Overview

We understand that dealing with tax refunds can be stressful, especially if you’ve overpaid. Did you know that the IRS pays interest on tax refunds when they’re not issued within 45 days of the tax deadline? This is an important aspect to consider, as it can provide some relief during a challenging time.

To qualify for this interest, there are a few conditions you need to meet:

- You must file your taxes on time.

- There has to be an overpayment.

- The IRS has specific processing timeframes that trigger interest compensation.

Knowing these details can empower you as a taxpayer.

It’s common to feel overwhelmed by the tax process, but you are not alone in this journey. If you find yourself in a situation where your refund is delayed, remember that you have rights. Understanding these can help you navigate the complexities of tax refunds with confidence.

If you have questions or need assistance, we’re here to help. Don’t hesitate to reach out for support. You deserve clarity and peace of mind regarding your tax situation.

Introduction

Navigating the complexities of tax refunds can feel overwhelming. We understand that many taxpayers worry about the nuances of interest payments from the IRS. If you've overpaid your taxes, the chance to receive interest on delayed refunds can be a silver lining, offering a unique opportunity to enhance your financial returns.

But you might be wondering: under what circumstances does the IRS actually pay interest on these refunds? And how can you ensure you qualify? This guide is here to help you explore the essential steps and conditions needed to navigate this often-overlooked aspect of tax refunds. You're not alone in this journey; we're here to empower you to take control of your financial entitlements.

