Overview

We understand that navigating tax regulations can be overwhelming. IRS backup withholding is a crucial tax mechanism designed to help you. It requires a payer to withhold 24% of certain payments when a recipient does not provide an accurate Taxpayer Identification Number (TIN) or underreports income. This process is essential for ensuring that tax revenue is collected on income that might otherwise go unreported.

It's common to feel concerned about tax compliance, but know that this withholding plays a vital role in mitigating tax evasion. By adhering to these regulations, we can collectively maintain the integrity of our tax system. Remember, you are not alone in this journey. We're here to help you navigate these complexities and ensure that you stay compliant with tax regulations.

Introduction

Navigating the nuances of tax regulations can feel overwhelming for many, especially when it comes to IRS backup withholding. This essential mechanism helps ensure that taxes are collected on income that might otherwise slip through the cracks, particularly for individuals who may not provide an accurate Taxpayer Identification Number (TIN). We understand that as you manage your financial responsibilities, a pressing question arises: how can you safeguard your earnings while ensuring compliance with IRS requirements?

In this article, we will explore the intricacies of IRS backup withholding, highlighting its significance and the types of payments affected. Additionally, we will discuss the exemptions available to help you maintain control over your finances. Remember, you are not alone in this journey, and we’re here to help you understand and navigate these complexities.

