Introduction

Navigating the complexities of tax returns can feel overwhelming, especially when it comes to amending a document you've already filed. We understand that millions of taxpayers rely on refunds each year, and grasping the amended return process is crucial for managing expectations and easing anxiety. But how can you effectively track the status of your amended federal refund amidst potential delays and confusion?

This guide is here to offer clear steps and valuable insights, helping you confidently navigate the IRS's amended return system. Remember, you're not alone in this journey, and we're here to help you every step of the way.

Understand the Amended Return Process

If you need to modify a tax document you've already submitted, don’t worry - you're not alone in this. To make those changes, you'll want to use IRS Form 1040-X. We understand that waiting can be tough, but typically, the IRS processes revised filings within 8 to 12 weeks. However, in some cases, it might take up to 16 weeks due to various factors, like mistakes or the need for additional information. As a tax professional wisely points out, "You should generally allow 8 to 12 weeks for your Form 1040-X to be processed. However, in some cases, processing could take up to 16 weeks."

After you submit your revised filing, you can check its status about three weeks later using the 'Where's My Revised Filing?' tool. This timeframe allows the IRS to update their systems with your revised information. Just a heads up: if your revised filing has a foreign address, it can't be tracked with this tool.

Understanding this timeline is crucial for managing your expectations and easing any anxiety during the waiting period. Many taxpayers have successfully navigated this process, often finding that patience is key as they wonder, 'where's my amended federal refund?'. In 2025, the average refund amount was $3,167, and around 104 million taxpayers (63%) received refunds. This highlights just how important timely processing can be. Remember, we're here to help you through this journey.

![]()

