Introduction

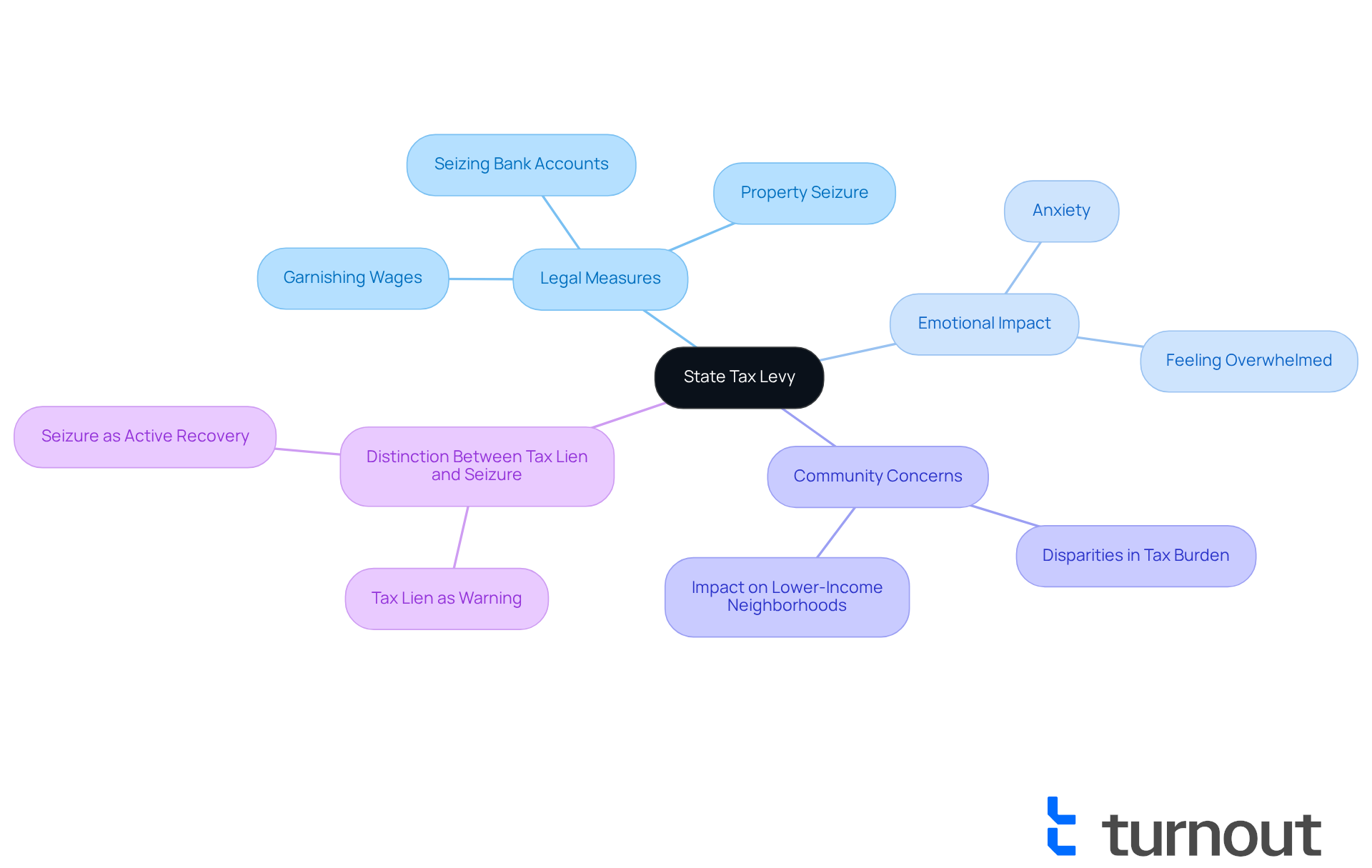

Understanding the implications of a state tax levy can feel overwhelming. We know that many individuals face anxiety as tax authorities intensify their collection efforts. This legal measure allows the government to seize assets, like wages, to settle unpaid tax obligations. The result? It can lead to significant financial distress.

As you navigate this challenging process, it’s important to explore the nuances of state tax levies. How do they impact your personal finances? What rights do you hold as a taxpayer? These are crucial questions that deserve attention.

What happens when a tax levy threatens not just your financial stability, but also your ability to provide for your family? It’s common to feel a sense of helplessness in such situations. But remember, you are not alone in this journey. We're here to help you understand your options and find a way forward.

