Overview

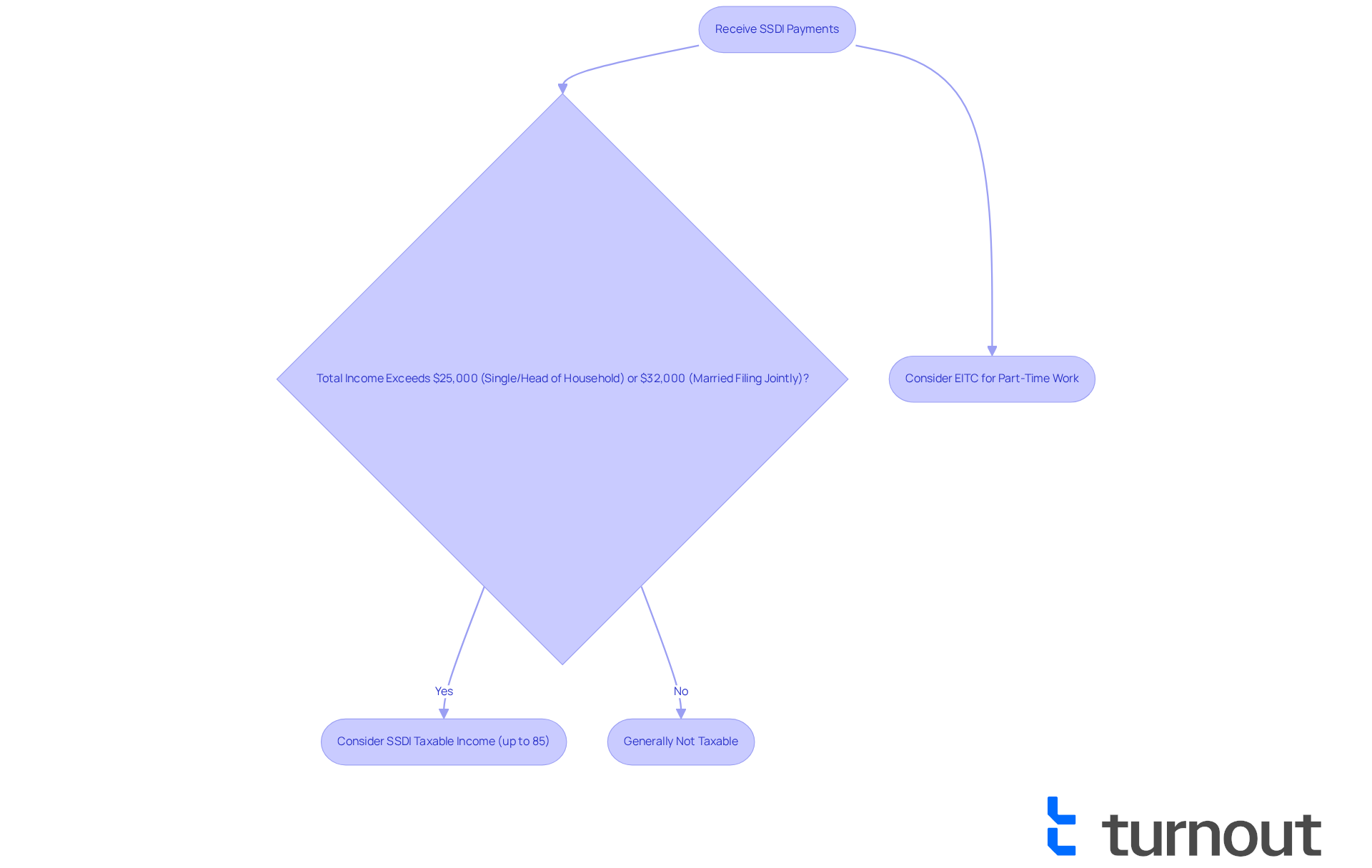

Understanding SSDI taxable income can feel overwhelming, especially when it comes to your financial future. Many people wonder how much of their Social Security Disability Insurance benefits might be subject to federal income tax. If your total earnings exceed certain thresholds—$25,000 for individuals or $32,000 for married couples filing jointly—up to 85% of your SSDI benefits could be taxable.

We understand that navigating these numbers can be stressful. It’s common to feel uncertain about how this might affect your overall financial planning. Knowing the tax implications is crucial for making informed decisions that can help secure your financial well-being.

