Introduction

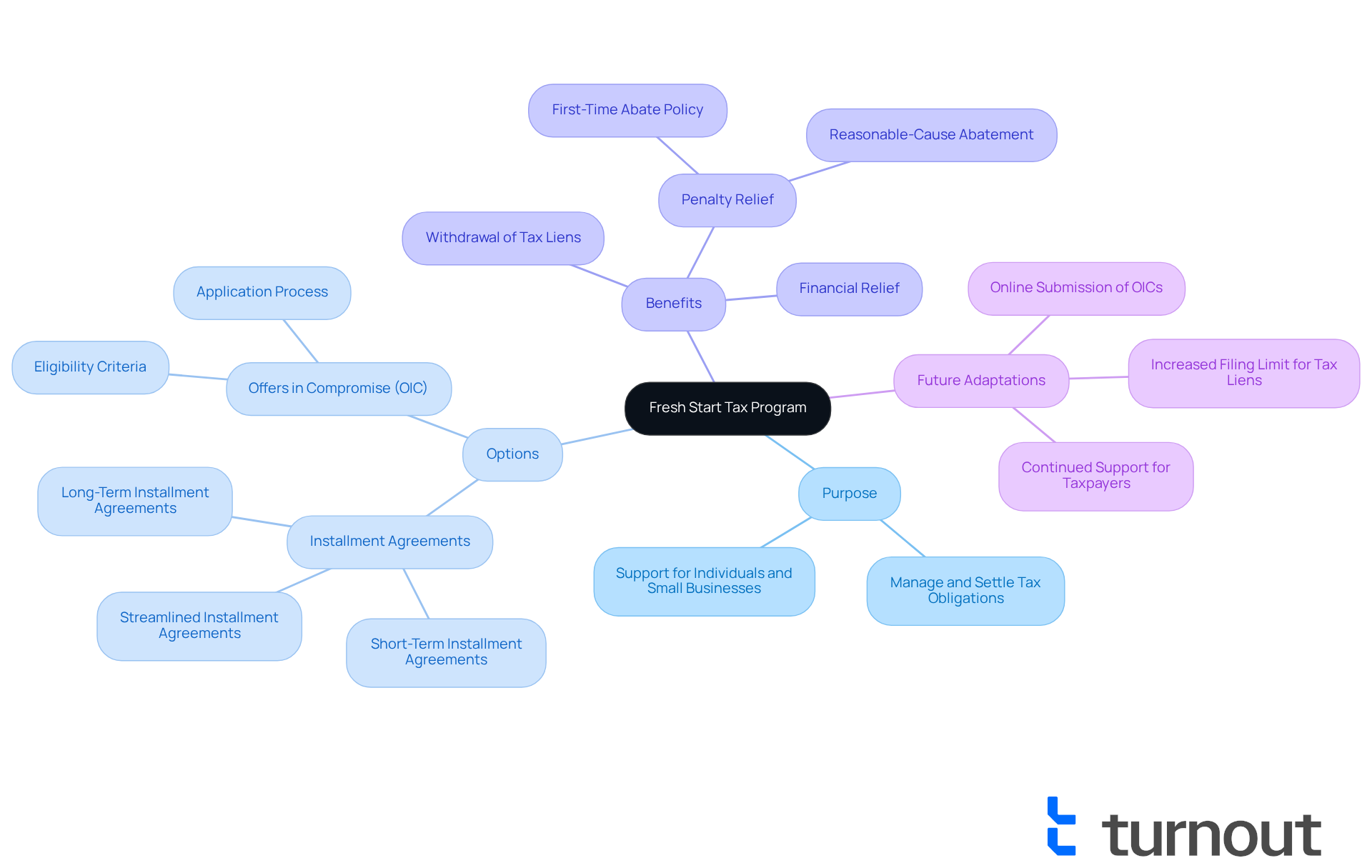

The Fresh Start Tax Program is a vital lifeline for individuals and small businesses struggling with tax burdens. We understand that financial stress can feel overwhelming, and this program offers a structured way to find relief. With options like installment agreements and offers in compromise, it empowers taxpayers to settle their debts for less than what they owe, significantly easing their financial strain.

