Introduction

Navigating Mississippi's tax system can feel like an overwhelming maze, leaving many taxpayers frustrated and anxious about delays in their state tax refunds. We understand that as you work through this intricate web of bureaucratic processes, you may encounter hurdles like:

- Incomplete forms

- Outdated technology

- Unclear communication from the Department of Revenue

With average wait times stretching to 10-12 weeks, it’s common to feel concerned about what’s causing these delays and how you can effectively tackle the challenges ahead. Exploring these complexities not only sheds light on the impact these delays have on your finances but also reveals broader implications for our state's economy.

You're not alone in this journey. Many individuals share your struggles, and together, we can seek solutions that bring clarity and relief. Let's take a closer look at the underlying issues and discuss how you can navigate this process more smoothly.

Examine Bureaucratic Complexities in Mississippi's Tax System

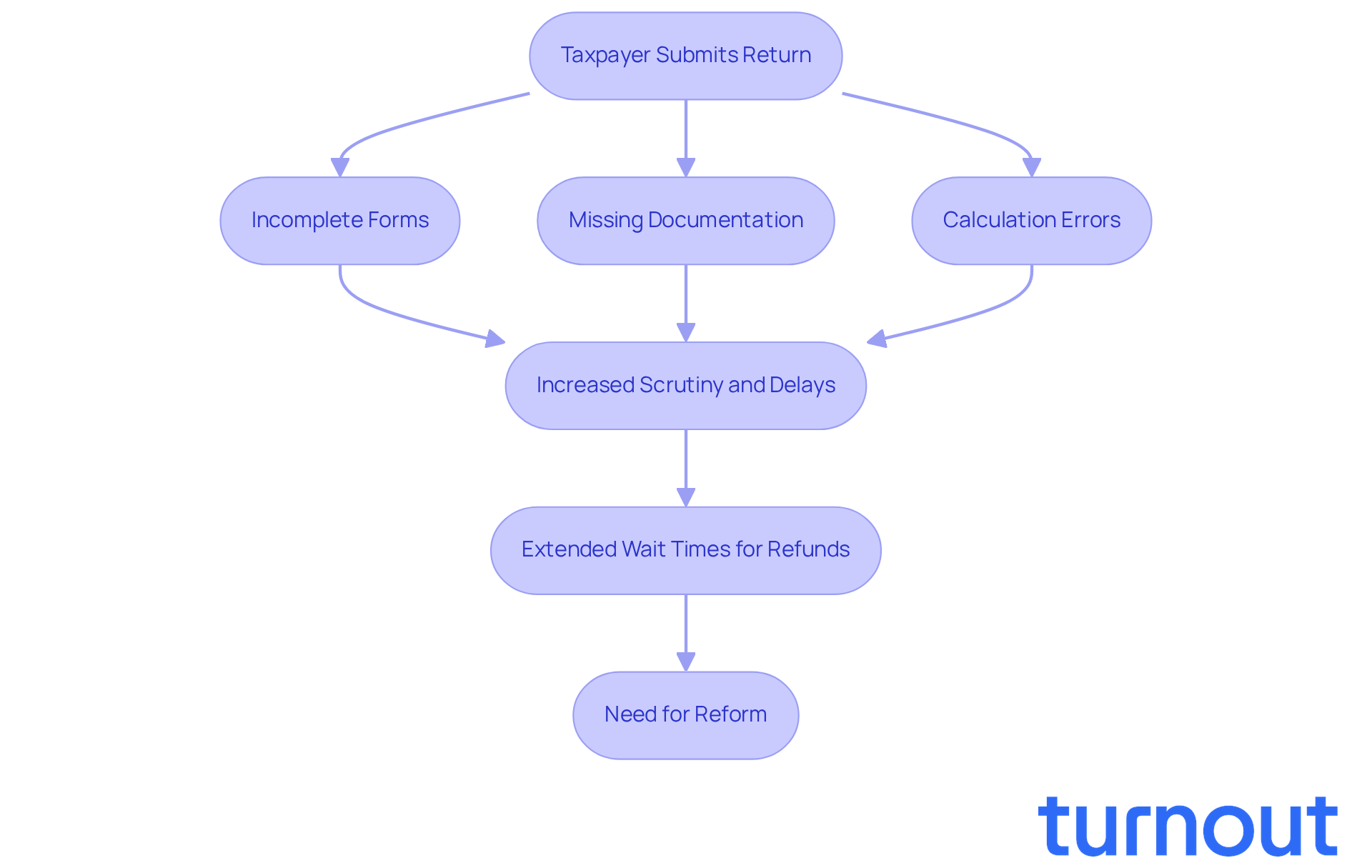

The bureaucratic complexities of Mississippi's tax system can feel overwhelming and often lead to frustrating delays, making many wonder if Mississippi state tax refunds are delayed. We understand that navigating these regulations can be a daunting task, especially when strict adherence to filing procedures is required. The Mississippi Department of Revenue (DOR) mandates accurate and timely submissions, yet the processes for filing, amending, and tracking returns can be confusing. Many taxpayers find themselves facing challenges like:

- Incomplete forms

- Missing documentation

- Calculation errors

These issues can result in additional scrutiny and longer waits for their refunds.

It's common to feel frustrated when dealing with the DOR's outdated technology and reliance on manual processing. As the agency grapples with an increasing volume of returns and the growing complexity of tax regulations, a backlog of unprocessed returns builds up. This situation leads to extended wait times for reimbursements, prompting inquiries about whether Mississippi state tax refunds are delayed, with some individuals now experiencing average delays of 10-12 weeks. Many have reported receiving conflicting information from DOR representatives about whether Mississippi state tax refunds are delayed, adding to the uncertainty.

For example, one individual submitted their return on February 10 and is still waiting for a response, expressing their frustration over the lack of transparency. Another person, who submitted on February 23, is facing similar delays, with the DOR's 'where's my payment' tool stuck on 'processing.' This highlights the urgent need for improvements in the DOR's processing capabilities. We recognize that timely reimbursements are crucial for individuals relying on these funds for essential expenses.

The bureaucratic maze not only frustrates taxpayers but also underscores the pressing need for reform within Mississippi's tax system. You're not alone in this journey, and we’re here to help advocate for the changes necessary to ease this burden. Together, we can work towards a more efficient and compassionate tax system.

