Introduction

Understanding the complexities of tax law can feel overwhelming. We know that many individuals find themselves caught in financial liabilities due to their partner's misreporting. Innocent spouse relief is a vital provision that offers protection to those who may be unfairly burdened by tax debts they didn’t incur.

Did you know that as many as 10% of taxpayers could qualify for this relief? Yet, the challenges of proving eligibility and navigating the application process can leave many feeling lost and anxious. It’s common to feel this way when grappling with the consequences of someone else's mistakes.

So, how can you reclaim your financial stability? You are not alone in this journey. We’re here to help you understand your options and find the support you need.

Define Innocent Spouse Relief

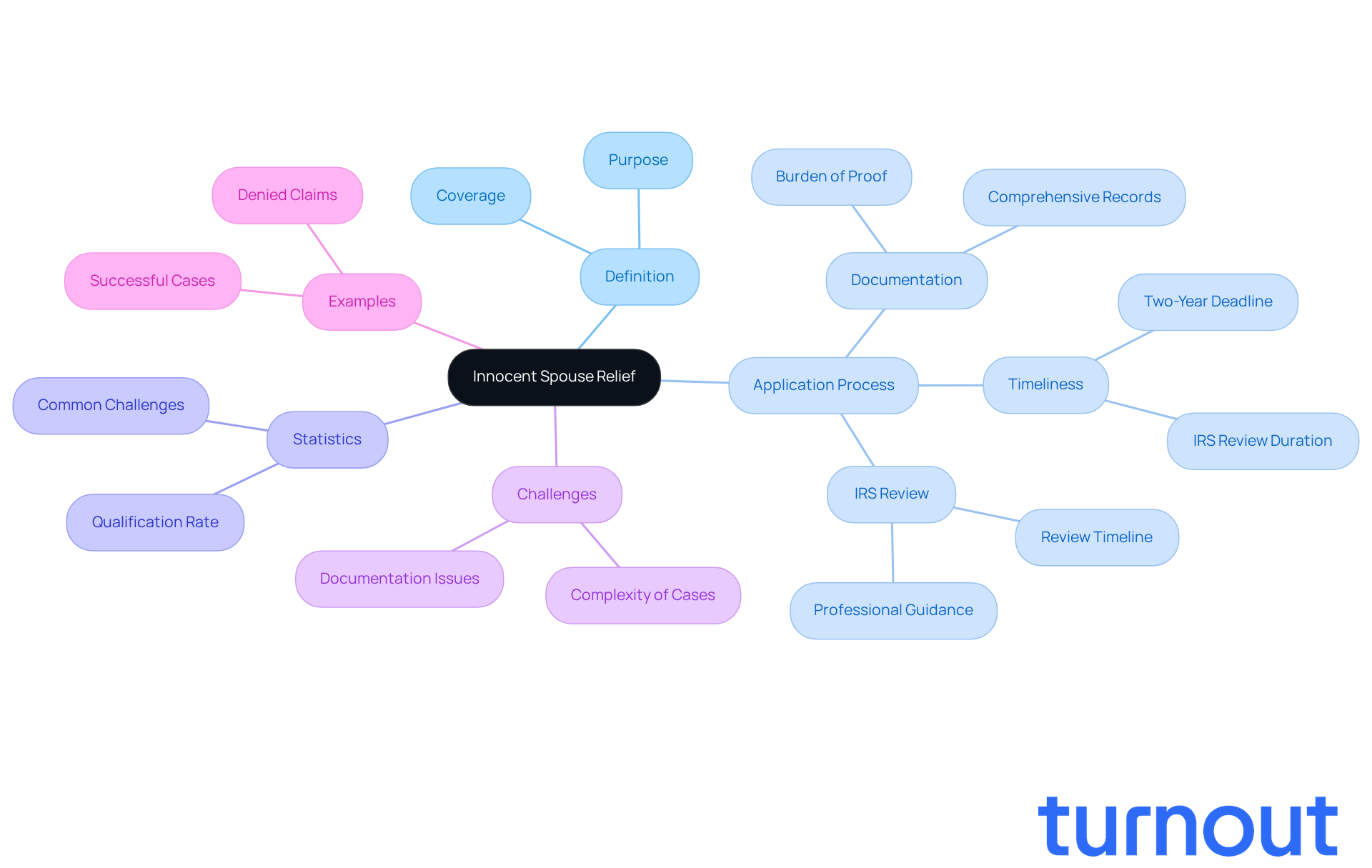

What is innocent spouse relief? It is a vital provision under U.S. fiscal law designed to protect individuals from being held responsible for extra liabilities that arise from mistakes or omissions made by their partner on a joint financial return. This relief covers not just the taxes owed but also any penalties and interest that come from misreported income or deductions. The primary goal of this provision is to clarify what is innocent spouse relief, safeguarding those who were unaware of the inaccuracies and ensuring they aren’t unfairly burdened by their partner's actions.

