Introduction

Form 1040 is the cornerstone of the U.S. tax filing process, and we understand that many individuals feel daunted by its complexities. This essential document not only determines your tax obligations but also opens the door to potential deductions and credits that can significantly ease your financial burden.

It's common to feel overwhelmed when faced with the stakes - ranging from missed refunds to costly penalties. So, how can you navigate the intricacies of Form 1040 with confidence and accuracy?

In this article, we’ll delve into the essentials of Form 1040, providing a comprehensive guide to ensure a smooth filing experience. Remember, you are not alone in this journey; we're here to help you maximize your benefits and make the process as stress-free as possible.

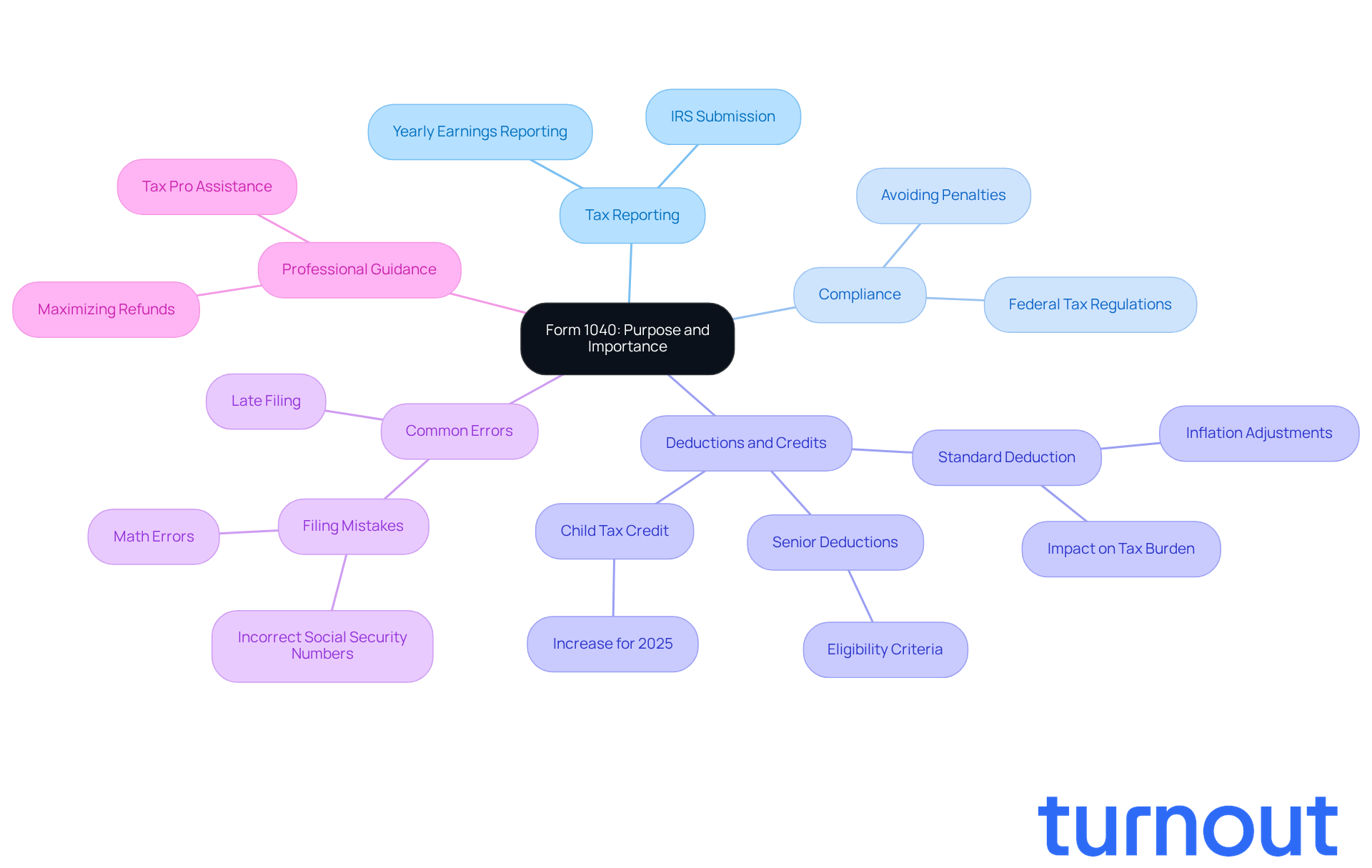

Define Form 1040: Purpose and Importance

Form 1040, officially known as the U.S. Individual Income Tax Return, is the primary document used by U.S. taxpayers to report their yearly earnings to the Internal Revenue Service (IRS). We understand that navigating this form can feel overwhelming. It’s essential for calculating your total taxable income and determining how much tax you owe or may get refunded.

Understanding que es la forma 1040 is crucial. It serves as the foundation for all tax submissions, ensuring you comply with federal tax regulations. Plus, it allows you to claim deductions and credits that can significantly reduce your tax burden. For 2025 and 2026, the standard deduction has been adjusted for inflation, making it more beneficial for nearly 90% of taxpayers who choose it.

However, it’s common to feel uncertain about filling out Form 1040 correctly. Many taxpayers still submit it with errors, leading to penalties and missed refund opportunities. Engaging with tax professionals can be a game-changer. They can guide you through these complexities, helping you maximize your refunds and minimize your tax obligations.

As Mark Steber, Senior Vice President and Chief Tax Officer for Jackson Hewitt, emphasizes, "Understanding the nuances of the 1040 can lead to significant savings and compliance." Real-world examples show that those who take the time to understand que es la forma 1040 often benefit from maximizing their refunds and reducing their tax liabilities. Remember, you’re not alone in this journey. We’re here to help you navigate the tax landscape with confidence.