Identify Challenges Faced by Taxpayers in Claiming Refunds

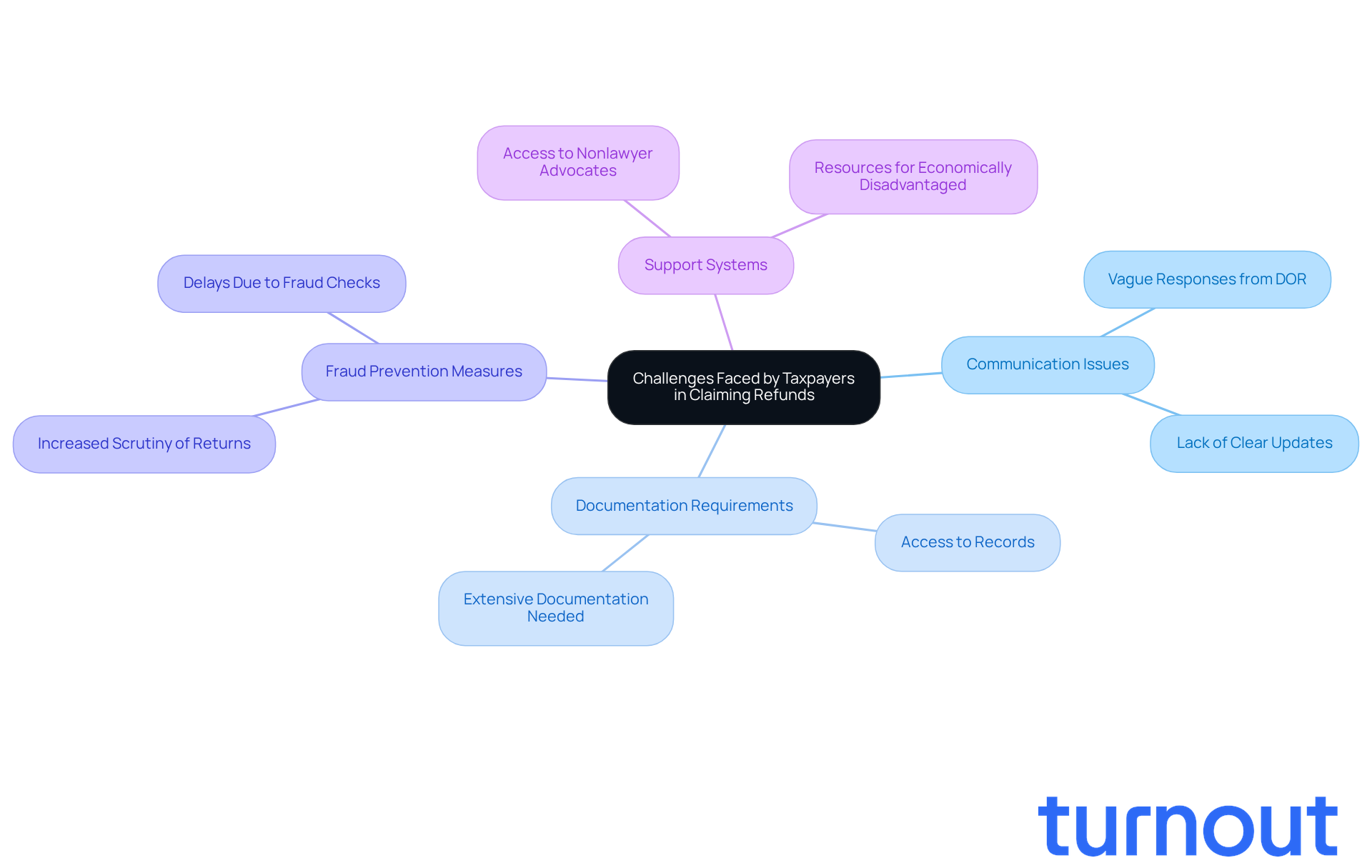

Taxpayers in Mississippi often face significant challenges when trying to claim their tax returns. We understand that navigating the bureaucratic complexities can be overwhelming. One major hurdle is the lack of clear communication from the Department of Revenue (DOR) about whether Mississippi State tax refunds are delayed and the status of reimbursements. Many individuals feel confused and frustrated when trying to track their refund status, often receiving vague or unhelpful responses from the agency.

Additionally, the requirement for extensive documentation can feel daunting, especially for those who may not have easy access to necessary records or who are unfamiliar with tax regulations. For individuals with disabilities or those who are economically disadvantaged, these challenges can be even more pronounced. They may lack the resources or support systems to effectively navigate the tax process.

But there is hope. Turnout offers a solution by providing access to trained nonlawyer advocates who can assist clients in understanding and managing their tax claims. With their guidance, you can overcome these obstacles and feel more confident in your journey.

Furthermore, the implementation of new fraud prevention measures has led to increased scrutiny of tax returns. This situation can lead to additional delays for many taxpayers, causing them to wonder if Mississippi state tax refunds are delayed, leaving them feeling caught in the crossfire of these policies. These challenges not only postpone reimbursements but also raise questions about whether Mississippi State tax refunds are delayed, creating significant financial strain for individuals who depend on these resources for essential expenses.

Remember, you are not alone in this journey. We’re here to help you navigate these complexities and find the support you need.

