Introduction

Many taxpayers are feeling the weight of increased scrutiny over personal finances, especially with the IRS keeping a closer eye on financial activities. We understand that this can be a source of anxiety. Knowing how deeply the IRS checks bank accounts is essential, as it can greatly affect your tax obligations and financial privacy.

What triggers these checks? It’s a common concern, and understanding this can help you protect yourself from potential audits. By exploring these important facets, you can navigate your financial responsibilities with confidence and clarity. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Defining IRS Bank Account Checks

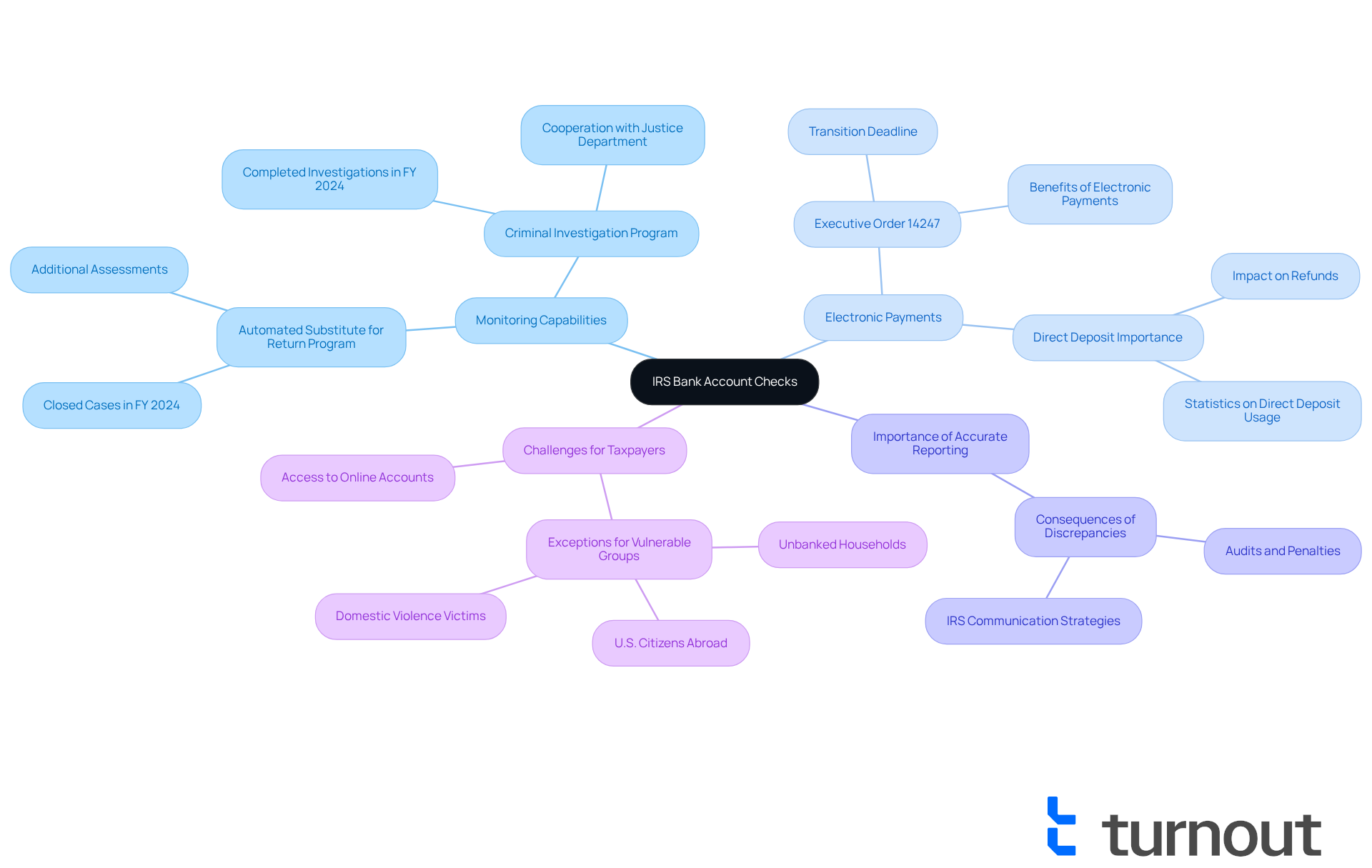

When discussing IRS account checks, one might wonder, does the IRS check your bank accounts to gather information about individuals' balances, transactions, and financial activities? We understand that this scrutiny can feel overwhelming, especially when it comes to tax compliance and enforcement. The IRS uses various methods to obtain this information, particularly when investigating potential tax evasion or verifying accurate income reporting. In fiscal year 2024, the IRS closed over 505,514 tax return audits, resulting in more than $29 billion in recommended additional taxes. This highlights the agency's active role in monitoring financial activities, and it’s important to be aware of how this might affect you.

