Introduction

Navigating financial options can often feel like wandering through a maze, especially when it comes to payment methods. We understand that making large purchases can be daunting. Installment payments have emerged as a popular solution, allowing you to ease the burden by breaking costs into manageable chunks.

While these plans offer affordability and flexibility, it’s important to recognize that they also come with potential pitfalls that can complicate your financial well-being. What are the true implications of choosing an installment payment plan? How can you ensure you’re making the best decision for your financial journey?

You’re not alone in this. Many people face similar dilemmas, and it’s crucial to explore your options thoughtfully. Let’s take a closer look at how installment payments can work for you.

Define Installment Payments: Understanding the Basics

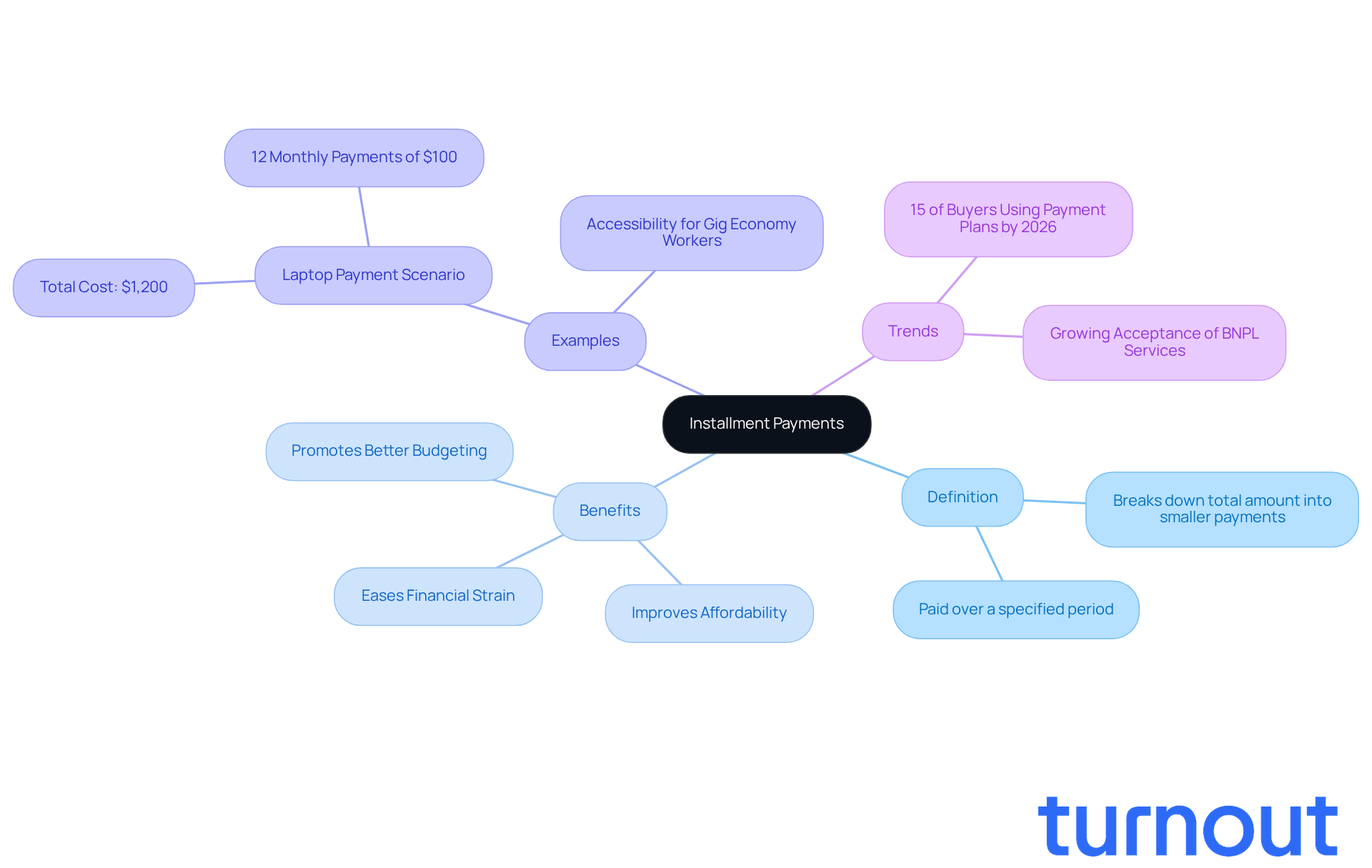

When it comes to managing your finances, understanding what is an installment payment can be a real lifesaver. We understand that sometimes, paying a large sum upfront can feel overwhelming. That’s where knowing what is an installment payment becomes useful. To grasp what is an installment payment, it allows you to break down the total amount owed into smaller, more manageable portions, paid over a specified period. This way, you can acquire the goods or services you need without the pressure of paying everything at once.

Imagine you’re looking to buy a laptop for $1,200. Instead of paying the full amount upfront, you could choose to pay it off in 12 monthly payments of $100 each. This approach helps clarify what is an installment payment for many people, especially when it comes to larger purchases. It improves affordability and accessibility for those who might not have the means to pay in full right away.

Chris Willis, managing director of banking and payments, highlights this trend by stating, "Consumers are generally most satisfied with the BNPL plans provided by their credit card issuers." This shows just how accepted deferred billing options have become. In fact, by 2026, around 15% of buyers reported using payment plans for major purchases, reflecting a growing trend towards this flexible financing choice.

As financial literacy continues to rise, more individuals are recognizing the benefits of payment plans. They can help promote better budgeting and financial management. The convenience of spreading expenses over time not only eases short-term financial strain but also empowers you to make informed purchasing decisions.

Moreover, case studies reveal that payment plans can make essential technology, like smartphones, more accessible for those who may not have the initial funds. This is especially beneficial for gig economy workers who rely on dependable devices for their jobs. Remember, you’re not alone in this journey, and we’re here to help you navigate your financial options.