Analyze State Policies Impacting Tax Refund Processing

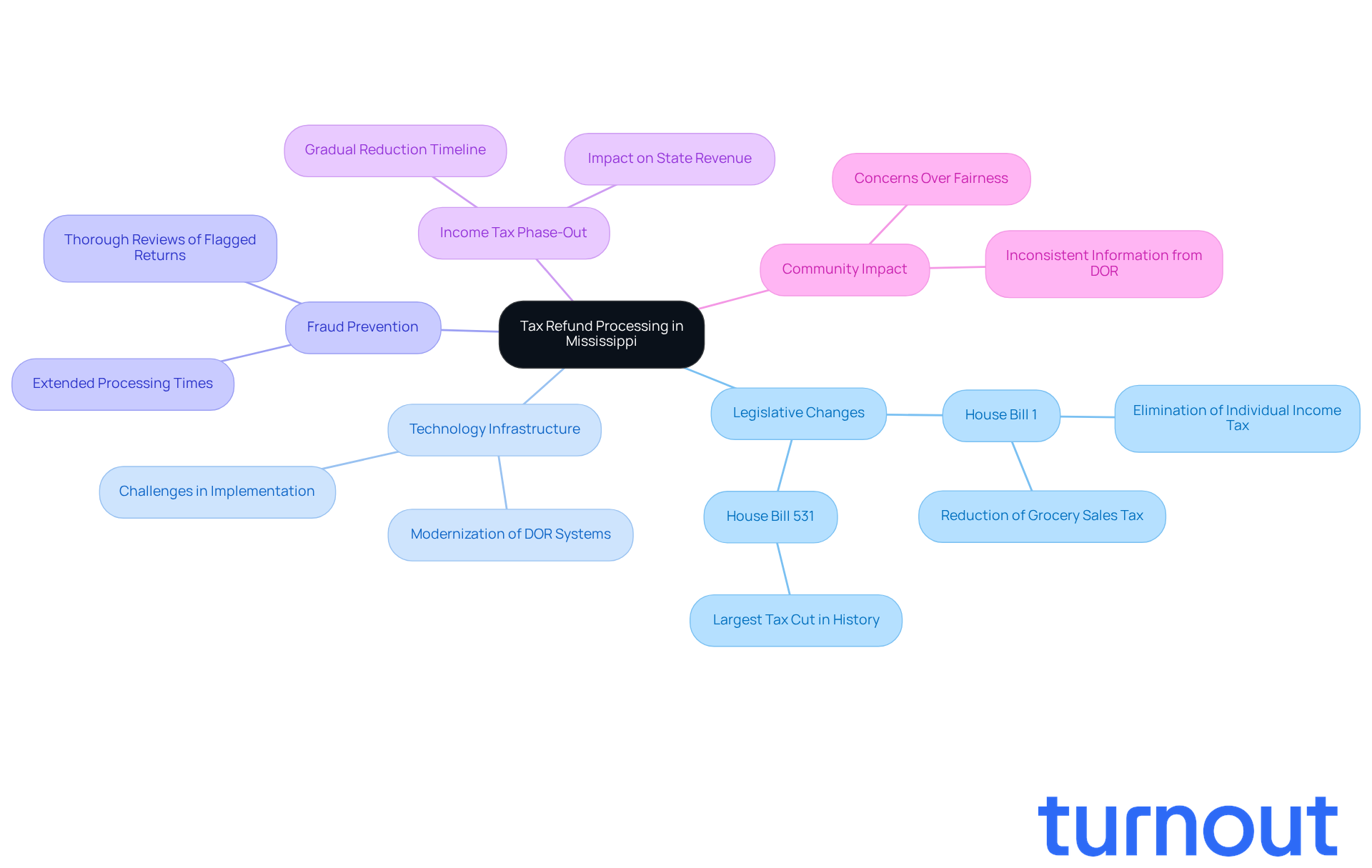

The efficiency of tax reimbursements in Mississippi raises the question of whether Mississippi state tax refunds are delayed due to state policies. We understand that recent legislative changes aimed at improving tax administration have led to mixed results. For instance, while the modernization of the Department of Revenue's (DOR) technology infrastructure is underway, its implementation has been slow and filled with challenges. Policies designed to combat tax fraud have, unfortunately, extended processing times for legitimate claims, as the DOR must conduct thorough reviews of returns flagged by these new systems.

Moreover, the decision to phase out the state income tax raises concerns about the sustainability of funding for essential services, including tax administration. As Mississippi transitions its revenue model, the DOR may feel increasing pressure to expedite reimbursement processing. However, limited resources and staffing could hinder these efforts. This complex interplay of policies not only affects the speed of reimbursement processing but also raises important questions about the fairness and accessibility of the tax system for Mississippi residents.

