Introduction

Navigating financial responsibilities can be overwhelming, especially when it comes to taxes. We understand that the implications of not paying taxes for several years can feel daunting. The consequences go beyond just monetary penalties; they can threaten your personal and professional stability. Imagine facing liens, wage garnishments, or even long-term damage to your credit score.

What happens when individuals ignore their tax obligations? It's common to feel stressed and anxious about these challenges. But you’re not alone in this journey. This article explores the multifaceted effects of unpaid taxes and offers viable options for relief and resolution. We’re here to help you safeguard your financial future with the knowledge you need.

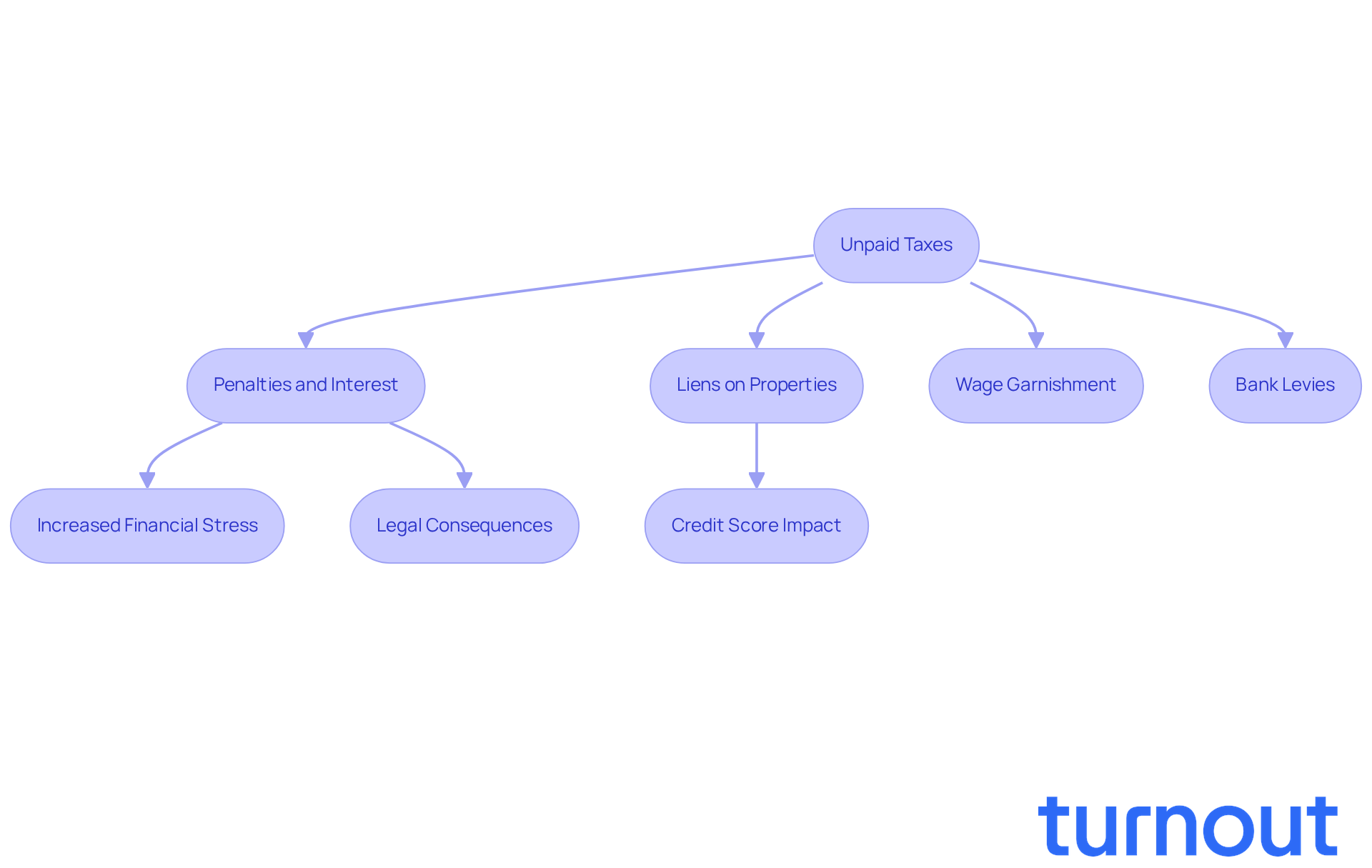

Define Consequences of Unpaid Taxes

It is important to understand what happens if you don't pay taxes for several years, as it can lead to serious repercussions that threaten both your financial stability and legal standing. We understand that facing the Internal Revenue Service (IRS) can be daunting. They impose various penalties, including late fees and interest on unpaid amounts, which can escalate quickly. For instance, one client who owed $106,520.83 in sales tax managed to settle for just $17,927.49 through an Offer in Compromise, saving over $88,000. Imagine the relief that comes with such a resolution!

The IRS also has the authority to place liens on properties, garnish wages, and levy bank accounts to recover owed payments. Tax liens can significantly impact your credit score, making it difficult to secure loans or mortgages. For example, a client with a $330,429 debt to the Louisiana Department of Revenue had all penalties and interest waived after persistent negotiation, saving over $150,000. It’s common to feel overwhelmed by these financial pressures, and many people report heightened stress and mental health challenges due to unresolved tax issues.

For anyone navigating their tax obligations, it is crucial to understand what happens if you don't pay taxes for several years. The impact of what happens if you don't pay taxes for several years goes beyond simple monetary penalties; it can significantly affect your personal and professional life. Proactive management, including timely payments and seeking professional assistance, is essential to safeguard your financial future and avoid these dire outcomes.

As J. David Tax Law emphasizes, "Every case we take on reflects our commitment to providing protection, professional representation, and peace of mind to our clients who are being aggressively pursued by Federal and State tax agencies." Remember, you are not alone in this journey. We're here to help you navigate these challenges.

