Introduction

Tax season can feel like a daunting maze, can’t it? We understand that navigating the complexities of filing can be overwhelming, especially when considering the consequences of failing to file. The penalties imposed by the IRS for late submissions can escalate quickly, leading to financial burdens that many may not fully grasp.

What happens when deadlines are missed? It’s common to feel anxious about the potential fallout. But don’t worry; there are ways to safeguard yourself from these costly consequences. This article delves into the intricacies of tax filing penalties, exploring their historical evolution and key characteristics. We’ll also discuss the serious implications of neglecting to file, ultimately guiding you toward informed decision-making in your tax responsibilities. Remember, you are not alone in this journey, and we’re here to help.

Defining Tax Filing Penalties

Tax submission charges can feel overwhelming, especially when deadlines loom. We understand that life can get busy, and sometimes tax documents slip through the cracks. However, it’s important to be aware of what's the penalty for not filing taxes, as enforced by the Internal Revenue Service (IRS) for late submissions.

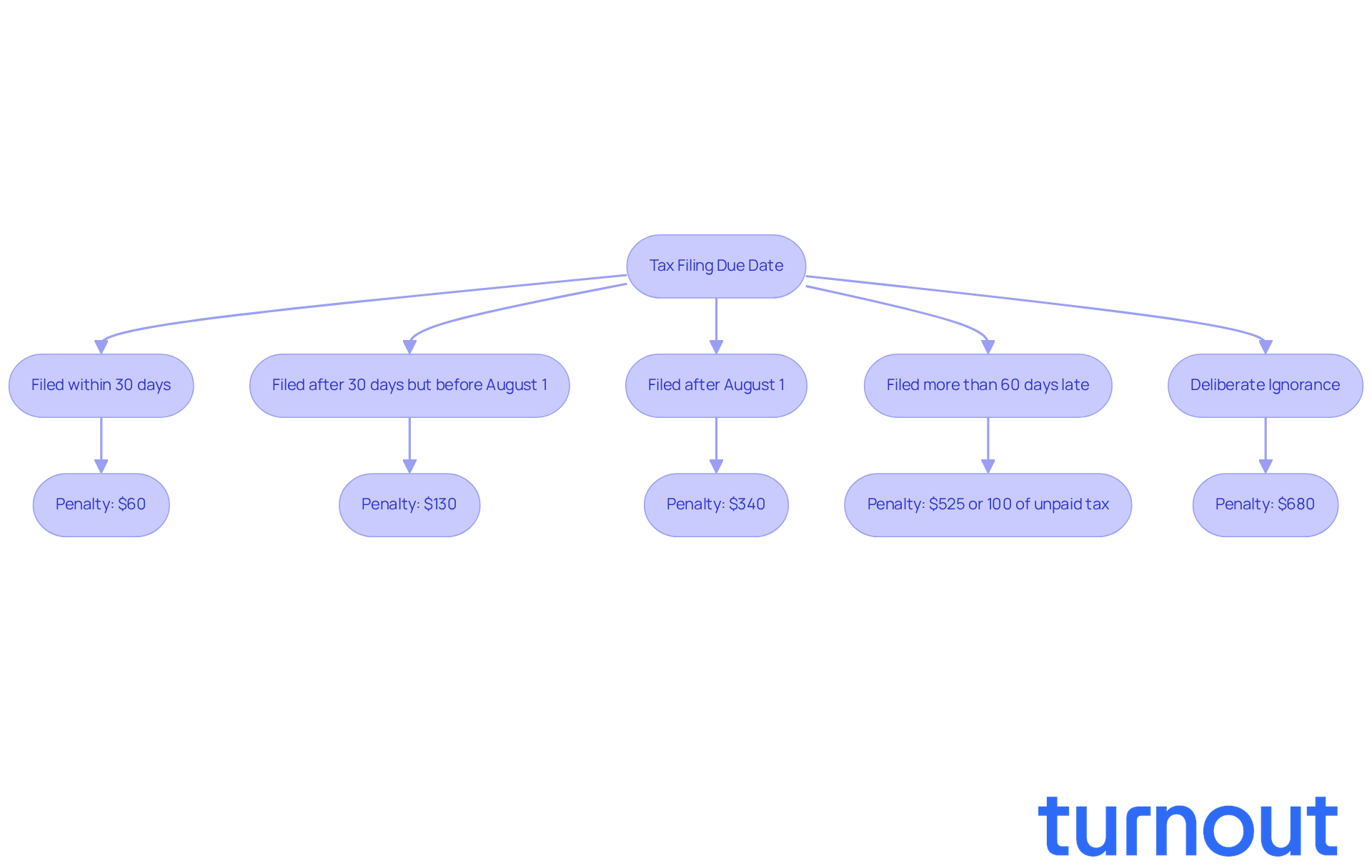

The main charge for not submitting your tax documents on time is typically 5% of the owed tax for each month, or part of a month, that your submission is overdue, capped at a maximum of 25%. If you find yourself filing more than 60 days late in 2026, the minimum fee jumps to $525 or 100% of the unpaid tax, whichever is lower.

