Introduction

Navigating the complexities of U.S. tax obligations can feel overwhelming, especially when it comes to understanding IRS Form 1040. We know that this pivotal document is crucial for reporting your annual income, but it also holds the key to potential refunds and deductions that can significantly enhance your financial well-being.

It's common to feel uncertain about how to maximize your benefits while steering clear of costly mistakes. That’s why we’re here to help! This guide aims to demystify Form 1040, shedding light on its importance, eligibility requirements, available deductions, and the steps you need to take for successful filing.

You are not alone in this journey. Together, we can navigate these complexities and ensure you’re making the most of your tax situation.

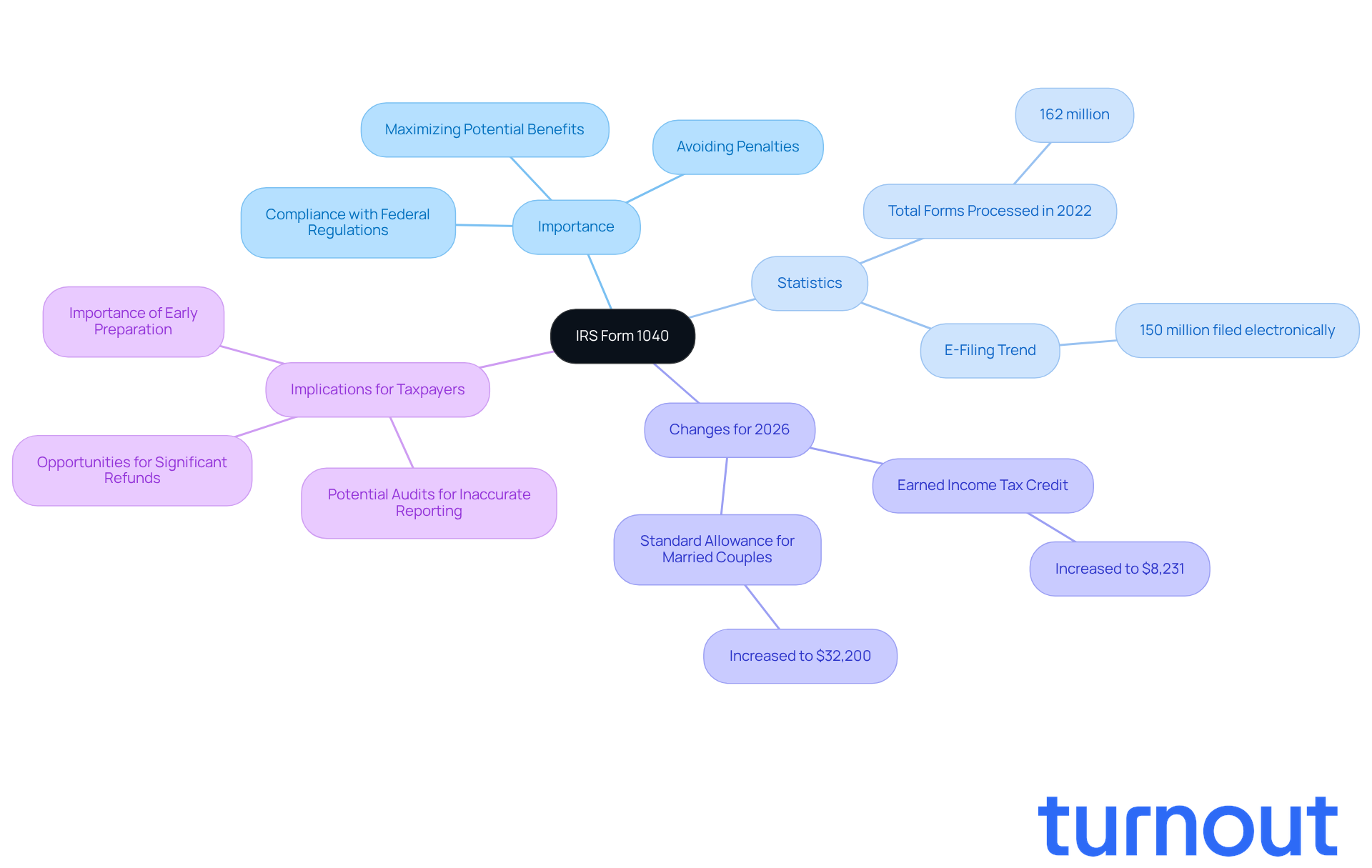

Define IRS Form 1040 and Its Importance

IRS Form 1040, officially known as the U.S. Individual Income Tax Return, is essential for U.S. taxpayers to report their yearly earnings to the Internal Revenue Service (IRS). We understand that navigating taxes can be overwhelming, but this form is crucial for determining the tax owed or the refund due, based on your income, deductions, and credits. Understanding que es la form 1040 is vital, as it supports all tax submissions, ensuring compliance with federal regulations while optimizing your potential benefits. Remember, accurately completing this form can help you avoid penalties and seize refund opportunities.

In 2022, the IRS processed over 162 million Form 1040 returns, with around 150 million filed electronically. This growing trend towards e-filing not only simplifies the documentation process but also improves accuracy, reducing the chances of mistakes that could delay your refunds. For the 2026 tax year, significant adjustments include:

- The maximum Earned Income Tax Credit increasing to $8,231

- The standard allowance for married couples filing jointly rising to $32,200

These changes can greatly impact your financial situation.

The real-world implications of Form 1040 are clear in the experiences of many taxpayers. For instance, individuals who don’t report their earnings accurately may face audits or penalties. On the other hand, those who effectively utilize deductions can secure significant refunds. We know tax season can be stressful, so the IRS emphasizes the importance of preparing early. Gathering necessary documents ahead of time can help you avoid complications. As the IRS continues to simplify the filing process, understanding que es la form 1040 remains vital for navigating the complexities of tax compliance and maximizing your financial benefits. Remember, you’re not alone in this journey; we’re here to help.