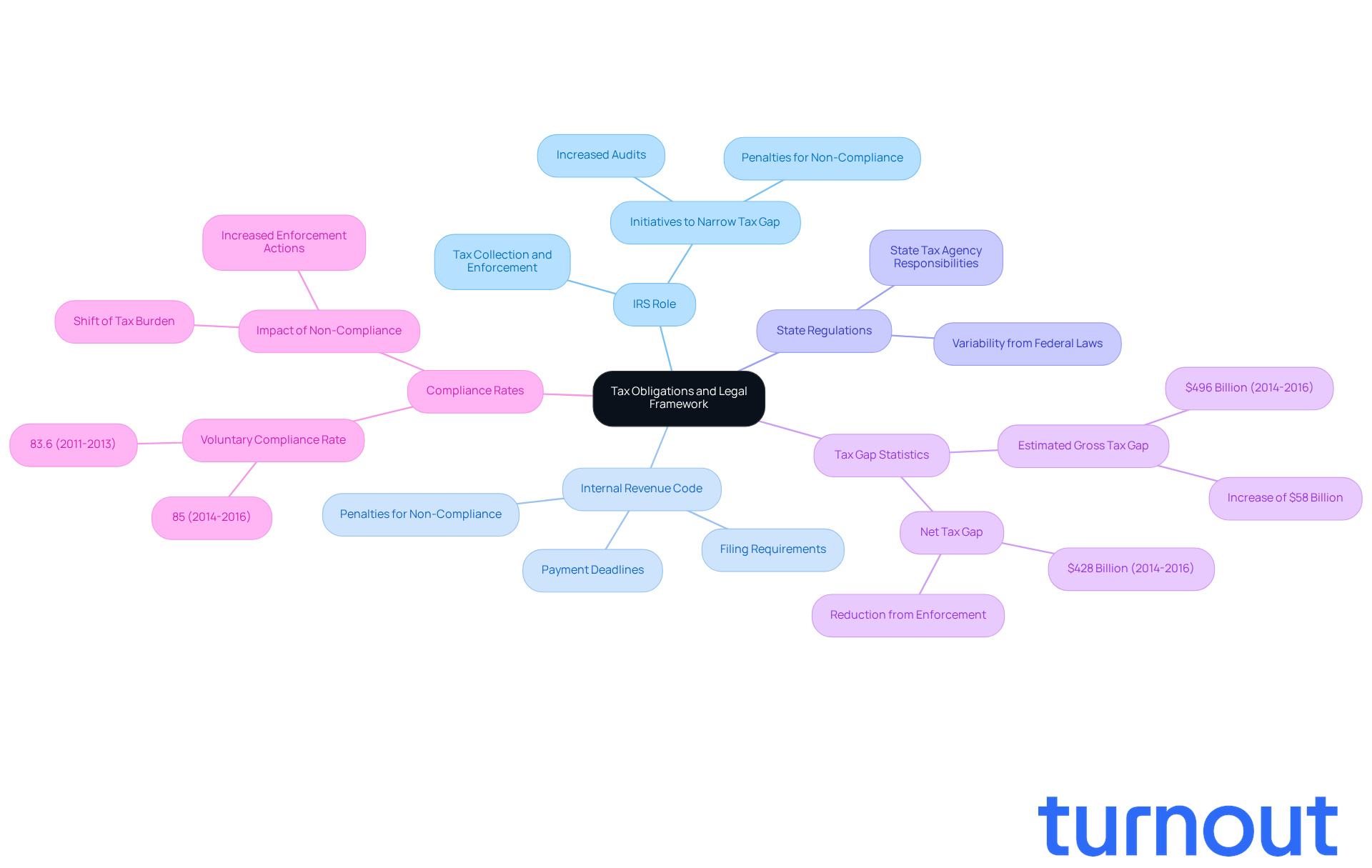

Contextualize Tax Obligations and Legal Framework

Navigating financial responsibilities in the United States can feel overwhelming. We understand that the legal structure surrounding taxes is complicated, requiring individuals to disclose their earnings and pay dues accordingly. The IRS, as the federal agency responsible for tax collection and enforcement, operates under the authority of the Internal Revenue Code. This code outlines essential requirements for tax filing, payment deadlines, and the penalties for non-compliance.

It's important to note that state tax agencies impose their own regulations, which can differ significantly from federal laws. Understanding this legal context is crucial for you to manage your tax responsibilities effectively and to comprehend what happens if you don't pay taxes for several years. Did you know that the tax gap was estimated at $496 billion for tax years 2014-2016? This reflects an increase of over $58 billion from previous estimates. Approximately 85% of levies were settled willingly and punctually during this timeframe, compared to a compliance rate of 83.6% for the previous period of 2011-2013.

As we move forward, the IRS continues to enhance its enforcement capabilities, focusing on narrowing the tax gap through various initiatives. For instance, IRS enforcement actions have included increased audits and penalties for non-compliance. This underscores the importance of adhering to your tax obligations. As the IRS states, 'The average gross tax gap was estimated at $441 billion per year based on data from those three years.' Understanding this context is essential, as it highlights what happens if you don't pay taxes for several years. Remember, you are not alone in this journey, and we're here to help you navigate these challenges.