We understand that navigating tax issues can be overwhelming. Recent statistics indicate that around 10% of taxpayers may qualify for Relief for Uninvolved Partners, highlighting its significance for many individuals facing complex tax situations. For instance, one woman successfully obtained relief after proving she was unaware of her husband's unreported income from a side business, which resulted in a hefty tax liability. This example underscores the importance of thorough documentation and timely action in the application process.

Both partners can apply for Unjust Partner Relief, but each application is evaluated separately based on individual circumstances. It’s common to feel daunted by the challenges applicants face, such as the burden of proof, which requires comprehensive documentation to demonstrate a lack of knowledge about erroneous items. Missing the two-year application deadline after IRS collection activities can lead to a denied claim, making timely filing crucial.

The IRS review process for Relief applications can take anywhere from six months to a year, depending on the complexity of the case and the quality of documentation provided. Seeking professional guidance is essential during this process. Tax professionals can help assemble the necessary documentation and present a compelling case for relief. As Secretary Robert E. Rubin emphasized, it’s imperative to protect taxpayers whose partners violate tax laws without their knowledge.

In summary, what is innocent spouse relief provides a crucial safety net for individuals caught in tax liabilities due to their partner's misreporting. Remember, you are not alone in this journey. We’re here to help you navigate these challenges and ensure that you’re not penalized for someone else’s mistakes.

