Introduction

Navigating the complexities of financial regulations can often feel overwhelming, especially when it comes to compliance with forms like the 8300. We understand that this essential document, which requires reporting cash payments exceeding $10,000, is crucial for maintaining transparency in our financial system and combating financial crimes.

However, the stakes are high. It's common to feel anxious about the potential penalties and reputational damage that can arise from non-compliance. How can organizations effectively manage these requirements while also contributing positively to the fight against illicit activities?

You're not alone in this journey. Many businesses face similar challenges, and there are supportive solutions available to help you navigate these waters with confidence. Let's explore how you can ensure compliance while fostering a culture of integrity and transparency.

Define Form 8300: Purpose and Importance

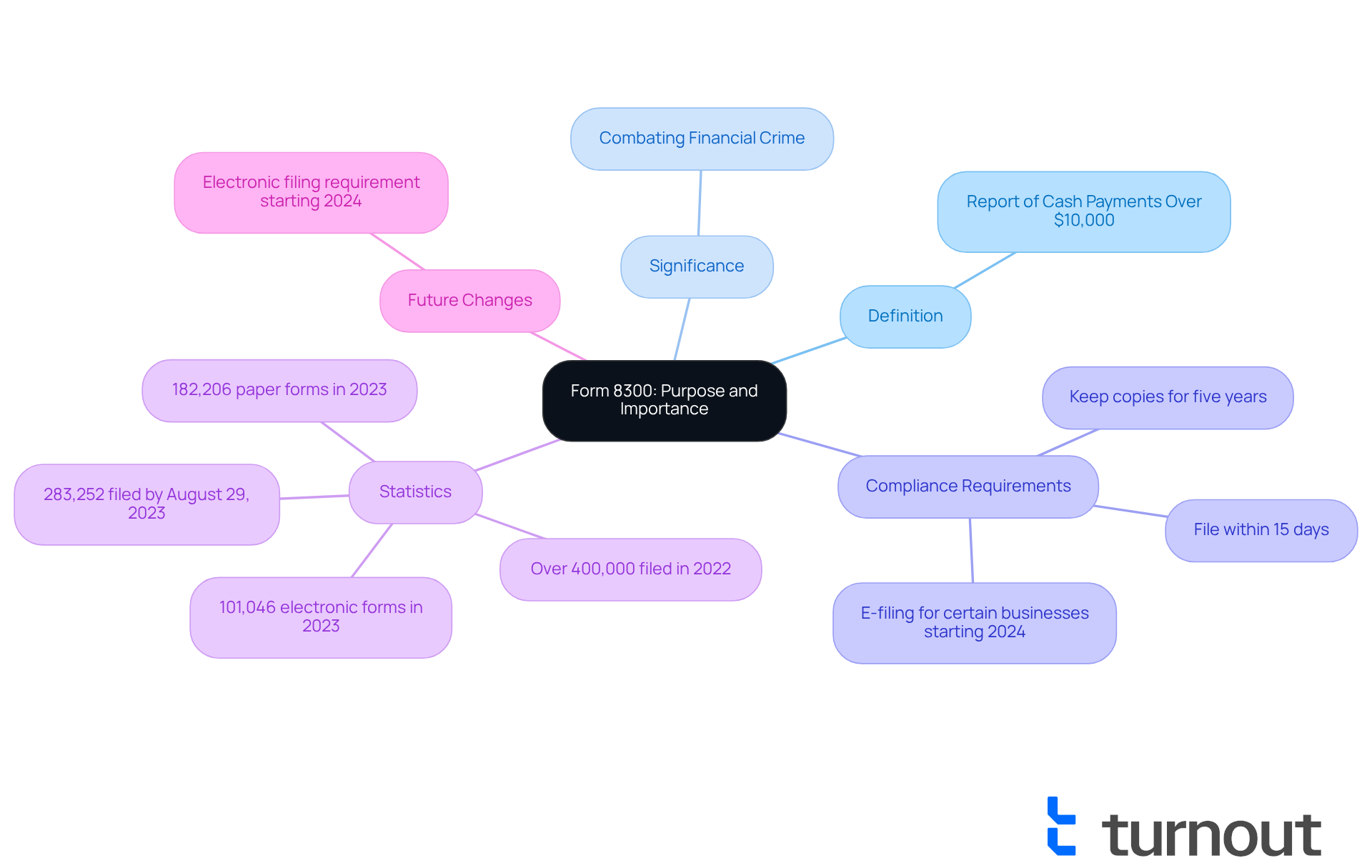

What is a 8300 form? It is officially known as the Report of Cash Payments Over $10,000 Received in a Trade or Business, and it serves as a vital tool for businesses receiving cash payments that exceed $10,000 in a single transaction or related transactions. We understand that navigating financial regulations can be daunting, but this document is essential for helping the IRS and the Financial Crimes Enforcement Network (FinCEN) monitor large cash activities. By reporting these transactions, you contribute to a transparent financial environment and help deter illegal activities.