As this program evolves to meet changing economic conditions, one pressing question arises: how can eligible individuals effectively navigate its complexities? It’s common to feel uncertain about where to start, but know that you’re not alone in this journey. We’re here to help you explore the possibilities and secure the relief you desperately need.

Defining the Fresh Start Tax Program

What is the fresh start tax program? It is a vital initiative designed by the Internal Revenue Service (IRS) to support individuals and small businesses in managing and settling their tax obligations with ease. If you’re feeling overwhelmed, know that this program offers various options, like installment agreements and offers in compromise (OIC), allowing you to resolve your debts for significantly less than what you owe. In 2024 alone, around 100,000 OICs were approved, demonstrating how effective this program can be in alleviating financial stress and saving citizens billions.

We understand that facing economic difficulties can be daunting. What is the fresh start tax program, and how does it simplify the process of obtaining tax relief, making it more accessible for those in need? Key features include the ability to withdraw tax liens, which can improve your credit and borrowing options, along with penalty relief for those who comply. However, it’s important to remember that interest and penalties continue to accumulate until the amount is fully settled, even after a lien is removed. This highlights the ongoing financial implications that can affect you.

Experts agree that what is the fresh start tax program provides significant benefits, especially for those struggling with tax obligations. Tax professionals often recommend consulting with a qualified advisor to help navigate the various options within what is the fresh start tax program. This ensures that you choose the relief path that best suits your financial situation. For instance, many small businesses have successfully utilized the program to manage their tax responsibilities, allowing them to focus on growth and stability.

As we look ahead to 2025, what is the Fresh Start Tax Program continues to adapt, providing essential tax relief initiatives tailored to the needs of individuals and small businesses alike. Notably, the IRS has increased the federal tax lien filing limit from $5,000 to $10,000, reducing the likelihood of liens for smaller amounts. By understanding the program's features and benefits, you can take proactive steps toward addressing your tax challenges and achieving economic stability. Remember, you are not alone in this journey, and we’re here to help.

