Overview

The California Board of Equalization (BOE) plays a vital role in our community, overseeing tax administration and fee collection. We understand that navigating taxes can be overwhelming, and the BOE is dedicated to ensuring fair tax management across California's counties. This article highlights the BOE's significant responsibilities and its commitment to transparency and fairness.

As we explore the BOE's historical evolution and recent reforms, it's important to recognize the ongoing challenges it faces. These efforts are crucial in building a tax system that works for everyone. We want you to know that the BOE is here to support you in understanding these complexities.

In conclusion, the BOE's work is essential in maintaining a just tax system in California. If you have questions or concerns about your taxes, remember that you are not alone. The BOE is here to help you navigate this journey with compassion and care.

Introduction

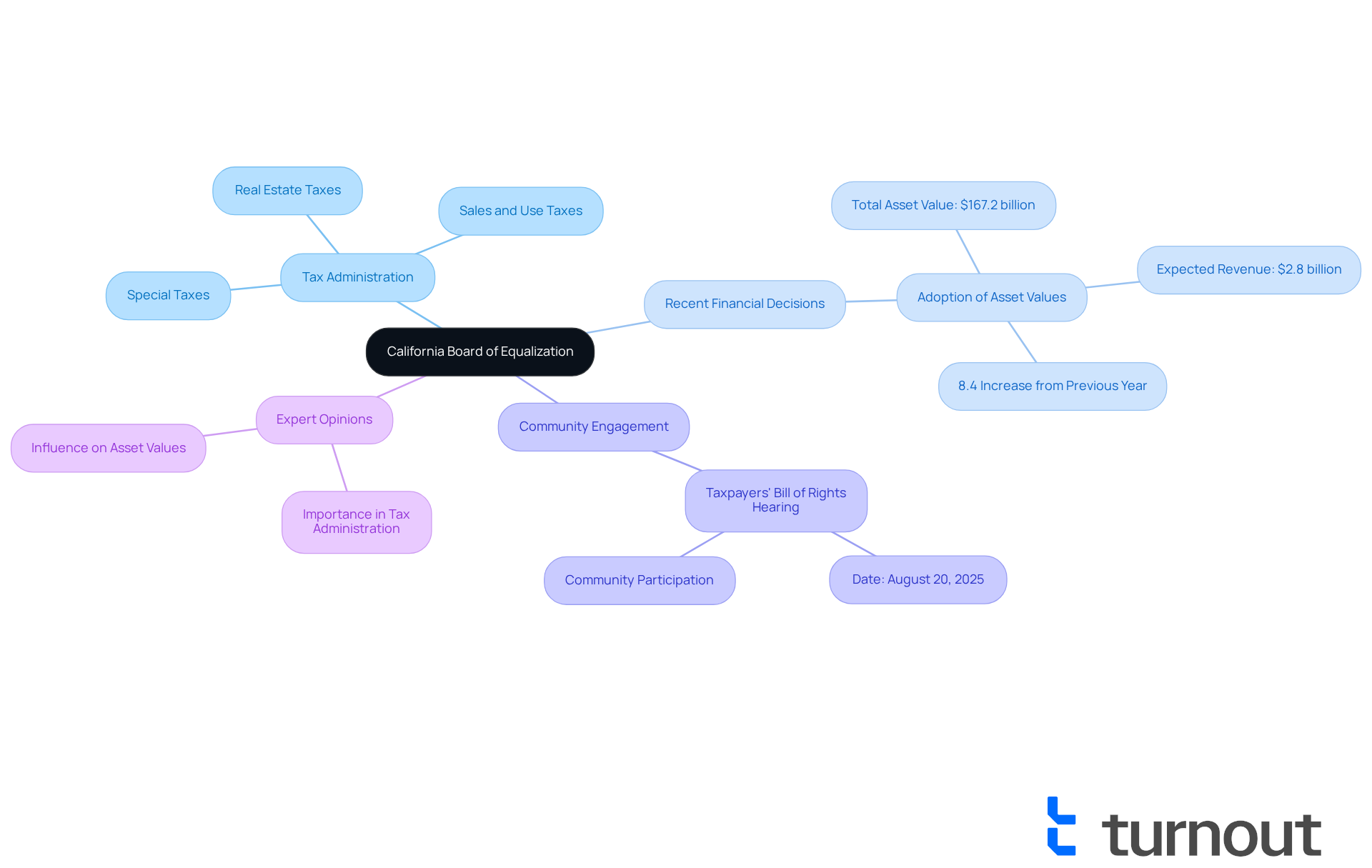

The California Board of Equalization (BOE) serves as a vital support system in the state's tax administration, dedicated to ensuring fairness and efficiency in tax assessments across its diverse counties. By overseeing an impressive $167.2 billion in state-assessed asset values, the BOE not only impacts real estate taxation but also plays a crucial role in funding essential community services.

However, we understand that the agency's history has been marked by controversies and challenges, leading to important questions about its effectiveness and accountability.

How can the BOE navigate these complexities to restore public trust and enhance its operations in the ever-evolving landscape of California's taxation system? Together, we can explore solutions that foster a more transparent and supportive environment for all.

Define the California Board of Equalization

What is the (BOE), a public agency dedicated to tax administration and fee collection in our state? What is the California Board of Equalization, which was founded under the California Constitution, aims to ensure equitable and efficient tax management. This involves overseeing real estate taxes, sales and use taxes, and various special taxes. What is the California Board of Equalization? It plays a vital role in maintaining fairness in , ensuring that taxpayers are treated with respect and consistency.

In 2025, the BOE adopted $167.2 billion in state-assessed asset values for 322 companies, including utilities and railroads. This decision is expected to generate approximately $2.8 billion in , crucial for funding schools and supporting local communities. This reflects an 8.4% increase in asset value from the previous year. Chairman Ted Gaines noted, "For the past 13 years, real estate values statewide have steadily risen year after year." This statement underscores the BOE's significant influence on real estate values and the financial well-being of our communities.

The BOE also actively engages with taxpayers through initiatives like the annual , set for August 20, 2025. This event invites , gathering suggestions and feedback from taxpayers. This commitment to transparency and responsiveness exemplifies , reinforcing the concept of what is the California Board of Equalization as a protector of taxpayer rights and equitable tax practices.

Expert opinions highlight what is the California Board of Equalization, emphasizing its importance in tax administration and how its efforts lead to a more balanced and fair tax system, ultimately benefiting all Californians. By ensuring that real estate levies are assessed fairly, the BOE fosters trust and accountability within our state's financial framework.

We understand that navigating tax matters can be challenging, but rest assured, the BOE is here to help you every step of the way.