Take a moment to reflect: Are you aware of how your combined income might impact your benefits? Understanding these details can empower you to plan effectively. Remember, you’re not alone in this journey. We’re here to help you make sense of it all and ensure you’re prepared for what lies ahead.

Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) can feel overwhelming, especially when it comes to understanding whether SSDI payments are considered taxable income. We understand that this crucial aspect not only impacts your financial planning but can also lead to unexpected tax liabilities for many recipients. As you work through your financial landscape, it’s common to feel uncertain about how your total earnings affect your SSDI benefits.

So, how can you determine if your SSDI income is taxable? What strategies can you use to manage potential tax burdens? These are important questions that deserve careful consideration. Remember, you are not alone in this journey, and there are resources available to help you navigate these challenges.

Define SSDI Taxable Income

Navigating the world of Social Security Disability Insurance (SSDI) can be overwhelming, especially when it comes to understanding whether SSDI is taxable income. We understand that many recipients worry about whether SSDI is taxable income when it comes to their benefits. It’s important to know that, according to IRS regulations, the question of whether SSDI is taxable income is relevant because disability payments aren’t automatically taxable. Instead, their tax status hinges on your overall earnings.

If half of your disability assistance, along with other income, exceeds certain limits, you may need to consider if SSDI taxable income affects your tax obligations. For instance, if you’re filing as single or head of household, the threshold is $25,000. Married couples filing jointly have a slightly higher threshold of $32,000. If your total income surpasses these amounts, it may determine whether SSDI taxable income applies to up to 85% of your disability assistance.

However, there’s good news! Disability support payments are generally protected from garnishment and most tax seizures, providing a sense of financial stability. Many recipients find that they don’t owe federal taxes, especially when considering if SSDI is taxable income and is their only source of income. But as your income increases, the likelihood of SSDI taxable income on your benefits also rises. It’s crucial to keep an eye on your overall earnings, particularly to understand if SSDI taxable income impacts them.

If you’re working part-time while receiving SSDI, you might qualify for tax credits like the Earned Income Tax Credit (EITC). This can help you make the most of your financial resources. Each January, you’ll receive Form SSA-1099 from the SSA, detailing the total payments you’ve received. This form is essential for understanding your tax obligations.

Given the complexities surrounding tax regulations and the question of whether SSDI is taxable income, seeking help from a qualified advocate can be incredibly beneficial. As the Disability Advice Team reminds us, the question of whether SSDI is taxable income can be confusing, particularly without support from a professional advocate. Remember, you’re not alone in this journey, and there are resources available to help you navigate these challenges.

Context and Importance of SSDI Taxable Income

Understanding if SSDI is taxable income is crucial for anyone navigating the tax implications of Social Security Disability Insurance (SSDI) in this complex landscape. Many recipients may not realize that SSDI is taxable income, which could lead to unexpected financial challenges. If you have additional income—like wages or investment returns—you might find yourself in a tax bracket where some of your disability payments are taxed, leading to the question of whether SSDI is taxable income.