Historical Context and Evolution of the Program

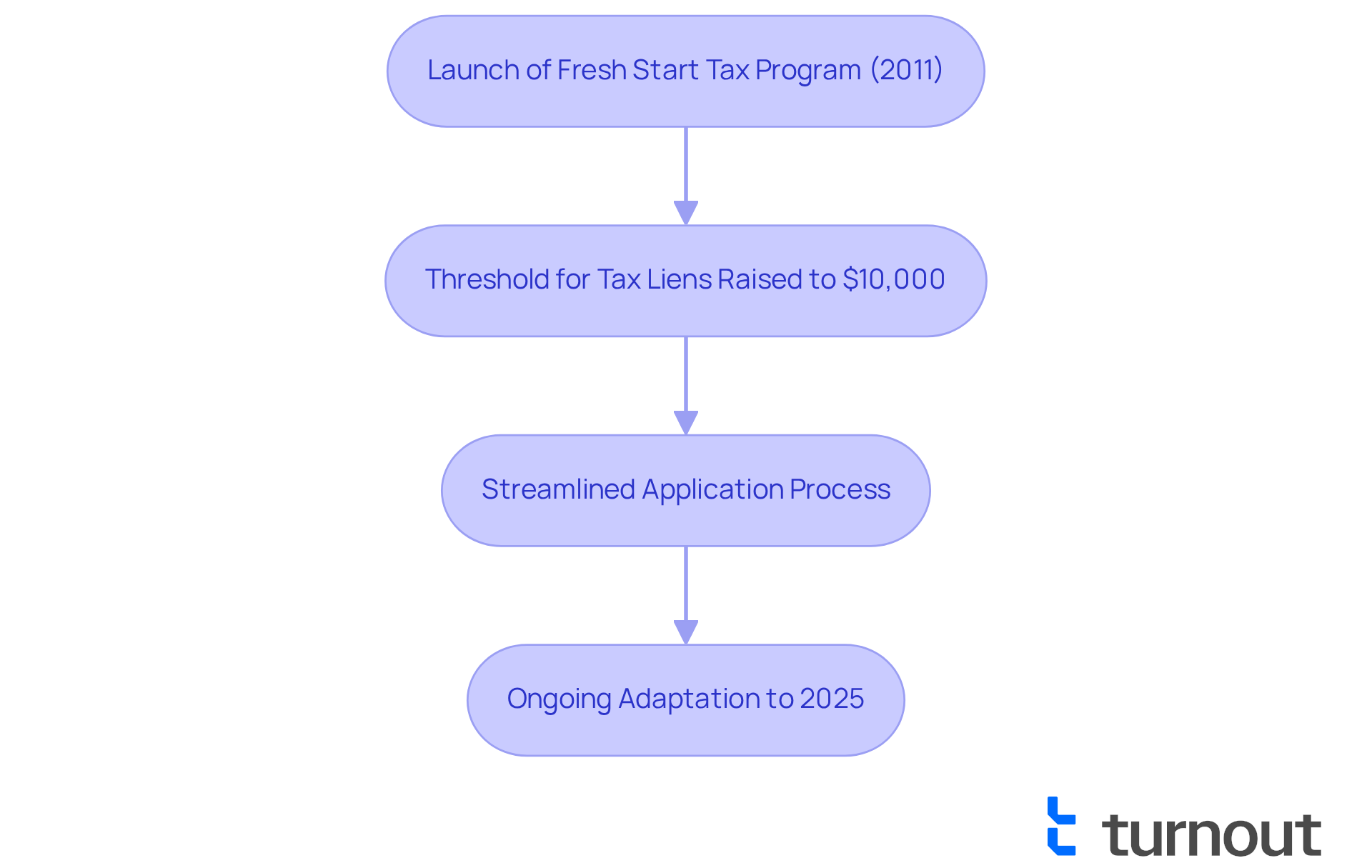

Launched in 2011 in response to the financial crisis, what is the Fresh Start Tax Program was designed with you in mind. If you’re grappling with significant financial obligations, know that you’re not alone. This program, which answers what is the fresh start tax program, aims to broaden access to the Offer in Compromise (OIC), allowing individuals like you to settle tax liabilities for less than what you owe.

Over the years, this program has evolved to better serve your needs. For instance, the threshold for tax liens has been raised from $5,000 to $10,000. This change means fewer liens for smaller debts, which can be a relief for many. Additionally, the application process for installment agreements has been streamlined, making it easier for you to seek the relief you deserve.

As we look ahead to 2025, what is the Fresh Start Tax Program continues to adapt, reflecting the IRS's commitment to providing meaningful assistance to those facing economic hardships. This ongoing evolution underscores the program's importance in helping individuals manage their obligations and regain financial stability. Remember, we’re here to help you navigate this journey.