Explore Types of Installment Payments: Variations and Examples

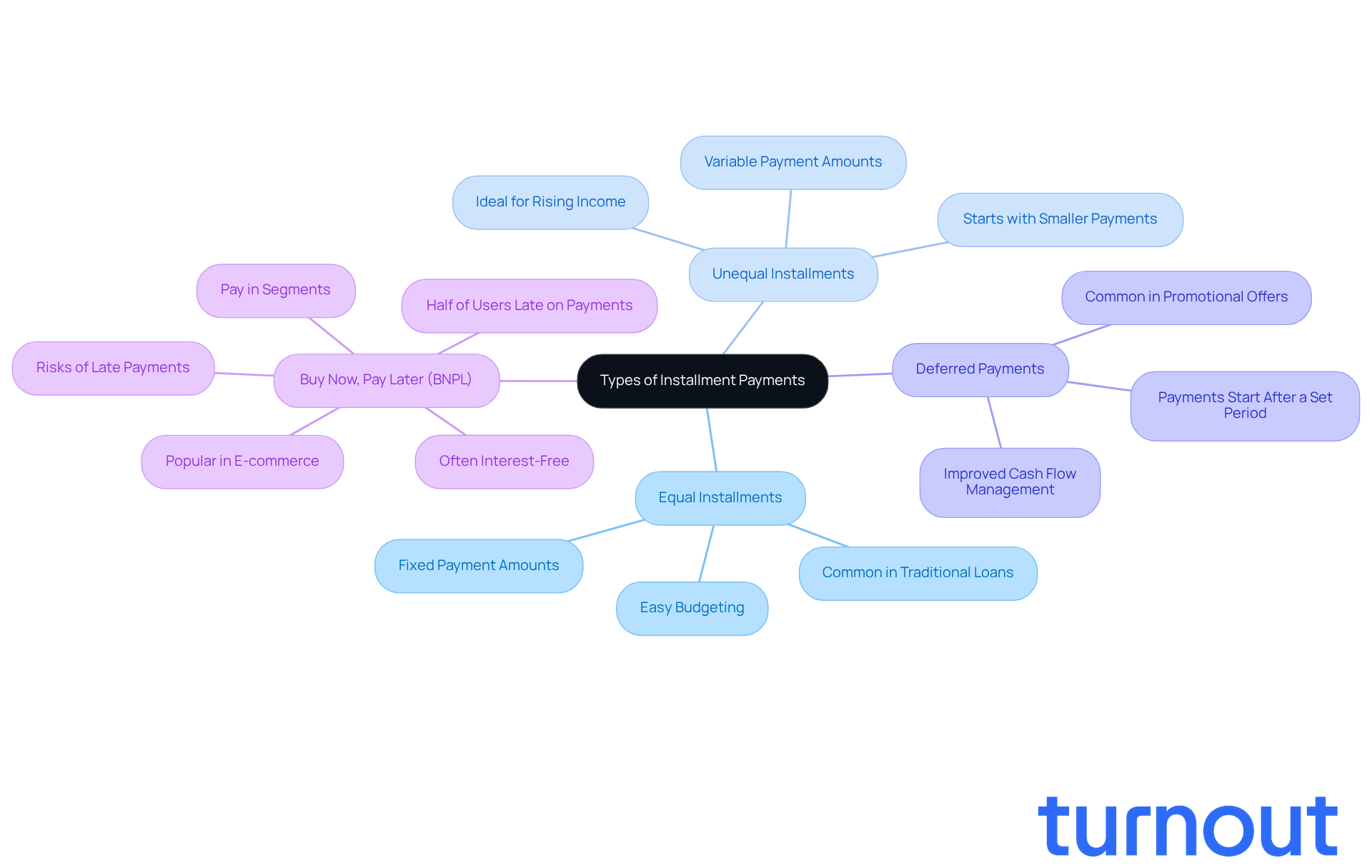

Navigating the world of installment plans can feel overwhelming, but understanding what is an installment payment and your options can make a significant difference. There are several types of plans, each designed to meet different consumer needs and preferences. Let’s explore some common variations:

- Equal Installments: This straightforward option divides the total amount into equal payments over the repayment period. It’s often seen in traditional loans or financing plans, making it easy to budget.

- Unequal Installments: Here, the amounts vary, typically starting with smaller sums that increase over time. This can be a great choice for those who expect their income to rise in the future.

- Deferred Payments: With this plan, you can begin making payments after a set period. This flexibility allows you to manage your cash flow better at the start, often featured in promotional financing offers.

- Buy Now, Pay Later (BNPL): This popular option lets you acquire an item and pay for it in segments, often without interest if settled within a designated timeframe. It’s especially useful in e-commerce, helping buyers manage larger purchases more easily. In fact, about half of Americans have turned to BNPL services, with shoppers accruing a record $10 billion in BNPL loans in November 2025.

To understand what is an installment payment, it's essential to recognize that each type of installment plan offers unique benefits, so you should choose the one that aligns with your financial situation. However, it’s important to be aware that while BNPL provides flexibility, nearly half of its users are currently late on their payments. This highlights the potential risks associated with this method. As Karen Webster noted, BNPL can help with timing issues for buyers, but it’s crucial to stay mindful of your financial obligations.

Remember, you’re not alone in this journey. We’re here to help you navigate these options and find the best fit for your needs.

