Overview

We understand that failing to file taxes can be a daunting experience, and it can lead to severe financial and legal consequences. You might face substantial penalties, interest on unpaid taxes, and even potential criminal charges for willful neglect. It’s common to feel overwhelmed by these possibilities.

As these consequences accumulate over time, it’s important to recognize that individuals not only face fines and loss of refunds but may also encounter aggressive IRS collection actions. This can significantly disrupt your financial stability and future prospects.

But you are not alone in this journey. There are supportive resources available to help you navigate these challenges. We’re here to help you find the assistance you need to regain control of your financial situation. Remember, taking action now can make a difference.

Introduction

Choosing not to file your taxes can lead to a series of serious consequences that go far beyond just financial penalties. We understand that life can get busy, and sometimes tax obligations slip through the cracks. However, neglecting these responsibilities can result in steep fines from the IRS, mounting interest on unpaid amounts, and even severe legal repercussions, including potential criminal charges.

As the stakes rise, it’s essential to grasp not only the immediate financial implications but also the long-term effects on your financial stability and legal standing. What may seem like a simple oversight could quickly spiral into a complex web of debt and legal challenges.

How do you navigate these treacherous waters and avoid the pitfalls of non-filing? You’re not alone in this journey, and we’re here to help. It’s common to feel overwhelmed, but understanding your options can make a significant difference. Let’s explore the steps you can take to regain control and ensure your financial future remains secure.