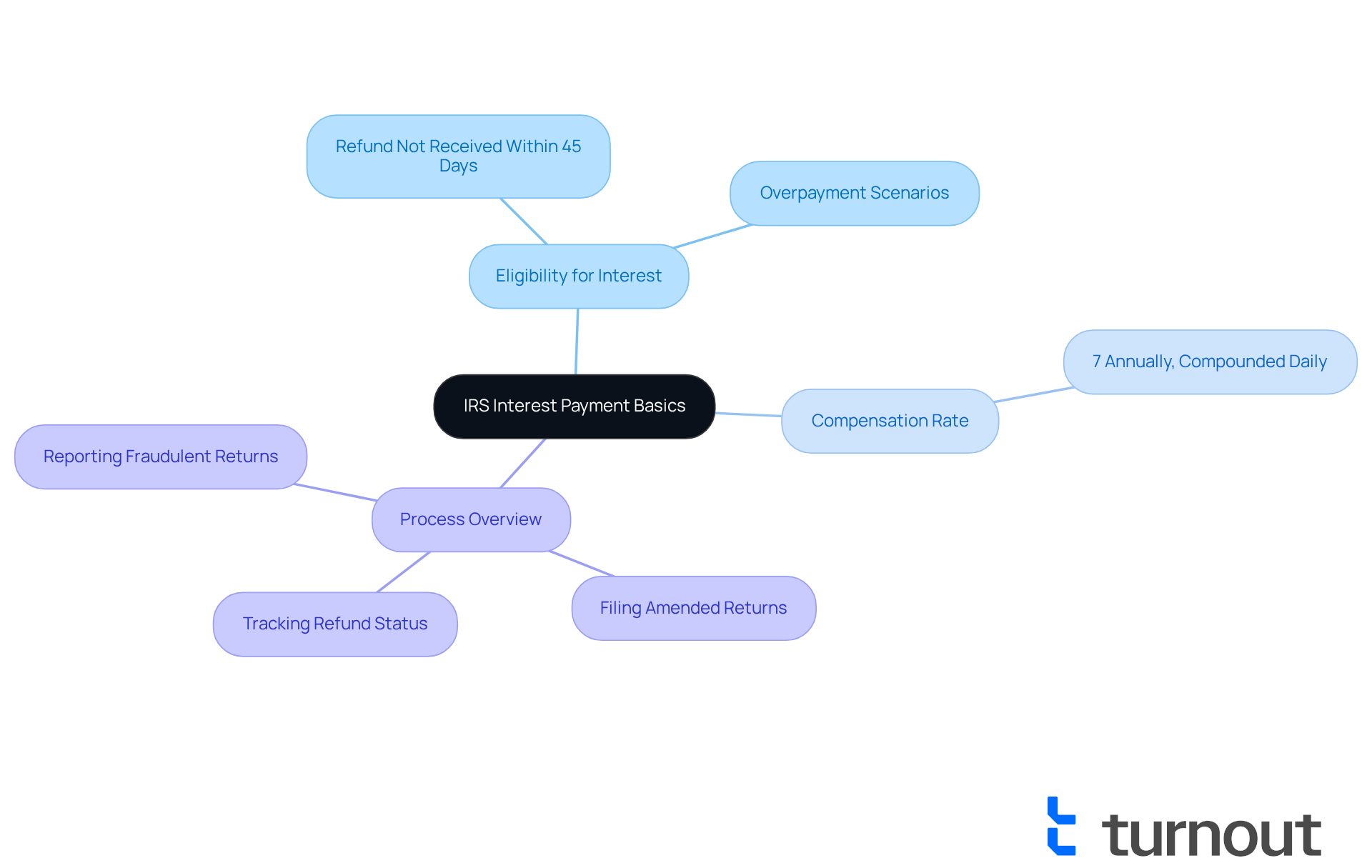

Understand IRS Interest Payment Basics

We understand that dealing with taxes can be overwhelming, especially when it comes to refunds. If you've paid more than necessary, you might be wondering about your options. The IRS does compensate for funds on tax returns in certain situations. Typically, if you pay more than you owe and the IRS doesn’t provide your refund within 45 days of the tax deadline, you may want to know when does the IRS pay interest on refunds, as you could be eligible for compensation on that refund.

The compensation rate is determined by the IRS's established rates, which are updated every three months. For 2025, the rate for overpayments is set at 7% annually, compounded daily. Knowing this can empower you as a taxpayer, helping you recognize your rights and the potential for additional compensation from the IRS.

It's common to feel uncertain about these processes, but you're not alone in this journey. Understanding these basics can make a significant difference. If you think you might be eligible, take a moment to explore your options. We're here to help you navigate this and ensure you receive what you deserve.

