Introduction

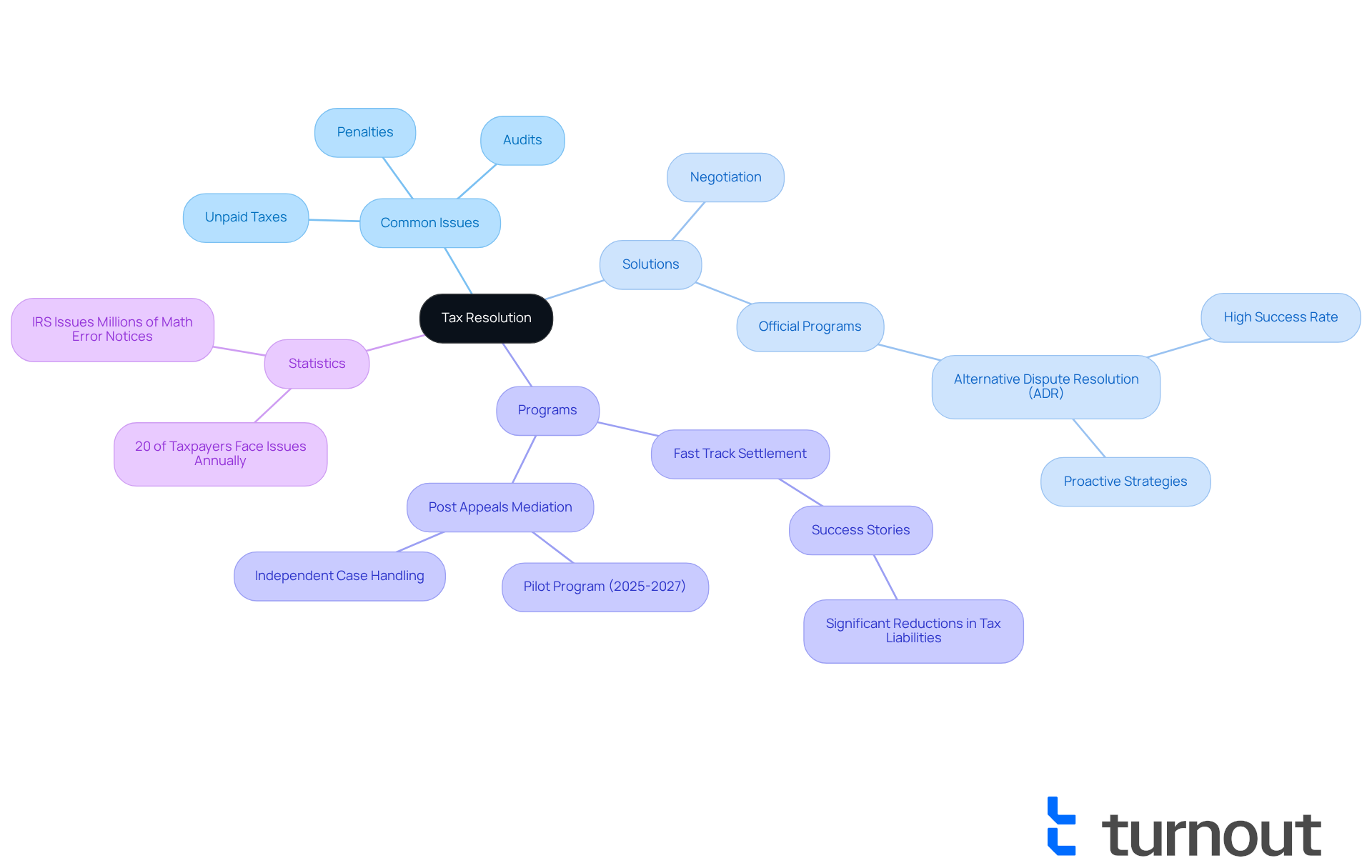

Understanding tax resolution is crucial for anyone facing the complexities of tax-related issues. Did you know that nearly 20% of U.S. taxpayers encounter such challenges each year? We understand that navigating these waters can feel overwhelming. This article explores the importance of tax resolution, highlighting various options to ease financial burdens and help you regain compliance with your tax obligations.