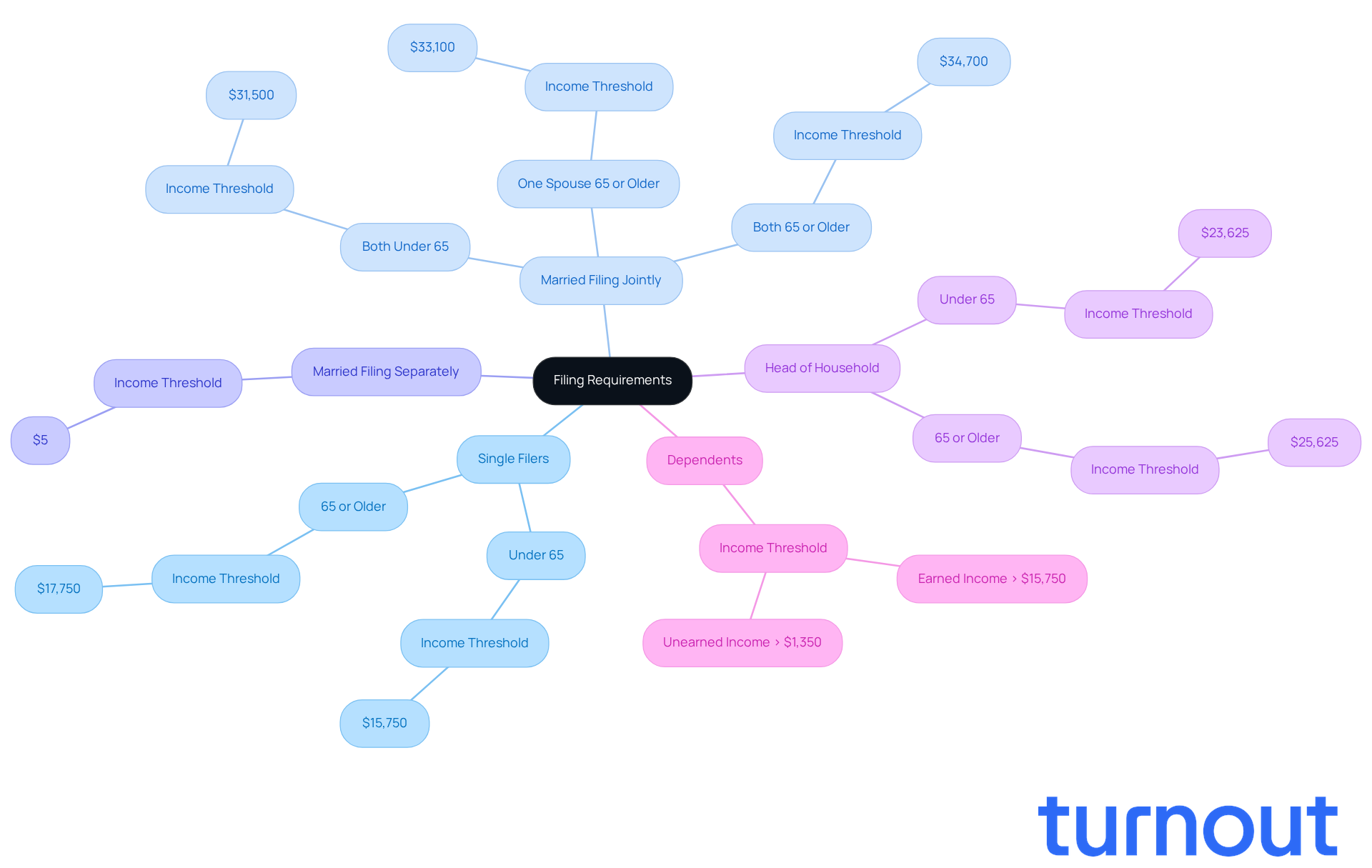

Identify Filing Requirements: Who Needs to File and What Documents Are Necessary

Are you unsure about que es la forma 1040 and whether you need to submit it? We understand that navigating tax requirements can be overwhelming. To help you out, let’s break it down together. Generally, U.S. citizens and resident aliens must file if their total earnings exceed certain limits, which vary based on your tax status.

For instance, if you’re a single filer under 65, you’ll need to file if your gross earnings reach at least $15,750. If you’re 65 or older, that limit increases to $17,750. Married couples filing jointly must report if their combined gross earnings are at least $31,500 when both are under 65, or $33,100 if one spouse is 65 or older. And if you’re married but filing separately, you’ll need to submit if your gross earnings are at least $5, no matter your age. If you’re the head of household and under 65, the threshold is $23,625 for the 2025 tax year.

But it’s not just about earnings. If you’re self-employed or owe special taxes, you’re also required to file. Dependents must submit a tax return if their earned income exceeds $15,750 for the 2025 tax year. To make the process smoother, gather essential documents like:

- W-2 forms from your employers

- 1099 forms for any additional income

- Records of deductions or credits you plan to claim

For self-employed individuals, don’t forget to include Schedule SE with que es la forma 1040.

Collecting these documents ahead of time can really simplify your filing process and help ensure everything is accurate. As tax consultant Ines Zemelman wisely points out, "Understanding your actual reporting requirement can assist you in preventing overlooked refunds, IRS notifications, or fines that occur when earnings are neglected." Remember, understanding these requirements is key to a smooth tax submission experience. You’re not alone in this journey; we’re here to help!

