Overview

The PATH Act 2025 is designed with your concerns in mind, aiming to enhance tax refund security and combat fraud. We understand that waiting for your tax refund can be stressful, especially when it involves claims related to the Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC). To ensure that only eligible individuals receive these important credits, refunds will be delayed until after February 15.

This approach not only protects you but also gives the IRS additional time to verify claims. By doing so, we can work together to improve the overall integrity of the tax system, ensuring that you receive the support you deserve. Remember, you are not alone in this journey; we are here to help you navigate these changes with confidence.

Introduction

The Protecting Americans from Tax Hikes (PATH) Act stands as a vital piece of legislation designed to support taxpayers during the often challenging tax season. We understand that navigating tax complexities can be overwhelming. By extending essential tax credits and implementing strong anti-fraud measures, the PATH Act aims to expedite refunds for those claiming the Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC). Additionally, it addresses the critical issue of identity theft within the tax system.

As you navigate these changes, questions may arise:

- How will these provisions affect the timing of your refunds?

- What steps can you take to ensure compliance while still accessing the financial support you need?

You're not alone in this journey, and we're here to help.

Define the PATH Act: Key Objectives and Legislative Intent

The , enacted in December 2015, is here to provide you with stability and protection. It extends various and implements , addressing the concerns many individuals face during tax season. One of the key goals of the PATH Act is to ensure that you receive your , especially if you are claiming the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC). We understand that .

By postponing reimbursements for certain claims until the end of February, the Act aims to reduce . This measure is designed to protect your interests and enhance the integrity of the tax system. You are not alone in this journey; the PATH Act is here to support you every step of the way. Rest assured, the measures put in place are meant to safeguard your hard-earned money and provide peace of mind during tax season.

Context and Evolution: The Journey of the PATH Act

What is , which emerged from growing concerns about tax fraud and the need for ? We understand that many individuals faced , particularly those claiming the EITC and ACTC. This legislative journey began with heartfelt discussions about what is [[the PATH Act 2025](https://investopedia.com/terms/p/path-act.asp)](https://optimataxrelief.com/blog/what-is-the-path-act) and the need for reforms to . What is the PATH Act 2025, which was designed not only to expand crucial tax credits but also to introduce anti-fraud measures that ultimately benefit millions?

Over the years, what is the PATH Act 2025 has undergone various amendments to adapt to the changing economic landscape and the needs of individuals. This reflects a continuous commitment to protecting American citizens. You are not alone in this journey; we’re here to help ensure that your tax experience is as smooth and secure as possible.

