Overview

Navigating the process of checking the status of your amended tax return refund can feel overwhelming. We understand that you may have concerns and questions. This article serves as a caring guide to help you through each step, ensuring you feel equipped and informed.

Start by utilizing the IRS 'Where's My Amended Return?' tool. This resource is designed to provide you with the most accurate updates on your refund status. If you encounter any issues, don’t worry; we’ll walk you through common troubleshooting steps that many taxpayers face. Remember, you’re not alone in this journey.

Tracking your amended return status effectively can ease some of the stress you might be feeling. It's common to experience delays, and having the right knowledge can empower you to stay informed. We’re here to help you understand what to expect and how to address any potential setbacks.

By following these steps, you can approach the process with confidence. Take a moment to reflect on your experiences and know that support is available. You are not alone in this, and together, we can navigate the complexities of tax returns.

Introduction

Navigating the complexities of tax filings can feel overwhelming, especially when it comes to amended returns. We understand that these revised submissions are crucial for correcting mistakes and ensuring you receive the refunds or credits you deserve. It's common to find yourself asking, "Where's my amended return refund?" This article is here to help.

We’ll provide you with a step-by-step guide to checking the status of your amended returns. Along the way, we’ll address common challenges that may arise, empowering you to take control of your tax situation with confidence. You're not alone in this journey, and we're here to support you every step of the way.

Understand Amended Returns and Their Importance

A revised submission is a tax document sent to the IRS to correct mistakes or alter a previously filed tax declaration. We understand that navigating tax filings can be challenging, and common reasons for filing include:

- Correcting income

- Altering filing status

- Claiming missed deductions

This process is crucial, as it can lead to potential refunds or adjustments in tax liability. Did you know that data from the Statistics of Income (SOI) show that around 2% of taxpayers submit revised filings annually? This highlights the significance of this corrective action.

Tax experts stress that amending tax filings can help avert future issues and ensure you receive any credits or refunds you deserve. For example, a taxpayer who realized they had missed a deduction for medical costs submitted a revised filing and obtained a significant refund, illustrating the concrete advantages of this procedure. It's important to remember that taxpayers must submit a revised document within three years after the date they filed their initial submission, especially when considering where's my amended return refund.

Additionally, we want to caution you against social media schemes that promise large tax breaks and refunds, as these offers are often too good to be true. Comprehending the significance of submitting a revised document not only aids you in staying aware of your financial status with the IRS but also empowers you to manage your tax circumstances. Remember, you are not alone in this journey—we're here to help you every step of the way.