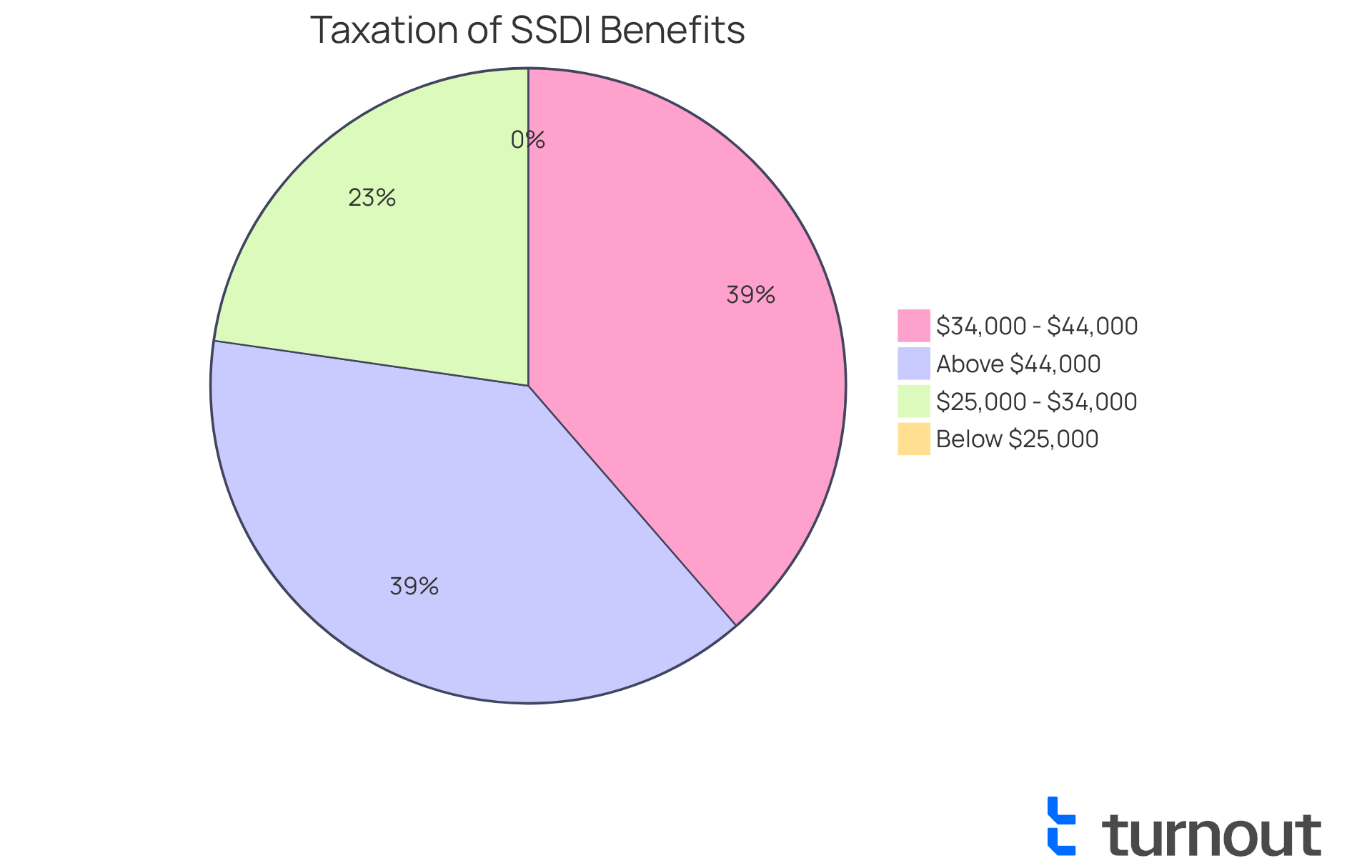

It’s common to feel overwhelmed by these details. In fact, statistics reveal that a significant number of disability benefit recipients are unaware of these tax implications, which can hinder effective financial planning. Projections indicate that by 2030, about 58% of beneficiary families will owe taxes on their Social Security benefits. This underscores the importance of being informed as you budget and save for the future.

Understanding how SSDI being taxable income can impact your overall financial health is essential. It empowers you to take control of your financial situation. At Turnout, we’re here to help. We offer tools and services, including trained nonlawyer advocates and IRS-licensed enrolled agents, to guide you through these complexities. Our goal is to help you manage your SSD claims and tax obligations effectively, without the need for legal representation. Remember, our services do not constitute legal advice, but we’re dedicated to supporting you on this journey.