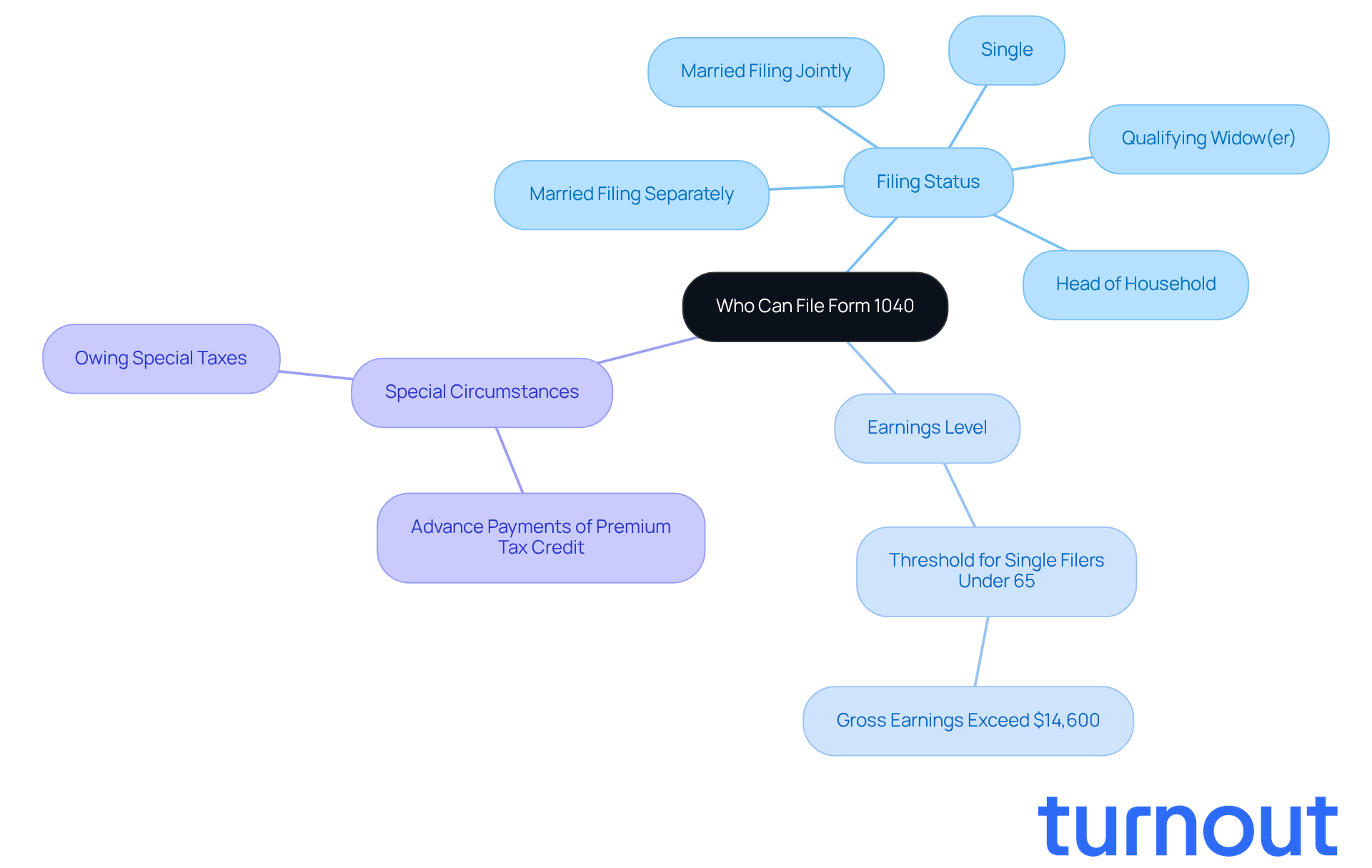

Identify Who Can File Form 1040

Filing your taxes can feel overwhelming, but we're here to help you navigate the process. Most U.S. citizens and residents need to submit Form 1040, which raises the question of que es la form 1040 if their earnings exceed a certain threshold. If you're self-employed, receive wages, or have other types of income, this form is likely necessary for you.

Filing Status: It's important to know that different thresholds apply based on your filing status. Whether you're single, married filing jointly, married filing separately, head of household, or a qualifying widow(er), each situation has its own requirements.

Earnings Level: For example, in 2026, if you're a single filer under 65, you'll need to file if your gross earnings exceed $14,600. Remember, these thresholds can change each year, so it’s essential to check the latest IRS guidelines to stay informed.

Special Circumstances: There are also specific situations that might require you to submit Form 1040, which is related to que es la form 1040, even if your earnings are below the threshold. If you've received advance payments of the Premium Tax Credit or owe special taxes, filing is necessary.

We understand that tax season can be stressful, but knowing what you need to do can ease some of that burden. You're not alone in this journey, and taking these steps can help ensure you're on the right track.