If you submit within 30 days past the due date, a fee of $60 applies. After 30 days but before August 1, the charge increases to $130. Submissions made after August 1 can incur a hefty fee of $340 for each filing. It’s crucial to note that if you deliberately ignore filing requirements, you could face a staggering fee of $680 per return, with no maximum limit.

Additionally, the IRS charges interest on unpaid fines until they are fully paid, which can add to your financial burden. It's vital to understand what's the penalty for not filing taxes to help you avoid unnecessary strain and legal complications. Remember, you’re not alone in this journey; we’re here to help you navigate these challenges.

Understanding the Consequences of Not Filing Taxes

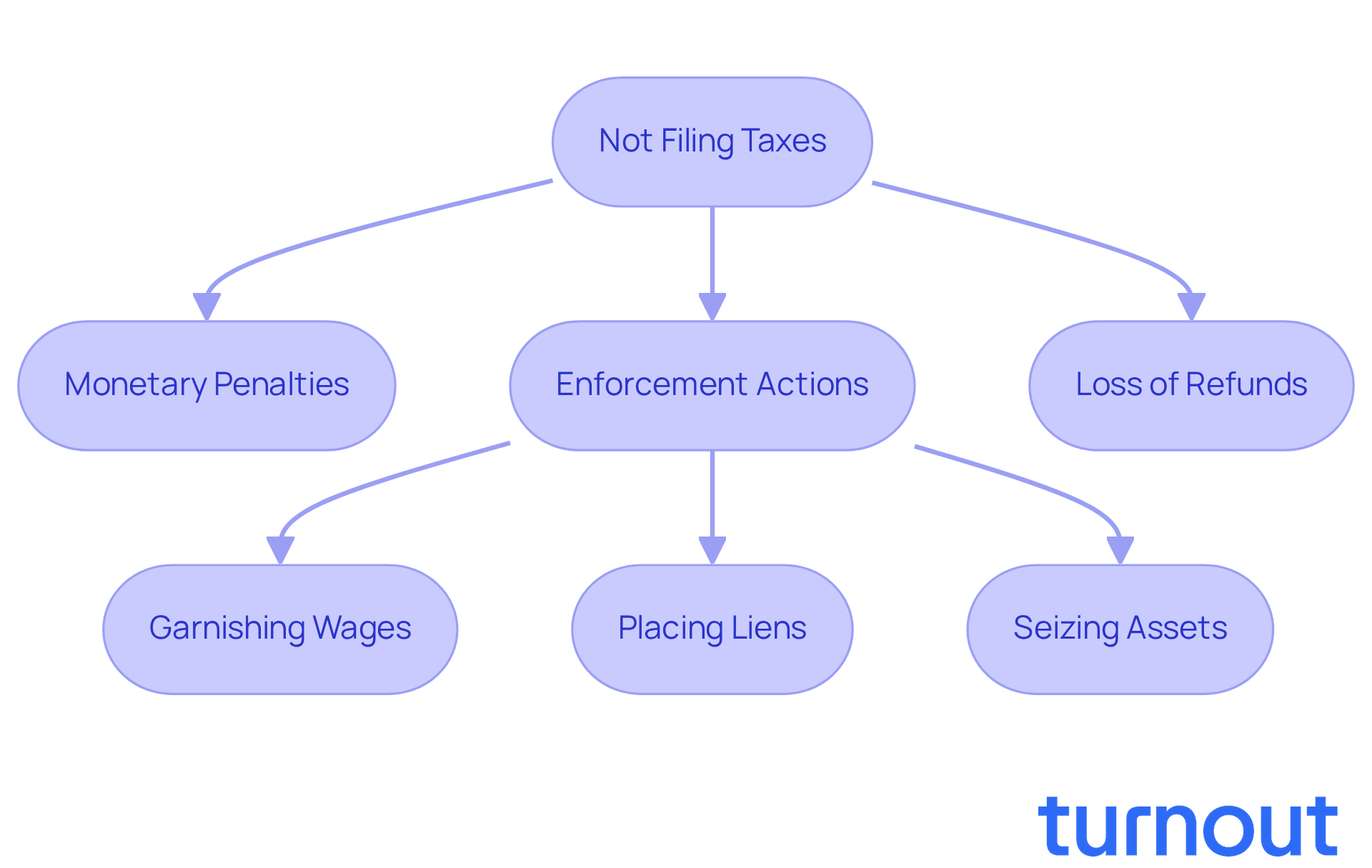

Neglecting to submit required financial documents can lead to serious repercussions, including concerns about what's the penalty for not filing taxes, that go beyond just monetary fines. We understand that dealing with taxes can be overwhelming, and individuals may find themselves facing escalating interest on unpaid taxes. This interest compounds monthly, significantly increasing the total amount owed.

The IRS has the authority to take aggressive enforcement actions, which can include:

- Garnishing wages

- Placing liens on property

- Seizing assets

It's common to feel anxious about these possibilities. Moreover, taxpayers who neglect to file risk losing out on potential refunds or credits, which can further strain their financial situation. Remember, you must file within three years of the return due date to claim any refund. Sadly, millions of taxpayers miss out on refunds each year due to unfiled returns.

In extreme cases, willful failure to file can lead to criminal charges, prompting individuals to wonder what's the penalty for not filing taxes, which may include hefty fines or imprisonment. Grasping these consequences is crucial for managing your responsibilities efficiently. We’re here to help you navigate this process and prevent increasing fines. You are not alone in this journey.

