Introduction

Navigating the complexities of amended tax returns can feel overwhelming, especially when it comes to correcting financial discrepancies. We understand that each year, millions of taxpayers face the challenge of ensuring their filings are accurate. This often leads to the need for revisions, which can be stressful.

This guide is here to provide a comprehensive roadmap for checking the status of your amended tax returns. We aim to offer essential steps and resources to help alleviate the stress of uncertainty. But what happens when the waiting game turns into frustration? How can you effectively track down your amended returns?

You're not alone in this journey. Many share your concerns, and together, we can navigate this process with confidence.

Understand Amended Tax Returns

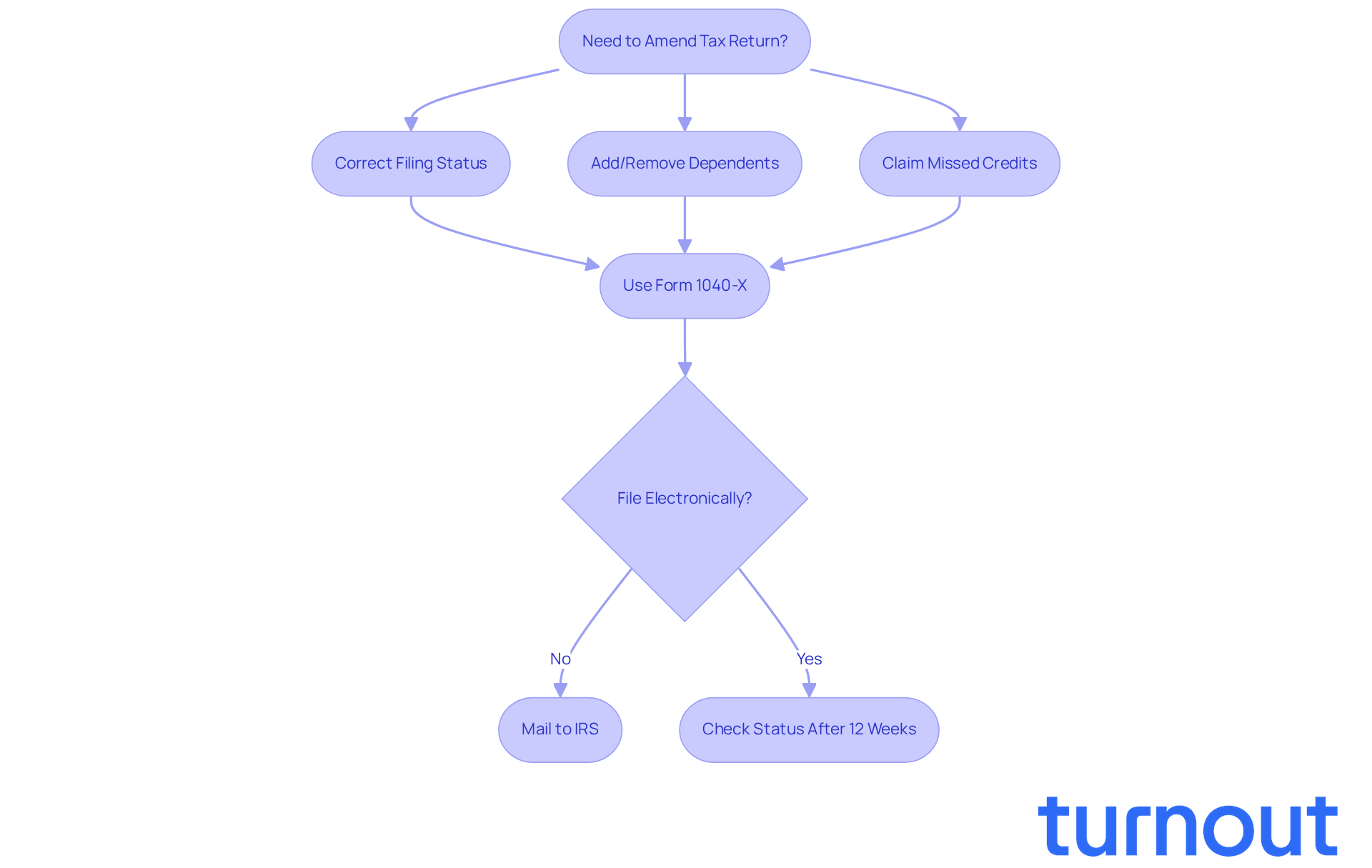

Submitting a revised tax document is crucial for correcting any mistakes or making changes to a previously filed statement. We understand that navigating tax issues can be overwhelming, and you’re not alone in this journey. Here are some common reasons why you might need to file an amended return:

- Correcting your filing status, income, deductions, or credits.

- Adding or removing dependents.

- Claiming missed tax credits or deductions.

To submit a revised filing, you’ll typically use Form 1040-X. It’s important to note that these submissions can’t be filed electronically; they must be mailed to the IRS. This process matters because around 2.5 million taxpayers submit corrected filings each year. Ensuring your tax documents are accurate and up-to-date is essential.

Tax professionals often highlight reasons for amendments, such as overlooked deductions or changes in income, which can significantly affect your tax liability. It’s common to feel anxious about these details, but knowing you can address them is empowering. Additionally, some revised filings may require extra scrutiny if they contain errors, are incomplete, lack signatures, or need more information.

By understanding the purpose and process of a revised filing, including the fact that it may take longer than 12 weeks to process, you can manage your tax obligations more effectively. After you submit your amended return, you can check the status by asking 'where are my amended taxes?' I am wondering where are my amended taxes, which I submitted about three weeks later. Remember, we’re here to help you through this process.

Check Your Amended Tax Return Status

Checking where are my amended taxes can feel daunting, but we're here to help you through it. Just follow these simple steps:

