Introduction

Neglecting tax obligations for an entire decade can lead to a cascade of severe consequences that extend far beyond mere financial penalties. We understand that facing this daunting reality can be overwhelming. Individuals in this situation may grapple with escalating fines and interest, along with potential legal ramifications that could even result in criminal charges.

As the stakes rise, you might be wondering: what options exist for those who have fallen behind? How can you navigate the complexities of tax debt resolution? Understanding the implications of long-term tax evasion is crucial for anyone seeking to reclaim their financial stability. Remember, you are not alone in this journey, and there are paths to help you avoid the pitfalls of inaction.

Define the Consequences of Not Paying Taxes for 10 Years

There can be serious consequences when considering what happens if you don't pay taxes for 10 years. We understand that this can feel overwhelming. The potential for substantial financial charges, legal ramifications, and lasting impacts on your personal finances is significant.

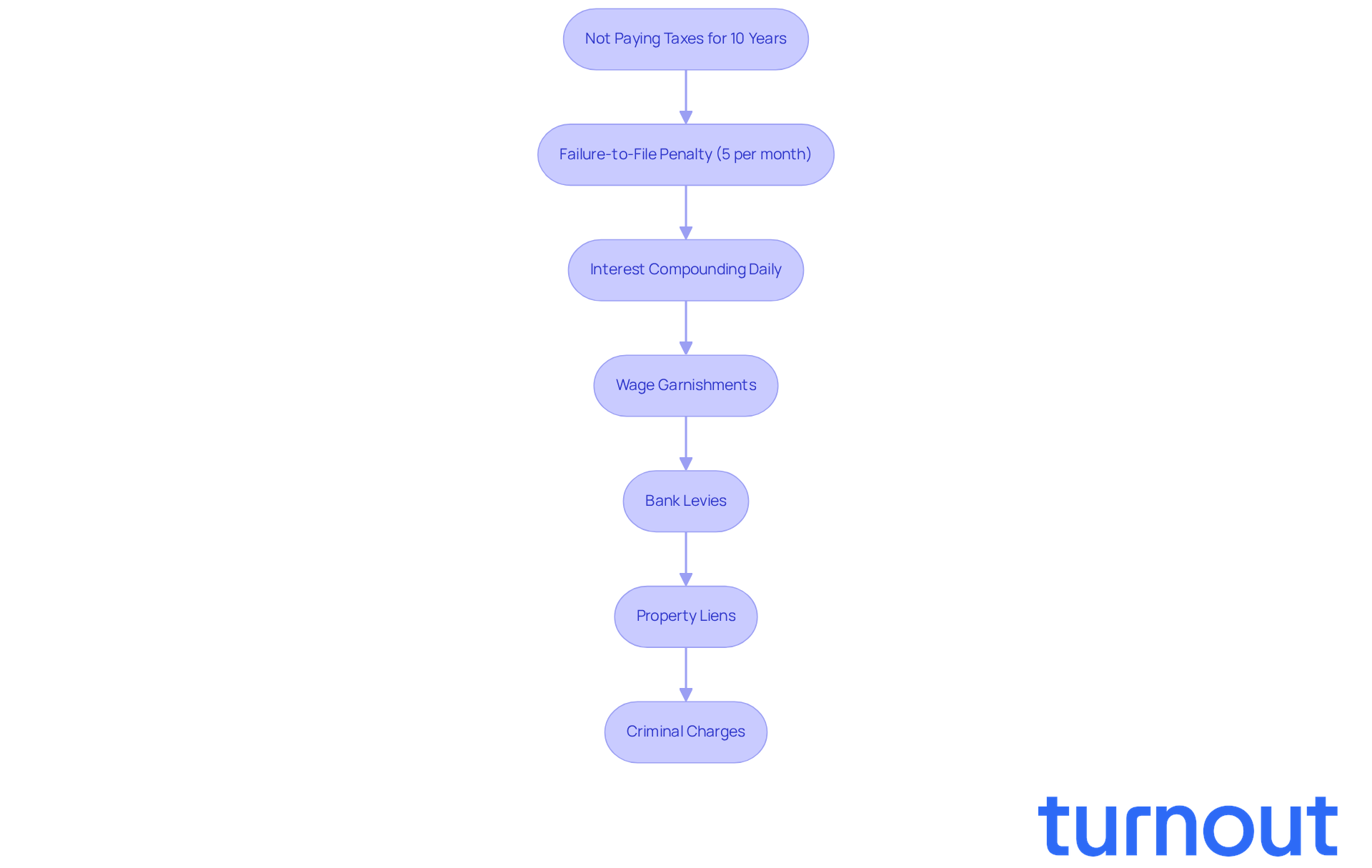

The IRS imposes a failure-to-file penalty of 5% of the unpaid tax for each month your return is late, capping at 25%. Additionally, interest on overdue payments compounds daily, which can quickly increase the total amount owed. It's common to feel anxious about aggressive collection actions, such as:

- Wage garnishments

- Bank levies

- Property liens

These can linger on your records for more than seven years, adding to your stress.

In severe cases, deliberately failing to pay taxes can lead to criminal charges. Fines can reach up to $250,000, and incarceration could last as long as five years. As Michael Clark wisely notes, "These fines emphasize the monetary repercussions of failing to submit returns and the significance of filing even if you are unable to pay the entire sum owed."

It's crucial to understand what happens if you don't pay taxes for 10 years if you're considering neglecting your tax responsibilities. The longer you wait, the more severe the repercussions can become. But remember, you're not alone in this journey. It's advisable to reach out to the IRS for information on payment plans or penalty relief programs. We're here to help you navigate these challenges and find a way forward.