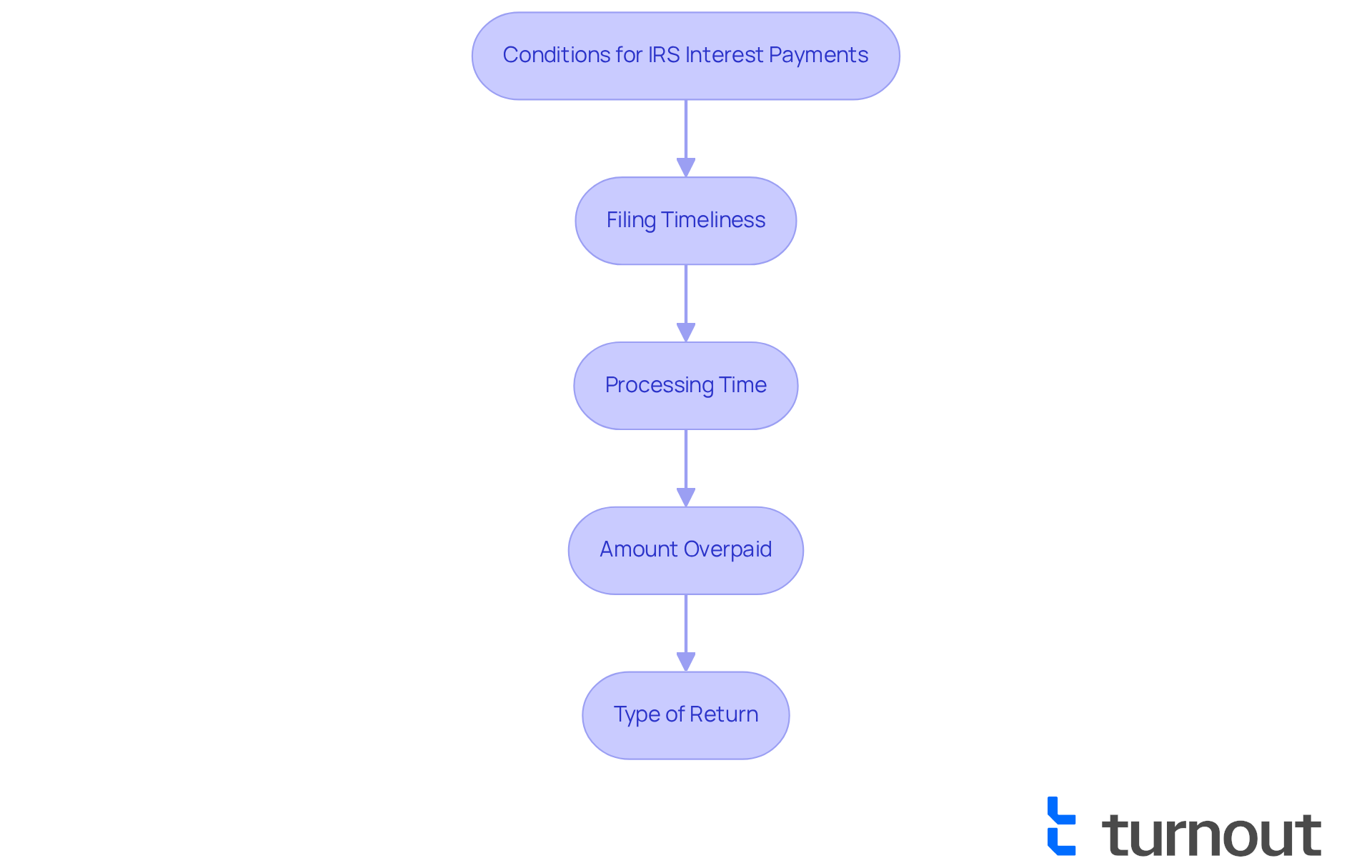

Identify Conditions for Interest Payments

We understand that navigating tax refunds can be stressful, and it's essential to know when does the IRS pay interest on refunds to qualify for that interest. Here are some key conditions to keep in mind:

- Filing Timeliness: It’s crucial to file your tax return on time, including any extensions. If you file late, you might lose your right to interest, particularly in terms of when does the IRS pay interest on refunds.

- Processing Time: The IRS needs to take longer than 45 days to process your refund after the tax deadline, which raises the question of when does the IRS pay interest on refunds? This includes both the original filing deadline and any extensions you may have requested.

- Amount Overpaid: You must have overpaid your taxes, leading to a refund. If you owe taxes, interest won’t apply.

- Type of Return: Typically, interest is paid on individual income tax returns. Different rules may apply to corporate returns or other types of filings.

In 2025, around 90% of taxpayers submitted their returns on time, which is vital for qualifying for these payments. For instance, if you submit your return by the April 15 deadline and the IRS doesn’t provide your refund within 45 days, you might be asking when does the IRS pay interest on refunds for that delayed amount.

As of Q2 2025, the rate for individual overpayments stands at 8%, compounded daily. Remember, any earnings you receive from the IRS are considered taxable income and should be reported on your next tax return. If you notice any inaccuracies in the earnings received, you have the right to contest them. It’s also important to keep in mind that the IRS updates its rates every three months, which can affect the total amount of overdue payments.

Understanding these conditions can help you manage your expectations regarding IRS compensation payments. You are not alone in this journey; we’re here to help you navigate through it.

Track Your Refund and Interest Status

To effectively track your refund and any potential interest payments, follow these essential steps:

-

Use the IRS 'Where's My Refund?' Tool: This online resource allows you to verify the status of your reimbursement. Just enter your Social Security number, filing status, and the exact amount to access your information. Most tax returns are processed within 21 days after the IRS receives your submission, so this tool can provide timely updates.

-

IRS2Go Mobile App: Download the IRS2Go app for convenient mobile access to your payment status. This app offers real-time updates and is designed for easy navigation, making it simpler to stay informed. The IRS voicebot has helped thousands of callers, showing how effective the app is in providing quick information.