Identify Key Characteristics of Installment Payments: What to Know

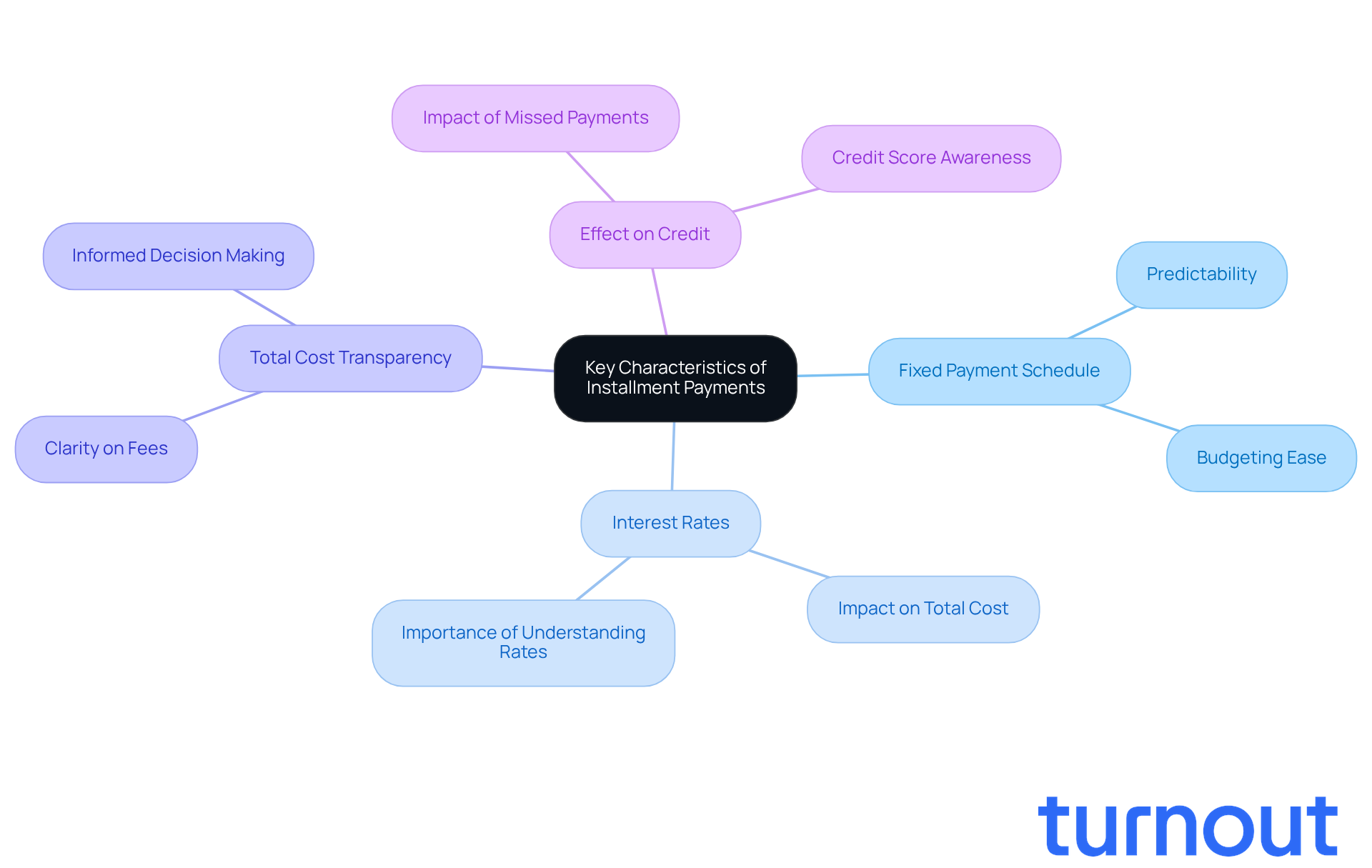

When discussing what is an installment payment, understanding their key characteristics can make a world of difference for your financial journey.

- Fixed Payment Schedule: Payments are made on a set schedule-whether weekly, bi-weekly, or monthly. This predictability can really help you budget effectively, easing some of that financial stress.

- Interest Rates: Depending on your agreement, those scheduled payments might come with interest. Knowing the interest rate is crucial, as it can significantly affect the total cost of your purchase.

- Total Cost Transparency: It’s important to know exactly how much you’ll pay over the life of the payment plan, including any fees or interest. This transparency is vital for making informed choices that suit your needs.

