Overview

Long-Term Disability (LTD) on a paystub signifies an essential insurance policy designed to provide income replacement for employees who find themselves unable to work due to a prolonged illness or injury. Typically, this coverage is activated once short-term disability benefits have been exhausted. We understand that navigating these circumstances can be challenging, which is why LTD is highlighted as a crucial element of financial planning and employee benefits. It plays a vital role in ensuring economic stability during difficult times, helping to alleviate some of the stress you may feel.

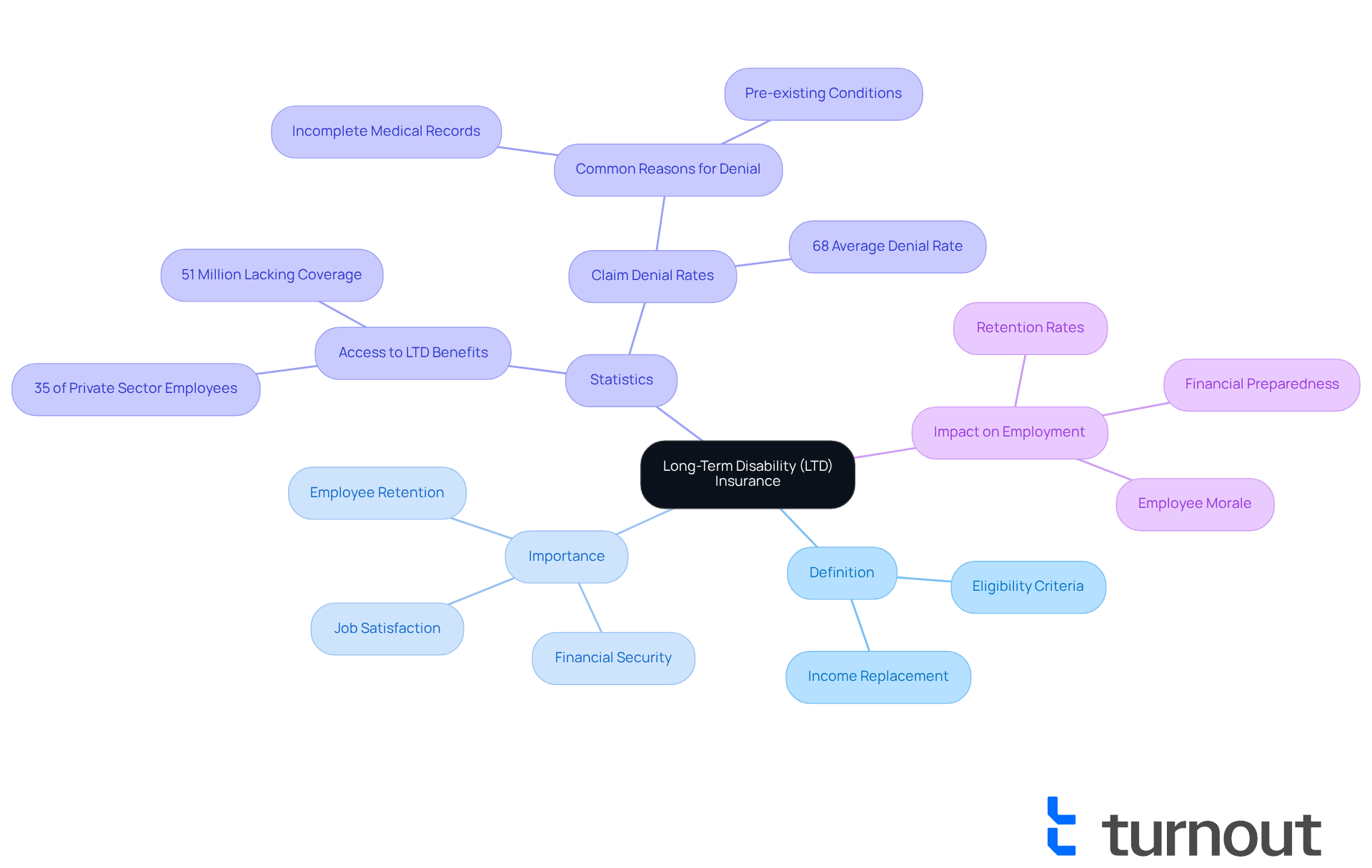

Moreover, LTD contributes to improving employee retention rates by fostering a supportive work environment. This nurturing approach not only aids individuals in their time of need but also strengthens the overall workplace culture. Remember, you are not alone in this journey, and we’re here to help you through these trying times.