Trace the History and Evolution of the BOE

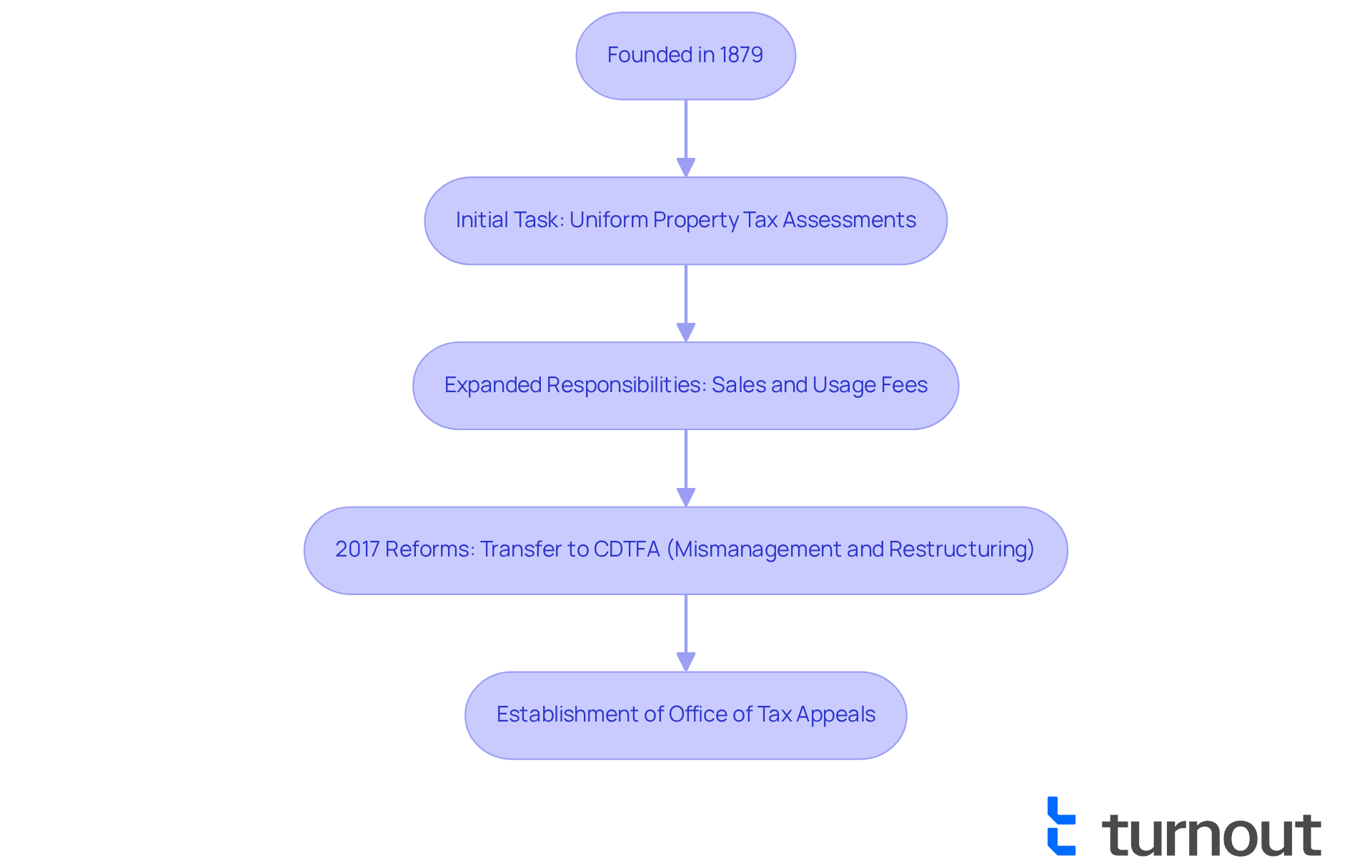

What is the , founded in 1879 as part of the state's second Constitution, which was initially tasked with ensuring uniform property tax assessments across counties? Over time, the California Board of Equalization's responsibilities expanded to include the , along with the supervision of various special levies. The BOE was accountable for gathering over $60 billion in levies each year in the state, underscoring the and the necessity for reforms.

However, we understand that , regarding the California Board of Equalization, marked a pivotal shift in its operations. The passage of the Taxpayer Transparency and Fairness Act led to the of the California Board of Equalization to the newly established Department of Tax and Fee Administration (CDTFA). This restructuring was a response to ongoing issues of mismanagement and inefficiency within the BOE, raising the question of the California Board of Equalization's role in addressing that hindered public agencies' planning for essential services.

It's common to feel concerned when institutions we rely on face challenges. The investigation into the California Board of Equalization by California's Department of Justice for misdirecting $350 million in sales taxes highlights the urgent need for these reforms. These changes aimed to streamline and enhance accountability, reflecting a broader commitment to improving the California Board of Equalization within the state's tax system.

Following these changes, the Office of Tax Appeals (OTA) was established to handle tax appeals independently, ensuring a fair and transparent process for taxpayers. Yet, the OTA's performance in 2018 revealed a concerning trend: taxpayers prevailed in only 3% of income tax appeals, and notably, not a single sales tax appeal was heard that year. This highlights the challenges that remain in the reformed system, and we want you to know that you are not alone in this journey. Together, we can .

