Overview

We understand that checking the status of your tax amendment can feel overwhelming. To help you through this process, we’ve outlined some simple steps:

- Gather your personal information.

- Visit the IRS website and use the 'Where's My Amended Return?' tool.

- Monitor the processing time, as it can take up to 16 weeks.

Remember, patience is key during this time.

You are not alone in this journey. Many people experience similar concerns and uncertainties. If you encounter any issues while checking your status, we’ve also provided troubleshooting tips to guide you. Just know that we’re here to help you every step of the way.

Introduction

Navigating the complexities of tax amendments can often feel overwhelming, especially when the potential for refunds or corrections to financial records is at stake. We understand that checking the status of a tax amendment is crucial for taxpayers who wish to stay informed and ensure their adjustments are processed efficiently.

However, it’s common to encounter challenges like processing delays and technical issues, leaving many individuals wondering: how can you effectively track your tax amendment status and avoid unnecessary stress?

This guide offers practical steps and insights to empower you in managing your amendments with confidence. Remember, you're not alone in this journey; we’re here to help.

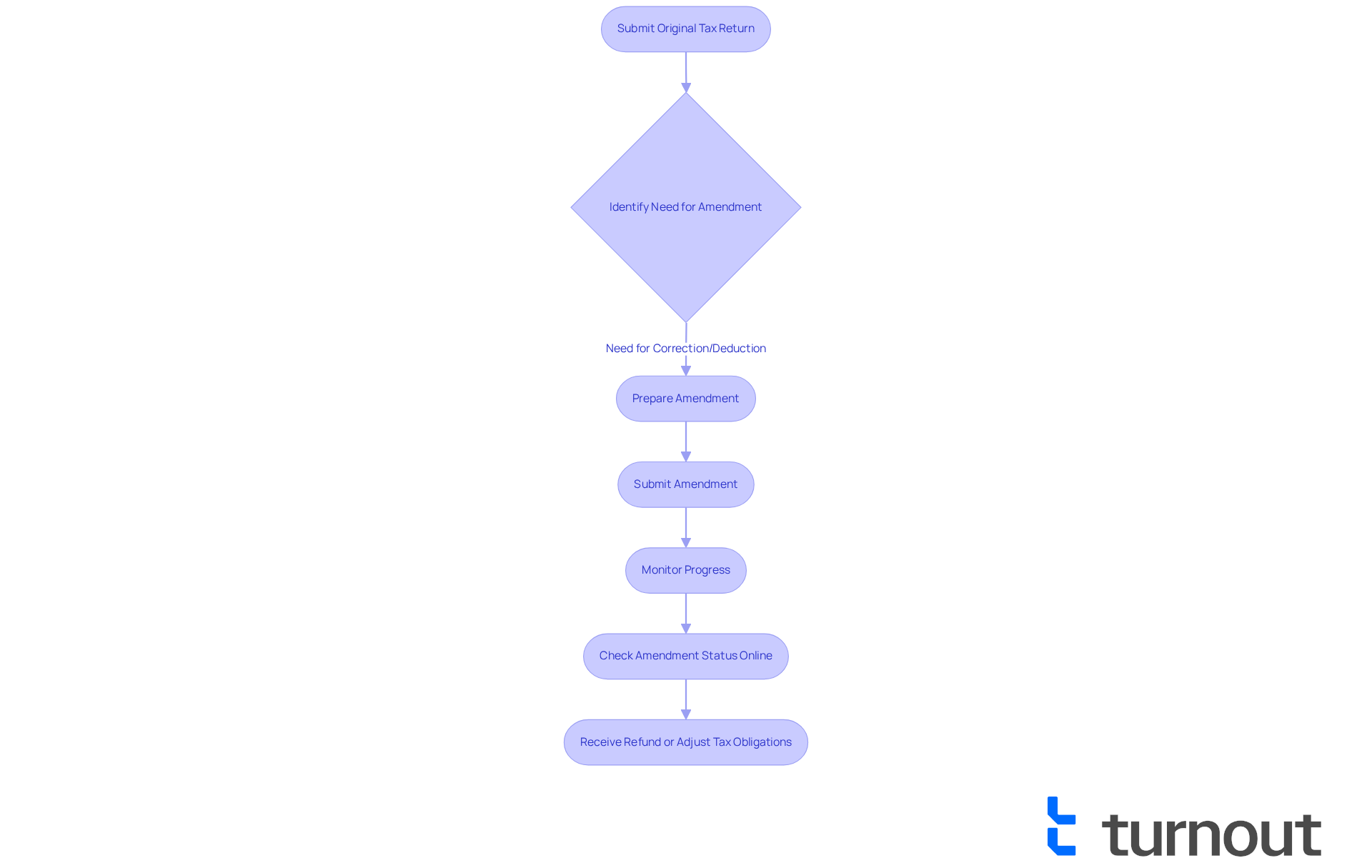

Understand Tax Amendments and Their Importance

Tax changes are modifications made to your original tax return after submission. We understand that these adjustments can often be necessary for correcting errors, claiming missed deductions, or adjusting reported income. Such changes are crucial, as they can significantly influence your tax obligations and potential refunds. For instance, the IRS has indicated that many taxpayers who amend their returns can see substantial changes in their tax outcomes, leading to potential refunds.