-

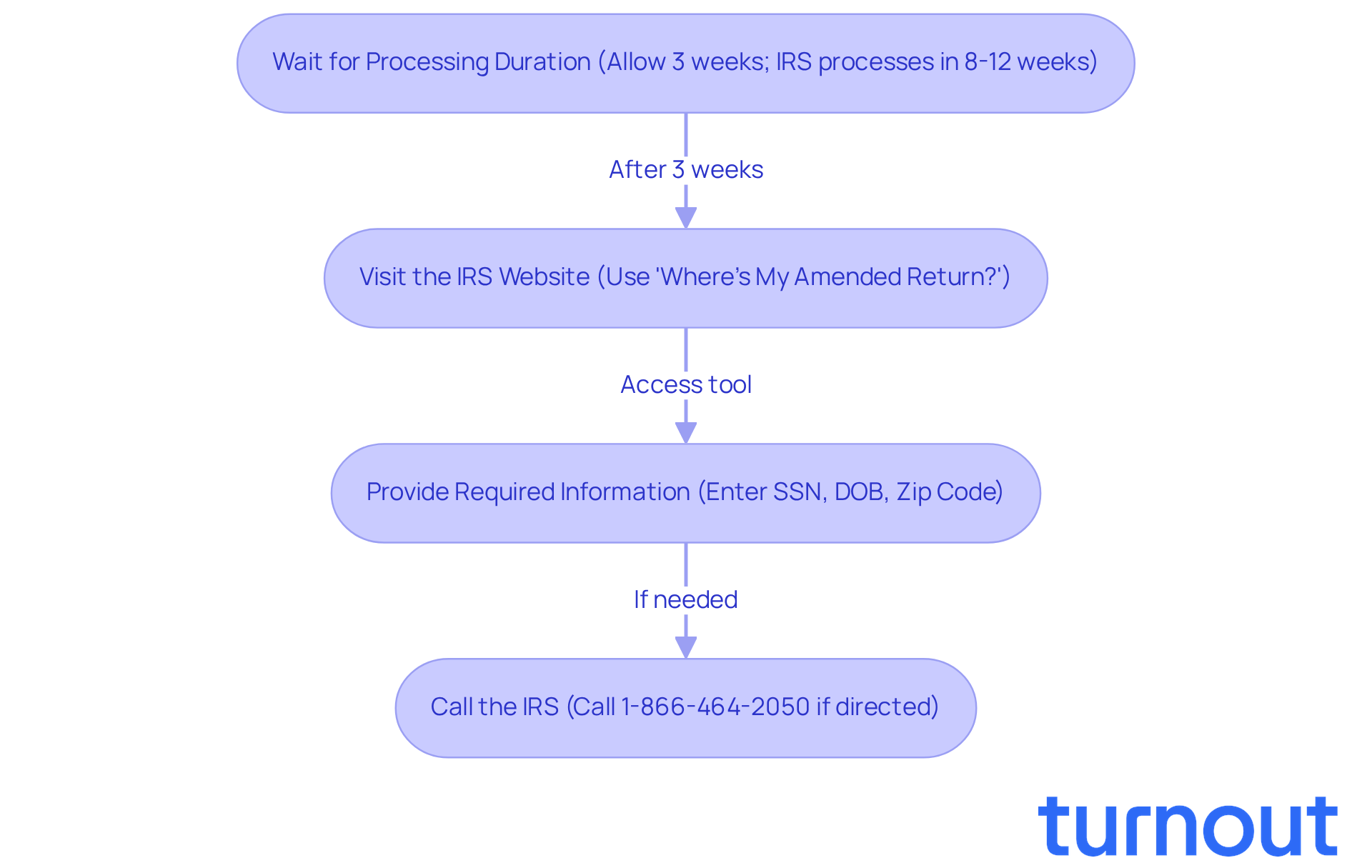

Wait for Processing Duration: After submitting your revised filing, it’s important to give it some time. Allow about three weeks before checking your status. The IRS typically processes Form 1040-X within 8 to 12 weeks, but some cases might take up to 16 weeks. We understand that waiting can be stressful, but patience is key.

-

Visit the IRS Website: Head over to the IRS 'Where's My Amended Return?' tool on their website. This handy resource provides real-time updates on where my amended taxes are, indicating whether your revised submission is pending, processing, or completed. It’s available 24/7, except for brief maintenance periods on Mondays and occasional Sundays. Knowing where you stand regarding where are my amended taxes can ease your mind.

-

Provide Required Information: To check your status, you’ll need to enter your Social Security number, date of birth, and zip code. This information is crucial for verification. We know it can feel a bit overwhelming, but this step is necessary to keep your information secure.

-

Call the IRS: If you prefer to speak with someone directly, you can call the IRS at 1-866-464-2050. Just remember to do this only if the 'Where's My Amended Return?' tool directs you to. Be ready to provide your personal details for verification. It’s okay to seek help when you need it.

By following these steps, you can effectively monitor the progress of your submission and find out where are my amended taxes to ensure that any necessary corrections are being processed. Remember, you’re not alone in this journey, and the 'Where's My Amended Return?' tool is here for you, available 24 hours a day, except for brief maintenance periods on Mondays and occasional Sundays.

Troubleshoot Common Issues with Amended Returns

If you’re facing challenges with your amended tax return, you may be wondering where are my amended taxes, and we’re here to help. Here are some supportive tips to guide you through the process:

-

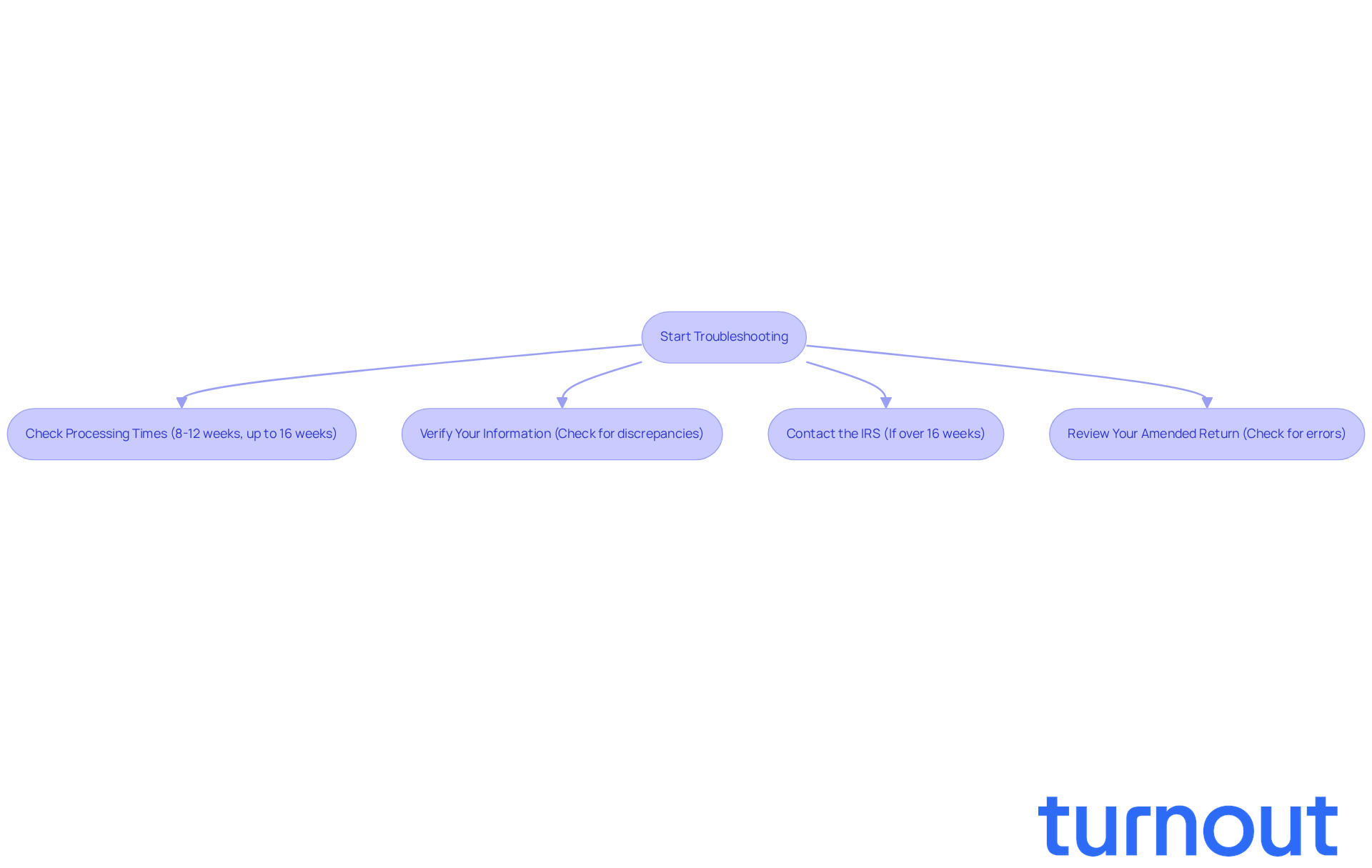

Check Processing Times: We understand that waiting can be stressful. Typically, the IRS processes revised filings within 8 to 12 weeks, but sometimes it can take up to 16 weeks. If it’s been more than 12 weeks since you filed, take a moment to check the where are my amended taxes? tool or reach out to the IRS for an update.

-

Verify Your Information: It’s common to feel anxious about discrepancies. Make sure the information you provided when checking your status matches exactly with what’s on your tax document. Even small errors, like incorrect Social Security Numbers or misspelled names, can lead to delays.

