Introduction

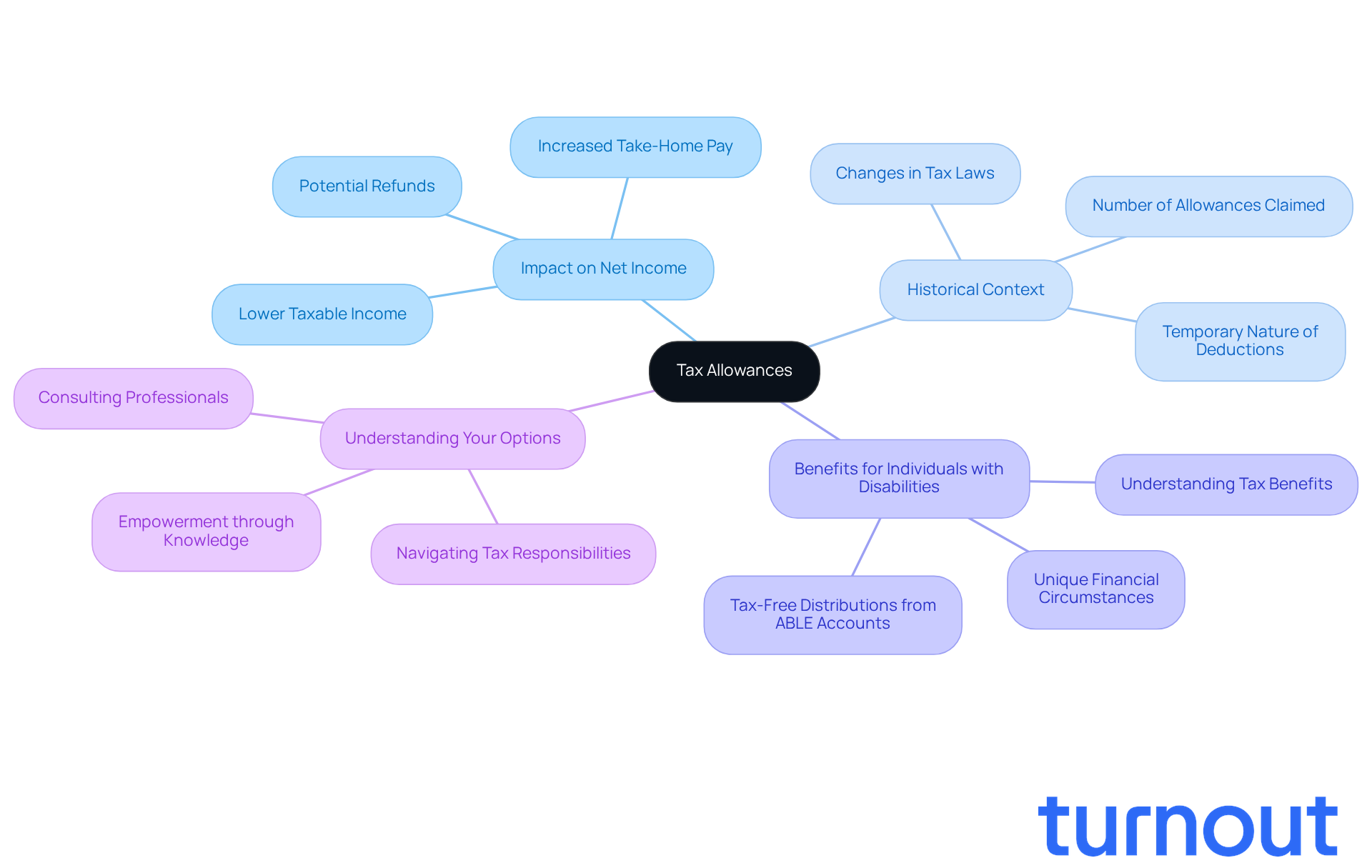

Navigating the complexities of tax allowances can often feel like deciphering a foreign language. We understand that this critical aspect of personal finance is essential for maximizing your take-home pay and minimizing tax liabilities. Tax allowances historically influenced the amount withheld from paychecks, playing a pivotal role in determining how much income is subject to taxation.

However, with recent legislative changes and evolving tax codes, many taxpayers - especially those with disabilities - may find themselves grappling with misconceptions and uncertainties. It's common to feel overwhelmed by these changes. How can you ensure that you’re optimizing your tax benefits in this shifting landscape?

We're here to help you navigate these challenges. Understanding your tax allowances can empower you to make informed decisions and secure the benefits you deserve.