Define IRS Backup Withholding

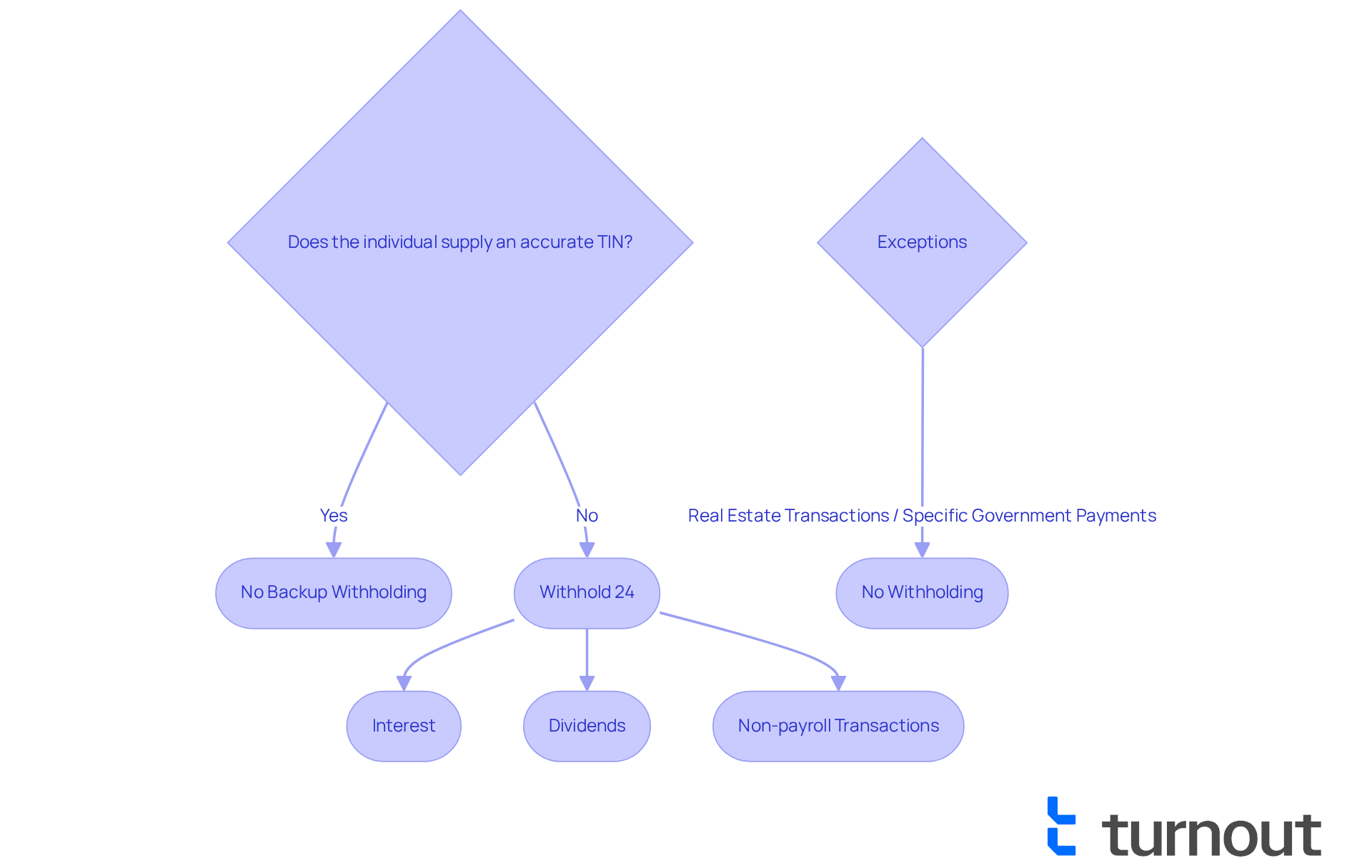

When considering IRS enforcement of tax collection, it's important to understand what is IRS backup withholding, as it involves retaining a specific percentage of certain disbursements made to individuals who either do not supply an accurate Taxpayer Identification Number (TIN) or underreport their earnings. As of 2025, the backup deduction rate is set at 24%. This withholding mainly pertains to amounts reported on Forms 1099 and W-2G, which include interest, dividends, and various non-payroll transactions. The intent behind this mechanism is to help ensure that the IRS collects taxes on income that might otherwise remain unreported, addressing what is IRS backup withholding.

We understand that navigating these requirements can be challenging. For instance, if a person receives interest distributions from a bank but has not supplied an accurate TIN, the bank must withhold 24% of those distributions, which relates to what is IRS backup withholding. This ensures that the IRS receives the appropriate tax revenue, thereby preventing potential tax evasion. In 2025, it is essential for taxpayers to understand what is IRS backup withholding, as amounts subject to secondary tax deductions include not just interest and dividends but also transactions processed through third-party networks and specific government disbursements.

It's important to verify your TIN when establishing new accounts or receiving amounts reportable on Form 1099. Not supplying an accurate TIN can initiate additional tax deductions, leading to what is IRS backup withholding, which may affect your earnings from interest or dividends. Payments not subject to retention include real estate transactions, foreclosures, and specific government payments. Furthermore, sums retained under alternative tax retention must be disclosed on your income tax return for the year the earnings were obtained, ensuring clarity and adherence to tax regulations. Remember, 'There are situations when the payer is required to withhold at the current rate of 24 percent,' which raises the question of what is IRS backup withholding and highlights the importance of compliance.

You're not alone in this journey; we're here to help you navigate these complexities.