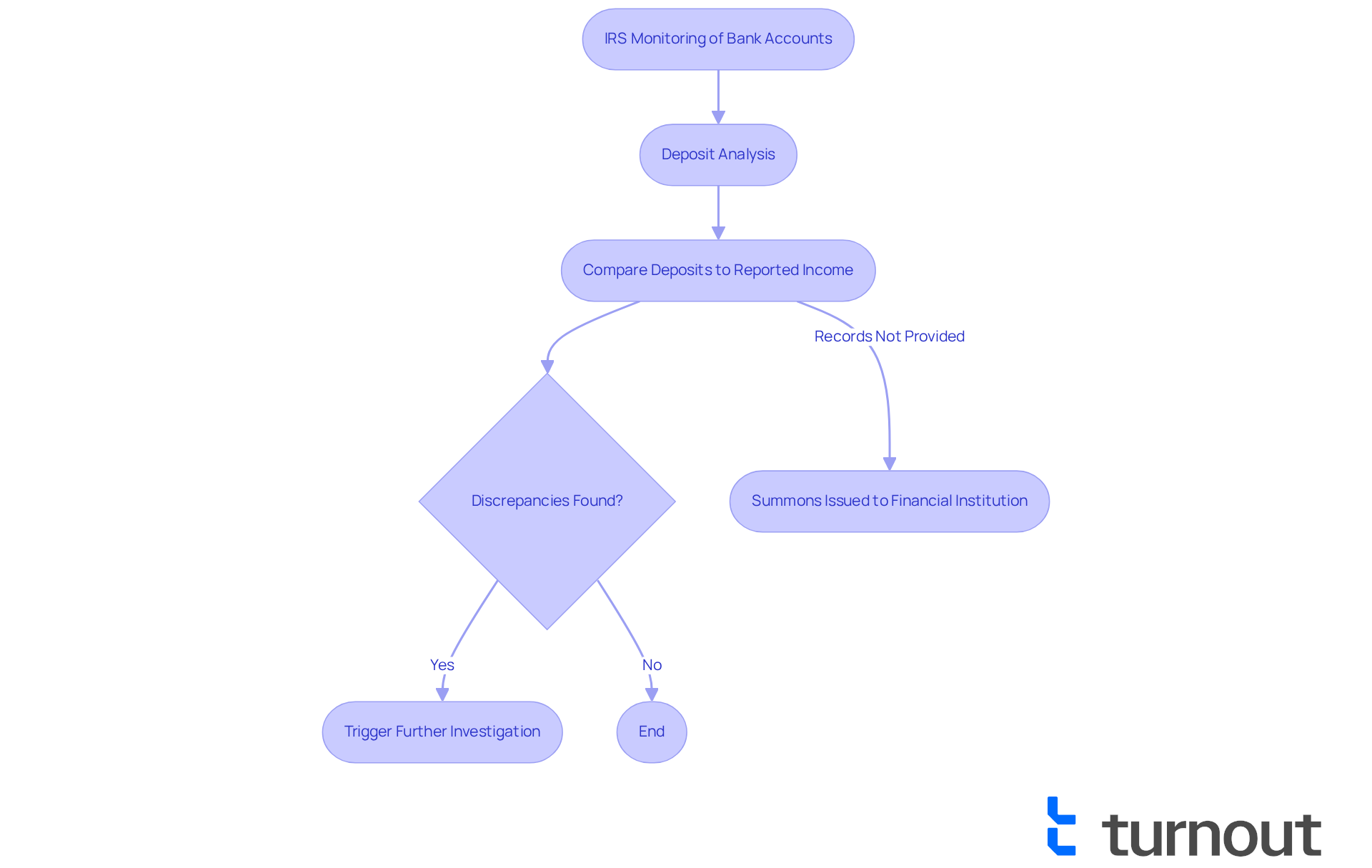

One key mechanism the IRS uses to access account information is the Deposit Analysis. This process compares total deposits to reported income on tax returns. If there are discrepancies, it can trigger further investigations, leading to additional tax assessments. For instance, if the IRS suspects unreported income, it may look into unexplained cash deposits in your account. This underscores the importance of keeping thorough records of all financial transactions. Accurate reporting is crucial to avoid penalties during audits, and we’re here to help you navigate this process.

Real-world instances show how the IRS operates. If you don’t provide the requested financial records by the IRS deadline, the agency can issue a summons to your financial institution to obtain the necessary information. Additionally, financial institutions are required to report interest earned over $10 to the IRS using Form 1099-INT. This ensures that the agency stays informed about individuals' financial activities, which can feel daunting.

As a tax expert from H&R Block notes, "If you’re in this situation, it’s likely that you’re entangled in a serious tax issue that requires a tax professional’s help." Understanding these mechanisms is crucial for you, particularly in relation to whether the IRS does check your bank accounts, as this can significantly impact your financial obligations and adherence to tax regulations. Remember, you are not alone in this journey; seeking assistance can make a world of difference.

Context and Importance of IRS Bank Account Checks

The IRS's power to perform account inspections stems from its vital role in upholding tax regulations and ensuring compliance. We understand that as concerns about tax evasion grow, the agency has stepped up its monitoring capabilities. This is especially true as it transitions from paper checks to electronic payment methods, mandated by Executive Order 14247, which requires all federal disbursements to shift to