Monitoring the progress of your modification is essential to ensure prompt handling by the IRS, so you can know where's my tax amendment. It's common to feel anxious about delays in processing, as they can lead to unexpected tax bills or prolonged waits for refunds. In 2025, the IRS simplified the correction process, enabling taxpayers to verify their adjustment status online. This enhancement has considerably improved processing times, offering some peace of mind.

Practical instances highlight the importance of modifications: one taxpayer rectified a mistake in their reported income, resulting in a refund that alleviated their financial strain. Such corrections not only help ensure compliance with tax regulations but also provide much-needed financial relief.

Tax experts emphasize that understanding the effects of tax changes is essential. As Rohit Kumar, a National Tax Office Co-Leader at PwC, noted, "Amendments can be a powerful tool for taxpayers, allowing them to rectify mistakes and optimize their tax outcomes." Thus, staying updated on where's my tax amendment can empower you to manage the intricacies of tax obligations effectively. Remember, you are not alone in this journey, and we're here to help.

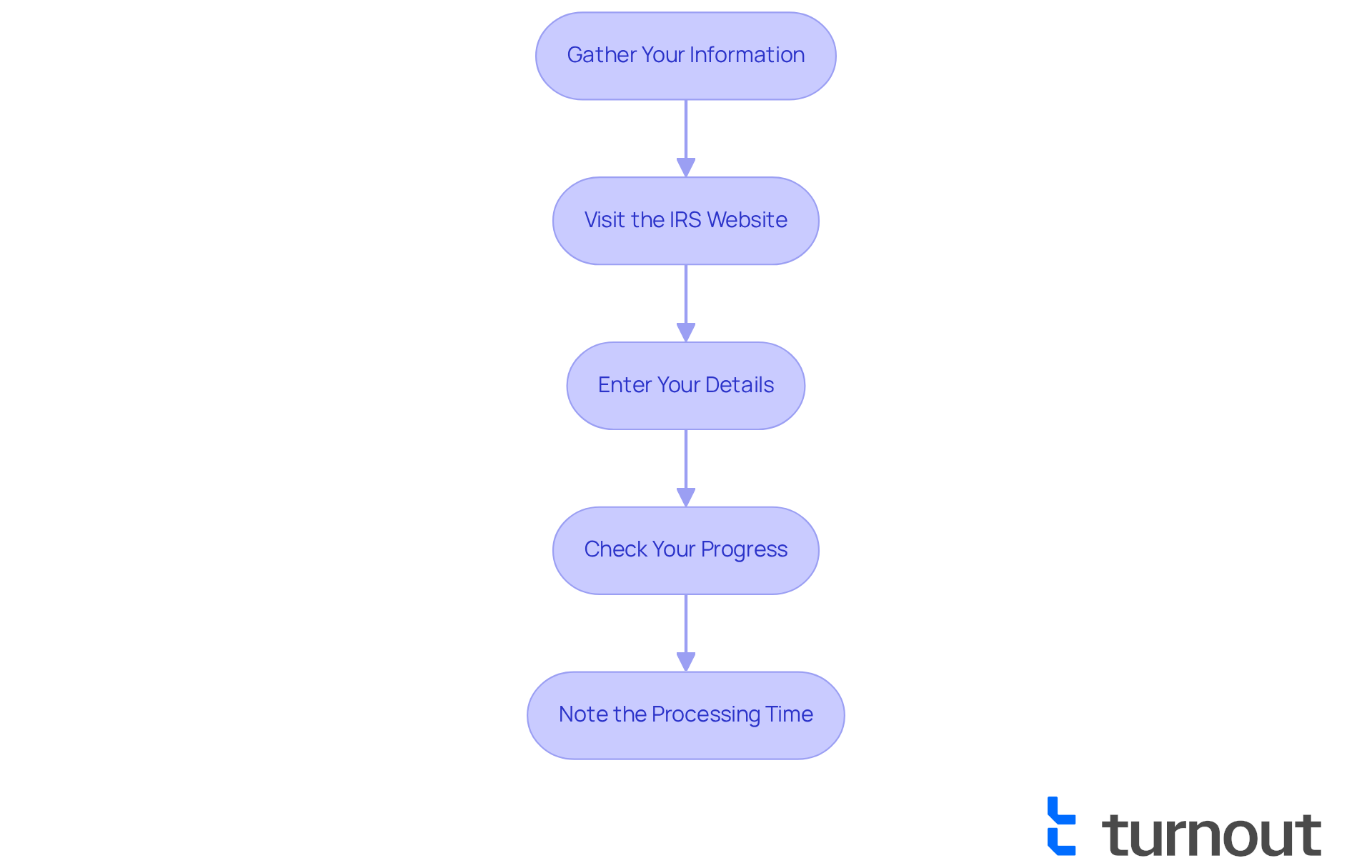

Follow Steps to Check Your Tax Amendment Status

We understand that checking where's my tax amendment status can feel overwhelming. To help you navigate this process, follow these simple steps:

-

Gather Your Information: Make sure you have your Social Security number, date of birth, and the zip code associated with your tax return ready. This will make the process smoother for you.

-

Visit the IRS Website: Navigate to the official IRS website and find the 'Where's My Amended Return?' tool. This tool is specifically designed to help you track changes to your return, so you can easily find out where's my tax amendment.

-

Enter Your Details: Input your Social Security number, date of birth, and zip code into the tool. Double-check your entries for accuracy to avoid any errors. We know how important it is to get this right.

-

Check Your Progress: After submitting your information, the tool will show your modification progress. You might see options like 'Received', 'Adjusted', or 'Completed', which indicate the current phase of your modification.

-

Note the Processing Time: It’s common to feel anxious about waiting, but be aware that it can take up to 16 weeks for the IRS to process an amended return. Typically, it takes between 8 and 12 weeks. If your status shows 'Received', please exercise patience and remember to check back periodically for updates on where's my tax amendment. Remember, the 'Where's My Amended Return?' tool is available 24 hours a day, except for specific downtime on Mondays from midnight to 3 a.m. ET and occasional Sundays from 1 to 7 a.m. ET. If your amended return requires further review due to errors or missing information, processing may take longer. The IRS will send all information related to your amended return by mail, so keep an eye on your mailbox for updates. You're not alone in this journey; we're here to help you every step of the way.