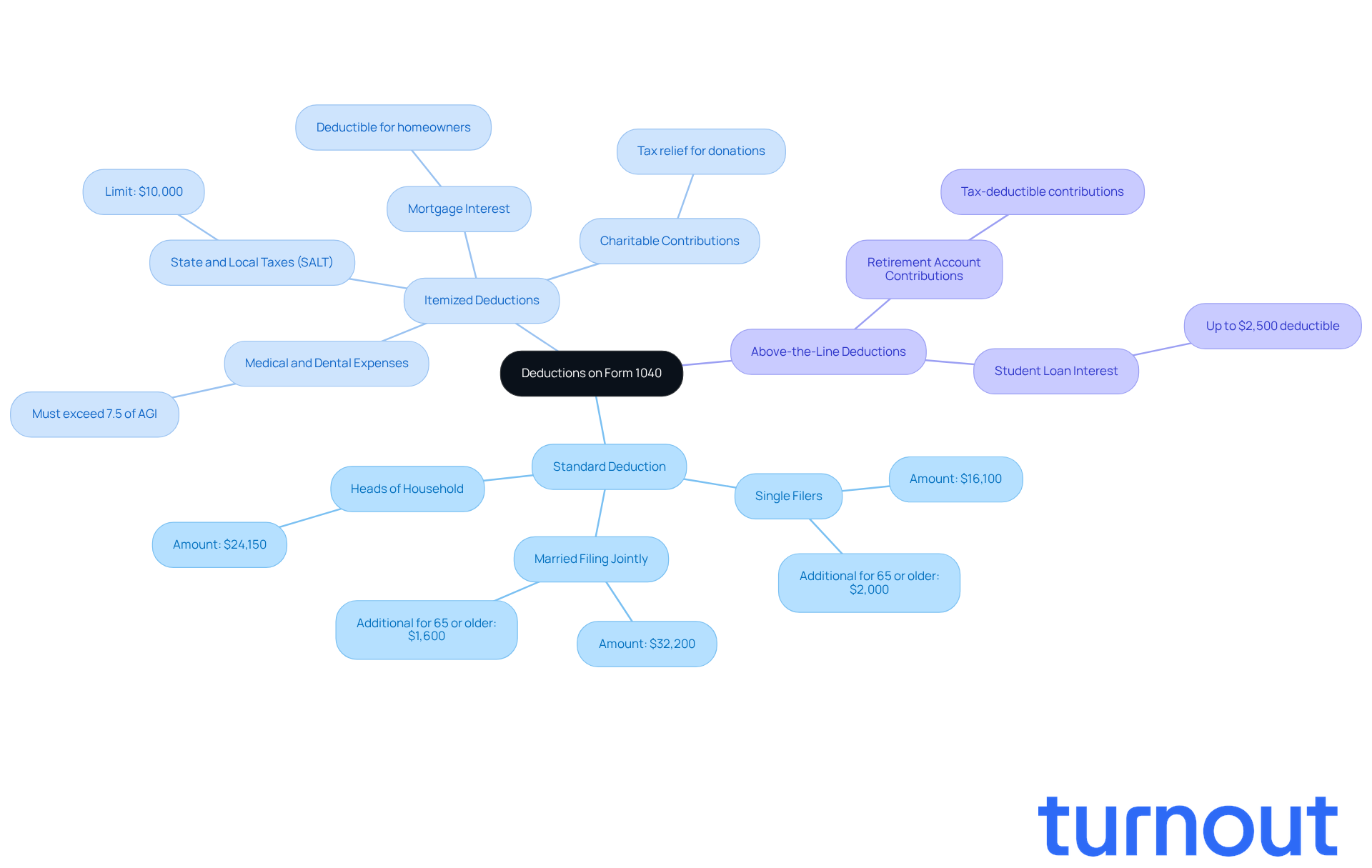

Explore Deductions Available on Form 1040

Understanding que es la form 1040 is crucial since deductions on this form are essential for reducing your taxable income, which can lead to a lower tax bill. We understand that navigating taxes can be overwhelming, so let’s explore some key deductions that might help you.

-

Standard Deduction: For the tax year 2026, the standard deduction is $16,100 for single filers and $32,200 for married couples filing jointly. If you’re 65 or older or visually impaired, you can claim an extra $2,000 for single filers and $1,600 for married filers. This reduction simplifies the filing process for many, allowing you to lower your taxable income without the hassle of itemizing.

-

Itemized Deductions: If your total deductions exceed the standard amount, you might want to consider itemizing. Common itemized deductions include:

- Medical and dental expenses that exceed 7.5% of your adjusted gross income (AGI).

- State and local taxes (SALT), limited to $10,000, which can significantly affect your overall tax liability.

- Mortgage interest, a valuable benefit for homeowners.

- Charitable contributions, which not only help others but also provide you with tax relief.

-

Above-the-Line Deductions: These deductions are available whether you itemize or take the standard deduction. They include contributions to retirement accounts and student loan interest, both of which can further reduce your taxable income.

Understanding these deductions is essential for maximizing your tax refund and minimizing your tax bill. Many taxpayers find that itemizing their expenses can lead to significant savings, with average tax savings from itemized deductions expected to rise in 2026. By thoughtfully utilizing available tax benefits, you can enhance your financial situation during tax season.

It's also important to note that the IRS will discontinue its free Direct File program for 2026. This change may affect how some taxpayers file their taxes and claim credits. Remember, you’re not alone in this journey; we’re here to help you navigate these changes.