Defining Tax Allowances: What They Are and Their Purpose

Tax exemptions can be a lifeline for many, as they lower the amount of income subject to taxation, ultimately affecting the net income you receive. We understand that navigating taxes can be overwhelming, and historically, the number of allowances claimed on tax forms has been used to adjust the amount withheld from your paycheck. The goal of tax deductions is to help you manage your tax responsibilities more efficiently, which raises the question of what the number of allowances is to ensure that what’s withheld aligns closely with your actual tax duties.

Imagine keeping more of your hard-earned money throughout the year instead of waiting for a potential refund after filing your tax returns. This system is designed to ease your financial burden, allowing you to focus on what truly matters. For individuals with disabilities, understanding tax benefits is especially crucial, as unique financial circumstances can significantly impact how these benefits are claimed.

You are not alone in this journey. We’re here to help you grasp these tax benefits and make the most of them. By taking the time to understand your options, you can empower yourself to navigate your financial landscape with confidence.

The Evolution of Tax Allowances: Historical Context and Changes

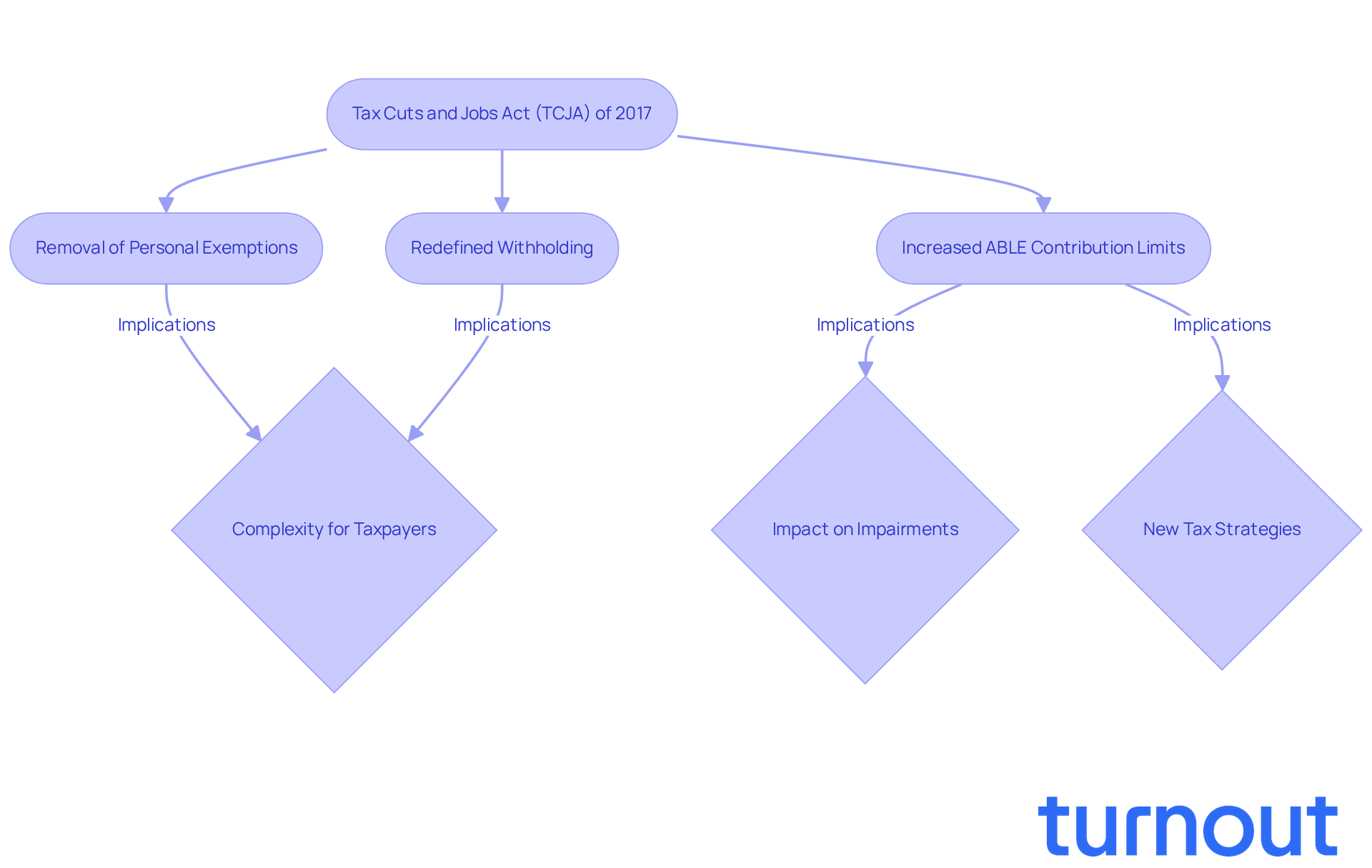

Tax deductions have changed quite a bit, especially since the Tax Cuts and Jobs Act (TCJA) of 2017. This legislation removed personal exemptions and redefined how withholding works, which has a big impact on how you handle your deductions. In the past, the number of allowances you could claim was determined by personal and dependent exemptions, which directly affected your withholding amounts. The TCJA aimed to simplify the tax code and make things clearer, reflecting broader trends in tax policy.

