Introduction

Navigating tax regulations can often feel overwhelming, especially when it comes to backup withholding required by the IRS. We understand that this critical tax mechanism can seem daunting, but it plays a vital role in ensuring compliance and preventing revenue evasion. When a valid Taxpayer Identification Number (TIN) is missing, a flat rate deduction from certain payments is mandated.

As we look ahead to potential changes in 2026, the stakes become even higher. It’s common to feel anxious about how to manage tax obligations effectively while avoiding the pitfalls of backup withholding.

But you’re not alone in this journey. We’re here to help you navigate these complexities with confidence. Together, we can explore strategies that will ease your concerns and empower you to take control of your tax situation.

Define Backup Withholding: Understanding the Basics

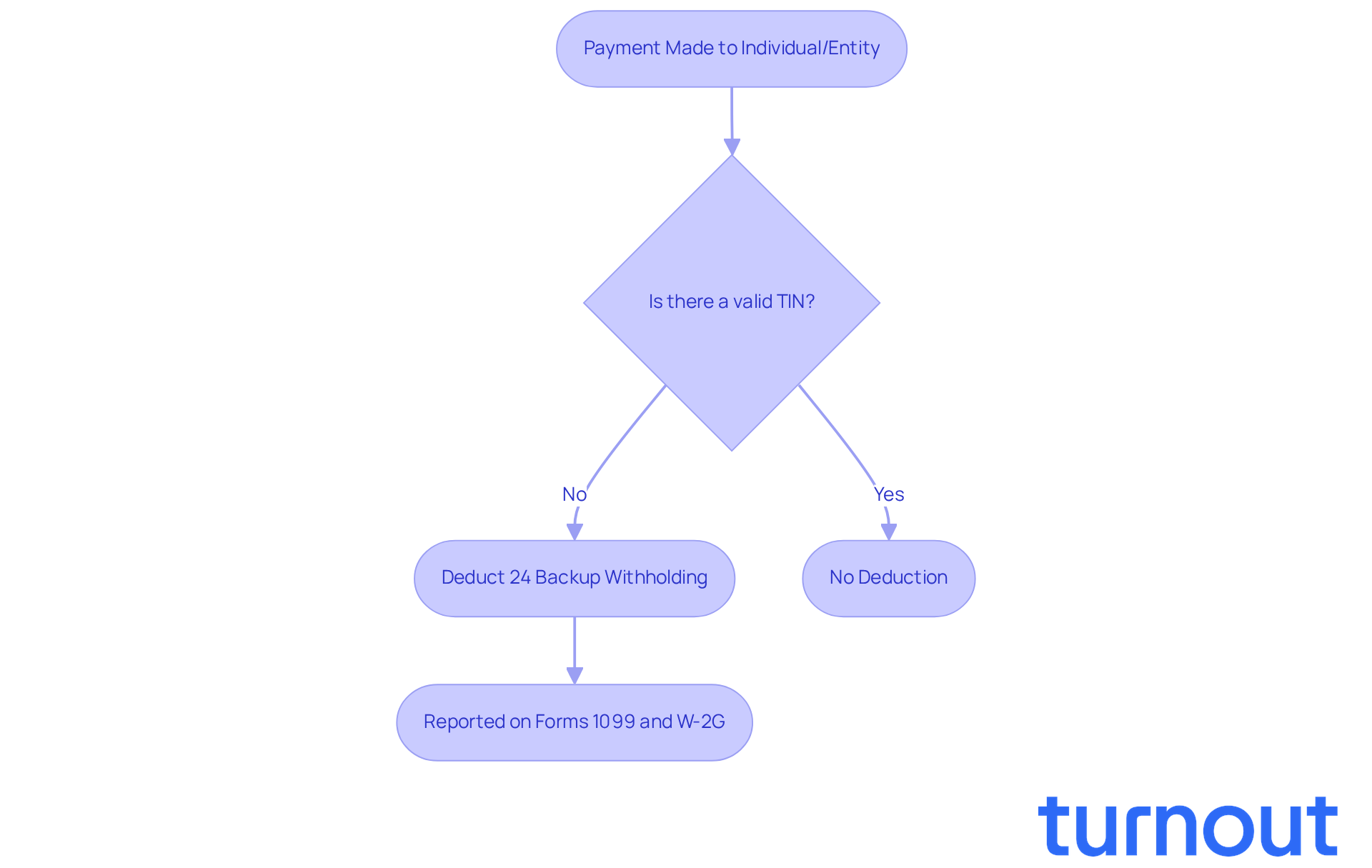

Backup retention is a tax mechanism that the Internal Revenue Service (IRS) mandates. To understand what is backup withholding from the IRS, it requires payers to deduct a flat rate of 24% from certain payments made to individuals or entities without a valid Taxpayer Identification Number (TIN). This retention mainly applies to nonemployee compensation reported on Forms 1099 and W-2G.