As tax enforcement actions are set to increase, you might be wondering: how can you effectively navigate this intricate process to find the relief you need? You're not alone in this journey, and we're here to help you explore the paths available to you.

Defining Tax Resolution: Understanding Its Core Concept

Understanding what is tax resolution is a crucial process for anyone facing tax-related challenges with authorities like the IRS or state tax agencies. Whether it’s unpaid taxes, audits, or penalties, these issues can feel overwhelming. We understand that navigating these waters can be daunting, but there are solutions available that can ease your burden. Often, this involves negotiation or engaging in official programs designed to help resolve debts.

Did you know that around 20% of taxpayers in the U.S. encounter tax problems each year? The IRS issues millions of math error notices, highlighting just how common these issues are. It’s essential to grasp the various tax solutions out there, as they encompass strategies aimed at achieving compliance and financial relief. One effective approach is utilizing Alternative Dispute Resolution (ADR) techniques, which have shown a high success rate in resolving disputes efficiently.

The IRS has expanded its ADR programs, including:

- Fast Track Settlement

- Post Appeals Mediation pilot program, running from October 1, 2025, through September 30, 2027.

Tax professionals emphasize the importance of being proactive. Timely intervention can lead to more favorable outcomes, and we’re here to help you navigate this process.

Consider the success stories of individuals who participated in the IRS's Fast Track Settlement program. Many reported significant reductions in their tax liabilities, showcasing the potential for financial relief. Additionally, recent legislative changes by the IRS strengthen taxpayer rights and ensure clear communication, which is vital for anyone dealing with tax disputes. As tax regulations evolve, staying informed about your options and understanding what is tax resolution can greatly empower you to manage your tax difficulties more effectively.

Remember, you are not alone in this journey. We’re here to support you every step of the way.