Introduction

Understanding the intricacies of a paystub can often feel like deciphering a foreign language. We understand that this can be overwhelming. Yet, one abbreviation stands out with significant implications: LTD, or Long-Term Disability insurance. This essential coverage not only provides a safety net for employees facing prolonged illness or injury but also plays a pivotal role in overall financial security and workplace satisfaction.

It's common to feel uncertain, especially with a staggering number of working adults lacking adequate disability insurance. So, how can you ensure you are adequately protected against unforeseen health challenges while navigating the complexities of your paystub? We're here to help you find clarity and peace of mind.

Define Long-Term Disability (LTD) and Its Role in Employment

Long-Term Disability (LTD) insurance, which is what is LTD on paystub, is a vital policy that offers income replacement to those unable to work due to a prolonged illness or injury. We understand how challenging it can be to face such circumstances. Typically, what is LTD on paystub refers to benefits that begin after short-term disability benefits are exhausted, often following a waiting period of several months. This protection is crucial for workers, as it ensures economic stability during difficult times, allowing them to focus on healing without the added stress of financial obligations.

Understanding what is LTD on paystub is crucial as its importance in the workplace goes beyond individual financial security; it serves as a key element of a comprehensive benefits package for employees. In 2025, approximately 35% of private sector employees will have access to LTD benefits. This highlights a significant gap in protection, as 51 million working adults in the U.S. currently lack disability insurance. Employers who provide LTD insurance can clarify what is LTD on paystub, which not only enhances job satisfaction but also improves retention rates among their staff. Research indicates that organizations prioritizing comprehensive disability coverage experience higher staff morale and loyalty. Employees are more likely to remain with employers who genuinely support their long-term health needs. Understanding what is LTD on paystub benefits and its connection to employee retention underscores the necessity for businesses to invest in such policies, fostering a stable and committed workforce.

Moreover, securing some form of long-term disability insurance is essential for overall financial well-being, as emphasized by industry experts. The impact of LTD insurance on employee retention is evident in various case studies, reinforcing the importance of these benefits in nurturing a supportive work environment. Remember, you are not alone in this journey; we’re here to help you navigate these challenges.