Calculate Your SSDI Taxable Income

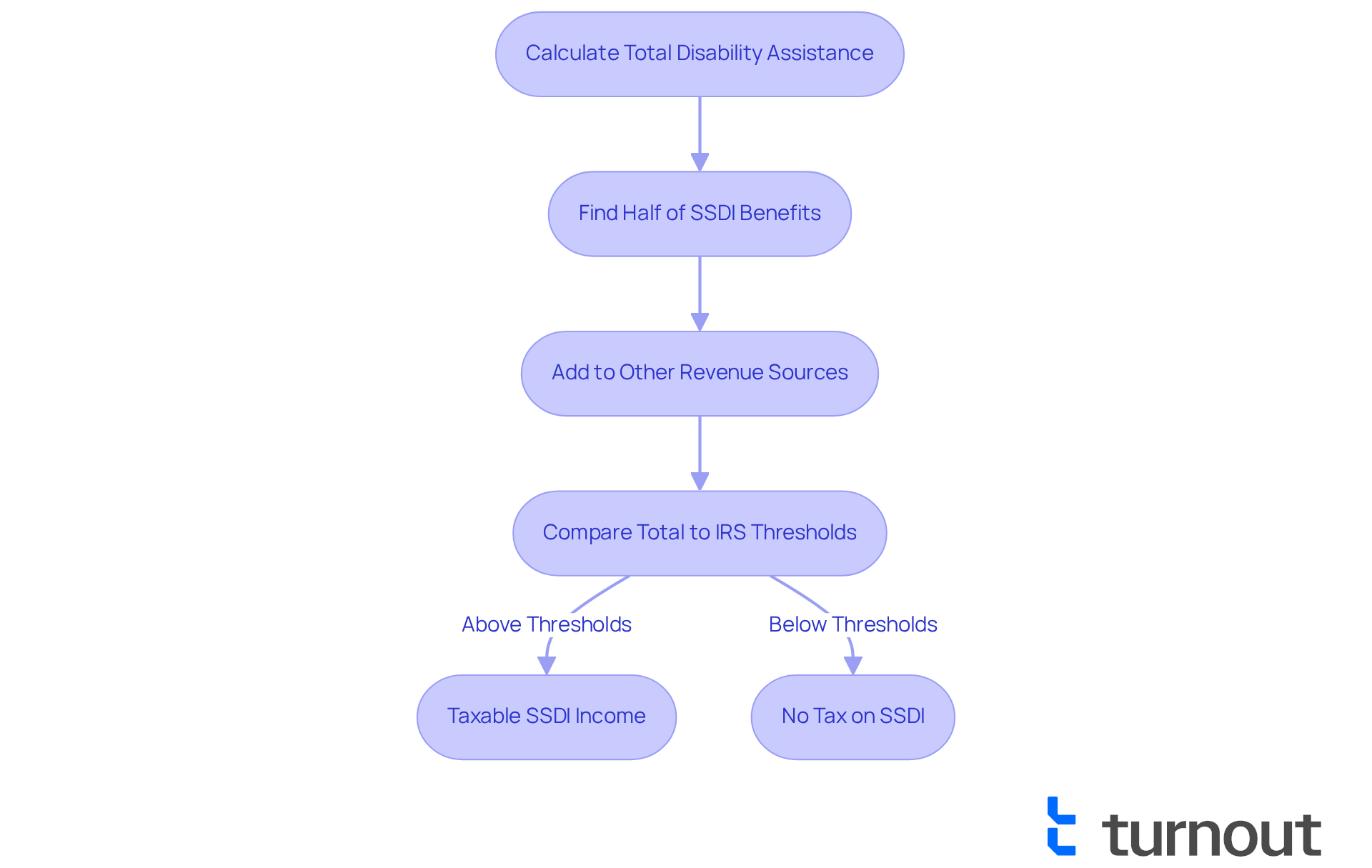

Determining if your taxable income for disability benefits is SSDI taxable income can feel overwhelming, but we’re here to help you through it. Let’s break it down into manageable steps:

- First, calculate your total disability assistance received for the year.

- Next, find out half of your SSDI benefits.

- Then, add this amount to all other sources of revenue, including wages, interest, and dividends.

- Finally, compare the total to the IRS earnings thresholds: $25,000 for single filers and $32,000 for couples filing jointly.

If your total earnings exceed these figures, some of your disability assistance may be subject to taxation.

For instance, if you receive $2,000 each month in disability payments, that totals $24,000 for the year. If you also earn $1,000 monthly from a part-time job, your total income would reach $36,000. Since this surpasses the $25,000 limit for individual filers, you might need to pay taxes on 50% of your disability assistance. Specifically, if your disability payments total $24,000, then 50% of that amount—$12,000—could be taxable. On the flip side, if your total earnings as an individual filer are $30,000, you would also be required to pay taxes on 50% of your disability assistance, as your total earnings exceed the base amount.

It’s important to note that for married couples filing jointly, if your total earnings exceed $44,000, up to 85% of your disability benefits may be subject to taxation. The IRS states that 'Other revenue encompasses pensions, wages, interest, dividends, and capital gains.'