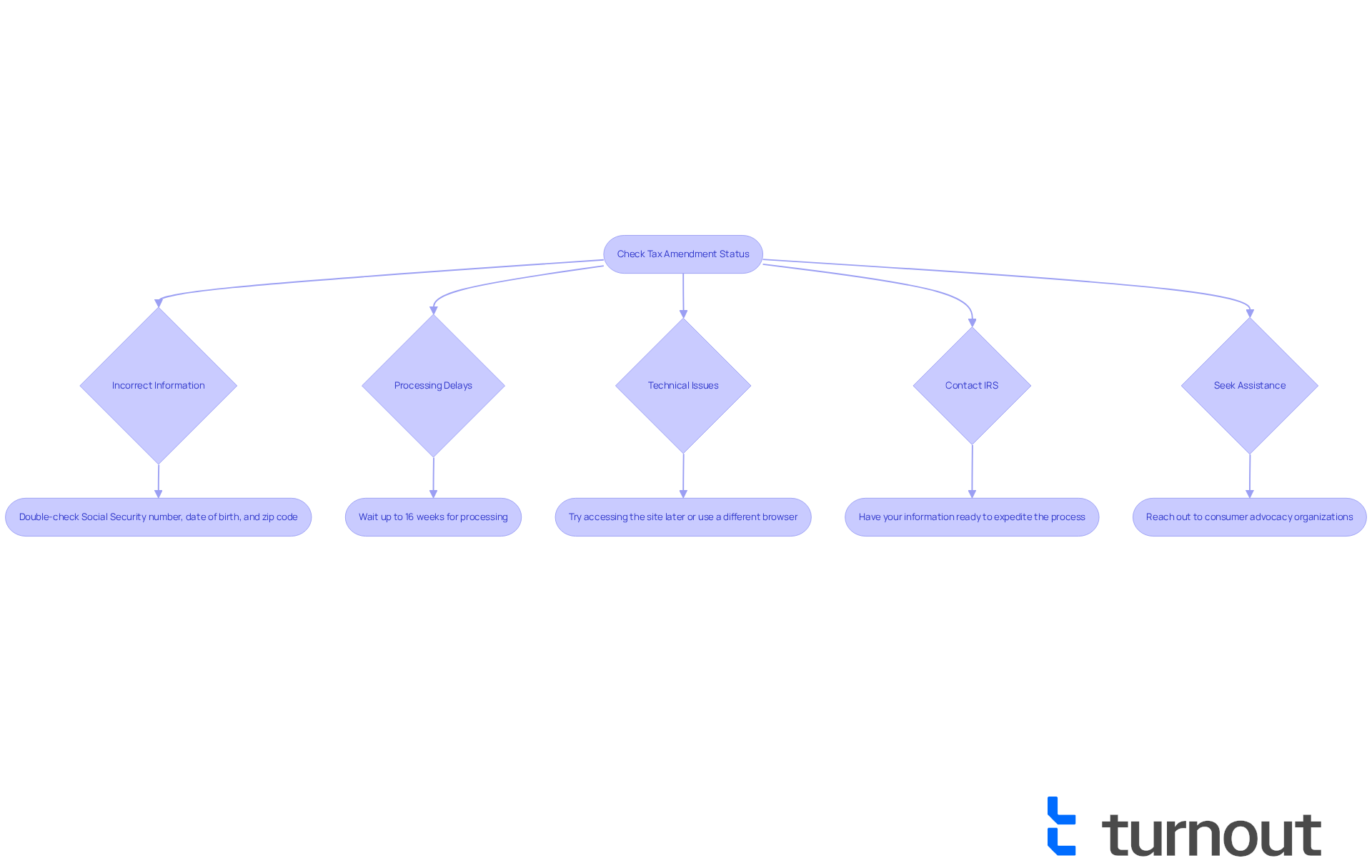

Troubleshoot Common Issues with Tax Amendment Status Checks

If you find yourself facing challenges while asking, where's my tax amendment status, know that you're not alone. Here are some helpful tips to guide you through this process:

-

Incorrect Information: We understand how frustrating it can be to enter your details only to find discrepancies. Double-check that your Social Security number, date of birth, and zip code are accurate. Remember, even a small typo can hinder your access to vital information.

-

Processing Delays: It's common to feel anxious if your modification was submitted recently. Please be aware that it may not yet be reflected in the system. Processing can take up to 16 weeks, so patience is key during this time.

-

Technical Issues: If the IRS website is down or you're experiencing technical difficulties, don't worry. Try accessing the site at a different time or consider using an alternative browser. We understand how these issues can add to your stress.

-

If you've waited beyond the typical processing time and still can't find your status, asking 'where's my tax amendment' when contacting the IRS directly may be the best course of action. Have your information ready to help expedite the process. You're taking a proactive step towards resolution.

-

Seek Assistance: Should challenges persist, remember that support is available. Consider reaching out to a consumer advocacy organization like Turnout. They can provide guidance and assist you in navigating the complexities of tax amendments. You're not alone in this journey, and we're here to help.

Conclusion

Navigating the complexities of tax amendments can feel overwhelming, and we understand how important it is to grasp their significance and track their status for effective financial management. Tax amendments are not merely bureaucratic formalities; they are essential tools for correcting errors and optimizing tax outcomes, which could lead to significant refunds. By learning how to check the status of your amendment, you can ease your worries and ensure that your tax obligations are managed promptly.