Understand the Importance of Backup Withholding

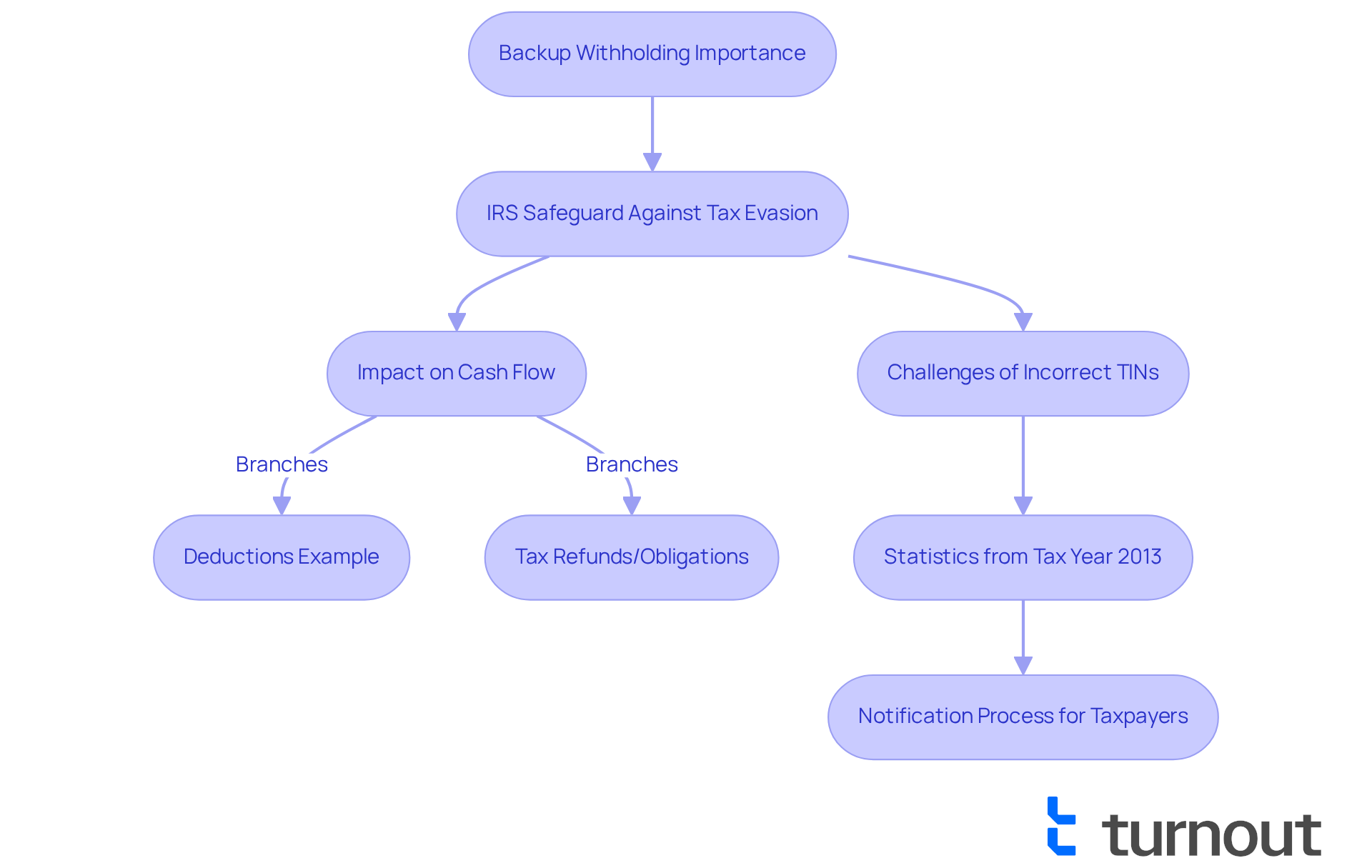

Backup retention serves as a crucial safeguard for the IRS, ensuring that taxes are collected on income that might otherwise escape taxation. We understand that this can be particularly important for individuals who may not regularly file tax returns or who have discrepancies in their reported income. By implementing tax collection measures, the IRS aims to reduce the risk of tax evasion, helping to ensure that all taxpayers contribute their fair share.

For those subject to secondary tax collection, cash flow can be significantly impacted. A portion of their earnings is retained and sent directly to the IRS, which may lead to larger tax refunds or obligations at the end of the tax year. For instance, if a person receives a payment of $1,000 subject to retention, 24% would be deducted, resulting in only $760 being received. It’s common to feel concerned about these deductions, but understanding the process can help ease some of that worry.

Statistics reveal that in Tax Year 2013 alone, nearly $9 billion in tax collection was not achieved due to absent or incorrect taxpayer identification numbers (TINs). Most American citizens are free from secondary deductions if their TIN or Social Security number is properly recorded, which helps avoid unnecessary deductions. Remember, alternative retention can also be applied as a credit against any income tax submission for that year, enabling taxpayers to potentially reclaim some of the deducted amounts.