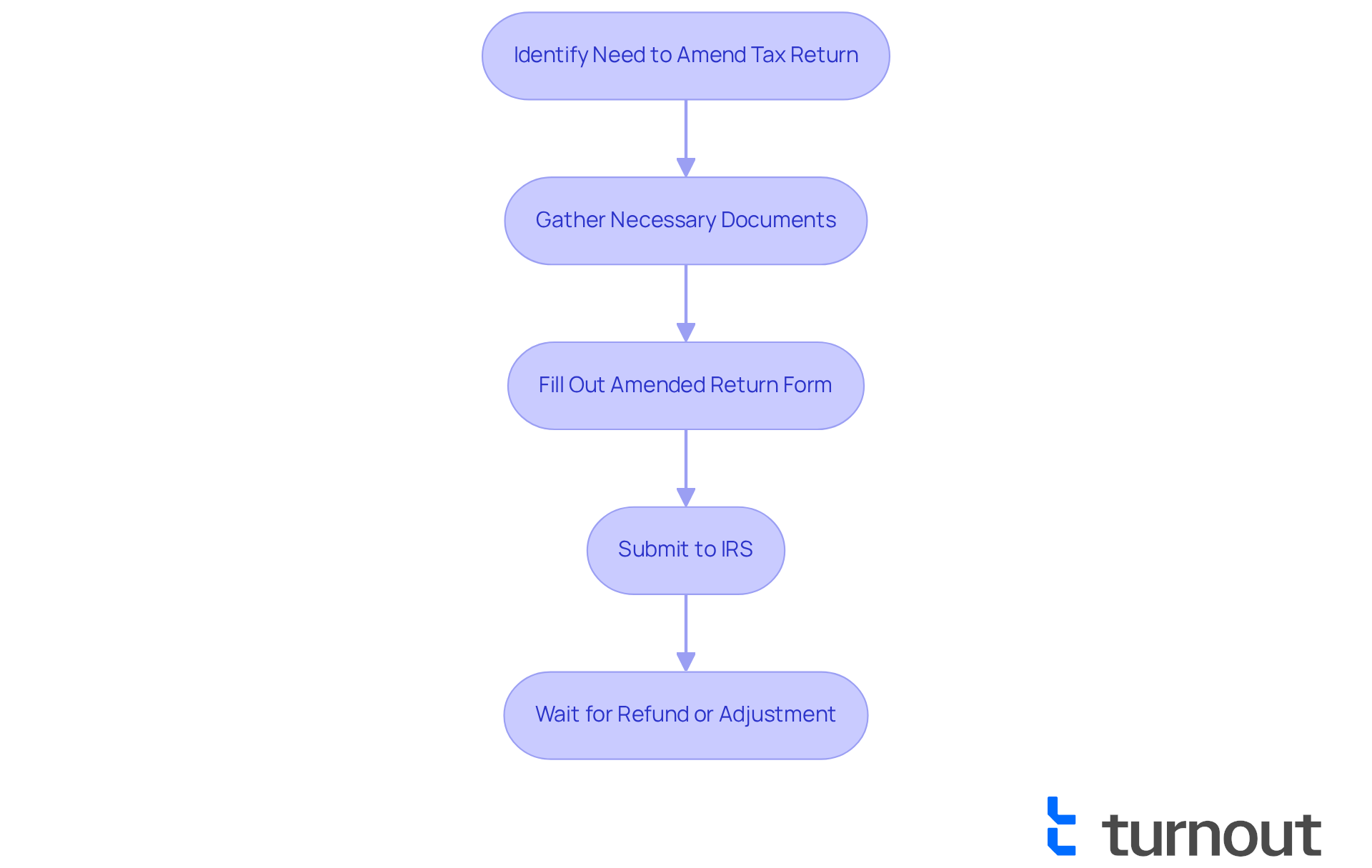

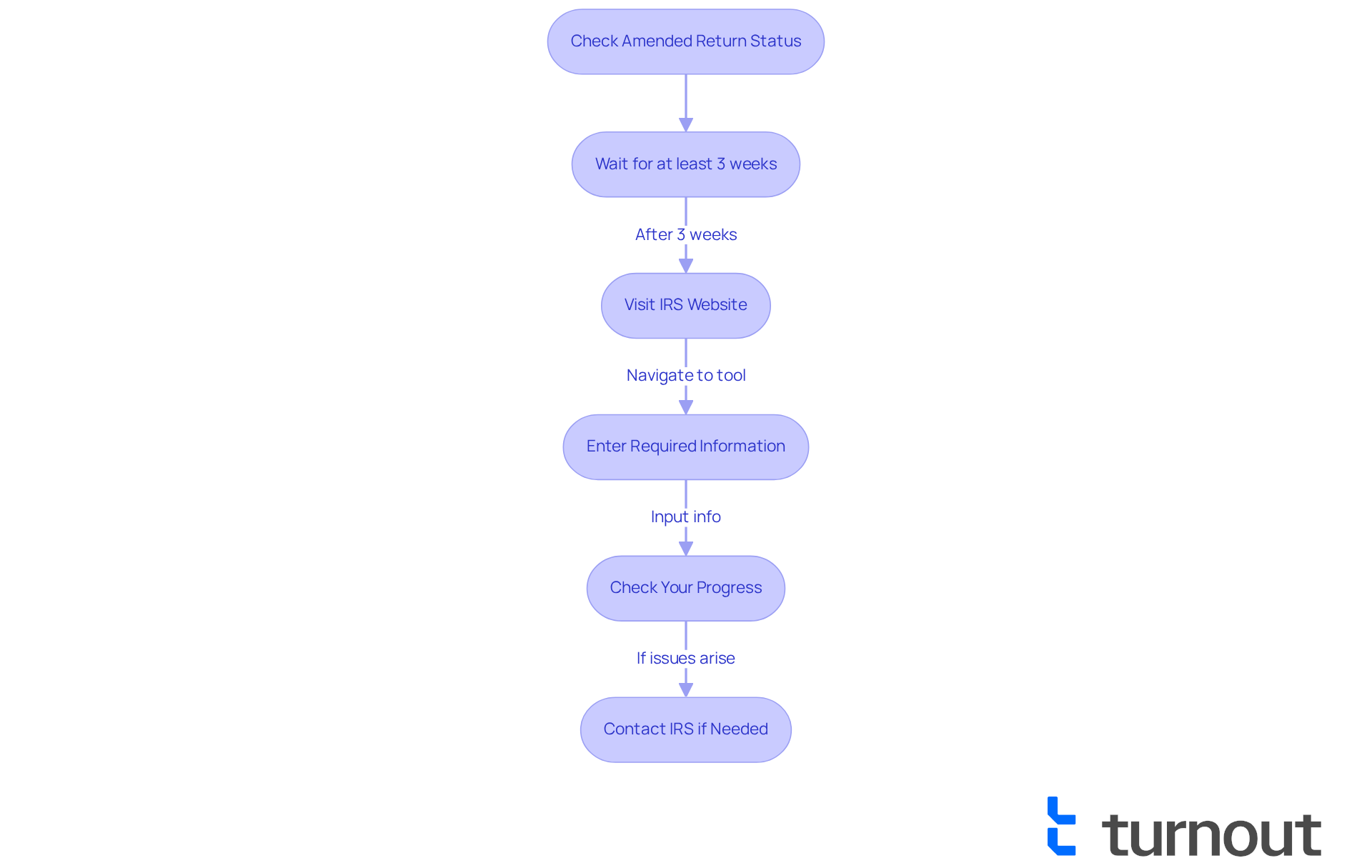

Follow Steps to Check Your Amended Return Status

We understand that you might be wondering, 'where's my amended return refund,' as checking the status can feel daunting. To help ease your mind, here are some steps to follow:

-

Wait for the Suitable Duration: Allow at least three weeks after submitting your revised filing before checking its status. The IRS usually handles revised filings within 8 to 12 weeks, but it may require up to 20 weeks in certain situations.

-

Visit the IRS Website: Navigate to the IRS 'Where's My Amended Return?' tool available at IRS.gov. This resource is designed to assist you.

-

Enter Required Information: Input your Social Security number, date of birth, and ZIP code. Ensure that this information matches what you provided on your revised filing.

-

Check Your Progress: After entering your information, the tool will show the condition of your revised submission. It will indicate whether it is pending, processing, or finished.

-

Reach out to the IRS if Needed: If you encounter any issues or your progress does not change after the expected period, consider calling the IRS at 866-464-2050 for assistance. This hotline is available for questions regarding your revised submission three weeks after filing.

Remember, the 'Where's My Amended Return?' tool is available 24 hours a day, except for Mondays from 12 - 3 a.m. Eastern time and occasional Sundays from 1 - 7 a.m. Eastern time. It’s important to note that the tool cannot provide updates for specific categories of submissions, such as business submissions or those with international addresses. Delays in processing may occur due to errors, incomplete information, or requests for additional information from the IRS. As the IRS states, "the 'Where's My Amended Return?' tool remains the best resource for up-to-date information on the condition of your Form 1040-X." This resource is vital for monitoring where's my amended return refund efficiently. You are not alone in this journey; we’re here to help.

