Overview

An installment plan is a financing arrangement designed to help you manage your purchases more comfortably. By breaking down the total cost into smaller, manageable payments over time, this method can ease the financial burden of larger expenses. We understand that budgeting can be challenging, and this payment option not only enhances your financial flexibility but also aids in managing your budget effectively.

It's heartening to see a shift in consumer behavior, where many individuals now view installment plans as a strategic budgeting tool. Rather than simply a way to avoid financial constraints, these plans reflect a thoughtful approach to spending. You are not alone in this journey; many are finding that this method allows them to navigate their financial landscape with greater confidence and ease.

If you're considering an installment plan, know that it can be a valuable ally in achieving your financial goals. We're here to help you explore this option and find the best solution for your needs.

Introduction

Understanding the intricacies of financing can often feel like navigating a maze. We recognize that making significant purchases can be overwhelming. An installment plan emerges as a practical solution, allowing you to break down hefty costs into manageable payments over time. This article explores the core benefits and features of installment plans, showing how they can enhance your financial flexibility and budgeting strategies.

However, as appealing as these arrangements may be, it's common to feel concerned about spending habits and financial responsibility. How can you strike the right balance between convenience and caution? We're here to help you navigate this journey.

Define Installment Plan: Understanding the Basics

A financing arrangement can be a valuable method for individuals seeking to understand what is an installment plan to acquire goods or services while managing their expenses. This approach helps ease the financial burden by allowing payments to be made gradually, which is what an installment plan entails. What is an installment plan typically involves dividing the total cost into smaller, manageable amounts that are paid at regular intervals until the full amount is settled.

We understand that making significant purchases can be daunting. For instance, consider a situation where a buyer wishes to purchase a new appliance. To understand what is an installment plan, it allows them to make monthly contributions, alleviating the pressure of covering the entire cost upfront. This not only makes essential items more accessible but also aids in effective budget management.