Explain How LTD is Represented on Paystubs

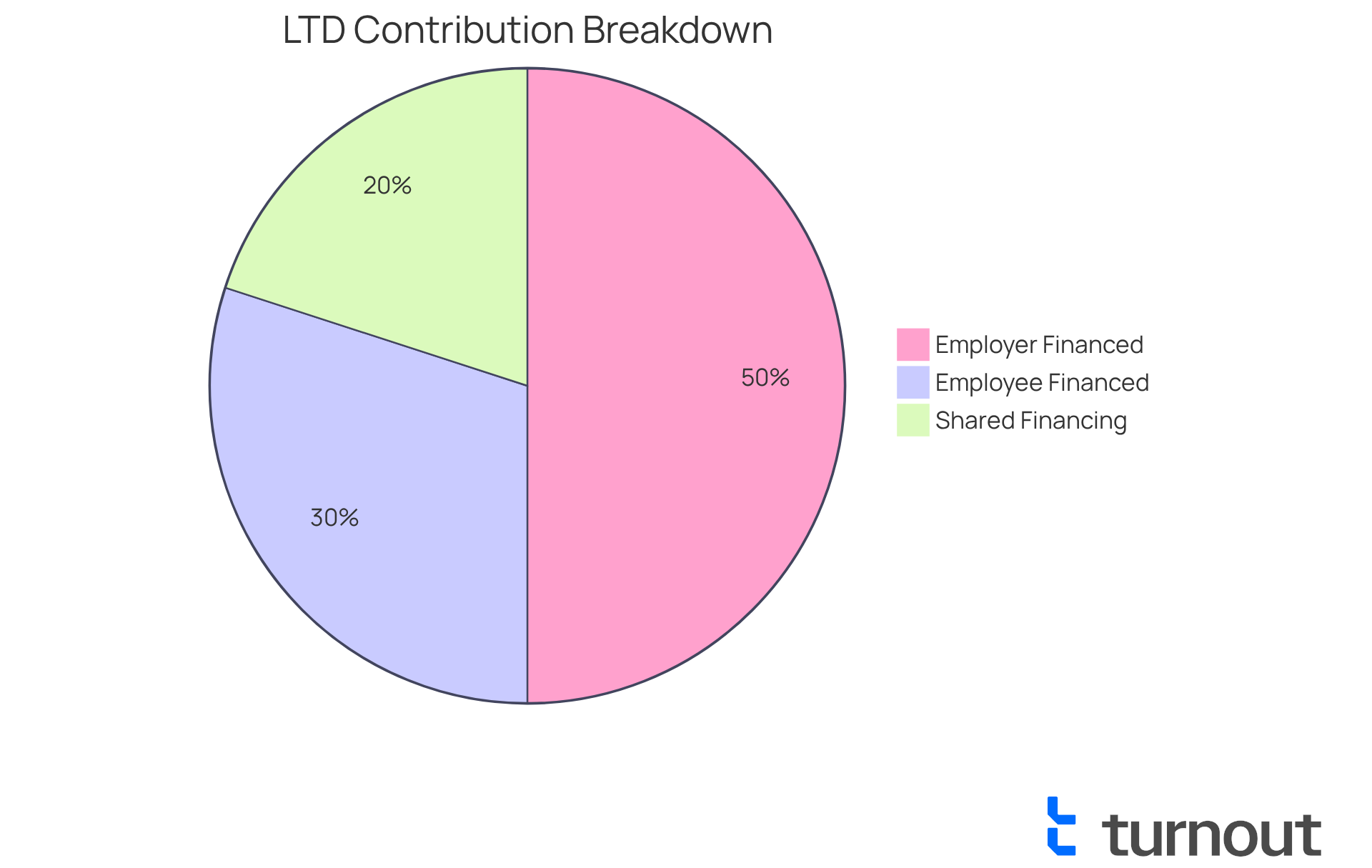

On paystubs, what is ltd on paystub is often indicated by a deduction labeled 'LTD' or 'Long-Term Disability Insurance.' This deduction represents the premiums that staff members contribute toward their LTD protection. It's important to know that this can be fully financed by the employer, partially financed, or shared between the employer and staff. The amount deducted can vary based on the specific policy and the worker's salary.

For instance, typical deductions for LTD insurance might range from 1% to 3% of a worker's gross income, depending on the level of protection and the employer's plan arrangement. We understand that navigating these deductions can be overwhelming, but grasping this information is crucial. It directly impacts your net income and underscores the importance of maintaining sufficient coverage for your future financial security.

In 2025, you will understand what is ltd on paystub as the deductions will be clearly itemized. This transparency allows staff to easily monitor their contributions, ensuring they are adequately covered in the event of long-term illness or injury. Remember, you are not alone in this journey; we’re here to help you understand and secure your financial well-being.