Define the Consequences of Not Filing Taxes

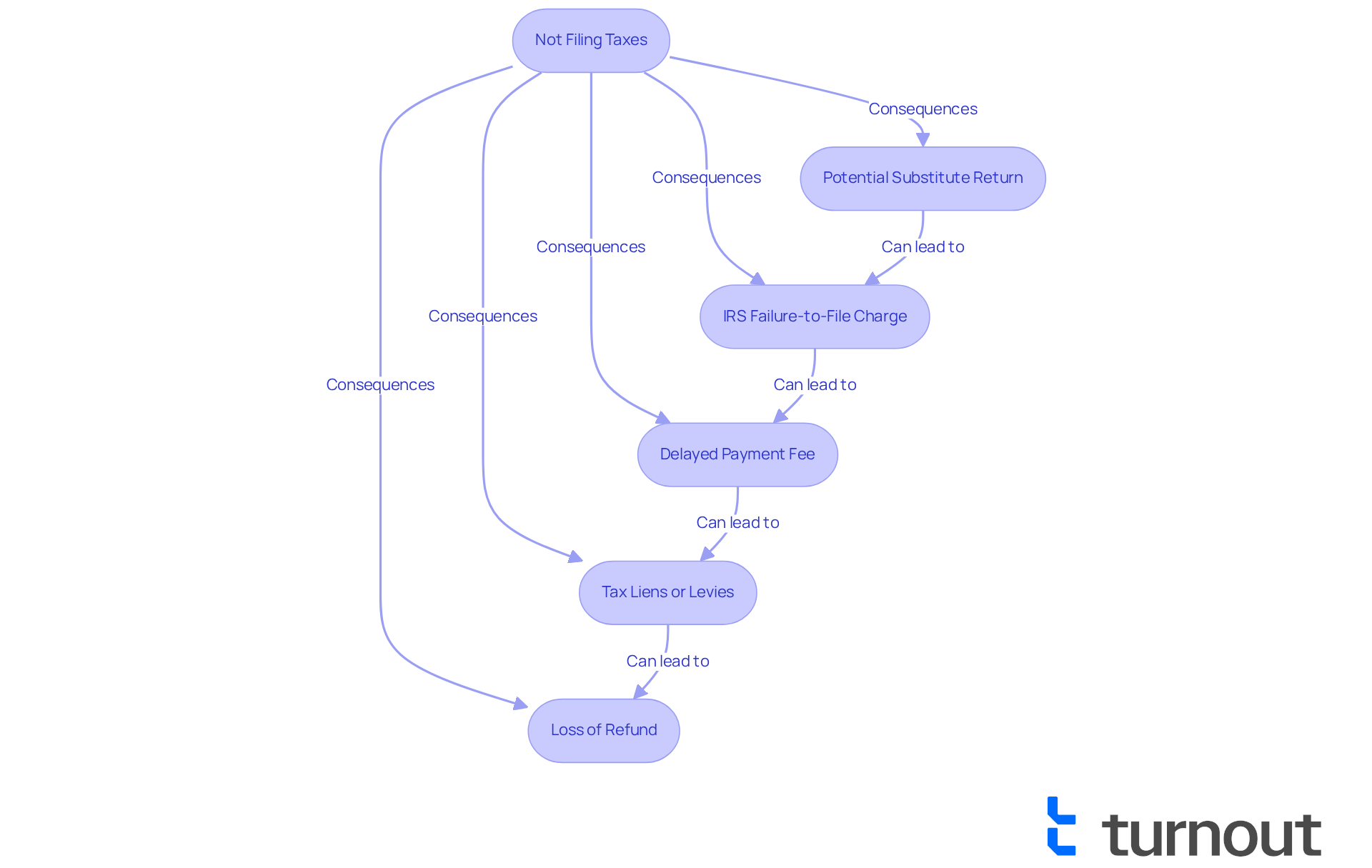

We understand that dealing with taxes can be overwhelming, and what happens if you never file taxes can lead to serious consequences. The IRS imposes a failure-to-file charge of 5% of the unpaid tax for each month the return is overdue, capped at 25%. Additionally, there's a fee for delayed payment, which is 0.5% of outstanding dues for each month, also capped at 25%. These charges can add up quickly, especially when combined with interest on the unpaid amount, further escalating your total debt.

It's common to feel anxious about the IRS potentially filing a substitute return on your behalf. Unfortunately, these substitute returns often overlook available deductions and credits, which can lead to a higher tax liability than if you had filed your own return.

Neglecting to submit taxes can lead to tax liens or levies on your personal assets, highlighting what happens if you never file taxes, which can greatly disturb your financial stability. For instance, after 60 days of non-filing, a charge of $485 or 100% of the tax due, whichever is less, is applied. This highlights the significance of prompt filing. The repercussions can extend beyond simple financial penalties, leading to significant concerns about what happens if you never file taxes, which can influence your overall financial well-being and future prospects.

It's important to note that if you're due a refund but haven't filed, you won't face penalties. However, you will lose that refund if you don't file within three years. The ultimate deadline for 2024 tax refunds is April 15, 2028. It is vital for anyone considering their tax obligations to understand what happens if you never file taxes. Remember, you're not alone in this journey, and we're here to help you navigate through it.