electronic payments by September 30, 2025. This shift isn’t just a procedural change; it reflects a broader strategy to streamline operations and enhance payment security. In fact, electronic payments are 16 times less likely to be lost, stolen, returned, or altered compared to traditional Treasury checks.

For those of you who pay taxes, it is crucial to understand what it means when we ask, does the IRS check your bank accounts? Accurate reporting is essential, as discrepancies can lead to audits or penalties. In FY 2024, the IRS closed over 442,000 cases under its Automated Substitute for Return Program, showcasing its commitment to identifying noncompliance and ensuring tax obligations are met. With about 94 percent of individual filers providing direct deposit information during the 2025 filing season, it’s clear that keeping accurate banking details is vital. If you don’t provide direct deposit information or request an exception, you may face delays in receiving your refunds, which can significantly impact your financial situation.

Case studies reveal the challenges faced by various groups of taxpayers. For example, U.S. citizens living abroad often find it difficult to access U.S. financial institutions, necessitating exceptions to ensure they receive their refunds. Similarly, individuals from unbanked households-about 4.2 percent of U.S. households-rely on paper checks, highlighting the need for the IRS to accommodate those unable to provide electronic banking information. The National Taxpayer Advocate emphasizes that exceptions must be accessible, clearly communicated, and fairly administered to support vulnerable groups.

As the IRS continues to refine its processes, we encourage you to stay informed about your rights and responsibilities. Understanding whether the IRS checks your bank accounts can empower you to manage your finances proactively, reducing the risk of complications that could arise from noncompliance. Remember, you are not alone in this journey; we’re here to help.