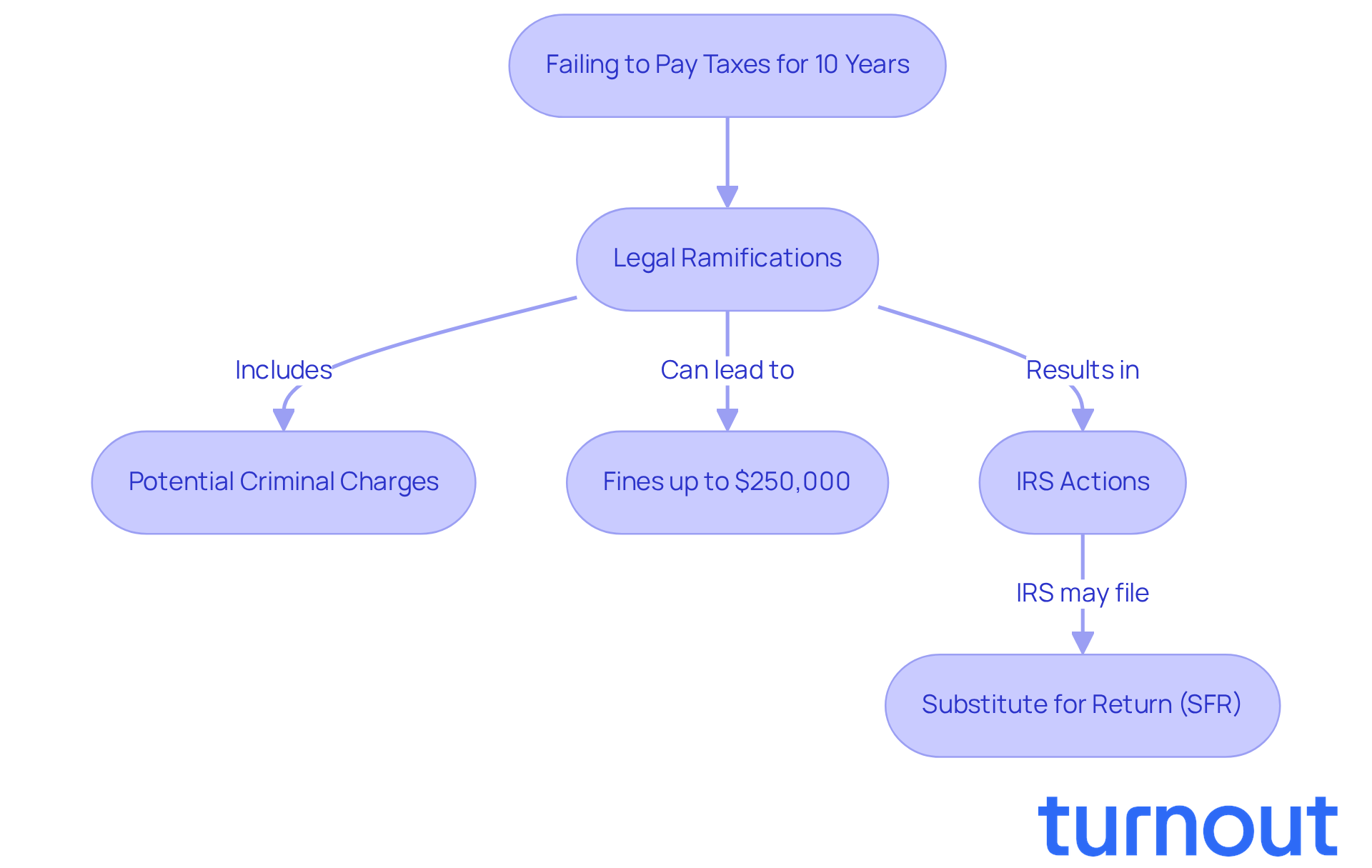

Examine Legal Implications of Long-Term Tax Non-Payment

The daunting legal ramifications stem from what happens if you don't pay taxes for 10 years. We understand that facing such issues can feel overwhelming. Under the Internal Revenue Code, failing to file a tax return can lead to serious consequences, including criminal charges for tax evasion. This is punishable by up to five years in prison and fines that can reach $250,000 for individuals. The IRS has the authority to take legal action against those who willfully evade their tax responsibilities.

It's common to feel anxious about what this means for you. The IRS can file a Substitute for Return (SFR) on your behalf, but this often doesn’t accurately reflect your actual income or deductions. This could lead to a significantly higher tax liability than you might expect. For instance, in 2026, a notable case involved Jaffar Syed, who admitted guilt to evasion of revenue obligations and faced severe penalties for failing to report over $100,000 in dues.

The IRS projected the gross tax gap for 2022 at a staggering $696 billion, highlighting how widespread tax evasion is becoming. It is crucial for anyone who hasn’t filed taxes for an extended period to understand what happens if you don't pay taxes for 10 years. You are not alone in this journey, and it’s important to take action before facing significant legal challenges. Remember, we're here to help you navigate these complexities.

