Introduction

Navigating the complexities of probate in Texas can feel overwhelming. We understand that when families face the emotional toll of losing a loved one, the last thing they need is confusion over financial obligations during the estate settlement process.

This article explores the intricacies of probate attorney fees in Texas, offering valuable insights into fee structures and the factors that influence costs. It's common to feel uncertain about who bears the responsibility for these fees.

Amidst the myriad of options and potential expenses, one pressing question remains: how can families ensure they are not left with unexpected financial burdens during this challenging time? We're here to help you find clarity and peace of mind.

Understand the Basics of Probate in Texas

Probate is the legal process through which a deceased person's estate is administered in Texas. We understand that dealing with the loss of a loved one can be overwhelming, and navigating the legalities can add to that stress. Here’s a brief overview of the key steps involved:

- Filing the Will: The executor, often a trusted family member, is responsible for filing the will with the probate court in the county where the deceased resided.

- Court Approval: The court reviews the will to confirm its validity, which may require a hearing.

- Asset Distribution: After settling any outstanding debts, the remaining assets are distributed according to the will or, if no will exists, according to Texas intestacy laws.

In 2025, Texas has seen a significant number of estate cases, with independent administration preferred in about 80% of instances. This method is favored for its efficiency and reduced expenses. As Texas estate lawyers often say, "Independent administration allows families to manage most estates with minimal court involvement."

Understanding these basic elements of the legal process is crucial. It helps clarify who pays probate attorney fees in Texas and how legal fees are generated and handled during this procedure. The administration period is where the real work occurs-managing creditor claims, settling debts, and distributing assets.

We’re here to help you navigate through the estate administration process more effectively. With the right knowledge, you can prevent unnecessary complications and focus on what truly matters during this challenging time. Remember, you are not alone in this journey.