Context and Importance of Innocent Spouse Relief

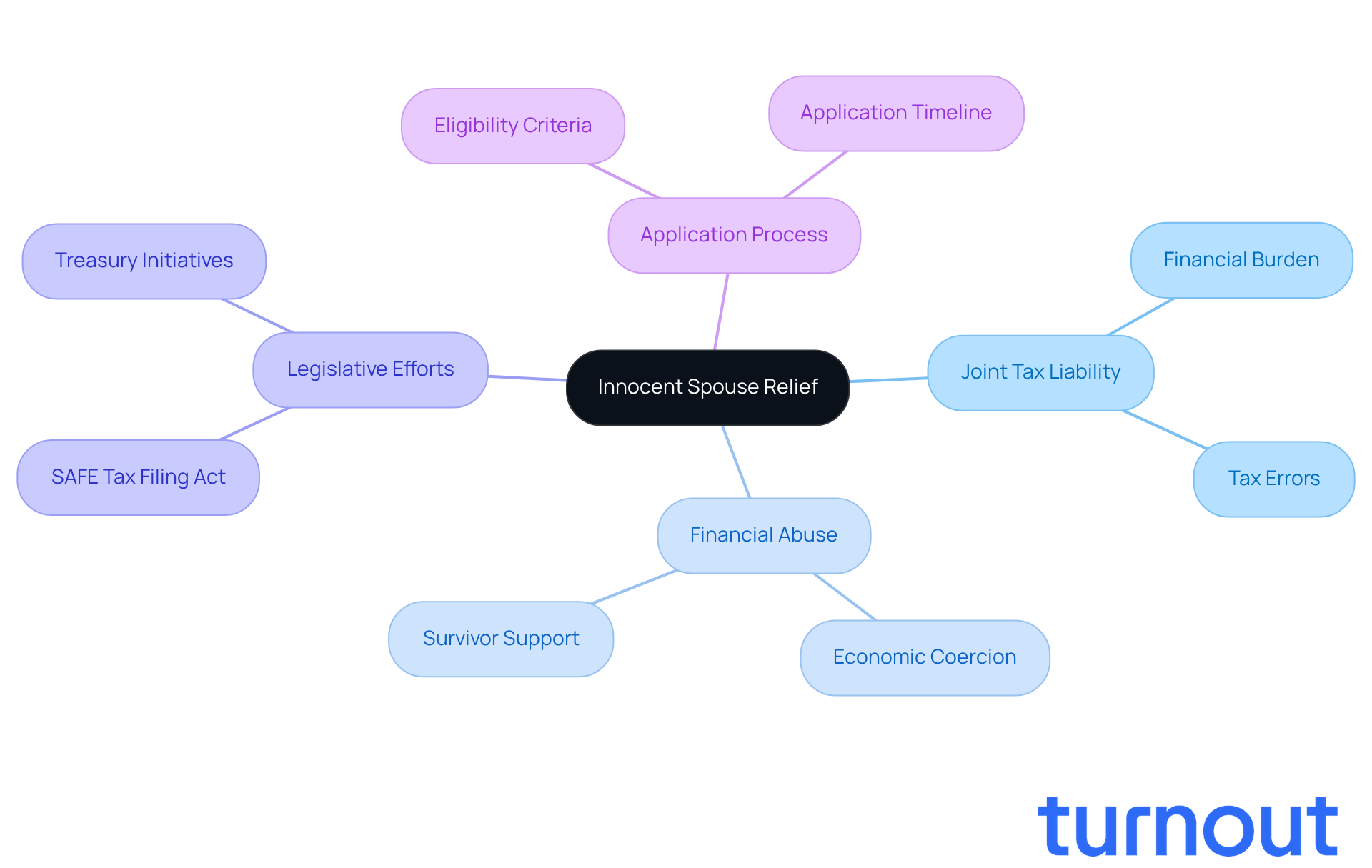

Understanding what is innocent spouse relief is crucial when it comes to joint tax filings. Both partners are usually held jointly and severally liable for any tax debts, which can create significant financial burdens for one partner if the other misreports their taxes. This provision acts as a safeguard, ensuring that individuals unaware of their partner's tax errors understand what is innocent spouse relief and aren't unfairly penalized. It's especially vital for those who may have experienced domestic abuse or financial manipulation, as it offers a legal path to relief from undue financial stress.

We understand that financial abuse is a common issue in domestic violence situations. Many survivors face economic coercion that complicates their financial independence. What is innocent spouse relief? It recognizes these challenges by allowing individuals to seek relief from tax liabilities they didn't cause, helping to ease some of the financial pressures they endure.

Expert opinions highlight the importance of this provision. Joint tax liability can worsen the financial burdens on spouses, particularly when one partner conceals financial information. For example, the SAFE Tax Filing Act of 2025 aims to empower survivors by allowing them to file taxes as if they are unmarried, avoiding the need to file jointly with their abuser. This legislative effort reflects a growing recognition of the need to support survivors in reclaiming their financial autonomy.

Individuals can request Relief for Uninvolved Partners within two years from when the IRS first initiated collection efforts on the tax debt. The evaluation of an application may take up to six months. Real-world instances show how the Relief for Unjustly Affected Partners has been vital for individuals leaving abusive relationships. By providing a way to contest joint tax liabilities, this provision helps survivors navigate the complexities of tax law while focusing on rebuilding their lives.

As the IRS continues to enhance its training and outreach regarding Relief for Affected Individuals, it's clear that this provision is not just a legal protection. It serves as an essential lifeline for those aiming to regain control over their financial futures. Remember, you are not alone in this journey, and we're here to help.