Discuss the Importance of LTD for Employees and Financial Planning

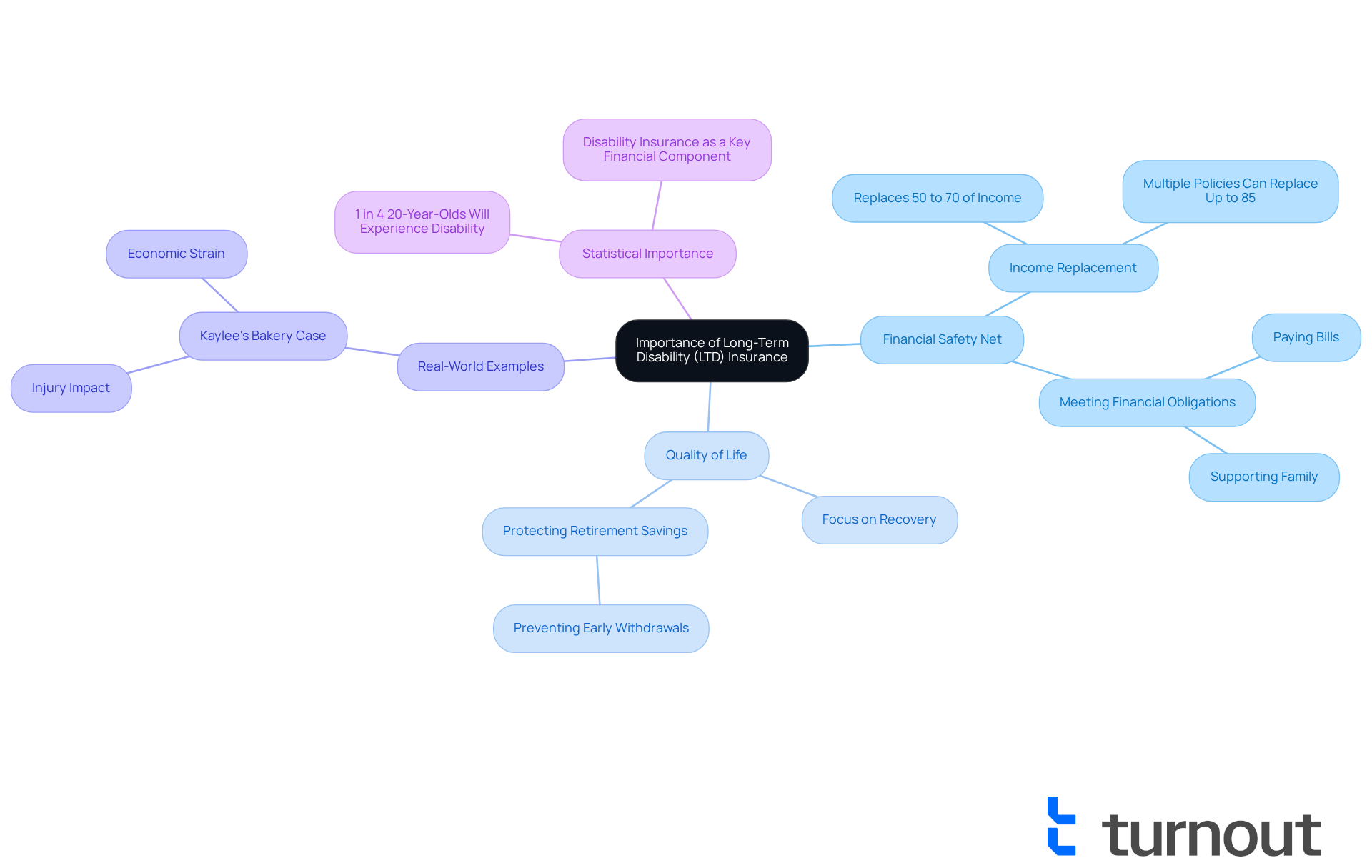

Long-Term Disability (LTD) insurance is a vital part of economic planning for employees. It acts as a crucial safety net, replacing a significant portion of income—typically ranging from 50% to 70%—when individuals are unable to work due to qualifying health conditions. This coverage is essential for sustaining a stable quality of life, allowing individuals to meet their financial obligations, pay bills, and support their families during challenging times.

Consider the case of Kaylee, a bakery owner who faced a serious injury. She found herself unable to work, and without sufficient income protection, her savings quickly dwindled. This led to economic strain and compelled her to reduce production. Such situations highlight the importance of having LTD insurance to safeguard against unforeseen circumstances.

Moreover, LTD insurance alleviates the financial burden that often accompanies long-term health issues. It allows individuals to focus on their recovery rather than being overwhelmed by economic stress. It also plays a crucial role in protecting retirement savings by preventing the need to withdraw from retirement accounts early due to prolonged disability.

As a security strategy, we urge employees to view LTD not merely as an optional benefit but as a fundamental element of their overall economic well-being. It's significant to note that one in four 20-year-olds will face disability before reaching retirement age. This statistic emphasizes the importance of LTD insurance in planning for the future.

By incorporating LTD into their financial plans, individuals can feel more prepared to navigate the challenges posed by health crises. Remember, you are not alone in this journey, and securing your financial future is within reach.