-

Contact the IRS: If you haven’t received any updates and it’s been over 16 weeks, don’t hesitate to call the IRS for assistance. They can provide specific information about your case and help troubleshoot any issues, such as where are my amended taxes, that you might be facing.

-

Review Your Amended Return: Take a moment to double-check your Form 1040-X for any errors or missing information that could slow down processing. Common mistakes include math errors and incorrect filing statuses. If you find any errors, you may need to submit another corrected filing.

By being proactive and addressing these common issues, you can help ensure a smoother process for your revised submission. Remember, you’re not alone in this journey.

Access Resources for Further Assistance

If you're feeling overwhelmed with your amended tax return, you might be wondering where are my amended taxes, and know that you're not alone. Many people find this process challenging, and it's completely normal to seek help. Here are some resources that can guide you through:

-

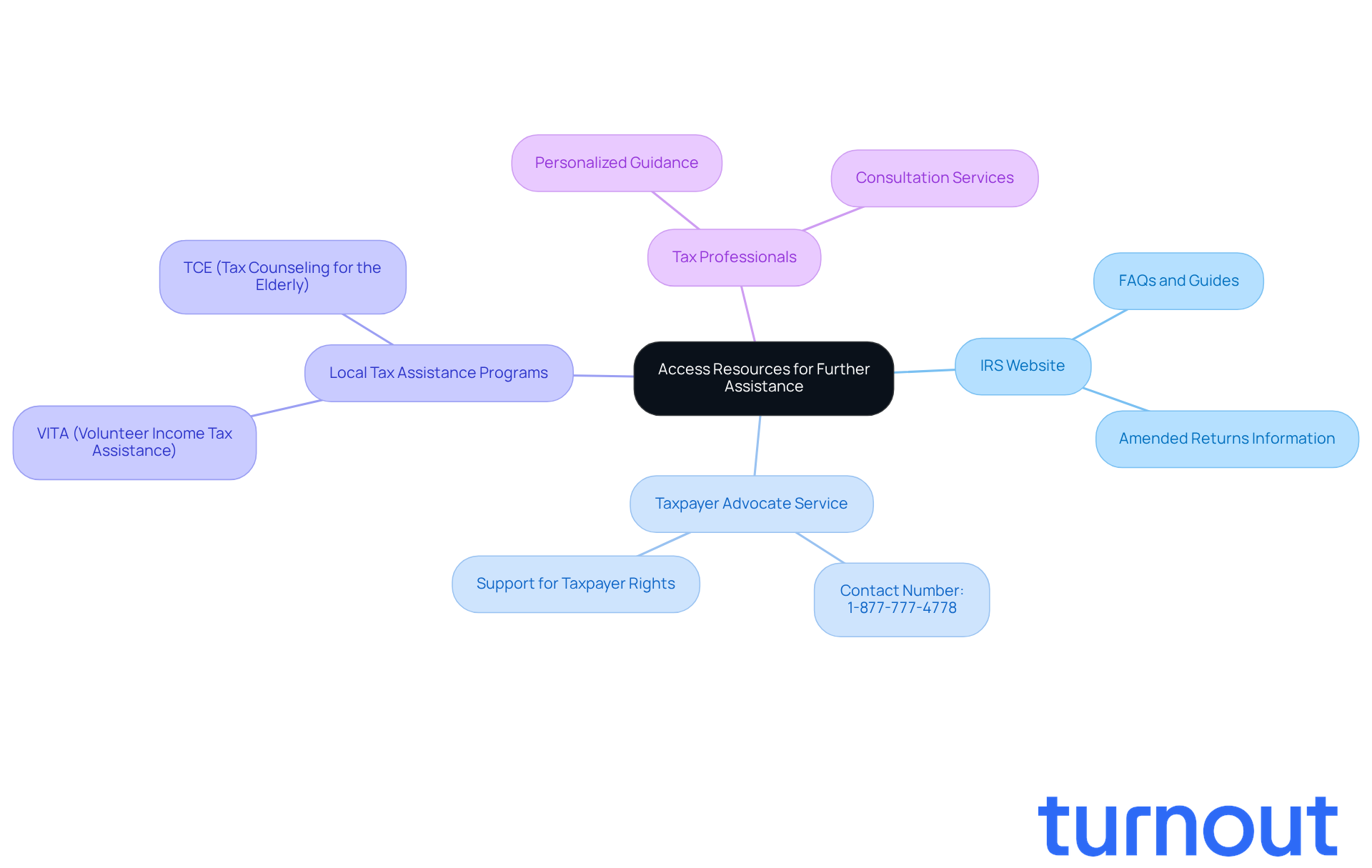

IRS Website: The IRS has a wealth of information available, including FAQs and detailed guides on revised submissions. You can find more at IRS Amended Returns.

-

Taxpayer Advocate Service: This independent organization within the IRS is dedicated to helping taxpayers like you resolve issues and understand your rights. They assist millions each year, providing essential support. If you need help, reach out to them at 1-877-777-4778. As Erin M. Collins, the National Taxpayer Advocate, wisely noted, "With the IRS workforce reduced by 26% and significant tax law changes on the horizon, there are risks to next year’s filing season."

-

Local Tax Assistance Programs: Many communities offer free tax assistance programs, such as VITA (Volunteer Income Tax Assistance) and TCE (Tax Counseling for the Elderly). These programs can provide in-person help tailored to your needs.

-

Tax Professionals: If the process feels daunting, consider consulting a tax professional. They can offer personalized guidance and support, making the journey smoother for you.

By utilizing these resources, you can find the support you need to determine where are my amended taxes and ensure they are handled correctly. Remember, staying informed about updates for 2026 can also help you navigate your filing process with confidence. We're here to help you every step of the way.

Conclusion

