Introduction

Navigating the complexities of IRS payment plans can feel overwhelming for many taxpayers. We understand that the interest rates governing these agreements can add to your worries. Currently, the rate for underpayments stands at 7%. This means that delayed payments can lead to significant financial implications, creating a compounding effect that increases your overall debt.

How do these rates impact your financial strategies? What steps can you take to minimize costs? Exploring the details of IRS interest rates not only clarifies the mechanics of tax management but also empowers you to make informed decisions about your repayment options. Remember, you're not alone in this journey. We're here to help you find the best path forward.

Defining IRS Payment Plans and Their Interest Rates

IRS installment plans, often called installment agreements, are here to help you manage your tax obligations over time, rather than facing a hefty lump sum all at once. We understand that not everyone can pay their tax debts immediately, and these plans can be a lifeline for those in need.

Every three months, the charges on these arrangements are typically set based on the federal short-term rate plus an additional 3%, leading to inquiries about what is the interest rate on IRS payment plans. As we look ahead to the first quarter of 2026, it’s important to note that what is the interest rate on IRS payment plans for both underpayments and overpayments will be 7% annually, compounded daily. This means that the longer you take to settle your debt, the more charges can pile up. It’s crucial to grasp these figures when entering into an agreement with the IRS. Remember, as the IRS states, 'For individuals, what is the interest rate on IRS payment plans is 7% per year, compounded daily for both overpayments and underpayments.'

For example, if you enter into an installment plan for a $5,000 tax obligation, you might see your total repayment amount increase significantly if you extend the duration. This highlights the importance of making timely payments to minimize borrowing costs.

Additionally, considering that the average refund for American taxpayers during the 2024 filing season was $3,453, it’s wise to thoughtfully evaluate your options when planning your financial strategy. You are not alone in this journey, and we’re here to help you navigate these decisions.