Analyze Financial Consequences of Unpaid Taxes Over a Decade

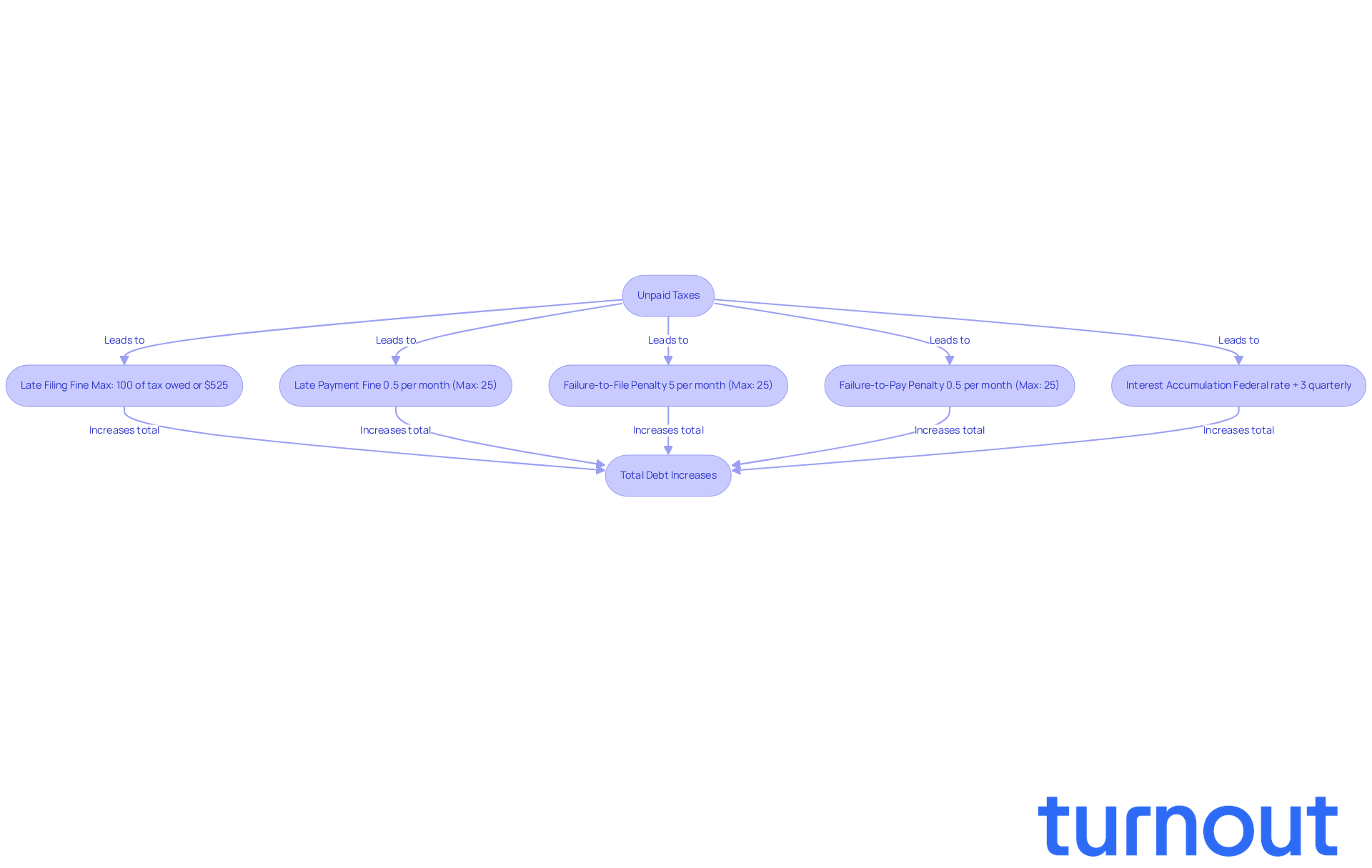

Neglecting tax obligations for ten years can lead to overwhelming financial consequences, illustrating what happens if you don't pay taxes for 10 years. We understand that facing such a situation can be daunting. Initially, individuals may encounter fines for both late filing and late payment, which can accumulate to an astonishing maximum of 47.5% of the unpaid tax owed. If a return is more than 60 days overdue, the minimum fine is the lesser of $525 or 100% of the tax owed. For instance, if you owe $10,000 in dues, you may discover what happens if you don't pay taxes for 10 years, which could lead to being responsible for over $30,000 when considering fines and daily accumulating interest.

The IRS imposes a failure-to-file penalty of 5% of the amount owed for each month on unpaid charges, capped at 25%. Additionally, the failure-to-pay penalty adds another 0.5% per month, also reaching a maximum of 25%. Interest on outstanding dues is assessed every three months, calculated as the federal short-term rate plus 3%. This means that the longer you postpone, the more serious the financial consequences become.