Define State Tax Levy: Understanding the Basics

A government tax assessment can feel overwhelming, as it represents a legal measure taken by a fiscal authority to seize an individual's assets to cover overdue tax obligations. This process might involve garnishing wages, seizing bank accounts, or even taking possession of property. Unlike a tax lien, which serves as a claim against property to ensure payment, a seizure means the government is actively taking steps to recover owed taxes. It's common to feel anxious when a government tax collection begins, especially after previous notifications about tax responsibilities have gone unanswered.

In recent years, many individuals have faced increasing state tax assessments, raising concerns about what is state tax levy on paycheck as tax authorities intensify efforts to collect outstanding debts. For instance, in New York City, disparities in property taxes have led to legal actions aimed at reforming the tax system. These challenges particularly affect individuals in lower-income neighborhoods, highlighting the complexities of tax collection and the potential for unfair burdens on certain communities.

Understanding the difference between a tax lien and a tax collection is crucial for taxpayers. A tax lien serves as a warning, indicating that the government has a claim against your property. In contrast, a seizure means the government is taking active measures to recover owed taxes. This distinction can have significant implications, especially for those facing financial difficulties. A seizure can lead to immediate and severe consequences, including loss of income and assets.

We understand that navigating these issues can be daunting, but you are not alone in this journey. If you find yourself in a challenging situation, remember that there are resources and support available to help you manage your tax obligations.