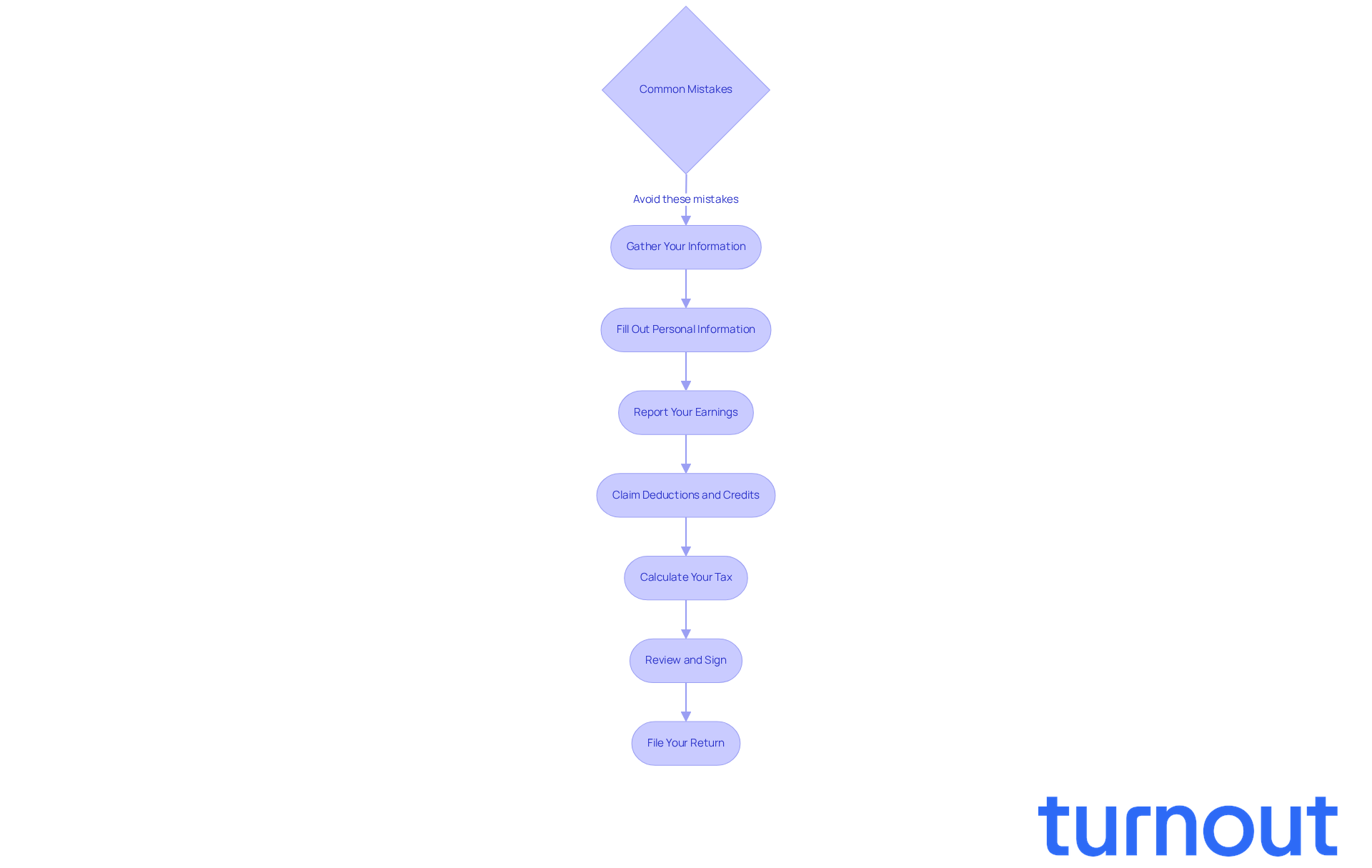

Complete Form 1040: Step-by-Step Instructions and Common Mistakes to Avoid

-

Gather Your Information: We understand that getting started can feel overwhelming. Begin by collecting all necessary documents, like W-2s, 1099s, and any other earnings statements. Don’t forget to have your Social Security number and those of your dependents handy.

-

Fill out personal information, which is important when considering que es la forma 1040, by entering your name, address, and filing status at the top. It’s important to double-check the spelling and accuracy of your Social Security number to avoid any hiccups.

-

Report Your Earnings: Use the information from your W-2 and 1099 forms to report your total earnings. Be thorough - make sure all sources of revenue are included. This step is crucial for a smooth filing process.

-

Claim Deductions and Credits: Now, decide whether to take the standard deduction or itemize your deductions. If you choose to itemize, complete Schedule A and attach it to your que es la forma 1040 document. This can really help reduce your tax burden.

-

Calculate Your Tax: Follow the instructions carefully to determine your tax liability based on your taxable income. Use the tax tables provided by the IRS to guide you through this process.

-

Review and Sign: Before you submit, take a moment to review your form for any errors. Common mistakes include incorrect Social Security numbers, math errors, and missing signatures. Remember to sign and date your return before filing - it’s an important step!

