Introduction

Understanding IRS interest can feel overwhelming, especially when you're already facing financial pressures. These interest charges, which build up on unpaid taxes and penalties, aim to encourage timely payments and reflect the time value of money lost due to delays. We understand that navigating this complex landscape can leave you questioning how these rates are calculated and what impact they might have on your overall financial health.

Have you ever wondered what happens when a seemingly manageable tax obligation turns into a mountain of debt because of compounding interest? You're not alone in this journey. Many people find themselves in similar situations, and it's important to know that help is available.

Define IRS Interest: Understanding Its Nature and Purpose

IRS charges can feel overwhelming, especially when you're already facing financial challenges. These fees, imposed by the Internal Revenue Service on unpaid taxes, penalties, and additional obligations, begin accumulating from the due date of your tax obligation, highlighting what interest does the IRS charge. They continue to grow until the total amount owed is fully paid. As of the first quarter of 2026, what interest does the IRS charge for underpayments is 7%. The primary goal of these fees is to encourage timely tax payments and to clarify what interest does the IRS charge for the time value of funds lost due to delays.

It's important to understand what interest does the IRS charge, especially since it is compounded daily. This means that if you don’t address your tax charge promptly, you may be concerned about what interest does the IRS charge, as the total amount owed can escalate quickly. For instance, if you have a $5,000 tax charge at a 7% annual rate, you could see your balance rise to $5,147.04 in just 30 days due to this daily compounding effect. Additionally, penalties start accumulating from the original due date of your tax return, not from when the penalty is issued, which can further increase the total amount owed.

We understand that navigating IRS charges can be daunting. The longer a tax obligation remains overdue, the more significant the accumulation of fees becomes, leading to potentially overwhelming debts. That’s why it’s crucial to pay your balances in full as soon as you can. This helps stop the increase of charges and prevents further financial strain. Remember, you’re not alone in this journey. Options like Reasonable Cause Relief may be available for those with legitimate reasons for late payments, potentially removing fees and associated charges.

If you’re feeling stressed about your tax situation, take a moment to breathe. There are solutions out there, and we’re here to help you find them.

Contextualize IRS Interest: Why It Is Charged and When

We understand that dealing with taxes can be overwhelming, particularly when it comes to understanding what interest does the IRS charge. These fees often arise when individuals don’t settle their tax obligations by the deadline. This includes situations where tax returns aren’t filed on time or the full amount owed isn’t paid. Interest starts to accrue on the original due date of the return, even if an extension has been granted. Additionally, penalties for late payments or filings can add to the financial burden. This system is designed to encourage compliance and ensure that the government receives timely revenue to fund essential public services. By understanding what interest does the IRS charge and when these charges are applied, you can avoid unnecessary financial strain.

For example, let’s say you owe $5,000 and don’t pay promptly. The charges can escalate quickly, highlighting what interest does the IRS charge due to daily compounding. After just one year at a 7% annual rate, your total debt could balloon to around $14,000. This highlights the importance of timely compliance. The IRS’s system is structured to motivate prompt payment and ensure that government revenue is collected efficiently.

It’s important to know what interest does the IRS charge, as they typically don’t lower or waive charge fees unless the related fines are eliminated. Moreover, making partial payments won’t stop what interest does the IRS charge from accumulating on the remaining balance, which can lead to increased overall debt. However, you can take proactive steps to ease these financial burdens. For instance, filing your returns on time-even if you can’t pay the full amount owed-can help you avoid the costly failure-to-file penalty.

Additionally, exploring options like installment agreements can help you manage your tax obligations over time, although charges will continue to accrue on any remaining balance. By understanding when and why charges are applied, you can make informed decisions that help you navigate this challenging situation. Remember, you’re not alone in this journey, and we’re here to help.