Explore Variations of LTD Policies and Their Implications

Long-Term Disability (LTD) policies come in various types, each with unique characteristics that significantly influence your protection. It's important to understand the key distinction between 'own occupation' and 'any occupation' protection. 'Own occupation' policies provide benefits if you are unable to perform your specific job, offering a safety net for professionals with specialized and irreplaceable skills. In contrast, 'any occupation' protection only offers benefits if you cannot work in any position for which you are reasonably qualified based on your education, training, or experience.

As we approach 2025, the importance of 'own occupation' protection is increasingly recognized as essential for professionals, particularly in fields like medicine. Here, specialized skills are crucial. For example, physicians often face unique challenges; if they cannot perform their specific duties, they may still be considered capable of working in a different role under 'any occupation' policies, which could leave them financially vulnerable.

Statistics show that a significant percentage of LTD policies offer 'own occupation' coverage, reflecting a growing awareness of the need for personalized protection. However, many employer-sponsored plans default to 'any occupation' definitions, which may lead to less favorable terms for claimants. It's also worth noting that some 'own occupation' policies may include a re-evaluation clause after 24 to 60 months, shifting to a less favorable 'any occupation' definition. Understanding this is crucial for policyholders.

Grasping these differences is vital for you when choosing a policy that aligns with your career path and financial responsibilities. When exploring LTD options, consider your occupation, health condition, and monetary obligations. The right policy can provide essential support during challenging times, ensuring that your financial stability is maintained even when faced with unexpected health issues. Additionally, portability is an important aspect to think about, as policies obtained outside of an employer can protect coverage without lapses during job changes.

We understand that navigating these choices can be overwhelming, but remember, you are not alone in this journey. We're here to help you find the right protection for your needs.

Conclusion

Long-Term Disability (LTD) insurance is a vital aspect of financial security for employees, providing essential income protection during times of prolonged illness or injury. We understand that navigating financial stability can be challenging, and recognizing what LTD means on a paystub can help individuals appreciate its significance. This coverage is not just important for personal financial well-being; it is a crucial component of a comprehensive employee benefits package. With many workers lacking access to such protection, it is imperative for employees and employers alike to prioritize LTD insurance, fostering a supportive workplace environment.

This article highlights key points about the importance of LTD insurance:

- It plays a critical role in ensuring financial stability during difficult times.

- It is represented on paystubs.

- It comes in various policy types that can significantly affect coverage.

Real-life examples illustrate the necessity of having adequate LTD protection, while statistics reveal the alarming reality that many individuals face disability before retirement age. By understanding these elements, employees can make informed decisions about their financial planning and the benefits they seek from their employers.

In light of these insights, it is crucial to view LTD insurance as more than just an optional benefit; it is a fundamental part of safeguarding your financial future. As the landscape of employment benefits continues to evolve, taking proactive steps to secure long-term disability coverage can help ensure you are prepared for unforeseen challenges. Embracing this understanding can lead to a more secure and stable financial future, ultimately enhancing your overall quality of life. Remember, you are not alone in this journey, and we’re here to help you navigate these important decisions.

Frequently Asked Questions

What is Long-Term Disability (LTD) insurance?

Long-Term Disability (LTD) insurance is a policy that provides income replacement to individuals who are unable to work due to a prolonged illness or injury.

When do LTD benefits begin?

LTD benefits typically begin after short-term disability benefits are exhausted, often following a waiting period of several months.

Why is LTD insurance important for employees?

LTD insurance is crucial for employees as it ensures economic stability during difficult times, allowing them to focus on healing without the added stress of financial obligations.

How prevalent is access to LTD benefits among private sector employees?

In 2025, approximately 35% of private sector employees are expected to have access to LTD benefits.

What is the current situation regarding disability insurance among working adults in the U.S.?

Currently, 51 million working adults in the U.S. lack disability insurance, highlighting a significant gap in protection.

How can employers benefit from providing LTD insurance?

Employers who provide LTD insurance can enhance job satisfaction and improve retention rates among their staff, as employees are more likely to stay with employers who support their long-term health needs.

What impact does LTD insurance have on employee morale?

Organizations that prioritize comprehensive disability coverage experience higher staff morale and loyalty, fostering a supportive work environment.

Why is securing long-term disability insurance important for financial well-being?

Securing long-term disability insurance is essential for overall financial well-being, as it protects individuals from loss of income during prolonged periods of inability to work.