Historical Context of Tax Filing Penalties

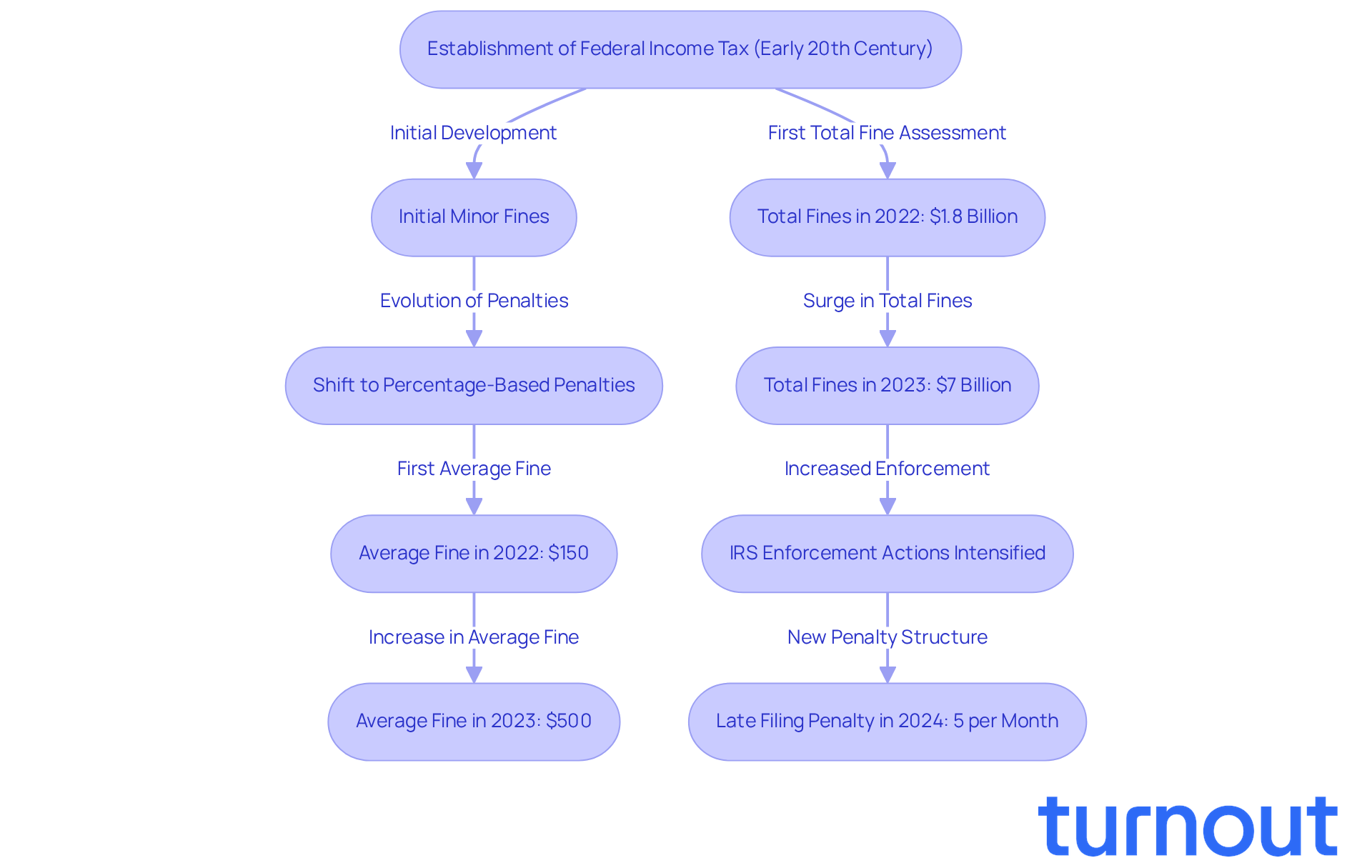

The origins of tax filing fines go back to the early 20th century, right when the federal income tax was established. Initially, these fines were quite minor, reflecting a new system of tax compliance. But as the importance of tax revenue grew, the IRS began to enforce stricter consequences, leading many to wonder what's the penalty for not filing taxes to encourage compliance. Over the years, these penalties have been adjusted not just for inflation but also to deter non-filing more effectively.

For example, the failure-to-file charge evolved from a small fixed amount to a percentage of unpaid dues. This change shows the government's commitment to ensuring everyone adheres to tax regulations. In 2024, the late submission charge will rise to 5% of unpaid taxes for each month a declaration is overdue, capped at 25%.

Moreover, the average tax fine has increased significantly, jumping from about $150 in 2022 to $500 in 2023. This shift highlights the serious financial implications of late filing, including what’s the penalty for not filing taxes. Jennifer Taylor pointed out that not filing a tax return can be an expensive mistake, which raises the question of what's the penalty for not filing taxes and reminds us of the importance of timely submissions.

This historical evolution illustrates how seriously tax compliance is treated today. It reflects broader fiscal policies aimed at ensuring government revenue stability. The IRS's enforcement actions have also intensified, with fines soaring from $1.8 billion in 2022 to a staggering $7 billion in 2023. This surge follows the agency's receipt of $80 billion in new federal funding in 2022.

We understand that navigating tax regulations can be overwhelming. You're not alone in this journey, and we're here to help you make sense of it all.