The Importance of Tax Resolution in Navigating Financial Challenges

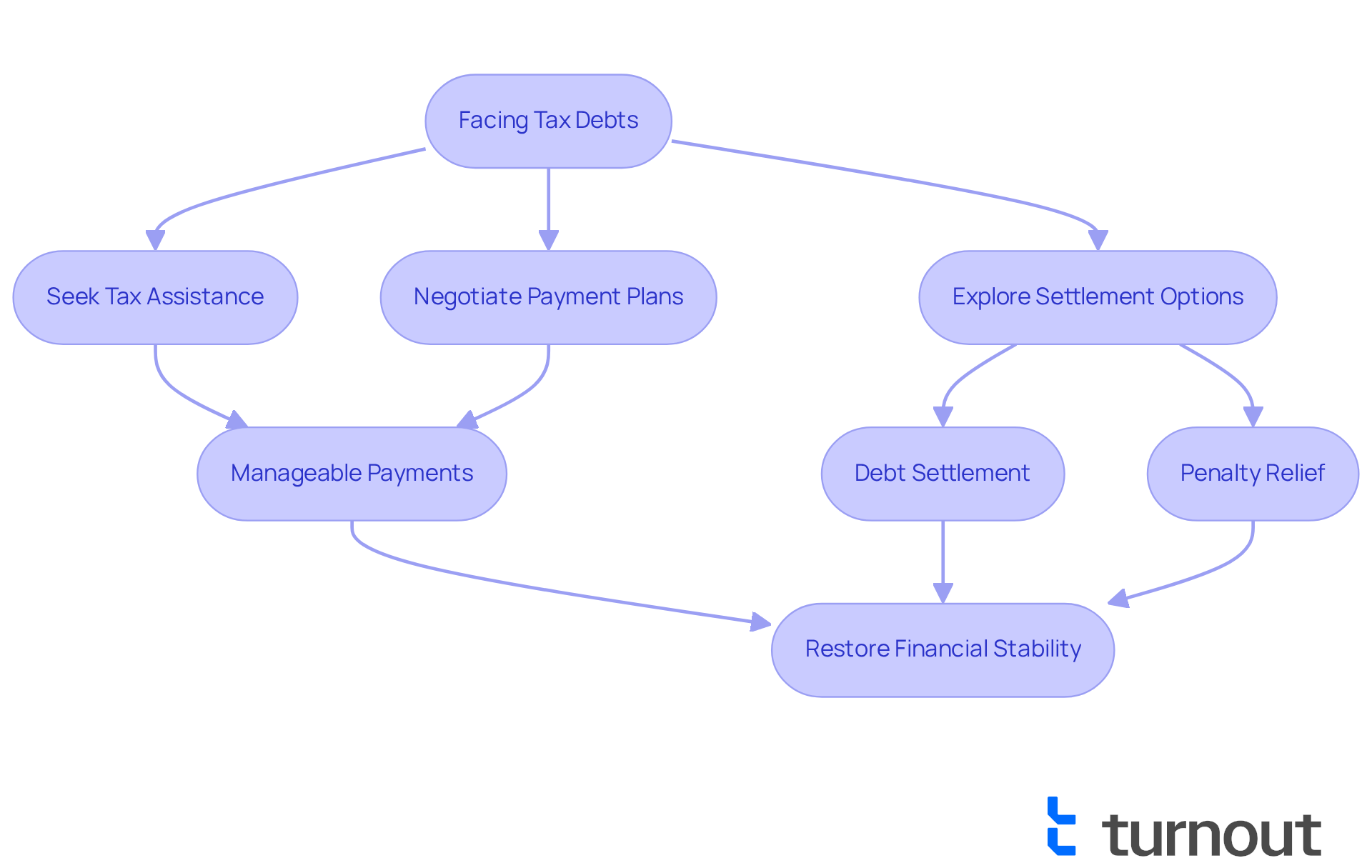

Tax assistance is vital for those feeling the weight of tax debts. We understand that the economic pressures can be overwhelming. In 2025, the landscape of tax enforcement is expected to intensify, with IRS actions leading to more wage garnishments and bank levies. Statistics show that millions of taxpayers face these serious consequences, which can disrupt their financial stability and personal lives. Many have found relief by turning to tax assistance services, which explain what is tax resolution through expert negotiation and strategic planning tailored to their unique situations.

The consequences of ignoring tax debts can be severe. Taxpayers may face aggressive collection actions, including legal proceedings initiated by tax authorities. Financial advisors emphasize that unresolved tax debts can lead to mounting penalties and interest, complicating an already challenging situation. By actively seeking to understand what is tax resolution, individuals can negotiate manageable payment plans, settle debts for less than what’s owed, or even obtain penalty relief, easing their immediate financial stress.

This journey not only helps restore compliance with tax obligations but also empowers individuals to take charge of their financial futures. With expert tax assistance, daunting tax issues can transform into manageable solutions, paving the way for long-term financial stability and peace of mind.

Remember, you are not alone in this journey. We're here to help you navigate these challenges and find the support you need.