-

File Your Return: You can choose to file electronically or by mail. If you opt for mailing, ensure you send it to the correct address based on your state of residence. Direct deposit is the fastest way to receive your refund, so consider providing your bank account information for quicker processing.

Common Mistakes to Avoid: Many first-time filers take an average of 13 hours to complete Form 1040, often due to confusion about que es la forma 1040 and the required information. It’s common to overlook gathering all necessary documents, misreport income, or neglect to claim eligible deductions. Tax experts advise maintaining organized records and reviewing all entries carefully to minimize errors. For instance, claiming the home office deduction without proper documentation can lead to issues with the IRS. By preparing early and following these steps, you can simplify your submission process and avoid unnecessary delays. Remember, you’re not alone in this journey - we’re here to help!

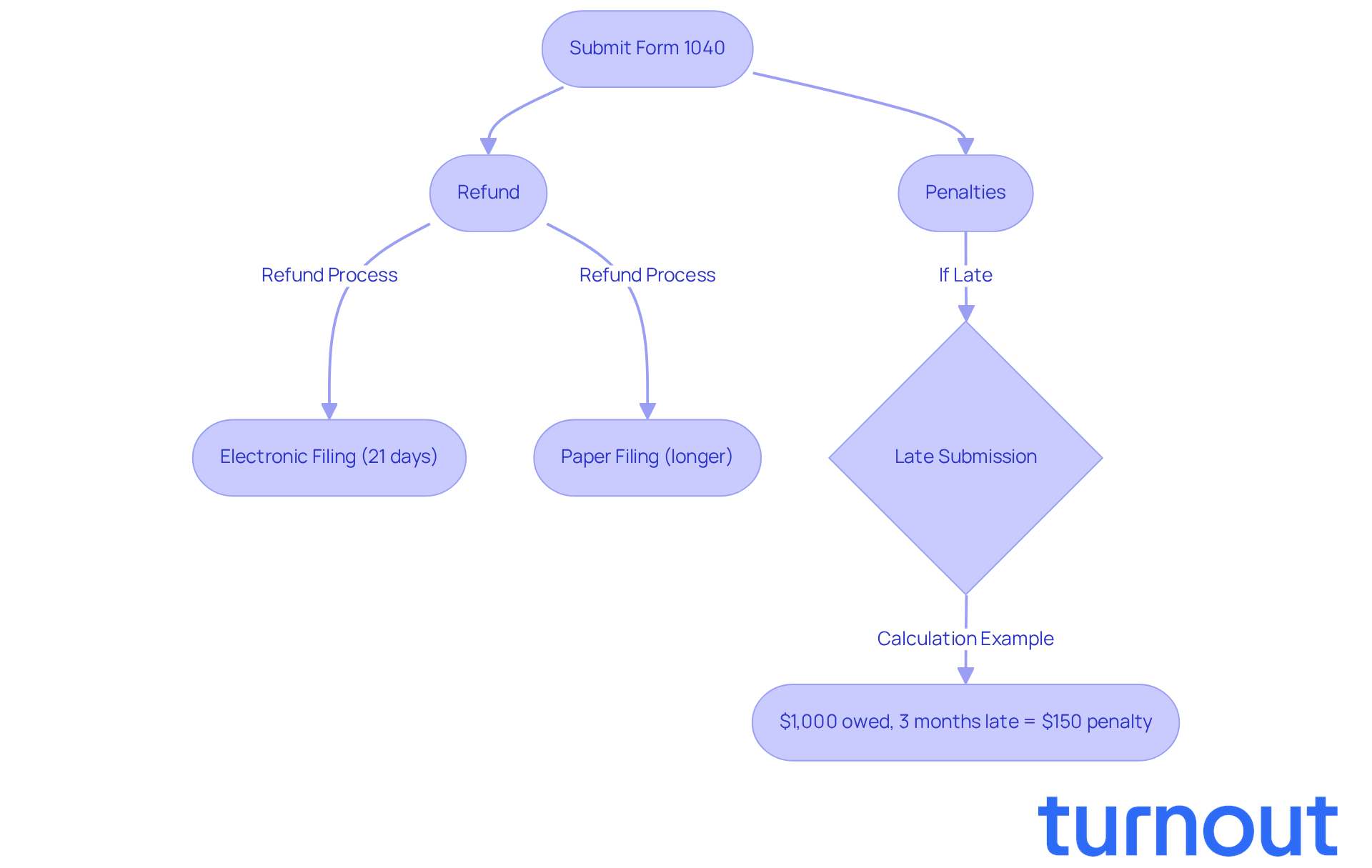

Understand Filing Outcomes: Refunds, Penalties, and What to Expect

When you submit Form 1040, it’s natural to wonder what que es la forma 1040 and what happens next. If you’re due a refund, the IRS usually processes it within 21 days for electronic filings, while paper returns might take a bit longer. In fact, during the 2025 tax season, a remarkable 93% of tax refunds were issued via direct deposit, showcasing the efficiency of electronic refunds. To keep track of your refund, you can use the IRS 'Where's My Refund?' tool or the IRS2Go app, which lets you monitor your refund status as soon as 24 hours after your return is accepted.

However, if you have financial obligations, it’s important to be aware that late submissions can lead to significant penalties. The failure-to-file penalty is generally 5% of the unpaid tax for each month your return is late, capping at 25%. For example, if you owe $1,000 and submit your return three months late, you could face a penalty of $150. To avoid these penalties, make sure to file your return by the deadline and pay any taxes owed promptly.

Additionally, starting September 30, 2025, the IRS will phase out paper checks for refunds, which highlights the growing importance of electronic filing. Understanding these potential outcomes can help you navigate the post-filing process with greater confidence. Remember, we’re here to help you through this journey.

Conclusion

Form 1040 is more than just a form; it’s a vital tool for U.S. taxpayers, acting as the primary document for reporting income and calculating tax obligations. We understand that navigating this process can feel overwhelming, but grasping its purpose can significantly impact your financial outcomes. From ensuring compliance with tax regulations to maximizing potential refunds, this form opens the door to financial benefits that can ease tax burdens for many individuals.