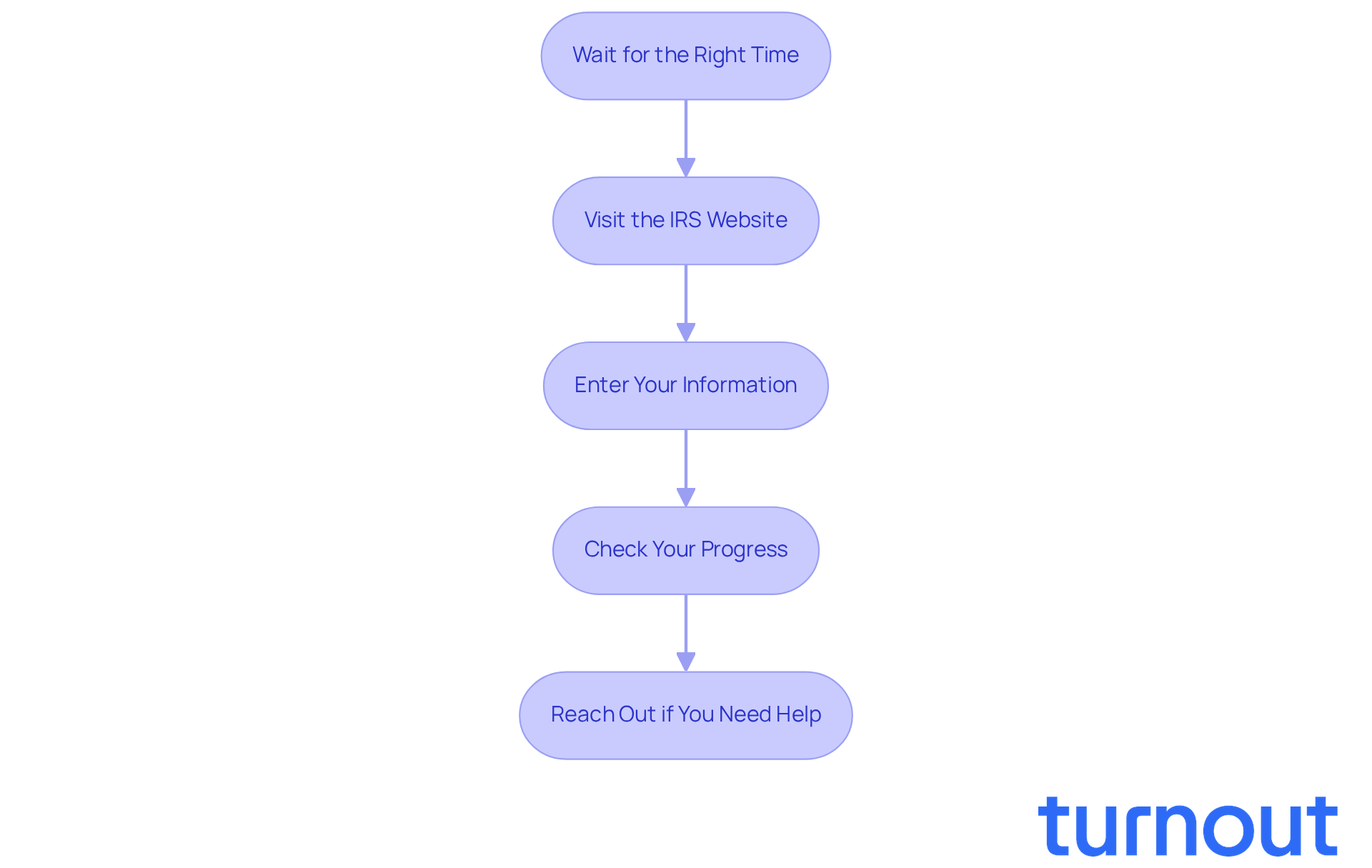

Follow Steps to Check Your Amended Refund Status

Checking where's my amended federal refund can feel overwhelming, but we're here to help you through it. Follow these simple steps to stay informed:

- Wait for the Right Time: Make sure at least three weeks have passed since you submitted your revised filing. This gives the IRS enough time to process your request.

- Visit the IRS Website: Head over to the IRS 'Where's My Amended Return?' tool at IRS.gov.

- Enter Your Information: You’ll need to provide your Social Security number, date of birth, and ZIP code. Double-check that this information matches what you submitted on your revised filing.

- Check Your Progress: After entering your details, the tool will show the status of your amended return. It will let you know if it’s still under review, has been finalized, or if there are any issues.

- Reach Out if You Need Help: If you run into any problems or if the status is unclear, don’t hesitate to call the IRS at 866-464-2050 for assistance.

As of February 2026, the IRS expects that most amended filings will be processed within three weeks of submission. It’s comforting to know that the IRS typically issues most refunds in less than 21 days when the return is accurate and complete. However, common issues can arise, like discrepancies in personal information or processing delays. Using the 'Where's My Amended Return?' tool can provide clarity and updates on your refund progress, helping you feel more in control of the situation.

Remember, you’re not alone in this journey. Approximately 75% of Americans receive tax refunds each year, and 34% rely on these funds to make ends meet. As IRS Chief Executive Officer Frank J. Bisignano wisely stated, "Filing electronically and choosing direct deposit remains the fastest way to receive a refund." We're here to support you every step of the way.