Exploring Types of Tax Resolution Services: Options for Relief

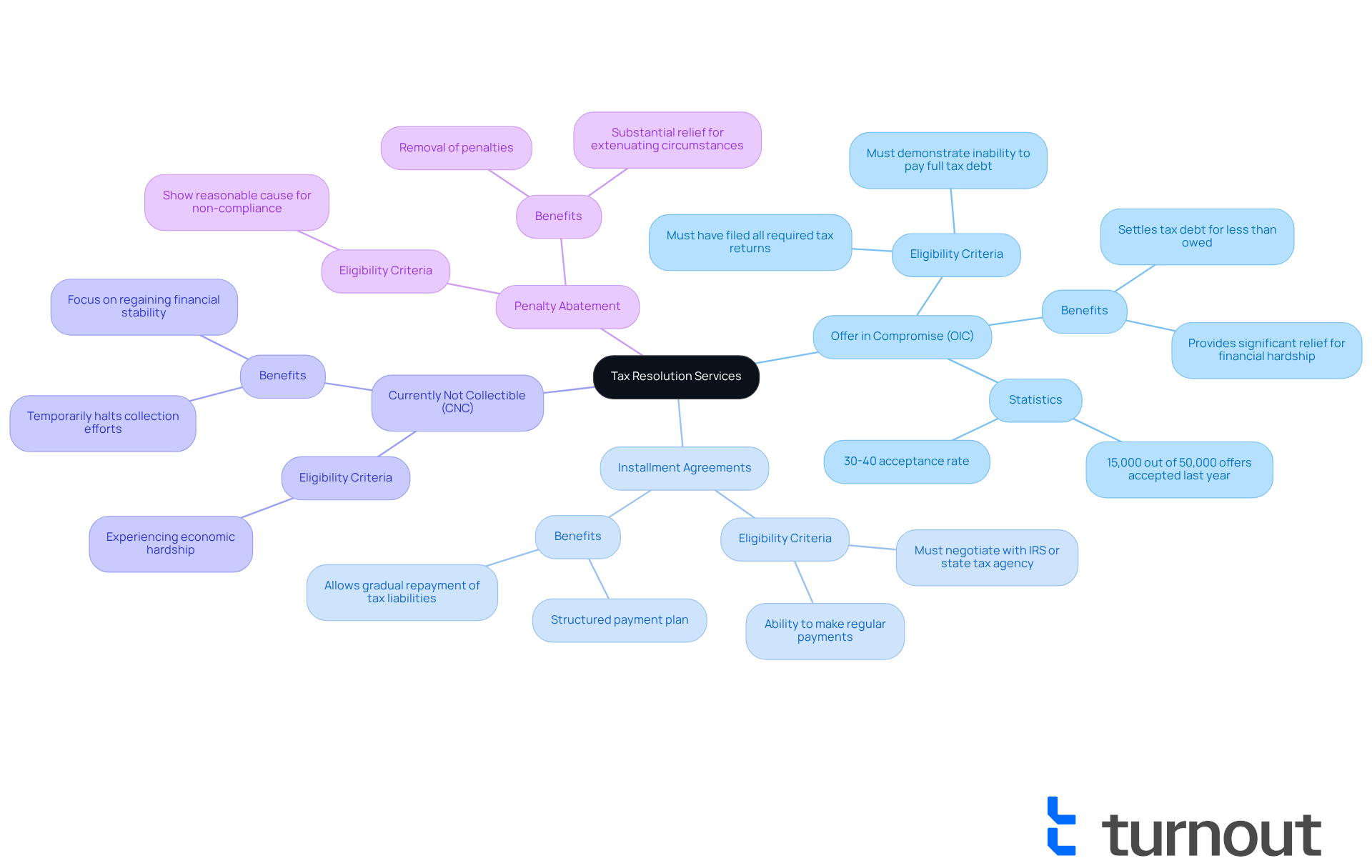

Tax assistance services offer various options tailored to address what is tax resolution related to your specific challenges. Here’s how they can help:

-

Offer in Compromise (OIC): If you're feeling overwhelmed by tax debts, this program allows you to settle for less than what you owe, based on your financial situation. Last year, out of about 50,000 offers filed, just over 15,000 were accepted. This highlights the importance of thorough preparation and understanding eligibility criteria. Remember, a well-prepared application can significantly boost your chances of approval, as the IRS evaluates offers based on your Reasonable Collection Potential (RCP). Just a heads up, there’s a non-refundable application fee of $205 for submitting an OIC.

-

Installment Agreements: If paying your tax liabilities in full feels daunting, you can negotiate a structured payment plan with the IRS or your state tax agency. Thousands have successfully set up Installment Agreements in recent years, allowing them to pay off debts over time. This option is especially beneficial for those who can demonstrate their ability to make regular payments without facing additional financial strain.

-

Currently Not Collectible (CNC): If you're experiencing economic hardship, this status can temporarily stop collection efforts. It’s a vital relief option for those facing significant financial difficulties, allowing you to focus on regaining stability without the pressure of tax collection.

-

Penalty Abatement: Have you faced challenges that led to non-compliance with your tax obligations? You may request the removal of penalties if you can show reasonable cause. This option can provide substantial relief, especially for those who have encountered extenuating circumstances.

Navigating what is tax resolution can feel overwhelming, but you don’t have to do it alone. Consulting with tax assistance experts can help you identify the best options for your unique situation, ensuring you receive the support you need. Remember, we're here to help, and you are not alone in this journey.