This guide has offered clear steps to check your tax amendment status, highlighting the importance of accurate information and the need for patience during the processing period. From gathering necessary details to utilizing the IRS's online tools, each step is crafted to empower you as a taxpayer. Moreover, addressing common issues that may arise during this process helps to demystify the experience and encourages you to engage proactively with the IRS when needed.

Ultimately, staying informed about tax amendments and their status can foster greater financial security and peace of mind. It is vital to take these steps seriously and reach out for help when necessary, as the implications of tax amendments can significantly impact your financial situation. By actively managing your tax amendments, you not only comply with regulations but also open doors to potential financial relief. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What are tax amendments?

Tax amendments are modifications made to your original tax return after submission, often necessary for correcting errors, claiming missed deductions, or adjusting reported income.

Why are tax amendments important?

Tax amendments are crucial because they can significantly influence your tax obligations and potential refunds. They help ensure compliance with tax regulations and can lead to financial relief for taxpayers.

How can tax amendments affect my tax outcomes?

Many taxpayers who amend their returns can see substantial changes in their tax outcomes, potentially leading to refunds. For example, correcting a mistake in reported income can result in a refund that alleviates financial strain.

How can I monitor the progress of my tax amendment?

It's essential to monitor the progress of your modification to ensure prompt handling by the IRS. In 2025, the IRS simplified the correction process, allowing taxpayers to verify their adjustment status online.

What should I do if there are delays in processing my tax amendment?

Delays in processing can lead to unexpected tax bills or prolonged waits for refunds. Staying updated on the status of your amendment can help manage any anxiety related to these delays.

What do tax experts say about tax amendments?

Tax experts emphasize that understanding the effects of tax changes is essential. Amendments can be a powerful tool for taxpayers to rectify mistakes and optimize their tax outcomes, as noted by Rohit Kumar, a National Tax Office Co-Leader at PwC.