We understand that navigating tax regulations can be overwhelming. The main goal of secondary income retention is to clarify what is backup withholding from the IRS to ensure the collection of revenue on earnings that might otherwise go unreported. This helps prevent evasion and encourages compliance with federal revenue regulations. It’s important to note that reserve retention isn’t an extra tax; it’s a prepayment of taxes due on income that will be reported on your tax returns.

Looking ahead to 2026, taxpayers may face additional tax collection if they don’t provide a correct TIN, which could be a Social Security number, employer identification number, or individual taxpayer identification number. For instance, if a Third Party Settlement Organization (TPSO) processes 201 payments totaling $20,000.01 to a payee without a TIN, alternative tax collection applies to the entire 201st transaction. This shows how easily taxpayers can be subject to deductions if they don’t meet the necessary reporting requirements.

Grasping these regulations is essential, especially as the IRS continues to enforce secondary deductions, which raises the question of what is backup withholding from the IRS to ensure compliance. You might receive notifications from payers requesting a valid TIN, and deductions can start promptly if an incorrect or no TIN is provided. As Sam Taube wisely noted, "If you end up paying more additional tax than you actually owe, it can be partially refunded, just like any other tax payment."

Overall, understanding the nuances of alternative tax retention can help you manage your financial responsibilities more effectively. Remember, you’re not alone in this journey, and we’re here to help you navigate these complexities.