Understanding the Significance of IRS Interest Rates in Tax Management

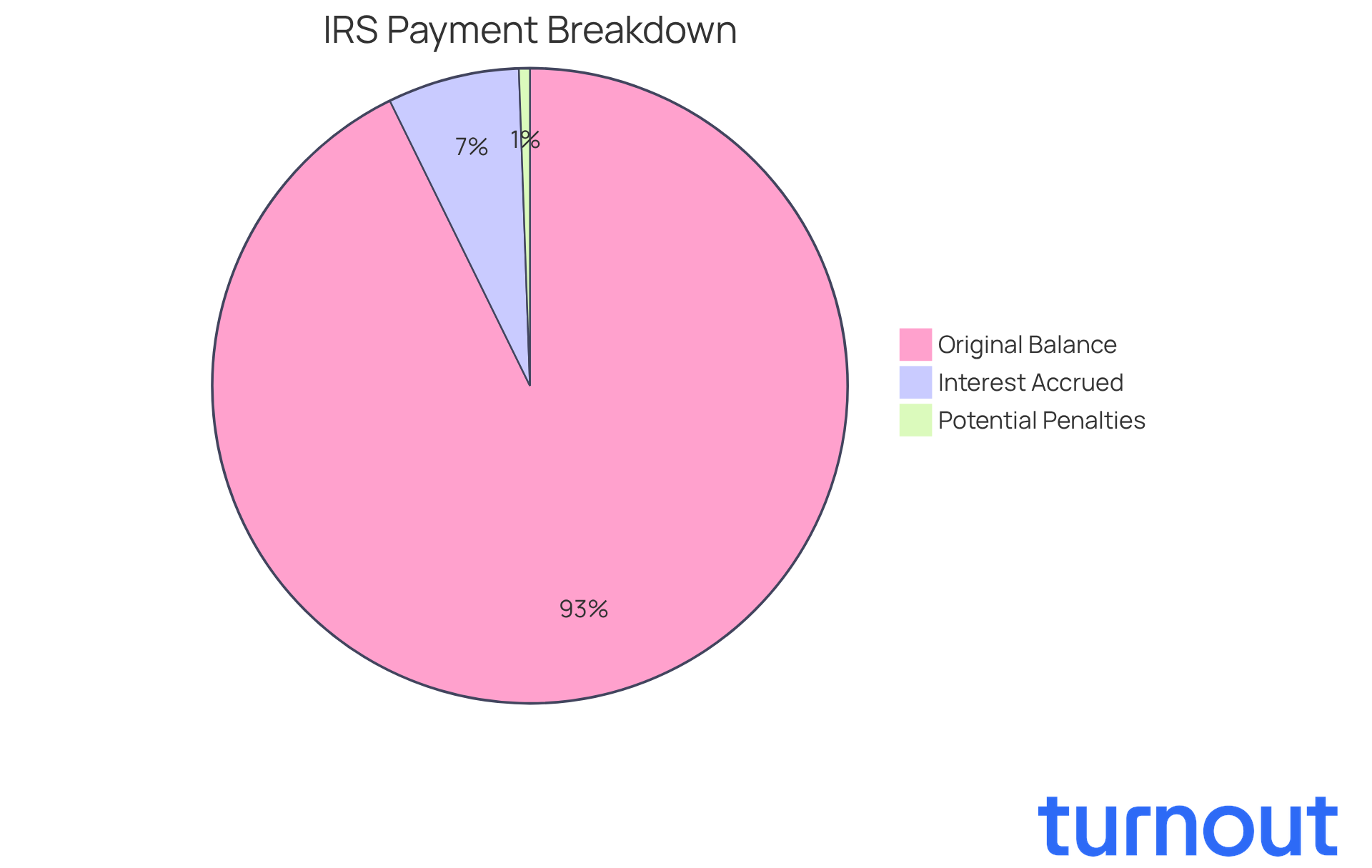

Managing IRS installment plan charges can feel overwhelming, and we understand that. With a percentage set at 7% for most individuals, understanding what is the interest rate on IRS payment plans is important, as daily compounding of interest can lead to a significant increase in what you owe over time. For instance, if you start a repayment plan with a $10,000 balance, you might see that amount grow to about $10,724 after just one year if no payments are made. This compounding effect underscores the importance of prioritizing your contributions.

Consider making additional payments whenever possible. Financial advisors often recommend exploring options like the Partial Payment Installment Agreement. This can help lower your monthly costs based on what you can afford, easing some of the financial pressure.

It's also important to note that the failure-to-pay penalty starts at 0.5% monthly but drops to 0.25% once your plan is approved. This provides extra motivation to settle your debts promptly. Real-life examples show that taxpayers who actively manage their payments can significantly reduce the total charges over time. Understanding IRS fees is crucial for achieving financial stability and minimizing tax burdens.

We encourage you to keep track of quarterly updates on IRS charges. Staying informed about potential changes can help you adjust your repayment strategies effectively. Remember, you are not alone in this journey, and we're here to help.

Exploring the History and Calculation of IRS Interest Rates

Understanding what is the interest rate on IRS payment plans can feel overwhelming, especially when managing your finances. These charges are closely tied to the federal short-term cost, which is updated every three months to reflect current economic conditions. The IRS determines its charges by adding a fixed percentage - currently set at 3% - to the federal short-term yield. This approach ensures that borrowing costs align with broader economic trends.

For example, if the federal short-term percentage is 4%, the IRS charge for underpayments would be 7%. It’s important to know what is the interest rate on IRS payment plans, since charges on unpaid taxes accumulate from the due date until full payment is made, and these fees compound daily. We understand that seeing these numbers can be daunting, but knowing how they work can help you forecast potential expenses related to unpaid taxes and organize your finances accordingly.