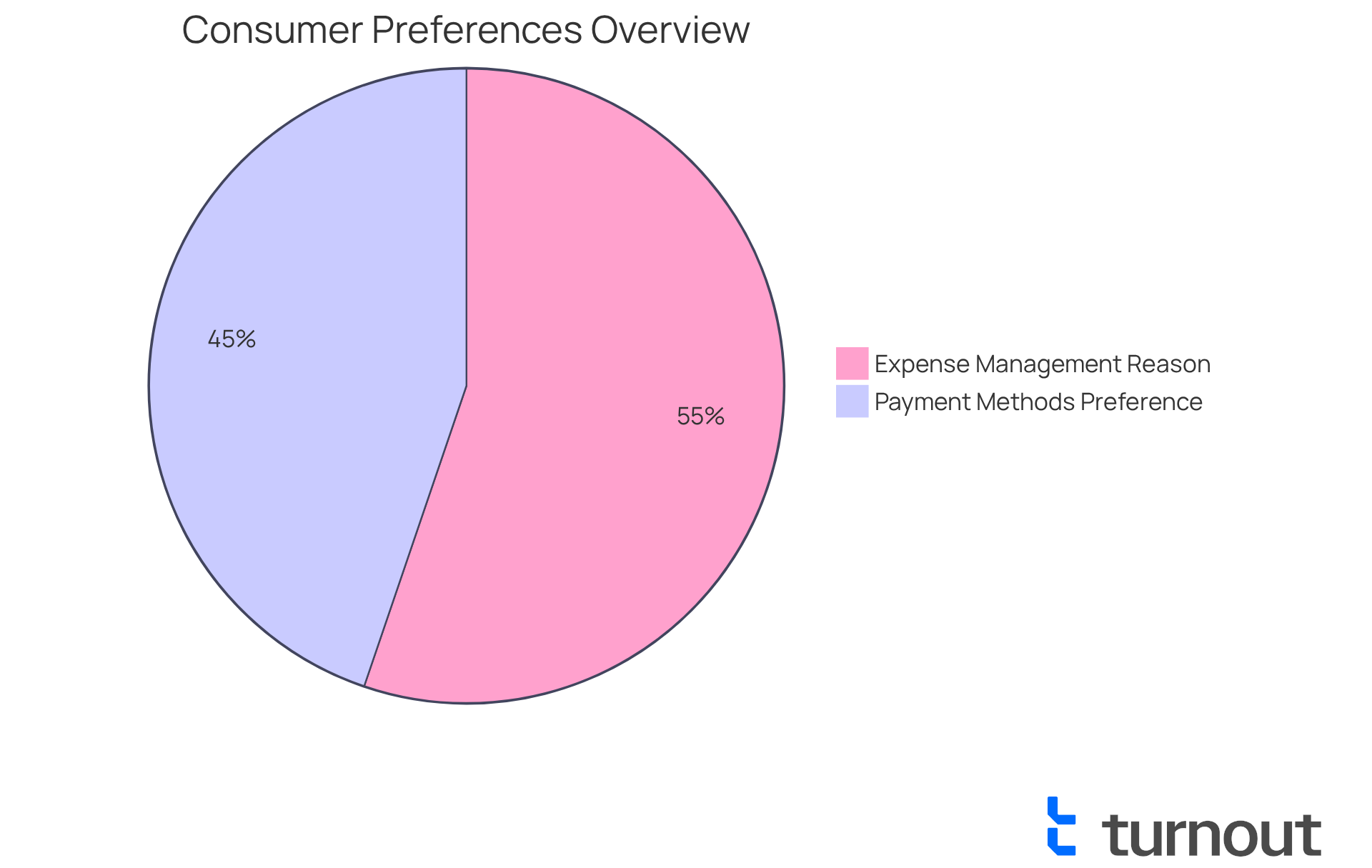

It's heartening to note that a survey conducted in August 2023 revealed that 60% of consumers from various demographics favor payment methods over time. This trend highlights the growing appeal of financing arrangements, particularly in understanding what is an installment plan. Financial specialists have observed that these arrangements can also serve as a budgeting tool. In fact, 74% of users cite expense management as a primary reason for their utilization. This shift reflects a change in buyer behavior, viewing these arrangements more as a budgeting strategy rather than a necessity due to financial constraints.

However, it's important to recognize the potential challenges associated with payment schemes. Many buyers may feel tempted to overspend, or they might encounter difficulties when using multiple Buy Now, Pay Later (BNPL) services. We want to emphasize the importance of understanding the financial implications, such as the risk of accumulating debt and the necessity of being aware of repayment terms. If you are contemplating this payment choice, remember that you are not alone in this journey. We're here to help you navigate these options with confidence.

Explore Benefits of Installment Plans: Why Choose This Payment Method?