Submitting an amended tax return is a crucial step in ensuring your financial documents are accurate and truly reflect your tax obligations. We understand that the process can feel overwhelming, but it’s essential for correcting any errors and claiming missed deductions or credits. Knowing how to check the status of your amended return can help ease the stress of waiting for updates.

In this guide, we’ve outlined key steps to help you navigate the process of checking your amended tax return status. From understanding the importance of filing Form 1040-X to utilizing the IRS 'Where's My Amended Return?' tool, each point highlights the need for patience and attention to detail. If you encounter any issues, our troubleshooting tips can assist you in resolving common problems that may arise during the processing of your return.

Ultimately, being proactive and informed about your amended tax return is vital. By utilizing available resources, such as the IRS website, Taxpayer Advocate Service, and local assistance programs, you can significantly improve your experience. Remember, you are not alone in this journey. Take charge of your tax situation and don’t hesitate to seek help when needed. We’re here to support you in staying on top of your financial responsibilities.

Frequently Asked Questions

What is an amended tax return?

An amended tax return is a revised tax document submitted to correct mistakes or make changes to a previously filed tax statement.

Why might I need to file an amended return?

You might need to file an amended return to correct your filing status, income, deductions, or credits, add or remove dependents, or claim missed tax credits or deductions.

Which form do I use to submit an amended tax return?

To submit an amended tax return, you typically use Form 1040-X.

Can I file an amended return electronically?

No, amended returns cannot be filed electronically; they must be mailed to the IRS.

How common is it for taxpayers to submit amended returns?

Around 2.5 million taxpayers submit corrected filings each year.

What are some common reasons for needing an amendment?

Common reasons for needing an amendment include overlooked deductions or changes in income, which can significantly affect tax liability.

How long does it take to process an amended return?

It may take longer than 12 weeks to process an amended return.

How can I check the status of my amended return?

You can check the status of your amended return by asking, 'Where are my amended taxes?'

What should I be aware of when submitting an amended return?

Be aware that some revised filings may require extra scrutiny if they contain errors, are incomplete, lack signatures, or need more information.