How IRS Bank Account Checks Are Issued and Processed

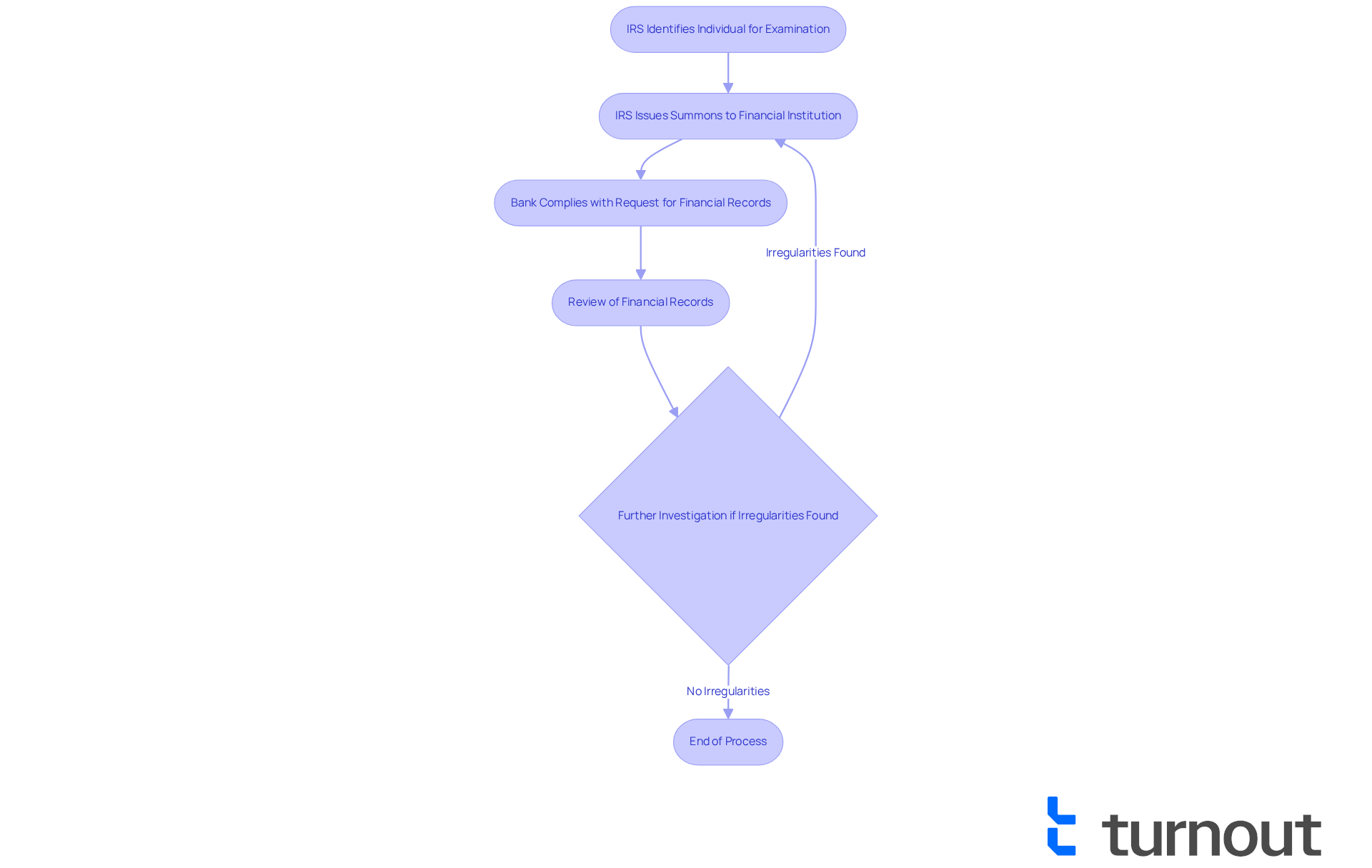

We understand that dealing with IRS account checks raises the question of whether the IRS checks your bank accounts, which can be daunting. Typically, during audits or investigations when there are concerns about discrepancies in reported income or tax obligations, a question that arises is, does the IRS check your bank accounts? The process begins when the IRS identifies an individual for examination, often triggered by warning signs like substantial cash deposits or inconsistencies between declared income and financial activity.

Once a case is opened, the IRS may issue a summons to the financial institution to determine if the IRS checks your bank accounts, requesting access to the individual's financial records, including transaction histories and account balances. It's important to know that banks are legally required to comply with requests related to whether the IRS checks your bank accounts. If any irregularities are found, it could lead to further investigation.