Context and Purpose: Why Backup Withholding Exists

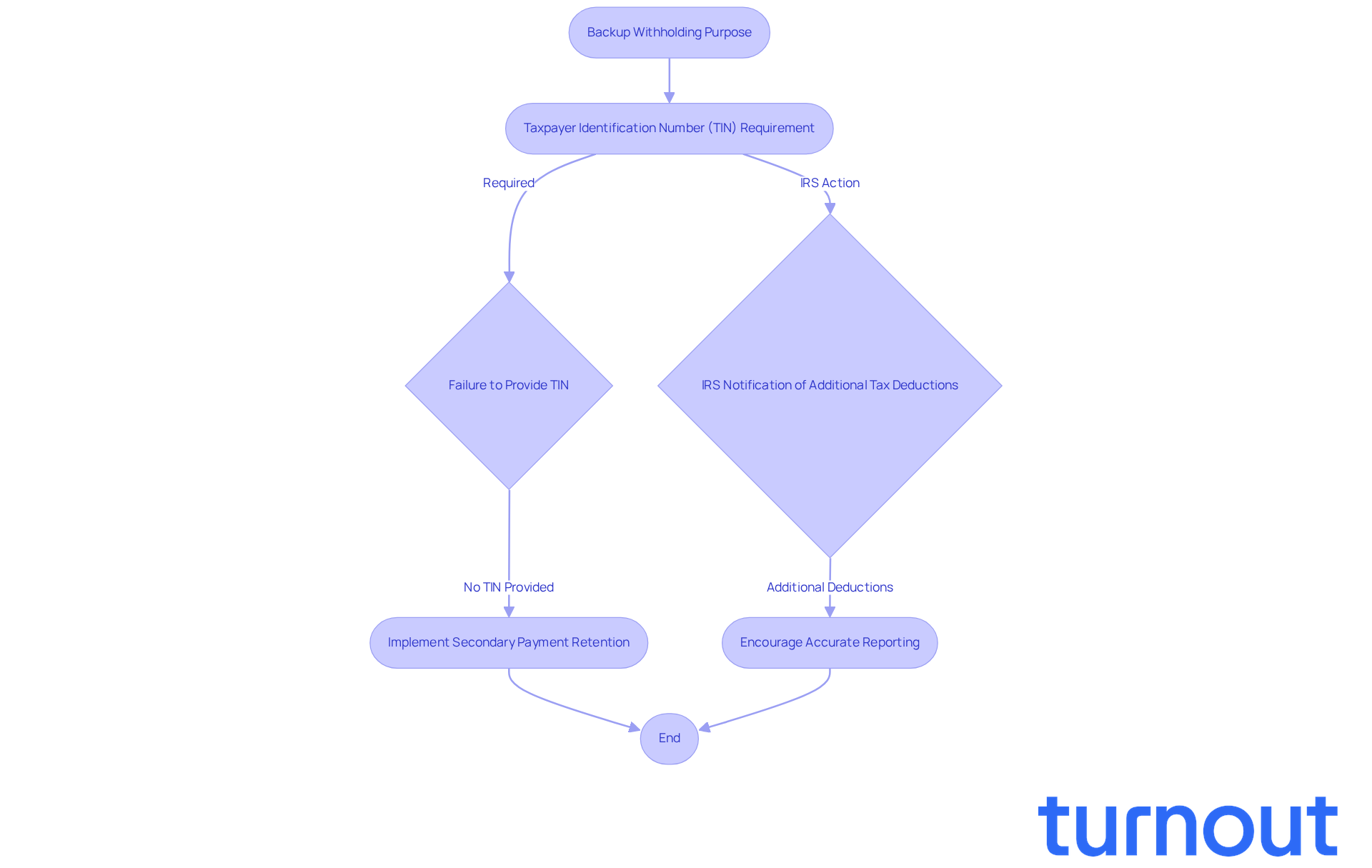

Backup retention is a vital approach to help combat revenue evasion and ensure that the IRS can effectively collect funds on income that might not be reported. We understand that navigating tax obligations can be overwhelming, especially when it comes to understanding requirements like the need for a correct Taxpayer Identification Number (TIN). When a payee fails to provide this, or if the IRS notifies a payer of additional tax deductions, it can feel daunting. This mechanism serves as a safeguard for the government, ensuring that taxes are collected on income that might otherwise go unreported.

The importance of reserve taxation in preventing tax evasion cannot be overstated. For instance, the IRS requires third-party settlement organizations (TPSOs) to implement secondary payment retention if gross reportable payments exceed $20,000 and the number of transactions surpasses 200. This requirement, recently reaffirmed by the One Big Beautiful Bill Act, underscores the IRS's commitment to maintaining tax compliance and integrity within the system.

Tax compliance specialists emphasize that supplementary retention plays a dual role: it not only aids the IRS in securing revenue but also encourages taxpayers to report their income accurately. As House Ways and Means Committee Chairman Jason Smith pointed out, the IRS must take action to prevent fraud financed by taxpayers. This highlights the significance of alternative deductions in today’s tax landscape. By implementing these tax deductions, the IRS aims to ensure that all taxpayers contribute their fair share, thereby strengthening the overall integrity of the tax system.

As we approach 2026, the effectiveness of alternative tax deductions in reducing tax evasion remains a key focus. It’s common to feel overwhelmed as tax experts and their clients face increasingly complex fraud schemes. The IRS's proactive measures in this area are crucial for fostering a fair and equitable tax environment. Remember, you are not alone in this journey; we’re here to help you navigate these challenges.