Identify Factors Influencing Attorney Fee Responsibility

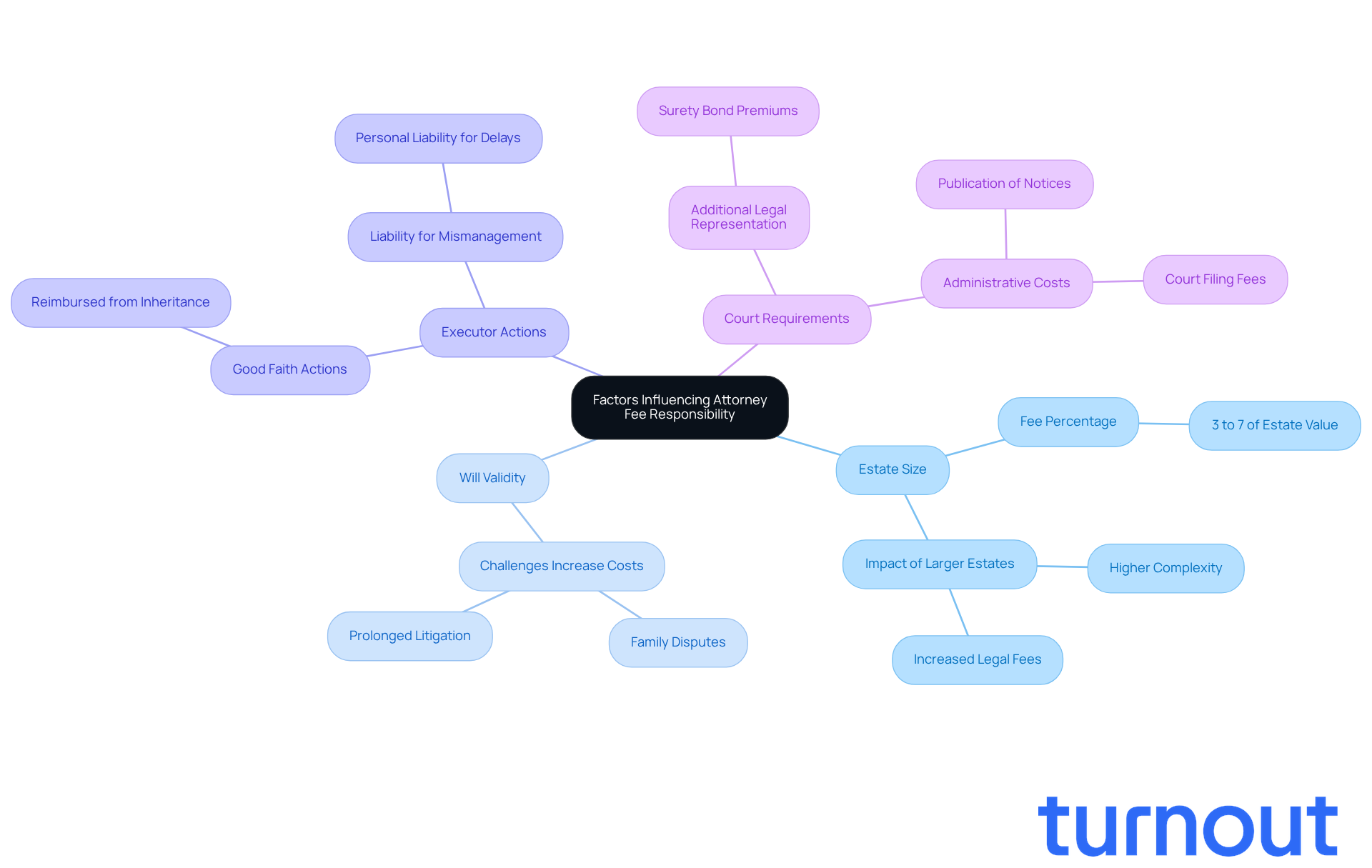

In Texas, it can feel overwhelming to understand who pays probate attorney fees. We recognize that navigating this process is challenging, and several key factors come into play:

- Estate Size: Larger estates often incur higher fees due to their complexity. Lawyer charges can typically range from 3% to 7% of the property's worth. This means that a larger property could lead to significantly greater expenses. For example, if a property is valued at $1 million, legal fees might range from $30,000 to $70,000.

- Will Validity: If the will faces challenges, additional legal costs may arise, complicating the probate process and increasing overall expenses. Disputes can escalate costs by thousands, especially in cases where family disagreements lead to prolonged litigation.

- Executor Actions: Executors acting in good faith are usually reimbursed for reasonable fees from the inheritance, according to the Texas Estates Code. However, if they fail to meet legal obligations, they may become personally liable for costs incurred due to delays or mismanagement.

- Court Requirements: Certain court procedures may require additional legal representation, impacting overall costs. For instance, if the court mandates a surety bond for the executor, the related premium is considered an administrative cost paid from the estate's funds.

Grasping these elements is vital for executors and beneficiaries to foresee potential costs and prepare accordingly. This understanding can help clarify who pays probate attorney fees in Texas, leading to a smoother estate settlement. Remember, as Texas Estate Lawyers remind us, "Most individuals don’t recognize that estate legal charges are usually covered by the estate itself - not from your personal resources." You're not alone in this journey; we're here to help you navigate these complexities.