Throughout this article, we’ve explored key points that matter to you, including the filing requirements based on income thresholds and the importance of accurate documentation. We’ve provided step-by-step instructions to help you avoid common pitfalls. Remember, thorough preparation is essential - gathering necessary documents and understanding the implications of deductions and credits can make a world of difference. We also highlighted the potential outcomes of filing, such as timely refunds and the penalties for late submissions, to stress the importance of adhering to deadlines.

In conclusion, navigating the complexities of Form 1040 is a crucial step in managing your personal finances effectively. We encourage you to take proactive measures, like seeking professional guidance and staying informed about your filing requirements. By doing so, you can ensure a smoother tax filing experience, maximize your refunds, and avoid unnecessary penalties. Embracing this knowledge empowers you to approach your tax obligations with confidence and clarity, ultimately leading to better financial health. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is Form 1040?

Form 1040, officially known as the U.S. Individual Income Tax Return, is the primary document used by U.S. taxpayers to report their yearly earnings to the Internal Revenue Service (IRS).

Why is Form 1040 important?

Form 1040 is essential for calculating total taxable income, determining tax owed or potential refunds, and ensuring compliance with federal tax regulations. It also allows taxpayers to claim deductions and credits that can reduce their tax burden.

How has the standard deduction changed for 2025 and 2026?

The standard deduction for 2025 and 2026 has been adjusted for inflation, making it more beneficial for nearly 90% of taxpayers who choose to use it.

What common mistakes do taxpayers make when filling out Form 1040?

Many taxpayers submit Form 1040 with errors, which can lead to penalties and missed refund opportunities.

How can tax professionals assist with Form 1040?

Tax professionals can guide taxpayers through the complexities of filling out Form 1040, helping them maximize refunds and minimize tax obligations.

What does Mark Steber emphasize about understanding Form 1040?

Mark Steber highlights that understanding the nuances of Form 1040 can lead to significant savings and compliance with tax regulations.

What benefits can come from understanding Form 1040?

Those who take the time to understand Form 1040 often benefit from maximizing their refunds and reducing their tax liabilities.