- Effect on Credit: Some financial plans can impact your credit score, especially if payments are missed. Understanding how your spending habits influence your creditworthiness is essential for maintaining a healthy financial profile.

These characteristics highlight the importance of careful evaluation when considering what is an installment payment. They can greatly influence your financial well-being, and remember, you’re not alone in this journey. We’re here to help you navigate these choices with confidence.

Assess Benefits and Drawbacks of Installment Payments: Making Informed Choices

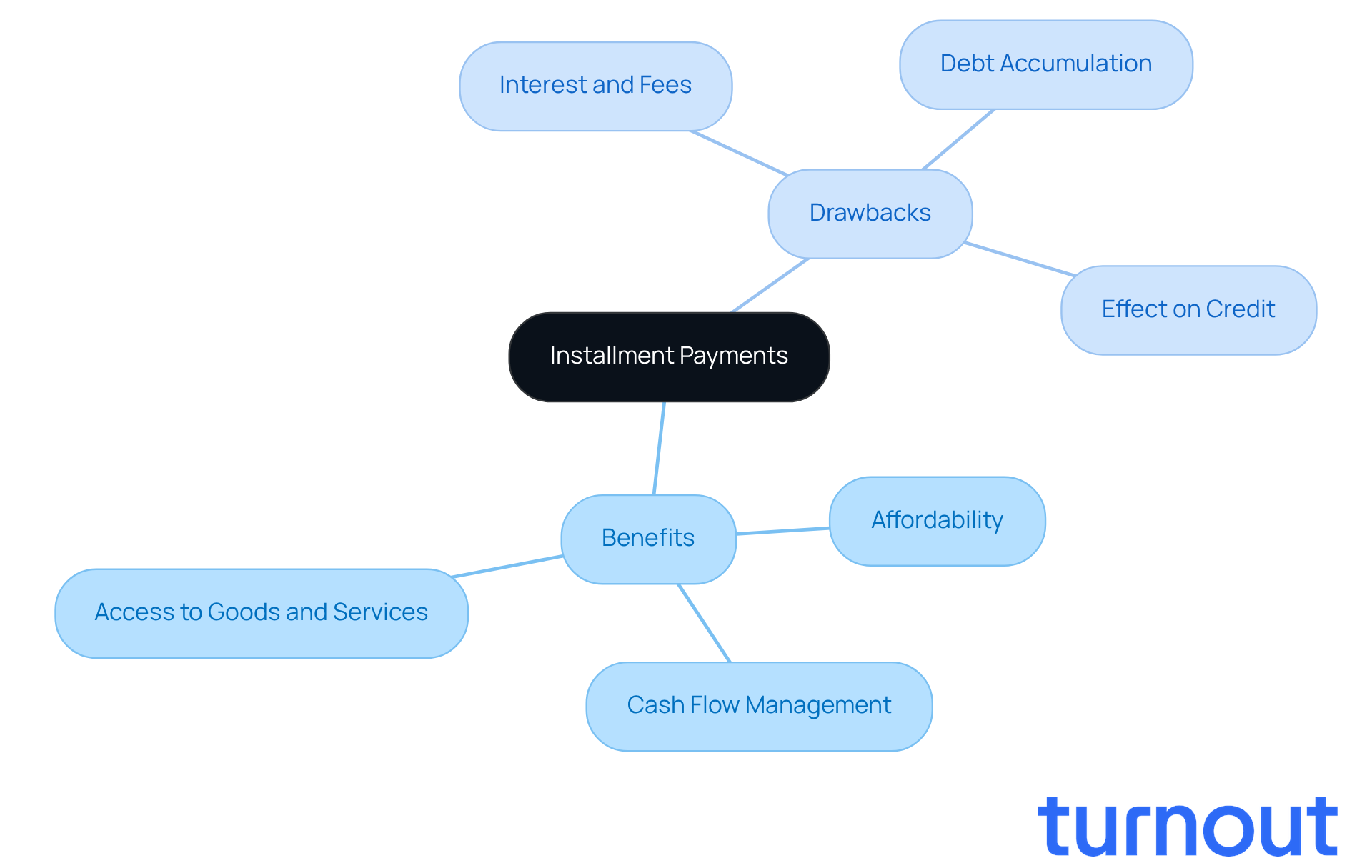

When considering what is an installment payment, it’s important to weigh both its benefits and drawbacks. We understand that managing finances can be challenging, and you may wonder what is an installment payment as a helpful option.