The notification process is equally important; taxpayers will receive multiple notifications regarding their status. This helps them understand their obligations and take necessary actions. We’re here to help you navigate these dynamics, ensuring you can manage your financial landscape effectively. You're not alone in this journey, and with the right information, you can feel more confident about your tax responsibilities.

Identify Payments Subject to Backup Withholding

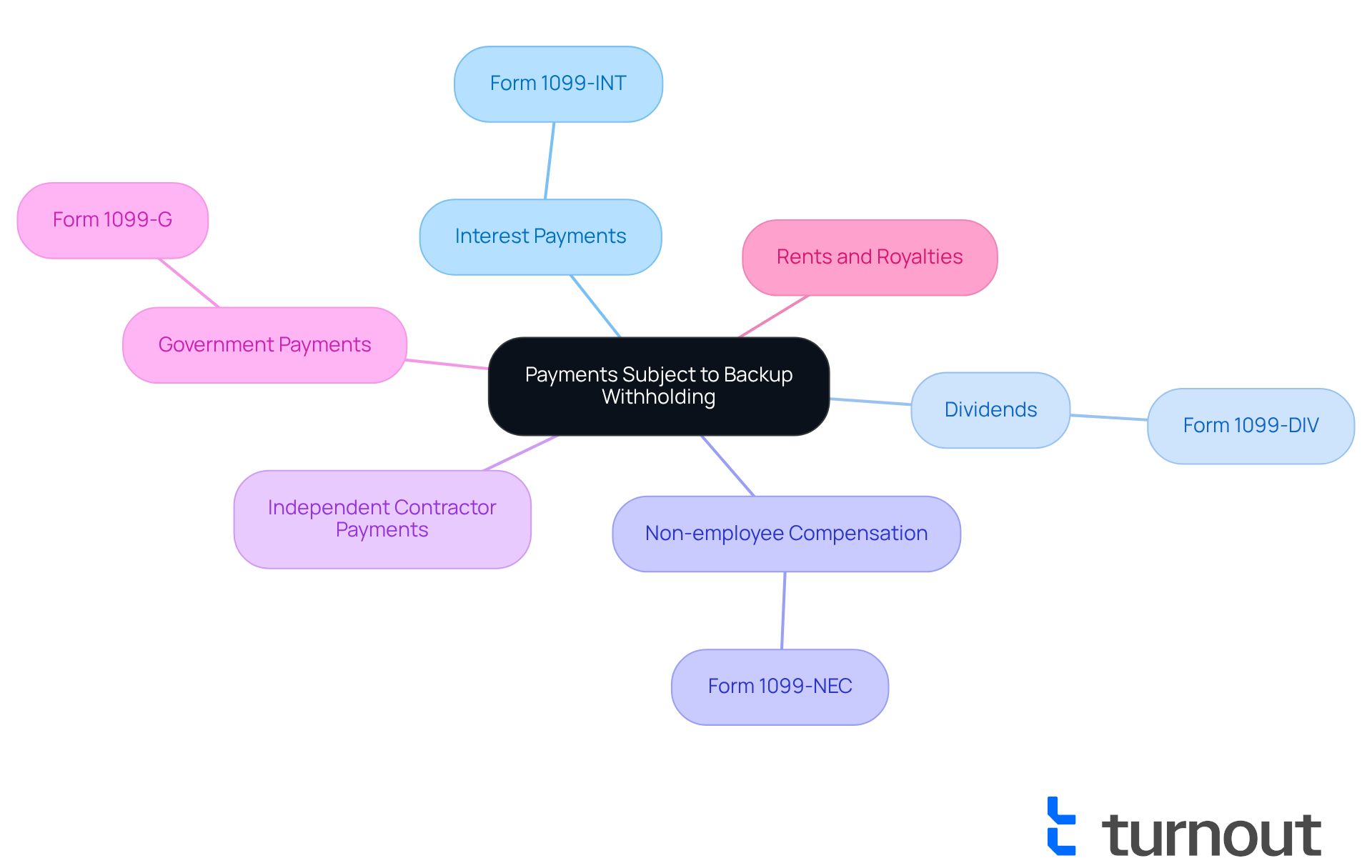

We understand that navigating tax responsibilities can be overwhelming. Payments that may be subject to IRS backup withholding encompass a variety of income types reported on Forms 1099. These include:

- Interest payments (Form 1099-INT)

- Dividends (Form 1099-DIV)

- Non-employee compensation (Form 1099-NEC)

- Payments for services provided by independent contractors

- Certain government payments (Form 1099-G)

- Rents and royalties

If a payee does not provide a correct TIN or fails to certify their TIN when necessary, it is essential to understand what IRS backup withholding is, as this requires the payer to withhold 24% from these disbursements. This ensures adherence to your tax responsibilities. Remember, you are not alone in this journey, and we’re here to help you through it.

Explore Exemptions from Backup Withholding

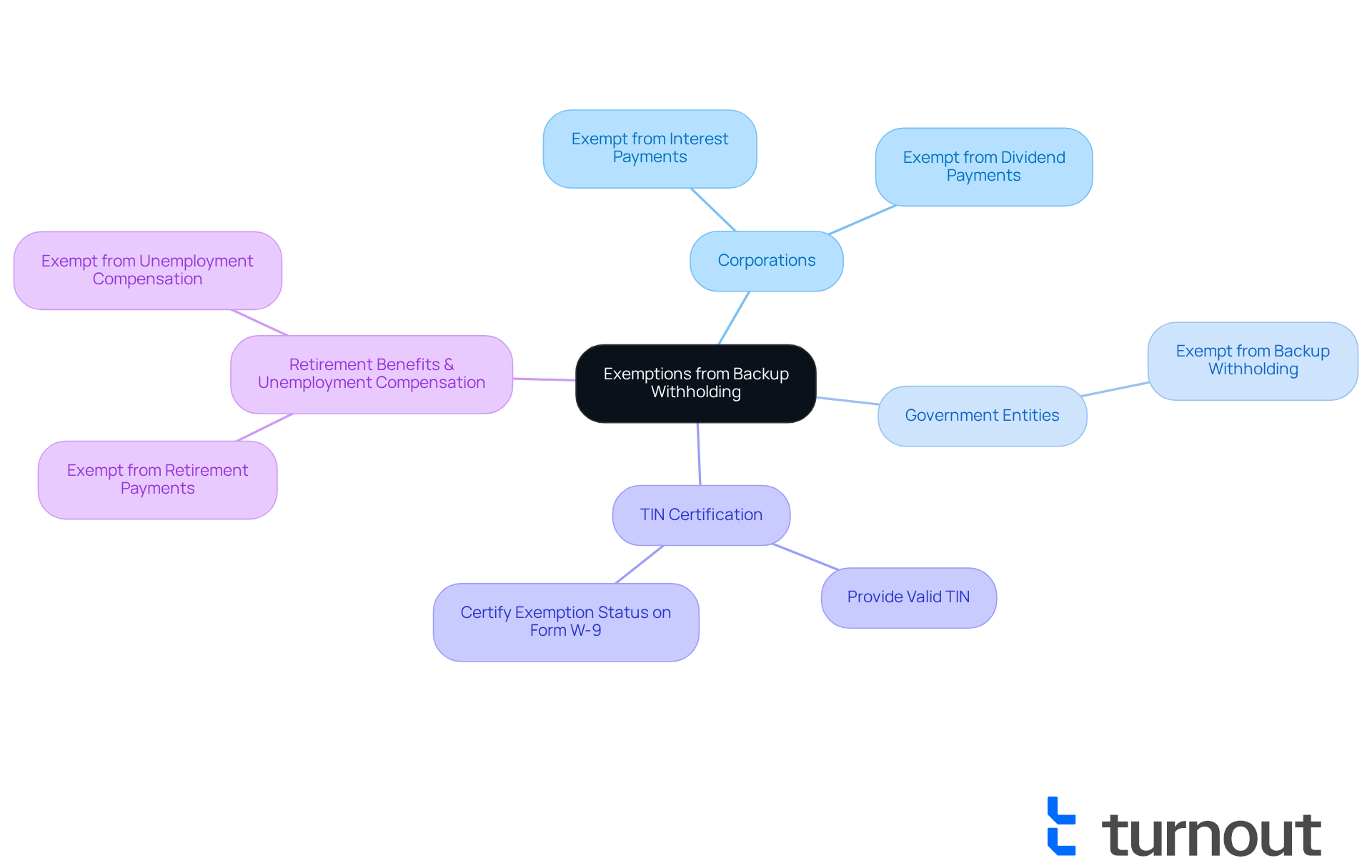

We understand that navigating the complexities of tax regulations can be daunting. Certain individuals and organizations may find relief from retention when they understand what is IRS backup withholding under specific circumstances. Here are some common exemptions you might find helpful:

- Corporations are generally exempt from backup withholding for certain payments, such as interest and dividends.

- Government entities and tax-exempt organizations also enjoy this exemption.

- If you provide a valid TIN and certify your exemption status on Form W-9, you may qualify under what is IRS backup withholding.

- Additionally, payments for retirement benefits and unemployment compensation are exempt.

To ensure you benefit from these exemptions, it’s crucial to provide accurate information to the payer. Completing the necessary forms can help you avoid unnecessary withholding. Remember, you are not alone in this journey—we’re here to help you navigate these processes with ease.

Conclusion

Understanding IRS backup withholding is essential for taxpayers, as it serves as a mechanism to ensure that taxes are collected on income that may otherwise go unreported. By withholding a specific percentage of certain payments, the IRS aims to mitigate the risks of tax evasion and ensure compliance with tax regulations. It's important to provide an accurate Taxpayer Identification Number (TIN) to avoid unnecessary deductions and financial implications.

We recognize that navigating tax regulations can be overwhelming. Key points highlight:

- The definition and function of backup withholding

- The types of payments affected

- Potential exemptions available to individuals and organizations