Explore Common Structures of Probate Attorney Fees

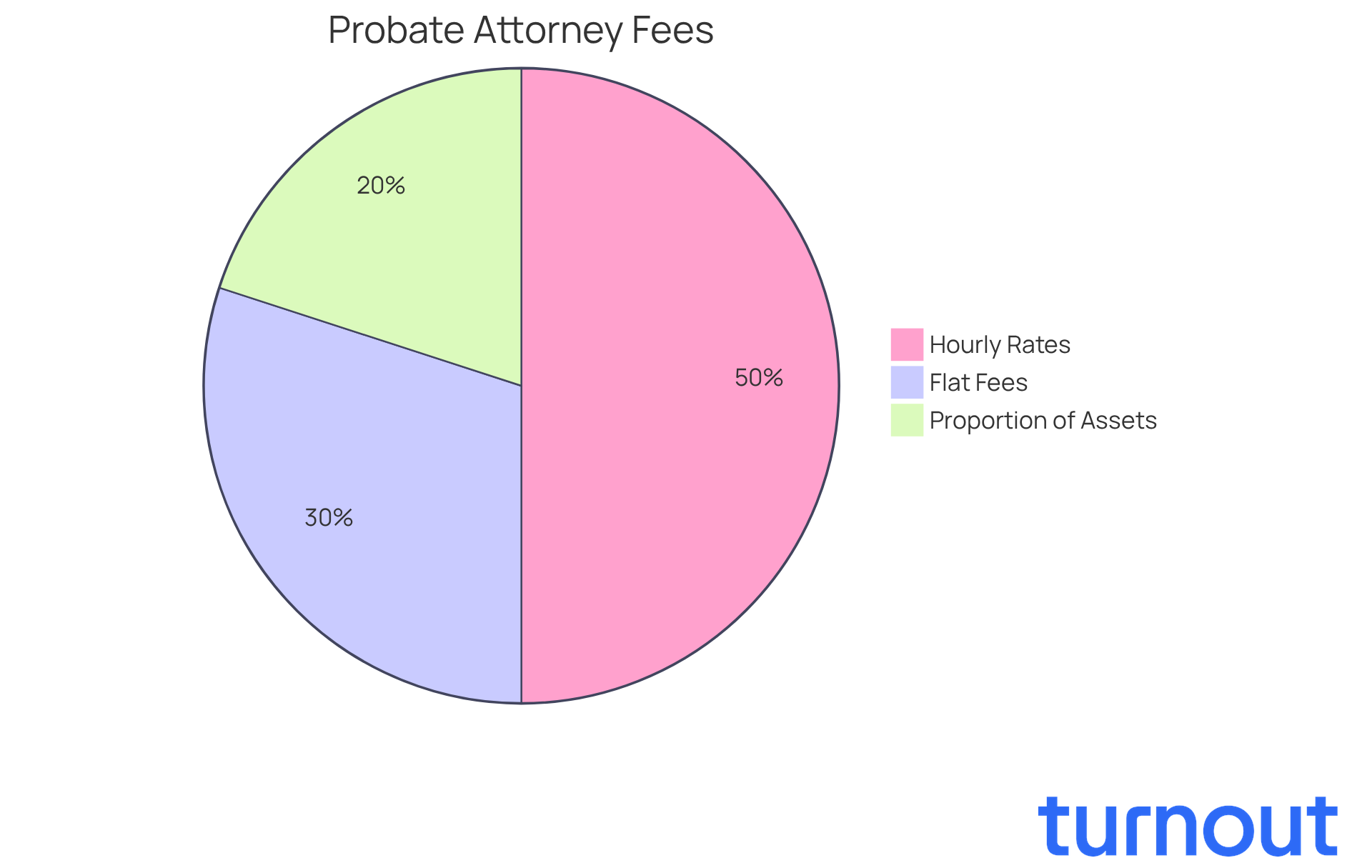

Navigating who pays probate attorney fees in Texas can feel overwhelming, but understanding your options can make a significant difference.

-

Hourly Rates: Many attorneys charge between $400 to $900 per hour, depending on their experience and the complexity of your case. While this method offers flexibility, it can lead to substantial costs, especially for lengthy or complicated estate settlements.

-

Flat Fees: For more straightforward probate cases, you might find legal professionals offering flat fee arrangements ranging from $3,000 to $7,000. This structure provides predictability in costs, covering everything from filing the initial application to asset distribution.

-

Proportion of the Assets: Some attorneys charge a percentage of the estate's value, typically between 3% to 5%. While this aligns their payment with the estate's complexity, it can sometimes result in higher charges for simpler estates.