Moreover, outstanding dues can significantly harm your credit rating, making it challenging to secure loans or mortgages. The burden of tax debt can create a vicious cycle of economic strain. It’s crucial to address your tax obligations promptly to prevent experiencing what happens if you don't pay taxes for 10 years and avoid escalating consequences. Ignoring taxes doesn’t make the problem disappear; it only makes it more expensive. Remember, you are not alone in this journey. As the saying goes, 'The longer you wait, the more you’ll owe.' We're here to help you navigate these challenges.

Explore Options for Resolving Long-Term Tax Debt

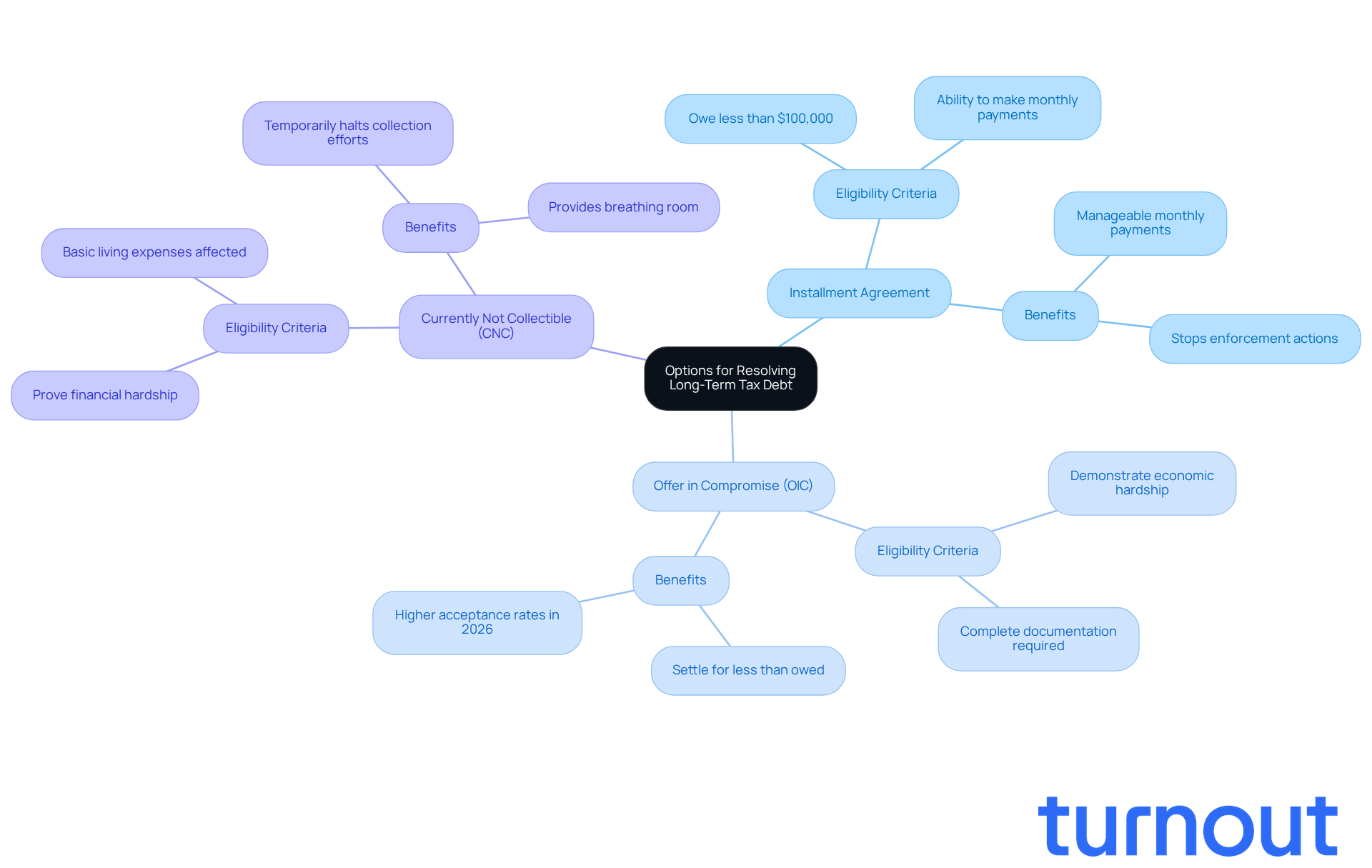

If you're dealing with long-term tax debt, it's important to understand what happens if you don't pay taxes for 10 years, and know that you're not alone, as there are options available to help you find relief. One effective method is applying for an Installment Agreement. This allows you to pay your tax debt over time with manageable monthly payments. In 2026, the IRS made these agreements easier to access for those who owe less than $100,000. Plus, if you can settle your full balance within 180 days, there’s no minimum payment required for short-term plans.

Another option to consider is the Offer in Compromise (OIC). This program lets you resolve your tax obligation for less than what you owe, provided you can demonstrate economic hardship. It's encouraging to see that acceptance rates for OIC applications have risen significantly in recent years, especially for those who can show they genuinely can't pay.

You might also qualify for Currently Not Collectible (CNC) status. This status can temporarily stop collection efforts if you can prove that paying your tax debts would make it hard to cover basic living expenses. It’s a crucial lifeline for those facing financial difficulties.

Navigating these options can feel overwhelming, but engaging with a tax professional or an advocacy agency like Turnout can make a world of difference. They can help you create a personalized plan for resolving your tax debt, ensuring you understand your rights and any associated fees. Taking proactive steps not only increases your chances of finding an affordable resolution but also helps you avoid the consequences of what happens if you don't pay taxes for 10 years, thereby protecting your financial future. As Mike Habib, an Enrolled Agent, wisely puts it, "The key is to take action, seek qualified help, and commit to addressing your tax situation proactively." Remember, we're here to help you through this journey.

Conclusion