Key Benefits of the Fresh Start Tax Program

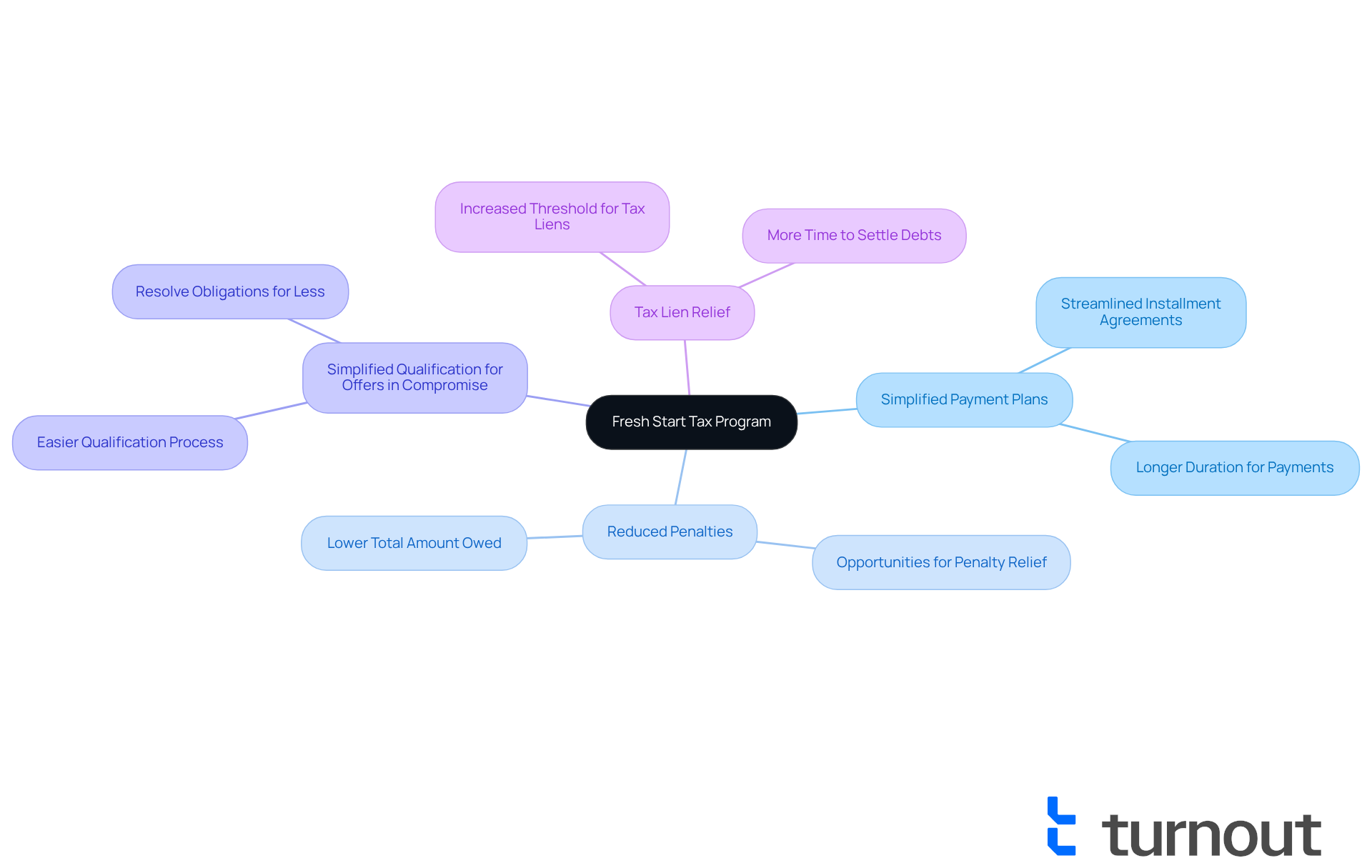

Are you feeling overwhelmed by your tax obligations? The Fresh Start Tax Program offers several essential advantages that can help lighten your burden:

-

Simplified Payment Plans: You can enter into streamlined installment agreements, allowing you to settle your tax obligations over a longer duration. This makes it much more manageable.

-

Reduced Penalties: The program provides opportunities for penalty relief, which can significantly lower the total amount you owe.

-

Simplified Qualification for Offers in Compromise: It’s now easier for individuals to qualify for offers in compromise, enabling you to resolve your obligations for less than the total sum owed.

-

Tax Lien Relief: What is the Fresh Start tax program? It increases the threshold for tax liens, giving you more time to settle your debts before facing liens or levies.

We understand that navigating these options can be daunting. That’s why Turnout utilizes IRS-licensed enrolled agents to assist you in making the most of these benefits. You don’t have to go through this alone; we’re here to help you every step of the way.