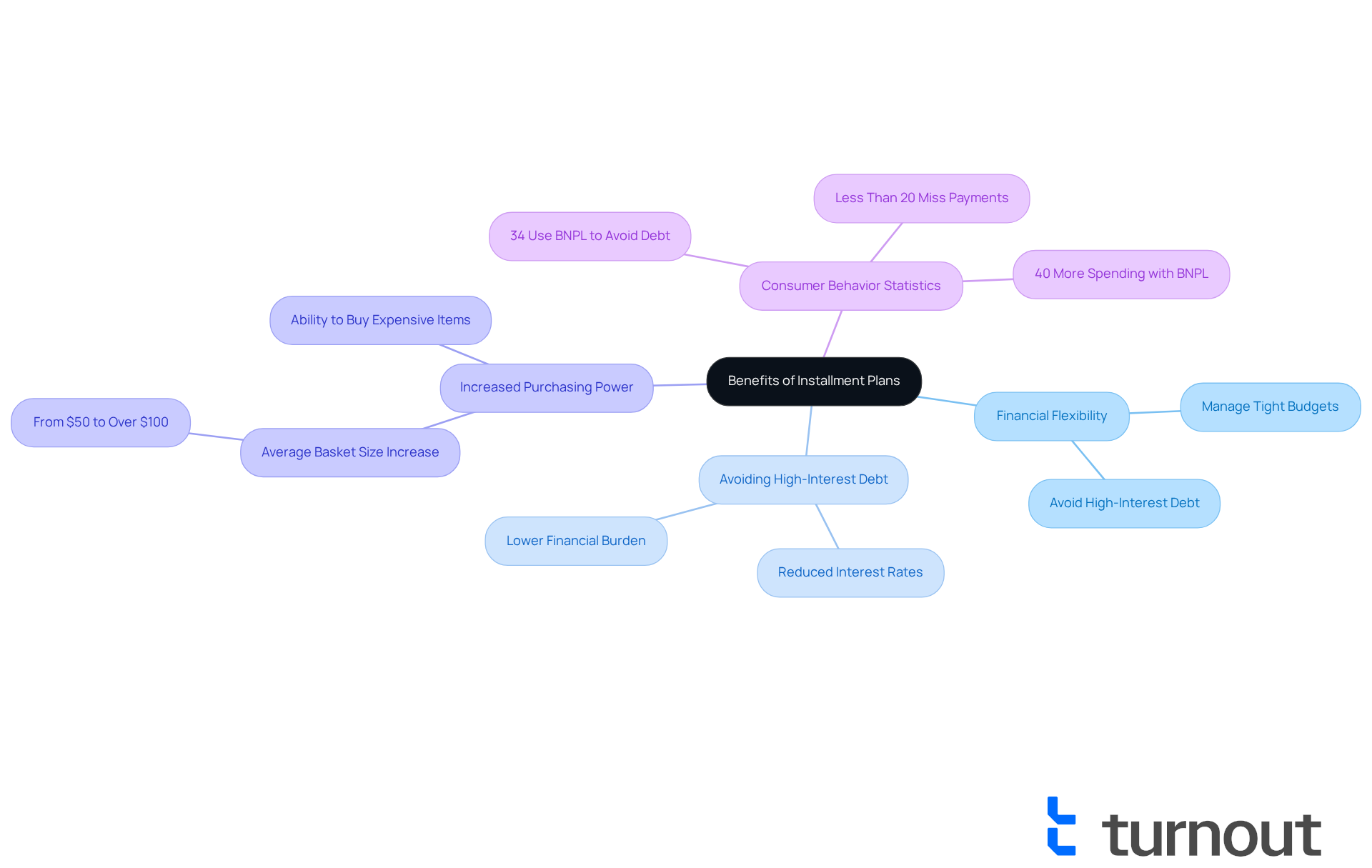

The benefits of payment schedules are truly remarkable, significantly enhancing the buying experience for customers like you. We understand that financial flexibility is essential, and this is where understanding what is an installment plan can help you spread the cost of a purchase over time. This is particularly helpful for those managing tight budgets, as it can help you avoid the burden of high-interest credit card debt. Many payment options even offer reduced or no interest rates, making it easier for you to manage your finances. In fact, a study revealed that 34% of respondents have turned to Buy Now, Pay Later (BNPL) options to steer clear of accumulating credit card debt.

Imagine a family deciding on a payment arrangement to purchase a new computer. This choice enables them to maintain their monthly budget without compromising on other essential needs. Financial specialists often highlight that what is an installment plan can enhance your buying capability, enabling you to acquire more expensive items that might otherwise seem out of reach if paid for all at once. Notably, the average basket size increases from $50 to over $100 when using digital installments, showcasing how these plans empower you to make larger purchases.

Moreover, fewer than 20% of BNPL consumers have missed a payment, indicating that this can be a reliable way to manage your financial responsibilities. This flexibility not only helps you tackle immediate financial obligations but also encourages a more responsible approach to spending, steering you away from the pitfalls of credit card debt. Remember, we're here to help you navigate these options and make informed choices that support your financial well-being.