-

Reach out to the IRS: If your reimbursement hasn’t arrived within the expected timeframe, you can contact the IRS at 1-800-829-1040 for assistance. Be prepared to share your personal information and details about your tax return to help with your inquiry. Remember, when considering your reimbursement, it's important to note that contacting the IRS about when does the IRS pay interest on refunds won’t speed up the process, as the information available via the hotline is the same as what you’ll find using the 'Where's My Refund?' tool.

-

Track Payment Returns: If your reimbursement is delayed beyond 45 days, keep an eye on the IRS's rate announcements to understand how much compensation you may qualify for. This is especially important since the IRS cannot provide reimbursements related to the Earned Income Tax Credit or Additional Child Tax Credit before mid-February.

By diligently monitoring your reimbursement, you can ensure that you receive any payment due to you in a timely manner. Utilizing tools like the IRS2Go app and the 'Where's My Refund?' tool can significantly enhance your ability to manage your tax return status effectively. Remember, you’re not alone in this journey, and we’re here to help you every step of the way.

![]()

Navigate Exceptions and Common Issues

Many taxpayers may qualify for interest on their refunds, but it’s important to be aware of some exceptions and common issues that can arise:

-

Revised Returns: If you submit a revised return, the 45-day timer for payment of accrued charges resets. If the IRS takes longer than 45 days to process your revised return, you may be interested in knowing when does the IRS pay interest on refunds for the payment from the amended return. For example, if you submit a revised return on August 1 for an extra payment of $1,000, the IRS must provide the payment by September 15. If this schedule is surpassed, additional charges would accumulate.

-

Identity Verification Delays: We understand that if the IRS requires confirmation of your identity, this can delay your reimbursement and earnings. The IRS sends letters to taxpayers whose returns are flagged for potential identity theft, which can further postpone processing. Make sure all information provided is accurate to minimize these delays.

-

Outstanding Debts: It’s common to feel concerned if you have additional obligations to the IRS, like unpaid taxes or penalties. Your reimbursement might be allocated to those debts, which can affect your qualification for earnings. This means that even if you are eligible for earnings, they might not be disbursed if your payment is reduced due to these debts.

-

IRS Processing Errors: Occasionally, the IRS may make mistakes that delay payments. If you suspect an error, don’t hesitate to contact the IRS to resolve the issue promptly.

By being aware of these exceptions and common issues, you can better navigate the complexities of IRS payment calculations and know when does the IRS pay interest on refunds to ensure you receive what you are owed. As of Q2 of 2025, the interest rate for overpayments of tax is 7% per year, compounded daily. This highlights the financial implications of delayed refunds, and we’re here to help you understand your rights and options.

Conclusion

Understanding when the IRS pays interest on refunds is crucial for taxpayers like you, who are navigating the complexities of tax returns and potential overpayments. If a refund isn’t issued within 45 days after filing, you may be eligible for interest compensation. This can significantly enhance your overall refund amount. By being informed about the IRS's established rates and conditions, you can advocate for your rights and ensure you receive what you are owed.

Throughout this guide, we’ve discussed essential points, including:

- The conditions necessary for interest payments

- How to track refund statuses

- Common issues that may arise

Timely filing, processing delays, and the nature of your tax return all play pivotal roles in determining your eligibility for interest. Additionally, understanding the impact of revised returns and identity verification processes can help you prevent unnecessary delays in receiving your refunds and interest.

Ultimately, staying proactive and informed about IRS policies and procedures can make a substantial difference in your tax refund experience. We encourage you to utilize available tools like the IRS 'Where's My Refund?' feature and the IRS2Go app to track your refund status effectively. By being diligent and aware of your rights, you can navigate the intricacies of tax refunds and interest payments with confidence, ensuring you maximize your financial outcomes. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

When does the IRS pay interest on tax refunds?

The IRS pays interest on tax refunds if you have paid more than you owe and the refund is not issued within 45 days of the tax deadline.

How is the interest rate for IRS refunds determined?

The interest rate for IRS refunds is established by the IRS and is updated every three months.

What is the interest rate for overpayments in 2025?

The interest rate for overpayments in 2025 is set at 7% annually, compounded daily.

What should I do if I think I might be eligible for interest on my tax refund?

If you believe you might be eligible for interest on your tax refund, take a moment to explore your options and understand your rights as a taxpayer.