Explore Legal Ramifications of Non-Filing

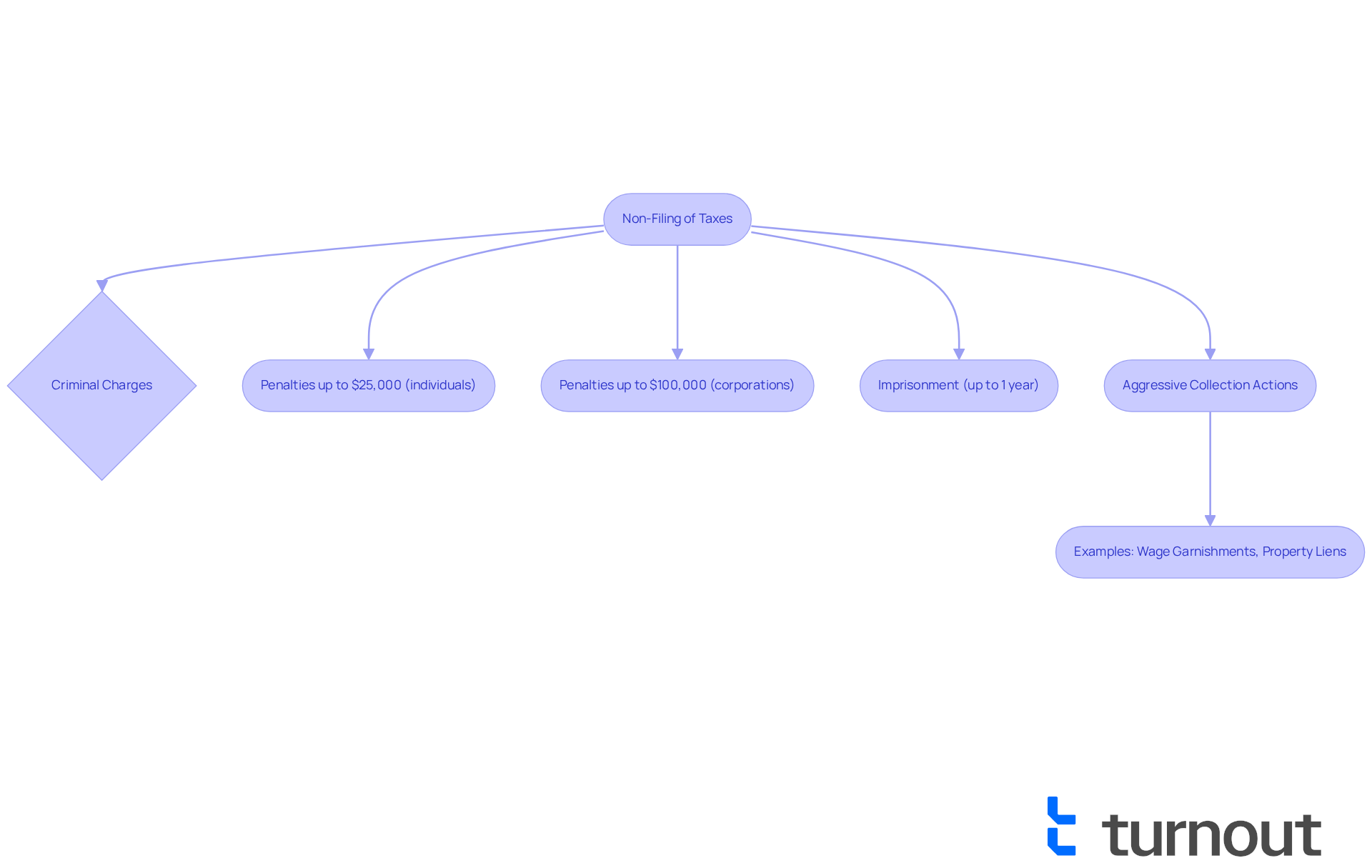

We understand that the thought of what happens if you never file taxes can feel overwhelming. The legal consequences can be quite severe, and it’s common to feel anxious about what happens if you never file taxes. If the IRS believes a taxpayer has intentionally neglected to file, they could face criminal charges, illustrating what happens if you never file taxes. This can lead to penalties of up to $25,000 for individuals and $100,000 for corporations. In extreme cases, individuals may even face imprisonment, with a maximum statutory sentence of up to one year for what happens if you never file taxes.

Moreover, the stakes are high when it comes to understanding what happens if you never file taxes. The highest punishment for plotting to deceive the United States can amount to $250,000, highlighting the serious economic repercussions. Civil sanctions also come into play, including failure-to-file charges and interest on unpaid taxes. The IRS has the authority to pursue aggressive collection actions, such as wage garnishments and property liens, which can significantly complicate your financial situation, particularly when considering what happens if you never file taxes.

Recent cases illustrate the gravity of these allegations. For instance, a woman from New Hampshire admitted to submitting a fraudulent tax return, showcasing the variety of consequences individuals might face. The IRS Criminal Investigation division has a 90% federal conviction rate, underscoring their commitment to enforcing tax laws and penalizing willful non-filing.

As seen in the case of Joseph Caravella, who received a 15-month prison term for avoiding employment tax fines, the consequences can be both financially and personally catastrophic. But remember, you are not alone in this journey. If you find yourself in a difficult situation regarding your taxes, we’re here to help. Seeking assistance can make a significant difference in navigating these challenges.