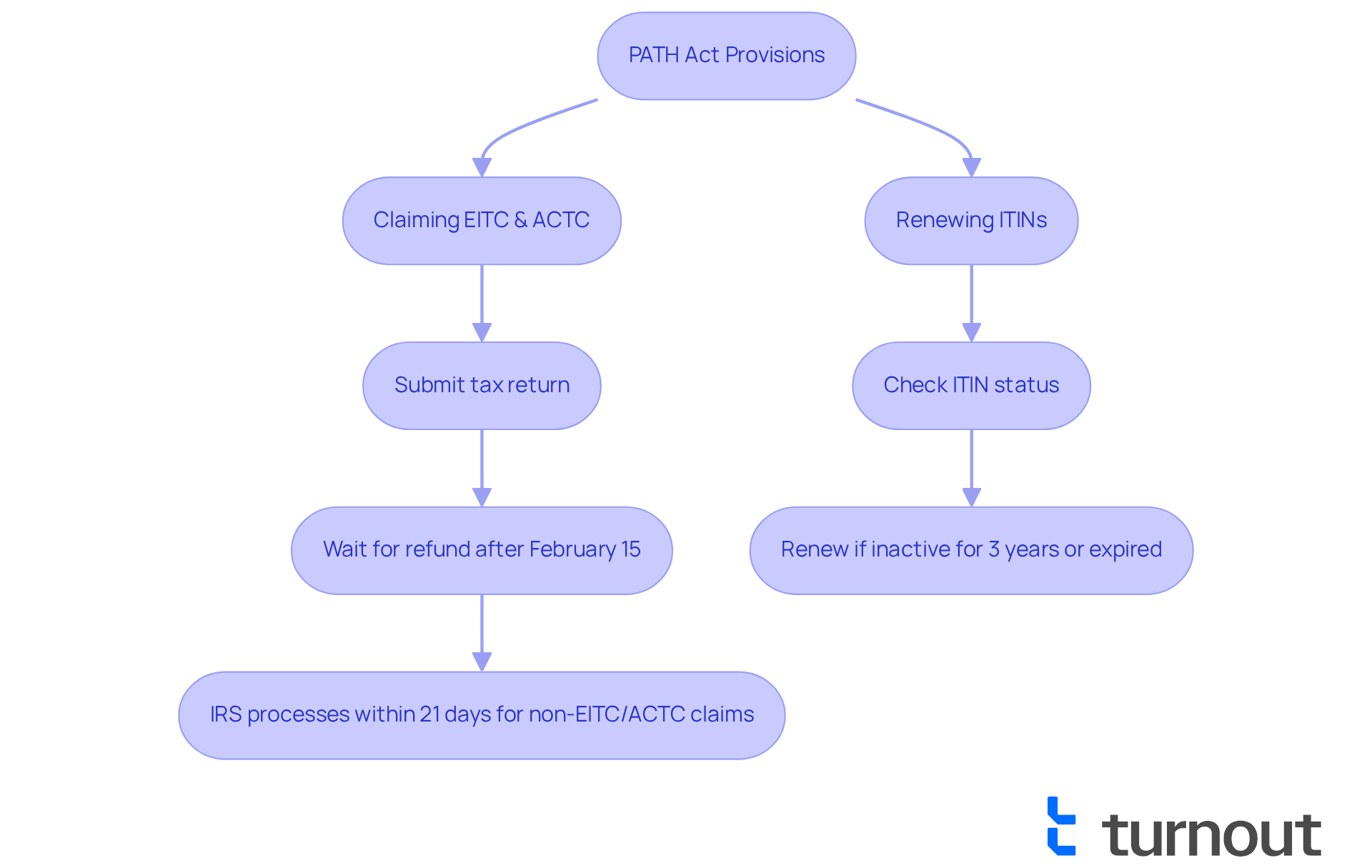

Provisions of the PATH Act: What It Means for Taxpayers

What is the , and how does it introduce several critical provisions that significantly affect individuals who pay taxes? We understand that can be overwhelming, and a key change to note is the requirement for the IRS to hold refunds for returns claiming the or the Additional Child Tax Credit (ACTC) until after February 15. This postponement is intended to provide the IRS extra time to confirm claims and tackle fraud, ensuring that only qualified individuals receive these credits. In 2023, around 23 million qualifying workers and families benefited from these tax credits, which allocated approximately $57 billion. This emphasizes the significance of these credits for individuals with low to moderate income.

Moreover, the Act enforces stricter rules for (ITINs). If you haven’t used your ITIN in three years or if it has expired, you must renew it. This requirement is crucial for maintaining valid identification for tax purposes. By doing so, we aim to enhance the integrity of the tax system while ensuring that qualified individuals can access the credits they deserve.

We recognize that the may cause some frustration, especially when considering what is the PATH Act 2025. However, these measures are designed to . Experts highlight that although these delays might be inconvenient, they are crucial for safeguarding the interests of the public. The IRS generally processes most refunds within 21 days for claims not associated with the earned income tax credit or additional child tax credit. However, those claiming these credits should anticipate their refunds to be issued only after mid-February, irrespective of when they submitted their applications.

This measure is part of a broader effort to enhance compliance and assistance for individuals navigating the complexities of the tax system. Remember, you are not alone in this journey; understand these changes and ensure you receive the support you need.