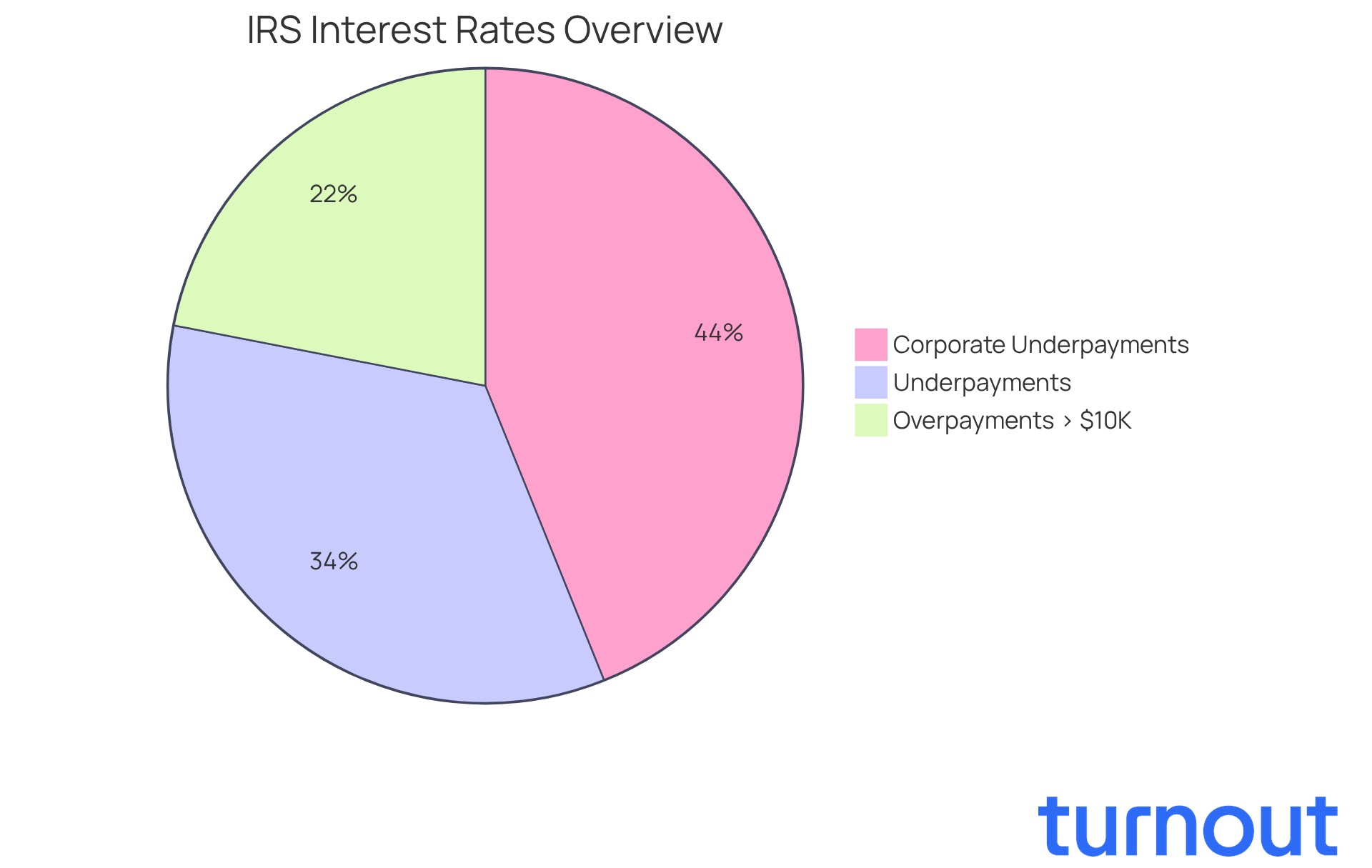

Moreover, for substantial corporate underpayments, the percentage rises to 9%. If your business has overpayments exceeding $10,000, the figure is 4.5%. Remember, you’re not alone in navigating these complexities. We’re here to help you understand and manage your tax obligations effectively.