Historical Background of Innocent Spouse Relief

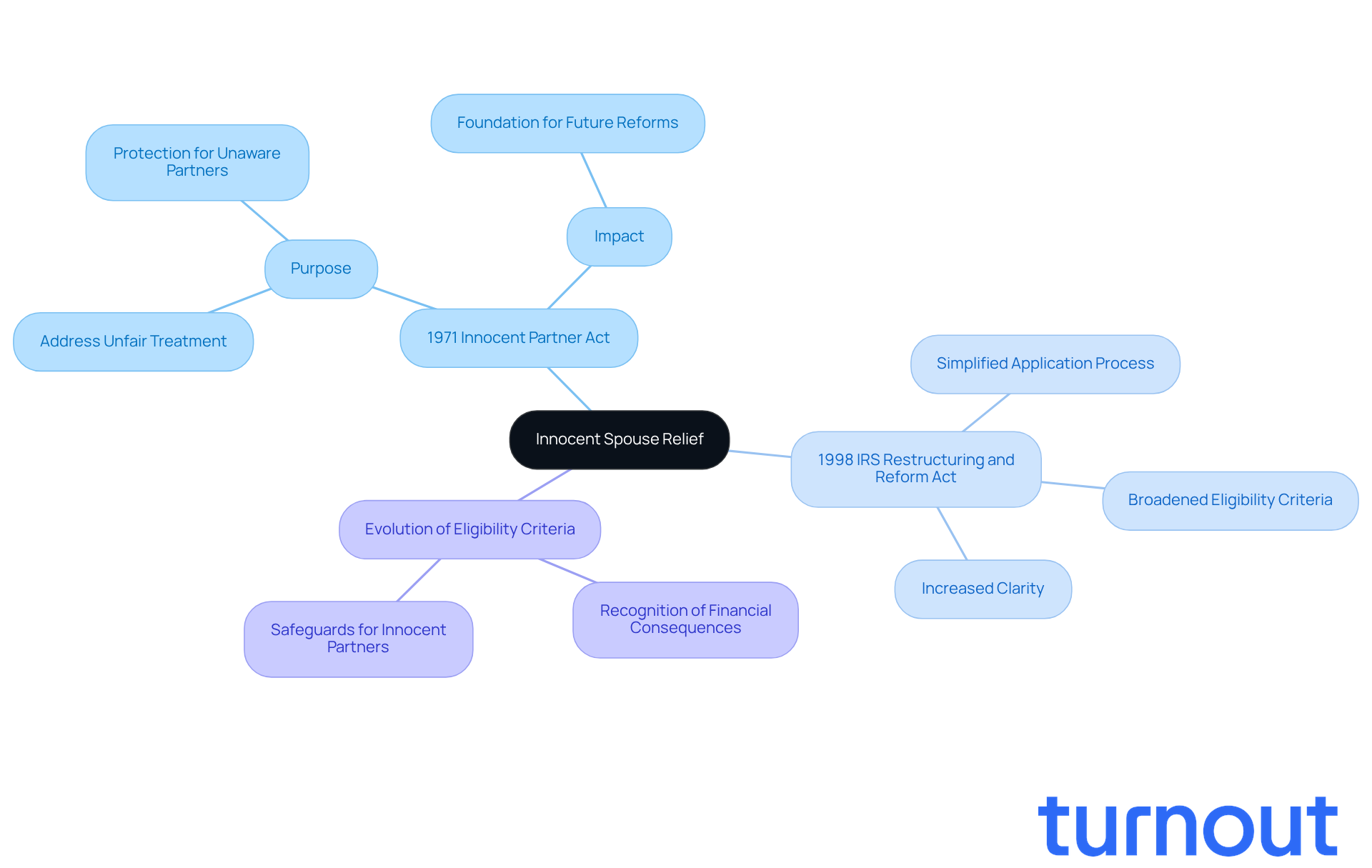

What is innocent spouse relief? It was first established by the 1971 Innocent Partner Act, aimed at addressing the unfair treatment of individuals who were unaware of their partner's tax misreporting. We understand that navigating tax issues can be overwhelming, especially when you find yourself entangled in someone else's mistakes. This provision has evolved significantly over the years, particularly after the IRS Restructuring and Reform Act of 1998. These reforms broadened eligibility criteria and simplified the application process, providing clarity on what is innocent spouse relief for innocent partners seeking assistance.