Identify Key Features of Installment Plans: What Sets Them Apart?

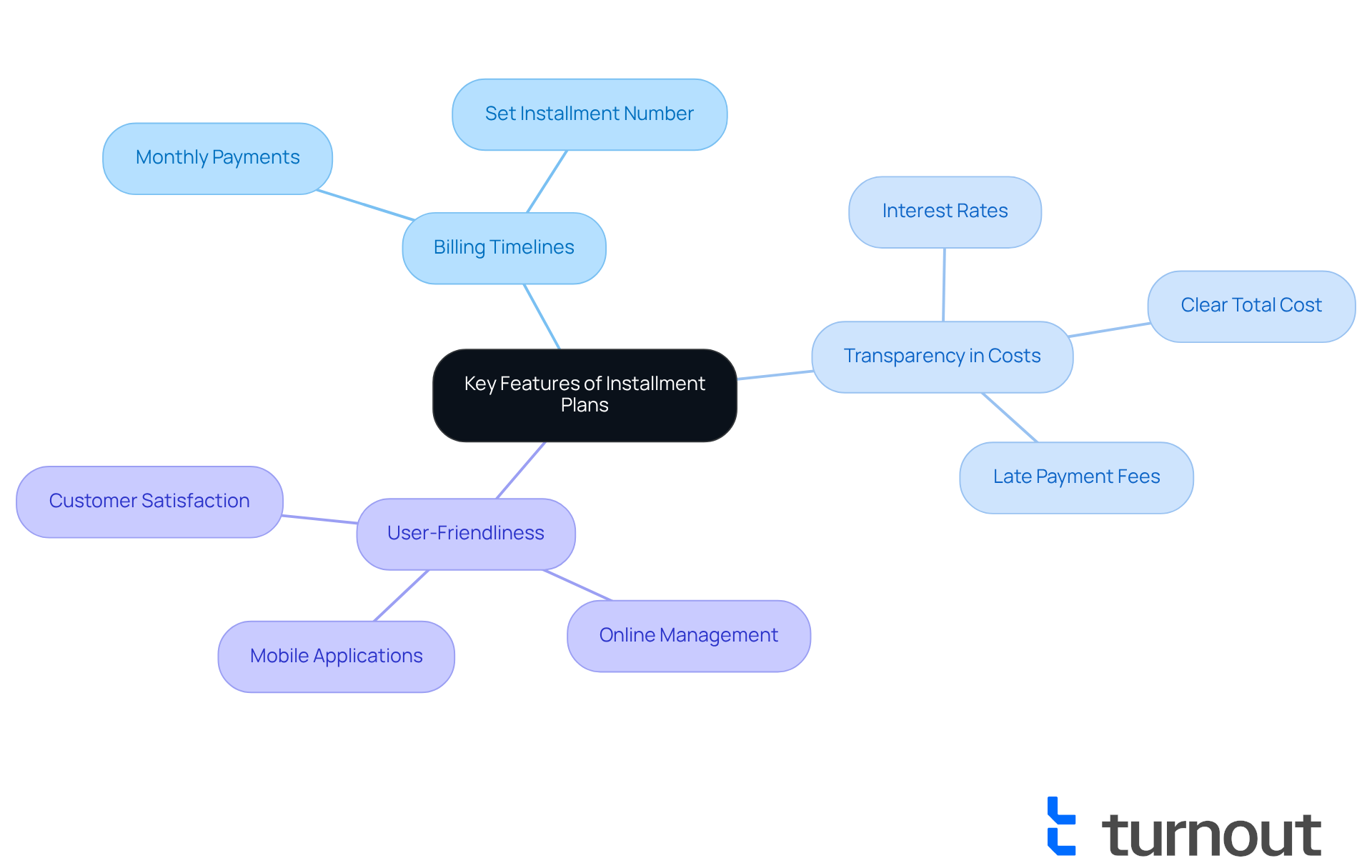

Navigating financing options can often feel overwhelming. We understand that the key characteristics of these options—set billing timelines, clarity about overall expenses, and the absence of hidden charges—are essential for making informed decisions. Typically, consumers agree to a specific number of installments as part of what is an installment plan, with payments due at regular intervals like monthly payments. This predictability allows for better financial planning and budgeting, easing some of the stress that often accompanies financial commitments.