Payments such as interest, dividends, and non-employee compensation are subject to this withholding if the correct TIN is not provided. Understanding the notification process and the potential for reclaiming withheld amounts can empower you to manage your financial responsibilities effectively.

It's common to feel uncertain about these obligations, but remaining informed about IRS backup withholding and its implications is vital. Taking proactive steps, such as ensuring accurate TIN submission and exploring available exemptions, can lead to better financial outcomes. By understanding the intricacies of this tax collection mechanism, you can navigate your obligations with confidence and contribute to a fairer tax system. Remember, we're here to help, and you are not alone in this journey.

Frequently Asked Questions

What is IRS backup withholding?

IRS backup withholding is the practice of retaining a specific percentage of certain disbursements made to individuals who do not provide an accurate Taxpayer Identification Number (TIN) or who underreport their earnings. As of 2025, the backup withholding rate is set at 24%.

What types of payments are subject to IRS backup withholding?

Payments subject to IRS backup withholding primarily include amounts reported on Forms 1099 and W-2G, which encompass interest, dividends, and various non-payroll transactions.

Why does the IRS implement backup withholding?

The IRS implements backup withholding to ensure that taxes are collected on income that might otherwise remain unreported, thereby addressing potential tax evasion.

What happens if I do not supply an accurate TIN?

If you do not supply an accurate TIN, the payer, such as a bank, is required to withhold 24% of your distributions, which relates to IRS backup withholding and affects your earnings from interest or dividends.

Are there any payments that are not subject to IRS backup withholding?

Payments not subject to IRS backup withholding include real estate transactions, foreclosures, and specific government payments.

What should I do to avoid backup withholding?

To avoid backup withholding, it is important to verify and provide an accurate TIN when establishing new accounts or receiving amounts reportable on Form 1099.

How should retained sums under backup withholding be reported?

Sums retained under backup withholding must be disclosed on your income tax return for the year the earnings were obtained to ensure clarity and compliance with tax regulations.