Explore Key Characteristics: Calculation and Influencing Factors

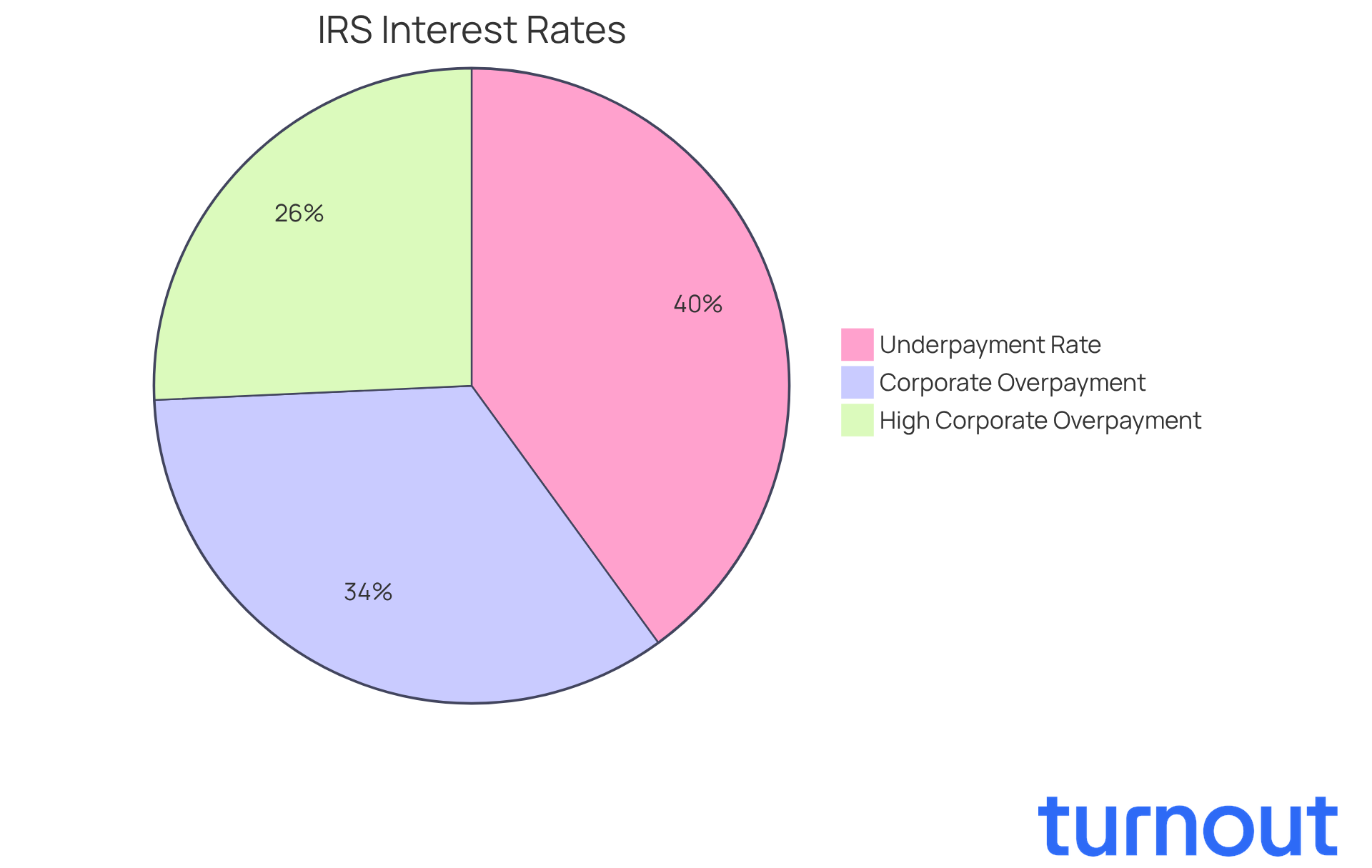

Understanding what interest does the IRS charge can be overwhelming, and we’re here to help you navigate this complex landscape. The calculation of these charges is based on the federal short-term rate, plus an additional margin, typically around 3%. This rate is reviewed and adjusted quarterly, reflecting changes in economic conditions. For instance, in the first quarter of 2026, the rate for underpayments was set at 7% annually, compounded daily.