The significance of Form 8300 goes beyond mere compliance; it’s a crucial part of the fight against financial crime. In 2022 alone, over 400,000 Forms 8300 were filed. As of August 29, 2023, 283,252 reports have already been submitted, showcasing a strong commitment to compliance. It’s common to feel overwhelmed, but neglecting to submit this form can lead to serious penalties. Many businesses have faced hefty fines for non-compliance, and the impact on reputation can be just as damaging.

IRS representatives emphasize that this document is critical for tracking significant cash transactions. If you receive over $10,000 in cash during your business activities, you need to understand what is a 8300 form to file it properly. This requirement is part of broader efforts to combat money laundering and tax evasion, underscoring the importance of compliance for businesses operating in cash-intensive sectors. Remember, you must keep a copy of each submitted document for five years from the filing date. Understanding and adhering to these requirements is essential to avoid legal issues and support the integrity of our financial system.

Looking ahead, starting in 2024, businesses that submit at least 10 additional information returns will be required to file this document electronically. This change signifies a shift in compliance obligations, and we’re here to help you navigate these updates. You are not alone in this journey; understanding these regulations can empower you to protect your business and contribute positively to the financial landscape.

Outline Filing Requirements for Form 8300

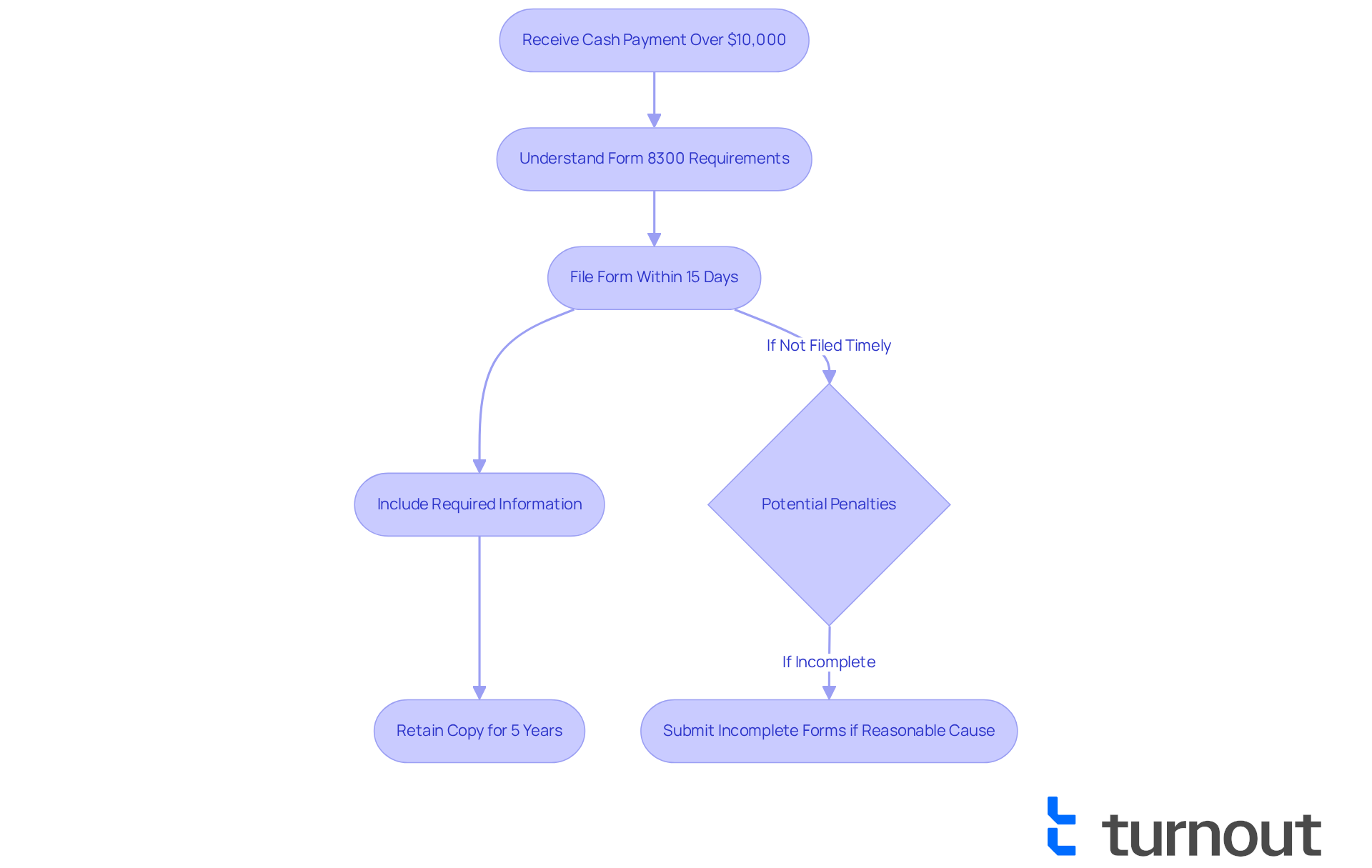

We understand that navigating the requirements for filing what is a 8300 form can feel overwhelming. Businesses must understand what is a 8300 form and file it within 15 days of receiving cash payments exceeding $10,000. This obligation isn’t just about individual transactions; it includes all related activities that together exceed this threshold within a 12-month period.

The form requires detailed information, such as the payer's name and address, the total cash received, and the nature of the transaction. If your organization needs to submit a delayed report electronically, remember to include the word 'LATE' in the comments section. Keeping precise documentation is crucial; companies should retain a copy of the form for five years.

It's common to feel anxious about compliance, especially with the potential civil penalties for non-filing, which can reach up to $250 per unfiled form, with a maximum annual penalty of $3,000,000. Companies that miss deadlines may face significant financial consequences, underscoring the importance of careful financial reporting.

Tax compliance specialists emphasize that understanding what is a 8300 form and submitting it promptly is essential - not just to avoid penalties, but also to support the government's efforts to combat financial offenses. Remember, even if your forms are incomplete, you should still submit them if you can demonstrate reasonable cause for the incompleteness.

We’re here to help you through this process, ensuring you meet your obligations while minimizing stress. You are not alone in this journey.