Assess Financial Implications of Late Tax Filing

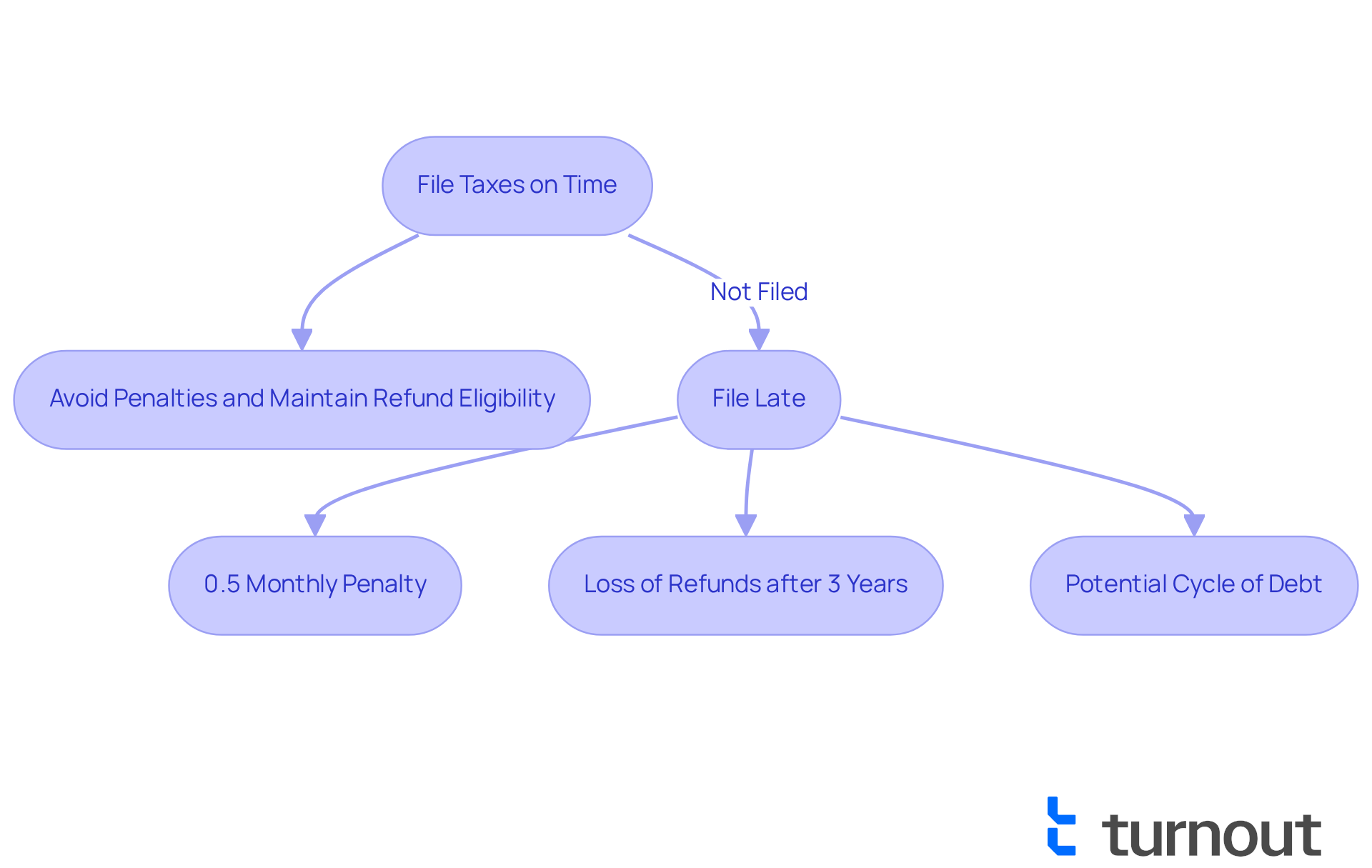

Submitting forms after the deadline can have significant financial consequences, much like what happens if you never file taxes. We understand that this can be overwhelming. Beyond the penalties already mentioned, you might miss out on valuable refunds and tax credits that could ease your financial burden. For instance, if you’re owed a refund but don’t file within three years, you lose that money completely. This can be particularly impactful, especially since the average taxpayer received around $2,743 in tax credits for the 2023 tax year, with potential increases in the future.