The Tax Resolution Process: Steps to Achieve Relief

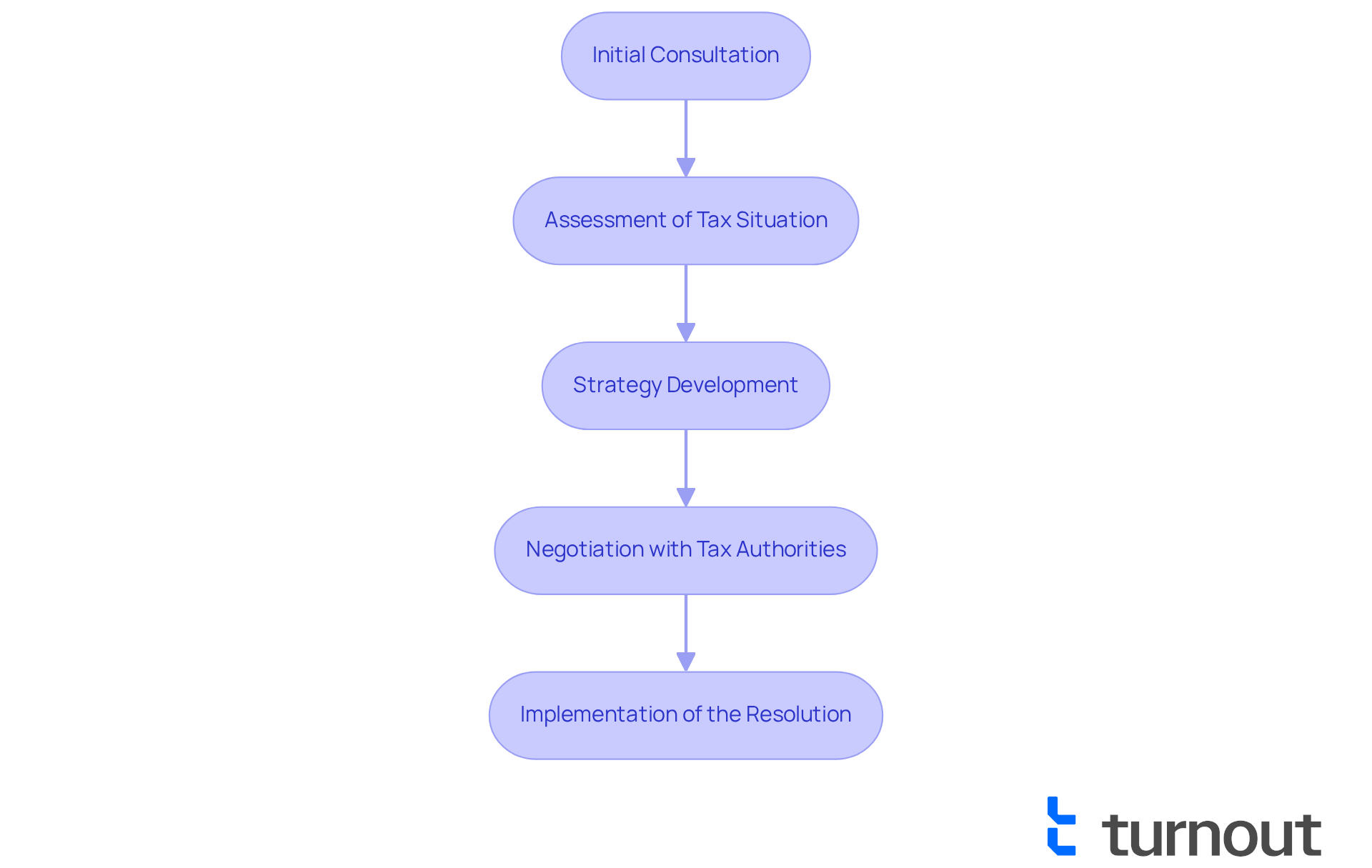

The tax settlement procedure illustrates what is tax resolution, as it is a thoughtful approach designed to help you regain control over your financial responsibilities. We understand that dealing with tax issues can be overwhelming, and this process typically involves several key steps:

- Initial Consultation: You begin by meeting with a tax expert who will listen to your unique situation and gather the necessary documentation. This step is crucial as it lays the groundwork for everything that follows.