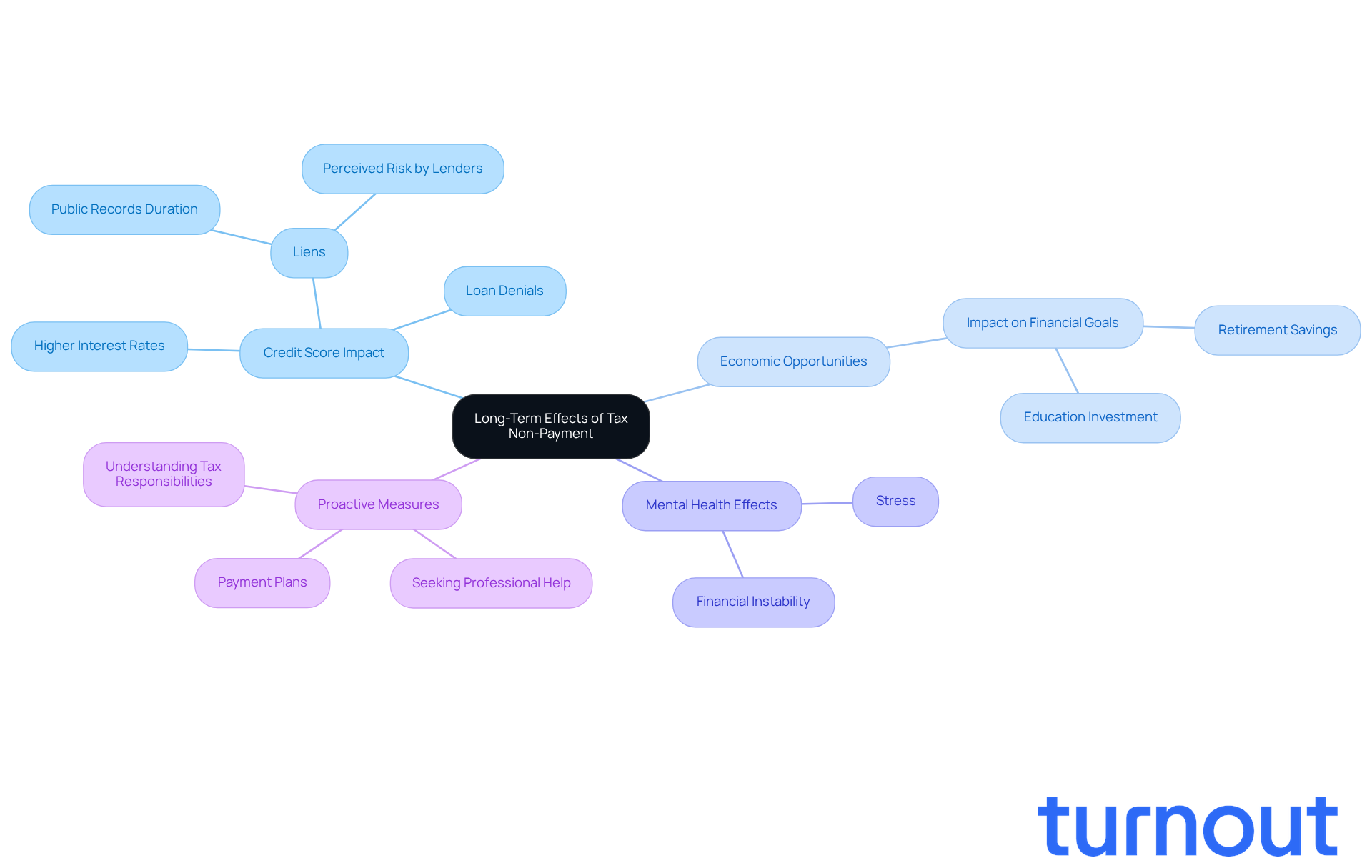

Examine Long-Term Effects of Tax Non-Payment

Neglecting financial obligations can lead to serious and complex long-term effects, including what happens if you don't pay taxes for several years. We understand that facing liens - government claims against property for unpaid dues - can be daunting. These can significantly lower your credit score, making future loan or mortgage applications more complicated. While tax debt itself might not show up on credit reports, the repercussions of tax liens can create a perception of higher risk among lenders. This could result in loan denials or higher interest rates. Did you know that unpaid tax liens can remain public records for up to 15 years? This can impact your economic opportunities long after the debt is resolved.

Moreover, the stress and anxiety from unresolved tax obligations can take a toll on your mental health and overall well-being. It’s common to feel trapped in a cycle of financial instability, particularly when thinking about what happens if you don't pay taxes for several years, as accumulating penalties and interest on unpaid taxes worsen your situation. This ongoing economic strain can hinder your ability to save for retirement, invest in education, or pursue other essential financial goals, ultimately diminishing your quality of life.