Eligibility Requirements for the Fresh Start Tax Program

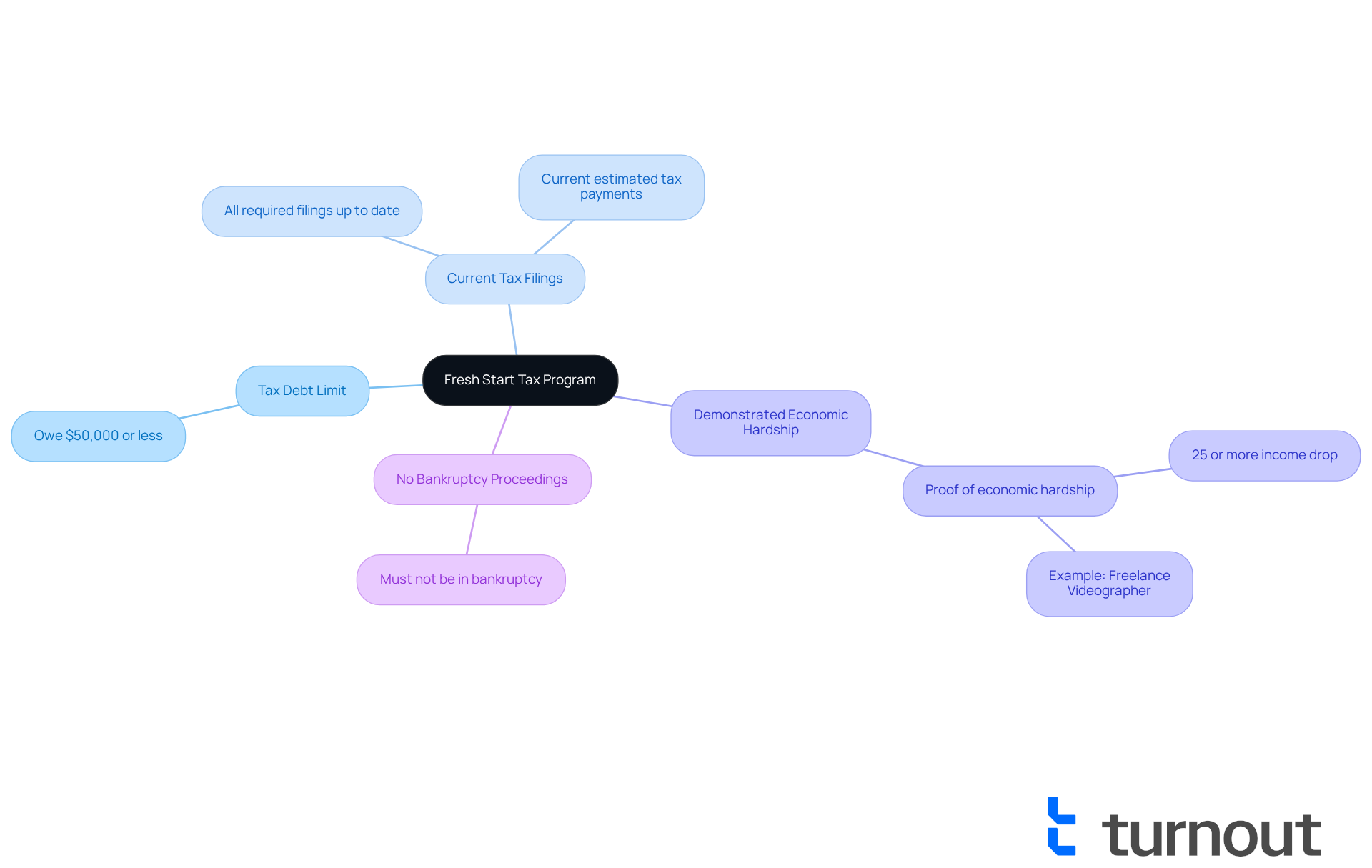

To qualify for what is the Fresh Start Tax Program, we understand that you may be facing some challenges. Here are the key eligibility requirements that can help you find relief:

-

Tax Debt Limit: You must owe $50,000 or less in combined tax, penalties, and interest. This limit is crucial as it opens the door to streamlined relief options.