Key Characteristics and Variations of IRS Interest Rates

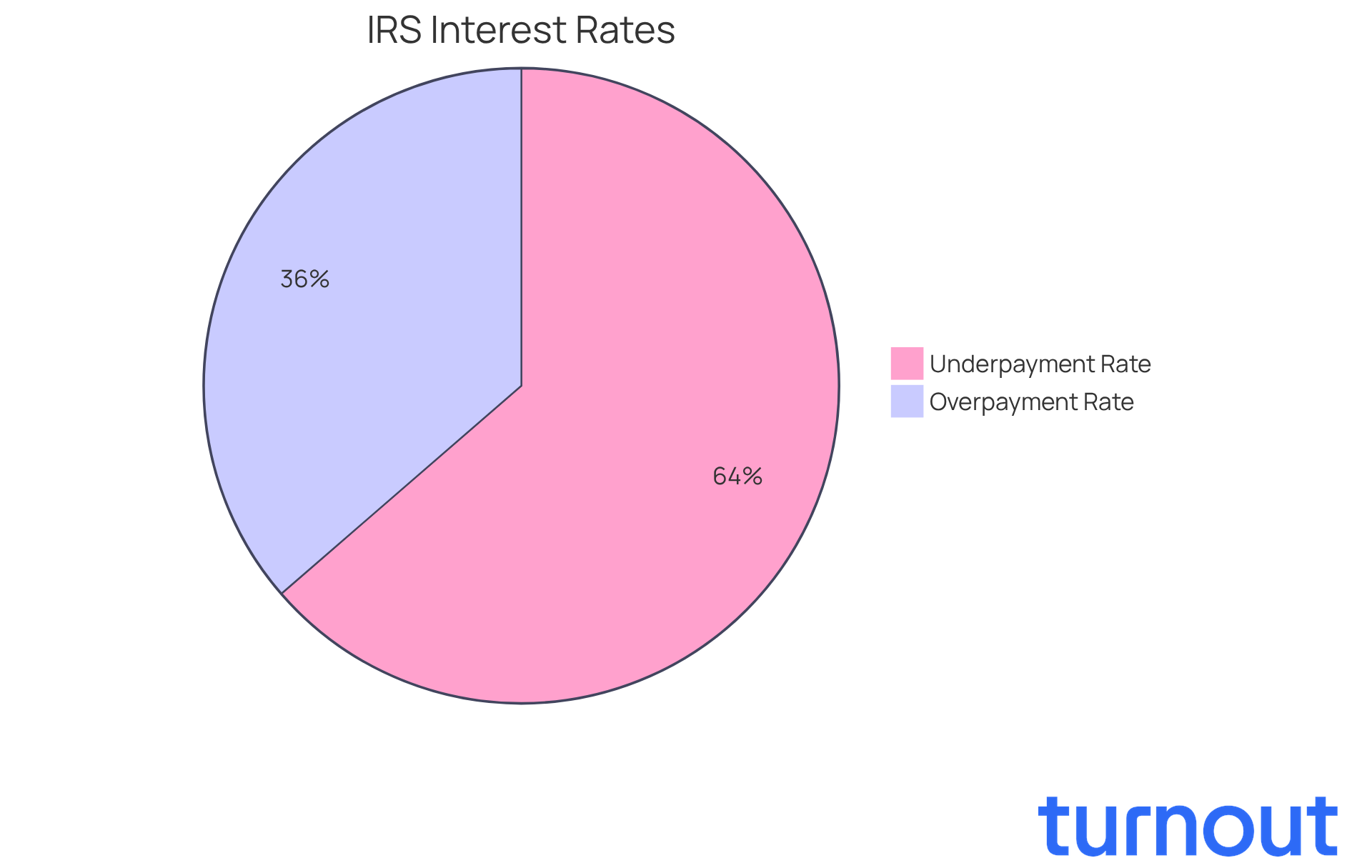

Understanding IRS charges can feel overwhelming, and it’s common to worry about how these fluctuations might impact your financial situation. Charges vary based on the type of tax obligation and your unique circumstances. For instance, the interest charge for underpayments is usually higher than for overpayments. As of early 2026, the underpayment percentage stands at 7%, while the overpayment percentage is at 4%.

Corporate underpayment levels often exceed those of individuals, especially for significant corporate underpayments over $100,000. In such cases, charges are calculated at the federal short-term rate plus an additional 5 percentage points. This can lead to substantial costs over time. It’s important to note that charges accumulate on unpaid taxes, penalties, and fees until they are fully settled. Changes to the percentage won’t affect amounts billed for previous quarters or years.

We understand that navigating these variations is crucial for you. By understanding how these charges work, you can better anticipate what is the interest rate on IRS payment plans and the overall financial impact of your tax obligations. This knowledge empowers you to make informed decisions about payment plans, including what is the interest rate on IRS payment plans, and strategies for managing your tax debts. The IRS publishes these interest rates in the Internal Revenue Bulletin for transparency, and the determination of the rate is governed by IRC Section 6621, with interest compounded daily. Remember, you’re not alone in this journey; we’re here to help you through it.

Conclusion

Understanding the interest rates tied to IRS payment plans is essential for managing your tax obligations effectively. We know that navigating these rates can be overwhelming, especially when they currently stand at 7% for underpayments and 4% for overpayments. These figures can significantly impact the total amount you owe over time. The daily compounding nature of these rates means that if payments aren’t made promptly, your debt can grow substantially. This highlights the importance of timely financial planning and management.

Throughout this article, we’ve highlighted key insights, such as how IRS interest rates are calculated based on the federal short-term rate. It’s crucial to understand the implications of failing to pay on time and the potential for additional fees. Real-life examples show how taxpayers can benefit from proactive payment strategies. For instance, making extra payments or opting for a Partial Payment Installment Agreement can help minimize the impact of accruing interest and penalties. These strategies can lead to greater financial stability, which is something we all strive for.

In conclusion, staying informed about IRS interest rates and understanding their impact on your tax payments is vital for every taxpayer. By actively managing your payment plans and keeping up with changes in rates, you can navigate your tax obligations more effectively. Remember, taking charge of your financial decisions today can lead to significant savings in the long run. You are not alone in this journey, and prioritizing your understanding of IRS payment plan interest rates is a step toward a more secure financial future.

Frequently Asked Questions

What are IRS payment plans?

IRS payment plans, also known as installment agreements, allow taxpayers to manage their tax obligations over time instead of paying a large lump sum immediately.

How is the interest rate on IRS payment plans determined?

The interest rate on IRS payment plans is typically set every three months based on the federal short-term rate plus an additional 3%.

What is the interest rate on IRS payment plans for the first quarter of 2026?

The interest rate on IRS payment plans for both underpayments and overpayments will be 7% annually, compounded daily.

How does compounding affect the total repayment amount on IRS payment plans?

Since the interest is compounded daily, the longer it takes to settle the debt, the more charges can accumulate, leading to a significantly higher total repayment amount.

Can you provide an example of how an installment plan works?

For instance, if you enter into an installment plan for a $5,000 tax obligation, extending the duration of the plan can lead to a significant increase in the total repayment amount due to accruing interest.

What was the average tax refund for American taxpayers during the 2024 filing season?

The average refund for American taxpayers during the 2024 filing season was $3,453.

Why is it important to make timely payments on IRS installment plans?

Making timely payments is crucial to minimizing borrowing costs, as the longer the debt remains unpaid, the more interest will accumulate.