Additionally, the IRS imposes a failure-to-pay penalty of 0.5% per month on unpaid taxes, which adds up daily based on the federal short-term interest rate. This financial strain can create a cycle of debt that feels impossible to escape. To avoid these challenges, it’s crucial to submit your taxes on time and understand what happens if you never file taxes.

During government shutdowns, filing your returns and getting help from the IRS can become even more difficult. That’s why meeting deadlines is so important. Remember, you’re not alone in this journey. Turnout offers tools and services to help you navigate these complexities, ensuring you receive the support and benefits you deserve, especially if you’re managing SSD claims and seeking tax relief without professional representation. We're here to help you every step of the way.

Identify Missed Benefits and Credits from Non-Filing

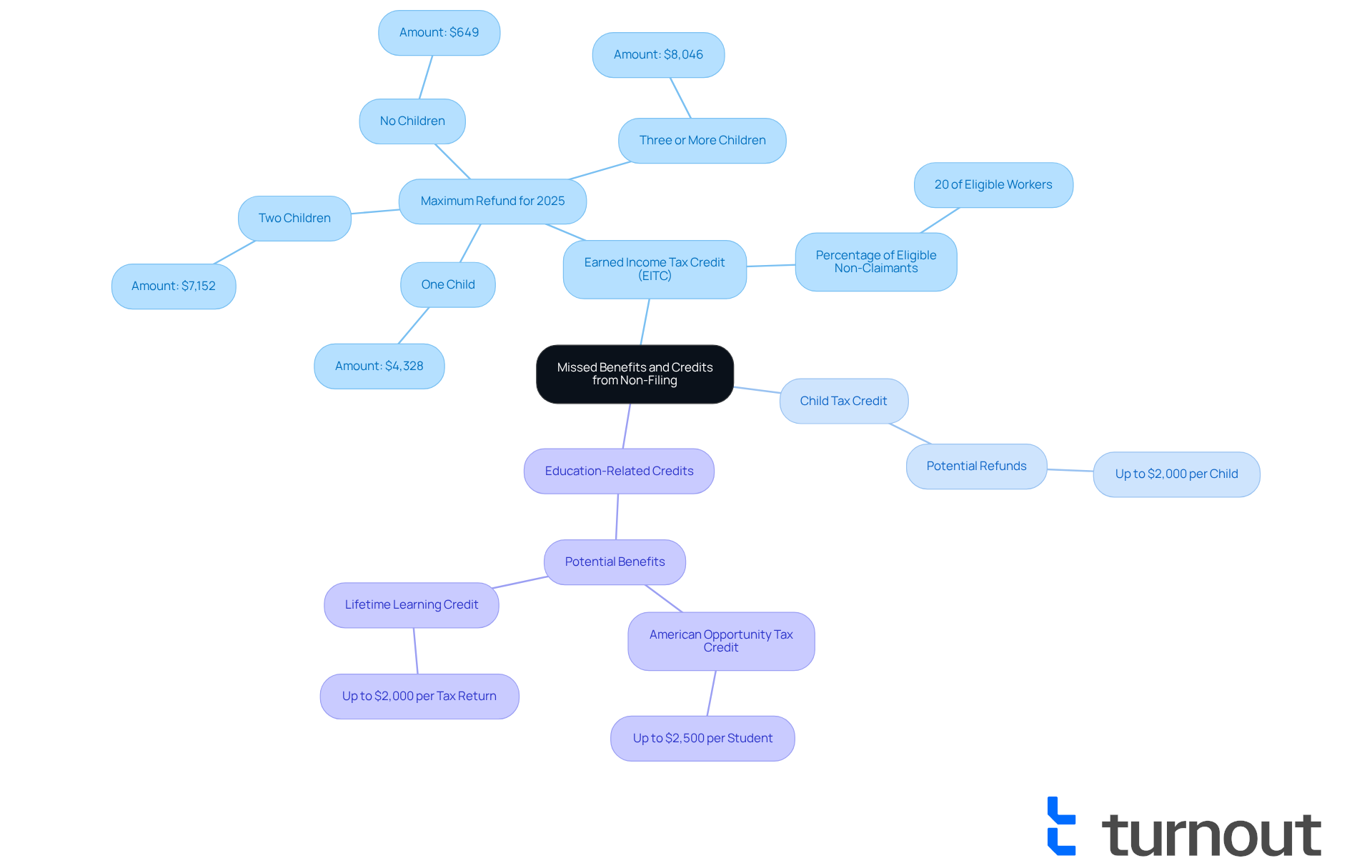

When considering what happens if you never file taxes, it's important to recognize that not submitting your taxes can lead to significant financial losses, especially due to missing out on benefits and credits that provide essential support. One of the most impactful credits is the Earned Income Tax Credit (EITC), designed specifically for low- to moderate-income workers. For the 2025 tax year, families with three or more children can receive up to $8,046 through the EITC, offering substantial refunds that can help ease financial burdens.

Additionally, there are other credits available, like the Child Tax Credit and education-related credits, which can further reduce your tax liabilities. By not filing taxes, you not only forfeit these potential refunds but also limit your access to crucial financial resources, highlighting what happens if you never file taxes during tough times. It's common to feel overwhelmed, and many eligible workers miss out on the EITC each year. In fact, estimates suggest that around 20% of those who qualify do not claim it, leaving billions of dollars unclaimed. This loss can be especially hard on families trying to make ends meet, emphasizing what happens if you never file taxes, which is crucial for accessing available financial support.

We understand that navigating these processes can be daunting. That’s why Turnout offers resources and expert advice to help you understand your eligibility for benefits like the EITC. Remember, Turnout is not a law firm and does not provide legal advice; we’re here to assist you in understanding your options for SSD claims and tax debt relief. The IRS also provides helpful tools, such as the EITC Assistant, to guide you in learning about the EITC and other family tax credits. You are not alone in this journey, and we’re here to help you every step of the way.

Conclusion

