the way.

Conclusion

Understanding that an IRS payment plan can stop automatically is vital for taxpayers striving to manage their financial obligations effectively. It's common to feel overwhelmed by the complexities of these arrangements. Several specific triggers can lead to the termination of these plans, highlighting the importance of staying compliant with tax responsibilities to avoid serious financial repercussions.

Consider the consequences of:

- Missed payments

- The necessity of filing required returns

- The impact of providing inaccurate information

Significant changes in your financial circumstances can also prompt the IRS to reassess payment agreements. Recognizing these triggers allows you to take proactive steps to maintain your agreements and mitigate the risk of default.

In light of these insights, we encourage you to prioritize open communication with the IRS and seek assistance when challenges arise. Engaging with tax professionals and utilizing available resources can empower you to navigate the complexities of IRS payment plans successfully. Remember, you are not alone in this journey. By staying informed and proactive, you can ensure compliance and avoid the pitfalls associated with automatic termination, ultimately fostering a more secure financial future.

Frequently Asked Questions

What are common triggers for the automatic termination of IRS payment plans?

Common triggers include missed installments, new tax responsibilities, failure to file required returns, providing inaccurate information, and significant alterations in financial situation.

What happens if I miss an installment payment?

Missing even one installment can initiate the termination process. While the IRS may allow a grace period to catch up, repeated failures can lead to severe consequences, such as wage garnishments.

How do new tax obligations affect my existing IRS payment plan?

Accumulating new tax obligations while under a financial arrangement can threaten your current agreement. The IRS expects continuous adherence to all tax responsibilities, and new obligations may prompt a review of your financial arrangement.

Why is it important to file all required tax returns?

Staying compliant with all filing requirements is crucial. Failing to provide necessary tax returns can lead to a review of your financial arrangement and potentially result in termination if deemed non-compliant by the IRS.

How can providing inaccurate information impact my IRS payment plan?

Providing incomplete or incorrect information during the application or review process can lead to termination of the agreement. The IRS relies on accurate information to assess your ability to pay, and inconsistencies can undermine your arrangement.

What should I do if my financial situation changes significantly?

Significant changes in your earnings or financial condition may prompt the IRS to reassess your payment arrangement. If you are unable to meet the agreed terms due to financial difficulties, this could result in termination.

How prevalent is the issue of automatic termination of IRS arrangements?

In 2025, approximately 30% of IRS arrangements were terminated due to missed installments, highlighting the importance of timely adherence to payment schedules.

What resources are available for assistance with IRS payment plans?

Resources like the Taxpayer Advocate Service (TAS) and Low-Income Taxpayer Clinics (LITCs) are available to assist taxpayers in navigating complex issues related to IRS payment plans.