Context and Purpose: Why State Tax Levies Matter

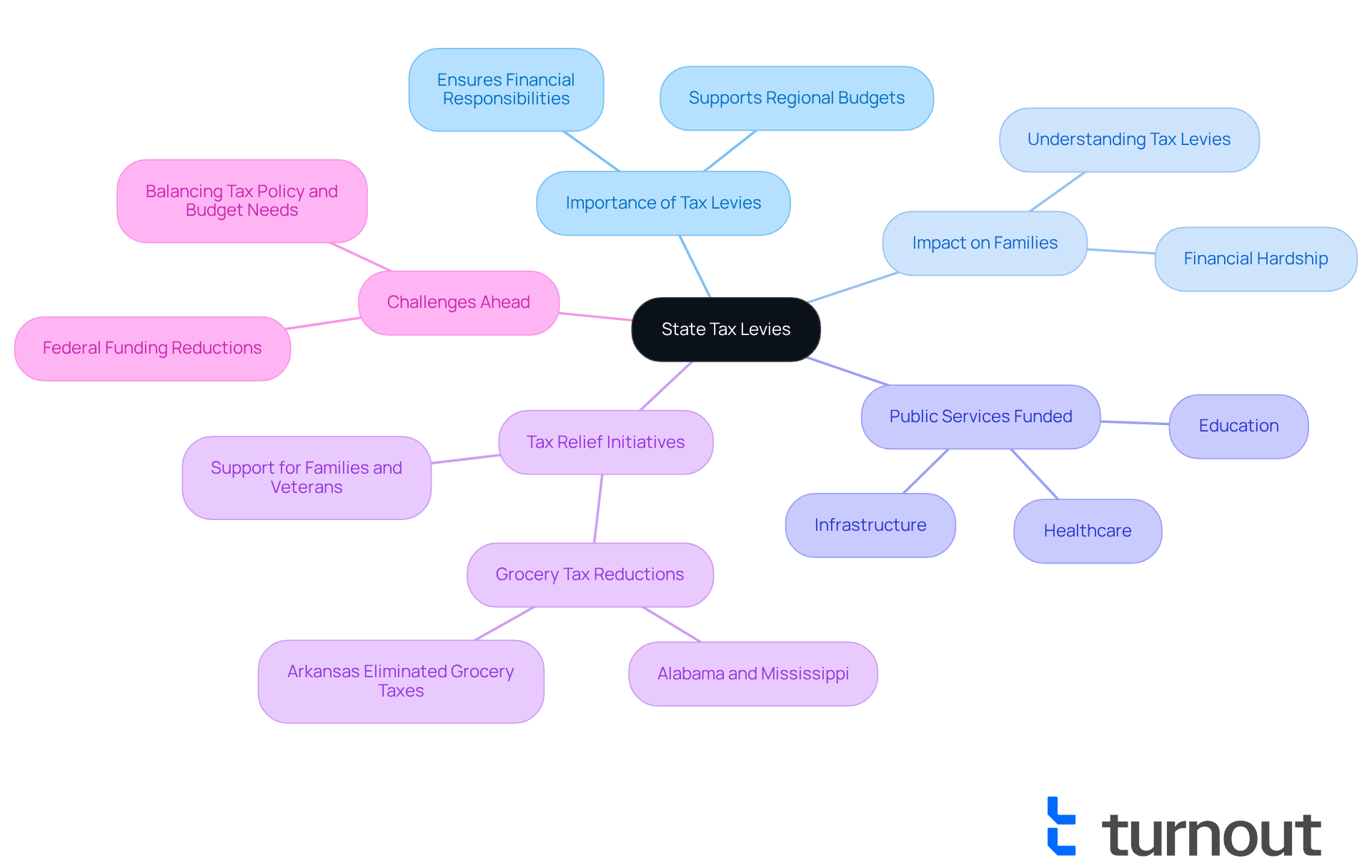

Tax levies are crucial tools for regional governments, helping to ensure that everyone meets their financial responsibilities. We understand that these obligations can feel overwhelming, especially when they impact your ability to provide for your family. Tax revenues play a vital role in funding essential public services like education, healthcare, and infrastructure, which we all rely on.

In 2025, many states, including Alabama and Mississippi, ended the fiscal year on a stable note, despite slower revenue growth forecasts. This highlights the importance of effective tax collection strategies. However, for individuals, understanding what is state tax levy on paycheck is crucial, as a tax charge can lead to serious consequences, including financial hardship and difficulty meeting basic living expenses. It's common to feel anxious about these situations, but understanding what is state tax levy on paycheck can motivate you to proactively address tax debts, helping you avoid more drastic measures.

Recent tax relief initiatives in regions like Alabama and Mississippi, which have lowered grocery tax rates, aim to ease some financial pressures on residents. These efforts particularly focus on supporting children, families, and veterans. We believe that a balanced approach to tax policy is essential, as lawmakers face the challenge of meeting budgetary needs while ensuring that tax burdens do not disproportionately affect low-income families.

Moreover, potential federal funding reductions pose a significant risk to regional budgets, complicating the fiscal landscape. As communities navigate these complexities, it becomes increasingly important to understand what is state tax levy on paycheck and its impact on personal financial stability. Remember, you are not alone in this journey; we're here to help you find the best path forward.