Neglecting to file taxes can lead to serious consequences that go beyond just financial penalties. We understand that the implications of non-filing can include hefty fees, potential legal issues, and missed opportunities for financial relief through credits and refunds. It's crucial to grasp these consequences, especially if you're navigating your tax obligations, as they can significantly impact both your current financial stability and future prospects.

Throughout this article, we've highlighted key points, such as:

- The escalating penalties imposed by the IRS for late or non-filing

- The risk of criminal charges for willful neglect

- The financial losses from unclaimed credits like the Earned Income Tax Credit

It's common to feel overwhelmed by these details, but timely filing can help you avoid complications like liens or levies on your personal assets. Each of these aspects reinforces the critical need for individuals to take their tax responsibilities seriously to prevent a cascade of negative outcomes.

Ultimately, the message is clear: filing taxes isn't just a legal obligation; it's a vital step toward securing your financial well-being. We encourage you to seek assistance and utilize available resources to ensure compliance and maximize your benefits. By taking proactive measures, you can mitigate risks, access valuable credits, and maintain your financial health. Remember, understanding the consequences of failing to file taxes is essential, and you are not alone in this journey.

Frequently Asked Questions

What are the consequences of not filing taxes?

Not filing taxes can lead to serious consequences, including a failure-to-file charge of 5% of the unpaid tax for each month the return is overdue, capped at 25%. Additionally, there is a delayed payment fee of 0.5% of outstanding dues for each month, also capped at 25%. These charges can accumulate quickly, especially with interest on the unpaid amount.

What happens if the IRS files a substitute return for me?

If you do not file your taxes, the IRS may file a substitute return on your behalf. However, these substitute returns often overlook available deductions and credits, which can result in a higher tax liability than if you had filed your own return.

Can not filing taxes lead to tax liens or levies?

Yes, neglecting to submit taxes can lead to tax liens or levies on your personal assets, which can significantly disrupt your financial stability. After 60 days of non-filing, a charge of $485 or 100% of the tax due, whichever is less, is applied.

What happens if I am due a tax refund but haven’t filed?

If you are due a refund but have not filed, you will not face penalties. However, you will lose that refund if you do not file within three years. The ultimate deadline for 2024 tax refunds is April 15, 2028.

How does not filing taxes affect my financial well-being?

The repercussions of not filing taxes extend beyond financial penalties, potentially influencing your overall financial well-being and future prospects. It is crucial to understand the importance of prompt filing to avoid these consequences.