Key Characteristics of Tax Penalties

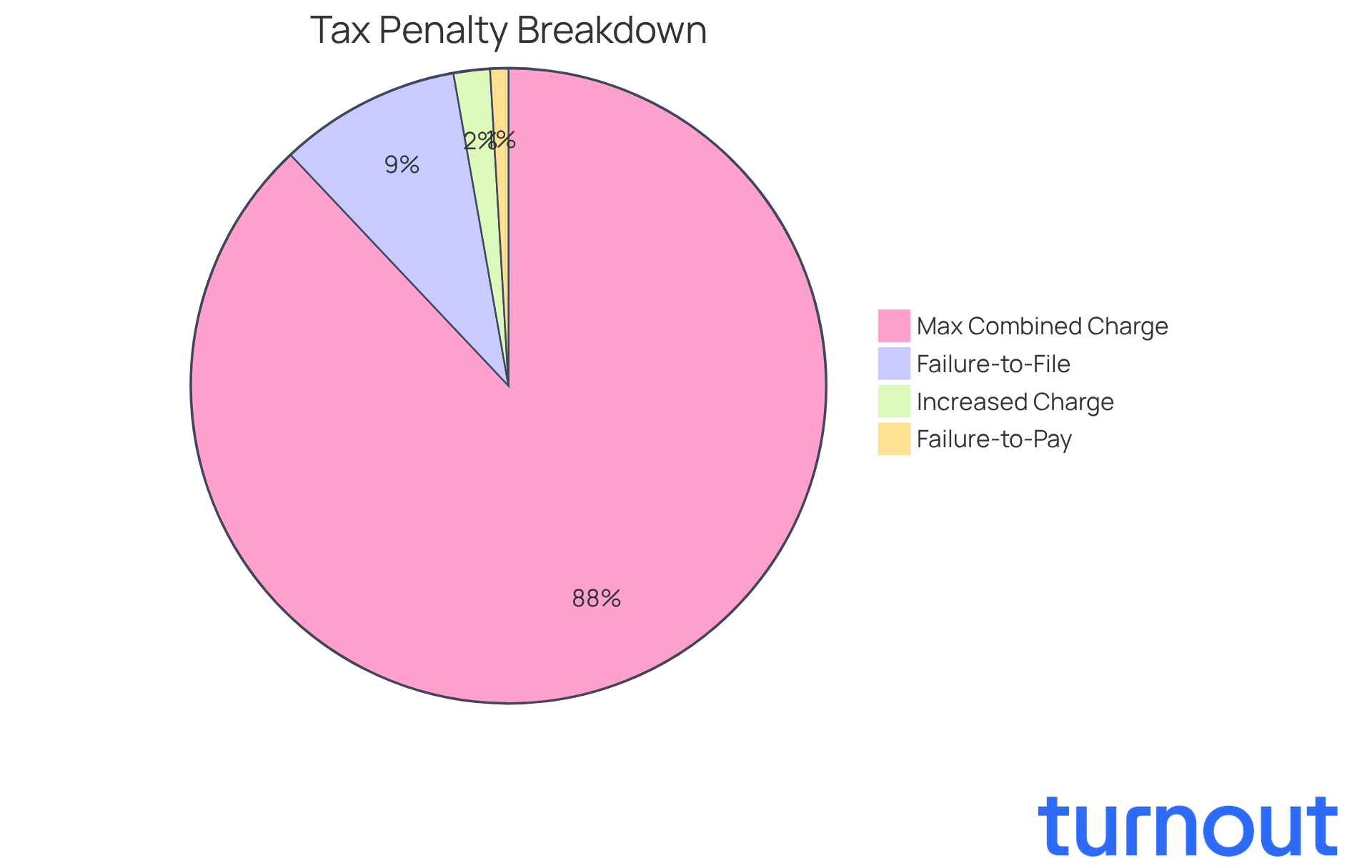

Understanding tax fines can feel overwhelming, and it's important to know what to expect. Key characteristics of these fines include their percentage-based structure, which varies depending on the type of sanction. For example, if you miss a filing deadline, the failure-to-file charge is 5% of the unpaid tax per month. On the other hand, the failure-to-pay charge is 0.5% per month, both capped at 25%.

We understand that it can be stressful when taxes remain unpaid. If the tax stays unpaid for over 10 days after receiving a notice of intent to levy, the failure-to-pay charge rises to 1% each month. Additionally, if both filing and payment are late, fines can compound, leading to a maximum combined charge of 47.5%.

It's also crucial to be aware that the IRS may impose a minimum fee if your return is over 60 days late. This fee can either be a fixed dollar amount or a percentage of the tax owed. Looking ahead to 2026, the IRS can impose fines that amount to 50% of the original tax owed over time.

We’re here to help you navigate these complexities. Understanding these characteristics is vital for managing your obligations and avoiding unnecessary penalties. Remember, you are not alone in this journey.

Conclusion

Understanding the penalties associated with not filing taxes is crucial for maintaining your financial health and staying compliant with IRS regulations. We know that the consequences of missing tax deadlines can feel overwhelming. They go beyond just monetary fines; they can lead to aggressive enforcement actions, escalating interest, and even the loss of potential refunds. Recognizing these implications empowers you to prioritize your tax responsibilities and avoid unnecessary stress.