In FY 2024, the IRS processed over 266.6 million tax returns and other forms. This statistic highlights the scale of their operations and underscores the importance of compliance. Understanding this process is vital for you, as it emphasizes the need to maintain precise financial records and to know whether the IRS checks your bank accounts.

For instance, a well-prepared analysis of your bank deposits can make the review process smoother and help ensure accurate income reporting. As discussed in the case study 'Steps to Prepare for IRS Bank Deposit Analysis,' organizing your financial records effectively can significantly assist you in navigating IRS audits.

Additionally, with the IRS collecting over $5.1 trillion in gross taxes, the implications of accurate reporting and compliance become even more critical for taxpayers. Remember, you're not alone in this journey. We're here to help you understand and manage your financial responsibilities.

Common Questions and Issues with IRS Bank Account Checks

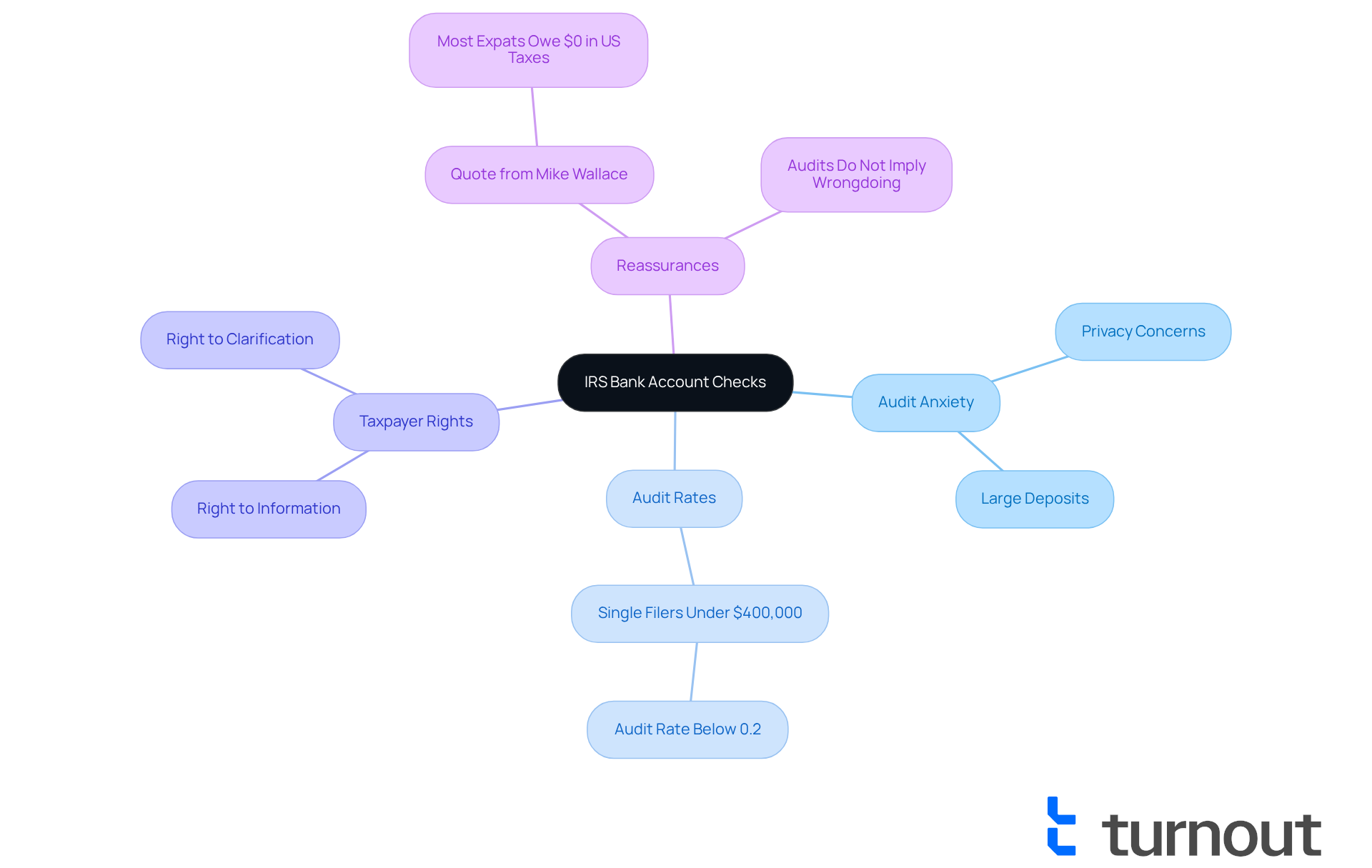

Taxpayers often feel anxious about IRS account inspections, especially regarding their privacy and the extent of the IRS's authority. We understand that while the IRS doesn't constantly monitor bank accounts, there are situations where it does check your bank accounts, particularly during audits. It's common to worry about being audited due to large deposits or unusual transactions. However, it's important to know that maintaining proper documentation and being transparent in your financial dealings can significantly lower these risks.

For instance, did you know that the audit rate for single filers with incomes under $400,000 is extremely low, typically below 0.2%? This statistic highlights that most individuals, including expats, face minimal audit risk when they file accurately and report all income. Furthermore, the IRS has assured that there will be no increase in audit rates for small businesses and taxpayers under this income threshold, which can help ease your concerns.

It's also vital to remember that taxpayers have rights during an IRS inquiry. You have the right to be informed about the information being requested and to seek clarification on any issues. As Mike Wallace, CEO at Greenback Expat Tax Services, wisely states, "With proper reporting and the right tax protections, most expats owe $0 in US taxes in 2025-and face minimal audit risk from what triggers IRS attention." This knowledge empowers you to engage with the IRS confidently and responsibly, ensuring you're prepared to address any inquiries that may arise.

Additionally, understanding that being audited doesn't imply wrongdoing can help alleviate fears. Most audits can be resolved with proper documentation. Remember, you're not alone in this journey; we're here to help you navigate these concerns with ease.

Conclusion