For those with impairments, these changes are particularly important. The adjustments made by the TCJA can affect your tax strategies and potential benefits. For instance, the measure raised contribution limits for ABLE accounts, allowing individuals with impairments to save more without jeopardizing their eligibility for public assistance. This change has been a game-changer for many families. Case studies show how rolling over funds from 529 college savings accounts to ABLE accounts has provided crucial financial support for disability-related expenses.

While the TCJA has streamlined some aspects, it has also raised questions about the number of allowances and introduced challenges. The removal of personal exemptions means that many taxpayers, including those with impairments, now face a more complex environment to optimize their benefits. Understanding these historical changes is vital for you, as it shapes your current tax strategies and underscores the importance of staying informed about ongoing legislative developments.

We understand that navigating these complexities can feel overwhelming. That’s where Turnout comes in. We offer tools and services to help you through this process. For example, did you know that the maximum credit for water pumps and heaters is $2,000? This could provide valuable context on tax benefits available to individuals with disabilities. Additionally, the potential extra deduction being inquired about and the maximum Earned Income Tax Credit (EITC) of $560 are important figures to consider when exploring your tax credits.

By leveraging the expertise of trained nonlawyer advocates and IRS-licensed enrolled agents, Turnout ensures that you receive qualified support in understanding and maximizing your tax benefits. Remember, you are not alone in this journey; we’re here to help.

Understanding the Impact of Tax Allowances on Withholding and Refunds

Tax exemptions can significantly impact how much income tax is deducted from your paycheck. What is number of allowances claimed can determine how much tax is withheld, often leading to a larger take-home pay. However, it's important to understand what is number of allowances, as claiming too few exemptions might lead to a smaller refund or even owing taxes at the end of the year.

For individuals with disabilities, who may face unique financial situations, understanding how to navigate these benefits is crucial for effective financial planning. We understand that this can feel overwhelming. That’s where Turnout comes in. Our team works with IRS-licensed enrolled agents who are dedicated to helping you understand your tax obligations and maximize your financial benefits.

It’s all about finding the right balance. You want to withhold enough to cover your tax liabilities while also enjoying the benefits of a larger take-home pay throughout the year. Remember, you’re not alone in this journey. We’re here to help you every step of the way.