Historical Background: The Evolution of State Tax Levies

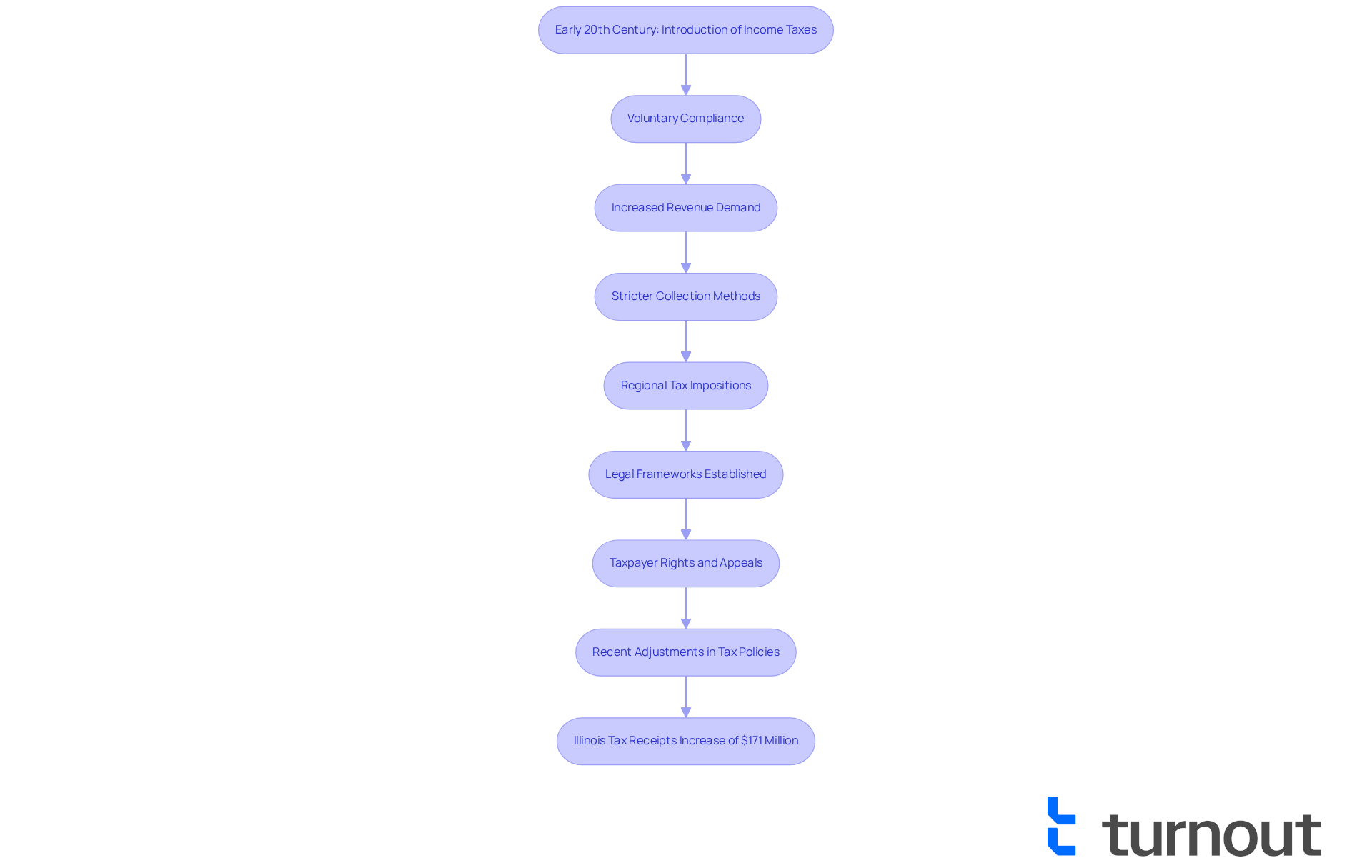

The landscape of tax impositions has evolved significantly since income taxes were first introduced by governments in the early 20th century. We understand that navigating tax obligations can feel overwhelming. Initially, tax collection relied heavily on voluntary compliance. However, as tax systems became more complex and the demand for revenue increased, governments began to implement stricter collection methods.

The rise of regional tax impositions stemmed from the need for effective enforcement mechanisms to combat widespread tax evasion and non-compliance. Over the years, governments have refined their levy processes, establishing legal frameworks that not only allow for asset seizure but also protect taxpayers' rights and provide avenues for appeal.

Recent discussions in various regional legislatures, like the Indiana General Assembly's consideration of tax conformity, highlight ongoing adjustments to tax policies. For example, total tax receipts in Illinois increased by $171 million (1.4%) in FY26, showcasing the impact of these evolving tax collection methods.

As states continue to adapt their tax collection strategies, understanding these historical changes is essential for individuals managing the complexities of state tax responsibilities. Remember, you are not alone in this journey. Excellent technical skills are crucial for success in the intricate world of tax, underscoring the importance of grasping tax laws for compliance. We're here to help you navigate these challenges.