Understanding these limits and calculations is essential for accurately assessing whether SSDI is taxable income. Remember, you’re not alone in this journey, and taking these steps can help clarify your financial situation.

Understand Tax Liabilities on SSDI Benefits

Navigating tax obligations on disability payments can feel overwhelming, and we understand that your personal situation plays a significant role in this process. Typically, if your total earnings exceed certain limits, you might find that up to 50% or even 85% of your disability payments is SSDI taxable income. For instance, if you're an individual taxpayer with total earnings over $34,000, you could face taxation on as much as 85% of your disability support payments.

In 2010, households in the third earnings bracket paid a median of 5% of their revenue as tax, and this figure is expected to rise to around 10% by 2050. This highlights the importance of being aware of potential tax liabilities, as they can significantly impact your financial planning and budgeting. Consulting with a financial planner can be a great step for disability benefit recipients, helping you manage your tax responsibilities effectively and explore available deductions or credits.

It's crucial to understand how combined income influences the question of whether SSDI is taxable income. If your income falls between $25,000 and $34,000, you may see up to 50% of your benefits taxed. Those earning above $44,000 could face up to 85% in taxes. As the tax landscape evolves, staying informed about these implications is essential for effective financial management.

Remember, you are not alone in this journey. Turnout is here to assist you, utilizing trained nonlawyer advocates and IRS-licensed enrolled agents to help you navigate these complexities. We ensure you understand your SSD claims and tax relief options without the need for legal representation. We're here to help you every step of the way.

Conclusion

Understanding whether SSDI constitutes taxable income is crucial for anyone receiving Social Security Disability Insurance. We know that navigating tax obligations can feel overwhelming, but it’s important to recognize that the taxability of SSDI benefits isn’t a straightforward matter. It largely depends on your overall income. If your total income exceeds certain thresholds—$25,000 for single filers and $32,000 for married couples filing jointly—up to 85% of your SSDI benefits may be subject to taxation. This knowledge empowers you to make informed financial decisions and avoid unexpected tax liabilities.

Key insights from this article emphasize the importance of accurately calculating your total income, including SSDI benefits and any additional earnings. The thresholds set by the IRS play a critical role in determining your tax obligations. It’s also essential to be aware of available tax credits, like the Earned Income Tax Credit (EITC), which can ease financial burdens for those working part-time while receiving SSDI. Engaging with qualified advocates can provide invaluable support in navigating these complexities, ensuring you understand your rights and responsibilities.

Ultimately, staying informed about SSDI taxable income is vital for effective financial planning. As projections indicate that a growing percentage of beneficiaries will owe taxes on their Social Security benefits, proactive management of your financial situation becomes increasingly important. Seeking guidance and utilizing available resources can significantly enhance your understanding and optimization of tax obligations related to SSDI. Taking these steps not only fosters financial stability but also empowers you to navigate your unique circumstances with confidence. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

Is Social Security Disability Insurance (SSDI) considered taxable income?

SSDI is not automatically considered taxable income. Its tax status depends on your overall earnings and whether your total income exceeds certain thresholds.

What are the income thresholds for determining if SSDI is taxable?

For individuals filing as single or head of household, the threshold is $25,000. For married couples filing jointly, the threshold is $32,000. If your total income exceeds these amounts, up to 85% of your SSDI benefits may be taxable.

Are SSDI payments protected from garnishment or tax seizures?

Yes, disability support payments are generally protected from garnishment and most tax seizures, which helps maintain financial stability for recipients.

Do most SSDI recipients owe federal taxes?

Many SSDI recipients do not owe federal taxes, especially if SSDI is their only source of income. However, as overall income increases, the likelihood of SSDI being taxable also rises.

Can working part-time while receiving SSDI affect my tax situation?

Yes, if you work part-time while receiving SSDI, you may qualify for tax credits like the Earned Income Tax Credit (EITC), which can help maximize your financial resources.

What form do SSDI recipients receive to understand their tax obligations?

SSDI recipients receive Form SSA-1099 from the Social Security Administration (SSA) each January, which details the total payments received and is essential for understanding tax obligations.

Should I seek help regarding SSDI tax-related questions?

Yes, due to the complexities of tax regulations concerning SSDI, seeking assistance from a qualified advocate can be beneficial in navigating these challenges.