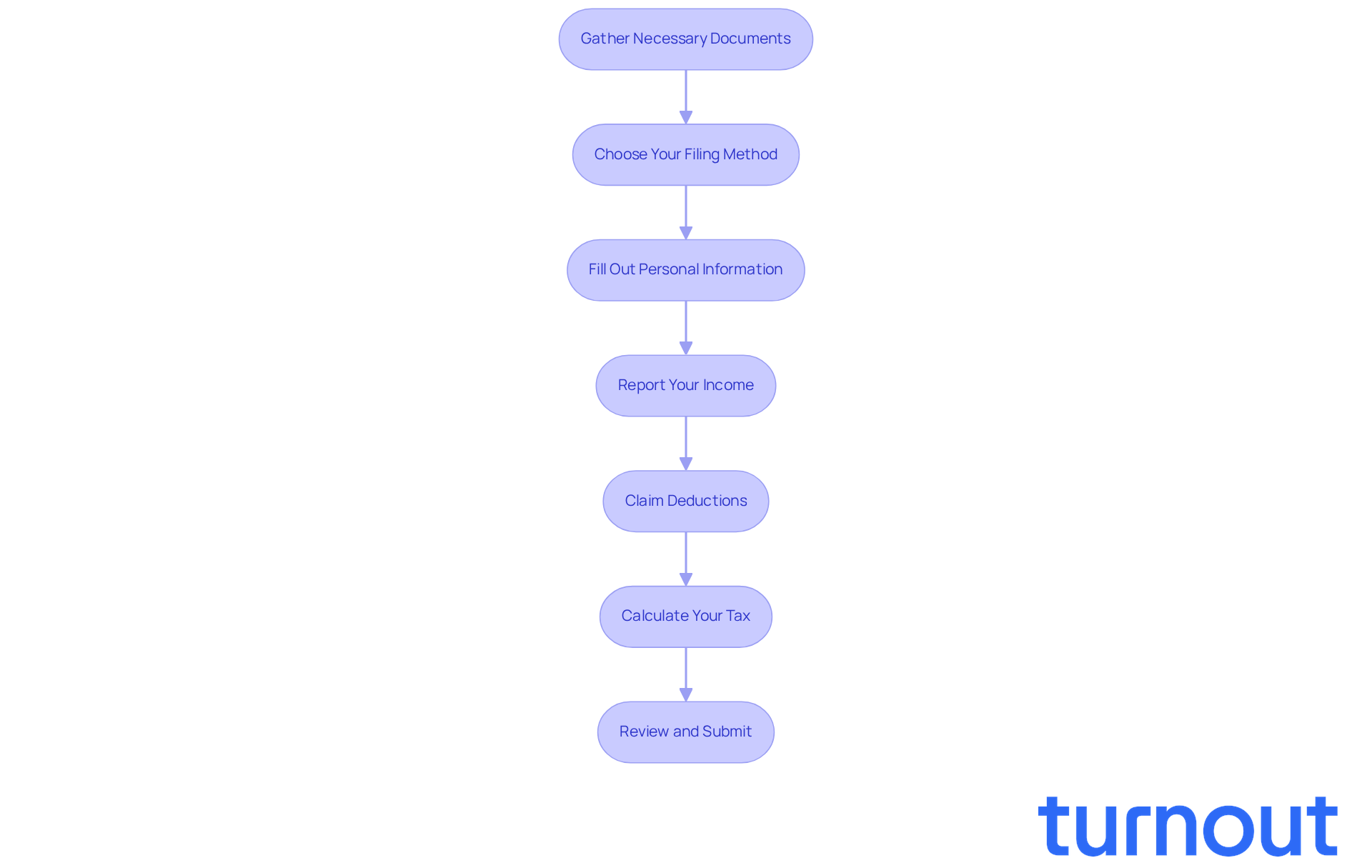

Outline Steps to File Form 1040 Successfully

Filing Form 1040, which is que es la form 1040, can feel overwhelming, but it doesn’t have to be. By following these essential steps, you can navigate the process with confidence:

-

Gather Necessary Documents: Start by collecting all relevant documents, like W-2s, 1099s, and any statements for expenses. Having organized records makes reporting easier and helps you claim all eligible deductions. Remember, it’s common to overlook essential items, such as a 1099 form, which can lead to complications down the line.