We understand that choosing the right fee structure is crucial for your financial peace of mind. By comprehending these options, you can select the most suitable choice for your situation, ensuring you receive the legal assistance you need without unexpected financial burdens. Remember, you are not alone in this journey; we're here to help.

Implement Strategies to Minimize Attorney Fees

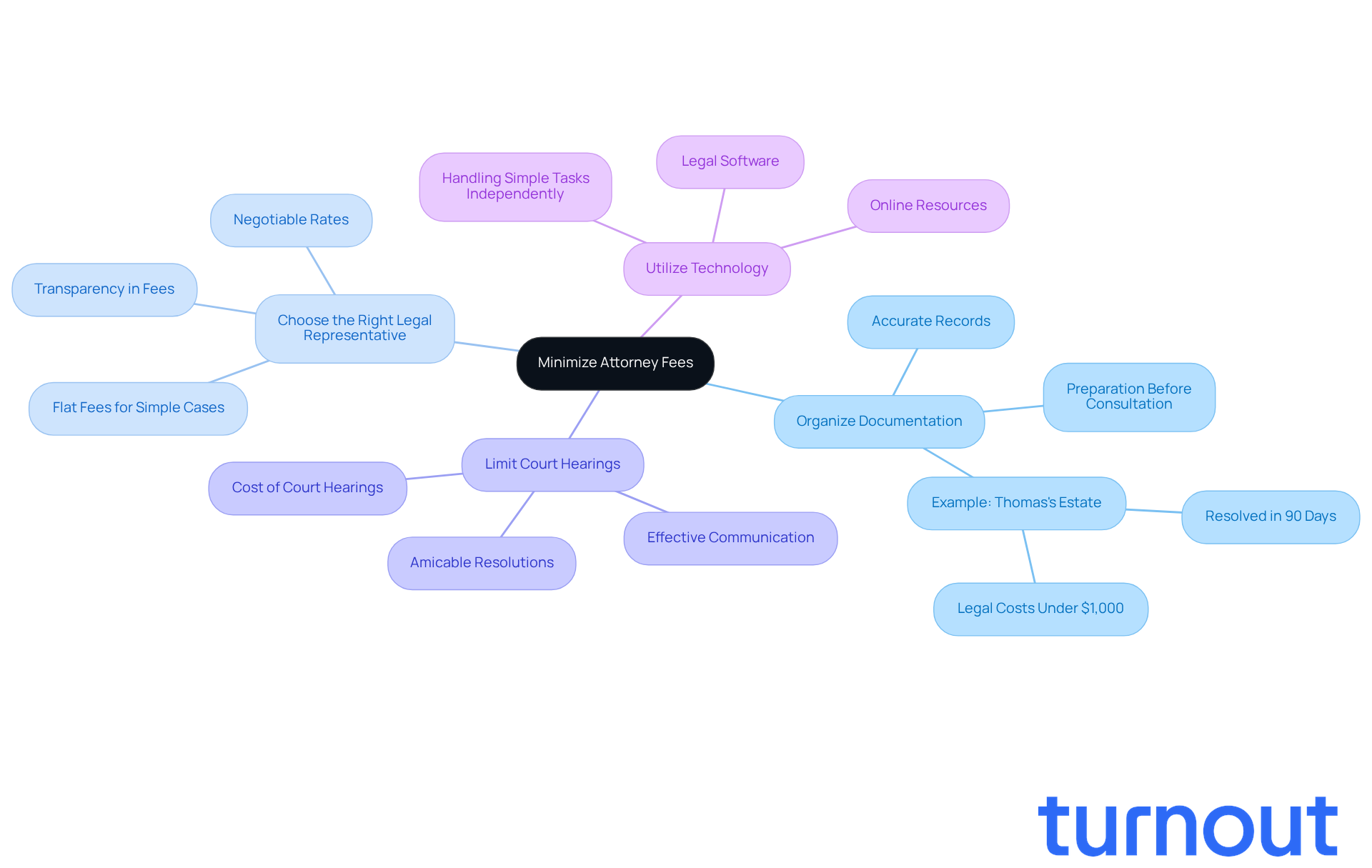

To effectively minimize probate attorney fees in Texas, consider these caring strategies:

- Organize Documentation: Preparing and organizing all necessary documents before consulting with an attorney can significantly reduce billable hours. Imagine how much easier it could be! Executors who keep accurate records and provide detailed information can help lawyers simplify the process, potentially saving thousands in legal costs. For instance, Thomas actively organized his estate, allowing his family to resolve matters in just 90 days with legal expenses under $1,000, avoiding costly court proceedings.

- Choose the Right Legal Representative: It’s important to seek out legal professionals who offer flat fees for straightforward cases or are open to negotiating their rates. This transparency helps avoid unexpected costs and ensures you understand the financial commitment upfront. As legal expert Jennifer Nichols says, 'Taking the time to plan now is one of the best gifts you can give your loved ones.'

- Limit Court Hearings: Strive to resolve disputes amicably to avoid unnecessary court appearances. Each court hearing can add to overall expenses, so effective communication among beneficiaries can lead to quicker resolutions and lower costs. Jennifer Nichols notes, "Being efficient, organized, and proactive during the process can shave thousands off your final costs."

- Utilize Technology: Leverage online resources or legal software to manage simpler aspects of the estate process. By handling straightforward tasks independently, executors can reduce their reliance on attorney services, further cutting down on costs.

Implementing these strategies can help clarify who pays probate attorney fees in Texas and lead to significant savings in the overall costs associated with probate. Remember, families should focus on what truly matters during a challenging time. You're not alone in this journey, and we're here to help.

Conclusion

Navigating the complexities of probate in Texas can be overwhelming, especially when it comes to understanding who is responsible for attorney fees. We know that this process can be challenging, and being aware of the financial implications can help you prepare better for settling an estate. It’s important to feel equipped to handle these costs effectively.

Several key factors influence probate attorney fees, including the size of the estate, the validity of the will, the actions of the executor, and specific court requirements. Each of these elements can significantly affect the overall expenses you may encounter during the probate process. By familiarizing yourself with common fee structures - like hourly rates, flat fees, and percentages of the estate’s value - you can make informed decisions that align with your financial situation.

Ultimately, there are proactive strategies you can implement to minimize probate attorney fees. Organizing documentation, choosing the right legal representative, limiting court hearings, and utilizing technology can all help ease the financial burden. Embracing these approaches not only alleviates stress but also allows you and your family to focus on what truly matters during this difficult time.

Understanding who pays probate attorney fees in Texas is more than just navigating the legal landscape; it’s about ensuring that the estate settlement is as smooth and cost-effective as possible. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Frequently Asked Questions

What is probate in Texas?

Probate is the legal process through which a deceased person's estate is administered in Texas, involving the validation of the will and distribution of assets.

Who is responsible for filing the will in Texas?

The executor, often a trusted family member, is responsible for filing the will with the probate court in the county where the deceased resided.

What happens after the will is filed with the court?

The court reviews the will to confirm its validity, which may require a hearing.

How are assets distributed after probate?

After settling any outstanding debts, the remaining assets are distributed according to the will or, if no will exists, according to Texas intestacy laws.

What is independent administration in Texas probate?

Independent administration is a preferred method in about 80% of estate cases in Texas, allowing families to manage most estates with minimal court involvement for greater efficiency and reduced expenses.

What are some key responsibilities during the probate administration period?

Key responsibilities include managing creditor claims, settling debts, and distributing assets.

How can understanding probate help families during this process?

Understanding the basics of probate helps clarify who pays attorney fees and how legal fees are generated and handled, allowing families to navigate the estate administration process more effectively.