Moreover, financing arrangements usually outline distinct conditions regarding interest rates and any potential fees for late payments. For instance, a retailer may offer a six-month financing option for a new smartphone, clearly communicating the total cost and timeline for payments. Such transparency is crucial for buyers, as it helps them grasp their financial responsibilities and avoid unexpected fees.

It's also important to note that many payment arrangements are designed with user-friendliness in mind. This enables individuals to manage their payments through online platforms or mobile applications, enhancing convenience and accessibility. Financial specialists emphasize that the clarity and simplicity of these strategies significantly boost customer satisfaction, making them a preferred choice for managing expenses.

Did you know that:

- 64% of consumers who utilized payment arrangements last year earn over $100,000?

- 72% of Millennials have engaged with a payment scheme in the past year, showcasing a strong interest among this demographic?

- The rising trend of private-label installment plans illustrates what is an installment plan, as they have been growing at a compound annual rate of 4.8% over the last two years, highlighting the increasing relevance of these payment options in today’s market?

Remember, you are not alone in this journey; we’re here to help you find the best financial solutions that suit your needs.

Conclusion

Understanding installment plans offers valuable insights into effective financial management. We recognize that making significant purchases can feel overwhelming, especially when faced with the burden of full payment. These arrangements allow consumers to spread costs over time, making manageable, periodic payments that fit within their budgets. By breaking down expenses, installment plans not only enhance access to essential goods but also provide a thoughtful approach to budgeting, which is why they are becoming increasingly popular.

Throughout this article, we've highlighted key benefits of installment plans, such as:

- Financial flexibility

- Improved buying power

- The potential to avoid high-interest credit card debt

It's crucial to pay attention to clear terms and user-friendly platforms, ensuring that you can navigate your financial commitments with confidence. Furthermore, the growing trend of installment plans signals a shift in consumer behavior, demonstrating their effectiveness as a budgeting tool rather than just a means of financing.

Ultimately, the rise of installment plans reflects a broader movement toward responsible spending and thoughtful financial planning. As you become more aware of your financial choices, embracing installment plans can lead to smarter purchasing decisions. Engaging with these options not only enhances your financial well-being but also paves the way for a more secure future. We encourage you to explore installment plans as a viable solution for your purchasing needs, and remember, you are not alone in this journey—take charge of your financial path today.

Frequently Asked Questions

What is an installment plan?

An installment plan is a financing arrangement that allows individuals to acquire goods or services by dividing the total cost into smaller, manageable payments made at regular intervals until the full amount is settled.

How does an installment plan help with budgeting?

An installment plan helps with budgeting by allowing buyers to make monthly contributions, which alleviates the pressure of covering the entire cost upfront and makes essential items more accessible.

What percentage of consumers prefer payment methods over time?

A survey conducted in August 2023 revealed that 60% of consumers from various demographics favor payment methods over time.

Why do users cite expense management as a reason for using installment plans?

74% of users cite expense management as a primary reason for utilizing installment plans, indicating that these arrangements serve as a budgeting tool rather than just a means to make purchases.

What challenges might buyers face when using installment plans?

Buyers may feel tempted to overspend or encounter difficulties when using multiple Buy Now, Pay Later (BNPL) services, leading to potential financial strain.

What should individuals consider before opting for an installment plan?

Individuals should understand the financial implications, such as the risk of accumulating debt and the necessity of being aware of repayment terms before opting for an installment plan.