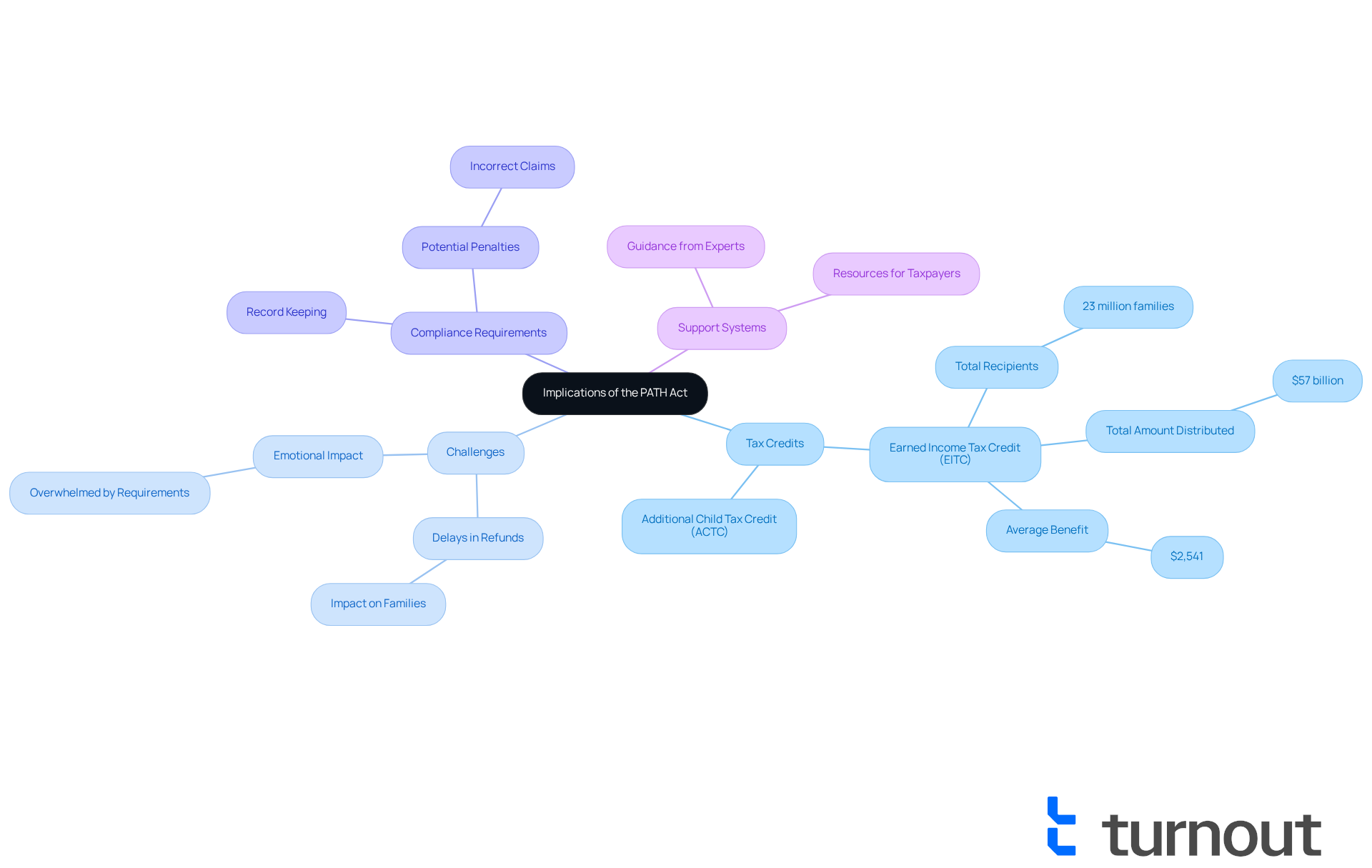

Implications of the PATH Act: Effects on Tax Refunds and IRS Processes

The implications of what is are significant for taxpayers, particularly for those who rely on the and the Additional Child Tax Credit for financial stability. We understand that can create serious challenges for families relying on these credits to cover essential expenses. As of December 2023, nearly 23 million qualified workers and families received approximately $57 billion in , with an average benefit of about $2,541 per recipient for the tax year 2022. This is crucial for many, as the EITC and Child Tax Credit together lifted 10.6 million people above the SPM poverty line.

However, what is the PATH Act 2025's focus on fraud prevention may lead to . This means individuals must keep detailed records and comply rigorously with IRS guidelines. It's common to feel overwhelmed by these requirements. Additionally, the Act imposes penalties for clients who incorrectly claim refundable credits exceeding their tax liabilities, highlighting the potential consequences of non-compliance.

While the Act aims to protect against fraudulent claims, it also underscores the need for taxpayers to understand what is the PATH Act 2025 and to in receiving their refunds. Remember, you're not alone in this journey. and financial support, providing expert guidance to help disabled individuals .

Real-world examples show that many families face hardships due to these delays. It's essential to be proactive and informed as you navigate the complexities of tax credits under the new regulations. We're here to help you through it all.

Conclusion

The PATH Act 2025 is a vital legislative measure designed to offer taxpayers enhanced protections and stability during tax season. We understand that tax time can be stressful, especially for those claiming the Earned Income Tax Credit and the Additional Child Tax Credit. This Act aims to ensure you receive the financial support you rely on while effectively combating tax fraud. Striking a balance between efficiency and security is essential for fostering trust in the tax system.

Key insights reveal the PATH Act's objectives, such as:

- Postponing refunds to facilitate thorough verification

- Enforcing stricter rules for Individual Taxpayer Identification Numbers

These measures aim to protect vulnerable populations, particularly those with low to moderate incomes. However, it’s important to recognize that these provisions also require greater diligence from individuals to comply with new requirements and avoid penalties.

Understanding the PATH Act 2025 is crucial for both taxpayers and benefits seekers. As the landscape of tax legislation evolves, being informed and proactive can help mitigate the challenges posed by delayed refunds and stringent compliance measures. Remember, you are not alone in this journey. Engaging with available resources and support systems can empower you to navigate these complexities effectively, ensuring you benefit from the protections and credits that are rightfully yours.

Frequently Asked Questions

What is the PATH Act?

The Protecting Americans from Tax Hikes (PATH) Act, enacted in December 2015, is legislation aimed at providing stability and protection during tax season by extending various tax credits and implementing measures to combat tax fraud.

What are the key objectives of the PATH Act?

The key objectives of the PATH Act include ensuring timely refunds for taxpayers, particularly those claiming the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), and reducing identity theft and fraudulent claims.

How does the PATH Act address tax fraud?

The PATH Act addresses tax fraud by postponing reimbursements for certain claims until the end of February, which helps to reduce the risk of identity theft and enhances the integrity of the tax system.

Why are timely refunds important according to the PATH Act?

Timely refunds are important as they are crucial for the financial well-being of individuals, especially those who rely on credits like the EITC and ACTC.

What measures does the PATH Act implement to protect taxpayers?

The PATH Act implements measures designed to safeguard taxpayers' interests, enhance the integrity of the tax system, and provide peace of mind during the tax season by reducing fraudulent claims.