Key Characteristics: How State Tax Levies Function

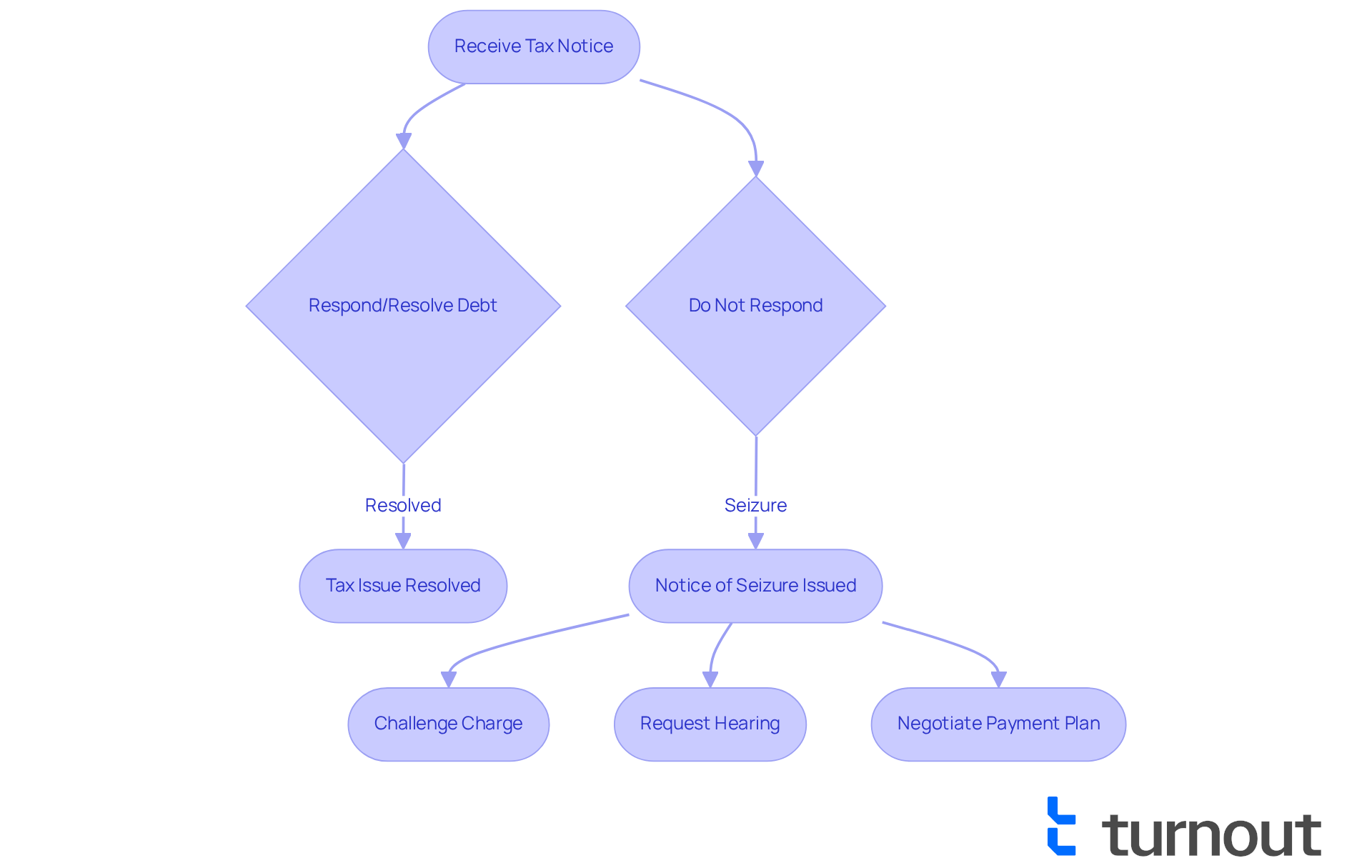

Facing state tax assessments can be overwhelming, and we understand that many individuals feel anxious about unpaid taxes. Initially, the tax authority sends multiple notices, which can feel daunting. If you don’t respond or resolve the debt, the state may issue a notice of seizure, warning you about the potential confiscation of your assets. This can include wages, bank accounts, and other financial resources.

It’s important to know that you have rights during this process. You can:

- Challenge the charge

- Request a hearing

- Negotiate a payment plan

Understanding these rights is essential for anyone confronting a tax charge. It empowers you to take informed steps to protect your financial interests.

As Oliver Wendell Holmes, Jr. wisely noted, 'Taxes are what we pay for a civilized society.' This highlights the importance of being knowledgeable about your rights. With the average per capita state and local tax burden in the U.S. being $7,109, understanding what is state tax levy on paycheck is crucial when dealing with your options.

Remember, you are not alone in this journey. We’re here to help you navigate these challenges and ensure you understand your rights and the steps you can take.

Conclusion

Understanding what a state tax levy entails is essential for anyone facing tax obligations. We understand that this legal action, which allows the government to seize assets to recover overdue taxes, can profoundly impact your personal finances. Awareness of how a state tax levy affects your paycheck is crucial for navigating your financial responsibilities effectively.

Key insights from our discussion highlight:

- The differences between tax liens and levies

- The historical evolution of tax collection methods

- The rights you possess during this process

It's important to be informed about your obligations and the resources available to manage tax debts. Additionally, we shed light on the broader societal implications of tax levies, particularly how they affect funding for essential public services and the financial stability of families like yours.

In light of these considerations, it’s imperative to take proactive steps in understanding and addressing your tax responsibilities. Staying informed and seeking assistance when needed can help ease the anxiety associated with tax levies and promote your financial well-being. By recognizing the significance of state tax levies and their role in governmental funding, you can better navigate your obligations and contribute to a more equitable tax system. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is a state tax levy?

A state tax levy is a legal measure taken by a government authority to seize an individual's assets to cover overdue tax obligations. This can involve garnishing wages, seizing bank accounts, or taking possession of property.

How does a state tax levy differ from a tax lien?

A tax lien serves as a claim against property to ensure payment of taxes, acting as a warning. In contrast, a tax levy involves active measures by the government to recover owed taxes, which can result in immediate consequences such as loss of income or assets.

What are the potential consequences of a state tax levy?

The consequences of a state tax levy can include garnished wages, seized bank accounts, and loss of property, leading to significant financial difficulties for the affected individual.

Why are state tax assessments increasing?

Many individuals are facing increasing state tax assessments due to intensified efforts by tax authorities to collect outstanding debts, which has raised concerns among taxpayers.

How do disparities in property taxes affect individuals?

Disparities in property taxes, such as those seen in New York City, can lead to legal actions aimed at reforming the tax system and may disproportionately burden individuals in lower-income neighborhoods.

What should individuals do if they are facing a tax levy?

If facing a tax levy, individuals should seek resources and support to help manage their tax obligations, as there are options available to assist them in navigating these challenges.