-

Current Tax Filings: It’s important to be current on all required tax filings and estimated tax payments. This shows your commitment to resolving tax issues and is essential for eligibility.

-

Demonstrated Economic Hardship: You’ll need to provide proof of economic hardship, which can include a significant decrease in income-often defined as a 25% or more drop-or other financial challenges. In 2025, about 35% of taxpayers seeking relief met these hardship criteria, underscoring the program's relevance. For example, a freelance videographer who received collection notices due to unpaid taxes showed economic difficulty by revealing a notable decline in income.

-

No Bankruptcy Proceedings: If you are in an open bankruptcy proceeding, unfortunately, this disqualifies you from participating in the program.

Additionally, the updated policy changes for 2025 include a lien threshold increase to $10,000 and an installment agreement limit of up to $50,000, with options extending up to 72 months. By meeting these criteria, you can access various relief options under what is the Fresh Start Tax Program. This program, known as what is the Fresh Start Tax Program, aims to alleviate the burden of tax debt and provide a pathway to financial stability. Remember, you are not alone in this journey, and we’re here to help.

Conclusion

The Fresh Start Tax Program is a vital lifeline for individuals and small businesses facing tax obligations. We understand that navigating tax issues can be overwhelming, but this initiative offers options like installment agreements and offers in compromise, making tax relief more attainable for those in financial distress. As the program evolves, it remains committed to providing meaningful assistance, empowering taxpayers to regain control over their financial situations.

Key benefits of the Fresh Start Tax Program include:

- Streamlined payment plans

- Reduced penalties

- Increased thresholds for tax liens

This program was born out of economic challenges, adapting to better serve the needs of taxpayers. Understanding the eligibility requirements can help you navigate your options more effectively, ensuring you access the relief you need.

Ultimately, the Fresh Start Tax Program represents hope and opportunity for those facing tax challenges. By taking proactive steps to understand and utilize this program, you can work towards achieving financial stability. Remember, seeking guidance from qualified tax professionals can make a significant difference. You don’t have to face your tax burdens alone. Embracing the resources available through this initiative can lead to a brighter financial future.

Frequently Asked Questions

What is the Fresh Start Tax Program?

The Fresh Start Tax Program is an initiative by the Internal Revenue Service (IRS) designed to help individuals and small businesses manage and settle their tax obligations more easily. It offers options like installment agreements and offers in compromise (OIC) to resolve debts for less than what is owed.

What options does the Fresh Start Tax Program provide for tax relief?

The program provides various options, including installment agreements and offers in compromise (OIC), which allow taxpayers to settle their debts for significantly less than the total amount owed.

How effective is the Fresh Start Tax Program?

In 2024, approximately 100,000 offers in compromise were approved, indicating the program's effectiveness in alleviating financial stress and helping citizens save billions on their tax obligations.

What are the benefits of the Fresh Start Tax Program?

Key benefits include the ability to withdraw tax liens, which can improve credit and borrowing options, as well as penalty relief for compliant individuals. However, interest and penalties continue to accrue until the full amount is settled, even after a lien is removed.

Should I consult a tax professional when considering the Fresh Start Tax Program?

Yes, it is recommended to consult with a qualified tax advisor to navigate the various options within the Fresh Start Tax Program, ensuring you choose the relief path that best suits your financial situation.

How has the Fresh Start Tax Program adapted for 2025?

The program continues to evolve, with the IRS increasing the federal tax lien filing limit from $5,000 to $10,000, which reduces the likelihood of liens for smaller amounts and provides further relief to individuals and small businesses.

What should I do if I am struggling with tax obligations?

If you are facing tax challenges, consider exploring the options available through the Fresh Start Tax Program and seek assistance from qualified professionals to help you address your tax responsibilities effectively.