Throughout this article, we’ve highlighted key points about the various penalties based on submission timing. The IRS imposes fees that can compound quickly. For instance, there’s an initial 5% charge for late filings, and the severe consequences of willful neglect can be daunting. The importance of timely tax submissions cannot be overstated. Additionally, the historical context provided emphasizes how tax penalties have evolved, underscoring the government's commitment to ensuring compliance and fiscal stability.

Ultimately, staying informed about the impact of not filing taxes is essential for anyone navigating their financial obligations. By understanding the potential repercussions, you can take proactive steps to file on time, seek assistance when needed, and safeguard your financial future. Embracing these responsibilities not only helps you avoid penalties but also fosters a sense of empowerment and control over your financial landscape. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is the main penalty for not filing taxes on time?

The main penalty for not submitting your tax documents on time is typically 5% of the owed tax for each month, or part of a month, that your submission is overdue, capped at a maximum of 25%.

What happens if I file my taxes more than 60 days late?

If you file more than 60 days late in 2026, the minimum fee increases to $525 or 100% of the unpaid tax, whichever is lower.

Are there specific fees for filing late within 30 days?

Yes, if you submit within 30 days past the due date, a fee of $60 applies.

What are the penalties for filing late after 30 days but before August 1?

After 30 days but before August 1, the penalty increases to $130.

What is the penalty for submissions made after August 1?

Submissions made after August 1 can incur a fee of $340 for each filing.

What is the penalty for deliberately ignoring filing requirements?

If you deliberately ignore filing requirements, you could face a penalty of $680 per return, with no maximum limit.

Does the IRS charge interest on unpaid fines?

Yes, the IRS charges interest on unpaid fines until they are fully paid, which can add to your financial burden.