Understanding the complexities of IRS bank account checks is vital for taxpayers who care about their financial privacy and tax compliance. We know that the IRS uses various methods to monitor financial activities, especially when there are discrepancies between reported income and actual bank deposits. By being aware of these processes, you can take charge of your financial records and navigate the intricacies of tax obligations more effectively.

Throughout this article, we've highlighted several key points:

- The IRS relies on deposit analysis to spot potential tax evasion.

- Banks are legally required to comply with IRS inquiries.

- Keeping thorough documentation is essential.

- Real-world examples show how IRS scrutiny can affect taxpayers, emphasizing the need for transparency and accurate reporting in financial dealings.

- Understanding your rights during audits can ease your worries and help you approach IRS inquiries with confidence.

Ultimately, staying informed about IRS bank account checks is crucial in today’s financial landscape. We encourage you to take proactive steps, like consulting with tax professionals and maintaining precise records, to reduce the risks of noncompliance. Embracing this knowledge not only enhances your financial security but also builds your confidence in managing your tax responsibilities. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

Does the IRS check my bank accounts for information about my financial activities?

Yes, the IRS can check your bank accounts to gather information about balances, transactions, and financial activities, particularly when investigating potential tax evasion or verifying income reporting.

How does the IRS obtain information about my bank account?

The IRS uses various methods, including Deposit Analysis, which compares total deposits to reported income on tax returns. Discrepancies can trigger further investigations.

What happens if the IRS suspects unreported income?

If the IRS suspects unreported income, it may investigate unexplained cash deposits in your account, leading to potential additional tax assessments.

What are the consequences of not providing requested financial records to the IRS?

If you do not provide the requested financial records by the IRS deadline, the agency can issue a summons to your financial institution to obtain the necessary information.

Are financial institutions required to report any interest earned on accounts?

Yes, financial institutions must report interest earned over $10 to the IRS using Form 1099-INT, which helps the agency stay informed about individuals' financial activities.

What should I do if I feel overwhelmed by the IRS's scrutiny of my financial activities?

It is advisable to seek help from a tax professional, especially if you are entangled in a serious tax issue, as they can provide guidance and support in navigating the situation.