Payments Subject to Backup Withholding: Key Examples

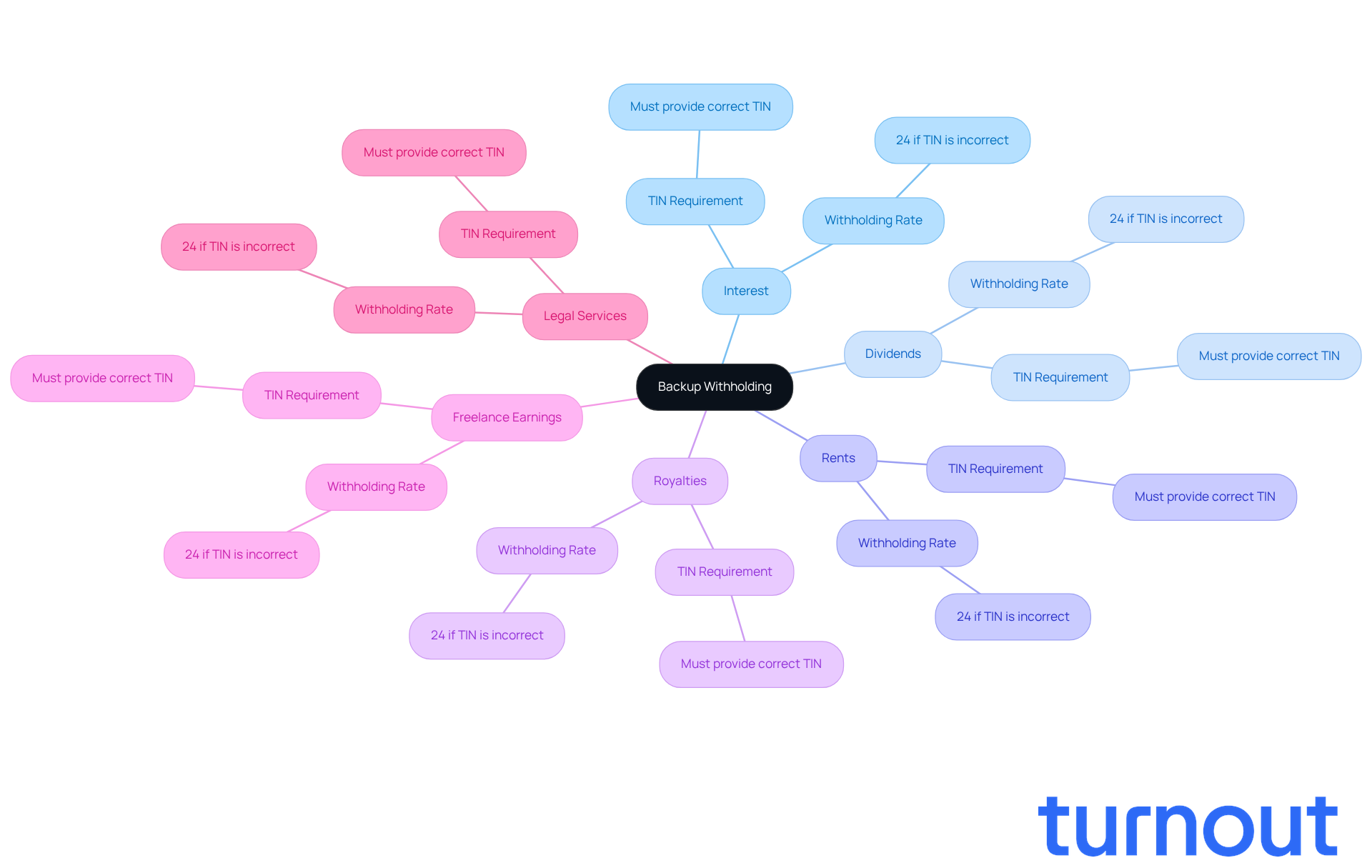

Understanding what is backup withholding from the IRS can help alleviate the overwhelming feeling that comes with managing various payments like interest, dividends, rents, royalties, and even freelance earnings. We understand that navigating these regulations can be challenging. For example, if a contractor doesn’t provide their taxpayer identification number (TIN) to a business, that business must withhold 24% from their payments, which is an example of what is backup withholding from the IRS. This can be a significant amount, and it’s important to be aware of these rules.