As we look ahead to 2025, when the state prepares for a gradual reduction of the income tax rate, many individuals have reported receiving inconsistent information from the DOR regarding reimbursement timelines. Some are wondering why Mississippi state tax refunds are delayed for over 14 weeks. It's common to feel frustrated in such situations, and this underscores the need for continuous evaluation and adjustment of tax policies. We must ensure they effectively meet the community's needs while maintaining operational efficiency.

Together, we can advocate for a tax system that works for everyone. You're not alone in this journey, and we're here to help.

Evaluate Consequences of Delayed Tax Refunds on Consumers and the Economy

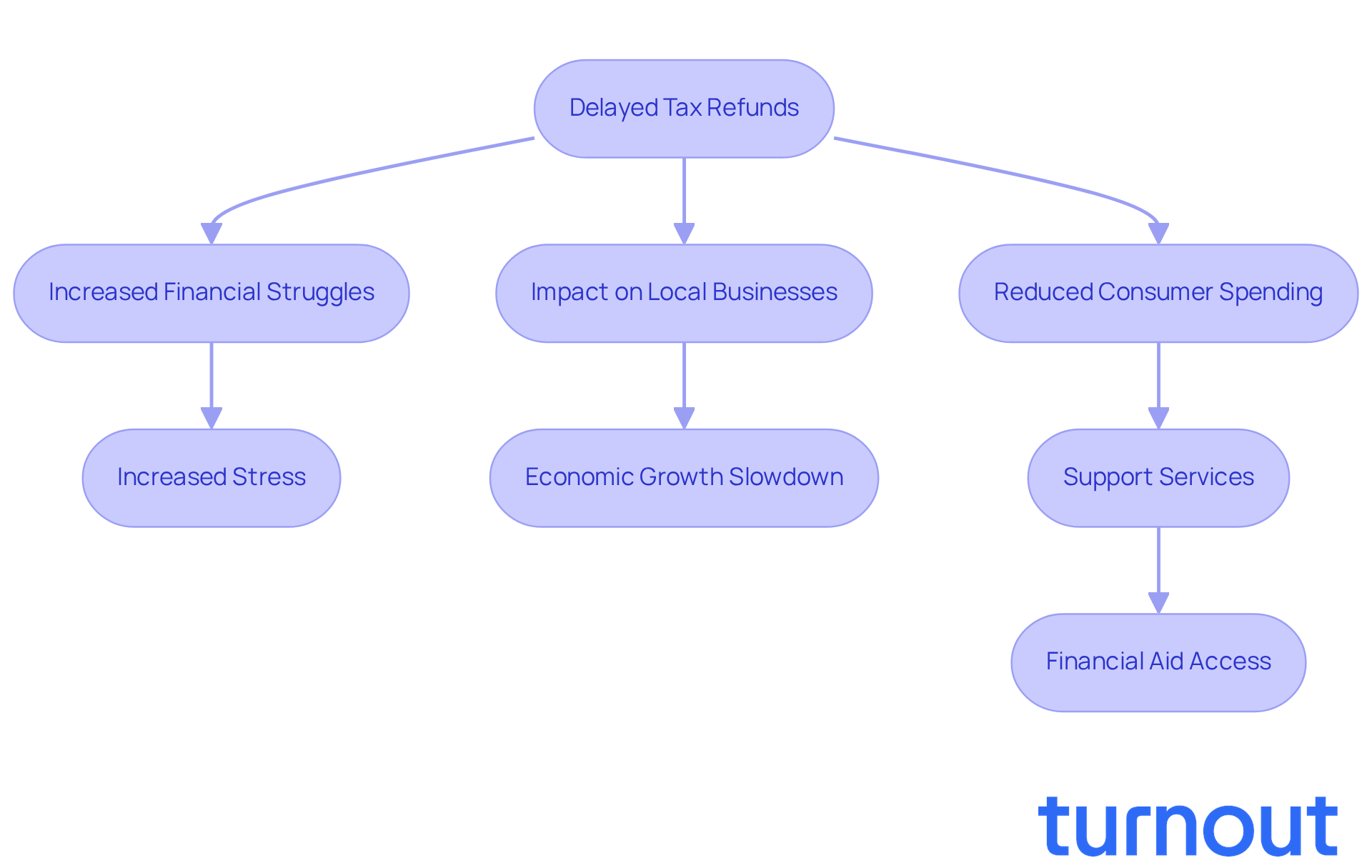

The consequences of postponed tax returns go beyond just individual frustration; they can significantly affect both consumers and the broader economy. We understand that for many taxpayers, especially those living paycheck to paycheck, tax returns represent a crucial source of income. This money often helps cover essential expenses like rent, utilities, and groceries. When considering if Mississippi state tax refunds are delayed, it can lead to struggles in meeting financial responsibilities, increasing stress and hardship.