Discuss Implications and Penalties of Non-Compliance

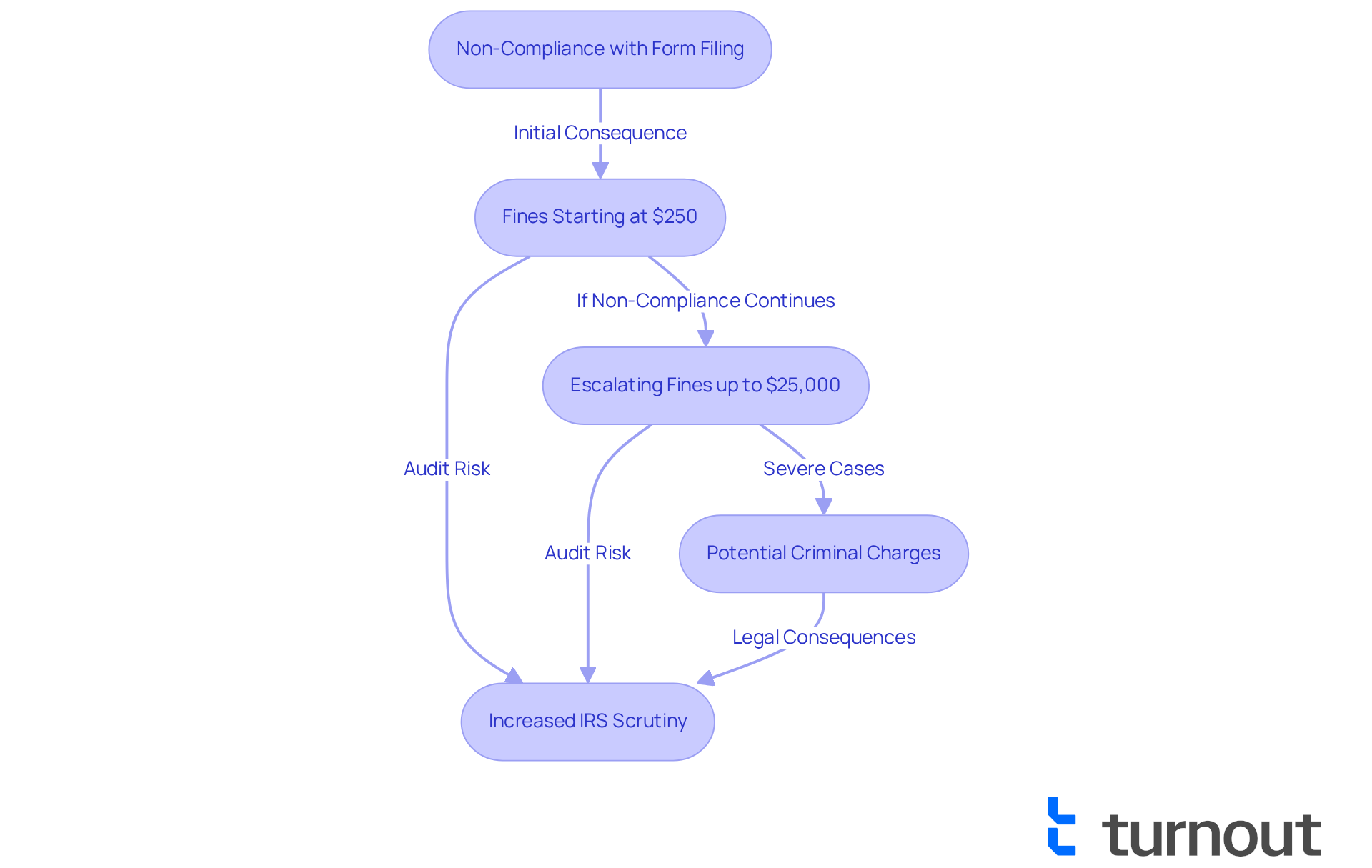

We understand that navigating compliance with Form filing requirements can be daunting. Failure to comply can lead to significant penalties and legal consequences, which can feel overwhelming. Businesses that miss the 15-day filing deadline may face fines starting at $250 per violation. If the failure is deemed willful, these fines can escalate dramatically. For those who intentionally disregard the rules, the penalty can be as high as $25,000 or the cash amount received, up to $100,000.

It's common to feel anxious about the potential repercussions. In severe cases, individuals might even face criminal charges, including imprisonment, for knowingly failing to report cash transactions. For example, an Arizona car dealer was fined $118,140 for not submitting the required Forms, highlighting the financial dangers of incorrect reporting.

Moreover, non-compliance can lead to audits and increased scrutiny from the IRS, which can damage your reputation and result in substantial financial losses. In 2025, the IRS intensified its focus on compliance with the specified form, leading to an uptick in criminal charges related to non-compliance.

Therefore, it’s crucial for businesses to prioritize adherence to what is a 8300 form requirements. By doing so, you can mitigate these risks and uphold your operational integrity. Remember, you are not alone in this journey; we’re here to help you navigate these challenges.

Conclusion

Understanding the nuances of Form 8300 is crucial for businesses dealing with cash transactions over $10,000. We know that navigating these requirements can feel overwhelming. This form isn’t just a compliance tool; it’s a vital part of promoting transparency in our financial system. By following the guidelines of Form 8300, you’re not only protecting your business but also joining the fight against money laundering and financial crimes. Together, we can create a more secure economic environment for everyone.