As we look ahead to 2026, the implications of tax liens on economic stability remain critical. With the IRS placing liens for debts of $10,000 or greater, it’s important to be proactive if you find yourself in this situation. Seeking professional assistance can provide clarity and options for managing tax debts, including potential payment plans or offers in compromise. By understanding the connection between tax responsibilities and credit wellness, you can take steps to reduce the long-term impacts of tax non-payment. Remember, you are not alone in this journey, and there are ways to strive for a more stable economic future.

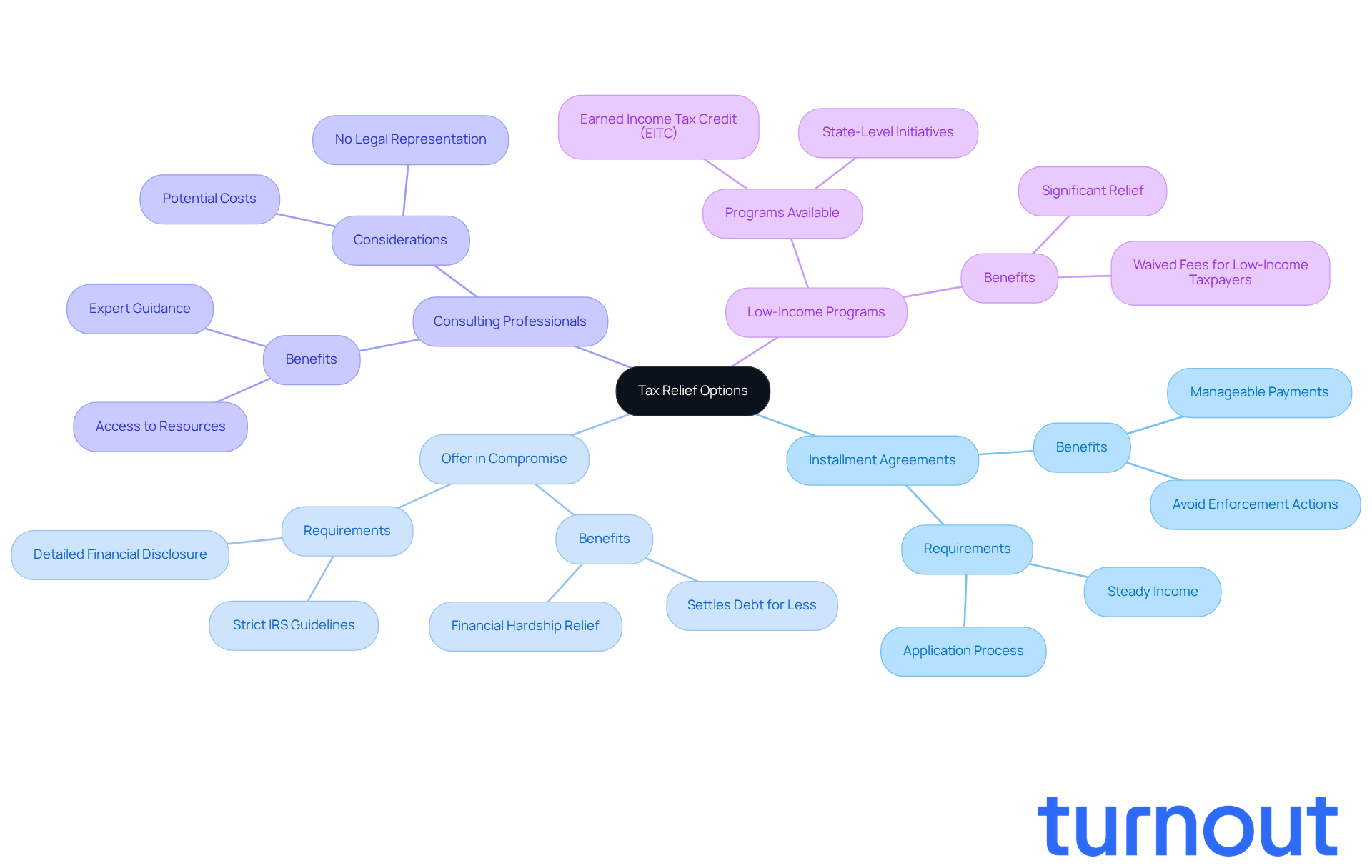

Explore Options for Tax Relief and Resolution

If you're grappling with unpaid taxes, know that you're not alone, and it's crucial to understand what happens if you don't pay taxes for several years, as there are several options available to help lighten your financial load. The IRS offers Installment Agreements, which allow you to spread your tax debts over time. This can make payments much more manageable, especially if you have a steady income. By sticking to these agreements, you can avoid enforcement actions, giving you peace of mind. Many find that these payment plans are among the easiest to qualify for, particularly if you're ready to commit to regular payments.

Another option worth considering is the Offer in Compromise (OIC). This program lets you settle your tax liabilities for less than what you owe, which can be a real lifesaver if paying in full would cause you financial hardship. However, qualifying for an OIC can be a bit tricky. It requires detailed financial disclosure and adherence to IRS guidelines. In FY 2024, the IRS accepted 7,199 out of 33,591 proposed offers, showing just how competitive this option can be.

You might also find it beneficial to consult with tax professionals or advocacy organizations like Turnout. They can connect you with IRS-licensed enrolled agents who provide valuable guidance on navigating the complex world of tax relief options. While they don’t offer legal representation, their expertise can be incredibly helpful. Additionally, programs aimed at low-income individuals, such as the Earned Income Tax Credit (EITC) and various state-level initiatives, can provide significant relief.

Understanding these pathways to resolution is crucial for anyone facing tax challenges, particularly to grasp what happens if you don't pay taxes for several years. They can truly pave the way for financial recovery and peace of mind. Many individuals have successfully established Installment Agreements or secured OICs, proving that taking proactive steps can lead to positive outcomes. Remember, we're here to help you through this journey.

Conclusion