Additionally, payments made to lawyers for legal services may face extra tax deductions if the attorney doesn’t provide a valid TIN. As we look ahead to 2026, the IRS is tightening these regulations. Specifically, reserve tax deductions will apply to payments over $20,000 and involving more than 200 transactions for third-party settlement organizations (TPSOs) like PayPal or Venmo. It is crucial for both payers and payees to understand what is backup withholding from the IRS to ensure compliance with IRS regulations and avoid potential penalties.

The IRS emphasizes, "You must furnish your TIN in writing to the bank or other business and certify under penalties of perjury that it's correct." It’s common to feel anxious about these requirements, but knowing the rules can help ease that worry. Remember, certain payments, like retirement benefits and unemployment compensation, are excluded from tax retention. This is especially important for individuals relying on these payments.

We’re here to help you navigate these complexities. If you have questions or need assistance, don’t hesitate to reach out. You are not alone in this journey.

Exemptions from Backup Withholding: Who Qualifies?

Are you feeling overwhelmed by the complexities of tax deductions? You're not alone. Many individuals and organizations may qualify for exemptions from secondary tax deductions, and understanding these can make a significant difference.

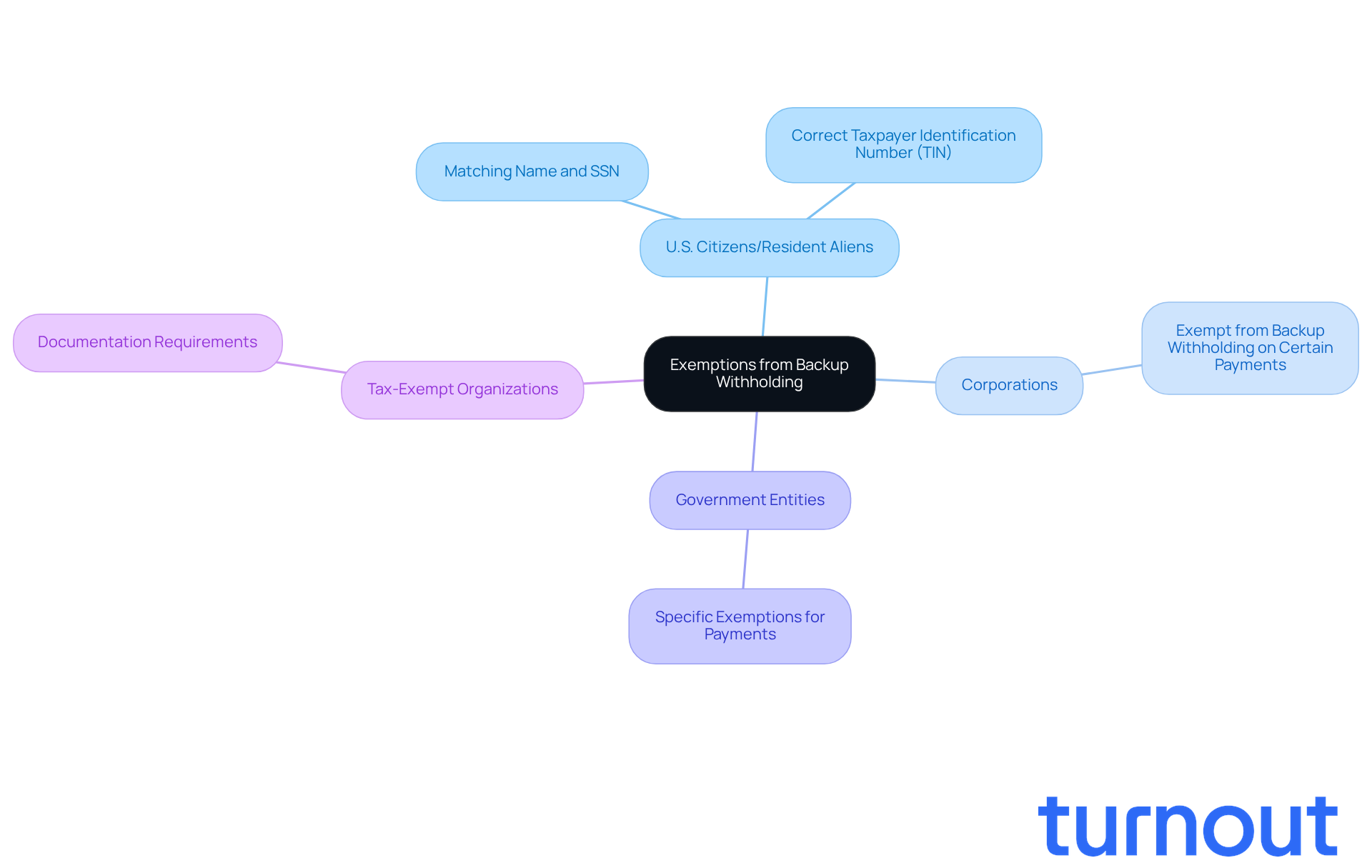

For instance, if you're a U.S. citizen or a resident alien, you might be exempt from these deductions if your name and Social Security Number match the IRS records. This is a relief for many, as it can simplify your tax experience. Additionally, corporations often enjoy exemptions from what is backup withholding from the IRS on certain payments, like interest and dividends. It's comforting to know that government entities and tax-exempt organizations also have their own exemptions.

To claim these exemptions, it's essential to provide the right documentation. A completed Form W-9 is typically required to be submitted to the payer. We understand that navigating these requirements can be daunting, but knowing what is backup withholding from the IRS can help you avoid unnecessary withholding and ensure compliance with IRS regulations.

Remember, you're not alone in this journey. We're here to help you understand your options and make the process smoother. If you have any questions or need assistance, don't hesitate to reach out!

Conclusion

Backup withholding is more than just a tax mechanism; it’s a vital tool designed by the IRS to help you meet your tax obligations. If you haven’t provided a valid Taxpayer Identification Number (TIN), this process deducts a flat rate of 24% from certain payments. It’s a safeguard for federal revenue, aiming to prevent tax evasion. Understanding how this works is crucial for you, as it emphasizes the importance of accurate reporting and following IRS regulations.