-

Choose Your Filing Method: Think about whether you’d prefer to file electronically or by mail. E-filing is often faster and more secure, with processing times significantly shorter than traditional mail submissions. As tax analyst Kemberley Washington points out, e-filing enhances security and reduces errors, giving you peace of mind.

-

Fill Out Personal Information: Begin by entering your name, address, Social Security number, and filing status at the top of the form. Accuracy is key here-double-checking your information can help avoid delays.

-

Report Your Income: Make sure to enter all sources of income, including wages, dividends, and any other earnings. It’s easy to miss important items, so take your time to be thorough in your reporting.

-

Claim Deductions: Decide whether to take the standard allowance or itemize your expenses. Fill out the appropriate sections carefully. Many taxpayers miss out on valuable tax benefits, so reviewing your options is crucial. Did you know the average refund in the 2016 tax season was $2,860? That’s a reminder of how important it is to claim all eligible deductions.

-

Calculate Your Tax: Use the tax tables provided by the IRS to determine your tax liability based on your taxable income. Even small errors in calculations can lead to significant consequences, so take your time here.

-

Review and Submit: Before you submit, double-check all entries for accuracy. Sign the form and make sure to submit it by the tax deadline. If you’re e-filing, follow the prompts to complete your submission. This step is vital to avoid common mistakes that could delay your refund.

By following these steps, you can ensure a successful filing of what is known as que es la form 1040. Remember, you’re not alone in this journey, and taking the time to do it right can minimize the risk of errors while maximizing your potential refund.

Conclusion

Understanding IRS Form 1040 is essential for anyone navigating the complexities of U.S. tax obligations. We know that tax season can feel overwhelming, but this form is your primary tool for reporting income, determining tax liability, and potentially securing refunds. By familiarizing yourself with the requirements and intricacies of Form 1040, you can ensure compliance with federal regulations while maximizing your financial benefits.

Throughout this article, we’ve discussed key insights, including:

- The importance of accurate reporting

- The various deductions available

- The steps necessary for successful filing

With the ongoing trend towards electronic submissions, knowing how to effectively utilize Form 1040 can lead to significant advantages, such as reduced errors and faster refunds. It’s common to feel uncertain about changes, especially with updates for the upcoming tax year, so staying informed is crucial.

Ultimately, mastering Form 1040 isn’t just about fulfilling a legal obligation; it’s an opportunity to optimize your financial situation. Embracing this knowledge empowers you to navigate tax season with confidence, avoid penalties, and make informed decisions that can enhance your financial well-being. Remember, taking proactive steps to understand and utilize Form 1040 can lead to a smoother filing experience and greater financial rewards. We’re here to help you on this journey!

Frequently Asked Questions

What is IRS Form 1040?

IRS Form 1040, officially known as the U.S. Individual Income Tax Return, is a form that U.S. taxpayers use to report their yearly earnings to the Internal Revenue Service (IRS).

Why is IRS Form 1040 important?

Form 1040 is crucial for determining the tax owed or the refund due based on your income, deductions, and credits. It ensures compliance with federal regulations and helps optimize potential benefits.

How many Form 1040 returns were processed by the IRS in 2022?

In 2022, the IRS processed over 162 million Form 1040 returns, with approximately 150 million filed electronically.

What are the benefits of e-filing Form 1040?

E-filing simplifies the documentation process and improves accuracy, reducing the chances of mistakes that could delay refunds.

What significant changes are expected for the 2026 tax year regarding Form 1040?

For the 2026 tax year, the maximum Earned Income Tax Credit is expected to increase to $8,231, and the standard allowance for married couples filing jointly will rise to $32,200.

What can happen if taxpayers do not report their earnings accurately on Form 1040?

Individuals who fail to report their earnings accurately may face audits or penalties.

How can taxpayers maximize their refunds using Form 1040?

Taxpayers can secure significant refunds by effectively utilizing deductions on their Form 1040.

What advice does the IRS give for preparing to file Form 1040?

The IRS emphasizes the importance of preparing early and gathering necessary documents ahead of time to avoid complications during tax season.