Examine the Functions and Responsibilities of the BOE

? It plays a vital role in our community by overseeing real estate tax assessments, administering the , and managing the Tax on Insurers. We understand that navigating , and what is the California Board of Equalization ensures that county assessors adhere to state regulations, promoting fairness and consistency in tax evaluations. Additionally, what is the California Board of Equalization serves as an appeals board for taxpayers contesting assessments, offering a platform for .

In Fiscal Year 2023-24, the Alcoholic Beverage Tax generated an impressive $418 million for the state's General Fund. This highlights its essential contribution to funding state programs that benefit us all. Moreover, the BOE adopted for the fiscal year 2025-26, which is projected to yield approximately $2.8 billion in property tax revenue for local communities and schools. This reflects an encouraging 8.4% increase from the previous year, signifying growth and support for our neighborhoods.

Tax professionals emphasize the crucial responsibilities of what is the California Board of Equalization in ensuring , which are fundamental for maintaining public trust in our tax system. We recognize that you may have concerns about these processes, and what is the California Board of Equalization's commitment to effective tax administration is reflected in its ongoing efforts to engage with taxpayers. We invite you to participate in the upcoming scheduled for August 20, 2025. This is an opportunity for you to share your experiences and suggestions for improvement, reinforcing that you are not alone in this journey.