- Assessment of Tax Situation: The expert will conduct a thorough analysis of your financial condition, outstanding tax obligations, and potential settlement options. This assessment is essential in identifying the best paths forward for you.

- Strategy Development: Based on the evaluation, a personalized plan is crafted that focuses on the most effective solutions tailored to your specific needs. This customized strategy is vital for maximizing your chances of success.

- Negotiation with Tax Authorities: Your tax expert will take the lead in communicating with the IRS or state agency on your behalf. Effective negotiation may involve presenting compelling evidence, leveraging available relief programs, and advocating for favorable terms.

- Implementation of the Resolution: Once an agreement is reached, it’s important for you to adhere to the terms, which may include making payments or fulfilling other obligations. Following through is crucial to ensure that the agreement remains intact and to avoid future complications.

By carefully following these steps, you can navigate the complexities of tax issues and learn what is tax resolution, significantly increasing your chances of achieving financial relief and restoring peace of mind. Remember, the timeline for resolving a tax relief case usually ranges from six months to two years, depending on the complexity of your situation. Submitting all overdue tax returns promptly is essential for compliance, as the IRS requires this to authorize any settlement. Delaying action on tax problems can lead to increased interest and penalties, so it’s important to address your issues as soon as possible. For example, Jane was able to reduce her IRS debt by 90% with the help of TaxAudit, demonstrating what tax resolution is and how effective these services can be.

You are not alone in this journey; we’re here to help.

Conclusion

Understanding tax resolution is essential for anyone grappling with tax-related issues. We know how overwhelming this can feel. This process not only provides a pathway to financial relief but also empowers you to regain control over your financial future. By navigating the complexities of tax obligations and exploring available solutions, you can alleviate the weight of unpaid taxes, audits, and penalties.

This article delves into various aspects of tax resolution, emphasizing the importance of seeking timely assistance. Key strategies such as:

- Offer in Compromise

- Installment Agreements

- Currently Not Collectible status

offer viable options for those in financial distress. It’s common to feel lost in these situations, but the structured tax resolution process-from initial consultation to negotiation with tax authorities-shows how expert guidance can lead to successful outcomes.

Ultimately, the significance of tax resolution extends beyond immediate relief; it fosters a sense of stability and confidence in managing your financial responsibilities. With the IRS's evolving programs and the increasing need for proactive measures, understanding and utilizing tax resolution services can pave the way for a more secure financial future. Remember, taking the first step towards addressing tax issues can lead to transformative results. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is tax resolution?

Tax resolution refers to the process of addressing and resolving tax-related challenges with authorities like the IRS or state tax agencies, including issues such as unpaid taxes, audits, or penalties.

How common are tax problems among taxpayers in the U.S.?

Approximately 20% of taxpayers in the U.S. encounter tax problems each year, highlighting the prevalence of these issues.

What are some strategies for achieving tax resolution?

Strategies for tax resolution include negotiation and engaging in official programs designed to help resolve debts, as well as utilizing Alternative Dispute Resolution (ADR) techniques.

What are some of the IRS's ADR programs?

The IRS has expanded its ADR programs to include the Fast Track Settlement and a Post Appeals Mediation pilot program, which runs from October 1, 2025, through September 30, 2027.

Why is it important to be proactive in tax resolution?

Being proactive can lead to more favorable outcomes in tax disputes, as timely intervention may help mitigate tax liabilities and improve communication with tax authorities.

What are some potential benefits of participating in the IRS's Fast Track Settlement program?

Individuals who participated in the IRS's Fast Track Settlement program reported significant reductions in their tax liabilities, demonstrating the potential for financial relief.

How have recent legislative changes affected taxpayer rights?

Recent legislative changes by the IRS have strengthened taxpayer rights and ensured clearer communication, which is crucial for those dealing with tax disputes.

How can individuals stay informed about their tax resolution options?

Staying informed about evolving tax regulations and understanding the concept of tax resolution can empower individuals to manage their tax difficulties more effectively.