Common Questions About Tax Allowances: Clarifying Misconceptions

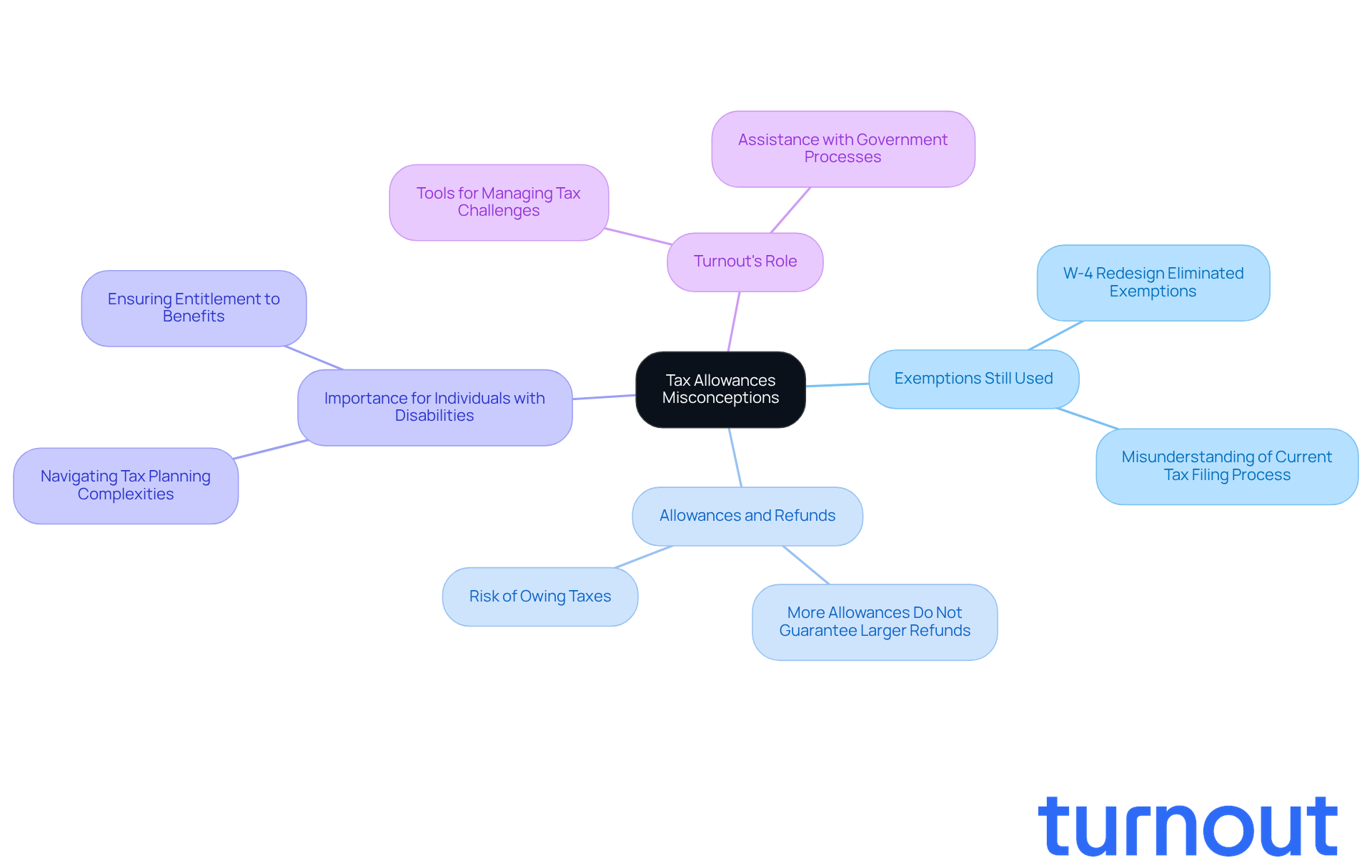

Many people face confusion when it comes to tax benefits, especially regarding their current relevance and application. It’s common to think that tax exemptions are still a standard part of the tax filing process. However, since the redesign of the W-4 form in 2020, exemptions are no longer utilized. Instead, taxpayers now provide information about their dependents and other factors that affect withholding.

Another misconception is that the number of allowances does not always equate to a larger refund. In reality, it can result in owing taxes if not managed properly. For individuals with disabilities, understanding these nuances is essential to avoid pitfalls in tax planning and to ensure they receive the benefits they are entitled to.

We understand that navigating these complexities can be overwhelming. That’s where Turnout comes in. We provide valuable tools and services to help you manage these challenges, especially if you’re seeking assistance with government-related processes like Social Security Disability claims and tax debt relief. Remember, you are not alone in this journey. We’re here to help you effectively manage your financial situation without the need for legal representation.

Conclusion

Understanding tax allowances is crucial for managing personal finances effectively. It’s especially important for individuals with disabilities, as maximizing these benefits can lead to a more favorable financial outcome throughout the year. By grasping the nuances of tax allowances, you can make informed decisions that enhance your financial well-being.

This article has explored the evolution of tax allowances, particularly the significant changes brought by the Tax Cuts and Jobs Act of 2017. These changes have redefined withholding practices, making it essential to stay informed about current tax policies. Key insights include:

- The impact of allowances on take-home pay

- The historical context of tax deductions

- Common misconceptions that can lead to financial pitfalls

Navigating the complexities of tax allowances isn’t just about understanding numbers; it’s about empowering you to take control of your financial future. We understand that this journey can feel overwhelming at times. By leveraging available resources and seeking assistance when needed, you can optimize your tax strategies and ensure you receive the benefits you deserve.

Staying informed and proactive in tax planning is crucial. It can lead to significant financial advantages and peace of mind. Remember, you are not alone in this journey. We’re here to help you every step of the way.

Frequently Asked Questions

What are tax allowances?

Tax allowances are exemptions that lower the amount of income subject to taxation, ultimately affecting the net income received.

How do tax allowances impact my paycheck?

The number of allowances claimed on tax forms is used to adjust the amount withheld from your paycheck, helping to align with your actual tax duties.

What is the purpose of tax deductions?

The purpose of tax deductions is to help individuals manage their tax responsibilities more efficiently, allowing them to keep more of their income throughout the year.

Why is it important for individuals with disabilities to understand tax benefits?

For individuals with disabilities, understanding tax benefits is crucial because unique financial circumstances can significantly impact how these benefits are claimed.

How can I navigate my tax responsibilities more effectively?

By taking the time to understand your options regarding tax allowances and deductions, you can empower yourself to navigate your financial landscape with confidence.