The changes brought about in 1998 were pivotal. They reflected a growing recognition of the need to protect individuals from the financial consequences of their partner's tax-related actions, especially in joint filings. It's common to feel anxious about the implications of tax misreporting, but know that there are safeguards in place. Tax historians note that these reforms were essential in addressing the complexities and inequities within the tax system. They ensure that innocent partners understand what is innocent spouse relief, providing them protection and recourse against unjust tax liabilities.

If you find yourself in this situation, remember: you are not alone in this journey. We're here to help you navigate these challenges and find the support you need.

Key Characteristics and Eligibility for Innocent Spouse Relief

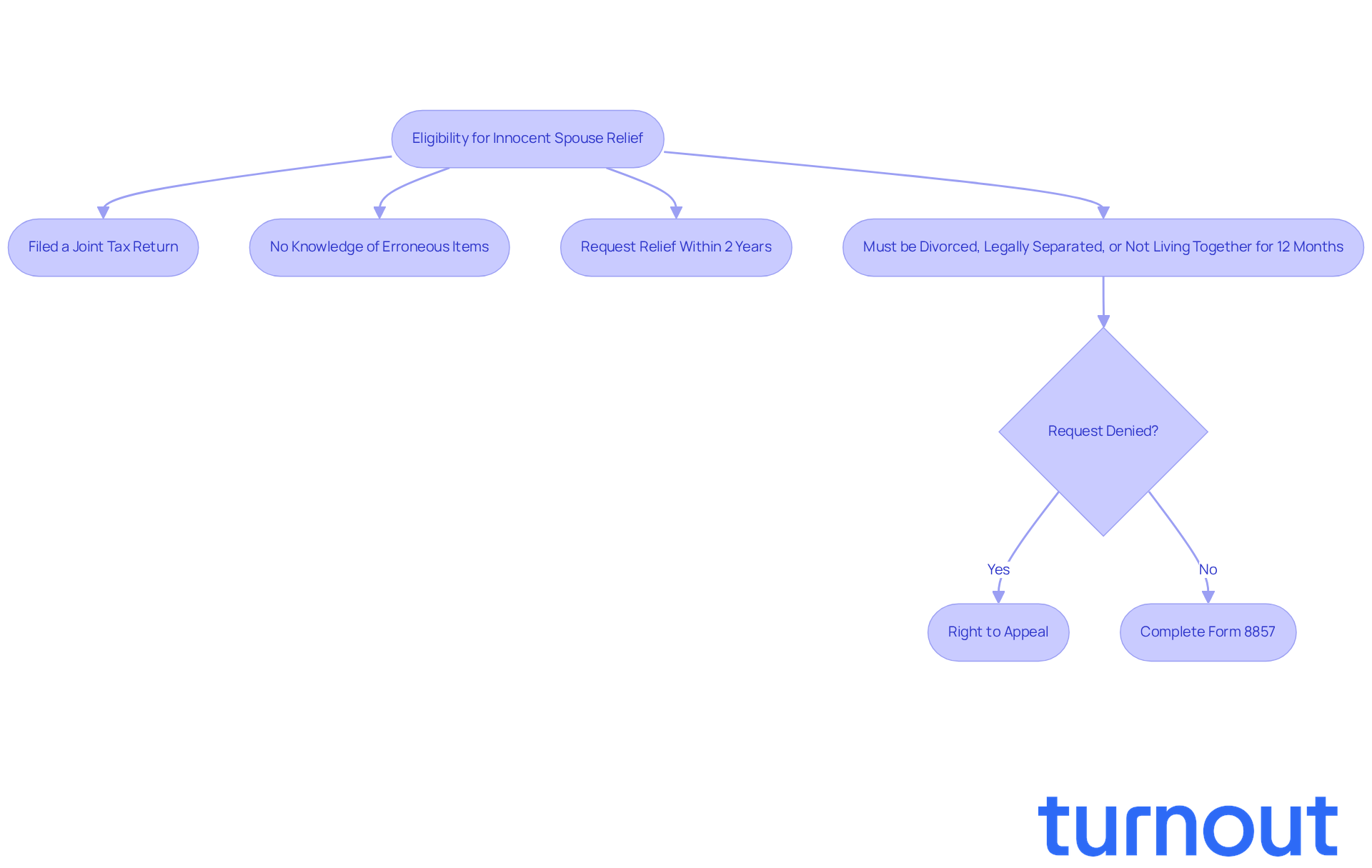

If you're feeling overwhelmed by your partner's tax obligations, you're not alone. To qualify for what is innocent spouse relief, you need to meet a few key criteria:

- You must have filed a joint tax return.