Throughout this article, we’ve shared important insights about backup withholding. From the need for accurate TINs to the types of payments affected - like nonemployee compensation and legal fees - the message is clear: awareness and compliance are essential. As the IRS tightens regulations leading up to 2026, grasping the nuances of backup withholding and its exemptions can help you avoid unnecessary tax deductions.

We know that tax regulations can feel overwhelming, but they also offer a chance for you to take charge of your financial responsibilities. By getting familiar with backup withholding rules and ensuring compliance, you can steer clear of penalties and contribute to a fairer tax system. Remember, you’re not alone in this journey. Engaging with tax professionals can provide the guidance you need to navigate these regulations effectively, reinforcing the importance of being informed and proactive in your tax matters.

Frequently Asked Questions

What is backup withholding?

Backup withholding is a tax mechanism mandated by the IRS that requires payers to deduct a flat rate of 24% from certain payments made to individuals or entities that do not have a valid Taxpayer Identification Number (TIN).

When does backup withholding apply?

Backup withholding primarily applies to nonemployee compensation reported on Forms 1099 and W-2G when a valid TIN is not provided.

What is the purpose of backup withholding?

The purpose of backup withholding is to ensure the collection of revenue on earnings that might otherwise go unreported, helping to prevent tax evasion and encouraging compliance with federal revenue regulations.

Is backup withholding an additional tax?

No, backup withholding is not an extra tax; it is a prepayment of taxes due on income that will be reported on tax returns.

What could happen if a taxpayer does not provide a correct TIN?

If a taxpayer does not provide a correct TIN, they may face additional tax collection, and backup withholding may apply to their payments.

Can you provide an example of how backup withholding works?

For instance, if a Third Party Settlement Organization processes payments totaling $20,000.01 to a payee without a TIN, backup withholding applies to the entire transaction if the TIN is not provided.

What should a taxpayer expect if they do not provide a valid TIN?

Taxpayers may receive notifications from payers requesting a valid TIN, and deductions can start promptly if an incorrect or no TIN is provided.

Can excess backup withholding be refunded?

Yes, if you end up paying more in backup withholding than you actually owe, it can be partially refunded, similar to any other tax payment.