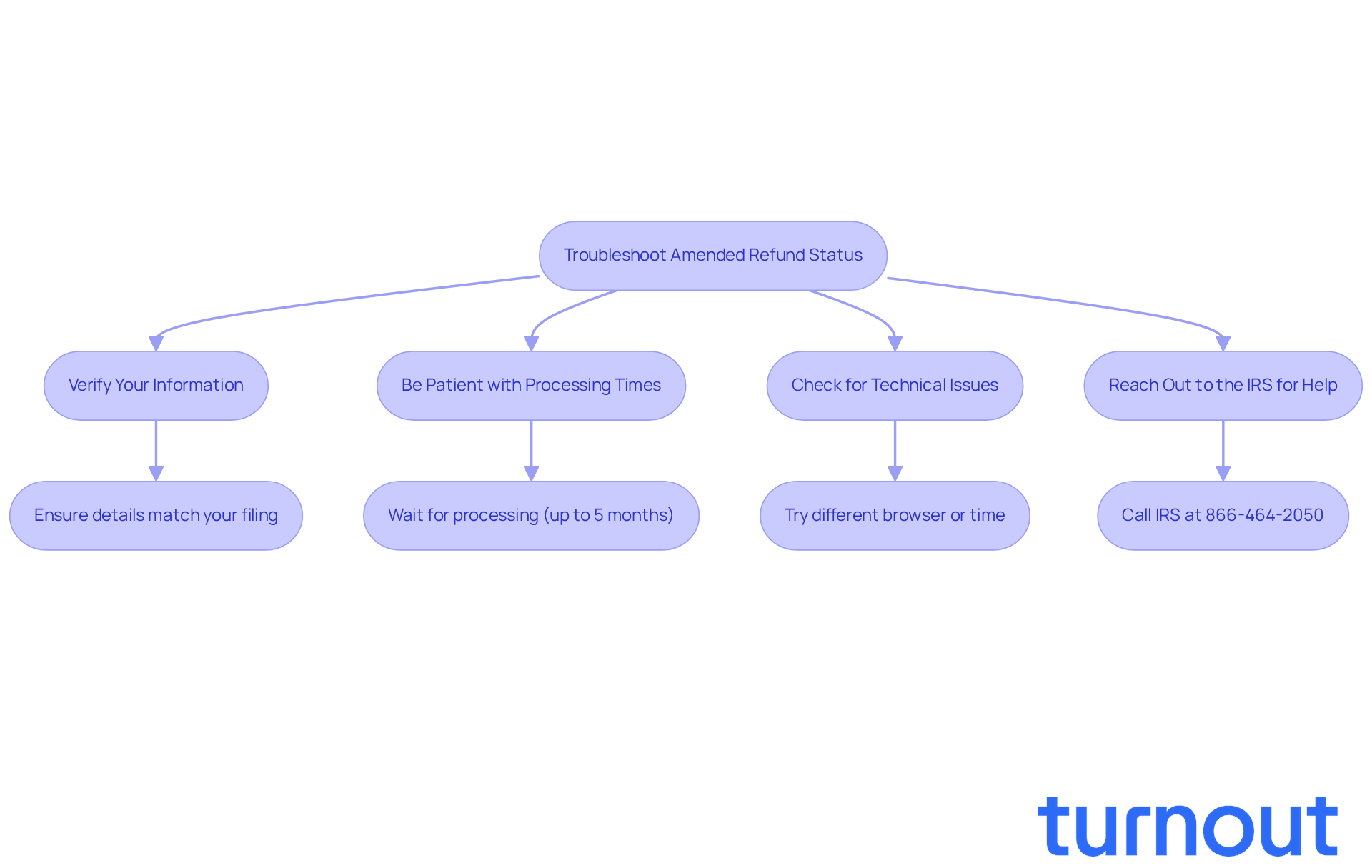

Troubleshoot Common Issues with Amended Refund Status

If you're having trouble checking where's my amended federal refund, don’t worry - you're not alone. Here are some helpful tips to guide you through the process:

-

Verify Your Information: Make sure the details you entered - like your Social Security number, date of birth, and ZIP code - match your updated filing exactly. Even small discrepancies can prevent you from retrieving your status.

-

Be Patient with Processing Times: If it’s been less than three weeks since you submitted your amended document, you might need to wait a bit longer. The IRS processes these returns in the order they’re received, which can lead to delays. On average, processing can take over five months, so patience is truly key.

-

Check for Technical Issues: If the IRS website is down or you’re facing technical difficulties, try accessing it at a different time or using another browser. Technical glitches can hinder your ability to verify your progress, and it’s common to feel frustrated in these situations.