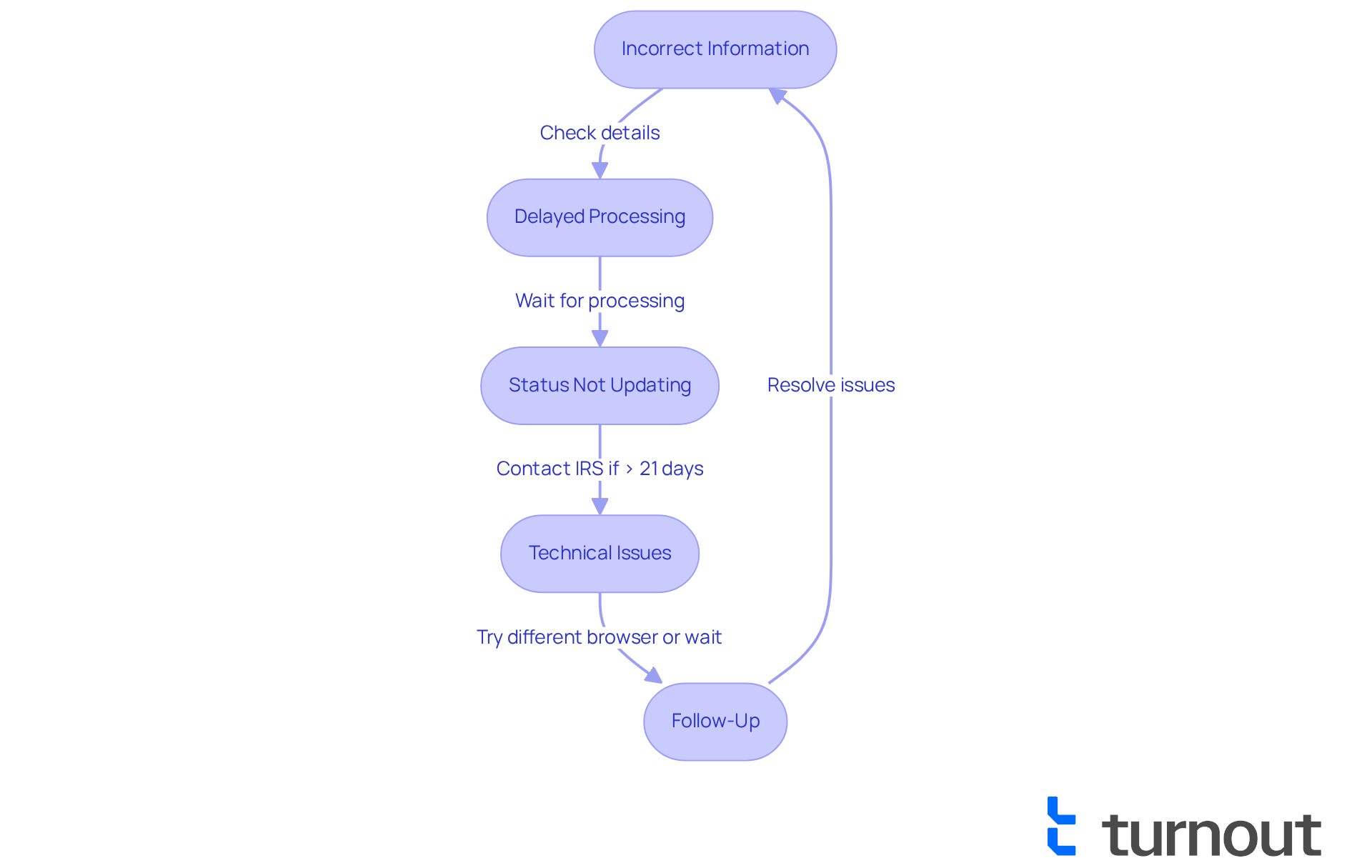

Troubleshoot Common Issues with Amended Return Status

When verifying the status of your revised submission, we understand that you may encounter some common challenges. Here’s how to troubleshoot them with care:

-

Incorrect Information: It's essential to ensure that the details you provided match precisely with those on your revised document. Even small discrepancies can lead to errors, and we want to help you avoid that.

-

Delayed Processing: If it has been over 12 weeks since you submitted your revised filing and you are still asking where's my amended return refund, it may be due to processing delays. The IRS is currently facing a backlog caused by staffing constraints and an increase in error-flagged filings, which can extend processing times up to 16 weeks. We understand that you're wondering where's my amended return refund, and this can be frustrating.

-

Status Not Updating: If your status remains unchanged for an extended period, consider reaching out to the IRS for clarification. Be prepared to supply your revised filing information for verification. Tax experts suggest contacting the IRS only if your submission has been awaiting processing for over 21 days without any updates. This could indicate a need for more documentation or a manual examination.

-

Technical Issues: If the IRS website is down or you cannot access the tool, try again later or use a different browser. Please note that the service is occasionally unavailable on Sundays from 1 - 7 a.m. Eastern time. Technical glitches can sometimes hinder access to online services, and we understand how inconvenient that can be.

-

Follow-Up: If you suspect there is a problem with your revised submission, such as missing documentation or errors, don't hesitate to contact the IRS directly for guidance on resolving the issue. Remember, making a mistake on a tax return isn't the end of the world; the IRS understands that honest mistakes happen, and you are not alone in this journey.

Conclusion

Filing an amended return is not merely a bureaucratic task; it represents a vital step for taxpayers eager to correct past mistakes and potentially reclaim funds owed to them. Understanding the significance of this process can empower you to take control of your financial situation with the IRS, ensuring you receive any credits or refunds you rightfully deserve.

We understand that navigating this process can feel overwhelming. That’s why this guide outlines essential steps to help you check the status of your amended returns. From waiting the appropriate duration to utilizing the IRS 'Where's My Amended Return?' tool, each step is designed to simplify what can often seem daunting. Common challenges, such as incorrect information or processing delays, are also addressed, providing clarity on how to effectively navigate these hurdles.

In summary, staying informed about the status of your amended return is crucial for managing tax obligations and ensuring financial accuracy. By following the outlined steps and understanding the process, you can alleviate concerns and gain peace of mind. Embracing the importance of amended returns not only fosters better tax practices but also encourages proactive engagement with your financial health. Remember, you are not alone in this journey—take the necessary steps today to check your amended return status and ensure you’re on the right path to resolving any tax issues.

Frequently Asked Questions

What is an amended return?

An amended return is a tax document submitted to the IRS to correct mistakes or alter a previously filed tax declaration.

Why would someone need to file an amended return?

Common reasons for filing an amended return include correcting income, altering filing status, and claiming missed deductions.

What are the potential benefits of filing an amended return?

Filing an amended return can lead to potential refunds or adjustments in tax liability, helping taxpayers receive any credits or refunds they deserve.

How common is it for taxpayers to submit amended returns?

According to data from the Statistics of Income (SOI), around 2% of taxpayers submit revised filings annually.

What is the time limit for submitting an amended return?

Taxpayers must submit a revised document within three years after the date they filed their initial submission.

Are there any warnings regarding tax schemes related to amended returns?

Yes, taxpayers should be cautious of social media schemes that promise large tax breaks and refunds, as these offers are often too good to be true.

How can filing an amended return help prevent future issues?

Amending tax filings can help avert future issues and ensure that taxpayers receive any credits or refunds they are entitled to.