Neglecting tax obligations for an entire decade can lead to serious and far-reaching consequences. We understand that the potential repercussions extend beyond mere financial penalties; they can also encompass legal ramifications and significant impacts on your personal finances. It's crucial to grasp these implications if you're considering the risks of not paying taxes. Remember, the longer you wait, the more severe the consequences can become.

Throughout this article, we've highlighted key points, including the substantial penalties imposed by the IRS, which can accumulate rapidly due to interest and late fees. It's common to feel overwhelmed by the thought of legal consequences escalating to criminal charges, with fines and potential imprisonment for those who deliberately evade their tax responsibilities. Furthermore, the financial burden of unpaid taxes can severely affect your credit rating and overall economic stability, creating a cycle of debt that can feel impossible to escape.

Addressing your tax obligations promptly is essential to avoid the escalating consequences of long-term tax delinquency. There are viable options available, such as Installment Agreements and Offers in Compromise, which can provide relief for those struggling with tax debts. Engaging with tax professionals can help you navigate these options effectively. Taking proactive steps not only mitigates the risks associated with unpaid taxes but also protects your financial future.

We want to emphasize that seeking help and addressing tax issues is a vital step toward regaining control and ensuring long-term financial health. You're not alone in this journey; we're here to help you find the support you need.

Frequently Asked Questions

What are the consequences of not paying taxes for 10 years?

The consequences include substantial financial charges, legal ramifications, and lasting impacts on personal finances.

What penalties does the IRS impose for failing to file taxes?

The IRS imposes a failure-to-file penalty of 5% of the unpaid tax for each month the return is late, capped at 25%.

How does interest affect overdue tax payments?

Interest on overdue payments compounds daily, which can significantly increase the total amount owed.

What aggressive collection actions can the IRS take for unpaid taxes?

The IRS may take actions such as wage garnishments, bank levies, and property liens.

How long can collection actions remain on your record?

Collection actions can linger on your records for more than seven years.

What severe consequences can result from deliberately failing to pay taxes?

Deliberately failing to pay taxes can lead to criminal charges, fines up to $250,000, and possible incarceration for up to five years.

What should someone do if they are unable to pay their taxes?

It's advisable to reach out to the IRS for information on payment plans or penalty relief programs.