It’s important to note that the rate for corporate overpayments is 6% for standard cases and 4.5% for those exceeding $10,000. Several factors influence what interest does the IRS charge, such as the amount of unpaid tax, the length of the delay in payment, and any applicable penalties. We understand that charges can accumulate daily until the full balance is settled, making timely payments essential to minimizing financial impact.

The IRS has announced that rates will remain unchanged for the first quarter of 2026. This stability emphasizes the importance of understanding these figures. Remember, you are not alone in this journey; staying informed can help you manage your tax responsibilities more effectively.

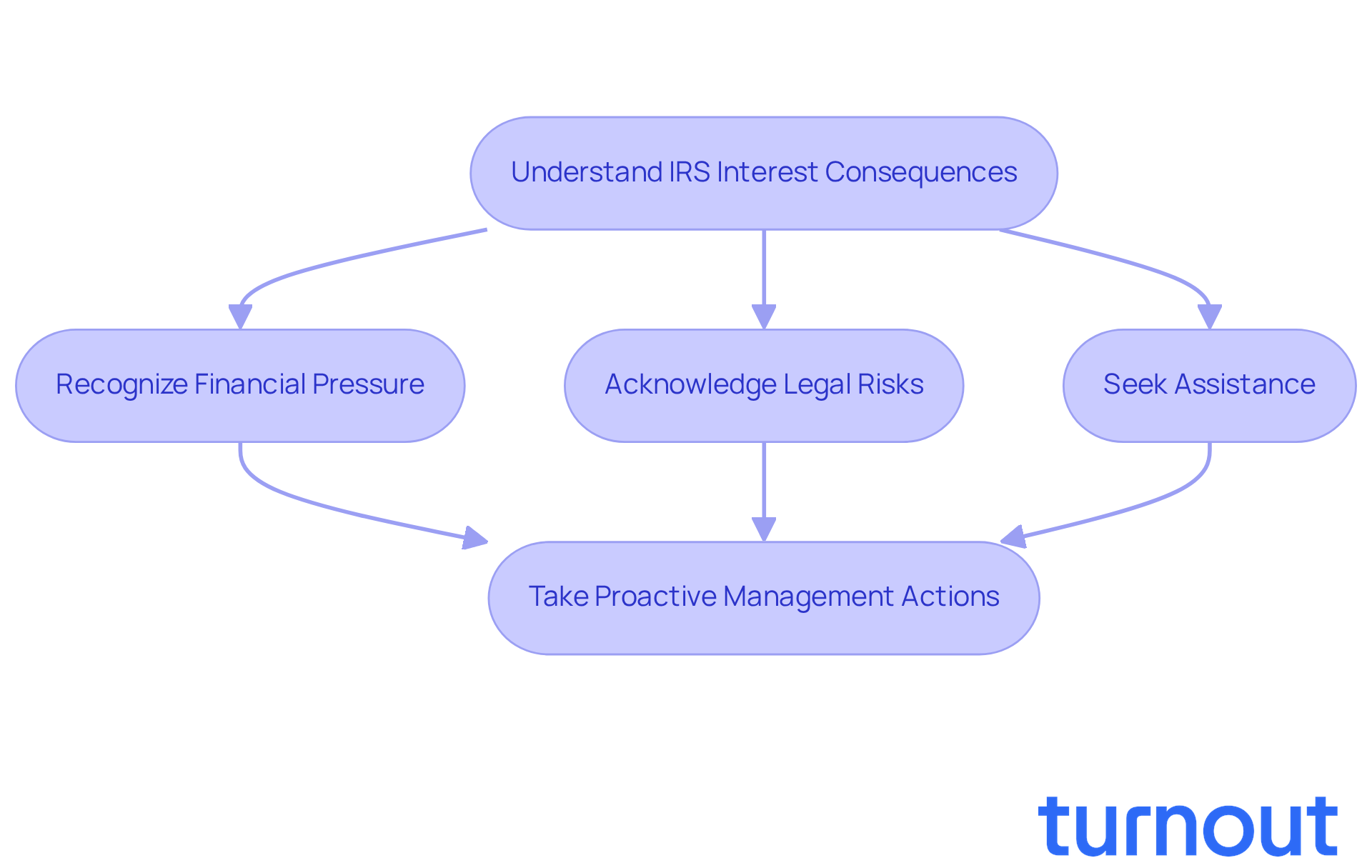

Assess Implications: Consequences of IRS Interest on Taxpayers

We understand that accumulating IRS charges can feel overwhelming. The repercussions can be substantial for those who pay taxes. As these charges pile up daily, the total amount owed can rise quickly, leading to significant financial pressure. For instance, if you owe $10,000 and delay payment, it is important to understand what interest does the IRS charge, as your debt could grow considerably over time.

It's common to feel anxious about unpaid tax liabilities. They can lead to further penalties, legal actions, and even wage garnishments. Understanding these implications is crucial for taxpayers like you to avoid falling into a cycle of debt. Remember, you are not alone in this journey. Seeking assistance when navigating complex tax situations can make a difference.

Proactive management of your tax obligations can help mitigate these risks. By taking action now, you can promote your financial stability and peace of mind. We're here to help you through this process.

Conclusion

Understanding the nature and impact of IRS interest is essential for anyone navigating tax obligations. We know that dealing with unpaid taxes can be overwhelming, and the fees imposed by the IRS are designed to encourage timely payments. With an annual interest rate of 7% as of the first quarter of 2026, these charges can add up quickly. It’s crucial to address tax liabilities promptly to avoid escalating debts.