Analyze the Controversies and Challenges Surrounding the BOE

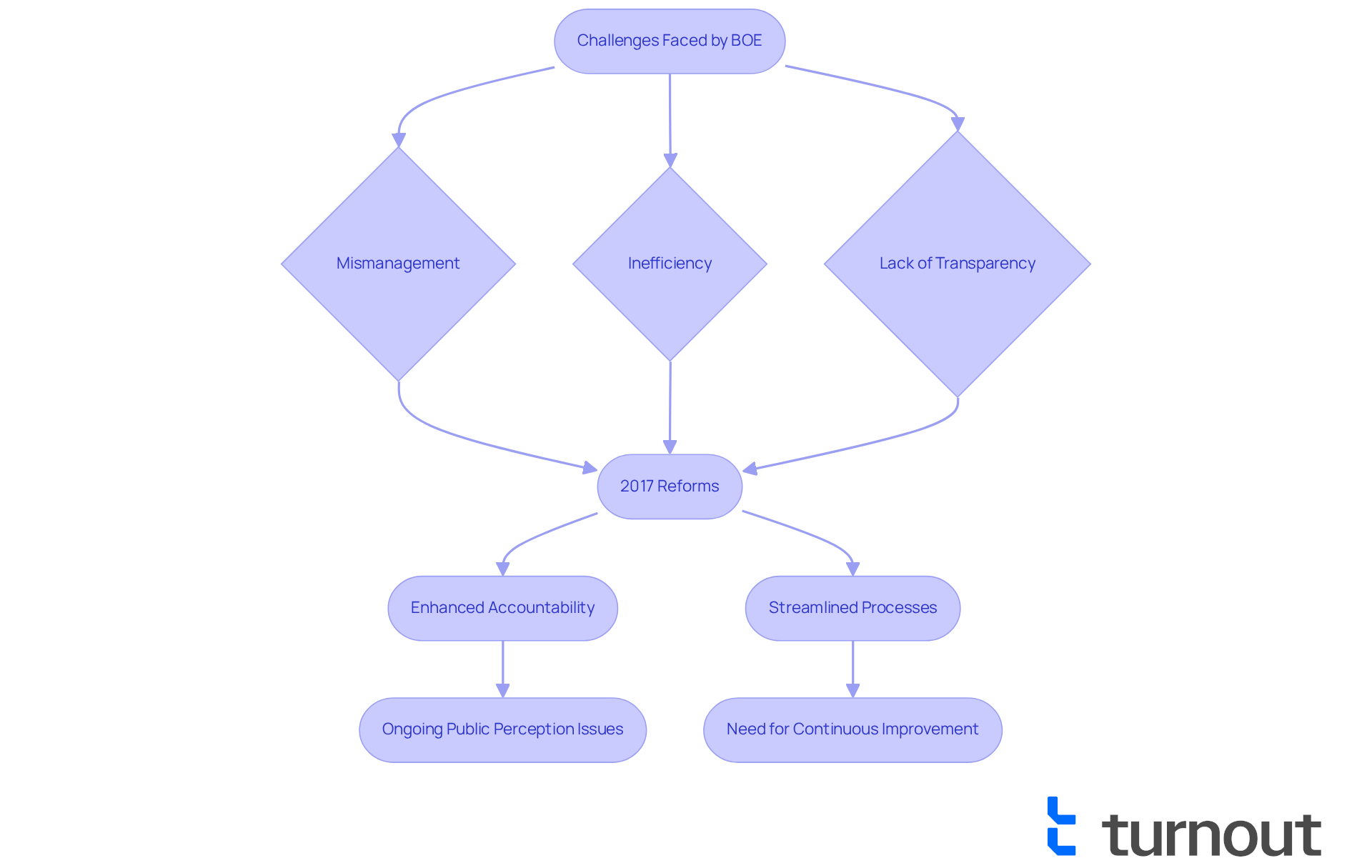

The Board of Equalization (BOE) has faced numerous challenges that have understandably raised concerns among California taxpayers about . Issues of mismanagement, inefficiency, and a lack of transparency have led to criticisms, particularly regarding the misuse of public funds and the need for better oversight of practices. We understand that these controversies can create feelings of uncertainty and frustration.

In light of these challenges, the BOE, known as what is the California Board of Equalization, took , focusing on . While these reforms were a positive move, we recognize that still linger. Many continue to call for further improvements to ensure that the agency effectively serves the needs of California taxpayers, especially in relation to what is the California Board of Equalization.

Tax policy analysts have pointed out that the historical has hindered its ability to fulfill its vital role. This highlights the . We believe that with continuous improvement, trust and efficiency in tax administration can be restored. Remember, you are not alone in this journey; we are here to .

Conclusion

The California Board of Equalization (BOE) plays a crucial role in the tax landscape of our state, dedicated to ensuring fairness and equity in tax assessments and revenue collection. We understand that navigating taxes can be overwhelming, but through its ongoing reforms, the BOE aims to adapt to the needs of California taxpayers, fostering trust and accountability in the tax system.

Key insights into the BOE's functions reveal its commitment to:

- Overseeing real estate taxes

- Administering various special taxes

- Engaging with the public through initiatives like the Taxpayers' Bill of Rights Hearing

While challenges such as mismanagement and controversies have arisen, the BOE's dedication to reform and transparency shows its determination to serve the community effectively.