Moreover, the ripple effect of these delays can hinder consumer spending, which is vital for economic growth. As individuals wait for their refunds, they might postpone purchases or cut back on non-essential spending. This behavior can ultimately impact local businesses and the overall economy. It's common to feel uncertain about the tax system when people wonder if Mississippi state tax refunds are delayed, which can discourage compliance and participation.

This cycle of delay and economic pressure highlights the urgent need for reforms that simplify tax processing and enhance system efficiency. We want you to know that there are solutions available. Turnout plays a crucial role by offering tools and services that help consumers navigate these complex financial systems, especially for those seeking assistance with government-related processes like tax debt relief.

By employing skilled nonlawyer advocates and IRS-licensed enrolled agents, Turnout streamlines access to financial aid. This support can help alleviate the anxiety associated with postponed payments, ensuring you receive the assistance you need. Additionally, understanding the connection between SSD claims and tax refunds can provide further context for those facing these challenges, as both processes can significantly impact your financial stability.

Remember, you are not alone in this journey. We're here to help you navigate these difficulties.

Conclusion

Navigating the complexities of Mississippi's tax system can feel overwhelming. Many taxpayers experience significant delays in receiving their state tax refunds, which can lead to frustration and anxiety. The intricate bureaucratic processes, outdated technology, and inconsistent communication from the Department of Revenue (DOR) create an environment where individuals often find themselves waiting weeks or even months for their rightful reimbursements. Understanding these challenges is essential for anyone seeking clarity on why Mississippi state tax refunds are delayed.

We understand that the refund process can be confusing. Key insights reveal various factors impacting refund processing times. Issues such as incomplete forms, extensive documentation requirements, and new fraud prevention measures have created a tangled web that complicates the tax return process. Furthermore, the ongoing transition in state policies, including the phasing out of the income tax, adds another layer of uncertainty, leaving many taxpayers in limbo regarding their refund status. These delays can affect not just individual finances but also consumer spending and the broader economy.

In light of these challenges, it’s crucial for taxpayers to seek support and advocate for a more efficient tax system. By raising awareness of the bureaucratic inefficiencies and pushing for necessary reforms, individuals can contribute to a future where tax refunds are processed in a timely manner, alleviating financial stress for many. Remember, you are not alone in this journey. The road may be tough, but with the right resources and community support, navigating Mississippi's tax landscape can become a more manageable and transparent experience.

Frequently Asked Questions

What are some common challenges taxpayers face in Mississippi's tax system?

Taxpayers often encounter challenges such as incomplete forms, missing documentation, and calculation errors, which can lead to additional scrutiny and longer wait times for refunds.

Why are Mississippi state tax refunds delayed?

Delays in Mississippi state tax refunds can be attributed to outdated technology, reliance on manual processing by the Department of Revenue (DOR), and an increasing volume of returns combined with complex tax regulations, leading to a backlog of unprocessed returns.

How long are the average delays for Mississippi state tax refunds?

Many individuals are experiencing average delays of 10-12 weeks for their state tax refunds.

What issues do taxpayers report regarding communication with the DOR?

Taxpayers often report receiving conflicting information from DOR representatives about the status of their refunds, which adds to the uncertainty and frustration.

What can taxpayers do if they are experiencing delays?

While the article does not provide specific actions for taxpayers, it emphasizes the importance of advocating for necessary reforms within Mississippi's tax system to improve processing capabilities and transparency.

What is the significance of timely reimbursements for taxpayers?

Timely reimbursements are crucial for individuals who rely on these funds for essential expenses, highlighting the need for a more efficient tax system.