Throughout this article, we’ve highlighted key insights about the purpose, filing requirements, and potential penalties related to Form 8300. It’s important to remember that businesses must file this form within 15 days of receiving qualifying cash payments. Documenting all related transactions meticulously is essential. The consequences of not complying can be serious, ranging from hefty fines to criminal charges. This underscores the importance of timely and accurate reporting.

Ultimately, embracing the responsibilities that come with Form 8300 safeguards your business from legal issues and enhances the integrity of our financial landscape. We encourage you to prioritize compliance, seek guidance when needed, and stay informed about regulatory changes. By doing so, you can navigate the complexities of financial reporting with confidence. Remember, you are not alone in this journey; we’re here to help you contribute positively to the broader fight against financial crime.

Frequently Asked Questions

What is Form 8300?

Form 8300, officially known as the Report of Cash Payments Over $10,000 Received in a Trade or Business, is a document that businesses must file when they receive cash payments exceeding $10,000 in a single transaction or related transactions.

Why is Form 8300 important?

Form 8300 is crucial for helping the IRS and the Financial Crimes Enforcement Network (FinCEN) monitor large cash activities, contributing to a transparent financial environment and deterring illegal activities such as money laundering and tax evasion.

What are the consequences of not filing Form 8300?

Failing to submit Form 8300 can lead to serious penalties, including hefty fines and damage to a business's reputation.

How many Forms 8300 were filed in recent years?

In 2022, over 400,000 Forms 8300 were filed, and as of August 29, 2023, 283,252 reports have already been submitted.

What should businesses do if they receive over $10,000 in cash?

Businesses that receive over $10,000 in cash must understand how to file Form 8300 properly to comply with legal requirements.

How long must businesses keep a copy of Form 8300?

Businesses must keep a copy of each submitted Form 8300 for five years from the filing date.

What changes are coming for Form 8300 filing in 2024?

Starting in 2024, businesses that submit at least 10 additional information returns will be required to file Form 8300 electronically.