As California continues to face the complexities of tax administration, the significance of the BOE remains paramount. We encourage you to stay engaged and informed, participating in discussions that shape the future of tax practices in our state. By advocating for transparency and equitable processes, you can play a vital role in creating a more just and efficient tax system that benefits all Californians. Remember, you are not alone in this journey; together, we can make a difference.

Frequently Asked Questions

What is the California Board of Equalization (BOE)?

The California Board of Equalization (BOE) is a public agency dedicated to tax administration and fee collection in California, ensuring equitable and efficient tax management across the state.

What are the main responsibilities of the BOE?

The BOE oversees real estate taxes, sales and use taxes, and various special taxes, maintaining fairness in tax assessments across California's 58 counties.

How does the BOE impact real estate tax revenue?

In 2025, the BOE adopted $167.2 billion in state-assessed asset values for 322 companies, which is expected to generate approximately $2.8 billion in real estate tax revenue, crucial for funding schools and supporting local communities.

What is the significance of the Taxpayers' Bill of Rights Hearing?

The annual Taxpayers' Bill of Rights Hearing invites community participation to discuss and improve the state's taxation system, allowing taxpayers to provide suggestions and feedback, and reinforcing the BOE's commitment to transparency and responsiveness.

How does the BOE ensure taxpayer rights and equitable tax practices?

The BOE actively engages with taxpayers and emphasizes fairness in tax assessments, fostering trust and accountability within California's financial framework.

What is the BOE's role in the financial well-being of communities?

By ensuring that real estate levies are assessed fairly, the BOE plays a vital role in maintaining the financial health of communities throughout California.