Benefits:

- Affordability: Breaking down the total cost into smaller payments allows you to make larger purchases without straining your budget. It’s a way to enjoy what you need without feeling overwhelmed.

- Cash Flow Management: These plans can help you manage your cash flow more effectively. You can allocate funds to other expenses while making smaller contributions, giving you more breathing room.

- Access to Goods and Services: This financing method opens doors to products or services that might be out of reach if you had to pay upfront. It enhances your purchasing power, making it easier to get what you need.

Drawbacks:

- Interest and Fees: Depending on the terms, installment payments may come with interest or fees, which can increase the total cost of your purchase. It’s essential to read the fine print.

- Debt Accumulation: It’s easy to overspend when using installment plans, which can lead to higher debt levels. Being mindful of your spending is crucial.

- Effect on Credit: Missing payments can negatively impact your credit rating. Keeping track of your payment schedule is vital to maintain your financial health.

By weighing these benefits and drawbacks, you can make informed decisions about what is an installment payment and whether it is the right choice for your financial journey. Remember, you’re not alone in this process, and we’re here to help you navigate your options.

Conclusion

Understanding installment payments is essential for anyone navigating the financial landscape. We know that making significant purchases can feel overwhelming, especially when faced with the burden of paying the entire amount upfront. This is where installment payments come in, enhancing affordability and accessibility. By breaking down a total cost into smaller, manageable payments, you can acquire necessary goods and services while maintaining better control over your budget.

Throughout this article, we explored various aspects of installment payments, including their definitions, types, key characteristics, and the benefits and drawbacks associated with them. From equal and unequal installments to deferred payments and Buy Now, Pay Later (BNPL) options, each plan caters to different financial situations. Understanding fixed payment schedules, interest rates, and potential impacts on credit scores is crucial for making informed decisions. We also highlighted the importance of weighing the advantages, such as improved cash flow management, against potential pitfalls like debt accumulation.

In reflection, the significance of installment payments in modern finance cannot be overstated. They serve as a valuable tool for consumers like you, seeking to enhance purchasing power while managing finances responsibly. As financial literacy continues to grow, we encourage you to embrace these options thoughtfully, ensuring that your choices align with your long-term financial goals. Remember, you are not alone in this journey. By staying informed and cautious, you can navigate the world of installment payments effectively, paving the way for a more secure financial future.

Frequently Asked Questions

What are installment payments?

Installment payments are a method of breaking down a total amount owed into smaller, more manageable portions, which are paid over a specified period, making it easier to acquire goods or services without paying everything upfront.

How does the installment payment system work?

For example, if you want to buy a laptop for $1,200, instead of paying the full amount at once, you could choose to pay it off in 12 monthly payments of $100 each.

What are the benefits of using installment payments?

Installment payments improve affordability and accessibility for larger purchases, help promote better budgeting and financial management, and ease short-term financial strain.

What does Chris Willis say about consumer satisfaction with payment plans?

Chris Willis, managing director of banking and payments, notes that consumers are generally most satisfied with the Buy Now Pay Later (BNPL) plans provided by their credit card issuers.

What is the trend regarding payment plans for major purchases?

By 2026, around 15% of buyers are expected to use payment plans for major purchases, indicating a growing trend towards flexible financing options.

Who benefits from payment plans?

Payment plans can make essential technology more accessible for individuals, especially gig economy workers who may not have the initial funds for reliable devices needed for their jobs.