- You should not have known or had any reason to know about the erroneous items on that return.

- It's important to request relief within two years of the IRS's first collection attempt.

Additionally, you must be divorced, legally separated, or not living with your partner for at least 12 months before filing for relief. For anyone facing undue burdens due to their partner's tax issues, understanding what is innocent spouse relief is crucial. Recent statistics show that about 30% of applicants successfully meet these criteria, highlighting the importance of being informed and acting promptly.

Tax professionals, like Valrie Chambers, remind us that "taxpayers who face unexpected tax liabilities have avenues to request relief from those liabilities." This underscores the need for thorough documentation and a clear understanding of the relief process. Real-life stories illustrate how individuals have successfully met the criteria for Relief for Partners, reinforcing the idea that help is available for those in tough situations because of their partner's tax problems.

If your request for relief is denied, remember that you have the right to an administrative appeal. This ensures you have a way to contest the decision. To get started, you'll need to complete Form 8857, which requests information on what is innocent spouse relief. This form is essential for seeking the relief you deserve. We're here to help you navigate this process.

Conclusion

Innocent spouse relief is a vital safety net for those who find themselves unfairly burdened by tax liabilities because of their partner's misreporting on joint tax returns. We understand that it can be overwhelming to face financial consequences for someone else's actions. This provision ensures that individuals who were unaware of any tax inaccuracies are not left to shoulder the burden alone. By grasping what innocent spouse relief entails, you can navigate the complexities of tax law and seek the relief you truly deserve.

Throughout this article, we've shared key insights about the eligibility criteria and application process for innocent spouse relief. It's important to note that to qualify, individuals must:

- Have filed jointly

- Lacked knowledge of the erroneous items

- Acted within a specified timeframe

The historical context and legislative changes surrounding this provision highlight its significance, especially for those who have faced financial manipulation or domestic abuse. Real-world examples illustrate how this relief has provided essential support for individuals striving to regain control over their financial futures.

The importance of innocent spouse relief cannot be overstated. It serves not only as a legal protection for taxpayers but also as a lifeline for those navigating the aftermath of difficult relationships. By raising awareness about this provision and encouraging timely action, you can take the necessary steps to secure your financial well-being. Seeking professional guidance and understanding the relief process are crucial to ensuring that no one is left to bear the weight of another's financial missteps. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

What is innocent spouse relief?

Innocent spouse relief is a provision under U.S. tax law that protects individuals from being held responsible for additional tax liabilities resulting from mistakes or omissions made by their partner on a joint tax return. It covers taxes owed, as well as any penalties and interest from misreported income or deductions.

Who can qualify for innocent spouse relief?

Individuals who were unaware of inaccuracies on a joint tax return may qualify for innocent spouse relief. Recent statistics suggest that around 10% of taxpayers may be eligible for this relief.

Can both partners apply for innocent spouse relief?

Yes, both partners can apply for relief; however, each application is evaluated separately based on individual circumstances.

What documentation is needed to apply for innocent spouse relief?

Comprehensive documentation is required to demonstrate a lack of knowledge about erroneous items on the tax return. This includes evidence proving that the applicant was unaware of any unreported income or deductions.

What is the application deadline for innocent spouse relief?

It is crucial to apply within two years after IRS collection activities begin, as missing this deadline can lead to a denied claim.

How long does the IRS review process take for relief applications?

The review process can take anywhere from six months to a year, depending on the complexity of the case and the quality of the documentation provided.

Should I seek professional help when applying for innocent spouse relief?

Yes, seeking professional guidance is highly recommended. Tax professionals can assist in assembling the necessary documentation and presenting a strong case for relief.