Throughout this article, we’ve discussed key insights, including how IRS interest is calculated and the factors that influence these rates. Daily compounding of interest can significantly increase the total amount owed, and penalties for late payments only add to the financial burden. But there’s hope! Proactive measures, such as timely filing and exploring options like installment agreements, can help ease the impact of these charges.

In conclusion, staying informed about IRS interest rates and their implications is vital for managing your tax responsibilities effectively. By understanding the system and taking timely action, you can alleviate financial stress and promote greater stability in your financial life. Remember, you’re not alone in this journey. Seeking assistance and utilizing available resources can make a significant difference in navigating these challenges. We're here to help!

Frequently Asked Questions

What is IRS interest and why is it charged?

IRS interest refers to fees imposed by the Internal Revenue Service on unpaid taxes, penalties, and additional obligations. It is charged to encourage timely tax payments and to account for the time value of funds lost due to delays in payment.

How does the IRS interest accumulate?

The IRS interest begins to accumulate from the due date of the tax obligation and continues to grow until the total amount owed is fully paid. It is compounded daily, meaning the total amount owed can increase rapidly if not addressed promptly.

What is the current interest rate for underpayments by the IRS?

As of the first quarter of 2026, the interest rate charged by the IRS for underpayments is 7%.

Can you provide an example of how IRS interest affects the total amount owed?

For instance, if you have a $5,000 tax charge at a 7% annual rate, the balance could rise to $5,147.04 in just 30 days due to daily compounding.

When do penalties start accumulating?

Penalties start accumulating from the original due date of your tax return, not from when the penalty is issued. This can further increase the total amount owed.

What can I do if I am struggling with IRS charges?

It is crucial to pay your balances in full as soon as possible to stop the increase of charges. Additionally, options like Reasonable Cause Relief may be available for those with legitimate reasons for late payments, potentially removing fees and associated charges.

What should I do if I feel stressed about my tax situation?

If you are feeling stressed about your tax situation, take a moment to breathe. There are solutions available, and assistance is offered to help you navigate your challenges.