-

Reach Out to the IRS for Help: If you still can’t access your information after following these steps, don’t hesitate to call the IRS at 866-464-2050. Be ready to provide your personal information and specifics about your revised submission. Remember, about 40% of taxpayers found the information regarding 'where's my amended federal refund?' The tool is unhelpful, so if you’re wondering where's my amended federal refund, reaching out directly may be necessary for resolution.

By staying proactive and following these steps, you can effectively manage any inconsistencies in your revised status. And don’t forget, your revised submission needs to be postmarked by April 18, 2026, to be accepted within the three-year limit. We’re here to help you through this journey!

Access Additional Resources for Amended Returns

If you’re feeling overwhelmed with your amended return and wondering where's my amended federal refund, know that you’re not alone. Here are some resources that can help you navigate this process with ease:

-

IRS Resources: For detailed information on revised filings and answers to frequently asked questions, visit the IRS Revised Filings FAQ. We understand that tax matters can be confusing, and this resource is designed to guide you.

-

Taxpayer Advocate Service: If you’re facing significant delays or issues, the Taxpayer Advocate Service is here to help. They provide assistance tailored to your needs. Check out their website at Taxpayer Advocate Service for more information.

-

Turnout's Support: While we don’t offer legal advice, Turnout is committed to helping you navigate government forms and procedures. Our advocates are ready to assist you in understanding your options for financial assistance. Plus, our AI agent, Jake, is available to streamline communications and tracking, making the process smoother for you.

-

Professional Tax Help: If you prefer personalized assistance, consulting a tax professional can be a great option. They can guide you through the process and help resolve any issues related to where's my amended federal refund.

Remember, seeking help is a positive step forward. We’re here to support you every step of the way.

Conclusion

Navigating the amended federal refund process can feel overwhelming. We understand that many taxpayers face uncertainty when trying to correct previous submissions. But knowing the steps and timelines involved can truly make a difference. By utilizing IRS Form 1040-X, you can amend your returns, and with the IRS typically processing these amendments within 8 to 12 weeks, you’ll have a clearer picture of what to expect. With a little patience and the right resources, tracking the status of your amended return can become a manageable task.

Here are some key insights to keep in mind:

- Ensure accurate information is provided when checking your refund status.

- Use the 'Where's My Amended Return?' tool for updates.

- Be aware of common pitfalls that may delay processing.

If issues arise, remember that reaching out to the IRS or seeking help from professionals can provide clarity and support throughout this journey. You are not alone in this process.

Ultimately, staying informed and proactive is crucial. Many taxpayers rely on refunds for financial stability, so understanding how to efficiently check the status of an amended return is vital. It’s not just about managing expectations; it’s about empowering you to take control of your financial situation. Engaging with available resources and support can lead to a smoother experience, ensuring that you receive the refunds you deserve in a timely manner.

Frequently Asked Questions

What is the purpose of IRS Form 1040-X?

IRS Form 1040-X is used to modify a tax document that has already been submitted.

How long does it typically take for the IRS to process a revised filing using Form 1040-X?

The IRS typically processes revised filings within 8 to 12 weeks, but in some cases, it may take up to 16 weeks.

What factors can affect the processing time of Form 1040-X?

Factors that can affect processing time include mistakes on the form or the need for additional information.

How can I check the status of my amended return after submission?

You can check the status of your amended return about three weeks after submission using the 'Where's My Revised Filing?' tool.

Is there any limitation on tracking amended returns with a foreign address?

Yes, amended filings with a foreign address cannot be tracked using the 'Where's My Revised Filing?' tool.

Why is it important to understand the processing timeline for amended returns?

Understanding the timeline is crucial for managing expectations and easing anxiety during the waiting period.

What was the average refund amount for taxpayers in 2025?

The average refund amount for taxpayers in 2025 was $3,167.

How many taxpayers received refunds in 2025?

Around 104 million taxpayers, or 63%, received refunds in 2025.