Neglecting tax obligations can lead to serious consequences that go beyond just financial penalties. We understand that failing to pay taxes for several years can threaten not only your financial stability but also your personal and professional well-being. Recognizing the weight of these repercussions is crucial for anyone striving to maintain their financial health and legal standing.

In this article, we've shared important insights about the consequences of unpaid taxes. These include:

- Penalties

- Liens

- Wage garnishments

- The lasting effects on credit scores

It's clear that the IRS has significant power to enforce tax laws, and the stress from unresolved tax issues can take a toll on mental health. But there’s hope! Exploring options for tax relief, like Installment Agreements and Offers in Compromise, can help you regain control over your financial situation.

Ultimately, the message is clear: managing your tax obligations proactively is essential to avoid the severe consequences of unpaid taxes. Seeking professional guidance and understanding available relief options can lead to a more secure financial future. If you're facing tax challenges, remember to take the necessary steps to address your obligations. Doing so not only protects your financial well-being but also enhances your overall quality of life. You're not alone in this journey, and we're here to help.

Frequently Asked Questions

What are the consequences of not paying taxes for several years?

Not paying taxes for several years can lead to serious repercussions, including financial instability and legal issues. The IRS imposes penalties such as late fees and interest on unpaid amounts, which can escalate quickly.

How can unpaid taxes affect my financial situation?

Unpaid taxes can result in liens on properties, wage garnishments, and bank levies. Tax liens can significantly impact your credit score, making it difficult to secure loans or mortgages.

Can I negotiate my tax debt?

Yes, it is possible to negotiate tax debt. For example, clients have successfully settled their debts for significantly lower amounts through an Offer in Compromise, saving substantial sums.

What emotional effects can arise from unresolved tax issues?

Many individuals experience heightened stress and mental health challenges due to unresolved tax issues, often feeling overwhelmed by financial pressures.

What steps can I take to avoid severe consequences from unpaid taxes?

Proactive management is crucial, including making timely payments and seeking professional assistance to safeguard your financial future and avoid dire outcomes.

What support is available for those facing tax issues?

Professional representation and assistance are available to help navigate tax challenges. Organizations like J. David Tax Law emphasize their commitment to providing protection and peace of mind for clients dealing with tax agencies.